How to Get Progressive Car Insurance Quotes Online in 2025 [Follow These 5 Steps]

How to get Progressive car insurance quotes online is simple by following specific steps. Enter your ZIP code, provide vehicle details like your VIN, and compare coverage options. Drivers who compare at least three quotes can save up to 20% on premiums, ensuring they get the best rate.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

How you get Progressive car insurance quotes online is straightforward and quick when you follow a few simple steps. You can secure the best rates by entering your ZIP code, providing accurate personal and vehicle information like your VIN, and comparing coverage options.

Progressive’s online quote tool makes the process seamless, helping you find affordable coverage tailored to your needs. Compare multiple quotes to maximize savings and explore the best car insurance discounts.

With a few minutes of effort, you’ll be on your way to better car insurance coverage. You can also enter your ZIP code above to compare car insurance rates.

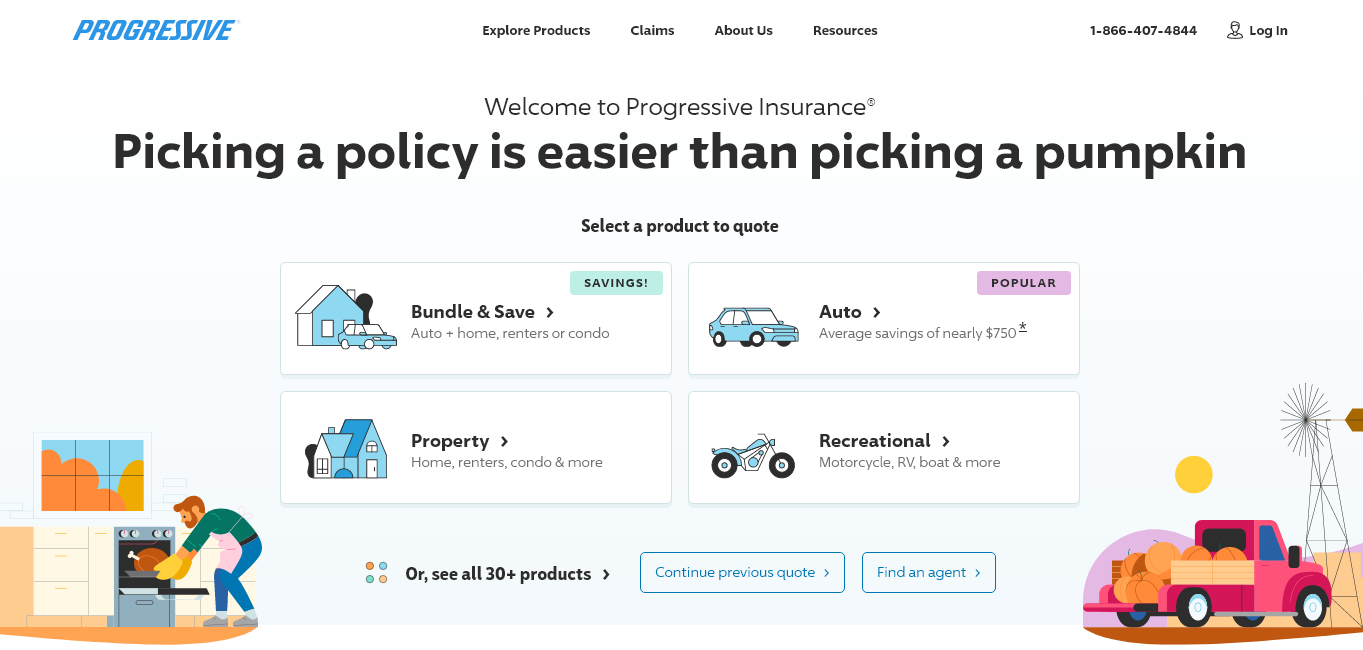

- Step #1: Enter ZIP Code – Visit Progressive’s site and input your ZIP code

- Step #2: Provide Personal Info – Submit your name, address, and date of birth

- Step #3: Add Vehicle Details – Enter your car’s year, make, model, and VIN

- Step #4: Enter Driver Info – Add all drivers in your household for accurate rates

- Step #5: Compare and Choose – Review quotes and select the best coverage for you

5 Steps to Get Progressive Car Insurance Quotes Online

Getting a Progressive car insurance quote online is straightforward and convenient. In this Progressive car insurance review, getting Progressive car insurance quotes online is simple; follow these five steps. You can explore coverage options, input accurate details, and compare rates to find the best policy for your needs. Let’s walk through the process step by step.

