Best AAA Car Insurance Discounts in 2025 (Save 25% With This Company)

The best AAA car insurance discounts include the good driver, multi-car, and good student discounts, with savings up to 25%. By utilizing these top discounts, drivers can significantly lower their premiums, making AAA one of the most best options for those seeking cheap AAA insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best AAA car insurance discounts offer significant savings for bundling, insuring multiple cars, and being a good student. Save up to 25% if you qualify for any of these AAA insurance discounts.

AAA also provides discounts for high deductibles, driver safety courses, and more. Active-duty members can also take advantage of the military discount for AAA membership.

Our Top 10 Picks: Best AAA Car Insurance Discounts

| Discount | Rank | Savings Potential | Eligibility |

|---|---|---|---|

| Bundling | #1 | 25% | Bundling auto, home, and other policies |

| Multi-Car | #2 | 20% | Insuring two or more vehicles |

| Good Student | #3 | 15% | Students with a 3.0 GPA or higher |

| Good Driver | #4 | 15% | Maintaining a clean driving record |

| Low Mileage | #5 | 12% | Driving fewer miles per year |

| Anti-Theft | #6 | 10% | Having anti-theft devices in a vehicle |

| Early Shopper | #7 | 10% | Buying a policy in advance |

| Loyalty | #8 | 10% | Staying with the same insurer over time |

| Defensive Driver | #9 | 8% | Completing an approved defensive driving course |

| New Car | #10 | 5% | Owning a recently purchased car |

In addition to insurance savings, you can also enjoy AAA rental car deals that make travel more affordable.

Whether you want to reduce your rates or take advantage of added perks, AAA delivers some of the best car insurance discounts available. Additionally, AAA’s membership provides access to emergency roadside assistance and savings on travel services.

Enter your ZIP code above to compare affordable premiums from AAA to begin saving today.

- Get up to 25% off with the best AAA car insurance discounts for safe drivers

- Enjoy savings for low-mileage driving and good credit with AAA discounts

- AAA offers discounts for high deductibles and driver safety courses

General Requirements for the Best AAA Car Insurance Discounts

AAA offers several ways to lower your car insurance premiums, but qualifying for the best AAA car insurance discounts depends on various factors. AAA provides a range of options for AAA auto coverage, ensuring drivers have affordable and comprehensive protection. The AAA auto insurance discount is one of the best ways to save on your premiums, particularly for safe and low-mileage drivers.

One of the best ways to save is through AAA car discounts, available for safe drivers and those with good credit. Students can also benefit from the AAA good student discount, which helps lower premiums for those with good grades. Drivers with good credit, a clean driving record, and low mileage typically receive the most significant savings.

Drivers with good credit or a clean driving record should take full advantage of AAA’s discounts. Adjusting mileage or raising your deductible can significantly lower premiums.

Daniel Walker Licensed Insurance Agent

The AAA good driver discount is offered to those who maintain a record free of accidents and violations. AAA also rewards those who choose higher deductibles, which reduce the insurer’s financial risk. Additionally, triple A insurance discounts help further reduce premiums for members who take proactive steps like increasing deductibles.

Another option for saving is the AAA multi-car discount, which allows members with more than one vehicle to reduce their premiums.

Good Credit

Many insurance agencies calculate your premium based on your credit score. AAA clubs typically pull a credit check before quoting a premium. The better your credit, the lower your premium. However, there are also the best car insurance companies that don’t use credit scores, offering options for those whose credit may not reflect their financial situation.

For most insurance providers, this is due to studies showing that individuals with poor credit are less likely to pay their policy premiums. Individuals who fail to pay policy premiums create a risk for the insurance company.

Reduce Coverage

AAA clubs often recommend reducing the coverage on older vehicles, which are usually not worth their insurance value. If you lower the coverage, your policy premiums will also be lower. As time goes on, your vehicle’s value decreases as well as the cost to fix it or replace it, so it might be worth it to lower the coverage.

Reduce Mileage

AAA clubs often offer discounts to individuals who drive less than the national average. You may qualify for the AAA-verified mileage discount if your annual mileage is below the national average, typically 10,000 miles. The national average is 10,000 miles a year. Instead of driving, try walking, riding your bike, or carpooling.

By making these changes, you will save money not only on your insurance policy but also on your gasoline consumption and wear and tear on your car.

Safe Drivers

AAA clubs typically reward safe drivers with discounts. The AAA safe driver discount is one of the primary ways to lower your insurance premiums, available for those with a clean driving record. Most driving records clear every three years, but it depends on the state and the infractions on the record.

