Compare Mississippi Car Insurance Rates [2025]

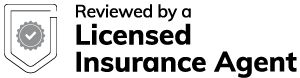

If you want to get cheap Mississippi car insurance coverage, the best way is to compare Mississippi car insurance . For example, a minimum liability insurance policy in Mississippi costs an average of $46 per month, while a full coverage insurance policy is an average of $137 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

715-Mississippi-Statistics-Summary-2019-03-14.csv

| Mississippi Statistics Summary | Stats |

|---|---|

| Road Miles | Total In State: 76,777 Vehicle Miles Driven: 39,890 million |

| Vehicles | Registered: 2,040,524 Total Stolen: 4,243 |

| State Population | 2,986,530 |

| Most Popular Vehicle | Ford F-150 |

| Motorists Uninsured | 23.7% State Rank: 2nd |

| Driving Deaths | 2008-2017 Speeding: 1,219 Drunk Driving: 1,667 |

| Average Premiums (Annual) | Liability: $460.50 Collision: $323.22 Comprehensive: $210.33 Combined Premium: $994.05 |

| Cheapest Provider | USAA |

- Drivers in Mississippi need 25/50/25 of liability car insurance

- Full coverage insurance is an average of $137/mo in Mississippi

- Mississippi car insurance rates will vary based on driving record

Need to find cheap car insurance in Mississippi? The best way is to compare Mississippi car insurance rates at different companies. However, you will first need to know how much coverage you need to carry in Mississippi before you can compare cheap car insurance.

Read on to learn everything you need to know about buying car insurance coverage in Mississippi, from Mississippi car insurance requirements to the best companies. If you want to start shopping right away, use our free quote comparison tool to find affordable Mississippi car insurance.

Mississippi Car Insurance Coverage and Rates

Mississippi requires all citizens to have car insurance, but finding the right insurance can be extremely hard. Researching and searching through thousands of websites can be exhausting, not to mention extremely time-consuming.

You deserve to have all of the information laid out for you in one convenient location. That way you can pick the best coverage and rates that are tailored to your needs.

We have gone ahead and laid out topics such as major coverage types, minimum coverage required, forms of financial responsibility, and more.

Keep reading to learn more about Mississippi car insurance!

Mississippi Minimum Coverage

Mississippi requires a minimum coverage that your insurance policy must cover in order to legally drive in the state. They operate under a 20/40/10 minimum liability limit. What in the world does this mean for you? Well, below we’ve broken up exactly what this kind of coverage means

- Compare Mississippi Car Insurance Rates

- 20 = $20,000 that can pay for bodily injury per person

- 40 = $40,000 that can pay for total bodily injury per accident

- 10 = $10,000 that can pay for property damage per accident

Mississippi, like a lot of states, places a higher value for the injuries of more than one individual and has different levels of cost for minimum coverage elsewhere in the country.

So this is the MINIMUM COVERAGE for the state. The way medical costs alone have skyrocketed within the past few years, however, this minimum amount can run out extremely quickly if you happen to find yourself in a bad enough accident. Purchasing insurance above this minimum will ensure the absolute protection for you in the long run.

Forms of Financial Responsibility

In order to drive your vehicle in the state of Mississippi, you will be required to carry some form of financial responsibility (or proof of insurance) with you whenever you operate a vehicle. What are some situations where you may be asked to provide this?

- When registering/renewing your vehicle’s registration

- When asked by a law enforcement officer

- After an Accident

There are several ways in which you can prove your financial responsibility. Aside from having your standard insurance policy, you can also post a bond through a state licensed company in the amount of your required liability coverage OR you can post a cash/security deposit in the amount of the liability requirements to the Mississippi State Treasurer.

Read more: Do you get your deposit back from car insurance?

The following are acceptable for providing proof of financial responsibility in Mississippi:

- Insurance ID Card

- Certificate of your insurance policy

- Certificate of Deposit showing cash or security deposited posted with the State Treasurer

- Proof of your bond

Even for a first time offense, you could be forced to pay a fine of $1,000 or even have your drivers license suspended for a year or until you provide proof of insurance.

How do you avoid all this trouble? Make sure you have your proof of insurance with you at all times while operating a vehicle!

Premiums as a Percentage of Income

Have you ever heard the term ‘per capita disposable income’ before? It basically means how much income a person has after taxes. So, for example, if you were to make $80,000 per year but after taxes, you end up with $65,000 or so.

This $65,000 would be considered your per capita disposable income. Well, believe it or not, this term can affect the amount you pay as a premium for your insurance.

The average per capita income for the state of Mississippi is $31,365. What does this mean for you? It means that on average, most Mississippi citizens have an average monthly income (after taxes) of $2,613.75. That includes all of your monthly expenses such as food/grocery bills, rent/mortgage payments, health insurance, etc.

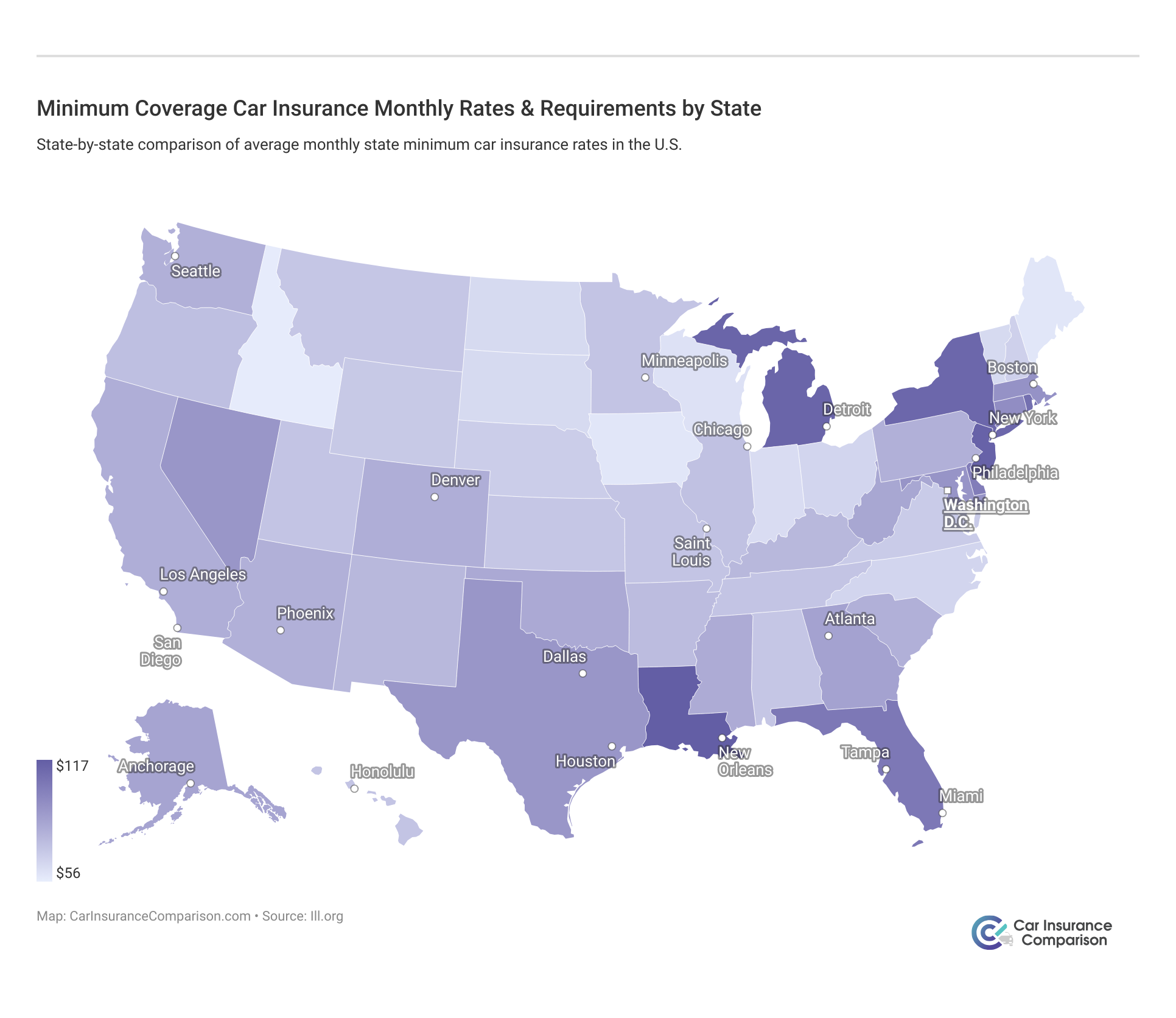

Full coverage car insurance in Mississippi is about $957.59 a year, meaning the average monthly full coverage premium is $79.80 in Mississippi.

So in Mississippi, if you were indeed had a per capita disposable income of $31,365 like the average citizen does, you would have to take that annual $957.59 car insurance premium out. To put this into perspective, however, the average annual rate for car insurance countrywide is $981. This means that Mississippi’s car insurance rate is LOWER than the national average. Good job Mississippi!

Average Monthly Car Insurance Rates in MI (Liability, Collision, Comprehensive)

The data listed below comes from one of the leading sources, the National Association of Insurance Commissioners. Rates will most definitely be significantly higher for 2019 and on.

716-Mississippi-Coverage-Type-Costs-2019-03-14.csv

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $460.50 |

| Collision | $323.22 |

| Comprehensive | $210.33 |

| Combined | $994.05 |

Having the required insurance is vital to operating a vehicle in the state of Mississippi, but keep in mind that just the minimum insurance might not cover you for other things you might not even think about. That’s where additional coverage can come in and assist you, and in the long run you’ll be happy you went the extra mile to protect yourself.

Want to learn more about what kinds of extra coverage you can get? Next, we’ll talk about the main types of coverage options you can add to your basic insurance plan.

Additional Liability

717-Mississipi Loss Ratios

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 74.81% | 77.44% | 80.03% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 69.10% | 74.67% | 79.20% |

All of the coverages listed in the above table are optional in Mississippi. While it might be tempting to skip them, it’s still important that you have coverage for these things.

These coverage types are some of the most important in the case of an accident. Say, for example, you get into an accident with an uninsured driver. Even worse, let’s say you get injured during this accident.

This means that the uninsured driver will have to pay for everything out-of-pocket. This uninsured driver could likely go bankrupt before they’re able to pay for all of the costs of the accident, meaning that they won’t be able to pay for your medical bills or the damage to your vehicle. Those costs will then fall on you if you don’t have this coverage.

Mississippi is currently ranked as the 2nd most uninsured drivers in the United States! This means that 23.7% of the population of Mississippi isn’t insured!

An absolutely terrifying statistic if you think back to the example above. All of the costs for medical bills and fixing your vehicle would FALL ON YOU, all because you didn’t have the kind of coverage you needed to protect you from these uninsured drivers.

Referring back to the above data, what exactly does a loss ratio mean? Why would this apply to you in this situation? Well, essentially what it means is that an insurance provider that has a high loss ratio (anything over 100%) loses money.

These companies are having to pay out far too many claims and are at high risk of going bankrupt. A company with a negative loss ratio, on the other hand, means they do not pay out enough claims.

