Best Saturn Outlook Car Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Geico, and Progressive offer the best Saturn Outlook car insurance with comprehensive coverage and competitive rates starting at $30 per month. These companies are known for their reliability, customer service, and affordability, making them top choices for insuring your Saturn Outlook.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Aug 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,760 reviews

17,760 reviewsCompany Facts

Full Coverage for Saturn Outlook

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Saturn Outlook

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Saturn Outlook

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews

State Farm, Geico, and Progressive offer the best Saturn Outlook car insurance options, providing comprehensive coverage with top-notch customer service. These providers stand out for their competitive rates, reliability, and extensive benefits tailored for Saturn Outlook owners.

This guide delves into their offerings, highlighting the pros and cons of each to help you make an informed decision.

Our Top 10 Company Picks: Best Saturn Outlook Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Reliable Service State Farm

#2 25% A++ Affordable Rates Geico

#3 12% A+ Customizable Plans Progressive

#4 25% A+ Feature Options Allstate

#5 10% A++ Military Members USAA

#6 20% A+ Vanishing Deductible Nationwide

#7 10% A Essential Workers Farmers

#8 12% A Add-on Options Liberty Mutual

#9 20% A Family Coverage American Family

#10 15% A++ Safe Driving Travelers

Whether you’re insuring a Saturn Outlook XE or XR, these companies deliver exceptional value and peace of mind. More information is available about this provider in our article called “Compare Car Insurance by Coverage Type.”

Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

Pros

- Bundling Coverage: State Farm stands out by offering significant discounts when you combine your Saturn Outlook insurance with other forms of coverage. This strategy not only streamlines your insurance management but also enhances your savings.

- Generous Low-Mileage Discount: If you use your Saturn Outlook less frequently, State Farm’s low-mileage discount can lead to considerable savings. This benefit is especially advantageous for those who drive infrequently. To find out more, explore our guide titled State farm car insurance review.

- Extensive Coverage Options: State Farm delivers a wide array of coverage options specifically designed for Saturn Outlook owners. Whether you require basic protection or more extensive coverage, there are numerous alternatives available to suit your needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is lower compared to competitors, potentially reducing savings for Saturn Outlook insurance.

- Premium Costs: Despite available discounts, premiums for Saturn Outlook coverage may still be relatively higher than some other providers.

#2 – Geico: Best for Affordable Rates

Pros

Pros

- Generous Multi-Policy Discount: Geico stands out with a substantial 25% discount when you combine policies, making it a compelling choice for Saturn Outlook insurance. This notable saving can substantially reduce your total expenses.

- Top A.M. Best Rating: Geico boasts an impressive A++ rating from A.M. Best, which signifies exceptional reliability and financial stability. This top rating ensures you receive dependable coverage and robust support for your Saturn Outlook. See more details on our guide titled Geico car insurance review.

- Competitive Rates: Known for its cost-effectiveness, Geico offers budget-friendly insurance solutions. Its competitive pricing positions it as a smart choice for Saturn Outlook owners seeking affordable coverage.

Cons

- Basic Coverage Options: While Geico excels in many aspects, its standard coverage options may not cater to the specialized needs of Saturn Outlook drivers. If you need more tailored protection, you might find its offerings somewhat lacking.

- Customer Service for Saturn Outlook: Even with its attractive rates, some customers have noted that Geico’s customer support lacks the personalized approach found with other leading insurers. If you prioritize excellent service, this could influence your decision when selecting your insurance provider.

#3 – Progressive: Best for Customizable Plans

Pros

Pros

- Adaptable Coverage Options: Progressive excels in offering a range of highly customizable insurance choices, tailored precisely to meet the diverse needs of Saturn Outlook owners. This adaptability ensures that each driver can select a policy that fits their distinct circumstances and preferences.

