10 Best Car Insurance Companies in 2026

Progressive, USAA, and Geico are the best car insurance companies for drivers. At Progressive, minimum coverage averages $39/mo. The top 10 car insurance companies all offer great coverage options and plenty of saving opportunities. For example, Geico offers up to 22% off insurance for good drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated December 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsProgressive, USAA, and Geico are the best car insurance companies on the market.

If you want to buy cheap car insurance coverage from the top 10 car insurance companies, take a look at the list below.

Our Top 10 Picks: Best Car Insurance Companies

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Options | Progressive | |

| #2 | 23% | A++ | Military Focus | USAA | |

| #3 | 22% | A++ | Good Drivers | Geico | |

| #4 | 21% | A+ | Pay-Per-Mile Rates | Allstate | |

| #5 | 20% | B | Agent Network | State Farm | |

| #6 | 19% | A+ | Flexible Payments | Nationwide |

| #7 | 18% | A | Customizable Policies | Liberty Mutual |

| #8 | 17% | A | Family Plans | Farmers | |

| #9 | 16% | A++ | Business-Use Coverage | Travelers | |

| #10 | 15% | A+ | Customer Satisfaction | Erie |

Read on to learn more about the top 10 best car insurance companies. Or, enter your zip code now to get car insurance quotes.

- Progressive, USAA, and Geico are some of the top ten car insurance companies

- A good company will have good ratings concerning claims payout

- The best insurance company for you depends on your budget and coverage needs

#1 – Progressive: Top Pick Overall

Pros

- Comprehensive Options: Learn about Progressive’s insurance options in our Progressive review.

- Online Tools: Progressive offers a number of online tools that are useful to customers, such as a budgeting tool.

- Competitive Rates: Progressive’s rates are usually competitive for most drivers.

Cons

- Snapshot Rates: It’s important to note that Progressive’s usage-based discount could raise rates for poor drivers.

- Customer Reviews: There are some negative claims handling reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Focus

Pros

- Military Focus: USAA sells exclusively to military and veterans.

- Exceptional Service: Our USAA review covers USAA’s high customer service ratings.

- Non-Auto Insurance Discounts: USAA members can save on various products with their membership.

Cons

- Eligibility: While USAA is one of the best companies on the market, its customer eligibility is limited.

- Physical Branch Locations: USAA operates mostly online.

#3 – Geico: Best for Good Drivers

Pros

- Good Drivers: Geico has some of the most competitive rates on the market for good drivers.

- Availability: Geico is sold in every state. Read our Geico car insurance review for more details about the company.

- Coverage Options: Provides various coverage types, such as roadside assistance.

Cons

- Claim Handling: A few negative reviews have mentioned slow claims processing.

- Personalized Service: Geico has less personalized service due to a lack of local agents and a focus on online processing.

#4 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: An affordable option for low-mileage drivers.

- Digital Tools: Allstate’s mobile app is great for managing policies and claims.

- Coverage Options: There are plenty to choose from for all drivers. Learn more in our Allstate review.

Cons

- Complaint Ratio: Allstate has a higher complaint ratio than its competition.

- High-Risk Rates: Alsltate’s rates are less competitive for drivers with multiple violations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Agent Network

Pros

- Agent Network: Most customers will be able to easily find an agent near them, thanks to State Farm’s vast network of agents.

- Financial Rating: State Farm is one of the top-rated companies for its financial management.

- Availability: Purchase coverage in any state. Learn more about the company in our State Farm review.

Cons

- Credit Score Ratings: State Farm charges more for bad credit scores in some states.

- Accident Forgiveness: It is easier to get accident forgiveness at companies other than State Farm.

#6 – Nationwide: Best for Flexible Payments

Pros

- Flexible Payments: You can pay in full or monthly, and there are several payment options.

- Vanishing Deductible: A great way for safe drivers to save over time. Our article on Nationwide discounts discusses more ways to save, too.

- Coverage Options: Car owners will have plenty of choices for their vehicles.

Cons

- Availability: Some states won’t have Nationwide coverage for sale.

- High-Risk Rates: Rates are less competitive at Nationwide for higher-risk drivers with violations.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual makes it easy to customize a policy based on your coverage needs and budget.

- Organization Discounts: Get discounts if you belong to certain organizations.

- 24/7 Service: Representatives are available at any time. Learn more in our Liberty Mutual review.

Cons

- High-Risk Rates: Liberty Mutual’s rates are less competitive for higher-risk customers.

- Claim Processing: Not always favorably rated by consumers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Family Plans

Pros

- Family Plans: Multi-vehicle discounts make Farmers ideal for families.

- On Your Side Review: If you aren’t 100% happy with your policy, you can work with a representative every year.

- Discount Options: There are plenty of opportunities to save on auto insurance policies.

