Root Car Insurance Review for 2025 [See Rates & Discounts Here]

Root car insurance review reveals that Root sets your rate based on how well you drive, with some safe drivers paying as little as $16 a month. You'll find coverage for liability, collision, comprehensive, roadside help, rental reimbursement, and medical payments—everything most drivers need.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Root Insurance

Average Monthly Rate For Good Drivers

$16A.M. Best Rating:

N/AComplaint Level:

LowPros

- Usage-Based Pricing

- Mobile App Functionality

- Quick Quote Process

Cons

- Limited State Availability

- Mandatory Driving Test

This Root car insurance review covers how the company offers personalized rates starting at $16 per month based on your driving behavior.

Root Insurance Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.9 |

| Business Reviews | 3.0 |

| Claim Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.4 |

| Coverage Value | 3.8 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 4.0 |

| Discounts Available | 3.7 |

| Insurance Cost | 4.1 |

| Plan Personalization | 4.0 |

| Policy Options | 3.4 |

| Savings Potential | 3.9 |

Root Insurance Company uses a mobile app to track your driving, potentially lowering rates for safe drivers. While ideal for tech-savvy drivers, those with poor driving records may face higher rates.

Root’s app makes it easy to manage policies and claims, making it simple to understand how to file a car insurance claim, but it’s still smart to compare quotes for the best deal.

- Root sets rates based on real-time driving habits, not just demographics

- Root Insurance Company uses driving behavior to determine your rate

- Get up to 10% discount by completing Root’s test drive app

Save money on car insurance today. Enter your ZIP code above to use our free quote tool to compare rates from leading providers in your area.

Root Insurance Monthly Rates by Coverage Level and Driving Record

Root’s rates vary by age and gender, with younger drivers paying more. A 16-year-old male pays about $130 for minimum coverage and $230 for full coverage.

Root Insurance Car Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $120 | $210 |

| 16-Year-Old Male | $130 | $230 |

| 18-Year-Old Female | $105 | $195 |

| 18-Year-Old Male | $115 | $215 |

| 25-Year-Old Female | $75 | $140 |

| 25-Year-Old Male | $85 | $155 |

| 30-Year-Old Female | $65 | $120 |

| 30-Year-Old Male | $70 | $130 |

| 45-Year-Old Female | $55 | $110 |

| 45-Year-Old Male | $16 | $43 |

| 60-Year-Old Female | $50 | $95 |

| 60-Year-Old Male | $55 | $100 |

| 65-Year-Old Female | $48 | $90 |

| 65-Year-Old Male | $52 | $95 |

In contrast, a 45-year-old male pays as low as $16 for minimum and $43 for full coverage.

Root Insurance adjusts pricing based on driving history. Drivers with clean records pay around $23 monthly.

A single ticket raises the rate to $29, while one accident or DUI can increase rates to $34 and $40, respectively. Therefore, it is essential to compare the best car insurance for a bad driving record.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What to Know About Root Auto Insurance

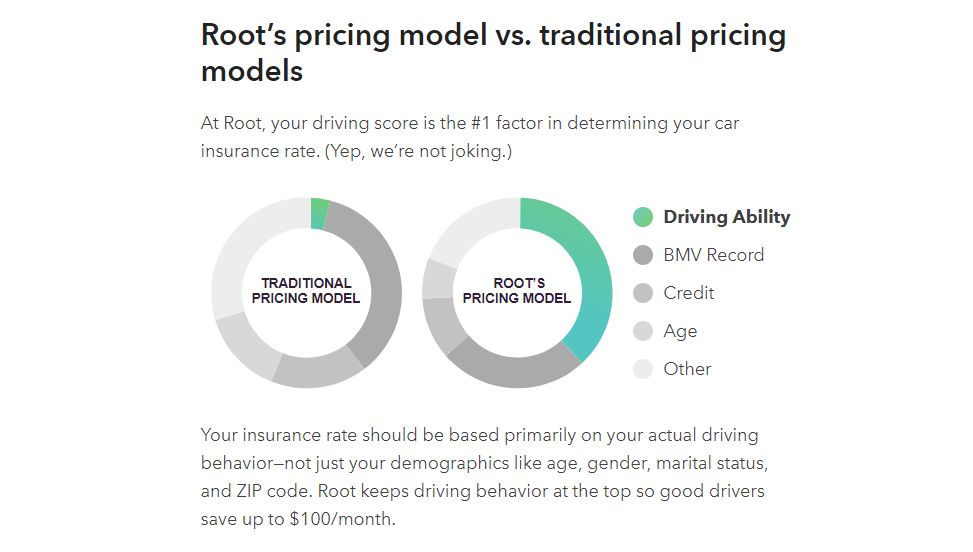

Every car insurance company calculates premiums differently, but all are based on criteria such as location, age, and even your job. As its name implies, Root gets to the origins of what matters regarding premiums—how well you drive.