Step #1: Learn About Progressive and Enter Your ZIP Code

Progressive has been offering insurance for over 80 years. They’re one of the most popular insurance providers in the nation, so it’s understandable why you’d want to consider them while shopping around for a car insurance policy.

Progressive has a lot to offer from car to life insurance, so before you even request a quote, take some time to explore their site and get a feel for who they are as a company.

Here’s a pathway we suggest: Start on their About page. Learn about their core values like integrity and respect, then check out their News Releases page to see what they’re doing worldwide.

One thing many people don’t consider when researching a car insurance company is their role in the industry at large; do they only care about you for your money, or are they passionate about car insurance and what that means— driver safety, affordability, accessibility, and accident prevention?

Once you’ve learned about Progressive as a brand, check out their Auto Insurance page and read about their coverage options. If you like what you see, it’s time to get quotes. On Progressive’s home page, you can select the type of insurance you’d like quotes for.

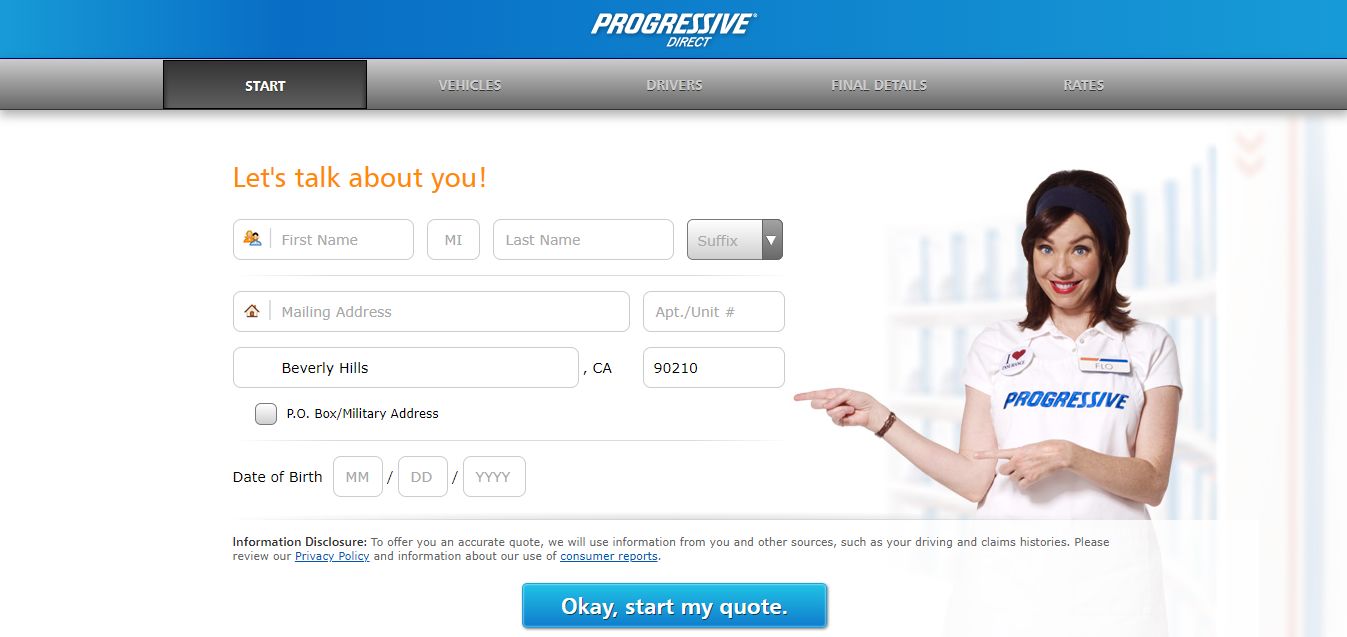

Step #2: Provide Basic Personal Information

Now that you’ve entered your ZIP code, you’ll be prompted to provide your legal first and last names, current address, and date of birth.

This basic information is essential to help Progressive generate an accurate quote, as rates vary based on factors like your location, age, and driving record. This step lays the foundation for the quote you’ll receive.

Read more: Compare Car Insurance Rates by State

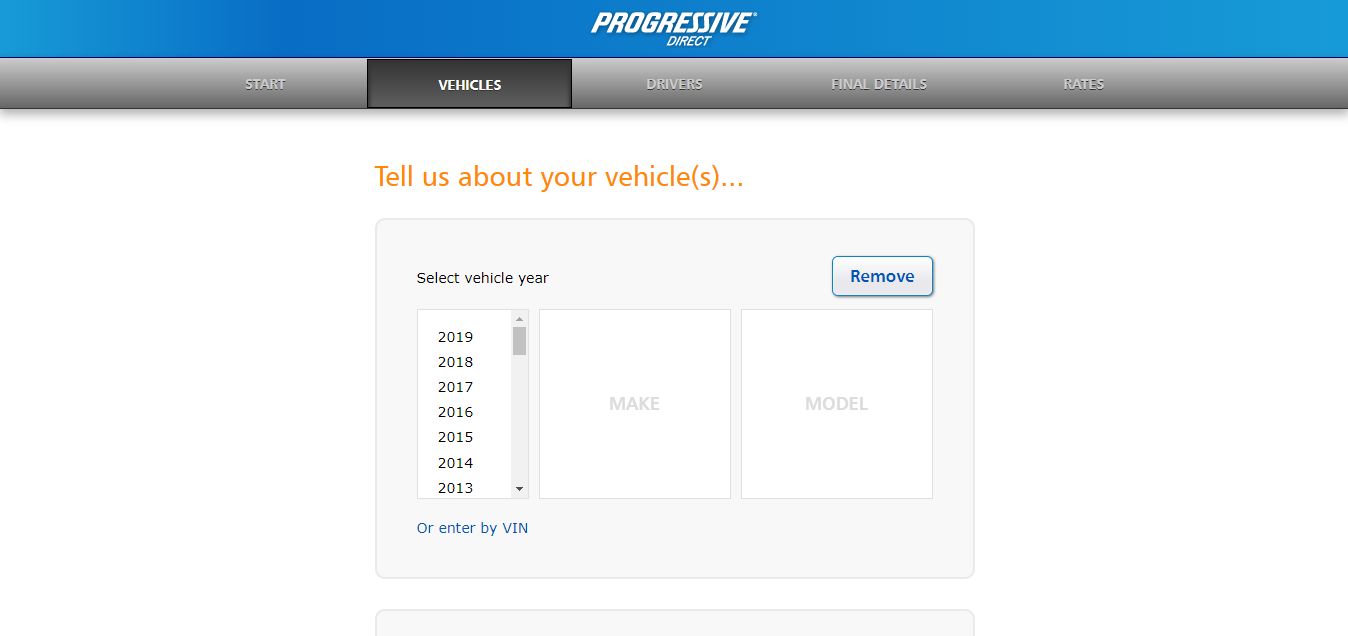

Step #3: Add Vehicle Information

Next, you’ll need to input details for each vehicle you want to insure. This includes the year, make, model, and Vehicle Identification Number (VIN). If you don’t know how to find your car’s VIN (Vehicle Identification Number), read this article to learn all about VINs and how to interpret and find your own. The VIN will help auto-populate your vehicle’s information.

Once you’ve entered the basic vehicle details, you must specify how you use the vehicle. Progressive offers four options:

- Pleasure: For everyday drivers using the car for errands, commuting, etc.

- Commuting: If you use the car to commute to another state for work or school.

- Business: For work-related activities, such as sales calls or business errands.

- Commercial: This is for rideshare drivers (like Uber or Lyft), pizza delivery, or other similar work.

- Farming: For vehicles used in agriculture or ranching.

Read more: Compare Rideshare Car Insurance: Rates, Discounts, & Requirements

Select the option that best reflects how you use the car most of the time, which can impact your coverage and rates.

There are a lot of essential details you have to know to fill out the information form correctly. Firstly, you’ll need to know precisely what make and model your car is. Just “Toyota” won’t work. So, how can you find this info if you aren’t sure? Check out this YouTube video (below) that will walk you through the simple process of finding the make and model of your car.

Your Vehicle Identification Number (VIN) is handy because you can input this directly into Progressive’s system, which will input all of the information for you. If you already saved a Progressive quote, this step can help you quickly retrieve a Progressive auto insurance quote without re-entering all your vehicle details.

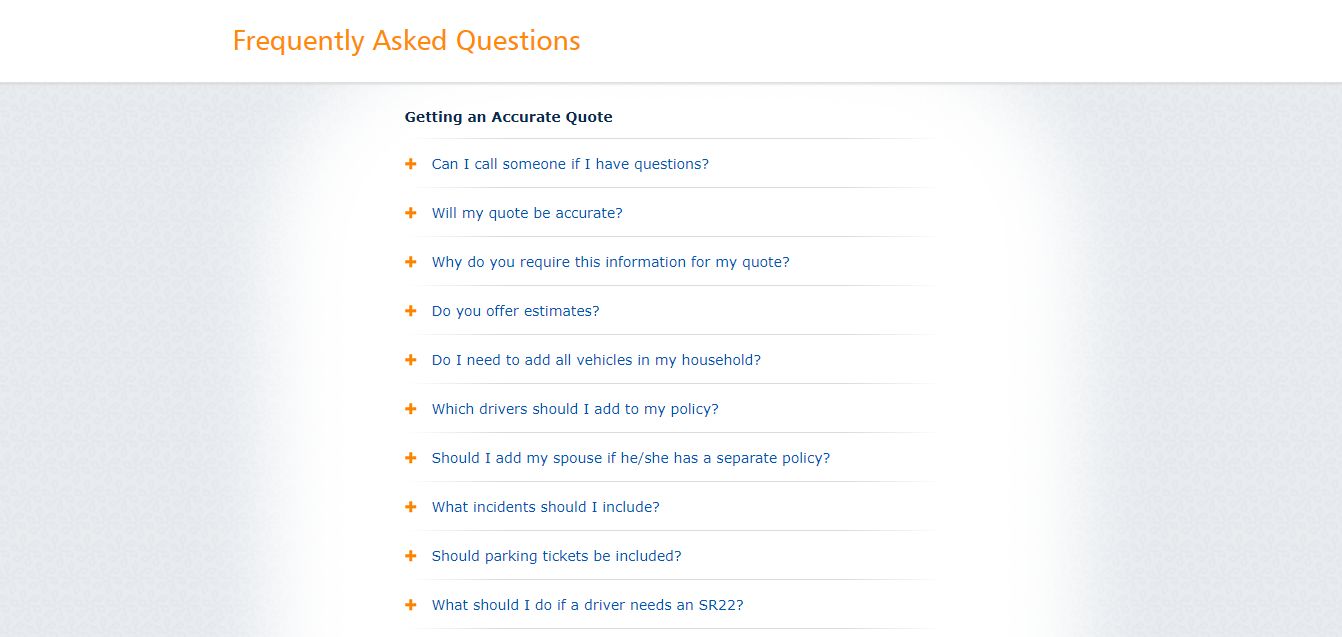

Step #4: Enter Driver Details and Review FAQs

After adding your vehicles, you’ll be prompted to provide driver details for yourself and any other drivers in your household. This information helps Progressive understand your driver profile and can influence your rates. Be sure to include all drivers, as withholding information could cause issues with your policy down the line.

Check out more information on “How do I add someone to my car insurance for a day?”

If you have any questions about the process, scroll down to the FAQ section, divided into helpful categories like “Getting an Accurate Quote” and “How and Why to Buy Progressive.” If you’re unsure, you can always request a call from a live customer service representative for further assistance.

If you previously started a quote but didn’t finish it, you can use the Progressive continue quote feature to pick up right where you left off. The Progressive quote retrieval option lets you quickly look up any saved information. Use the Progressive insurance quote number or follow their prompts to retrieve your Progressive quote.

Step #5: Compare Quotes and Finalize Your Choice

Once you’ve entered all the necessary information, you’ll receive your car insurance quotes from Progressive. It’s a good idea to compare at least three or four quotes from different providers to ensure you get the best coverage. If you choose Progressive, you can finalize the quote and, if needed, download the Progressive app to manage your policy, make payments, report accidents, and more.

