Best Saturn Car Insurance Rates in 2025 (Find the Top 10 Companies Here!)

Progressive, State Farm, and Geico have some of the best Saturn car insurance rates. At Progressive, minimum coverage for Saturns is an average of $39/mo. Saturns are often cheaper to insure because they are older vehicles and no longer manufactured, so insurance has to pay less if a Saturn is totaled.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Saturn

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews 17,760 reviews

17,760 reviewsCompany Facts

Full Coverage for Saturn

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Saturn

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsProgressive, State Farm, and Geico have the best Saturn car insurance rates.

Saturn is a brand of cars rather than a model, and your insurance costs will be based on the model you own, the year it was made, and the company you choose.

Our Top 10 Company Picks: Best Saturn Car Insurance Rates

| Company | Rank | Safe-Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 16% | A+ | Competitive Rates | Progressive | |

| #2 | 18% | B | Complete Coverage | State Farm | |

| #3 | 15% | A++ | Affordable Rates | Geico | |

| #4 | 16% | A+ | Usage-Based Discount | Allstate | |

| #5 | 14% | A | Group Discounts | Farmers | |

| #6 | 15% | A+ | Bundling Discounts | Nationwide |

| #7 | 12% | A | Quick Claims | Liberty Mutual |

| #8 | 16% | A | Loyalty Discounts | American Family | |

| #9 | 12% | A++ | Coverage Options | Travelers | |

| #10 | 14% | A+ | Tailored Policies | The Hartford |

The good news is that you will likely pay less for any Saturn that you are considering buying when finding free car insurance quotes online, as 2009 was the last year that any new Saturn was made. Read on to learn more about the best Saturn insurance companies.

You can also quickly compare rates online to find cheap Saturn insurance by typing your ZIP code in the box above.

- Progressive has the best Saturn insurance rates for most customers

- Since Saturn is no longer producing vehicles, it will be harder to find parts

- As Saturns get older, the safety features offered will be more out-of-date

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Pick Overall

Pros

- Competitive Rates: Progressive has competitive rates for good drivers. Learn more about rates in our Progressive review.

- Snapshot Program: Customers can lower their Saturn auto insurance rates by joining Snapshot.

- Online Tools: Progressive has many useful online functions for Saturn drivers.

Cons

- Snapshot Rate Changes: While Snapshot typically reduces customer rates, it may also raise bad driver rates.

- Customer Service: This could be improved according to reviews left by various customers.

#2 – State Farm: Best for Complete Coverage

Pros

- Complete Coverage: State Farm offers complete coverage packages to drivers. Learn more in our review of State Farm.

- Good Students: State Farm is a popular choice for younger drivers due to its good student and student-away discounts.

- Roadside Assistance: An optional coverage that may be useful for older models of Saturns.

Cons

- Financial Rating: State Farm’s financial reliability rating was recently downgraded.

- No Online Purchases: Saturn car insurance policies must be bought from an agent.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Unless drivers are high-risk, they will find affordable Saturn car insurance rates at Geico. Learn more about rates in our Geico car insurance review.

- Financial Stability: Geico’s financial management is well-rated by A.M. Best.

- Discount Variety: Geico has discounts for Saturn drivers that range from good student discounts to vehicle safety discounts.

Cons

- Lack of Local Agents: Geico offers primarily virtual interactions with representatives.

- High-Risk Rates: Geico will quote Saturn drivers who are high-risk higher rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Usage-Based Discount

Pros

- Usage-Based Discount: Joining Drivewise could help Saturn customers save on their car insurance. Read more in our Allstate Drivewise review.

- Pay-Per-Mile Insurance: This choice of insurance could help low-mileage customers save on their coverage.

- Claim Satisfaction Guarantee: Dissatisfied customers could receive premium credits.

Cons

- Customer Reviews: Allstate has more negative reviews than most other companies.

- High-Risk Rates: Rates are most affordable if drivers are low-risk.

#5 – Farmers: Best for Group Discounts

Pros

- Group Discounts: Get discounts for insuring multiple drivers or cars at Farmers.

- Local Agents: Farmers does have some local agents available for personalized assistance.