As you can see from the data above, Mississippi loss ratios have actually decreased for Uninsured/Underinsured coverage but have increased slightly over the years for MedPay. This is a good thing though!

The top insurance providers in the United States in 2015 had loss ratios ranging from 94-112 percent, Mississippi is lower than this for both Uninsured/Underinsured and MedPay.

What should you take away from this topic? Make sure you get coverage for MedPay and Uninsured/Underinsured Motorist coverage for yourself. In addition, make sure you avoid companies that have too high or too low of a loss ratio.

Add-ons, Endorsements, and Riders

So now that you know that minimum coverage isn’t going to be enough to protect yourself, what else should you add? There is a staggering amount of add on coverage options you can add, but which ones are worth it?

We’ve made a list of some of the most affordable add on coverage options you can add to your plan. They can be extremely useful add-on options in the case of an accident or any other mishap.

Additional Coverage Options (click on each to learn more about that specific type):

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Modified Car Insurance Coverage

- Non-Owners Car Insurance

- Classic Car Insurance

- Low-Mileage Discount

While not essential, or required in the state of Mississippi, they are definitely great coverage options you can add to your policy. You can add as many, or as little, as you desire.

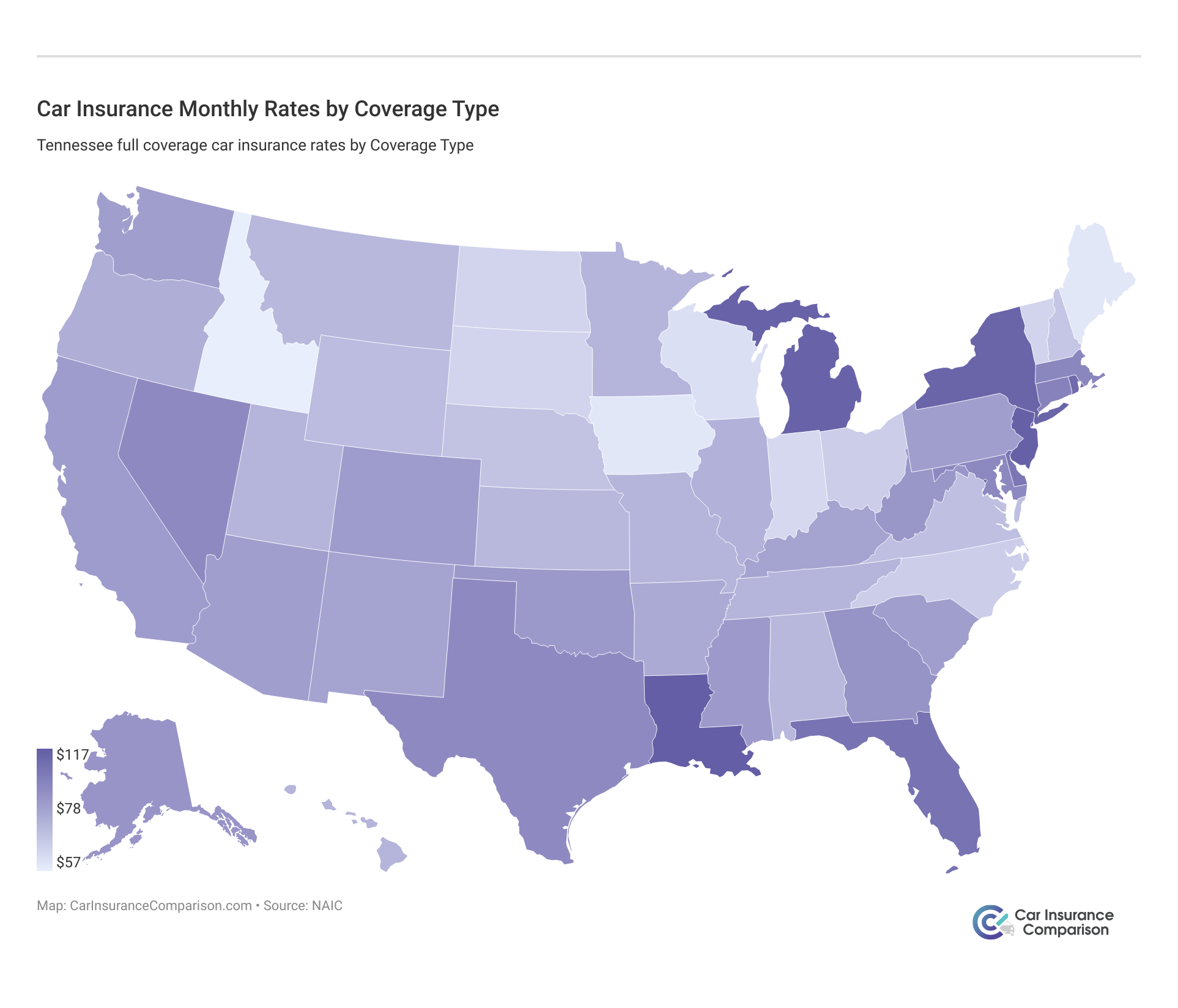

Average Monthly Car Insurance Rates by Age & Gender in MI

In case you didn’t have enough factors playing into how much you pay for your insurance rates, did you know that your own gender could factor in? Let’s see male vs female rates in Misssissippi.

718-Demographic-Rates-in-Mississippi-2019-03-14.csv

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| $2,759.49 | $2,635.21 | $2,463.36 | $2,519.32 | $11,031.99 | $11,772.88 | $3,133.31 | $3,215.18 | |

| $2,966.41 | $2,806.48 | $2,694.14 | $2,503.52 | $7,389.86 | $6,979.27 | $4,950.27 | $2,400.88 | |

| $2,046.11 | $2,102.48 | $1,835.74 | $1,945.49 | $4,088.44 | $5,202.84 | $2,318.23 | $2,510.05 |

| $2,591.63 | $2,419.61 | $2,124.47 | $2,061.68 | $9,375.44 | $10,495.41 | $2,662.75 | $2,769.80 | |

| $2,629.22 | $2,846.39 | $2,112.59 | $2,370.20 | $9,446.38 | $10,504.45 | $2,794.00 | $2,941.24 | |

| $1,877.59 | $1,877.59 | $1,680.17 | $1,680.17 | $5,427.70 | $6,823.62 | $2,091.75 | $2,382.03 | |

| $1,683.09 | $1,713.42 | $1,600.71 | $1,602.55 | $7,522.15 | $11,907.14 | $1,765.06 | $2,047.25 | |

| $1,385.56 | $1,371.97 | $1,293.28 | $1,308.31 | $3,448.85 | $4,091.04 | $1,689.16 | $1,861.86 |

So while it is usually thought that men pay more, it’s actually women who pay more in the state of Mississippi, at least after they turn 25. In the data above, married women seem to be paying more than their spouses are. Age seems to play a huge part in this, however, as you can see that 17-25-year-old single men are paying substantially more than their female counterparts.

For instance, from the data above, a single 17-year-old male would be paying $11,907.14 with Travelers Home & Marine Ins Co., while a 17-year-old girl would only be paying $7,22.15.

There are some insurers though that are seeing this gender bias and are trying to do away with them. For instance, married males and females (both 35 year olds and 60 year olds) pay the exact same rate with State Farm Mutual Auto!

While gender bias is being addressed, age still continues to play into insurance costs. Typically, the younger you are, the more you pay.

Highest and Lowest Insurance Rates by ZIP Code and City

Just like everything else, where exactly you live can play a role in your insurance costs.

Below, we’ve listed the car insurance for each city in Mississippi. Scroll through so you can see where your ZIP code ranks.

