10 Best Commercial Car Insurance Companies in 2025

Discover the best commercial car insurance companies with Progressive, State Farm, and Allstate, offering competitive rates starting at just $32 monthly. These providers excel in the industry by combining comprehensive coverage options, exceptional customer service, and affordable pricing to meet diverse business needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tonya Sisler

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Insurance Content Team Lead

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Commercial Car

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Commercial Car

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Commercial Car

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe top picks among the best commercial car insurance companies are Progressive, State Farm, and Allstate, with Progressive leading the pack due to its unbeatable affordability and comprehensive coverage.

Commercial auto insurance covers a vehicle you use for business purposes. It operates similarly to your policy with a few exceptions. With the rise of food delivery, online shopping, and rideshare apps, commercial insurance is more important than ever. However, understanding your car insurance policy needs can be confusing.

Our Top 10 Picks: Best Commercial Car Insurance Companies

| Company | Rank | Fleet Discount | Safety Training Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 20% | Comprehensive Coverage | Progressive | |

| #2 | 10% | 15% | Customer Service | State Farm | |

| #3 | 12% | 18% | Policy Options | Allstate | |

| #4 | 18% | 25% | Multi-Policy Discounts | Nationwide |

| #5 | 20% | 15% | Customizable Policies | Travelers | |

| #6 | 15% | 20% | Online Convenience | Liberty Mutual |

| #7 | 25% | 30% | Bundle Discounts | The Hartford |

| #8 | 10% | 15% | Local Agents | Farmers | |

| #9 | 15% | 20% | Big Discounts | American Family | |

| #10 | 20% | 25% | 24/7 Support | AAA |

If you’re looking for rates from the best commercial auto insurance companies, you should explore quotes from as many companies as you can. If you’re ready to see what quotes might look like for you, enter your ZIP code into our free tool today.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Fleet Discount: Offers a 15% discount for fleet vehicles. Learn more in our Progressive car insurance review.

- Safety Training Discount: Provides a substantial 20% discount for implementing safety training.

- Broad Coverage: Known for comprehensive coverage options that suit various business needs.

Cons

- Higher Base Rates: Despite discounts, baseline premiums can be high.

- Complex Policies: Coverage options might be complex for new policyholders to navigate.

#2 – State Farm: Best for Customer Service

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored to different business needs. See more details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#3 – Allstate: Best for Policy Options

Pros

- Policy Variety: Offers a wide array of policy options for different types of businesses.

- Fleet and Safety Discounts: Good discounts with 12% for fleet and 18% for safety training.

- Customizable Policies: Allows extensive customization of policies. More information is available about this provider in our Allstate car insurance review.

Cons

- Price Point: Can be expensive compared to some competitors.

- Claim Process: Some users report slower claim processing times.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Multi-Policy Discounts

Pros

- Highest Fleet Discount: Offers an 18% discount on fleet vehicles, the highest among the listed companies.

- Strong Safety Training Discount: Offers a 25% discount for safety training. Discover more about offerings in our Nationwide car insurance discounts.

- Multi-Policy Savings: Excellent for multiple policy discounts.

Cons

- Customer Service Variability: Service quality can vary significantly by location.

- Policy Clarity: Some customers may find policy terms and benefits confusing.

#5 – Travelers: Best for Customizable Policies

Pros

- Customizable Policies: Highly customizable policies suitable for various business sizes.

- Strong Fleet Discount: Offers a competitive 20% discount for fleets.

- Focused on Industries: Best for industry-specific coverage needs. Check out insurance savings in our complete Travelers car insurance review.

Cons

- Higher Premiums for Certain Risks: Can be more expensive for high-risk industries.

- Complexity in Policy Adjustments: Adjusting policies can be less straightforward.

#6 – Liberty Mutual: Best for Online Convenience

Pros

- Online Management: Strong focus on online tools and management ease. Access comprehensive insights in our Liberty Mutual car insurance review.

- Fleet and Safety Training Discounts: Competitive discounts of 15% and 20% respectively.

- Broad Acceptance: Covers a wide range of business types and vehicle models.

Cons

- Customer Support: Online focus can detract from personalized service.

- Pricing Strategy: Premiums can be less competitive without discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – The Hartford: Best for Bundle Discounts

Pros

- High Bundle Discounts: Offers the highest bundle discounts at 25%. Read up on The Hartford car insurance discounts for more information.

- Extensive Fleet Discount: Provides a 30% discount for fleet vehicles, the highest offered.

- Targeted Business Solutions: Excellent for businesses looking for comprehensive bundle policies.

Cons

- Limited Availability: Not as widely available as some other insurers.