However, if you have less than three points on your record, you usually qualify for a safe driver car insurance discount on your insurance policy. If you have the opportunity to clear up your driving record or avoid points due to a driving infraction, be sure to do so. Some programs can help you clear your record or remove points from it.

High Deductibles

AAA clubs can provide a discount in the form of a lower premium if you raise your car insurance deductible. The higher the deductible, the less the AAA club has to pay when you become involved in an accident.

Driver Safety Courses

Some AAA clubs offer discounts when members take approved driver safety courses. In addition to the AAA driver training discount, individuals who complete approved driver safety courses often see a reduction in their premiums. Taking part in an approved driving safety course can qualify you for the AAA driving course discount, which can reduce your premiums.

Individuals who enroll and complete a driver safety course receive a minimum of a five percent reduction in their premium cost. Defensive driving courses are run by state agencies as well as independent parties. Once your defensive driving course is complete, you will be eligible for a policy discount with your car insurance provider.

Drug Alcohol Awareness Testing

Teens who take the Drug Alcohol Awareness Testing usually receive a discount on the test from the AAA club. Teens are expensive to insure, so take advantage of a discount before they get their license.

In conclusion, qualifying for the best AAA car insurance discounts depends on your credit score, driving history, and even how much you drive. You can significantly lower your premiums by improving your credit, reducing your mileage, or opting for a higher deductible. AAA offers valuable options for new and experienced drivers looking to save on car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Additional Car-Related Discounts With an AAA Club Card

Some drivers purchase extended warranties on their vehicles to avoid expensive repair bills. Car warranties from the manufacturer usually cover major mechanical issues; however, many clauses and stipulations exist. AAA auto warranties can apply to repairs from a collision or if your car will no longer start. AAA club members can also often get their cars financed through the club.

Now that AAA clubs are expanding into car loan financing, you should be able to get even more out of your membership. In addition to insurance discounts, AAA members can enjoy savings on a wide range of products and services, including hotels, amusement parks, shopping, restaurants, roadside assistance, etc. Members can access various AAA automotive discounts covering repairs, parts, and more.

You can find more information on financial matters and banking regulations via the Federal Reserve’s website. If you insure your vehicle through an AAA club, you can access these discounts and further enhance the value of your membership. For a detailed evaluation, check out the AAA car insurance review to see how the company stacks up against others.

Becoming an AAA club auto insurance policyholder not only saves you money on your car insurance but also on the many other products and services for which AAA is known. The AAA membership discount is a great way to maximize savings, providing access to numerous benefits, including insurance reductions.