720- Mississippi Highest and Lowest Insurance Rates by Zip Code and City.csv

| City | Zipcode | Average Annual Rate |

|---|---|---|

| HERMANVILLE | 38601 | $3,529.60 |

| LORMAN | 38602 | $3,613.97 |

| PORT GIBSON | 38603 | $3,568.33 |

| NATCHEZ | 38606 | $3,732.00 |

| PATTISON | 38609 | $3,808.67 |

| FERNWOOD | 38610 | $3,410.42 |

| WASHINGTON | 38611 | $3,585.69 |

| WOODVILLE | 38614 | $3,910.45 |

| CROSBY | 38617 | $3,907.93 |

| TOUGALOO | 38618 | $3,621.23 |

| LAKESHORE | 38619 | $3,766.41 |

| TINSLEY | 38620 | $3,735.76 |

| FAYETTE | 38621 | $3,733.97 |

| JACKSON | 38622 | $3,786.36 |

| UTICA | 38623 | $3,989.17 |

| UNION CHURCH | 38625 | $3,374.28 |

| CHATAWA | 38626 | $3,753.83 |

| HURLEY | 38627 | $3,353.55 |

| PRENTISS | 38628 | $3,738.19 |

| ROME | 38629 | $3,489.04 |

| CENTREVILLE | 38630 | $3,994.56 |

| CARSON | 38631 | $3,890.85 |

| JACKSON | 38632 | $3,682.39 |

| WHITFIELD | 38633 | $3,512.62 |

| FARRELL | 38635 | $3,565.45 |

| HAZLEHURST | 38637 | $3,723.28 |

| DARLING | 38638 | $3,619.00 |

| PANTHER BURN | 38639 | $3,811.84 |

| GALLMAN | 38641 | $3,719.02 |

| FOXWORTH | 38642 | $3,638.78 |

| JACKSON | 38643 | $3,868.11 |

| GLOSTER | 38644 | $3,811.03 |

| CARRIERE | 38645 | $3,917.55 |

| KILN | 38646 | $3,837.93 |

| JACKSON | 38647 | $3,614.30 |

| KOKOMO | 38649 | $3,531.38 |

| SILVER CREEK | 38650 | $3,381.54 |

| JACKSON | 38651 | $3,698.93 |

| RENA LARA | 38652 | $3,284.97 |

| JACKSON | 38654 | $3,777.42 |

| COLUMBIA | 38655 | $3,546.16 |

| BASSFIELD | 38658 | $3,759.59 |

| JACKSON | 38659 | $3,515.40 |

| ROXIE | 38661 | $3,563.18 |

| D LO | 38663 | $3,430.33 |

| TIE PLANT | 38664 | $3,753.89 |

| PICAYUNE | 38665 | $3,651.72 |

| JACKSON | 38666 | $3,770.51 |

| VANCE | 38668 | $3,622.60 |

| LIBERTY | 38669 | $3,838.40 |

| NEW AUGUSTA | 38670 | $3,766.40 |

| BYRAM | 38671 | $3,764.60 |

| MC CALL CREEK | 38672 | $3,737.03 |

| LYON | 38673 | $3,529.00 |

| CRYSTAL SPRINGS | 38674 | $3,432.60 |

| JACKSON | 38675 | $3,565.33 |

| ELLIOTT | 38676 | $3,719.33 |

| SANDY HOOK | 38677 | $3,600.13 |

| CLARKSDALE | 38679 | $3,554.17 |

| TERRY | 38680 | $3,765.54 |

| COAHOMA | 38683 | $3,443.86 |

| POPLARVILLE | 38685 | $3,521.01 |

| SEMINARY | 38701 | $3,697.29 |

| TUTWILER | 38703 | $3,712.66 |

| WINTERVILLE | 38720 | $3,649.03 |

| PUCKETT | 38721 | $3,746.71 |

| SIBLEY | 38722 | $3,756.01 |

| RAYMOND | 38723 | $3,763.33 |

| HARPERVILLE | 38725 | $3,567.45 |

| MEADVILLE | 38726 | $3,553.33 |

| JACKSON | 38730 | $3,526.44 |

| WESSON | 38731 | $3,661.77 |

| SMITHDALE | 38732 | $3,547.21 |

| CHARLESTON | 38733 | $3,619.01 |

| SWAN LAKE | 38736 | $3,514.71 |

| FRIARS POINT | 38737 | $3,557.39 |

| CLINTON | 38738 | $3,812.76 |

| PACE | 38739 | $3,780.58 |

| OCEAN SPRINGS | 38740 | $3,637.80 |

| MIDNIGHT | 38744 | $3,651.42 |

| JACKSON | 38745 | $3,773.09 |

| BUDE | 38746 | $3,565.13 |

| WAVELAND | 38748 | $3,662.26 |

| WINSTONVILLE | 38751 | $3,465.74 |

| SUMRALL | 38753 | $3,479.37 |

| COLLINS | 38754 | $3,620.77 |

| LUCEDALE | 38756 | $3,658.99 |

| LAMBERT | 38759 | $3,536.26 |

| BAY SAINT LOUIS | 38760 | $3,858.94 |

| SUMNER | 38761 | $3,488.52 |

| METCALFE | 38762 | $3,632.23 |

| RICHTON | 38764 | $3,887.91 |

| PEARLINGTON | 38765 | $3,988.98 |

| MOUNT OLIVE | 38767 | $3,953.83 |

| GEORGETOWN | 38768 | $4,009.06 |

| SONTAG | 38769 | $3,528.71 |

| ENID | 38771 | $3,511.46 |

| MOSS POINT | 38772 | $3,834.98 |

| DIAMONDHEAD | 38773 | $3,507.10 |

| BEAUMONT | 38774 | $3,614.79 |

| NEWHEBRON | 38776 | $3,653.82 |

| SHERARD | 38778 | $3,512.44 |

| SAUCIER | 38780 | $3,689.71 |

| MARKS | 38781 | $3,877.63 |

| SCOTT | 38782 | $3,905.29 |

| JACKSON | 38801 | $3,258.36 |

| BRAXTON | 38804 | $3,239.30 |

| DELTA CITY | 38820 | $3,502.51 |

| GULFPORT | 38821 | $3,253.21 |

| BENTONIA | 38824 | $3,247.35 |

| JAYESS | 38825 | $3,314.90 |

| PINOLA | 38826 | $3,272.51 |

| OAK VALE | 38827 | $3,415.14 |

| PARCHMAN | 38828 | $3,293.99 |

| JONESTOWN | 38829 | $3,346.49 |

| VANCLEAVE | 38833 | $3,435.53 |

| LULA | 38834 | $3,383.63 |

| BELEN | 38838 | $3,419.25 |

| LUMBERTON | 38841 | $3,265.32 |

| GULFPORT | 38843 | $3,318.23 |

| PURVIS | 38844 | $3,369.73 |

| BILOXI | 38846 | $3,382.11 |

| MC NEILL | 38847 | $3,392.76 |

| CASCILLA | 38848 | $3,288.04 |

| GULFPORT | 38849 | $3,237.09 |

| MORTON | 38850 | $3,284.84 |

| RALEIGH | 38851 | $3,277.10 |

| BUCKATUNNA | 38852 | $3,441.34 |

| MC HENRY | 38855 | $3,336.26 |

| PASCAGOULA | 38856 | $3,274.20 |

| GLENDORA | 38857 | $3,287.84 |

| OSYKA | 38858 | $3,288.88 |

| YAZOO CITY | 38859 | $3,293.38 |

| PASCAGOULA | 38860 | $3,274.37 |

| SATARTIA | 38862 | $3,357.07 |

| SUMMIT | 38863 | $3,305.09 |

| PULASKI | 38864 | $3,329.46 |

| MOSS POINT | 38865 | $3,394.09 |

| MONTICELLO | 38866 | $3,251.39 |

| CROWDER | 38868 | $3,329.58 |

| WAYNESBORO | 38869 | $3,350.42 |

| STATE LINE | 38870 | $3,287.96 |

| PERKINSTON | 38871 | $3,412.67 |

| DUBLIN | 38873 | $3,370.72 |

| GAUTIER | 38874 | $3,284.95 |

| BENTON | 38875 | $3,587.22 |

| MONEY | 38876 | $3,343.84 |

| SWIFTOWN | 38877 | $3,334.47 |

| OLIVE BRANCH | 38878 | $3,246.01 |

| NEELY | 38879 | $3,289.64 |

| HARRISVILLE | 38880 | $3,569.73 |

| MORGAN CITY | 38901 | $3,701.07 |

| MIZE | 38913 | $3,442.80 |

| PASS CHRISTIAN | 38914 | $3,357.04 |

| VAUGHAN | 38915 | $3,366.35 |

| GRACE | 38916 | $3,364.61 |

| VOSSBURG | 38917 | $3,545.33 |

| SARDIS | 38920 | $3,803.75 |

| COMO | 38921 | $3,893.53 |

| SLEDGE | 38922 | $3,587.49 |

| PEARL | 38923 | $3,568.65 |

| WALLS | 38924 | $3,628.78 |

| BELLEFONTAINE | 38925 | $3,567.82 |

| SOUTHAVEN | 38926 | $3,913.97 |

| JACKSON | 38927 | $3,850.63 |

| AVON | 38928 | $3,799.62 |

| BILOXI | 38929 | $3,592.64 |

| TIPPO | 38930 | $3,515.83 |

| BILOXI | 38940 | $3,655.46 |

| POPE | 38941 | $3,459.81 |

| ARCOLA | 38943 | $3,619.19 |

| LEAKESVILLE | 38944 | $3,510.10 |

| ROBINSONVILLE | 38945 | $3,778.84 |

| DUNDEE | 38946 | $3,774.88 |

| TAYLORSVILLE | 38948 | $3,699.62 |

| DIBERVILLE | 38949 | $3,474.25 |

| LONG BEACH | 38950 | $3,646.01 |

| STONEWALL | 38951 | $3,333.71 |

| FLORENCE | 38952 | $3,445.67 |

| MAGNOLIA | 38953 | $3,650.55 |

| ANGUILLA | 38954 | $3,461.84 |

| HOLLY BLUFF | 38955 | $3,708.50 |

| TYLERTOWN | 38957 | $3,863.48 |

| PAULDING | 38958 | $3,892.34 |

| FALCON | 38959 | $3,778.81 |

| SOUTHAVEN | 38960 | $3,934.31 |

| COURTLAND | 38961 | $3,702.54 |

| SHUBUTA | 38962 | $3,761.01 |

| CRENSHAW | 38963 | $3,905.77 |

| BATESVILLE | 38964 | $3,932.66 |

| WALTHALL | 38965 | $3,643.19 |

| BOGUE CHITTO | 38966 | $3,725.45 |

| QUITMAN | 38967 | $3,462.61 |

| BILOXI | 39038 | $3,664.36 |

| MCCOMB | 39039 | $3,779.30 |

| ENTERPRISE | 39040 | $3,824.41 |

| WEBB | 39041 | $3,723.62 |

| CLINTON | 39042 | $3,715.66 |

| BOLTON | 39044 | $3,829.25 |

| HORN LAKE | 39045 | $3,655.41 |

| FLORA | 39046 | $3,659.71 |

| PICKENS | 39047 | $3,660.84 |

| MENDENHALL | 39051 | $3,696.62 |

| TUNICA | 39054 | $3,657.05 |

| LAKE CORMORANT | 39056 | $3,724.16 |

| LEXINGTON | 39057 | $3,425.08 |

| BRANDON | 39058 | $3,890.11 |

| HEIDELBERG | 39059 | $3,917.41 |

| PACHUTA | 39061 | $3,826.84 |

| GOODMAN | 39062 | $3,934.82 |

| GREENVILLE | 39063 | $3,689.07 |

| EDWARDS | 39066 | $3,710.36 |

| SLATE SPRING | 39067 | $3,533.98 |

| RICHLAND | 39069 | $4,107.16 |

| PINEY WOODS | 39071 | $3,722.60 |

| TILLATOBA | 39073 | $3,750.39 |

| RUTH | 39074 | $3,621.23 |

| GRENADA | 39077 | $3,988.22 |

| OAKLAND | 39078 | $3,854.09 |

| MC LAIN | 39079 | $3,713.87 |

| NESBIT | 39080 | $3,899.88 |

| GREENVILLE | 39082 | $3,775.82 |

| CARTHAGE | 39083 | $3,990.92 |

| FLOWOOD | 39086 | $4,323.64 |

| SANDERSVILLE | 39088 | $3,744.73 |

| EASTABUCHIE | 39090 | $3,555.26 |

| WAYSIDE | 39092 | $3,600.62 |

| DURANT | 39094 | $3,674.46 |

| HERNANDO | 39095 | $3,716.05 |

| WIGGINS | 39096 | $4,250.87 |