- Accident Forgiveness: Saturn customers may be able to avoid increased rates post-accident.

Cons

- Online Functions: There can be limitations to online services at Farmers.

- Customer Satisfaction: Customers don’t always rate service highly. Learn more in our Farmers review.

#6 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Discounts: Customers who bundle insurance will save on their Saturn coverage with Nationwide car insurance discounts.

- SmartMiles Insurance: Low-mileage Saturn customers may want to buy pay-per-mile coverage for extra savings.

- Vanishing Deductible: Nationwide vanishes deductibles over time for good drivers.

Cons

- Telematics Tracking: Customers should be okay with SmartMiles and Nationwide’s UBI program tracking driving data.

- Customer Ratings: Customer representation isn’t always rated highly.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Quick Claims

Pros

- Quick Claims: Filing a claim at Liberty Mutual is easy and quick, as it can be done online at any hour (learn more: How do you file a car insurance claim?).

- Availability: The company’s widespread availability means it can be kept as a provider when moving.

- Coverage Options: Fully protect your Saturn with the coverage options available at Liberty Mutual.

Cons

- Discount Options: Liberty Mutual discount options can vary by location.

- Customer Service: There are less favorable ratings from some customers.

#8 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Saturn rates will be discounted the longer a customer stays with American Family.

- Roadside Assistance: An optional coverage that could be beneficial for older models of Saturns. Learn more in our American Family review.

- Discount Variety: Saturn customers can save with accident forgiveness, bundling discounts, and more.

Cons

- Availability: Coverage isn’t sold in every state, so some Saturn customers won’t be able to get insurance from this company.

- DUI Rates: DUI drivers will have less competitive Saturn rates.

#9 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers offers a wider range of coverage options than most companies. Learn more in our Travelers review.

- IntelliDrive Program: Participation in the program could help Saturn customers reduce their rates.

- Online Convenience: Policy changes or claims can be made online from Travelers’ app.

Cons

- IntelliDrive Rate Changes: While most Saturn customers will save with the program, the program could raise rates for bad drivers.

- Customer Reviews: This could be improved, according to some reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: The Hartford is great for customers who want help tailoring policies to meet their needs.

- AARP Perks: AARP members will get discounts and perks on their auto insurance policy. Learn more in our review of the AARP auto insurance program by The Hartford.

- Accident Forgiveness: A great perk for Saturn drivers with clean driving records.

Cons

- Young Drivers: The Hartford tailors to older drivers, so young drivers should choose a different company.

- Mixed Reviews: There are a few negative reviews left by customers of The Hartford.

Saturn Insurance Rates by Model

The cost will play a major part in why the different types of Saturn vehicles cost different amounts to insure, but that isn’t the only factor that will impact them.

In addition, these vehicles are different in how they were made and for what they are used. For example, the Saturn SKY convertible is a sports car. Sports cars, in general, are more expensive to insure because of how people drive them.

Explore our concise comparison of Saturn car insurance rates across models like Saturn, Aura, and Outlook. Gain valuable insights into the factors shaping insurance premiums, empowering you to make informed decisions about your coverage needs.

Compare Saturn Car Insurance Rates by Model

| Saturn Model |

|---|

| Saturn |

| Saturn Aura |

| Saturn Outlook |

Sedans are often more expensive to insure because they are luxury vehicles with a higher price tag. Of course, this isn’t always the case, but this is to give you an idea of the reason for insurance premium differences.

As time passes, Saturns are likely to have higher premiums than comparable vehicles simply because they are no longer being made.

The harder it is to find replacement parts for a vehicle, the more the insurance company will have to pay to repair it after an accident. Therefore, they will charge more for the insurance. The good news is that this problem is a long way off for Saturn owners, as General Motors still carries parts for these cars and will maintain them at any GM facility.

Dani Best Licensed Insurance Producer

Eventually, Saturn vehicles will have an increase in premiums. Regardless, the premiums aren’t going to be astronomical, especially considering the fact that an older vehicle will be cheaper to insure overall.

Read more: Cheap Car Insurance for Older Vehicles

Keep in mind that as technology changes and the safety features on the Saturn don’t meet current standards, you will no longer qualify for the safety discount. Again, this isn’t something that will happen today, just over time as it would for any older vehicle.

Saturn Outlook XR Costs

Of course, this is an average, but according to Motor Trend, the average cost of insurance for the Outlook XR is $94 per month. This is based, in part, on the average resale value of the Outlook, which is $27,400 for a 2009 model.

The 2008 model is slightly less to insure, according to Motor Trend, at $91 per month to insure. As you can see, the older the vehicle, the less it will cost to insure.

The Saturn Outlook is a safe vehicle according to the Insurance Institute for Highway Safety and rated top marks in their safety testing system.

This is relevant because good safety features on your vehicle will help keep your insurance costs down.

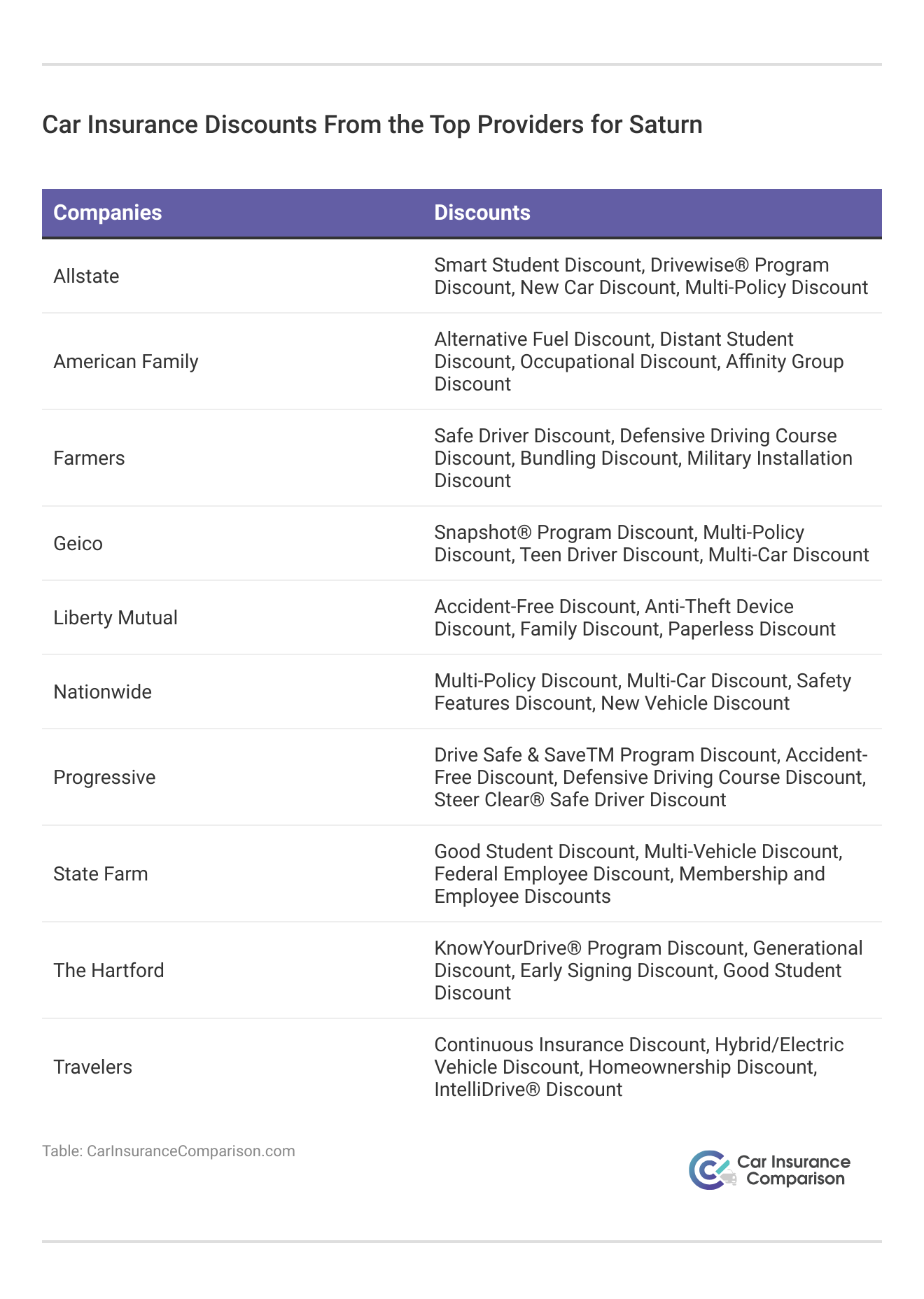

How to Save on Saturn Car Insurance

One of the first things you can do is apply for car insurance discounts at the best companies.

Most Saturn drivers should be able to qualify for at least a few discounts. Another way Saturn drivers can save is by carrying minimum coverage instead of full coverage at the best companies.

Saturn Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $37 | $99 |

We only recommend carrying minimum coverage if your Saturn’s overall value has degraded enough that you could afford to replace or repair the car out of pocket.

Getting Saturn Car Insurance Quotes

How can I find out how much it is going to cost to insure a Saturn? Probably the easiest part about buying a Saturn is finding out how much it will cost for you to insure the Saturn. The reason for this is that you don’t have to own a Saturn to get quotes for the vehicle. You need to know how old it is and the make and model to input it into a quote tool.

View this post on Instagram

In addition, you will have to provide your own driving information, such as:

- Your age

- Your anticipated credit rating

- Any incidents that may show up on your driving record

- Other people who will be driving the Saturn

Once you have provided all of this information, you will receive a quote from at least three reputable insurance companies. You can get quotes directly from the best companies for Saturns, such as Progressive.

This will give you an excellent idea as to what you can expect to pay for your car insurance. The price may vary slightly depending on whether the insurance company determines you qualify for more discounts or they find something on your driving record you didn’t include, and so on.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Final Word on the Best Saturn Car Insurance Rates

Progressive, State Farm, and Geico have some of the best Saturn insurance rates. Most Saturn vehicles are cheaper to insure when you compare car insurance rates by make and model, but shopping for quotes will ensure drivers get the cheapest Saturn insurance rates possible.

If you are ready to shop for the best Saturn auto insurance quotes today, enter your ZIP in our free tool to compare online car insurance rates now.

Frequently Asked Questions

How much does it cost to insure a Saturn Outlook XR?

The average to insure a Saturn Outlook XR is $94/mo, based on Motor Trend’s data. The 2008 is slightly less expensive to insure at $91/mo.

Why do different models of Saturn cars have different insurance costs?

Insurance costs vary among different Saturn models due to factors such as the vehicle’s cost, type (e.g., sedan or sports car), safety features, and availability of replacement parts. Luxury vehicles and sports cars tend to have higher premiums, especially if you get the best insurance for luxury cars or sports cars.

Will insurance premiums increase for Saturn cars over time?

As Saturn cars are no longer in production, insurance premiums may increase in the future. The availability of replacement parts affects insurance costs, but for now, General Motors still carries parts for Saturn vehicles.

How can I find out how to insure a Saturn?

You can easily find out how to insure a Saturn by using an online quote tool. Input the Saturn’s make and year, along with your personal driving information, to receive quotes from multiple insurance companies. Compare rates now with our free quote tool.

What factors influence Saturn car insurance costs?

Several factors influence Saturn car insurance costs, including the vehicle’s make and year, driving record, location, age, gender, and coverage options (read more: How do you get competitive quotes for car insurance?). Additionally, the safety features and condition of the Saturn can impact premiums.

Why are Saturn cars so cheap?

Saturn cars are cheap because they are older cars, so they are greatly depreciated in value.

Are Saturns reliable cars?

The different types of Saturn cars are usually reliable.

What is the cheapest Saturn insurance?

Minimum coverage will be the cheapest insurance you can buy for a Saturn (read more: Minimum Car Insurance Requirements by State).

Can you still get Saturn parts?

Yes, you can still get Saturn parts for repairs.

Does Saturn use GM parts?

Yes, Saturn repairs can be done with parts provided by GM.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.