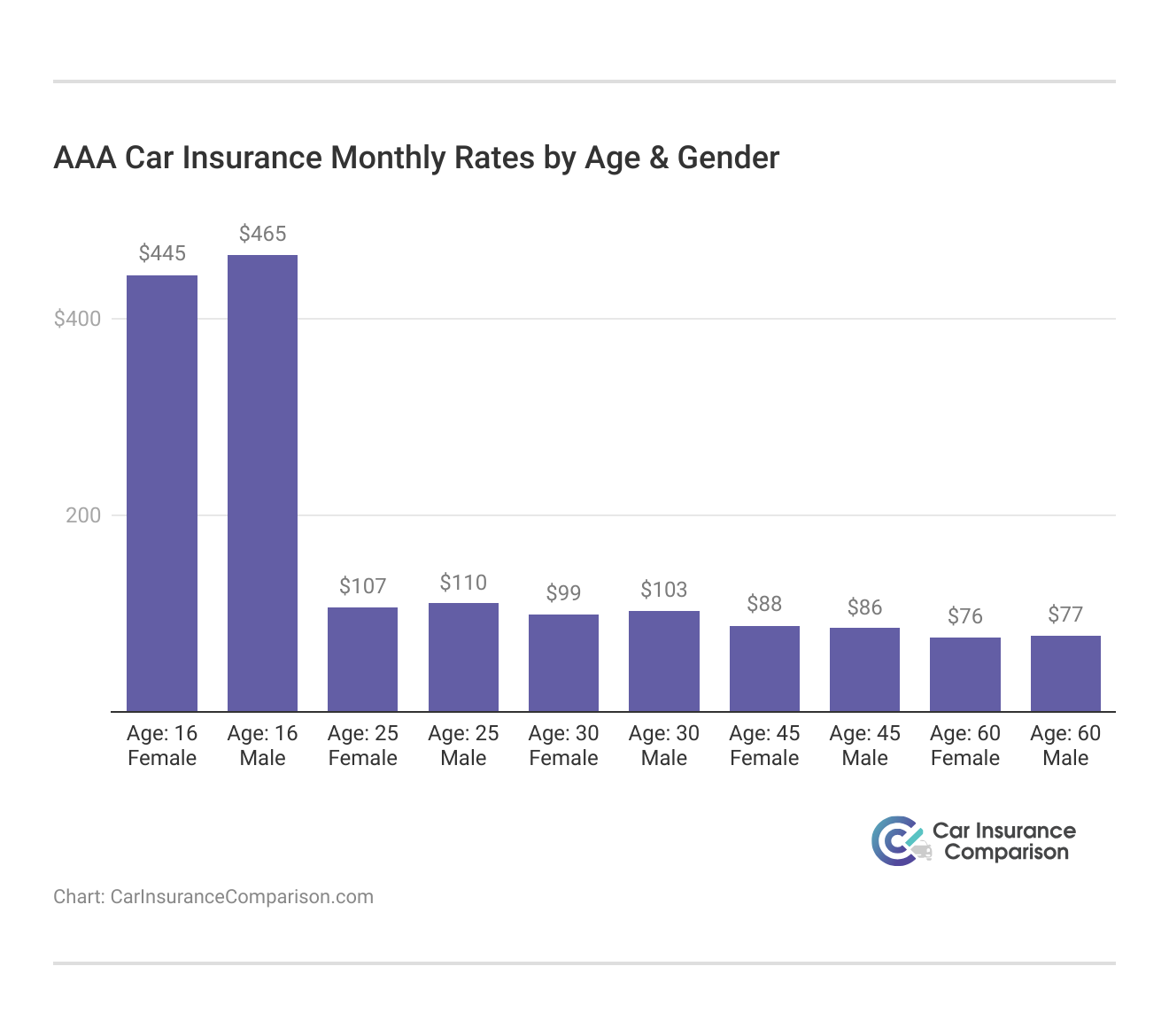

AAA Car Insurance Rates by Age & Gender

Regarding car insurance, age and gender can significantly impact the rates you’ll pay. AAA’s pricing structure reflects these factors, with younger drivers generally facing higher premiums. As drivers age, rates typically decrease, with males under 25 often paying more than their female counterparts.

The following chart illustrates AAA’s monthly average car insurance rates by age and gender, providing a clearer view of how premiums fluctuate across different demographic groups:

The table shows that younger drivers, particularly those aged 16, face some of the highest insurance premiums. However, drivers often enjoy lower rates as they age and maintain a clean driving record. It’s important to consider these factors when seeking the best AAA car insurance discounts to maximize savings on your premium.

Car Insurance Companies Associated With AAA Clubs

Although AAA clubs don’t have partnerships with major car insurance companies, you can use this membership to lower car-related expenditures. For instance, you can use the AAA roadside assistance program instead of adding this feature to your existing car insurance policy.

If you have to pay a deductible, your AAA club membership can be used to offset your replacement auto parts bill.

To get a substantial discount on your car insurance with your AAA club membership, you will need to purchase an auto insurance policy through the AAA club. Other insurance products, like homeowners coverage, are also typically offered by AAA clubs. If you’re considering ending your membership, here’s how to cancel your AAA membership and explore other options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways an AAA Membership Can Help Reduce Your Car Insurance Premiums

If you buy an AAA club membership, you will likely be better able to finance all emergency car-related expenses. Additionally, you won’t have to sign up for most of the optional programs available from your car insurance company. You will have lower rates by purchasing a standard car insurance policy for auto insurance.

Some consumers do not feel that AAA club memberships are of good value simply because they have never needed to make use of their services. Many years ago, AAA clubs only offered basic emergency roadside assistance programs. You can go to them first before consulting with your car insurance agent now that these clubs also provide the following:

- Extended Warranty Programs

- Finance Options

- Car Repair Services

Motorists who only own one car or those who have recently purchased a brand-new vehicle might not benefit from an AAA club membership. However, suppose you have several drivers on your policy and you insure two or more cars. In that case, your auto insurance premiums can go down continuously as a result of making use of your AAA club membership.

Case Studies: Real-Life Examples of AAA Car Insurance Discounts in Action

AAA offers a variety of discounts that can significantly reduce your car insurance premiums. The following case studies showcase how different drivers have successfully utilized these discounts to lower their rates, from safe driving to good credit.

- Case Study #1 – Safe Drivers Discount: John, a member of AAA, was rewarded with a safe driver discount on his car insurance policy after maintaining a clean driving record with no traffic violations or accidents for the past three years. As a result, he qualified for a discount, saving money while keeping comprehensive coverage.