| RIDGELAND | 39097 | $3,675.04 |

| OVETT | 39098 | $3,637.11 |

| BROOKHAVEN | 39107 | $3,515.10 |

| MAGEE | 39108 | $3,579.90 |

| SILVER CITY | 39109 | $3,624.08 |

| LOUISE | 39110 | $3,585.80 |

| CLARA | 39111 | $3,675.57 |

| LENA | 39113 | $3,577.34 |

| TCHULA | 39114 | $3,719.91 |

| BELZONI | 39115 | $3,887.65 |

| HOLLANDALE | 39116 | $3,774.16 |

| CHATHAM | 39117 | $3,803.32 |

| BRANDON | 39119 | $3,855.45 |

| CANTON | 39120 | $4,189.65 |

| LELAND | 39140 | $3,841.08 |

| CARY | 39144 | $4,185.94 |

| HOLCOMB | 39145 | $3,625.04 |

| CAMDEN | 39146 | $3,721.72 |

| STONEVILLE | 39148 | $3,702.55 |

| SARAH | 39149 | $3,818.60 |

| GLEN ALLAN | 39150 | $4,242.24 |

| SCOBEY | 39151 | $3,904.26 |

| ALLIGATOR | 39152 | $3,790.79 |

| PHILIPP | 39153 | $3,803.11 |

| WATER VALLEY | 39154 | $3,901.26 |

| WEST | 39156 | $3,588.08 |

| LAMAR | 39157 | $3,679.51 |

| BROOKLYN | 39159 | $3,636.31 |

| VICKSBURG | 39160 | $3,524.48 |

| DUNCAN | 39161 | $3,572.20 |

| LUDLOW | 39162 | $3,792.33 |

| ROLLING FORK | 39165 | $3,901.71 |

| MOUND BAYOU | 39166 | $3,675.49 |

| CRUGER | 39167 | $3,624.79 |

| PELAHATCHIE | 39168 | $3,753.10 |

| STAR | 39169 | $3,672.14 |

| MADDEN | 39170 | $3,909.79 |

| SENATOBIA | 39171 | $3,621.20 |

| COLDWATER | 39173 | $4,112.92 |

| FOREST | 39174 | $4,138.74 |

| THOMASTOWN | 39175 | $4,053.43 |

| ISOLA | 39176 | $3,449.52 |

| MC CARLEY | 39177 | $3,598.46 |

| CLEVELAND | 39179 | $3,773.12 |

| INDEPENDENCE | 39180 | $3,638.12 |

| SEBASTOPOL | 39183 | $3,612.05 |

| SHELBY | 39189 | $3,580.07 |

| MICHIGAN CITY | 39190 | $4,157.25 |

| ARKABUTLA | 39191 | $3,894.35 |

| VICKSBURG | 39192 | $3,639.14 |

| MOSS | 39193 | $3,994.81 |

| ARTESIA | 39194 | $3,796.49 |

| LAKE | 39201 | $3,834.60 |

| UNIVERSITY | 39202 | $3,943.82 |

| VALLEY PARK | 39203 | $3,932.74 |

| PETAL | 39204 | $3,996.62 |

| MONTPELIER | 39206 | $3,878.24 |

| ROSE HILL | 39208 | $3,766.27 |

| GORE SPRINGS | 39209 | $3,962.53 |

| ELLISVILLE | 39210 | $4,105.52 |

| MERIDIAN | 39211 | $3,763.62 |

| MOSELLE | 39212 | $3,984.87 |

| REDWOOD | 39213 | $3,953.96 |

| COFFEEVILLE | 39216 | $3,917.37 |

| TREBLOC | 39217 | $3,953.54 |

| MADISON | 39218 | $3,702.94 |

| MAYHEW | 39232 | $3,694.35 |

| BYHALIA | 39269 | $3,895.61 |

| LAUREL | 39272 | $3,928.45 |

| DE KALB | 39301 | $3,590.48 |

| WALNUT GROVE | 39305 | $3,408.00 |

| MC COOL | 39307 | $3,469.69 |

| MAYERSVILLE | 39320 | $3,435.11 |

| PORTERVILLE | 39322 | $3,799.94 |

| HATTIESBURG | 39323 | $3,452.16 |

| SANDHILL | 39324 | $3,675.00 |

| SCOOBA | 39325 | $3,391.49 |

| HATTIESBURG | 39326 | $3,433.51 |

| WHEELER | 39327 | $3,422.39 |

| HATTIESBURG | 39328 | $3,581.19 |

| COILA | 39330 | $3,725.47 |

| ASHLAND | 39332 | $3,483.53 |

| DUCK HILL | 39335 | $3,428.04 |

| BENOIT | 39336 | $3,406.58 |

| PRESTON | 39337 | $3,471.13 |

| HOLLY SPRINGS | 39338 | $3,551.31 |

| TULA | 39339 | $3,545.05 |

| GUNNISON | 39341 | $3,535.00 |

| LAUREL | 39342 | $3,563.25 |

| MARION | 39345 | $3,441.63 |

| RED BANKS | 39346 | $3,531.74 |

| DREW | 39347 | $3,715.17 |

| KOSCIUSKO | 39348 | $3,740.64 |

| VICTORIA | 39350 | $3,433.57 |

| BEULAH | 39352 | $3,577.24 |

| LOUIN | 39354 | $3,566.10 |

| BAY SPRINGS | 39355 | $3,728.41 |

| STRINGER | 39356 | $3,594.35 |

| TOOMSUBA | 39358 | $3,571.39 |

| SOSO | 39359 | $3,618.76 |

| CLEVELAND | 39360 | $3,735.32 |

| OXFORD | 39361 | $3,523.19 |

| CARROLLTON | 39362 | $3,783.41 |

| LOUISVILLE | 39363 | $3,751.02 |

| MERIGOLD | 39364 | $3,550.22 |

| MACON | 39365 | $3,414.63 |

| ETHEL | 39366 | $3,770.60 |

| WEIR | 39367 | $3,785.18 |

| NOXAPATER | 39401 | $3,576.03 |

| MOUNT PLEASANT | 39402 | $3,570.70 |

| STEWART | 39406 | $3,569.43 |

| ABBEVILLE | 39421 | $3,944.37 |

| TAYLOR | 39422 | $3,551.23 |

| ROSEDALE | 39423 | $3,842.30 |

| BOYLE | 39425 | $3,638.61 |

| SALLIS | 39426 | $3,984.17 |

| SHUQUALAK | 39427 | $4,005.18 |

| WATERFORD | 39428 | $3,874.34 |

| GREENWOOD | 39429 | $3,946.60 |

| POTTS CAMP | 39436 | $3,690.06 |

| MC ADAMS | 39437 | $3,591.52 |

| DODDSVILLE | 39439 | $3,715.21 |

| HICKORY FLAT | 39440 | $3,563.50 |

| SUNFLOWER | 39443 | $3,584.35 |

| RULEVILLE | 39451 | $3,753.90 |

| MINTER CITY | 39452 | $3,870.67 |

| ACKERMAN | 39455 | $3,807.38 |

| SHAW | 39456 | $3,698.94 |

| BROOKSVILLE | 39457 | $3,804.09 |

| ALGOMA | 39459 | $3,588.62 |

| KILMICHAEL | 39460 | $3,610.80 |

| FRENCH CAMP | 39461 | $3,776.69 |

| FALKNER | 39462 | $3,930.59 |

| MOORHEAD | 39464 | $3,679.49 |

| HICKORY | 39465 | $3,595.96 |

| EUPORA | 39466 | $3,932.75 |

| INVERNESS | 39470 | $3,906.10 |

| PARIS | 39474 | $4,013.94 |

| LITTLE ROCK | 39475 | $3,806.35 |

| MERIDIAN | 39476 | $3,858.15 |

| INDIANOLA | 39477 | $3,690.13 |

| WINONA | 39478 | $3,912.19 |

| SIDON | 39479 | $3,906.08 |

| ITTA BENA | 39480 | $3,547.87 |

| CHUNKY | 39481 | $3,550.30 |

| VAIDEN | 39482 | $3,875.20 |

| SCHLATER | 39483 | $3,987.89 |

| WALNUT | 39501 | $3,803.48 |

| BANNER | 39503 | $3,806.41 |

| NEWTON | 39507 | $3,826.06 |

| IUKA | 39520 | $3,866.44 |

| BURNSVILLE | 39525 | $3,845.45 |

| BAILEY | 39530 | $3,805.23 |

| PHILADELPHIA | 39531 | $3,761.10 |

| DALEVILLE | 39532 | $3,759.95 |

| TIPLERSVILLE | 39534 | $3,726.87 |

| RIPLEY | 39540 | $3,752.09 |

| LAUDERDALE | 39553 | $3,780.36 |

| MANTEE | 39555 | $4,024.29 |

| CONEHATTA | 39556 | $3,979.89 |

| MATHISTON | 39558 | $4,129.33 |

| DECATUR | 39560 | $3,752.02 |

| DENNIS | 39561 | $3,799.93 |

| BELMONT | 39562 | $3,845.78 |

| UNION | 39563 | $3,790.24 |

| THAXTON | 39564 | $3,887.70 |

| BLUE MOUNTAIN | 39565 | $3,811.40 |

| MERIDIAN | 39567 | $3,796.13 |

| LAWRENCE | 39571 | $3,773.31 |

| RIENZI | 39572 | $3,857.61 |

| GOLDEN | 39573 | $3,782.76 |

| COLLINSVILLE | 39574 | $3,838.19 |

| HAMILTON | 39576 | $3,878.23 |

| CORINTH | 39577 | $3,682.18 |

| GLEN | 39581 | $3,799.78 |

| MYRTLE | 39601 | $3,677.90 |

| DUMAS | 39629 | $3,728.91 |

| TISHOMINGO | 39630 | $3,878.24 |

| GATTMAN | 39631 | $4,006.38 |

| BRUCE | 39632 | $4,041.93 |

| CALHOUN CITY | 39633 | $4,144.61 |

| PLANTERSVILLE | 39635 | $4,170.57 |

| BIG CREEK | 39638 | $3,984.59 |

| ETTA | 39641 | $3,823.17 |

| SHERMAN | 39643 | $3,956.73 |

| BOONEVILLE | 39645 | $3,932.21 |

| TREMONT | 39647 | $3,921.02 |

| MANTACHIE | 39648 | $3,726.10 |

| VAN VLEET | 39652 | $3,749.56 |

| PITTSBORO | 39653 | $3,896.44 |

| SHANNON | 39654 | $3,788.18 |

| RANDOLPH | 39656 | $3,814.87 |

| FULTON | 39657 | $3,798.18 |

| BECKER | 39661 | $3,941.64 |

| PONTOTOC | 39662 | $3,702.34 |

| BLUE SPRINGS | 39663 | $3,955.17 |

| NEW SITE | 39664 | $3,894.09 |

| VERONA | 39665 | $3,853.84 |

| NETTLETON | 39666 | $3,791.10 |

| GREENWOOD SPRINGS | 39667 | $3,741.79 |

| SMITHVILLE | 39668 | $4,050.99 |

| MOOREVILLE | 39669 | $4,149.93 |

| NEW ALBANY | 39701 | $3,158.94 |

| TOCCOPOLA | 39702 | $3,243.42 |

| HOULKA | 39705 | $3,257.98 |

| CALEDONIA | 39710 | $3,246.30 |

| HOUSTON | 39730 | $3,269.64 |

| OKOLONA | 39735 | $3,507.47 |

| PRAIRIE | 39736 | $3,605.47 |

| MARIETTA | 39737 | $3,764.74 |

| BELDEN | 39739 | $3,505.06 |

| ABERDEEN | 39740 | $3,283.58 |

| ECRU | 39741 | $3,231.09 |

| PHEBA | 39743 | $3,180.23 |

| TUPELO | 39744 | $3,482.78 |

| COLUMBUS | 39745 | $3,491.89 |

| AMORY | 39746 | $3,383.81 |

| SALTILLO | 39747 | $3,501.38 |

| WEST POINT | 39750 | $3,228.95 |

| BALDWYN | 39751 | $3,427.87 |

| COLUMBUS | 39752 | $3,422.43 |

| VARDAMAN | 39753 | $3,585.73 |

| COLUMBUS | 39754 | $3,594.89 |

| TUPELO | 39755 | $3,261.14 |

| GUNTOWN | 39756 | $3,274.33 |

| CEDARBLUFF | 39759 | $3,077.33 |

| MABEN | 39766 | $3,208.63 |

| WOODLAND | 39767 | $3,530.20 |

| STEENS | 39769 | $3,196.85 |

| STURGIS | 39771 | $3,729.29 |

| CRAWFORD | 39772 | $3,533.04 |

| COLUMBUS | 39773 | $3,249.13 |

| STARKVILLE | 39776 | $3,220.89 |

For more details on a specific city, please search below:

Mississippi Rates by City

| City | Average Annual Rate |

|---|---|

| STARKVILLE | $3,077.33 |

| CRAWFORD | $3,180.23 |

| STURGIS | $3,196.85 |

| STEENS | $3,208.63 |

| WOODLAND | $3,220.89 |

| COLUMBUS | $3,226.66 |

| MABEN | $3,228.95 |

| CEDARBLUFF | $3,231.09 |

| GUNTOWN | $3,237.09 |

| VARDAMAN | $3,246.00 |

| BALDWYN | $3,247.35 |

| TUPELO | $3,248.83 |

| WEST POINT | $3,249.13 |

| SALTILLO | $3,251.39 |

| AMORY | $3,253.21 |

| PHEBA | $3,261.14 |

| ECRU | $3,265.32 |

| ABERDEEN | $3,269.64 |

| BELDEN | $3,272.51 |

| MARIETTA | $3,274.20 |

| PRAIRIE | $3,274.33 |

| OKOLONA | $3,274.37 |

| HOUSTON | $3,277.09 |

| CALEDONIA | $3,283.58 |

| HOULKA | $3,284.84 |

| TOCCOPOLA | $3,284.95 |

| NEW ALBANY | $3,284.97 |

| MOOREVILLE | $3,287.84 |

| SMITHVILLE | $3,287.96 |

| GREENWOOD SPRINGS | $3,288.03 |

| NETTLETON | $3,288.88 |

| VERONA | $3,289.64 |

| NEW SITE | $3,293.38 |

| BLUE SPRINGS | $3,293.99 |

| PONTOTOC | $3,305.09 |

| BECKER | $3,314.90 |

| FULTON | $3,318.23 |

| RANDOLPH | $3,329.46 |

| SHANNON | $3,329.58 |

| PITTSBORO | $3,333.71 |

| VAN VLEET | $3,334.46 |

| MANTACHIE | $3,336.26 |

| TREMONT | $3,343.84 |

| BOONEVILLE | $3,346.49 |

| SHERMAN | $3,350.42 |

| ETTA | $3,353.55 |

| BIG CREEK | $3,357.03 |

| PLANTERSVILLE | $3,357.07 |

| CALHOUN CITY | $3,364.61 |

| BRUCE | $3,366.35 |

| GATTMAN | $3,369.73 |

| TISHOMINGO | $3,370.72 |

| DUMAS | $3,374.28 |

| MYRTLE | $3,381.54 |

| GLEN | $3,382.11 |

| CORINTH | $3,383.63 |

| HAMILTON | $3,383.81 |

| COLLINSVILLE | $3,391.50 |

| GOLDEN | $3,392.76 |

| RIENZI | $3,394.09 |

| LAWRENCE | $3,406.58 |

| BLUE MOUNTAIN | $3,410.42 |

| THAXTON | $3,412.67 |

| UNION | $3,414.64 |

| BELMONT | $3,415.14 |

| DENNIS | $3,419.25 |

| DECATUR | $3,422.39 |

| MATHISTON | $3,422.43 |

| CONEHATTA | $3,425.08 |

| MANTEE | $3,427.87 |

| LAUDERDALE | $3,428.04 |

| RIPLEY | $3,430.33 |

| TIPLERSVILLE | $3,432.60 |

| DALEVILLE | $3,433.51 |

| PHILADELPHIA | $3,433.57 |

| BAILEY | $3,435.11 |

| BURNSVILLE | $3,435.53 |

| IUKA | $3,441.34 |

| NEWTON | $3,441.63 |

| BANNER | $3,442.80 |

| WALNUT | $3,443.86 |

| SCHLATER | $3,445.67 |

| VAIDEN | $3,449.52 |

| CHUNKY | $3,452.16 |

| ITTA BENA | $3,459.81 |

| SIDON | $3,461.84 |

| WINONA | $3,462.61 |

| INDIANOLA | $3,465.74 |

| LITTLE ROCK | $3,471.13 |

| PARIS | $3,474.25 |

| INVERNESS | $3,479.37 |

| EUPORA | $3,482.78 |

| HICKORY | $3,483.53 |

| MOORHEAD | $3,488.52 |

| FALKNER | $3,489.03 |

| MERIDIAN | $3,489.39 |

| FRENCH CAMP | $3,491.89 |

| KILMICHAEL | $3,501.38 |

| ALGOMA | $3,502.51 |

| BROOKSVILLE | $3,505.06 |

| SHAW | $3,507.10 |

| ACKERMAN | $3,507.47 |

| MINTER CITY | $3,510.10 |

| RULEVILLE | $3,511.46 |

| SUNFLOWER | $3,512.44 |

| HICKORY FLAT | $3,512.62 |

| DODDSVILLE | $3,514.71 |

| MC ADAMS | $3,515.10 |

| POTTS CAMP | $3,515.40 |

| GREENWOOD | $3,515.83 |

| WATERFORD | $3,521.01 |

| SHUQUALAK | $3,523.19 |

| SALLIS | $3,524.48 |

| BOYLE | $3,526.44 |

| ROSEDALE | $3,528.71 |

| TAYLOR | $3,529.00 |

| ABBEVILLE | $3,529.60 |

| STEWART | $3,530.20 |

| MOUNT PLEASANT | $3,531.38 |

| NOXAPATER | $3,531.74 |

| WEIR | $3,533.03 |

| ETHEL | $3,533.98 |

| MACON | $3,535.00 |

| MERIGOLD | $3,536.26 |

| LOUISVILLE | $3,545.05 |

| CARROLLTON | $3,545.32 |

| OXFORD | $3,546.16 |

| SOSO | $3,547.87 |

| TOOMSUBA | $3,550.22 |

| STRINGER | $3,550.30 |

| BAY SPRINGS | $3,551.23 |

| LOUIN | $3,551.31 |

| BEULAH | $3,553.33 |

| VICTORIA | $3,554.17 |

| KOSCIUSKO | $3,555.26 |

| DREW | $3,557.39 |

| RED BANKS | $3,563.18 |

| MARION | $3,563.25 |

| GUNNISON | $3,565.13 |

| TULA | $3,565.33 |

| HOLLY SPRINGS | $3,565.45 |

| PRESTON | $3,566.09 |

| BENOIT | $3,567.45 |

| DUCK HILL | $3,567.82 |

| ASHLAND | $3,568.33 |

| COILA | $3,568.65 |

| WHEELER | $3,569.73 |

| SCOOBA | $3,571.39 |

| HATTIESBURG | $3,572.05 |

| SANDHILL | $3,572.20 |

| LAUREL | $3,573.93 |

| PORTERVILLE | $3,577.24 |

| MAYERSVILLE | $3,577.34 |

| MC COOL | $3,579.90 |

| WALNUT GROVE | $3,580.07 |

| DE KALB | $3,581.18 |

| CLEVELAND | $3,583.11 |

| BYHALIA | $3,585.69 |

| MAYHEW | $3,585.73 |

| MADISON | $3,585.80 |

| TREBLOC | $3,587.22 |

| COFFEEVILLE | $3,587.49 |

| REDWOOD | $3,588.08 |

| MOSELLE | $3,588.62 |

| ELLISVILLE | $3,591.52 |

| GORE SPRINGS | $3,592.64 |

| ROSE HILL | $3,594.35 |

| MONTPELIER | $3,594.89 |

| PETAL | $3,595.96 |

| VALLEY PARK | $3,598.46 |

| UNIVERSITY | $3,600.13 |

| LAKE | $3,600.62 |

| ARTESIA | $3,605.47 |

| MOSS | $3,610.80 |

| ARKABUTLA | $3,613.97 |

| MICHIGAN CITY | $3,614.30 |

| SHELBY | $3,614.79 |

| SEBASTOPOL | $3,618.77 |

| INDEPENDENCE | $3,619.00 |

| MC CARLEY | $3,619.19 |

| ISOLA | $3,620.77 |

| THOMASTOWN | $3,621.20 |

| COLDWATER | $3,621.23 |

| FOREST | $3,621.23 |

| SENATOBIA | $3,622.60 |

| MADDEN | $3,624.08 |

| STAR | $3,624.79 |

| PELAHATCHIE | $3,625.04 |

| VICKSBURG | $3,625.09 |

| CRUGER | $3,628.78 |

| MOUND BAYOU | $3,632.23 |

| ROLLING FORK | $3,636.31 |

| LUDLOW | $3,637.11 |

| DUNCAN | $3,637.80 |

| BROOKLYN | $3,638.61 |

| LAMAR | $3,638.78 |

| WEST | $3,639.14 |

| WATER VALLEY | $3,643.19 |

| PHILIPP | $3,646.02 |

| ALLIGATOR | $3,649.03 |

| SCOBEY | $3,650.55 |

| GLEN ALLAN | $3,651.42 |

| SARAH | $3,651.72 |

| STONEVILLE | $3,653.82 |

| CAMDEN | $3,655.41 |

| HOLCOMB | $3,655.46 |

| CARY | $3,657.05 |

| LELAND | $3,658.99 |

| CANTON | $3,659.71 |

| CHATHAM | $3,661.77 |

| HOLLANDALE | $3,662.26 |

| BELZONI | $3,664.36 |

| TCHULA | $3,672.14 |

| LENA | $3,674.46 |

| CLARA | $3,675.01 |

| LOUISE | $3,675.04 |

| SILVER CITY | $3,675.49 |

| MAGEE | $3,675.57 |

| BROOKHAVEN | $3,677.90 |

| OVETT | $3,679.49 |

| RIDGELAND | $3,679.51 |

| WIGGINS | $3,682.18 |

| HERNANDO | $3,682.39 |

| BRANDON | $3,688.25 |

| DURANT | $3,689.07 |

| WAYSIDE | $3,689.71 |

| EASTABUCHIE | $3,690.06 |

| SANDERSVILLE | $3,690.13 |

| FLOWOOD | $3,694.35 |

| CARTHAGE | $3,696.62 |

| NESBIT | $3,698.93 |

| MC LAIN | $3,698.94 |

| OAKLAND | $3,699.62 |

| GRENADA | $3,701.07 |

| RUTH | $3,702.34 |

| TILLATOBA | $3,702.54 |

| PINEY WOODS | $3,702.55 |

| RICHLAND | $3,702.94 |

| GREENVILLE | $3,704.98 |

| SLATE SPRING | $3,708.50 |

| EDWARDS | $3,710.36 |

| GOODMAN | $3,713.87 |

| PACHUTA | $3,715.17 |

| HEIDELBERG | $3,715.21 |

| LEXINGTON | $3,716.05 |

| LAKE CORMORANT | $3,719.02 |

| TUNICA | $3,719.33 |

| MENDENHALL | $3,719.91 |

| PICKENS | $3,721.72 |

| FLORA | $3,722.60 |

| HORN LAKE | $3,723.28 |

| BOLTON | $3,723.62 |

| WEBB | $3,725.45 |

| ENTERPRISE | $3,725.47 |

| MCCOMB | $3,726.10 |

| QUITMAN | $3,728.41 |

| BOGUE CHITTO | $3,728.91 |

| WALTHALL | $3,729.29 |

| BATESVILLE | $3,732.00 |

| CRENSHAW | $3,733.97 |

| SHUBUTA | $3,735.32 |

| COURTLAND | $3,735.77 |

| FALCON | $3,738.19 |

| PAULDING | $3,740.64 |

| TYLERTOWN | $3,741.79 |

| HOLLY BLUFF | $3,744.73 |

| ANGUILLA | $3,746.71 |

| MAGNOLIA | $3,749.56 |

| FLORENCE | $3,750.39 |

| SOUTHAVEN | $3,750.82 |

| STONEWALL | $3,751.02 |

| LONG BEACH | $3,752.02 |

| DIBERVILLE | $3,752.08 |

| TAYLORSVILLE | $3,753.10 |

| DUNDEE | $3,753.83 |

| ROBINSONVILLE | $3,753.89 |

| LEAKESVILLE | $3,753.90 |

| ARCOLA | $3,756.01 |

| POPE | $3,759.59 |

| TIPPO | $3,761.01 |

| BILOXI | $3,763.29 |

| AVON | $3,763.33 |

| BELLEFONTAINE | $3,764.74 |

| WALLS | $3,765.54 |

| PEARL | $3,766.27 |

| SLEDGE | $3,766.40 |

| COMO | $3,766.41 |

| SARDIS | $3,770.51 |

| VOSSBURG | $3,770.60 |

| GRACE | $3,773.09 |