Dubbed by Forbes as “real-time, context-based” insurance, Root launched as a startup originally for Tesla owners but has since expanded and now offers lower coverage to drivers of any vehicle.

Founder Alexander Timm has over 14 years of experience in the insurance industry. He understands what works and where it needs improvement—including questions drivers often ask, like how far back do car insurance companies look. He started Root to make insurance more straightforward and more driver-focused.

How Does Root Car Insurance Work

Root embraces modern times and uses technology to determine precisely how well you drive, which reflects the results in the cost of your car insurance. When you download the app, you must take a driving test for Root Insurance to determine your eligibility.

Root will test your driving abilities based on braking, smoothness, and traffic habits using your smartphone’s GPS and motion sensors.

An AI will evaluate your results to determine whether Root offers you a quote, making finding free car insurance quotes online easier and more personalized.

Who is Root Car Insurance Good for

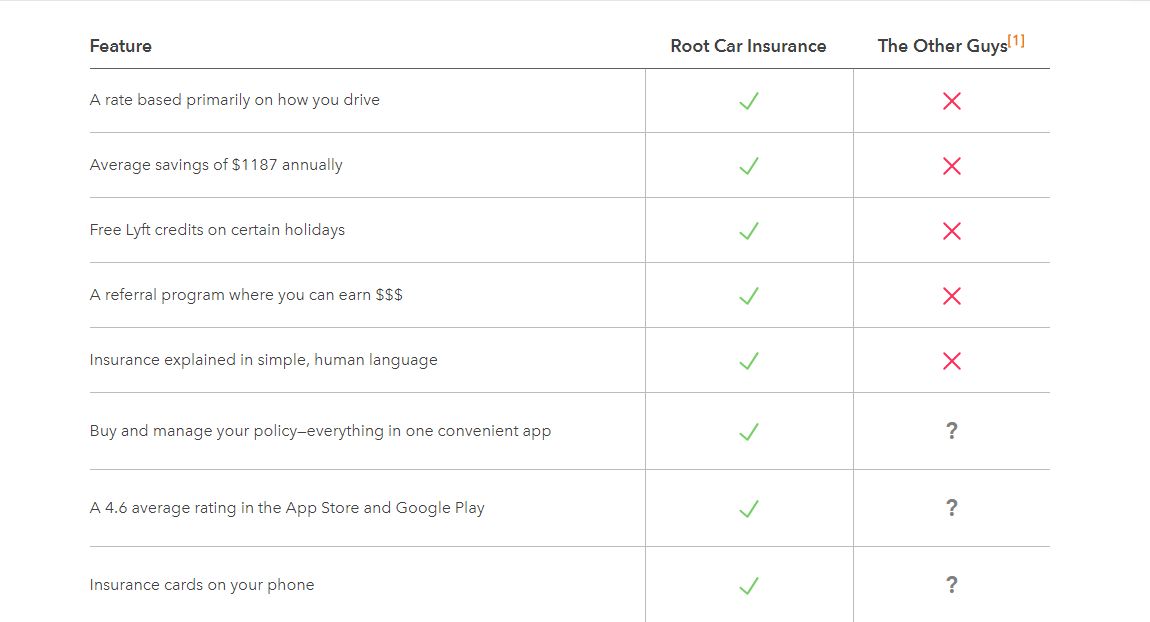

Root is a solid choice for safe drivers seeking lower car insurance rates. Its pricing is based mainly on driving behavior, not demographics like age, gender, or location. Root uses a mobile app to track habits, placing drivers in risk pools based on real data.

With over 12 million app downloads and 20 billion miles of driving data, Root’s algorithm often delivers more affordable rates for drivers unfairly penalized by traditional insurers. If you’ve asked, “Do all car insurance companies check your driving records?” Root may be a better fit, especially if you usually receive high quotes.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Root Car Insurance Explained

Car insurance is costly, and more drivers are considering alternatives to cut costs. Root simplifies coverage with no agents or phone calls, offering policies entirely through its app. It also provides options like gap insurance for added financial protection.

Despite having a great website design filled with helpful information and explanations, all the insurance work happens on your Apple or Android device. Root claims it can save good drivers up to 52 percent on car insurance, but how? Is Root a legitimate insurance company, considering it sells coverage through an app? If you’re asking if you need gap insurance on a used car, how does that factor into what Root offers?