- Strong A.M. Best Rating: With an outstanding A+ rating from A.M. Best, Progressive stands out for its reliable and trustworthy insurance solutions. This top-tier rating highlights Progressive’s dedication to providing solid coverage and financial reliability for your Saturn Outlook. Access comprehensive insights into our guide titled Progressive car insurance review.

- Mileage-Based Insurance: Progressive’s Snapshot program presents a forward-thinking approach to insurance. By assessing your driving patterns, this mileage-based insurance option offers the chance for significant savings, rewarding safe driving behavior with reduced premiums for your Saturn Outlook.

Cons

- Lower Multi-Policy Discount: Despite its advantages, Progressive’s 12% multi-policy discount is less substantial compared to some competitors’ offerings. This relatively modest discount might limit potential savings, especially when bundling multiple policies for your Saturn Outlook.

- Complexity of Plans: The extensive range of coverage options can sometimes be overwhelming. Navigating through the numerous choices may prove challenging, making it hard to determine the best policy for your Saturn Outlook amidst the intricate details and variations.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Feature Options

Pros

Pros

- Generous Multi-Policy Savings: Allstate provides up to a 25% discount when combining multiple policies, making it a highly attractive option for Saturn Outlook coverage. This reduction can significantly lower your overall insurance costs, offering considerable financial relief for those who insure more than one vehicle or merge their auto insurance with other types.

- Top A.M. Best Rating: Holding an impressive A+ rating from A.M. Best, Allstate is recognized for its dependability and financial stability. This outstanding rating underscores its ability to offer reliable and robust coverage for your Saturn Outlook, ensuring peace of mind for you as a policyholder. For further details, explore our extensive review titled “Allstate Car Insurance Review.”

- Broad Feature Options: Allstate excels with its wide range of features and add-ons, tailored to meet the unique needs of Saturn Outlook owners. Whether you’re interested in improved roadside assistance or extra rental car coverage, Allstate provides various customizable options to enhance your insurance plan

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors, affecting the overall cost for Saturn Outlook insurance.

- Discount Complexity: The range of available discounts can be confusing, which might complicate savings on Saturn Outlook insurance.

#5 – USAA: Best for Military Members

Pros

- Exclusive Military Discounts: USAA offers specialized discounts for military members, which can be advantageous for insuring a Saturn Outlook.

- Top A.M. Best Rating: With an A++ rating, USAA provides highly reliable coverage for your Saturn Outlook. Check out insurance savings in our complete article called USAA car insurance review.

- Excellent Customer Service: Known for superior service, USAA offers personalized assistance for Saturn Outlook insurance needs.

Cons

- Eligibility Restrictions: USAA’s insurance is available only to military members and their families, limiting access for others with Saturn Outlooks.

- Limited Availability: USAA’s coverage might not be available in all states, affecting access for some Saturn Outlook owners.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible feature provides savings as you maintain a clean driving record with your Saturn Outlook.

- Competitive Multi-Policy Discount: Offers a 20% discount for bundling policies, advantageous for Saturn Outlook insurance. Access comprehensive insights into our article called Nationwide car insurance discounts.

- Reliable Coverage: With an A+ rating from A.M. Best, Nationwide ensures dependable insurance for your Saturn Outlook.

Cons

- Higher Premiums: Nationwide’s premiums may be higher compared to some competitors, impacting the affordability of Saturn Outlook insurance.

- Complex Coverage Options: The variety of coverage options can be complex, making it challenging to select the best plan for your Saturn Outlook.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Essential Workers

Pros

- Discounts for Essential Workers: Farmers offers special discounts for essential workers, which can be beneficial for Saturn Outlook owners in this category.

- A.M. Best Rating: Farmers offers dependable coverage for your Saturn Outlook, backed by an A rating from A.M. Best. Read up on the “Farmers Car Insurance Review” for more information.

- Customizable Coverage: Offers a range of customizable options to suit different needs for Saturn Outlook owners.

Cons

- Lower Multi-Policy Discount: Farmers’ 10% multi-policy discount may be less competitive, reducing potential savings for Saturn Outlook insurance.