| VAUGHAN | $3,773.12 |

| PASS CHRISTIAN | $3,773.31 |

| MIZE | $3,774.16 |

| MORGAN CITY | $3,774.88 |

| HARRISVILLE | $3,775.83 |

| NEELY | $3,776.69 |

| OLIVE BRANCH | $3,777.42 |

| SWIFTOWN | $3,778.81 |

| MONEY | $3,778.84 |

| BENTON | $3,779.30 |

| GAUTIER | $3,780.36 |

| DUBLIN | $3,780.58 |

| PERKINSTON | $3,782.76 |

| STATE LINE | $3,783.41 |

| WAYNESBORO | $3,785.18 |

| CROWDER | $3,786.36 |

| MONTICELLO | $3,788.18 |

| PULASKI | $3,790.79 |

| SUMMIT | $3,791.10 |

| SATARTIA | $3,792.33 |

| YAZOO CITY | $3,796.49 |

| PASCAGOULA | $3,797.96 |

| OSYKA | $3,798.18 |

| GLENDORA | $3,799.62 |

| MC HENRY | $3,799.92 |

| BUCKATUNNA | $3,799.94 |

| RALEIGH | $3,803.11 |

| MORTON | $3,803.32 |

| CASCILLA | $3,803.75 |

| MC NEILL | $3,804.09 |

| PURVIS | $3,806.35 |

| CLINTON | $3,807.14 |

| LUMBERTON | $3,807.38 |

| BELEN | $3,808.67 |

| LULA | $3,811.03 |

| VANCLEAVE | $3,811.40 |

| JONESTOWN | $3,811.84 |

| GULFPORT | $3,811.98 |

| PARCHMAN | $3,812.76 |

| OAK VALE | $3,814.87 |

| MOSS POINT | $3,818.01 |

| PINOLA | $3,818.60 |

| JAYESS | $3,823.17 |

| BENTONIA | $3,824.40 |

| DELTA CITY | $3,826.84 |

| BRAXTON | $3,829.25 |

| SCOTT | $3,834.98 |

| MARKS | $3,837.93 |

| SAUCIER | $3,838.19 |

| SHERARD | $3,838.40 |

| NEWHEBRON | $3,841.07 |

| BEAUMONT | $3,842.30 |

| DIAMONDHEAD | $3,845.45 |

| ENID | $3,850.63 |

| SONTAG | $3,853.84 |

| GEORGETOWN | $3,854.09 |

| MOUNT OLIVE | $3,855.45 |

| PEARLINGTON | $3,857.61 |

| RICHTON | $3,858.15 |

| METCALFE | $3,858.94 |

| SUMNER | $3,863.48 |

| BAY SAINT LOUIS | $3,866.44 |

| LAMBERT | $3,868.11 |

| LUCEDALE | $3,870.67 |

| COLLINS | $3,874.33 |

| SUMRALL | $3,875.20 |

| WINSTONVILLE | $3,877.63 |

| WAVELAND | $3,878.23 |

| BUDE | $3,878.24 |

| MIDNIGHT | $3,887.65 |

| OCEAN SPRINGS | $3,887.70 |

| PACE | $3,887.91 |

| FRIARS POINT | $3,890.85 |

| SWAN LAKE | $3,892.34 |

| CHARLESTON | $3,893.53 |

| SMITHDALE | $3,894.09 |

| WESSON | $3,894.35 |

| MEADVILLE | $3,896.44 |

| HARPERVILLE | $3,899.88 |

| RAYMOND | $3,901.26 |

| SIBLEY | $3,901.71 |

| PUCKETT | $3,904.26 |

| WINTERVILLE | $3,905.29 |

| TUTWILER | $3,905.77 |

| SEMINARY | $3,906.08 |

| POPLARVILLE | $3,906.10 |

| COAHOMA | $3,907.93 |

| TERRY | $3,909.79 |

| CLARKSDALE | $3,910.45 |

| SANDY HOOK | $3,912.19 |

| ELLIOTT | $3,913.97 |

| CRYSTAL SPRINGS | $3,917.42 |

| LYON | $3,917.55 |

| MC CALL CREEK | $3,921.02 |

| BYRAM | $3,928.45 |

| NEW AUGUSTA | $3,930.59 |

| LIBERTY | $3,932.21 |

| JACKSON | $3,932.54 |

| VANCE | $3,932.66 |

| PICAYUNE | $3,932.75 |

| TIE PLANT | $3,934.31 |

| D LO | $3,934.83 |

| ROXIE | $3,941.64 |

| BASSFIELD | $3,944.37 |

| COLUMBIA | $3,946.60 |

| RENA LARA | $3,953.83 |

| SILVER CREEK | $3,955.17 |

| KOKOMO | $3,956.73 |

| KILN | $3,979.89 |

| CARRIERE | $3,984.17 |

| GLOSTER | $3,984.59 |

| FOXWORTH | $3,987.89 |

| GALLMAN | $3,988.22 |

| PANTHER BURN | $3,988.98 |

| DARLING | $3,989.17 |

| HAZLEHURST | $3,990.92 |

| FARRELL | $3,994.56 |

| WHITFIELD | $3,994.81 |

| CARSON | $4,005.18 |

| CENTREVILLE | $4,006.38 |

| ROME | $4,009.06 |

| PRENTISS | $4,013.94 |

| HURLEY | $4,024.29 |

| CHATAWA | $4,041.93 |

| UNION CHURCH | $4,050.99 |

| UTICA | $4,053.43 |

| FAYETTE | $4,107.16 |

| TINSLEY | $4,112.92 |

| LAKESHORE | $4,129.33 |

| TOUGALOO | $4,138.74 |

| CROSBY | $4,144.61 |

| WOODVILLE | $4,149.93 |

| WASHINGTON | $4,157.25 |

| FERNWOOD | $4,170.57 |

| PATTISON | $4,185.94 |

| NATCHEZ | $4,189.65 |

| PORT GIBSON | $4,242.24 |

| LORMAN | $4,250.87 |

| HERMANVILLE | $4,323.64 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Mississippi Car Insurance Companies

There are countless car insurance companies out there, all of them wanting your business. It can be pretty overwhelming having all of them trying to come at you at once. Especially when you are trying to find the best rates and coverage for you, it can be hard to weed through sincere companies.

We don’t want you to have to spend your hard-earned money on a bad insurance plan or to have to pay a ridiculously expensive rate for a decent plan.

We’ve gone through and looked through the biggest car insurance providers in Mississippi for you. We’ve covered their ratings, complaints, and more.

Let’s get to it!

The Largest Companies Financial Ratings

How can you determine how well an insurance company will cover you? Well, luckily there’s something called the AM Best Rating. This rating determines exactly what an insurance company’s financial strength is. The higher the rating, the more stable the company is.

So, for instance, in the table below you’ll see that several companies have an A+++ rating. This means that these companies are extremely stable. A lot of the more national insurance providers (i.e. Geico, State Farm, etc) will have these higher ratings for the simple reason that they’ve got very stable loss ratio’s.

Below you can find the AM Financial Ratings for the largest insurance providers in Mississippi.

Mississippi Largest Companies Financial Ratings

| Insurance Company | AM Best | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| B | $483,064 | 61.62% | 25.72% | |

| A+ | $223,023 | 69.60% | 11.87% |

| A+ | $192,012 | 65.31% | 10.22% | |

| A+ | $155,147 | 50.96% | 8.26% | |

| A++ | $117,890 | 70.29% | 6.28% | |

| A | $117,425 | 68.86% | 6.25% |

| A+ | $108,233 | 60.37% | 5.76% |

| A++ | $95,802 | 78.03% | 5.10% | |

| A | $70,841 | 64.72% | 3.77% |

| A | $59,844 | 68.58% | 3.19% |

| State Total | $1,878,254 | 64.24% | 100.00% |

As we had talked about before, companies with too high (over 100 percent) or too low loss ratio’s should be avoided. On average, all of the largest companies in Mississippi have around the same loss ratio (averaging in the range of 60-78 percent).

The good news for those in Mississippi is that none of these companies are in danger of going bankrupt! Below we’ve also included data for the overall customer satisfaction for the SouthEast Region (this is the region Mississippi is included in).

Companies with the Most Complaints in Mississippi

So the insurance provider has a really good AM Best Rating, what about the number of complaints? Complaints do not mean that a company is bad, but it can give you an idea of how the company will address the complaints they get. It also gives you an idea as to what the customer satisfaction for that company will be.

The data below shows the complaint index of the insurance companies in Mississippi.

Insurance Company Complaint Index in Mississippi

| Insurance Company | Complaint Index |

|---|---|

| 0.58 |

| 0.65 | |

| 1.2 |

| 1.45 | |

| 0.8 | |

| 1.1 | |

| 1.3 | |

| 1.2 | |

| 1.7 | |

| 0.55 | |

| 1.5 |

| 1.1 |

| Inverness Partners | 1.2 |

| 0.55 |

| 1 | |

| 0.9 |

| 0.95 | |

| 0.78 |

| 1.11 | |

| 0.9 | |

| 1.22 |

| 0.85 |

| 1.89 | |

| 0.78 | |

| 1.12 | |

| 1.74 | |

| 1.1 | |

| 1.3 | |

| 1.5 | |

| 2.85 |

| 1.25 | |

| 1.12 |

Read more:

Mississippi Car Insurance Rates by Company

745-Mississippi-Car-Insurance-Rates-by-Company-2019-03-14.csv

| Company | Average | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| $4,941.34 | $1,276.53 | 25.83% | |

| $4,086.36 | $421.54 | 10.32% | |

| $4,455.56 | $790.74 | 17.75% | |

| $2,756.17 | -$908.64 | -32.97% |

| $4,312.60 | $647.78 | 15.02% | |

| $2,980.08 | -$684.74 | -22.98% | |

| $3,730.17 | $65.35 | 1.75% | |

| $2,056.25 | -$1,608.56 | -78.23% |

Notably, USAA and Nationwide P&C are both about $1,000 LESS than the state average.