- Complex Product Offerings: Some offerings can be complex and require detailed understanding.

#8 – Farmers: Best for Local Agents

Pros

- Local Agent Network: Strong local presence with dedicated agents. Delve into our evaluation of Farmers car insurance review.

- Customizable Policies: Good for businesses seeking tailored coverage.

- Consistent Discounts: Offers steady discounts for fleets and safety training.

Cons

- Inconsistency in Service: Service quality can vary depending on the local agent.

- Pricing: This can be more expensive than online-first companies.

#9 – American Family: Best for Big Discounts

Pros

- Aggressive Discounts: Offers competitive discounts for fleets and safety training.

- Broad Policy Options: Wide range of policy options for different business needs.

- Customer-Oriented: Focuses heavily on customer satisfaction. Unlock details in our American Family car insurance review.

Cons

- Limited Reach: Not available in all states.

- Policy Complexity: Some policies can be complex and require careful consideration.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for 24/7 Support

Pros

- Round-the-Clock Support: Offers 24/7 support to all customers. Discover insights in our AAA car insurance review.

- Significant Safety and Fleet Discounts: Strong discounts at 25% and 20% respectively.

- Comprehensive Coverage: Provides robust coverage across many types of vehicles.

Cons

- Membership Requirement: Requires AAA membership, which could be an extra cost.

- Varied Service Quality: Service quality can vary depending on the region.