Cons

- Average Rates: Liberty Mutual’s rates can be pricier, especially for higher-risk drivers. Learn more by reading our Farmers review.

- Customer Reviews: Negative reviews focus on poor or slow claims handling.

#9 – Travelers: Best for Business-Use Coverage

Pros

- Business-Use Coverage: Travelers offers commercial auto insurance for vehicles used for business.

- Availability: Travelers is sold in all but a select few states.

- Discount Variety: There are plenty of saving opportunities for drivers.

Cons

- IntelliDrive Rate Increases: Travelers can raise rates for poor driving in its discount program.

- Customer Service: Not always highly rated by customers. Learn more in our Travelers review.

#10 – Erie: Best for Customer Satisfaction

Pros

- Customer Satisfaction: Highly rated by most customers. Learn more in our Erie review.

- Coverage Options: There are plenty of options for auto insurance on vehicles.

- Accident Forgiveness: Some customers will qualify to avoid rate increases.

Cons

- Availability: Not widely available in the U.S.

- Discount Availability: Some states may offer fewer discounts to customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Top Car Insurance Companies

Why are these the top 10 car insurance companies? The top 10 care insurance companies were determined by how many policies each company has written and how many claims each company successfully paid to their policyholders, as well as their policy perks and average rates.

This information is collected from insurance companies and through rating companies such as A.M. Best and Standards & Poor’s.

An insurance company that continues to grow each year because they are writing more policies tends to be financially strong, which is an important element when choosing an insurance company.

In addition, companies that experience growth have a good reputation, and people want to do business with companies that have a good reputation.

You also want to choose a company that has a strong claims payment rating. If you have an accident, your insurance company is going to be more likely to pay your claim. Now, it is important to note that none of these ratings are based on the affordability of each company.

Buying Insurance From the Top 10 Car Insurers

Should I buy my insurance from one of the top 10 car insurance companies? Here are some things to consider, however. For example, Allstate is well known for being the more expensive choice for auto insurance.

View this post on Instagram

Some of the other companies don’t sell insurance in every state, making it impossible for some people to consider them.

Just because a company isn't a top 10 car insurance company doesn’t mean that it isn't an excellent choice. Sometimes, a local company can offer a better deal than a nationwide brand.

Brandon Frady Licensed Insurance Agent

With over 100 auto insurance companies in the US, you don’t have to choose from the top 10 list to make a good choice. The bottom line is that if you choose one of the companies on the top 10 list, then you are likely, but not guaranteed, to be happy with your entire experience.

Rates at the 10 Best Car Insurance Companies

Is there a most affordable top 10 car insurance company list? Below, you can see the rates for different coverage options at the top ten companies.

Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| Erie | $22 | $58 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $22 | $59 |

| USAA | $37 | $99 |

If you want to see exactly how much auto insurance will cost you at the 10 best auto insurance companies, you can get quotes directly from sites like Progressive.