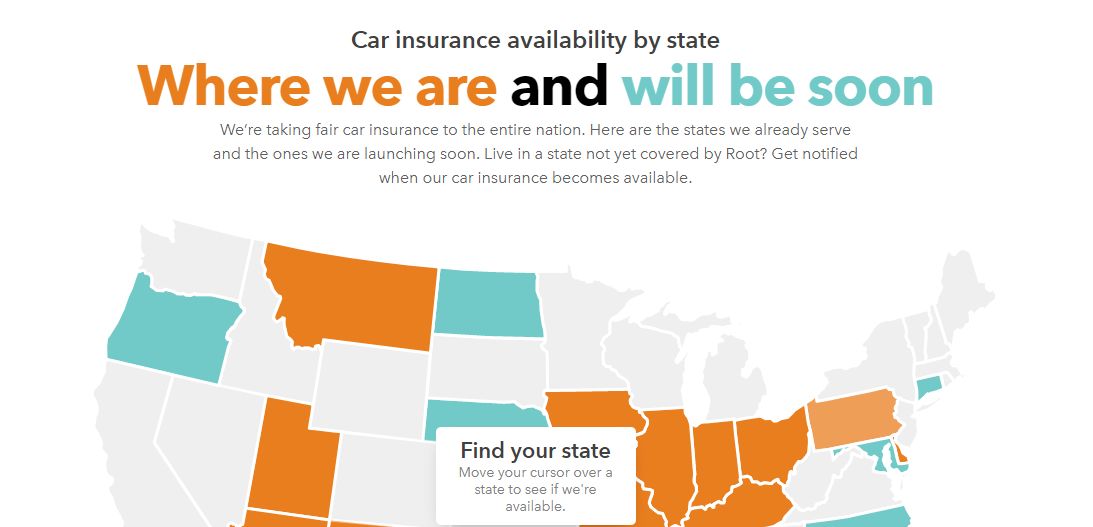

Root Insurance Availability

Based in Columbus, Ohio, Root is expanding nationwide to offer cheap car insurance, with recent coverage additions in Kentucky and Philadelphia.

Root car insurance is available in 17 states, including Arizona, Arkansas, Delaware, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, Montana, New Mexico, Ohio, Oklahoma, Pennsylvania, Texas, and Utah.

Root Insurance Options

They offer many of the significant types of car insurance coverages required by the state and needed by drivers. Here’s a complete list of their offerings:

Root offers the liability coverage required in every state and additional coverages every driver should have, like comprehensive and collision. Additional offers, like underinsured motorist coverage and personal injury protection (PIP), will keep you secure in the event of an accident.

Roadside assistance is included with every package, so you won’t have to worry about being stranded. Optional rental insurance makes it easier to afford to get back on the road while your car is in the shop.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Root Insurance Discounts

You know about discount programs at other auto insurance companies. The difference between Root Insurance and its larger competitors is that its entire model is based on giving you discounts.

Root offers substantial discounts for safe driving. It uses telematics data from its app to assess driving behavior and provide personalized rides.

Brandon Frady Licensed Insurance Agent

Instead of installing a device, downloading a separate app, or waiting an entire policy period to find out what you can save, Root offers instant car insurance discounts through its main app. Your savings, including the best car insurance discounts, are applied to all your coverages as soon as you’re eligible.

Root Pay-as-You-Go Car Insurance

Some people only need temporary coverage. Root’s auto insurance allows you to pay as you go. You can sign up and pay for your insurance monthly or switch to one payment every 6 months. If you switch to a six-month payment plan, you won’t be able to switch packs until the policy’s 6-month renewal.

Even if you choose a later start date for your policy, payments are deducted immediately, so make sure you’re serious about switching to Root before you buy from them. Gain deeper insights by perusing our article titled “Pay-As-You-Go Car Insurance.”

How to Get a Root Insurance Quote Online

Root wants to take the work out of car insurance. Everyone needs it, but that doesn’t mean it should be such a chore (or a bore).

You’ll find out whether or not you’re eligible for coverage, and then Root will walk you through the buying process. It’s fast, easy, and by far the most modern car insurance company we’ve seen so far.

Of course, just because Root insurance is easy to buy doesn’t mean you should jump in immediately. You still need to shop smart and understand what affects a car insurance quote to ensure you save money without losing valuable coverage. Download the Root app on the Apple App or Google Play store to get a quote and start your test drive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Save Money by Comparison Shopping

Enter your zip code below and get matched with personalized auto insurance quotes. Why enter the same information repeatedly on car insurance websites when you can be one and done with our site? We encourage you to take some time, explore our articles, and learn about car insurance coverage and the buying process.

Like Root, we believe auto insurance should be easy to find and affordable. Good drivers deserve fair premiums, and if you’ve ever asked, “Is it worth claiming a scratch on your car insurance?” You’re in the right place. Stick around and start saving.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Compare Cheap Root Auto Insurance Quotes Online

Root calculates premiums based on your driving habits. If you have a clean driving record and are looking for an alternative to traditional insurance, Root may be a good choice. You’ll need to complete a driving test via your smartphone to get a quote.

Root is reshaping the insurance industry with technology. Check our Root car insurance review to decide if it’s the right choice. Not interested in the driving test? Didn’t qualify? There are other options available. Enter your ZIP code above for free quotes from multiple insurers.

Step #1 – Get the Scoop on Root

Visit ViRoot’s site to learn what makes them tick. The site is easy to follow and includes a precise quote and purchase process breakdown, which can help you understand your car insurance policy.

Step #2 – Explore Coverage Options

Step #3 – Make Sure Your State Is Covered

Root is a growing company, so it isn’t available in every state yet. On the availability page, you can get a complete overview of all the states Root currently services, a glimpse of where it’s headed, and car insurance definitions to help you better understand the coverage offered in each state.

- Arizona

- Arkansas

- Delaware

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Montana

- New Mexico

- Ohio

- Oklahoma

- Pennsylvania

- Texas

- Utah

Step #5 – Create an Account

You can sign up for a Root account on the site and use it to log in to the app. You’ll need this to get your quote from one of the cheap car insurance companies that beat quotes.

Step #6 – Download the Root App for Car Insurance

Head over to the App or Google Play Store (depending on your phone) and download the Root Car Insurance app. For a comprehensive understanding, consult our article “Driving Device/App Car Insurance Discounts.”

Step #7 – Take the Driving Test

Rather than having you waste time answering a bunch of questions to give you a generic rate, Root calculates your premium based on how well you drive, taking into account factors more relevant than just asking how much parking tickets affect car insurance rates.

Step #8 – Buy a Policy

Root auto insurance policies are renewed monthly. This company is an excellent option if you’ve been looking for temporary car insurance.

Step #9 – Customize Your Coverage

When you buy a policy, Root lets you choose different types of insurance coverage and adjust the limits of each. You can check out your state’s requirements, but we suggest going higher than the bare minimum to guarantee coverage in the event of an accident. You can also compare monthly car insurance options to find the best coverage.

Step #10 – Find More Ways to Save

Root Insurance Is a Legitimate and Licensed Provider

Understandably, you’d wonder if Root insurance is real since you bought it on an app. We did our homework. You’re worried that Root Insurance could be a scam. The Better Business Bureau accredits Root. Root’s insurance rating from the BBB is an A+.

Root Insurance is a licensed provider that uses mobile technology and driving data to offer personalized premiums, providing a modern approach to car insurance.

Kristen Gryglik Licensed Insurance Agent

Root insurance customer reviews matter, too, especially when evaluating factors like your car insurance deductible. At the time of this review, the company was rated 4.5 stars on the App Store and 4.4 on the Google Play Store, with over 10,000 combined ratings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Root Insurance Performance: Customer Satisfaction & Complaints

Root Insurance earns strong marks across major industry rating agencies. J.D. Power scores 850 out of 1,000 for above-average customer satisfaction, and the Better Business Bureau gives Root an A+ for its excellent business practices.

Root Insurance Business Ratings and Consumer Reviews

| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints Than Avg. |

Consumer Reports rates it 78 out of 100, indicating solid customer feedback. According to NNARoots, the complaint index stands at 0.85, receiving fewer complaints than the industry average. Customer satisfaction ratings like these often reflect better service and more reliable experiences with car insurance companies.

Pros and Cons of Root Car Insurance

Root Insurance appeals to drivers who want pricing based on their driving style. Here’s a quick look at the benefits and drawbacks.

Pros

- Low Starting Rate: Some drivers qualify for rates starting at $ 16 monthly.

- Driving-Based Pricing: Uses app-tracked habits to set premiums fairly.

- Simple Claims Process: File and track claims easily through the mobile app.

Cons

- Not Offered in Every State: Availability is limited based on location.

- No Local Agents: Customer support is primarily digital, with no in-person service.

Root is best suited for safe, app-friendly drivers looking for a budget-conscious policy based on real behavior. If you’re wondering, “Does car insurance cover excluded drivers?” it’s essential to understand how Root handles exclusions to ensure you’re fully covered.

Root’s Data-Driven Approach to Modern Auto Insurance

Root car insurance sets rates based on driving behavior, not demographics. Founded in 2015, Root Insurance Company uses mobile telematics and has gathered 20 billion miles of data to determine pricing. For those looking for the best car insurance comparison websites, Root’s app allows users to get a policy in under a minute, manage coverage, and file claims.

Its machine learning claims system speeds up payouts and improves accuracy. Root operates in 35 states and became the first fully mobile-based licensed insurer. The company went public with Ohio’s largest IPO, offering API integrations for partners to embed insurance directly into other services. Ready to find lower car insurance rates? Use our free tool to compare offers from top providers in your area by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Root a good auto insurance company?

Root Insurance is suitable for drivers who prefer usage-based pricing, as it determines rates based on driving behavior. Some customers report significant savings and quick claims processing. However, others have raised concerns about inconsistent claims handling and customer service.

What is the most trusted car insurance company?

USAA consistently ranks highest in trust and customer satisfaction, particularly among military members and their families.

Which company is best for car insurance claims?

Travelers is recognized for its efficient claims process and overall performance. Uncover more by delving into our article, “How long do car insurance claims stay on your record?”

How long does Root take to process a claim?

Claim processing times vary; some customers report resolutions within a week, while others experience delays.

BBB

Is Root a real insurance company?

Root is a legitimate insurance company offering policies in multiple U.S. states.

Tired of high car insurance premiums? Let our free comparison tool help you discover better rates from top insurers by entering your ZIP code below.

Who offers the cheapest car insurance?

Auto-Owners offers some of the most affordable rates, averaging $447 per year for minimum coverage. Our article ” Cheapest Car Insurance Companies for New Drivers” will expand your understanding.

What are the top three insurance companies?

According to NerdWallet, the top three are Travelers, Auto-Owners, and American Family.

Does Root Insurance track your driving?

Root uses a mobile app to monitor driving behavior, including speed, braking, and phone usage, to determine rates.

What is the best comprehensive car insurance?

State Farm is often recommended for comprehensive coverage due to its extensive network and customer service. For additional insights, refer to the “Compare Comprehensive Car Insurance.”

At what age is car insurance the cheapest?

Car insurance rates are typically lowest for drivers aged 50 to 65, assuming a clean driving record.

Ready to find lower car insurance rates? Use our free tool to compare offers from top providers in your area by entering your ZIP code below.

Is Root profitable?

Root Inc.’s stock price is $120.00 USD as of April 12, 2025. Their latest financial statements provide detailed financial performance.

Which car insurance company has the best claim settlement ratio?

While specific ratios vary, companies like Travelers and USAA are known for high claim settlement satisfaction. Our article “How do you file a car insurance claim?” will help you gain a deeper understanding.

Which is better: TPL or comprehensive insurance?

Comprehensive insurance offers broader protection, covering third-party liabilities and damages to your vehicle. TPL (Third-Party Liability) covers only damages to others.

How much debt does Root Inc. have?

Consult Root Inc.’s latest financial reports or filings for the most accurate and current debt information.

Is Root a good investment?

Investment suitability depends on individual financial goals and risk tolerance. Before making investment decisions, review Root Inc.’s financial statements and market performance. Find out more by reading our article titled “How do I upgrade car insurance?”

Is Root a legitimate company?

Root is a legitimate, licensed insurance provider operating in several U.S. states.

What is the best full coverage car insurance?

State Farm is often cited as the best for full coverage due to its comprehensive policies and customer satisfaction.

Which type of insurance is cheaper: comprehensive or third-party?

Third-party insurance is generally cheaper but offers limited coverage compared to comprehensive insurance. Our article “Is it cheaper to purchase car insurance online?” will broaden your knowledge.

Which car is more expensive to insure?

Luxury and high-performance vehicles typically have higher insurance premiums due to increased repair costs and theft risk.

What are the four recommended types of insurance?

The four commonly recommended insurance types are:

- Health Insurance

- Life Insurance

- Auto Insurance

- Homeowners or Renters Insurance

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Texasgirl63

Auto insurance

Xan52

Fraud! Beware!

Frustratedashell

Money for nothing

Karolina_pilvyte

Easy sign up and affordable pricing

Kay_street

Insurance for the people

Denise9

New policy

Rodney89

Lower cost without compromising on quality, drama free

Mborer

Great company

Emazpa

Auto review

Waldo

Where's Waldo?