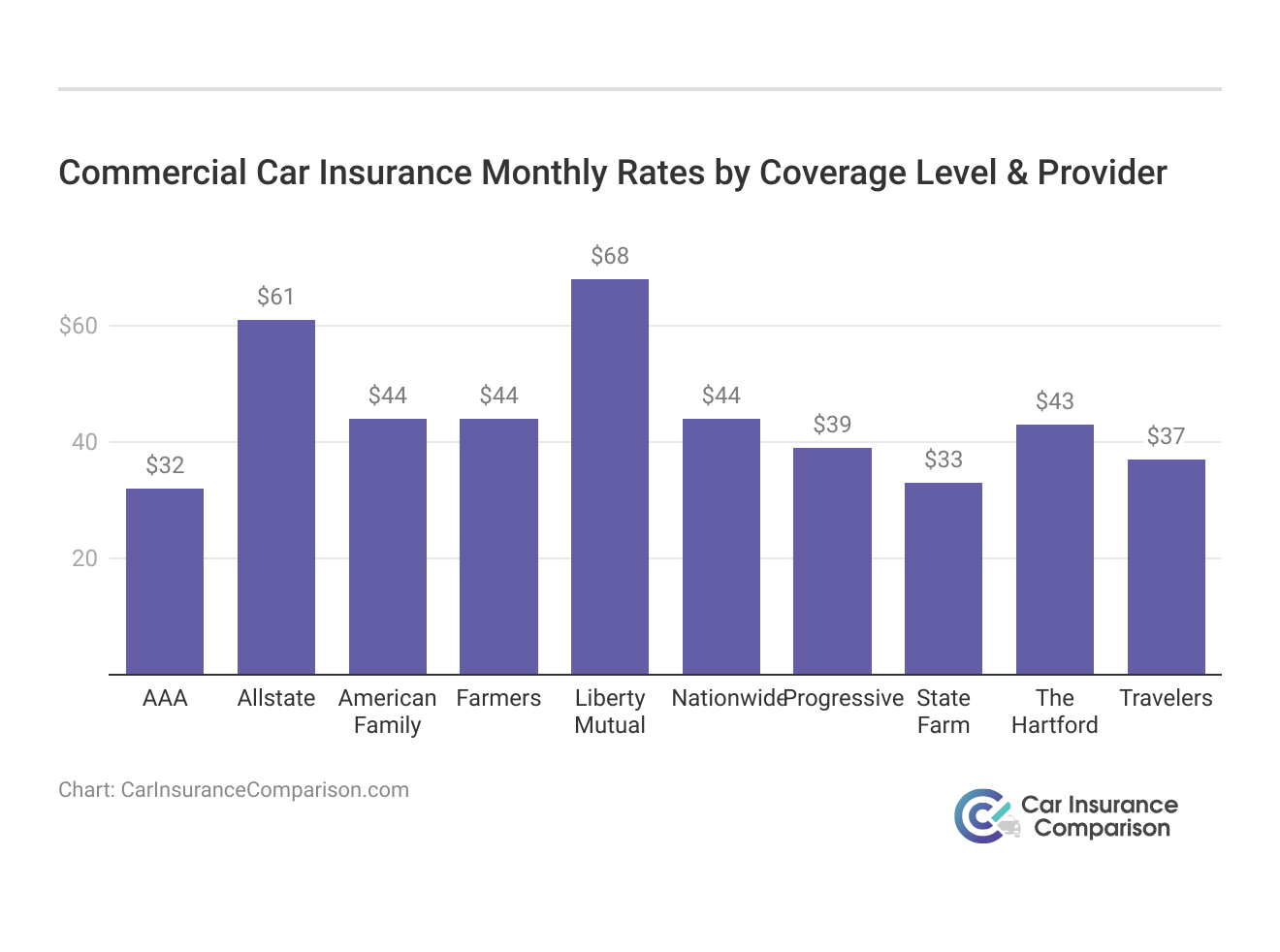

Exploring Commercial Car Insurance Coverage Rates

When it comes to commercial car insurance, understanding the variations in coverage rates is paramount. We’ve compiled the average monthly rates for both full and minimum coverage from the top commercial car insurance companies, shedding light on the financial considerations businesses face.

Commercial Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $37 | $99 |

In the realm of full coverage, Progressive leads with a competitive rate of $105, closely followed by Travelers at $99. State Farm and AAA share the spotlight with equally appealing rates of $86 each. Allstate, while providing comprehensive coverage, reflects a slightly higher cost at $160 per month.

For those seeking minimum coverage, State Farm and AAA stand out with the most budget-friendly options, both offering a monthly rate of $33. Travelers follows closely at $37, while Nationwide and Hartford provide economical choices at $44 and $43, respectively.

These figures underscore the importance of carefully assessing your business’s insurance needs and budget constraints. Whether opting for robust protection or adhering to minimum requirements, these rates provide valuable insights for businesses seeking cost-effective and reliable commercial car insurance solutions. For more information, read our “The Top 97 Most Reliable Vehicles (Updated).”

Read more:

The Best Commercial Car Insurance Companies

As with all other types of insurance, the company that will give you the best rates depends on what you need to be covered. For example, the best car commercial insurance company for limo service drivers won’t necessarily be the best company for rideshare drivers.

Progressive stands out with unbeatable affordability, comprehensive coverage, and a fleet discount, making it the top choice for cost-effective and tailored commercial car insurance solutions.

Dani Best Licensed Insurance Producer

More importantly, you need commercial car insurance. Delivery driver consistently ranks among the top 10 most dangerous jobs, and insurance can help protect you from those dangers.

Most of the big insurance companies offer commercial insurance. Each company has its own distinct rates, discounts, and eligibility requirements. To find the right commercial auto insurance quote for you, you should start by comparing companies.

Progressive Commercial Auto Insurance

Progressive has made a name for itself as a provider of affordable car insurance. In fact, Progressive is consistently ranked one of the top companies for trucking insurance. Progressive’s commercial car insurance covers:

- Cars, Light Trucks, SUVs, and Vans

- Food Trucks

- Tractor Trailers

- Dump Trucks

Read more:

- Food Truck Car Insurance: Compare Rates, Discounts, & Requirements

- How To Insure Commercial Trucks for Personal Use

A commercial policy from Progressive allows you to drive as many miles as your business needs without paying higher rates. You can buy liability, underinsured/uninsured motorist, collision, comprehensive, and medical payments coverage.

Progressive also offers coverage that not every company does, including non-owned commercial, auto, and hired auto. This ensures that your employees are covered for business driving whether they are in their own cars or vehicles you own.

One last advantage of Progressive is that you can change your coverage when you need to, and this might be helpful if you have some seasons that are busier than others.

You can also check your eligibility for the following discounts:

- Safe Driving

- Bundling

- Autopay

- Pay in Full

- Business Experience

You need to speak with a Progressive agent to get a quote for your specific needs and to sign up for a policy. You can speak with an agent 24 hours a day online or by phone.

Geico Commercial Auto Insurance

Geico’s personal insurance consistently receives high ratings for affordability, availability, and customer satisfaction, and the same goes for its commercial insurance. For business use, Geico covers:

- Cars, Pickup Trucks, and Vans

- Service Utility Vehicles

- Box Trucks

- Food Trucks

However, Geico does not cover semi-trucks and tractor-trailers. For the vehicles it does cover, you can buy liability, physical damage, uninsured/underinsured motorist, collision, and personal injury coverage.

You can work with an agent to customize the exact amount of coverage you need.

Geico is a great option for caterers, landscapers, contractors, and anyone else who spends at least part of their working hours behind the wheel of a car. There is one exception to that — Geico recommends its rideshare insurance for people who drive for rideshare apps.

Nationwide Commercial Auto Insurance

Nationwide offers very affordable rates for commercial car insurance. It depends on your unique situation, but you’re likely to find a good price with Nationwide. The following vehicles can get coverage:

- Cars, Pickup Trucks, and Vans

- Cargo Vans

- Box Trucks

- Utility Trucks

Nationwide does not cover semi-trucks or tractor-trailers with its commercial insurance. Coverage is available in 48 states and Washington DC. Residents of Massachusetts and Louisiana need to look elsewhere.

You can purchase liability, uninsured/underinsured motorist, personal injury protection, GAP coverage, roadside assistance, new car replacement, rental reimbursement, and medical payments coverage.

Nationwide offers a lot of discounts for commercial insurance, including:

- Bundling

- Pay in Full

- Hybrid Vehicles

- Anti-Theft Devices

Nationwide has high customer satisfaction ratings, and you can easily obtain a quote online. However, you need to speak directly with an agent to purchase a policy. You can also submit claims over the phone.

Travelers Commercial Auto Insurance

When it comes to commercial insurance, Travelers writes the second-highest number of policies in America. Travelers is frequently listed as a great option for industries that are heavily regulated and for larger companies. If you’re a smaller company, you might want to look somewhere else.

With Travelers, you can buy liability, uninsured/underinsured motorist, comprehensive, collision, and physical damage insurance. However, Travelers does not offer personal injury protection like many other insurance companies do.

Regardless of the type of vehicle you want to insure, Travelers is a great choice for fleets (which it considers five or more cars). It also offers insurance for specific industries, insuring buses and police cars, for instance.

There are also several other coverages you can purchase:

- Non-Owners

- Cargo Coverage

- Lifetime Repairs Guarantee

One of the most unique parts of Travelers’ commercial insurance is the industry-specific options available. Travelers offers some of the best commercial insurance for car haulers, agribusiness, construction, equipment haulers, food service, retail, and transportation services.

Other Companies That Offer Commercial Insurance

While the above companies earn higher reviews for commercial insurance, there are plenty of other options out there for you. These include:

- State Farm

- The Hartford

- Farmers

- Liberty Mutual

- Allstate

- American Family

There are so many options for commercial insurance that it’s important to look at as many insurance companies as possible. Without shopping around, you may be missing out on valuable savings for your business.

Read more:

- Geico vs. The Hartford Car Insurance Comparison

- Liberty Mutual vs. Travelers Car Insurance Comparison

- Progressive vs. Farmers Car Insurance Comparison

- Progressive vs. Travelers Car Insurance Comparison

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Much Does Commercial Car Insurance Cost

Like any other insurance, you’ll need to work with an agent to get the very best price possible. However, you can start by looking at national averages for a monthly commercial car insurance quote.

- Commercial Car Insurance: $167

- Taxi Insurance: $625

- Tractor-Trailer: $208

- Truck Insurance: $117

- Bus Insurance: $2,917

However, there are a lot of options available to you when it comes to affordable commercial auto insurance.

Learn more: Compare Taxi Cab Insurance Rates

Case Studies: Navigating Commercial Car Insurance Challenges

This collection of case studies delves into the practical challenges and solutions encountered by different businesses navigating the complexities of commercial car insurance. It highlights how tailored insurance solutions can effectively meet diverse coverage needs and budget constraints.

- Case Study #1 – Cost-Effective Comprehensive Coverage: For a small delivery service seeking cost-effective yet comprehensive insurance, Progressive emerged as the ideal choice. With a fleet of vehicles, the challenge was balancing extensive coverage needs within a limited budget. Progressive’s competitive average monthly rate of $105 for full coverage, coupled with a fleet discount.

- Case Study #2 – Safety-Focused Business Seeking Affordability: In the case of a local construction company prioritizing safety initiatives, the challenge was to find insurance that aligns with its safety-focused approach while maintaining affordability. State Farm proved to be the perfect solution, offering a safety training discount of up to 15% and a competitive full coverage rate of $86 per month.

- Case Study #3 – Budget-Conscious Business Prioritizing Minimum Coverage: For a startup rideshare service with a limited budget, the priority was to meet insurance requirements while minimizing costs. AAA emerged as the budget-conscious choice, providing a minimum coverage rate of $32 monthly. With 24/7 support, a safety training discount, and a reputation for a wide range of services.

These case studies illustrate that with careful consideration and strategic selection of insurance providers, businesses can secure suitable commercial car insurance that aligns with their operational priorities and financial limits. This ensures both compliance and protection cost-effectively. Learn more in our “Compare Commercial Car Insurance: Rates, Discounts, & Requirements.”

Find the Best Commercial Car Insurance for Your Business

Commercial car insurance is vital for businesses that depend on the use of vehicles. Without insurance, your company could face serious lawsuits from anyone involved in an accident with one of your vehicles. See more details on our “The Best Car Insurance Commercials.”

While there are plenty of options, finding quotes from the best commercial car insurance companies requires shopping around. If you’re ready to see what quotes might look like for you, enter your ZIP code into our free tool today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How do the coverage rates compare among the top commercial car insurance companies?

Coverage rates vary among top companies. For full coverage, Progressive offers a competitive rate of $105, followed closely by Travelers at $99. State Farm and AAA lead in minimum coverage, both offering a budget-friendly $33 per month.

For additional details, explore our comprehensive resource titled “How often should you check car insurance quotes?“

What factors influence commercial car insurance rates?

Commercial car insurance rates are influenced by various factors, including your credit score, mileage, coverage level, and driving history. Companies like Progressive, State Farm, and Allstate consider these elements when determining your insurance premiums.

What distinguishes the top three companies – Progressive, State Farm, and Allstate?

Progressive stands out for competitive rates and comprehensive coverage. State Farm excels in customer service and safety focus, while Allstate offers versatile policy options with competitive pricing.

How important is it to consider both full and minimum coverage rates for commercial car insurance?

It’s crucial to consider both full and minimum coverage rates to align with your business’s needs and budget. State Farm and AAA offer budget-friendly options for minimum coverage, while Progressive and Travelers provide competitive rates for comprehensive protection.

What types of discounts do these companies offer to businesses?

Top companies provide various discounts, such as fleet discounts, safety training discounts, and multi-policy discounts. For instance, Nationwide offers up to 18% fleet discount and up to 25% safety training discount.

To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

Which companies offer the best auto commercial insurance?

The best providers, such as Progressive and State Farm, stand out for their competitive pricing, extensive coverage options, and excellent customer support tailored to business needs.

Where can I get affordable commercial car insurance?

Providers like Progressive, State Farm, and Allstate offer competitive pricing with various discounts. Start by getting personalized quotes from these companies to find the best rates.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Which company offers the best auto commercial insurance?

Progressive is frequently rated as the best for auto commercial insurance due to its affordability, extensive coverage options, and positive customer reviews.

How can I find affordable business car insurance?

Compare quotes from multiple providers, look for discounts on fleet and safety training, and consider adjusting your coverage levels to balance cost and protection.

To learn more, explore our comprehensive resource on “How do you get competitive quotes for car insurance?“

What features are included in Allstate commercial truck insurance?

Allstate’s commercial truck insurance includes tailored coverage options for damage and liability, options for new vehicle replacement, and potential discounts for safe driving and business bundling.

Which Arizona insurance company offers taxi insurance?

Several Arizona companies provide taxi insurance; it’s advisable to request quotes from local insurers like State Farm or Allstate for specific offerings.

What are some leading auto commercial insurance companies?

Top auto commercial insurance providers include Progressive, Allstate, and Nationwide, known for their comprehensive coverage options and competitive rates.

What does Allstate commercial auto insurance cover?

Allstate commercial auto insurance covers liability, collision, and comprehensive damages, and can include coverage for uninsured motorists and medical payments, tailored to business needs.

Access comprehensive insights in our “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is the average cost of commercial auto insurance?

The average cost varies but typically ranges from $900 to $1,200 per vehicle annually, depending on factors such as vehicle type and usage.

What influences the average cost of commercial auto insurance?

Factors include the number of vehicles, types of vehicles, driving records, coverage amounts, and the level of risk associated with the business activities.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

How much does commercial car insurance usually cost?

On average, commercial car insurance costs about $1,000 to $1,500 per year per vehicle, with variations based on the coverage level and the risk profile of the business.

How can I get auto commercial insurance quotes?

Obtain quotes by providing your business details online to insurers like Progressive or Allstate, or consult a local agent specializing in commercial insurance.

Delve into our evaluation of “Finding Free Car Insurance Quotes Online.”

What is the best auto insurance for a small business?

Small businesses often benefit from insurers like Nationwide or Allstate, which offer customizable policies and competitive rates for smaller fleets.

Which insurer is recommended for the best business auto insurance?

Progressive and Allstate are highly recommended for their comprehensive coverage and flexible policies that cater to a wide range of business auto insurance needs.

What factors contribute to affordable business vehicle insurance?

Affordable rates are often influenced by the type of vehicles, driving records, and the industry your business operates. Utilizing discounts for safety features and lower mileage can also reduce costs.

Discover insights in our “Where can I find the lowest car insurance quotes?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tonya Sisler

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Insurance Content Team Lead

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.