Cost of Commutes by Carrier

How far you commute and the mileage of that commute factor into your rates for certain companies, though it is not the only factor considered by companies.

746-Commute-per-Carrier-Costs-in-Mississippi-2019-03-14.csv

| Insurance Company | Commute and Annual Mileage | Annual Average |

|---|---|---|

| 25 miles commute. 12000 annual mileage. | $13,847.08 |

| 10 miles commute. 6000 annual mileage. | $13,055.12 |

| MS | 25 miles commute. 12000 annual mileage. | $3,683.20 |

| MS | 10 miles commute. 6000 annual mileage. | $3,646.43 |

| 10 miles commute. 6000 annual mileage. | $2,926.49 |

| 25 miles commute. 12000 annual mileage. | $2,926.49 |

| 25 miles commute. 12000 annual mileage. | $2,899.06 | |

| 10 miles commute. 6000 annual mileage. | $2,824.14 | |

| 25 miles commute. 12000 annual mileage. | $2,122.82 | |

| 10 miles commute. 6000 annual mileage. | $2,011.15 |

Longer commutes tend to be more expensive across the board for most states.

Coverage Level Rates in Mississippi

It can certainly be a tempting idea to purchase the lowest coverage simply because of the lower cost. But what cost does that come at? A higher level of coverage will protect you significantly more and it will ensure that it has your back when you need it.

747-Cost-by-Coverage-Levels-Mississippi-2019-03-14.csv

| Group | Coverage Type | Annual Average |

|---|---|---|

| High | $5,160.28 | |

| Medium | $4,936.29 | |

| High | $4,750.94 |

| Low | $4,727.46 | |

| High | $4,710.11 | |

| Medium | $4,435.93 |

| Medium | $4,368.16 | |

| High | $4,286.85 | |

| Low | $4,179.80 |

| Medium | $4,114.68 | |

| High | $3,897.41 | |

| Low | $3,859.52 | |

| Low | $3,857.53 | |

| Medium | $3,752.92 | |

| Low | $3,540.18 | |

| High | $3,161.38 | |

| Medium | $2,967.50 | |

| High | $2,914.81 |

| Low | $2,811.35 | |

| Medium | $2,747.46 |

| Low | $2,606.25 |

| High | $2,200.90 | |

| Medium | $2,045.11 | |

| Low | $1,922.75 |

So as you can see from the above data, the difference between coverage levels by company is marginally small. USAA for example only differs by $278.15 from a low coverage plan and a high coverage plan. This means for only a few hundred dollars more per year, you can get a high coverage plan. It’s definitely an investment worth the money, as it gives you more bang for your buck.

Credit History Rates

What your credit history is like will also play a factor in what kind of insurance rates you’ll find. The better your credit history, the lower your rates will tend to be.

748-Credit-History-Costs-by-Company-Mississippi-2019-03-14.csv

| Company | Credit History | Annual Average |

|---|---|---|

| Poor | $14,094.18 |

| Fair | $9,029.73 |

| Good | $7,062.75 |

| Poor | $6,161.23 | |

| Poor | $5,721.87 | |

| Fair | $5,065.11 | |

| Poor | $4,891.94 | |

| Poor | $4,233.92 | |

| Fair | $4,170.46 | |

| Good | $4,037.04 | |

| Poor | $3,914.74 | |

| Good | $3,875.40 | |

| Good | $3,502.98 | |

| Fair | $3,490.89 | |

| Fair | $3,453.60 | |

| Poor | $3,451.55 | |

| Poor | $3,397.54 |

| Fair | $2,747.94 |

| Good | $2,606.95 | |

| Good | $2,459.66 |

| Fair | $2,102.98 | |

| Fair | $2,069.13 | |

| Good | $1,776.60 | |

| Good | $1,581.04 |

You can see from the above table, for example, that for Liberty Mutual if you were to have a good credit history you would only be paying $7,062.75 while a poor credit history would have you paying $14,094.18. That is a difference of $7,031.43, almost DOUBLE the cost!

Mississippi has an average credit score of 647 while the national average is 675. This places Mississippi in the top 10 states with the lowest credit scores!

Driving Record Rates

What kind of driver you are on the road also can affect your rates. Same as with your credit history, the better it is, the lower your rates are going to be.

749-Cost-by-Company-for-Driving-Records-Mississippi-2019-03-14.csv

| Company | Driving Record | Annual Average |

|---|---|---|

| With 1 DUI | $5,956.24 | |

| With 1 DUI | $5,869.23 | |

| With 1 DUI | $5,170.33 |

| With 1 accident | $5,046.99 |

| With 1 accident | $4,952.25 | |

| With 1 accident | $4,912.99 | |

| With 1 speeding violation | $4,726.86 | |

| With 1 DUI | $4,688.01 | |

| With 1 speeding violation | $4,442.21 |

| With 1 speeding violation | $4,338.27 | |

| With 1 DUI | $4,267.10 | |

| Clean record | $4,169.28 | |

| With 1 speeding violation | $4,078.45 | |

| With 1 accident | $3,856.26 | |

| Clean record | $3,692.78 | |

| With 1 DUI | $3,574.60 |

| With 1 speeding violation | $3,558.80 | |

| With 1 accident | $3,413.50 | |

| With 1 accident | $3,312.87 | |

| Clean record | $3,260.37 | |

| Clean record | $3,162.70 |

| With 1 DUI | $2,949.82 | |

| With 1 speeding violation | $2,949.82 | |

| With 1 accident | $2,809.29 |

| With 1 DUI | $2,783.92 | |

| Clean record | $2,707.79 | |

| Clean record | $2,541.48 | |

| With 1 speeding violation | $2,438.23 |

| Clean record | $2,202.58 |

| With 1 accident | $2,050.45 | |

| With 1 speeding violation | $1,785.46 | |

| Clean record | $1,605.19 |

From the table above you can see that with Allstate, a clean driving record has an annual average of $4169.28, but just one DUI skyrockets that to $5,956.24. That’s a difference of $1,786.96 with just ONE DUI! Even something like having one accident with Allstate would increase your rate by $1,0433.25. Moral of the story, be careful out there on the roads! Not only will it protect your life, but also your wallet!

How Much Auto Insurance Costs in Mississippi

Discovering the cost of auto insurance in Mississippi can be crucial for informed decision-making. By comparing rates across cities like Bay St. Louis, Southaven, Forest, Wiggins, Moss Point, Winona, and Olive Branch, drivers can gain insights into regional variations and make informed choices. Let’s delve into the intricacies of insurance costs in these areas.

| Compare Car Insurance Rates in Your City | |

|---|---|

| Bay St. Louis, MS | Southaven, MS |

| Forest, MS | Wiggins, MS |

| Moss Point, MS | Winona, MS |

| Olive Branch, MS |

Number of Insurers in Mississippi

750-Number-of-Insurers-in-Mississippi-2019-03-14.csv

| Number of Licensed Insurers in Mississippi | Number |

|---|---|

| Domestic | 15 |

| Foreign | 907 |

| Total Number of Licensed Insurers | 922 |

You must be wondering, from the table above, what exactly is the difference between domestic and foreign insurance. Domestic insurance is any insurance formed under Mississippi law while foreign insurance is any insurance formed under the laws of any U.S. state. Basically, if the company’s home offices are in Mississippi, it’s a domestic company. If the company’s home offices are located in another state, it’s a foreign company.

Mississippi State Laws

Now that we’ve covered some information about car insurance rates/coverage and car insurance companies in Mississippi, we’ll move on to discussing laws specific to the state of Mississippi. State laws can sometimes be confusing because what is legal in one state might not be legal in another.

So making sure you know exactly what is legal in the state of Mississippi is going to be key for you to drive lawfully in the state. The last thing we want is for you to get a fine for breaking a law you didn’t even know was there!

We’ve put together some of the most important driving laws you’ll need to know. So strap in and keep reading to find out more!

Car Insurance Laws

As discussed previously in another section, Mississippi required all drivers to have minimum liability insurance coverage. According to the NAIC, insurers in Mississippi must file their policies with the Mississippi Insurance Department prior to using it.

Mississippi required minimum liability insurance coverage of 20/40/10.

High-Risk Insurance

If you are considered a high-risk driver, you may have a difficult time finding a car insurance provider who will offer you coverage. What are some of the reasons you would need high-risk car insurance? Well, we’ve listed some of the reasons you would be considered a high-risk driver and would need mandatory high-risk insurance:

- Driving while uninsured

- Aged 70 years or older

- DUI/DWI conviction

- A traffic violation that resulted in a fatality/serious injury

- A high number of points on your driving record

- Owning a high-risk car (such as a sports car)

The DMV states that if you are turned away for being a high-risk driver from other providers, you may qualify for the Mississippi Automobile Insurance Plan (MSAIP). You only need to have two things in order to qualify for this insurance coverage:

- Possess a valid Mississippi driver’s license

- Current car registration in Mississippi

You need to have BOTH of these things in order to qualify for this. If you meet these two requirements, you can purchase MSAIP through any licensed Mississippi car insurance company. They are likely to have much higher rates than your typical insurance rate would be if you weren’t considered high risk.

However, if you are continuously turned away for being high risk, this may be your only option for getting that coverage you need in order to drive legally in the state. The Mississippi DMV recommends shopping around to see if you can find regular insurance coverage before opting for this option.

Low-Cost Insurance

Mississippi, unfortunately, does not currently have any government-sponsored insurance programs for those who are low-income. There are alternatives for those who are looking to cut down on costs, so don’t be discouraged by this!

Ask your provider if they offer any of the following discounts to save you some extra cash:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking – some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

If you want to save more, don’t forget to make sure you shop around to find the best coverage with the most cost-effective rates.

Windshield Coverage

In Mississippi, you may not have to worry so much about your windshield cracking or shattering from the cold, but there are still plenty of ways that a windshield can accrue some damage. What should you do if you need to replace or repair your windshield?

There are some states that require specific things when it comes to windshield coverage for your insurance, Mississippi is not one of them, however. There are no laws requiring windshield coverage in Mississippi, however, a good number of insurance companies may offer it with comprehensive coverage.

Automobile Insurance Fraud in Mississippi

Insurance fraud is universally illegal in every single state in the United States. How exactly can insurance fraud be committed? Well, according to the IIHS, there are two ways insurance fraud could be committed:

- Intentionally faking an accident / making a false claim

- Adding “extra” things onto a legitimate claim

Mississippi has a fraud bureau that works to catch those who commit insurance fraud.

If you were to commit insurance fraud in Mississippi, you could be facing some hefty fines, community service, or even some jail time. So moral of the story? Don’t make false claims or try to add “extra” onto your claim. It just wouldn’t be worth it in the long run.

Statute of Limitations

Did you know that if you were in a car accident and needed to make a claim, you only have a certain amount of time to file your claim? This is known as the statute of limitations, limiting the time you have to make your claim in order to receive the money you are owed.

The time starts from the day of your accident until you submit your claim. Each state is different in the time frame you are given for this statute of limitations.

- Personal Injury: 3 years

- Property Damage: 3 years

So if you were to try to file a claim because of an injury you had during an accident, you would have X years. If you wanted to file a claim for any damage to your vehicle, you would have x years to file for that.

While it may seem like you have a pretty hefty chunk of time to submit your claim, but time can fly by faster than you think. If you are dealing with all of the repercussions of these types of claims (i.e. if you’re dealing with any hospital time because of an injury you’ve had, or if you’re dealing with replacing and repairing your vehicle) then this time can sometimes flash right by before you even know it. So filing your claim as soon as you can is extremely important!

Mississippi Lemon Laws

What exactly is a “lemon” vehicle? Well, if you have ever purchased a vehicle and it has spent most of its time in a repair shop, then it’s probably a ‘lemon’. Luckily for Mississippi citizen, the state has special “lemon laws” that protect new car buys from situations like this.

The official title of the act in Mississippi is the “Motor Vehicle Warranty Enforcement Act”, but is more commonly referred to as the Mississippi Lemon Laws.

How do you know if your car qualifies as a ‘lemon’ in Mississippi? Below are just a few general guidelines your vehicle must fall under in order to qualify:

- The vehicle has to have some sort of substantial issue that happens within a certain time after purchase

- The issue has to be covered by a warranty

- The issue has to continue to exist even after a reasonable number of repairs that have been attempted

What happens if you meet these guidelines? Well according to the remedies for this law, it’s the consumers (i.e. you!) option. You have the choice of replacing your lemon vehicle with a comparable vehicle, or you can accept a return and refund of the full purchase price (which includes all collateral charges such as repair costs).

Vehicle Licensing Laws

Since we know that Mississippi requires all drivers to have the minimum insurance in order to drive, what happens to those who are caught driving without it? Well, in Mississippi, there are some pretty strict penalties in place.

Even if it is your first offense, if you are caught driving without your insurance in Mississippi you will be fined $1,000 and will have your driving privileges suspended for one year or until you can proof you are insured. (For more information, read our “What is the penalty for driving without insurance in Mississippi?“).

This means that you won’t be allowed to drive until you can prove you have some sort of car insurance, or else you won’t be allowed to drive for at least a year. Anytime law enforcement pulls you over, you will have to provide proof of insurance, as well as your car’s registration and driver’s license. What are some acceptable methods of proving you have insurance?

Any of the below are acceptable proofs of insurance:

- Copy of your current car insurance policy

- A valid insurance ID card

- Valid insurance binder (this is a temporary form of car insurance)

If you can provide proof that you had insurance at the time of the citation, you can get your fine and court fees waived, otherwise, you may be legally required to file an SR-22 form.

According to Mississippi’s DMV, you might have to file an SR-22 form from your insurance provider. This SR-22 form, also known as “proof of financial responsibility” is essentially a certification that your insurance provider that states you will maintain that minimum liability insurance you are required to have for a particular time frame.

It is NOT insurance but can help to prevent suspension/revocation of your driver’s license or reinstate an already suspended/revoked driver’s license.

Bottom line? If you break this law in Mississippi, you will immediately be fined and have your license suspended. So make sure you have your insurance on you at all times while operating your vehicle, or you will have to face the consequences.

Teen Driver Laws

Teenage drivers can apply for a learner’s license/permit as young as 16 years old. It’s important that teenagers know the laws that apply to them, as these rules help keep them safe while they try to learn how to drive. It’s stressful enough learning how to drive, the last thing they need is to run into trouble in the process.

758-Requirements-for-Getting-a-License-in-Mississippi-2019-03-14.csv

| Requirements for Getting a License in Mississippi | Time |

|---|---|

| Mandatory Holding Period | 12 months (individuals 17 years and older are exempt) |

| Minimum Supervised Driving Time | none |

| Minimum Age | 16 years old (individuals 17 and older are exempt from the requirement to get an intermediate license) |

In Mississippi, those teen drivers who are 17 years and older do not have to adhere to the learner’s permit/license rules, as they can just immediately get a restricted license. Those restricted license drivers still have to follow the rules listed below.

760-Restrictions-for-Restricted-Licenses-in-Mississippi-2019-03-14.csv

| Restrictions for Restricted Licenses in Mississippi | Time |

|---|---|

| Nighttime Restrictions | 10 p.m.-6 a.m. Sun.-Thur., 11:30 p.m.-6 a.m. Fri.-Sat. |

| Passenger Restrictions (excepting family members) | none |

| Minimum age at which restrictions may be lifted: | |

| Nighttime Restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) |

| Passenger Restrictions | none |

| Minimum age at which restrictions may be lifted | Time |

|---|---|

| Nighttime Restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) |

| Passenger Restrictions | none |

Older Driver License Renewal Procedures

Mississippi is one of the few states in which the requirements for license renewal procedures are the same for the general population as well as those who are older. For both, you need to renew your license once every 4-8 years and can do it online, as well as any other conventional method.

Though it’s not a requirement, it is still advisable for older drivers to have their vision checked.

New Residents

Have you recently decided that you want to make the Magnolia State your home? Well, you will need to make sure you contact your current insurance provider to make sure you update all of you information. You will need to update your rates to ensure you have the minimum liability insurance (as mentioned previously) as well as update your insurance ID cards.

As a reminder, Mississippi requires a minimum liability of 20/40/10

Definitely make sure you add this to your to-do list when moving to Mississippi!

License Renewal Procedures

All Mississippi citizens are required to renew their driver’s license every couple of years, but what are the basic procedures you need to know in order to get this done?

- Renewal Cycle: once every 4-8 years

- Online/Mail Renewal: anyone can renew their license online or by mail but only once every other renewal (meaning every other renewal cycle you will need to go to the DMV to get your renewal)

- Proof of Adequate Vision: Not required

The good news for this is that you don’t have to go to the DMV every single time you have to get your license renewed. Putting that into perspective, this means you’ll only have to go to the DMV to get your license renewed every 8-16 years!

Negligent Drivers

There are two classifications of ‘negligent driving’ in the state of Mississippi.

It is considered reckless driving in Mississippi if someone is driving in a manner that suggests either a willful or wanton disregard for the safety of both people and property. This type of negligent driving can have a fine of up to $100 for a first-time offense, and could have a $500 fine AND 10 days in jail for a second-time offense.

It is considered careless driving in Mississippi if someone is driving a vehicle in a careless way without regard for normal driving circumstances (i.e. width, grade, traffic, etc.). This type of negligent driving can have a fine of up to $50 no matter the number of offenses.

These types of offenses are considered misdemeanors and can put your license in danger of being suspended if you have other violations as well. In addition, your insurance rates will likely increase with these offenses. Bottom line? Drive responsibly while on the road and you won’t have to worry about having to pay fines or increased insurance rates, as well as avoiding possible jail time!

Mississippi’s Rules of the Road

We want to make sure that when you go out for that drive in your vehicle, that you are armed with all the tools you’ll need to cruise Mississippi’s roads. We are going to discuss some of the rules of the road in Mississippi so you can avoid any costly tickets or points off of your driver’s license. The last thing we want is for you to lose your hard-earned cash over something you could’ve easily avoided by knowing more about.

Keep reading to check out Mississippi’s rules of the road.

Fault VS. No-Fault

Mississippi is an at-fault state. What exactly does this mean? Well, if you’re in an accident and YOU are the one who caused the accident, then you will be held responsible for paying for the costs of anyone who was injured in the accident AND any property damage. If you have adequate insurance coverage, the provider will cover most of the costs.

If you DON’T have insurance/the right coverage, you will end up paying out of pocket for these costs. You can quickly drain your bank account this way, so making sure you have the right coverage to match what you need is essential. Just getting the minimum liability coverage won’t necessarily cut it in these circumstances.

Keep Right and Move Over Laws

Mississippi’s keep right laws are pretty simple to adhere to. If you are driving and are going SLOWER than the speed limit, you have to stay in the RIGHT lane. Most keep right laws are for 3+ lane roads. Passing on the right is allowed in certain conditions.

Another easy-to-follow law is the Move Over Law. This means that all drivers/motorists have to move over to safety pass a vehicle that is on the side of the road.

Vehicles you are required to move over for include:

- Firefighters

- Ambulances

- Utility Workers

- Law Enforcement

- Utility Trucks

- Drivers with Hazard Lights on

Basically, if you see a driver with flashing lights, move over! Laws like this are put in place to make sure everyone on the road is safe. Watch the video below to see why Move Over Laws are so important in Mississippi!

Speed Limits

Each and every state has speed limits for the varying road types in their state. There are a number of factors that contribute to why a speed limit is chosen for a particular road, from road visibility to where it’s located relative to the population of people in the surrounding area, to how many curves are in the road.

Below are the maximum speed limits that were chosen for the different road types in Mississippi. Keep in mind that these are the MAXIMUM speed limits. There will be some variety in speed limits depending on particular roads in Mississippi.

801-Mississippi-Speed-Limits-2019-03-14.csv

| Mississippi Speed Limits | MPH |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 65 mph |

Seat Belt and Car Seat Laws

Every year seat belts save lives, as do appropriate child car seats. Mississippi wants to keep all of the drivers in their state safe, which is why they have some pretty strict seat belt and car seat laws in place. Below the safety belt and child seat laws that are in effect in Mississippi.

802-Mississippi-Safety-Belt-Laws-2019-03-14.csv

| Safety Belt Use | Laws |

|---|---|

| Initial Effective Date | 07/01/94 |

| Primary Enforcement? | yes; effective 05/27/06 |

| Age/Seats Applicable | 7+ years in all seats |

| 1st Offense - maximum base fine | $25 |

803-Mississippi-Child-Seat-Laws-2019-03-14.csv

| Child Seat Requirements | Laws |

|---|---|

| Must be in child safety seat | 3 years and younger must be in a child restraint; 4 through 6 years and either less than 57 inches or less than 65 pounds must be in a booster seat |

| Adult Belt Permissible | 6 years and younger who either weigh 65 pounds or more or who are 57 inches or taller |

| 1st Offense Maximum Base Fine | $25 |

| Preference for Rear Seat | law states no preference for rear seat |

There are currently no state laws in Mississippi regarding passengers riding in the cargo area of a pickup truck, but it is always advised to exercise caution to make sure all passengers are safe.

Ridesharing

There has been an increased availability of ridesharing services over the past few years. What is a ridesharing service? Well if you’ve ever taken an Uber or a Lyft, you have used a ridesharing service. These services can be extremely useful for riders, but did you know that a lot of these companies require that the driver have a particular type of insurance on their policy, known as ridesharing insurance.

Currently the only insurance provider that offers ridesharing coverage in Mississippi is State Farm.

So if you’re looking to make some extra cash and thinking of applying to companies like these, make sure you check with your provider to see if they do offer ridesharing insurance. If they don’t, you may need to find a different insurer in order to get this coverage.

Automation on the Road

Automated vehicles are the way of the future in vehicle transportation according to some automotive experts. Now while you may be thinking of something such as a self-driving car, or even cars that can parallel park themselves, a lot of “automate vehicles” are more in reference right now to vehicles with items such as cruise control.

The technology is so new that most states do not have any particular rules regarding automation on the road.

Mississippi is one of 19 states that have been starting to regulate vehicle automation for large trucks. According to the IIHS, these states are starting to try and regulate platooning technology.