- Limited Add-On Options: Fewer add-on options compared to some competitors might limit customization for Saturn Outlook coverage.

#8 – Liberty Mutual: Best for Add-On Options

Pros

- Variety of Add-Ons: Liberty Mutual provides numerous add-on options to tailor coverage for your Saturn Outlook.

- Competitive A.M. Best Rating: With an A rating, Liberty Mutual offers reliable insurance solutions for Saturn Outlook owners.

- Customizable Plans: Offers flexible plans that can be customized to fit specific needs for Saturn Outlook insurance. Discover more about offerings in our article called Liberty Mutual car insurance review.

Cons

- Higher Premiums: Premiums with Liberty Mutual may be higher compared to some other providers, affecting overall cost for Saturn Outlook insurance.

- Discount Complexity: The structure of discounts and add-ons can be complex, potentially complicating savings for Saturn Outlook coverage.

#9 – American Family: Best for Family Coverage

Pros

- Family Coverage Options: American Family provides comprehensive coverage options ideal for families, including those with a Saturn Outlook.

- Competitive Multi-Policy Discount: Offers up to a 20% discount for bundling policies, beneficial for Saturn Outlook insurance.

- Strong A.M. Best Rating: With an A rating, American Family ensures reliable coverage for your Saturn Outlook. Unlock details in our guide titled “American Family Car Insurance Review.”

Cons

- Higher Premium Costs: American Family’s premiums might be higher compared to some competitors, impacting affordability for Saturn Outlook insurance.

- Limited Regional Availability: Coverage might not be available in all regions, affecting some Saturn Outlook owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Safe Driving

Pros

- Safe Driving Discounts: Travelers offers discounts for safe driving, beneficial for Saturn Outlook owners with a clean driving record. Read up on the “Travelers Car Insurance Review” for more information.

- Strong A.M. Best Rating: With an A++ rating, Travelers provides reliable and high-quality coverage for Saturn Outlook.

- Competitive Multi-Policy Discount: Provides a 15% discount for bundling multiple policies, advantageous for Saturn Outlook insurance.

Cons

- Complex Coverage Options: The variety of coverage options can be complex, making it challenging to find the best fit for Saturn Outlook.

- Premium Variability: Premiums may vary significantly based on individual risk factors, potentially affecting affordability for Saturn Outlook insurance.

Saturn Outlook Insurance: Monthly Rates by Coverage and Provider

When choosing car insurance for your Saturn Outlook, it’s essential to consider both minimum and full coverage rates. The following table provides a comparison of monthly rates across different insurance companies for minimum and full coverage options.

Saturn Outlook Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $120

American Family $40 $112

Farmers $48 $118

Geico $35 $105

Liberty Mutual $51 $125

Nationwide $42 $112

Progressive $45 $115

State Farm $44 $110

Travelers $38 $114

USAA $30 $100

For minimum coverage, USAA offers the lowest rate at $30, while Liberty Mutual has the highest at $51. When it comes to full coverage, Geico provides the most affordable option at $105, whereas Liberty Mutual’s full coverage is the most expensive at $125.

This variation highlights the importance of comparing rates and coverage options to find the best fit for your Saturn Outlook insurance needs. Discover more about offerings in our article called “Minimum Car Insurance Requirements by State.”

Car Insurance Cost Differrence Between Saturn Outlook XE and XR

There are very few differences between the Saturn Outlook XE and the Saturn Outlook XR. Both models received these crash test ratings:

- five stars for the driver side

- five stars for frontal impact

- five stars for front occupants

- five stars for side-impact

- four stars for rollover resistance

The XE Sport Utility has a 3.6L engine with 281 horsepower while the XR Sport Utility has a slightly higher horsepower of 288. The main difference between these two trims is in some of the amenities.

The XR, which is the more expensive of the two, has a power seat for the driver side that includes multiple-adjustment capability. It also has a higher torque of 270 compared to the XE torque of 266. Another feature of the XR is its extra height (almost three inches).

