Best St. Paul, MN Car Insurance in 2025

The average St. Paul, MN car insurance rates are $360/mo. St. Paul car insurance must meet Minnesota's minimum liability coverage requirements of 30/60/10 for bodily injury and property damage. Your insurance rates in St. Paul will vary based on ZIP code and your driving history.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- St. Paul was recently ranked the #1 most livable city in the U.S.

- Nearby Minneapolis is St. Paul’s “Twin City”

- Car insurance rates vary depending on your age, status, and ZIP code

Monthly St. Paul, MN Car Insurance Rates by ZIP Code

Find more info about the monthly St. Paul, MN car insurance rates by ZIP Code below:

St. Paul, MN Car Insurance Rates by Company vs. City Average

The cheapest St. Paul, MN auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Minnesota auto insurance company rates?” We cover that as well.

The Cheapest St. Paul, MN Car Insurance Rates by Credit Score

Your credit score will play a major role in your St. Paul, MN auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. There are still some options through car insurance with no credit check requirements.

Find the cheapest St. Paul, Minnesota auto insurance rates by credit score below.

St. Paul, MN Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare St. Paul, Minnesota against other top US metro areas’ auto insurance rates.

The Cheapest St. Paul, MN Car Insurance Rates by Coverage Level

Your coverage level will play a significant role in your St. Paul, MN auto insurance rates. Find the cheapest St. Paul, Minnesota auto insurance rates by coverage level below:

Average Monthly Car Insurance Rates by Age & Gender in St. Paul, MN

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in St. Paul. Minnesota does use gender, so check out the average monthly auto insurance rates by age and gender in St. Paul, MN.

Even though young drivers are expensive to insure, there are ways to find cheap car insurance for young drivers without cutting necessary coverage.

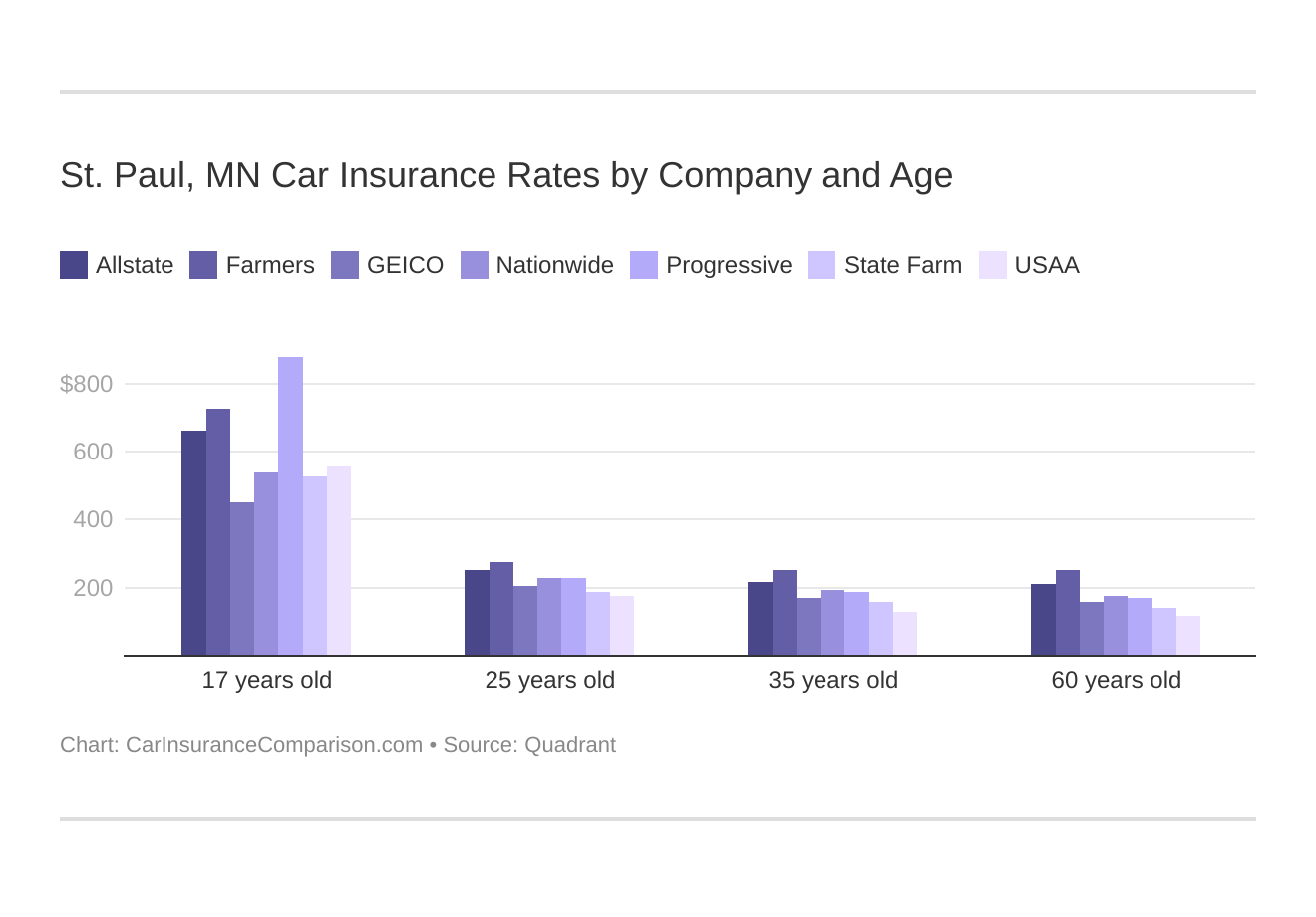

St. Paul, MN Car Insurance Rates by Company and Age

St. Paul, Minnesota auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

The Cheapest St. Paul, MN Car Insurance Rates by Driving Record

Your driving record will affect your St. Paul auto insurance rates. For example, a St. Paul, Minnesota DUI may increase your auto insurance rates 40 to 50 percent. And having a DUI on your record doesn’t automatically mean you’ll be dropped or unable to get insurance coverage. More information can be found at getting car insurance when you’ve had a DUI.

Read more: What are the DUI insurance laws in Minnesota?

Find the cheapest St. Paul, Minnesota auto insurance rates by driving record.

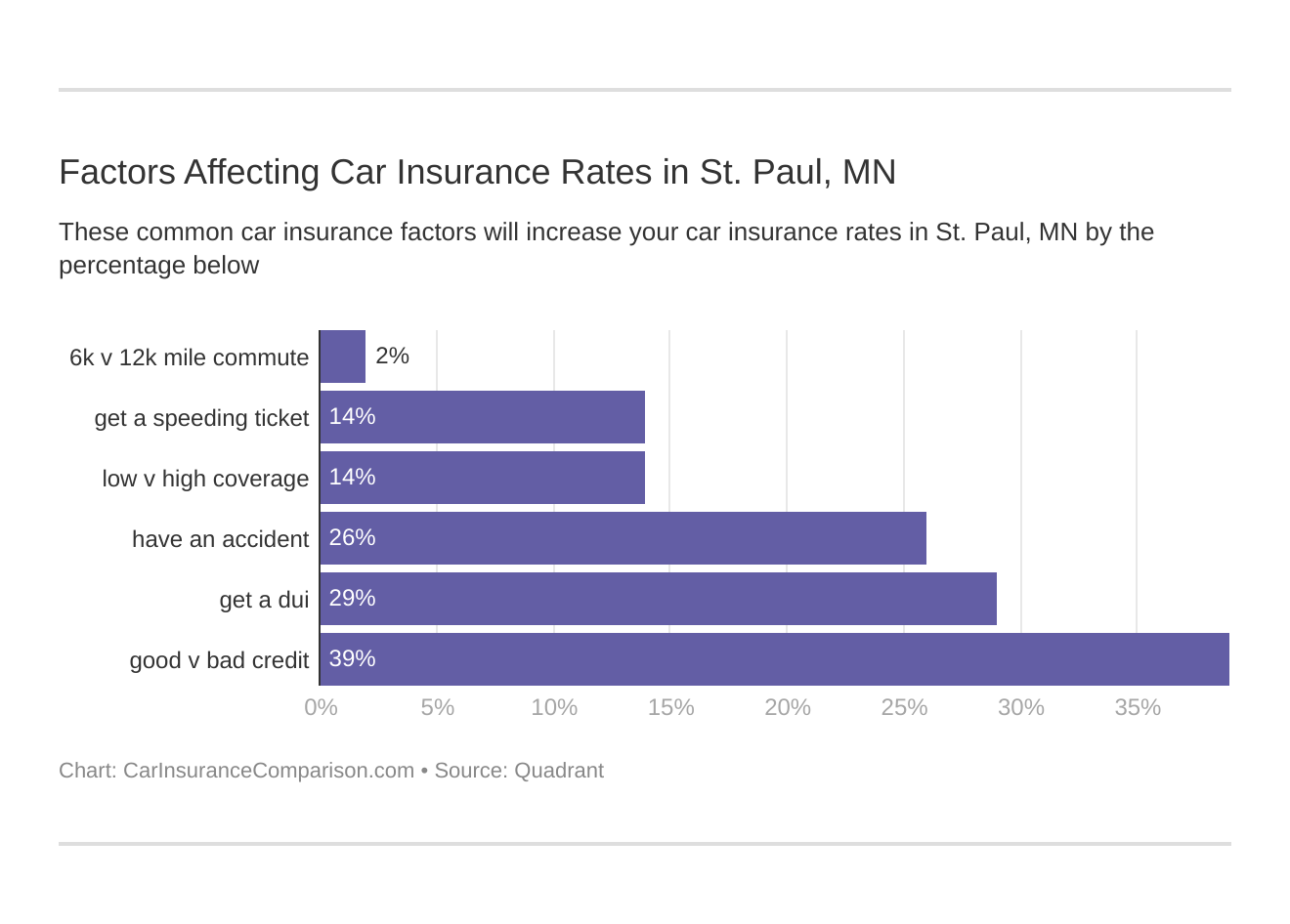

Factors Affecting Car Insurance Rates in St. Paul, MN

Factors affecting auto insurance rates in St. Paul, MN may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest St. Paul, Minnesota auto insurance.

The average cost of car insurance in St. Paul is over $4,313.50 per year. How much is car insurance per month in St. Paul, Minnesota? It works out to, on average, about $360/mo. Car insurance rates are based on many factors, including your age, marital status, and the neighborhood you live in. Finding out everything you need to know about car insurance can be an arduous task. You do hours of research and find conflicting information from different sources. It can be very confusing and frustrating. That’s why we’ve done the work for you. We’ll cover everything you need to know about car insurance in St. Paul. As we outline some insurance rates, it’s important to remember that these rates are averages, and your rates can be higher or lower, depending on your individual circumstances.Male vs. Female vs. Age and Car Insurance Rates

Age plays a significant role when it comes to the cost of car insurance. Not only do people 55+ get discounts on everything from food to hotels, but they also pay less for car insurance. Younger drivers, on the other hand, are subject to considerably higher insurance premiums. According to Data USA, the median age for residents of St. Paul is 32.6 years old.Average Annual St. Paul, MN Car Insurance Rates by Age and Gender

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| $4,106.75 | $5,042.84 | $2,473.98 | $2,233.79 | $1,879.44 | - | - | - | |

| $5,519.17 | $3,334.79 | $2,629.95 | $1,786.56 | $2,233.79 | $1,895.96 | $1,724.94 | $1,726.56 | |

| Illinois Farmers | $5,872.48 | $5,820.43 | $9,510.34 | $2,473.98 | $4,106.75 | $2,041.64 | $9,604.65 | $1,965.24 |

| AMCO | $6,105.97 | $5,026.90 | $2,641.10 | $2,494.27 | $1,970.26 | $1,970.26 | $2,233.79 | $1,753.51 |

| $7,047.50 | $5,545.67 | $9,510.34 | $9,604.65 | $9,604.65 | $2,661.52 | $2,672.81 | $2,544.82 | |

| $8,812.61 | $6,086.73 | $9,604.65 | $2,672.81 | $2,579.67 | $2,233.79 | $2,544.82 | $2,025.26 | |

| $9,968.67 | $6,885.00 | $3,860.95 | $3,677.99 | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | |

| $28,385.86 | $18,911.44 | $3,334.79 | $2,312.50 | $5,042.84 | $9,604.65 | $2,473.98 | $9,510.34 |

As the data shows, teenage males often pay thousands of dollars more than their female counterparts. Married drivers tend to see lower rates than single drivers because insurers consider married people to be more financially secure. See just how different the cost is for married couples at the cost of married car insurance vs. single car insurance.

Cheapest ZIP Codes in St. Paul for Car Insurance

Where you live in St. Paul can also impact how much you pay for car insurance. For example, if you live in a neighborhood with a high crime rate where it’s more likely you might be the victim of car thieves or vandals, you’ll likely pay more for your car insurance.

Check out the table below to see how much you might expect to pay for car insurance based on your ZIP code.Average Annual St. Paul, MN Car Insurance Rates by ZIP Code

| ZIP CODE | Average Annual Rate |

|---|---|

| 55324 | $4,264.01 |

| 55968 | $4,293.38 |

| 55971 | $4,296.06 |

| 55936 | $4,304.01 |

| 55026 | $4,336.40 |

| 55027 | $4,355.55 |

| 55041 | $4,356.73 |

| 55811 | $4,518.61 |

| 55003 | $4,534.15 |

| 55346 | $4,575.93 |

| 55806 | $4,641.43 |

| 55427 | $4,676.71 |

| 55713 | $4,685.24 |

| 55448 | $4,739.15 |

| 55602 | $4,761.70 |

| 55036 | $4,788.43 |

| 55769 | $4,788.75 |

| 55704 | $4,792.55 |

| 55735 | $4,811.86 |

| 55056 | $4,822.41 |

| 55032 | $4,836.87 |

| 55030 | $4,865.77 |

| 55118 | $4,869.43 |

| 55045 | $4,909.45 |

| 55017 | $4,913.94 |

| 55008 | $4,917.15 |

| 55038 | $4,940.45 |

| 55040 | $4,955.17 |

| 55002 | $4,966.16 |

| 55005 | $4,984.06 |

If you live in ZIP code 55324, you’ll be paying around $700 less than people living in ZIP code 55005.

Minimum Required Car Insurance Coverage in St. Paul

Minnesota is a no-fault state, which means that both parties’ insurance companies will be alerted after an accident and each company will be responsible for covering the damages of its own policyholder. The minimum auto insurance coverage needed in Minnesota is:

- $25,000 in bodily injury liability coverage for one person with a total of $50,000 per accident

- $15,000 in property damage liability coverage per accident

Remember, this is just the minimum. You should consider adding other important coverages for increased protection. Personal injury protection (PIP) coverage is also very important in no-fault states. The minimum coverage for PIP is $40,000 per person per accident, which breaks down as follows:

- $20,000 for hospital/medical expenses

- $20,000 for non-medical expenses

Your own insurance company is responsible for your medical expenses after an accident in a no-fault state, so PIP will help cover your medical costs, lost wages, and provide up to $2,000 toward funeral expenses in the event of death.

What’s the best car insurance company in St. Paul?

So what’s the best car insurance company in St. Paul? The word best can mean different things to different people. All in all, learning about the insurance companies in your city — and what they have to offer — can help you make the right decision.

Cheapest Car Insurance Companies

How much is car insurance in Minnesota? Who has the cheapest car insurance in Minnesota? We’re all looking for cheap Minnesota car insurance. But, we’re also looking for the best cheap car insurance. Most of the top providers are licensed in the Twin Cities.

In the table below, we’ve listed those companies, their average annual rates for car insurance, and how those rates compare to the state average.

Minnesota's Cheapest Car Insurance Rates by Company

| Insurance Company | Average Annual Rates | Difference from State Average |

|---|---|---|

| $2,066.99 | -$2,446.51 | |

| $2,861.60 | -$1,651.89 | |

| AMCO | $2,926.49 | -$1,587.01 |

| Illinois Farmers | $3,137.45 | -$1,376.04 |

| $3,498.53 | -$1,014.96 | |

| $3,521.29 | -$992.21 | |

| $4,532.01 | $18.51 | |

| $13,563.61 | $9,050.11 |

Next, we’re going to break down how these companies determine their rates so you can figure out which one might be best for your specific circumstances.

Best Car Insurance Companies for Commuters

With the average Minnesota driver putting 17,095 miles on their odometer per year in Minnesota, commute rates are super relevant. As you’ll see in the table below, some insurance companies charge higher rates to people with longer commutes. This is because the longer you’re behind the wheel, the more likely it is you’ll have an accident.

Minnesota Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $152 | $160 |

| American Family | $88 | $93 |

| Amica | $130 | $137 |

| Farmers | $103 | $108 |

| Geico | $86 | $90 |

| Liberty Mutual | $356 | $375 |

| Progressive | $96 | $101 |

| State Farm | $63 | $67 |

| The Hartford | $143 | $150 |

| USAA | $65 | $68 |

| U.S. Average | $118 | $124 |

The cheapest company for Minnesota residents with longer commutes is State Farm, with average rates of $2,122 per year.

Best Car Insurance for Coverage Level Rates

Finding the right coverage level for your personal needs is one of the best strategies for saving money on car insurance. Let’s take a look at the rates charged by different companies for different levels of coverage.

Minnesota Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $372 | $377 | $383 |

| American Family | $293 | $302 | $286 |

| Farmers | $252 | $263 | $270 |

| Geico | $283 | $291 | $300 |

| Liberty Mutual | $1,103 | $1,131 | $1,156 |

| Nationwide | $231 | $246 | $255 |

| State Farm | $165 | $173 | $178 |

| USAA | $232 | $238 | $245 |

If you’re looking for high coverage at a low price, your best bets are insurers like Nationwide, USAA car insurance, and State Farm car insurance.

Best Car Insurance for Credit History Rates

Among other factors, your credit history has a huge impact on how much you pay for insurance. Insurance rates and credit scores correlate for a variety of reasons, one being how insurance adjusters judge the financial solvency of their clients. But there are some car insurance companies that don’t use credit scores when determining car insurance rates, and these can be options for some people.

The table below shows Minnesota insurance companies’ rates based on credit history.

Minnesota Car Insurance Monthly Rates by Credit History

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $279 | $300 | $554 |

| American Family | $214 | $266 | $401 |

| Farmers | $221 | $237 | $326 |

| Geico | $238 | $286 | $350 |

| Liberty Mutual | $796 | $1,019 | $1,576 |

| Nationwide | $208 | $234 | $290 |

| State Farm | $112 | $154 | $251 |

| USAA | $159 | $183 | $374 |

As you can see, a poor credit history equals higher rates. If you have a less-than-stellar credit history, State Farm offers an average annual rate of $3,013, which is much cheaper than the competitors.

Best Car Insurance for Driving Record Rates

Getting car insurance when you’ve dad a DUI, a speeding ticket, or an accident can be difficult, and your car insurance rates will probably increase, as insurance companies believe that incidents like these indicate the potential for expensive claims in your future. The table below shows average rates for drivers with one of these three violations compared to a clean record.

Average Annual Car Insurance Rates by Driving Record

| Driving Record | Average Annual Rates | Increase After One Violation |

|---|---|---|

| Clean record | $3,371.35 | $0 |

| 1 Accident | $3,552.72 | $181 |

| 1 Speeding violation | $4,722.77 | $1,351 |

| 1 DUI | $6,131.51 | $2,760 |

The repercussions of an accident or speeding are less severe than a DUI. However, all driving offenses can increase your rates.

Driving in St. Paul

We’ve mentioned that your driving record, gender, and marital status can contribute to the cost of car insurance. But insurance companies also base rates on the car you drive, road conditions, traffic congestion in your area, crime reports, and so much more.

Roads in St. Paul

St. Paul is a large city with many neighborhoods. If you move to town in the winter, you may be thrown off by sleet, snow, or icy road conditions. In this section, we’ll cover the highways and interstates and everything else you need to know about driving in St. Paul.

Major Highways in St. Paul

Rush hour in St. Paul can be stressful for drivers taking 1-35E, I-94, or US 52.Certain sections of the roadway are prone to flooding. There are 10 busy stretches of road within the Minneapolis-St. Paul metro area.

- Interstate 35E southbound, Larpenteur Avenue to downtown St. Paul

- Interstate 694 eastbound, between Interstate 35W and Lexington Avenue

- Interstate 94 eastbound, heading into downtown St. Paul

- I-35E northbound, heading out of downtown St. Paul

- I-35E northbound, between Interstate 494 and the Mississippi River

- I-94 westbound, between Mounds Boulevard and Marion Street

- I-35W northbound, between Minnesota Highway 36 and I-694

- I-35E southbound, between I-694 and Larpenteur Avenue

- MN-36 eastbound, from I-35W to Lexington Avenue

- MN-36 westbound, from I-35E to Snelling Avenue

In 2017, parts of the highway sections above were congested for up to seven hours per day. If possible, avoid traveling at peak times of the day (like the morning and evening commutes) to limit the time you have to spend in traffic.A few of the toll bridgers you may encounter in Minnesota are the International Falls Bridge and the Fargo-Moorhead Toll Bridge. Neither of these toll roads runs through St. Paul, but consider purchasing an MnPass to keep you covered in the Twin Cities.

Vehicles in St. Paul

Your insurance rates are also dependent on vehicular factors such as what car you drive and if this vehicle is prone to theft. In this section, we’ll cover topics pertaining to vehicle theft and more.

Most Popular Vehicles Owned

According to Your Mechanic, the most popular car in Minnesota is the Ford F-150. In a sense, the Ford F-150 has captured the hearts of many American cities because it is a practical vehicle. This video explains the Ford F-150’s available safety features:https://www.youtube.com/watch?v=8mfQZWSaqiEFolks in the Twin Cities may love this truck for its utility and storage, but the parts are not grade-A materials. The interior includes many plastic parts. In St. Paul, the average household has two vehicles.

Vehicle Theft in St. Paul

According to the FBI, 2,084 vehicle thefts occurred in St. Paul in 2017. When considering your next car purchase, one thing to consider is that certain vehicles are stolen more frequently than others, and thus may have higher insurance rates. Statistics provided by Neighborhood Scout indicate that St. Paul ranks as being safer than 7 percent of U.S. cities, and you can see where that ranks among the 15 states with the highest vehicle theft rates. Your chances of becoming a victim of violent crime in Phoenix, on the whole, are one in 151, which is higher than the average across Minnesota. Don’t let those stats alarm you. There are numerous safe neighborhoods in the Twin Cities area. The video below explains where:https://www.youtube.com/watch?v=KNXk-nKW5sI

Whether you live in a neighborhood that’s not so safe, or in a neighborhood where there are no issues, it’s always a good idea to have extra coverage on your vehicles to protect your investment.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Unique St. Paul Laws

Following many unnecessary deaths in the Minneapolis-St. Paul area, Minnesota has imposed unusual crosswalk laws. The new crosswalk law states that pedestrians have the right-of-way at every corner, marked or unmarked. What insurance coverage is needed for food trucks in Minnesota? Food truck owners need the following types of liability insurance: public, food products, property damage insurance, and bodily injury insurance.The minimum amount you need to carry is one million dollars per occurrence. Also, you’ll need to carry workers’ compensation insurance in Minnesota to have others perform food services in your truck.If you want to follow the latest trends, it’s best to be informed about the insurance you need to do so.

What tiny home coverage do you need in Minnesota? The law dictates owners should follow NOAH certification, as well as insuring their homes during the building phase, when the home is being towed, and when it is parked.Now that you’ve read through this comprehensive guide and know everything there is to know about St. Paul, MN, car insurance it’s time to hit the road.

Enter your ZIP code below to get a free car insurance quote comparison.

Frequently Asked Questions

How can I compare car insurance rates in St. Paul, MN?

To compare car insurance rates in St. Paul, MN, you can follow these steps:

- Research insurance providers: Look for reputable insurance companies that operate in St. Paul, MN.

- Gather quotes: Contact multiple insurance companies and request quotes based on your specific needs.

- Provide accurate information: Ensure you provide accurate details about your vehicle, driving history, and coverage requirements when requesting quotes.

- Compare coverage options: Review the coverage levels, deductibles, and additional features offered by each insurance provider.

- Consider customer reviews: Check online reviews and ratings to gauge customer satisfaction and the insurer’s reputation.

- Evaluate premiums: Compare the premiums for similar coverage options from different insurance companies.

- Make an informed decision: Based on your research, choose the insurance policy that best fits your needs and budget.

Are car insurance rates the same for all drivers in St. Paul, MN?

No, car insurance rates in St. Paul, MN can vary from one driver to another. Insurance companies consider several factors when determining rates, such as your age, driving experience, vehicle type, driving record, credit history, and location. Additionally, factors specific to St. Paul, MN, such as local traffic patterns and accident statistics, may also influence insurance rates.

What factors affect car insurance rates in St. Paul, MN?

Several factors can impact car insurance rates in St. Paul, MN. Some common factors include:

- Age and gender: Younger drivers, especially teenagers, often have higher insurance rates compared to older, more experienced drivers.

- Driving record: Drivers with a history of accidents or traffic violations may face higher premiums.

- Vehicle type: The make, model, year, and safety features of your vehicle can affect insurance rates.

- Location: Where you live in St. Paul, MN can impact rates due to factors like crime rates, population density, and traffic patterns.

- Credit history: In some states, insurance companies may consider your credit history when determining rates.

- Coverage and deductibles: The level of coverage you choose and the deductible amount can affect your insurance premium.

How can I find affordable car insurance rates in St. Paul, MN?

To find affordable car insurance rates in St. Paul, MN, you can:

- Shop around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Bundle policies: Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially qualify for discounts.

- Maintain a good driving record: Avoid accidents and traffic violations to maintain a clean driving history, which can lead to lower premiums.

- Increase deductibles: Opting for a higher deductible can lower your premium, but be sure you can afford the deductible amount if you need to file a claim.

- Inquire about discounts: Ask insurance providers about available discounts, such as good student discounts, safe driver discounts, or discounts for installing anti-theft devices in your vehicle.

Are there any specific requirements for car insurance coverage in St. Paul, MN?

Yes, Minnesota state law requires drivers in St. Paul, MN to carry a minimum level of auto insurance coverage. The minimum requirements include:

- $30,000 bodily injury liability coverage per person

- $60,000 bodily injury liability coverage per accident

- $10,000 property damage liability coverage per accident

- $40,000 personal injury protection (PIP coverage)

Can my credit score affect my car insurance rates in St. Paul, MN?

Yes, in St. Paul, MN, as in many other states, your credit score can be a factor in determining your car insurance rates. Insurance companies often use credit-based insurance scores to assess risk. Individuals with better credit scores may be eligible for lower insurance premiums, as studies have shown a correlation between credit history and the likelihood of filing insurance claims. However, not all states or insurance companies consider credit scores, so it’s essential to check with your insurance provider regarding their specific practices.

Can I get discounts on car insurance in St. Paul, MN?

Yes, there are various discounts available that can help you save on car insurance in St. Paul, MN. Some common discounts include:

- Safe driver discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a safe driver discount.

- Good student discount: If you’re a student and maintain good grades, you may be eligible for a discount.

- Multi-policy discount: Insuring multiple vehicles or bundling your car insurance with other policies, such as home or renters insurance, can often lead to discounted rates.

- Anti-theft device discount: If your vehicle has anti-theft devices installed, such as alarms or tracking systems, you may be eligible for a discount.

- Defensive driving course discount: Completing a recognized defensive driving course can sometimes result in a discount on your premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.