Comparing at least three quotes is key to finding the best deal. Providers like Progressive calculate rates using details like driving history, vehicle use, and location. Review available discounts to maximize savings.

Kristen Gryglik Licensed Insurance Agent

If you’re coming back to finalize a quote, the Progressive return to quote option allows you to continue the Progressive quote process seamlessly. With features like retrieving a Progressive quote and looking up a Progressive quote, you can quickly pick up where you left off. These tools simplify how you get a quote from Progressive and complete the process with minimal hassle.

Understanding how car insurance rates are calculated and the multiple factors providers consider can also help you know which discounts your lifestyle may qualify you for. For more information, read “Is it a bad idea to give your Social Security number when shopping for car insurance?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Progressive’s Coverage Options

Choosing the right coverage options for your car insurance is crucial in ensuring you get the protection you need while managing your costs. Progressive offers several types of coverage that can affect your overall premium. This section will help you understand each option and how it impacts your Progressive car insurance quote.

Progressive makes it easy to explore its coverage options, whether starting fresh or using the Progressive insurance online platform to retrieve Progressive quote details or check a previous Progressive quote. Their streamlined tools ensure you can view details at any time.

Progressive Car Insurance Coverage Options and Their Impact on Your Premium

| Coverage Option | What It Covers | Effect on Premium |

|---|---|---|

| Liability Coverage | Covers others' injuries and property | Lower premium with minimum coverage |

| Collision Coverage | Pays for car damage from collisions | Increases premium, offers more protection |

| Comprehensive Coverage | Covers theft, fire, and non-collision damage | Raises premium, adds full coverage |

| Uninsured/Underinsured Motorist | Protects against uninsured drivers | Moderate impact, adds safety net |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages | Higher premium, required in some states |

| Roadside Assistance | Helps with towing and breakdowns | Minimal impact; optional add-on |

| Rental Reimbursement | Covers rental car costs during repairs | Small premium increase; optional coverage |

By understanding each of Progressive’s coverage options, you can tailor your policy to fit your protection needs and your budget. It’s important to consider what coverage best matches your lifestyle, and remember, you can always adjust your coverage levels as your needs change.

Be sure to shop around, compare quotes, and understand car insurance policies from different providers to ensure you get the best value for the required coverage.

How to Maximize Your Savings With Progressive Car Insurance Discounts

Progressive offers a variety of discounts that can significantly reduce your car insurance premiums. These discounts are designed to reward safe driving, bundling policies, and other factors that lower your risk as a driver. This section will explain the top discounts available and how to qualify.

Progressive Car Insurance Discounts and How to Qualify

| Discount | What It Covers | Eligibility Criteria |

|---|---|---|

| Safe Driver Discount | Rewards accident-free driving | No accidents or tickets for 3–5 years |

| Multi-Policy Discount | Saves when bundling policies | Bundle auto with home or other policies |

| Multi-Car Discount | Reduces cost for multiple cars | Insure two or more cars on one policy |

| Pay-in-Full Discount | Savings for full upfront payment | Pay the entire policy premium at once |

| Paperless Discount | Offers savings for digital billing | Sign up for paperless documents |

| Good Student Discount | Rewards good grades | Maintain a B average or better |

| Homeowner Discount | Reduced rates for homeowners | Own a home, regardless of insurer |

| Usage-Based Discount (Snapshot®) | Rewards safe driving habits | Enroll in Snapshot® and drive safely |

You can significantly lower your premiums by using Progressive’s car insurance discounts. Review all available options and ask your Progressive agent about any discounts you might qualify for.

The more discounts you apply, the more you can save, so it’s worth exploring all possibilities.

Case Studies: Obtaining Progressive Car Insurance Quotes Online

Understanding how others approach getting Progressive car insurance quotes online can provide valuable insights. These real-life examples demonstrate how accurate reporting, research, and comparison shopping can help secure the best coverage and rates.

Progressive offers tools to retrieve Progressive quote details or find Progressive quote number for those already in the process. Clients note how easy it was to Progressive retrieve quote information after pausing the process midway.

Case Study #1: John’s Accurate Reporting

John wanted to get car insurance quotes online, so he reported accurate information. He provided his correct personal details, driving history, and vehicle information. By providing precise information, John received accurate quotes that helped him make an informed decision.

Case Study #2: Lisa’s Customer Reviews Research

Lisa understood the importance of reading third-party customer service reviews. Before getting car insurance quotes online, she researched and read reviews about Progressive’s customer service. This allowed her to gain insights into other customers’ experiences and make a well-informed decision based on their feedback.

Case Study #3: Mark’s Comparison Shopping

Mark compared quotes from multiple companies to find the best car insurance coverage. He used Progressive’s online quote tool and researched how to purchase the right car insurance quote online, comparing rates with other insurers. This helped him find affordable and suitable coverage.

These examples highlight the importance of accuracy, research, and comparison when obtaining Progressive car insurance quotes online. By reporting accurate details, researching reviews, and comparing multiple options, you can ensure you’re making an informed choice.

Getting a Progressive car insurance quote online is quick and easy and can help you save significantly on your premiums. Start today and see how much you can save.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Find the Best Progressive Car Insurance Quote Online

Getting Progressive car insurance quotes online is a simple, streamlined process that can help you get competitive quotes for car insurance while saving time and money. You can quickly compare coverage options and rates by entering your ZIP code and providing accurate details about yourself, your vehicle, and other drivers.

Finding the best car insurance starts with accurate details and comparison. Progressive’s online tools make exploring coverage, applying discounts, and saving money easy—all in just minutes.

Brandon Frady Licensed Insurance Agent

Remember to explore discounts and compare at least three quotes to ensure you get the best deal. With the proper steps, finding affordable and reliable coverage is easy, and Progressive’s tools make managing your policy a breeze.

Start your search today and take the first step toward securing the best car insurance coverage. Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

Frequently Asked Questions

Are there mobile app features available for Progressive car insurance policyholders?

Yes, Progressive has a mobile app available for iPhone and Android users. The app provides various features for policyholders, such as viewing policy details, making payments, reporting accidents, requesting roadside assistance, communicating with an agent, and finding a service center.

Can I get roadside assistance through Progressive’s car insurance policy?

Yes, Progressive offers roadside assistance as part of their car insurance coverage. This service can be helpful in case of breakdowns, flat tires, or other roadside emergencies. You can contact Progressive’s customer service to request roadside assistance when needed. Explore more details with our guide on “Does car insurance cover tire blowouts?”

Can I access information on my Progressive car insurance policy online?

Yes, Progressive provides an online portal to manage your policy, view details, retrieve a Progressive quote, or check a Progressive quote number. Use a free online quote tool and enter your ZIP code to compare car insurance quotes from different companies and find the best rates for your needs.

Is it necessary to enter my social security number to receive accurate quotes from Progressive?

Entering your social security number is not mandatory to receive accurate quotes from Progressive. However, providing your social security number may allow for more precise rate calculations. You can skip that step if you’re uncomfortable providing this information during the quote process.

How long are the quotes provided by Progressive valid?

The validity of the quotes provided by Progressive may vary. It’s best to confirm how long the car insurance quote lasts when you receive it. If you need additional time to consider the quotes or decide, contact Progressive to inquire about extending the validity period.

Can I get assistance from Progressive if I have questions or need help during the quote process?

Yes, Progressive provides 24-hour support for its customers. If you have any questions or need assistance during the quote process, contact Progressive’s customer service by calling their toll-free number at 1-877-776-4266.

How can I retrieve a saved quote from Progressive?

You can retrieve a Progressive Insurance quote by logging into your Progressive account or using your quote number to access and continue your saved details. Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

Can I bundle my Progressive car insurance with other policies for additional savings?

Yes, Progressive offers a bundling discount when you combine your car insurance with other policies, such as homeowners, renters, or motorcycle insurance. Bundling your policies simplifies management and saves you up to 20% on your premiums with the multiple-policy car insurance discount.

Can I continue a Progressive quote if I didn’t finish it earlier?

Yes, Progressive allows you to Progressive continue the quote seamlessly. You can log back in, select “Continue Quote,” and pick up where you left off without re-entering all your information.

Does Progressive offer usage-based insurance programs for additional savings?

Yes, Progressive offers the Snapshot program, a usage-based insurance option that tracks driving habits. By enrolling, safe drivers can save an average of $156 annually on car insurance premiums. Snapshot monitors braking, acceleration, and mileage to reward low-risk driving behavior.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.