Read up on the “How Do You Get Competitive Quotes for Car Insurance?” for more information.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Get Car Insurance for My Saturn Outlook

GM officially folded their Saturn division in 2010, closing all manufacturing lines of all Saturn vehicles. Just because Saturn is no longer in business does not mean you cannot get car insurance for your Saturn.

Scott W. Johnson

Licensed Insurance Agent

State Farm’s comprehensive policies and 17% multi-policy discount make it a top choice for Saturn Outlook insurance.

If you already have car insurance for your Outlook, you do not have to feel like you are locked in with your current agent. You can still shop around for car insurance with other car insurance companies if you want to do so.

Cars can be insured for years after they are no longer in production.

There are antique cars and classic cars that haven’t been produced in fifty years but they are still insurable.

The Saturn Outlook is most likely not going to become a classic or a collector car. However, since they only really started getting produced in 2007, they will be around for a long time. Saturn has a strong reputation in making solid cars that last for years.

How to Budget the Car Insurance Costs for a Saturn Outlook

If you are buying a Saturn Outlook and you want to budget for your car insurance, you can expect to pay about $1,500 every year for insurance.

The cost of car insurance will depend on where you live and other personal factors, but budget $125 every month for your Outlook car insurance. Check out insurance savings in our complete guide titled “Factors That Affect Car Insurance Rates.”

The car insurance price listed above is for the Saturn Outlook XR. If you are buying a Saturn Outlook XE, you can expect to pay a little less. Your car insurance will be approximately $1,400 every year.

Budget $115 every month for your car insurance on the Saturn Outlook.

To create a budget, you need to list out all of your expenses and then list your income. Put every expense on the list, including unexpected purchases such as maintenance, clothes, gifts, and broken appliances. Check out insurance savings in our complete guide title “Does Car Insurance Cover Non-accident Repairs?”

Michelle Robbins

Licensed Insurance Agent

State Farm’s monthly rate of $44 for minimum coverage on the Saturn Outlook ensures cost-effective protection.

For larger expenses such as broken appliances, you can prorate the monthly expense and categorize it as an emergency expenditure. Access comprehensive insights into our article called “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

It is always better to overestimate your expenses than to underestimate them. If you do not pay for your car insurance, you will be driving without coverage. This is against the law and can cause you to lose your driving privileges, pay large fines, and possibly even serve jail time.

Additionally, if you do not pay for your car insurance, your company will not honor any claims you submit for the time you are not covered.

Many car insurance policies will give you a break if you are late paying, but they do not have to do so. It is best to avoid that situation altogether by budgeting for your car insurance and paying it on time.

Budgeting for your car insurance based on the above information is useful, but it is even better to have accurate quotes so you know what you can expect to pay for your car insurance.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Frequently Asked Questions

Is the car insurance cost different for the Saturn Outlook XE and XR?

The car insurance cost for the Saturn Outlook XE and XR models is generally similar, with only minor differences in amenities and engine specifications. Both models receive comparable crash test ratings.

For additional details, explore our comprehensive resource titled “Does car insurance cover engine failure?”

How can I get car insurance for my Saturn Outlook?

Despite Saturn no longer being in business, you can still get car insurance for your Saturn Outlook. You are not obligated to stay with your current agent and can shop around for car insurance with different companies.

How can I budget for car insurance costs for a Saturn Outlook?

To budget for car insurance costs, you can expect to pay around $1,500 per year for insurance on a Saturn Outlook XR and approximately $1,400 per year for a Saturn Outlook XE. Budgeting around $125 per month for an XR and $115 per month for an XE is a good estimate.

Can I insure a Saturn Outlook even though it is no longer in production?

Yes, cars can be insured for years after they are no longer in production. While the Saturn Outlook may not become a classic or collector car, it is still insurable as it is a reliable vehicle with a strong reputation.

Why is it important to budget for car insurance and pay it on time?