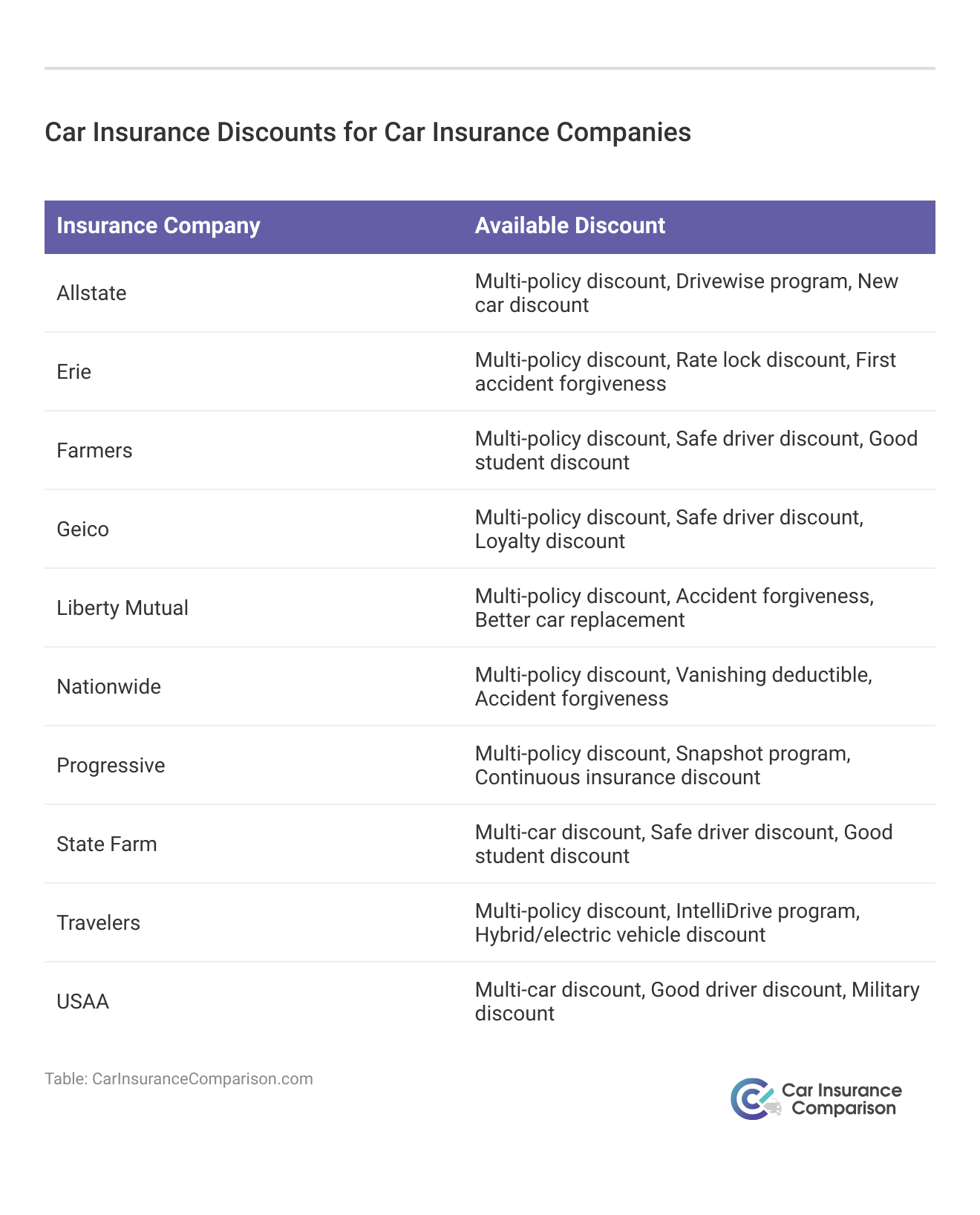

You will also find the following car insurance discounts at the 10 best insurance companies.

Of course, definitions of cheap car insurance are subject to opinion and income, so it’s helpful to use our free quote tool and get quotes from the companies that have the most affordable plans for you.

The Final Word on the Top 10 Car Insurance Providers

Now that you know the answer to what are the top 10 auto insurance companies, you can start comparing quotes and coverages to find the right match for you (learn more: How do you get competitive quotes for car insurance?).

Ready to start shopping at top-ranked auto insurance companies? Enter your zip code right now and get your online car insurance quotes.

Frequently Asked Questions

What are the 10 best car insurance companies in the US?

Some of the top car insurance companies in the US include State Farm, Allstate, Travelers, and Nationwide. Comparison shopping may reduce your rates by up to 20%.

Why are these the top 10 car insurance companies?

The top 10 car insurance companies were determined based on the number of policies each company has written and the successful claims payments made to their policyholders (read more: How do you file a car insurance claim?). This information is collected from insurance companies and rating companies such as A.M. Best and Standards & Poor’s.

Should I buy my insurance from one of the top 10 car insurance companies?

While the top 10 car insurance companies are reputable choices, it’s important to consider factors such as affordability and availability. Some companies on the list may be more expensive or not available in certain states. It’s also worth noting that there are over 100 auto insurance companies in the US, and you can find excellent choices outside of the top 10 list.

How can I compare car insurance quotes and find the most affordable plans?

To compare car insurance quotes and find the most affordable plans from the top 10 auto insurance companies, you can use a free quote tool. Enter your ZIP code to get quotes from various companies. By comparing quotes, you can find the companies that offer the most affordable plans for your specific needs and circumstances.

How reliable is the information provided by the Insurance Information Institute (III)?

The Insurance Information Institute (III) is a reputable organization dedicated to providing reliable information about insurance trends. The III collects data from insurance companies and rating agencies to determine the top 10 car insurance companies based on written policies and claims payments.

While the information is based on reliable sources, it’s important to conduct your own research and consider other factors, such as customer reviews and minimum car insurance required by states, when choosing an insurance company.

Is State Farm cheaper than Liberty Mutual?

State Farm is cheaper on average than Liberty Mutual. Learn more in our State Farm vs. Liberty Mutual car insurance comparison.

Who is cheaper, Geico or Progressive?

Geico has cheaper rates on average than Progressive.

Who has to pay the most for car insurance?

High-risk drivers like teenagers or DUI drivers will pay the most for car insurance from the top 10 auto insurers (learn more: Best Car Insurance for High-Risk Drivers).

What is the best car insurance coverage?

The best coverage from the 10 top auto insurance companies is full coverage (learn more: Best Full Coverage Car Insurance).

How can I save on insurance from a top 10 auto insurance company?

Having a good driving record will go a long way to getting affordable rates at the top 10 car insurance companies. You can also apply for discounts, comparison shop, and adjust your deductibles.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.