- Case Study #2 – Good Credit Discount: Samantha benefited from her excellent credit score, which allowed her to secure a lower premium for her car insurance policy. AAA calculates premiums based on credit ratings, and Samantha’s responsible financial habits demonstrated her trustworthiness, resulting in significant savings.

- Case Study #3 – Reduce Mileage Discount: David reduced his mileage to below the national average of 10,000 miles per year, qualifying for a mileage discount on his car insurance. By choosing to walk, bike, or carpool, he saved on his insurance premiums while also cutting fuel costs and reducing wear and tear on his vehicle.

- Case Study #4 – High Deductible Discount: Emily opted for a higher car insurance deductible on her car insurance policy, assuming more financial responsibility in the event of an accident. In return, AAA provided her with a discount, allowing her to lower her monthly payments while still maintaining coverage for significant incidents.

- Case Study #5 – Driver Safety Course Discount: Mark completed an approved driver safety course and received a minimum of a five percent reduction in the cost of his car insurance policy. The defensive driving course improved his skills and helped him save on his premiums.

These members successfully reduced their insurance premiums by leveraging AAA’s various discounts. Whether through safe driving, maintaining good credit, or choosing higher deductibles, AAA offers multiple ways for members to save on car insurance.

AAA's discounts, from safe driving to good credit, offer drivers real opportunities to lower their premiums. By strategically using these options, members can save significantly, making AAA an excellent choice for those who want to reduce insurance costs without sacrificing coverage.

Dani Best Licensed Insurance Producer

These discounts can lead to significant long-term savings, making AAA an excellent choice for drivers looking to reduce their insurance costs. Taking advantage of these offers ensures you’re getting the most value out of your policy while keeping your premiums low.

Unlocking Savings With AAA Car Insurance Discounts

Drivers can significantly lower their premiums by strategically taking advantage of the best AAA car insurance discounts, including those for the best low-mileage car insurance.

Whether it’s through maintaining a clean driving record, leveraging good credit, reducing mileage, or opting for higher deductibles, AAA offers a variety of opportunities to save. Additionally, membership provides valuable perks like roadside assistance and discounts on travel and auto-related services.

With AAA, drivers not only gain affordable insurance options but also access to exclusive benefits that can enhance their overall savings. Comparing quotes and understanding which discounts apply to your profile can help you maximize your savings and secure the best possible rate. With our free quote comparison tool, you can easily find quotes from top providers in your area by simply entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What car insurance discounts does AAA offer?

AAA car insurance discounts go to safe drivers, good credit, reduce mileage, and more. AAA also offers discounts on other products like hotels, rental cars, and amusement parks to AAA club members.

How can I compare AAA car insurance quotes?

To get AAA car insurance quotes online and from other top companies, you can use the free quote tools.

What discounts are available for good credit?

AAA clubs typically calculate your premium based on your credit. The better your credit, the lower your premium is likely to be. Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

How can reducing coverage lower my premiums?

AAA clubs often recommend reducing coverage on older vehicles that may not be worth their insurance value. By lowering the coverage, your policy premiums can also be lower.

How does AAA’s roadside assistance work with my car insurance?

AAA’s roadside assistance is a valuable membership benefit that provides coverage for emergency services such as flat tire changes, battery jump-starts, towing, and lockout assistance. If you already have AAA car insurance, you may not need to add roadside assistance to your policy, as it is included in your membership. Check out more information on our “Does car insurance cover tire blowouts?”

Do AAA clubs offer discounts for low mileage?

Yes, AAA clubs often offer discounts to individuals who drive less than the national average, around 10,000 miles per year.

Can I use AAA discounts with other car insurance policies?

AAA discounts are typically available when you purchase car insurance through AAA clubs. However, membership discounts on services like roadside assistance or travel benefits can be used independently of your car insurance policy, even if you’re with another insurer.

Are AAA car insurance discounts available for young drivers?

AAA offers several discounts for young drivers, including the good student discount for those maintaining a certain GPA, the good driver discount for those with clean driving records, and discounts for teens who complete drug and alcohol awareness programs. These benefits help make cheap car insurance for young drivers more accessible.

How can I qualify for AAA’s military discount on car insurance?

AAA offers a military discount to active-duty military members. To qualify, you’ll need to provide proof of military service, which may include a service ID or a copy of your military orders. This discount can help reduce your premiums as a military member. Enter your ZIP code into our free comparison tool to find the most affordable rates for your vehicle.

Does AAA offer any discounts for hybrid or electric vehicles?

Yes, AAA often offers discounts for drivers of hybrid and electric vehicles due to their lower environmental impact. These discounts can vary by state or region, so it’s best to check with your local AAA club for specific details and eligibility requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.