Budgeting for car insurance ensures that you can cover the cost and avoid driving without coverage, which is illegal and can lead to penalties. Paying on time is essential to maintain continuous coverage and ensure your insurance company will honor any claims you submit.

To find out more, explore our guide titled “How do you file a car insurance claim?”

Which company is best for car insurance claims for the Saturn Outlook?

Bajaj Allianz is highly rated with a 98% claim settlement ratio, offering seamless claims processing and cashless services at over 6,500 network garages.

Is the Saturn Outlook discontinued?

Yes, the Saturn Outlook, a full-size crossover SUV, was produced from 2006 to 2010 and discontinued when the Saturn brand ceased operations in 2010.

Which coverage is best for the Saturn Outlook?

Fully comprehensive car insurance is ideal for the Saturn Outlook, providing extensive protection including coverage for damages to your vehicle and third-party property.

Which insurance company has the highest customer satisfaction for the Saturn Outlook?

USAA leads with a 96% customer satisfaction rating, making it a top choice for insuring the Saturn Outlook, alongside Amica Mutual and Country Insurance.

To learn more, explore our comprehensive resource on “How do car insurance table ratings affect car insurance rates?”

What type of insurance is best for the Saturn Outlook?

A comprehensive car insurance policy is best for the Saturn Outlook, offering complete coverage including protection against both third-party liabilities and damage to your own vehicle.

What years of the Saturn Outlook should I be cautious of for insurance?

Be cautious with the 2008 Saturn Outlook due to frequent transmission issues, and the 2009 model for reported power steering pump problems, which may affect insurance claims.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What kind of car is the Saturn Outlook, and how does it affect insurance?

The Saturn Outlook is a large, car-based SUV known for its seating capacity and comfort, which can influence insurance premiums based on its size and potential repair costs.

Where was the Saturn Outlook made, and does it impact insurance?

The Saturn Outlook was built at the Delta Township Assembly plant near Lansing, Michigan; its production location may impact insurance rates based on regional repair costs and availability.

Learn more by reading our guide titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Who offers the cheapest car insurance for the Saturn Outlook?

USAA, Nationwide, and Geico are known for offering some of the most affordable car insurance options for the Saturn Outlook, depending on individual factors.

What is the most cost-effective car insurance type for the Saturn Outlook?

Fully comprehensive insurance is often the most cost-effective option for the Saturn Outlook, as it balances coverage and cost effectively, considering the vehicle’s repair and replacement value.

Which insurance company is best for handling claims for the Saturn Outlook?

State Farm is noted for its strong claims handling, making it a reliable choice for insuring the Saturn Outlook with good coverage and efficient claims processing.

Which car insurance cover is best for the Saturn Outlook?

Fully comprehensive insurance offers the best coverage for the Saturn Outlook, ensuring protection for both your vehicle and third-party liabilities, making it suitable for various driving conditions.

Access comprehensive insights into our guide titled “Compare Full Coverage vs. Liability Car Insurance: Rates, Discounts, & Requirements.”

What is the best vehicle insurance for the Saturn Outlook?

Travelers is recommended for overall coverage, American Family is best for budget-conscious drivers, and State Farm excels in customer satisfaction for the Saturn Outlook.

Which insurance company is most popular for the Saturn Outlook?

State Farm is the most popular choice for insuring the Saturn Outlook, with strong coverage options and customer satisfaction across many states.

What is the most expensive type of insurance for the Saturn Outlook?

Fully comprehensive insurance for the Saturn Outlook is generally the most expensive type, as it offers extensive coverage, including both third-party and own vehicle damage.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Which insurance company provides the best value for the Saturn Outlook?

USAA often provides the best value for the Saturn Outlook with competitive rates and high customer satisfaction, particularly for military members and their families.

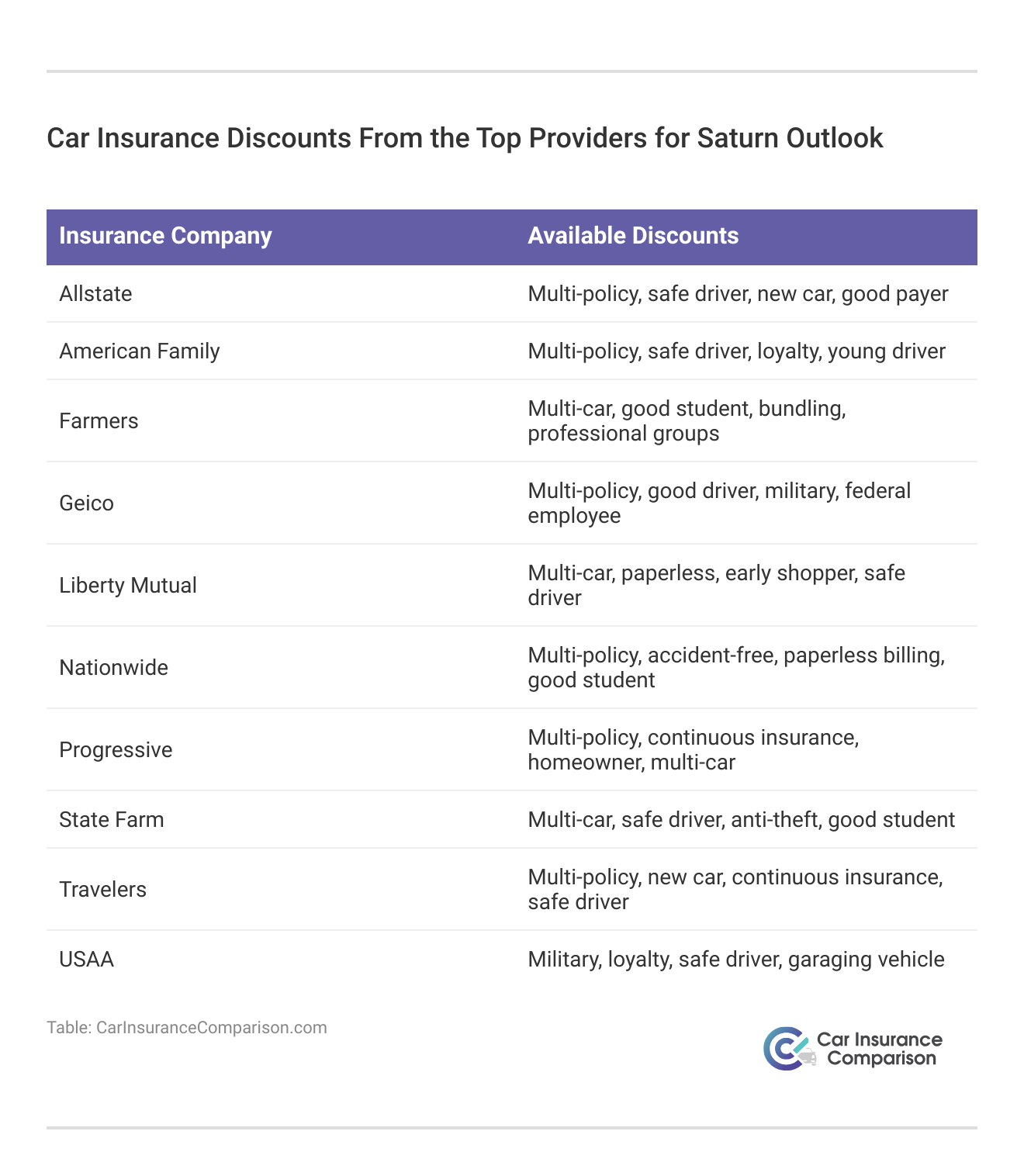

Which insurance company offers the best discounts for the Saturn Outlook?

Geico offers attractive discounts for the Saturn Outlook, including those for safe driving and bundling, which can significantly lower insurance costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros