Best Hyundai Santa Fe Car Insurance in 2024 (Check Out the Top 10 Companies)

The best Hyundai Santa Fe car insurance options include top picks like Progressive, Geico and State Farm, offering coverage as low as $27/month. These companies are the best for their competitive rates, extensive coverage, and reliable customer service, making them ideal for Hyundai Santa Fe car insurance seekers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Sep 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Hyundai Santa Fe

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Santa Fe

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 17,760 reviews

17,760 reviewsCompany Facts

Full Coverage for Hyundai Santa Fe

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviewsThe best Hyundai Santa Fe car insurance options include Progressive, Geico, and State Farm, with rates beginning at as low as $27 per month.

This article explores what makes these companies exceptional, focusing on their competitive rates, extensive coverage options, and outstanding customer service. With the Hyundai Santa Fe’s top safety features and low insurance loss risk, these insurers offer highly affordable and comprehensive coverage options.

Our Top 10 Company Picks: Best Hyundai Santa Fe Car Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Customizable Plans | Progressive | |

| #2 | 15% | A++ | Affordable Rates | Geico | |

| #3 | 17% | B | Customer Service | State Farm | |

| #4 | 10% | A+ | High Coverage | Allstate | |

| #5 | 10% | A++ | Military Members | USAA | |

| #6 | 15% | A | Claims Service | Farmers | |

| #7 | 10% | A | Coverage Options | Liberty Mutual |

| #8 | 10% | A+ | Policy Options | Nationwide |

| #9 | 10% | A++ | Hybrid Cars | Travelers | |

| #10 | 15% | A | Financial Stability | American Family |

Start comparing quotes today to secure the best deal for your Santa Fe. Finding affordable car insurance doesn’t have to be a challenge. To learn more, explore our comparison resource titled, “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Enter your ZIP code above into our free comparison tool to find the lowest prices in your area.

- Top providers for Hyundai Santa Fe insurance start at $27/month

- Low risk and safety features keep Hyundai Santa Fe premiums low

- Progressive is a top pick for its comprehensive coverage and competitive pricing

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Overall Top Pick

Pros:

- Flexible Coverage Options: Progressive offers a range of customizable plans, making it easy to tailor the best Hyundai Santa Fe car insurance to your specific needs.

- Discounts for Bundling: Save more on the best Hyundai Santa Fe car insurance by bundling with other Progressive insurance products. Learn more in our Progressive car insurance review.

- User-Friendly Tools: Progressive’s online tools and app make managing and adjusting your Hyundai Santa Fe car insurance straightforward.

Cons:

- Complex Pricing Structure: The customizable plans may lead to a complex pricing structure, making it harder to compare the best Hyundai Santa Fe car insurance rates.

- Limited Local Agents: Fewer local agents may mean less personalized service when finding the best Hyundai Santa Fe car insurance.

#2 – Geico: Best for Affordable Rates

Pros:

- Competitive Premiums: Geico consistently offers some of the most affordable rates for the best Hyundai Santa Fe car insurance.

- Extensive Discounts: A variety of discounts are available, making it easier to find cheap rates on the best Hyundai Santa Fe car insurance. Read our Geico car insurance review to learn what else is offered.

- Efficient Claims Process: Geico’s efficient claims process ensures quick resolution and reliable service for your Hyundai Santa Fe.

Cons:

- Basic Coverage Options: Geico’s focus on affordability may result in fewer options for comprehensive coverage in the best Hyundai Santa Fe car insurance plans.

- Limited Customer Service: Customer service may be less personalized compared to other providers, which can be a drawback for the best Hyundai Santa Fe car insurance.

#3 – State Farm: Best for Customer Service

Pros:

- Personalized Assistance: State Farm is known for its exceptional customer service, providing personalized support for the best Hyundai Santa Fe car insurance.

- Local Agents: With a wide network of local agents, State Farm offers in-person help for your Hyundai Santa Fe car insurance needs.

- Comprehensive Coverage: State Farm provides extensive coverage options, ensuring the best Hyundai Santa Fe car insurance meets all your requirements.

Cons:

- Higher Premiums: State Farm’s high level of customer service may come with slightly higher premiums for the best Hyundai Santa Fe car insurance. Read more in our review of State Farm car insurance.

- Limited Discounts: Fewer discount opportunities compared to other insurers might lead to less competitive pricing on the best Hyundai Santa Fe car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for High Coverage

Pros:

- Extensive Coverage Options: Allstate provides high coverage limits, making it ideal for those seeking the best Hyundai Santa Fe car insurance with comprehensive protection. Discover our Allstate car insurance review for a full list.

- Accident Forgiveness: Offers accident forgiveness, ensuring your first at-fault accident won’t affect your rates for the best Hyundai Santa Fe car insurance.

- Strong Financial Ratings: Allstate’s strong financial stability provides peace of mind that you’re getting reliable coverage for your Hyundai Santa Fe.

Cons:

- Higher Costs: Comprehensive coverage options often come at a higher cost, potentially making the best Hyundai Santa Fe car insurance more expensive.

- Complex Policy Details: Allstate’s extensive coverage options can lead to complex policy details, which may be confusing when selecting the best Hyundai Santa Fe car insurance.

#5 – USAA: Best for Military Members

Pros:

- Exclusive Military Discounts: USAA offers unique discounts for military members, making it a top choice for affordable best Hyundai Santa Fe car insurance.

- Excellent Customer Service: Known for exceptional customer service, USAA provides top-tier support for your Hyundai Santa Fe insurance needs.

- Tailored Coverage: USAA’s policies are tailored to meet the specific needs of military members, ensuring the best Hyundai Santa Fe car insurance for unique situations.

Cons:

- Eligibility Restrictions: Only available to military members and their families, which may limit access to the best Hyundai Santa Fe car insurance for non-military individuals. Find out more in our USAA car insurance review.

- Limited Local Agents: Fewer local agents may result in less personal assistance compared to other providers for the best Hyundai Santa Fe car insurance.

#6 – Farmers: Best for Claims Service

Pros:

- Efficient Claims Handling: Farmers is renowned for its efficient claims service, ensuring quick resolution for any issues with the best Hyundai Santa Fe car insurance.

- Comprehensive Coverage Options: Offers a wide range of coverage options to meet diverse needs, providing the best Hyundai Santa Fe car insurance which is covered in our Farmers car insurance review.

- Strong Customer Support: Farmers provides strong customer support throughout the claims process, enhancing your experience with the best Hyundai Santa Fe car insurance.

Cons:

- Higher Rates: The emphasis on claims service may come with higher insurance rates, which could affect the cost of the best Hyundai Santa Fe car insurance.

- Limited Discounts: Farmers may not offer as many discounts compared to competitors, potentially affecting the affordability of the best Hyundai Santa Fe car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Coverage Options

Pros:

- Wide Range of Coverage Choices: Liberty Mutual offers a broad range of coverage options, allowing you to customize the best Hyundai Santa Fe car insurance to your needs.

- Innovative Features: Includes unique features like new car replacement and accident forgiveness in some plans for the best Hyundai Santa Fe car insurance.

- Flexible Policy Options: Discover our Liberty Mutual car insurance review for flexible policy options to fit various budgets and needs, making it easy to find the best Hyundai Santa Fe car insurance.

Cons:

- Potentially Higher Premiums: Comprehensive coverage options might lead to higher premiums for the best Hyundai Santa Fe car insurance.

- Complex Policy Structure: The range of coverage options can make understanding the policy details challenging for the best Hyundai Santa Fe car insurance.

#8 – Nationwide: Best for Policy Options

Pros:

- Varied Policy Choices: Nationwide offers diverse policy options, allowing you to find the best Hyundai Santa Fe car insurance that fits your needs.

- Customizable Coverage: Provides customizable coverage plans to tailor the best Hyundai Santa Fe car insurance according to your preferences.

- Strong Discounts: Offers multiple discounts that can make the best Hyundai Santa Fe car insurance more affordable which you can read more about in our review of Nationwide car insurance discount.

Cons:

- Higher Costs for Some Options: Certain policy options may come with higher costs, affecting the affordability of the best Hyundai Santa Fe car insurance.

- Complex Policy Details: The extensive range of policy options can make it challenging to select the best Hyundai Santa Fe car insurance without thorough review.

#9 – Travelers: Best for Hybrid Cars

Pros:

- Specialized Coverage for Hybrids: Travelers offers specialized coverage options for hybrid vehicles, making it a great choice for the best Hyundai Santa Fe car insurance.

- Competitive Rates: Provides competitive rates for hybrid vehicles, ensuring affordable best Hyundai Santa Fe car insurance.

- Comprehensive Benefits: Includes benefits tailored to hybrid cars, such as repair and replacement coverage for specialized parts.

Cons:

- Limited Options for Non-Hybrids: Focus on hybrid vehicles may result in fewer options for non-hybrid models of the best Hyundai Santa Fe car insurance. For a complete list, read our Travelers car insurance review.

- Potentially Higher Costs for Non-Hybrids: Hybrid-focused coverage options might be more expensive for non-hybrid Hyundai Santa Fe models.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Financial Stability

Pros:

- Strong Financial Ratings: American Family’s strong financial stability ensures reliable coverage for the best Hyundai Santa Fe car insurance.

- Comprehensive Coverage: Offers comprehensive coverage options that provide extensive protection for your Hyundai Santa Fe which you can check out in our American Family car insurance review.

- Customer Satisfaction: Known for high customer satisfaction, which enhances the overall experience with the best Hyundai Santa Fe car insurance.

Cons:

- Higher Premiums: The focus on financial stability and comprehensive coverage may result in higher premiums for the best Hyundai Santa Fe car insurance.

- Limited Discount Options: May offer fewer discounts compared to competitors, potentially affecting the cost of the best Hyundai Santa Fe car insurance.

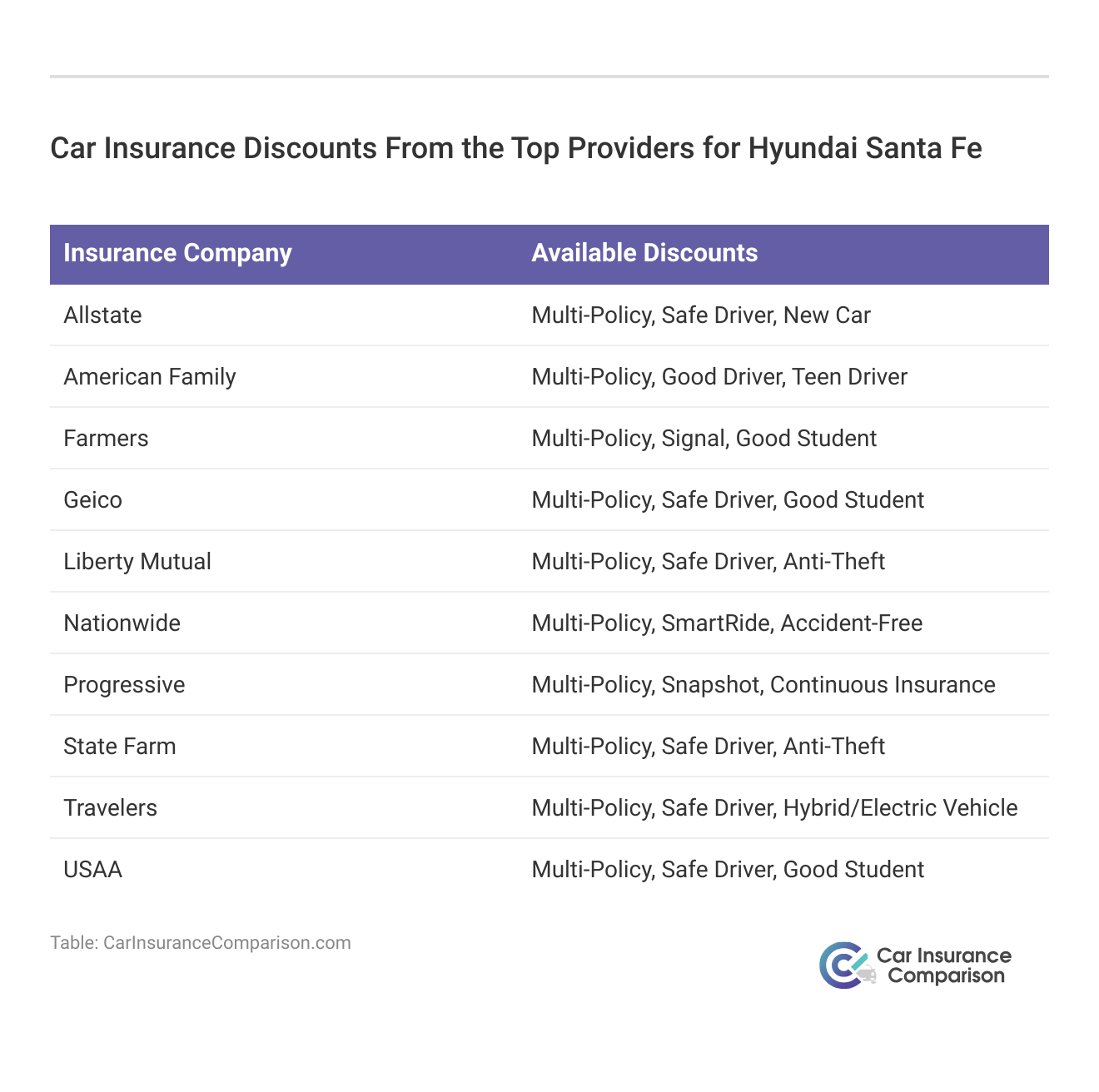

Hyundai Santa Fe Car Insurance Rates & Discounts by Provider

Discover the monthly car insurance rates for Hyundai Santa Fe from leading providers, categorized by minimum and full coverage options. Below, we outline monthly insurance rates for minimum and full coverage from top providers.

Progressive offers the best overall coverage for the Hyundai Santa Fe, combining affordability with top-notch service.

Scott W. Johnson Licensed Insurance Agent

Understanding the costs of various coverage levels helps you make an informed choice. To gain further insights, consult our guide titled, “How do you find competitive car insurance rates?”

Hyundai Santa Fe Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $35 | $110 |

| American Family | $27 | $92 |

| Farmers | $33 | $105 |

| Geico | $37 | $85 |

| Liberty Mutual | $39 | $108 |

| Nationwide | $46 | $102 |

| Progressive | $30 | $100 |

| State Farm | $28 | $95 |

| Travelers | $44 | $99 |

| USAA | $41 | $80 |

This comparison highlights how rates vary by provider, giving you a clearer picture of what to expect. Additionally, we’ve compiled a list of car insurance discounts offered by these providers specifically for Hyundai Santa Fe owners. These discounts can further reduce your premiums and make your insurance more affordable.

Whether it’s through multi-policy bundles, safe driver discounts, or good student rewards, each company offers unique opportunities to reduce your premiums. Use this information to find the best coverage at the best price for your Hyundai Santa Fe.

To explore these discounts and find the best coverage for your needs, start comparing quotes today. Enter your ZIP code above into our free comparison tool to see how much car insurance costs in your area.

Hyundai Santa Fe Car Insurance Comprehensive Breakdown

When evaluating Hyundai Santa Fe car insurance, understanding how different coverage types and driver profiles impact your monthly rates is crucial. The average insurance rate for a Hyundai Santa Fe is $116 per month. However, if you qualify for discounts, your rate could drop to $68.

Hyundai Santa Fe Car Insurance Rates by Drive Profile

| Driver Profile | Monthly Rates |

|---|---|

| Average Rate | $116 |

| Discount Rate | $68 |

| High Deductibles | $100 |

| High Risk Driver | $246 |

| Low Deductibles | $146 |

| Teen Driver | $422 |

High deductible policies cost about $100 per month, while low deductible plans average $146. High-risk drivers pay around $246, and teen drivers face the highest rates at about $422. This breakdown illustrates how coverage choices and driver profiles affect insurance costs. For additional details, refer to our detailed analysis titled, “Car Insurance Deductible: Explained Simply.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Hyundai Santa Fe Car Insurance Rates

It is crucial to understand how different vehicles impact your monthly rates when choosing the right car insurance. In this comparison, we examine the monthly insurance rates for the Hyundai Santa Fe and several other popular vehicles. To delve deeper, refer to our in-depth report titled, “Compare Car Insurance Rates by Vehicle Make and Model.”

Hyundai Santa Fe Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Hyundai Santa Fe | $25 | $47 | $31 | $116 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| GMC Terrain | $27 | $47 | $26 | $111 |

| GMC Acadia | $25 | $39 | $31 | $108 |

| Mercedes-Benz GLA 250 | $31 | $60 | $38 | $143 |

| Lexus LX 570 | $37 | $70 | $33 | $153 |

| Jeep Compass | $25 | $42 | $31 | $110 |

We break down the costs associated with comprehensive, collision, minimum, and full coverage types to help you make an informed decision. By comparing these rates, you’ll gain a clearer picture of how the Hyundai Santa Fe stacks up against its competitors in terms of insurance affordability and coverage options.

Key Factors Influencing Hyundai Santa Fe Insurance Rates

Being aware about the key factors impacting Hyundai Santa Fe insurance rates is essential for finding the best coverage at the most affordable price. Insurance premiums can vary widely based on several critical elements, including the vehicle’s age, the driver’s profile, and geographical location. In this guide, we delve into these factors to reveal how they impact your insurance costs.

By gaining insight into aspects such as vehicle safety ratings, driver demographics, and regional risk factors, you can make more informed decisions and potentially lower your insurance expenses while ensuring comprehensive protection for your Hyundai Santa Fe. For additional details, consult our resource titled, “Compare Assigned Risk Car Insurance: Rates, Discounts, & Requirements.”

Age of the Vehicle

Exploring Hyundai Santa Fe car insurance rates by model year and coverage type provides valuable insight into how premiums evolve over time. In this analysis, we break down monthly insurance costs for different Hyundai Santa Fe model years, including comprehensive, collision, minimum, and full coverage types.

Hyundai Santa Fe Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Hyundai Santa Fe | $26 | $49 | $32 | $118 |

| 2023 Hyundai Santa Fe | $25 | $48 | $31 | $116 |

| 2022 Hyundai Santa Fe | $25 | $47 | $31 | $116 |

| 2021 Hyundai Santa Fe | $25 | $47 | $31 | $116 |

| 2020 Hyundai Santa Fe | $25 | $47 | $31 | $116 |

| 2019 Hyundai Santa Fe | $23 | $45 | $33 | $114 |

| 2018 Hyundai Santa Fe | $23 | $45 | $33 | $114 |

| 2017 Hyundai Santa Fe | $22 | $44 | $35 | $113 |

| 2016 Hyundai Santa Fe | $21 | $42 | $36 | $112 |

| 2015 Hyundai Santa Fe | $20 | $40 | $37 | $110 |

| 2014 Hyundai Santa Fe | $19 | $38 | $38 | $107 |

| 2013 Hyundai Santa Fe | $18 | $35 | $38 | $105 |

| 2012 Hyundai Santa Fe | $18 | $32 | $38 | $101 |

| 2011 Hyundai Santa Fe | $16 | $29 | $38 | $97 |

| 2010 Hyundai Santa Fe | $16 | $27 | $39 | $95 |

Use this information to make an informed decision about which model best fits your budget and coverage needs, ensuring you get the most value for your insurance investment. For a comprehensive analysis, refer to our detailed guide titled, “Compare Car Insurance by Coverage Type.”

Driver Age

Insurance costs vary significantly based on the driver’s age, with younger drivers typically facing higher rates compared to their older counterparts. This chart displays the monthly car insurance rates for the Hyundai Santa Fe across different age groups.

Hyundai Santa Fe Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $1,250 |

| Age: 18 | $422 |

| Age: 20 | $262 |

| Age: 30 | $121 |

| Age: 40 | $116 |

| Age: 45 | $112 |

| Age: 50 | $105 |

| Age: 60 | $103 |

As drivers age, insurance premiums typically decrease, reflecting reduced risk. Rates are highest for younger drivers, particularly those aged 16, and gradually lower as drivers reach their 30s and beyond which is covered in our detailed resource titled, “Average Car Insurance Rates by Age and Gender.”

Driver Location

Car insurance rates can vary significantly depending on your location. This is particularly true for the Hyundai Santa Fe, where monthly insurance costs fluctuate across different cities. Comparing Hyundai Santa Fe insurance rates across different cities highlights how location can impact your monthly premiums.

Hyundai Santa Fe Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $198 |

| New York, NY | $183 |

| Houston, TX | $181 |

| Jacksonville, FL | $168 |

| Philadelphia, PA | $155 |

| Chicago, IL | $153 |

| Phoenix, AZ | $134 |

| Seattle, WA | $112 |

| Indianapolis, IN | $98 |

| Columbus, OH | $96 |

As shown, premiums vary from $96/month in Columbus to $198/month in Los Angeles. This shows how city location impacts insurance costs, helping you find the most affordable coverage for your area. To gain further insights, consult our comprehensive guide titled, “Compare Car Insurance Rates by City.”

Your Driving Record

Navigating auto insurance rates can be challenging, especially when considering how age and driving history impact premiums. This analysis provides a detailed look at Hyundai Santa Fe insurance rates based on various age groups and driving records.

Hyundai Santa Fe Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $1,250 | $2,100 | $2,500 | $2,000 |

| Age: 18 | $422 | $820 | $1,100 | $750 |

| Age: 20 | $262 | $520 | $750 | $500 |

| Age: 30 | $121 | $240 | $350 | $220 |

| Age: 40 | $116 | $230 | $330 | $210 |

| Age: 45 | $112 | $225 | $320 | $205 |

| Age: 50 | $105 | $215 | $310 | $200 |

| Age: 60 | $103 | $210 | $300 | $195 |

By reviewing the monthly costs for different driving records, we highlight how factors like accidents, DUIs, and tickets affect insurance rates. This insight helps you anticipate costs and make informed decisions about your Hyundai Santa Fe coverage. To broaden your understanding, check our comprehensive resource on insurance coverage titled, “DWI vs. DUI: What Is the Difference?”

Hyundai Santa Fe Safety Ratings

When evaluating the safety of a vehicle, crash test ratings provide valuable insights into its performance in various collision scenarios. For the Hyundai Santa Fe, these ratings are particularly reassuring, as they reflect the vehicle’s ability to protect occupants in different types of crashes.

Hyundai Santa Fe Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Hyundai Santa Fe’s top crash test ratings highlight its exceptional safety, offering strong protection for both drivers and passengers. With high scores in various collision scenarios, including front and side impacts, the Santa Fe ensures reliable safety on the road. For a comprehensive overview, explore our guide titled, “Understanding Car Accidents.”

Hyundai Santa Fe Crash Test Ratings

Crash test ratings provide crucial insights into every vehicle protection capability. The Hyundai Santa Fe has consistently performed well in crash tests across various model years and configurations.

Hyundai Santa Fe Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Hyundai Santa Fe SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Hyundai Santa Fe SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Santa Fe XL SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Santa Fe XL SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Santa Fe SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Hyundai Santa Fe SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Hyundai Santa Fe SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Hyundai Santa Fe SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Hyundai Santa Fe Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Hyundai Santa Fe Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Santa Fe SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Santa Fe SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Santa Fe Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Santa Fe Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Santa Fe SUV FWD | N/R | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Santa Fe SUV AWD | N/R | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Santa Fe Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Santa Fe Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

Its impressive crash test ratings underscore its robust safety features and reliable performance in critical impact scenarios. With consistently high scores across different models and configurations, the Santa Fe stands out as a dependable option for those prioritizing safety. To delve deeper, refer to our in-depth report titled, “Will a single vehicle accident affect car insurance rates?”

Hyundai Santa Fe Insurance Loss Probability

Assessing the Hyundai Santa Fe’s loss probability across different coverage types provides valuable insights into its insurance risk profile. With lower loss rates in categories such as comprehensive and personal injury coverage, the Santa Fe may offer potential savings on your insurance premiums.

Hyundai Santa Fe Insurance Loss Probability

| Coverage | Loss Rate |

|---|---|

| Collision | -9% |

| Property Damage | -6% |

| Comprehensive | -18% |

| Personal Injury | -14% |

| Medical Payment | -8% |

| Bodily Injury | -9% |

By understanding these probabilities, you can better evaluate your coverage needs and choose a policy that balances cost with protection. This information helps ensure that you secure the most appropriate and cost-effective insurance for your Hyundai Santa Fe. For further insights, check our guide titled, “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Hyundai Santa Fe Finance and Insurance Cost

Evaluating the finance and insurance costs for a Hyundai Santa Fe is essential for making a well-informed purchase decision. The Santa Fe is recognized for its affordability, often resulting in lower insurance rates compared to similar vehicles.

This section explores the financial aspects of owning a Santa Fe, covering both financing options and insurance costs. Whether you’re considering a new or used model, this guide will help you understand the expenses involved and assist in making financially savvy choices.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

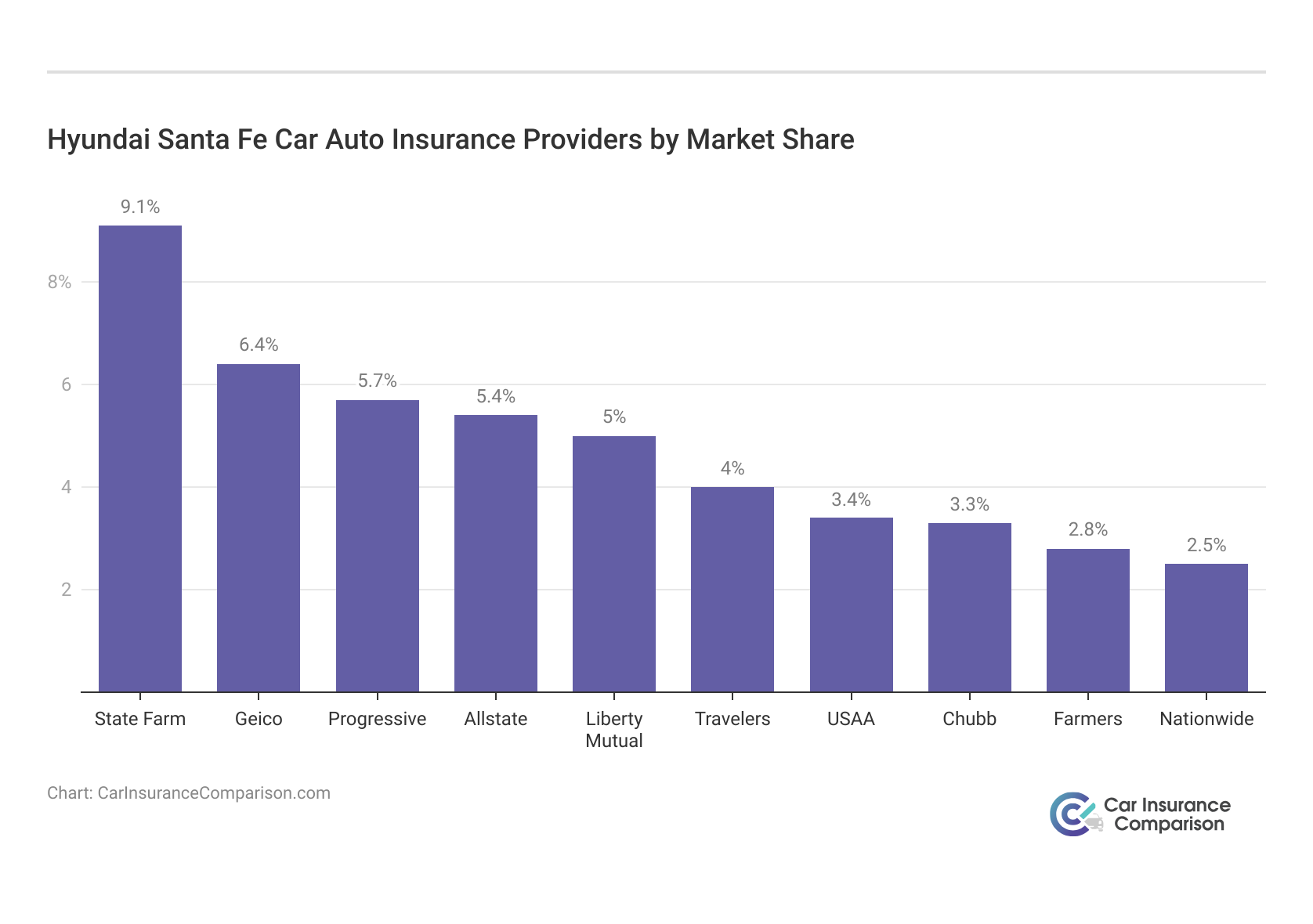

Top Hyundai Santa Fe Insurance Companies

With a clearer picture of the top Hyundai Santa Fe auto insurance providers and their market share, you can make more strategic choices when selecting your insurance. The rankings provide valuable context about each company’s prominence and financial presence in the market.

Top Hyundai Santa Fe Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Allstate | $35.6 million | 5.1% |

| #5 | Liberty Mutual | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

By analyzing these rankings, you gain the ability to compare the offerings of leading insurers in detail. This process enables you to identify the best insurance policies that not only meet your specific coverage requirements but also fit within your budget.

Use this information to compare offerings and find the best coverage that suits your needs and budget. Whether you prioritize competitive rates or comprehensive service, the leading insurers in this list are well-equipped to meet your requirements for protecting your Hyundai Santa Fe.

Ways to Save on Hyundai Santa Fe Insurance

Finding ways to lower your Hyundai Santa Fe insurance costs can help you save significantly. Here are the practical tips to ensure you receive the best value for your coverage.

- Minimize Modifications: Less modification equals lower premiums.

- Explore Costco Insurance: Get competitive rates with Costco insurance.

- Ask About Safety Discounts: Use Santa Fe’s safety features for discounts.

- Look Beyond Price: Choose value over cheap insurance.

- Promote Safe Driving: Safe driving keeps premiums low.

Evaluate policies for overall value rather than just cost and promote safe driving habits to qualify for additional discounts. These strategies help reduce premiums while ensuring you maintain comprehensive coverage. To enhance your understanding, explore our comprehensive resource titled, “Compare Ways to Save Money on Car Insurance.”

Dive into these practical approaches to maximize your savings and make informed decisions about your Hyundai Santa Fe insurance. By implementing these practical approaches, you can optimize your policy and reduce costs while ensuring you have the coverage you need.

Compare Free Hyundai Santa Fe Insurance Quotes Online

Finding the right insurance for your Hyundai Santa Fe is essential, and using online comparison tools is the quickest way to uncover the best coverage at the most affordable prices. With just a few steps, you can receive quotes from leading insurance providers, giving you the opportunity to assess a variety of options that fit your unique needs and financial plan.

Whether you’re looking for basic liability insurance or a more comprehensive policy, online comparisons help you make well-informed choices. By reviewing different plans, discounts, and premium costs, you can secure the best deal specifically tailored to your Hyundai Santa Fe. Begin comparing quotes today to confidently protect your vehicle while saving on insurance expenses.

The Santa Fe is a mid-size crossover SUV built by Hyundai. It has been produced since 2001, as Hyundai’s first ever SUV model, and is a very popular vehicle for a variety of reasons. To gain profound insights, consult our extensive guide titled, “How do you get competitive quotes for car insurance?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Hyundai Santa Fe Safety Features

The Hyundai Santa Fe is renowned for its robust safety features, making it a top choice for drivers seeking peace of mind on the road. This vehicle is equipped with advanced safety systems designed to protect occupants and enhance driving stability across all its models.

- Five-Star Crash Ratings: Top scores for front, back, and side impacts in all seats.

- All-Wheel Drive: Enhances safety in various weather conditions.

- Stability and Traction Control: Improves handling and prevents skidding.

- ABS and Airbags: Provides enhanced protection with anti-lock brakes and multiple airbags.

- 3-Point Seatbelts: Standard for all passengers, ensuring secure restraint.

It excels in navigating adverse weather conditions and maintaining stability during sudden maneuvers, thanks to its seamless integration of safety technologies. This combination of features significantly reduces risks and boosts overall driving confidence.

As a result, the Hyundai Santa Fe stands out as a dependable and trusted option for both families and individuals seeking a secure driving experience. For a comprehensive overview, explore our detailed resource titled, “How to Drive Safely in Bad Weather.”

Factors that Affect Car Insurance Rates for a Hyundai Sante Fe

When determining car insurance rates for a Hyundai Santa Fe, several factors come into play, influencing the overall cost of coverage. Beyond the vehicle’s general safety and performance features, there are some factors that contribute to insurance premium cost.

- Burglar Alarm: All Santa Fe models have a burglar alarm, lowering insurance costs.

- Not a Luxury Vehicle: As a non-luxury vehicle, the Santa Fe has lower insurance premiums.

- Available Colors: The lack of bright colors in the Santa Fe’s palette helps keep insurance rates down.

Each of these elements plays a role in determining the overall cost of insurance. However, by recognizing and considering these factors, Santa Fe owners can better navigate their insurance options and find a policy that offers both comprehensive coverage and cost-effectiveness.

Comprehensive Guide to Hyundai Santa Fe Insurance

Securing the best insurance for your Hyundai Santa Fe involves choosing from top-rated companies like Progressive, Geico, and State Farm, known for their competitive rates and excellent coverage. This article provides a detailed comparison of the leading insurers, highlighting their strengths, such as affordability, customer service, and comprehensive coverage options.

It also explains how factors like vehicle age, driver profile, and location affect insurance costs. To maximize savings, the article recommends exploring various discounts and using free comparison tools to find the best rates tailored to your needs. For a comprehensive overview, explore our detailed resource titled, “Best Full Coverage Car Insurance.”

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors impact the cost of Hyundai Santa Fe insurance?

The cost of Hyundai Santa Fe insurance can be influenced by factors such as the vehicle’s age, the driver’s age, location, driving record, safety ratings, and the specific trim and model of the Santa Fe. Learn more in our guide titled, “Factors That Affect Car Insurance Rates.”

What safety features does the Hyundai Santa Fe have?

The Hyundai Santa Fe comes equipped with various safety features, including but not limited to anti-lock brakes, airbags, stability control, traction control, and advanced driver assistance systems.

Is insurance high on a Hyundai Santa Fe?

No, insurance for the Hyundai Santa Fe is generally not high compared to other SUVs. The vehicle’s safety features, and low risk of theft contribute to lower insurance premiums.

Is Hyundai Santa Fe cheap to maintain?

Yes, the Hyundai Santa Fe is generally considered affordable to maintain. Routine maintenance costs are typically lower compared to luxury brands, and the vehicle’s reliability contributes to fewer unexpected repairs. To gain in-depth knowledge, consult our resource titled, “Do I have to use the car insurance payout to fix my car?”

What age is Hyundai car insurance most expensive?

Insurance rates for Hyundai cars are generally higher for newer models due to their higher value and repair costs. As a vehicle ages, the insurance cost typically decreases.

What is the best type of Hyundai car insurance to get?

The best type of insurance depends on your needs, but fully comprehensive coverage is often recommended for new vehicles to protect against a wide range of potential issues. For older models, a combination of third-party, fire, and theft coverage may suffice.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

How long will a Hyundai Santa Fe last?

With proper maintenance, a Hyundai Santa Fe can last well over 150,000 miles. The vehicle’s durability and reliability make it a good long-term investment. To gain further insights, consult our guide titled, “Can my car insurance company make me use a specific car repair shop?”

What is fully comprehensive Hyundai car insurance?

Fully comprehensive insurance for a Hyundai covers all types of damage to your vehicle, including accidents, theft, vandalism, and natural disasters. It also typically includes third-party liability coverage.

What is the star rating of the Hyundai Santa Fe?

The Hyundai Santa Fe often receives high safety ratings, typically earning 5 stars in various safety tests from organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS).

Which Hyundai Santa Fe is top of the line?

The Hyundai Santa Fe Calligraphy is considered the top-of-the-line trim, offering premium features such as advanced driver assistance systems, high-quality interior materials, and enhanced comfort features.

What is a common problem in the Hyundai Santa Fe?

Common issues reported with the Hyundai Santa Fe include problems with the transmission and electrical system. Regular maintenance and timely repairs can help mitigate these issues. For additional insights, explore our resource titled, “How do you find things you need for your car?”

How efficient is the Hyundai Santa Fe?

The Hyundai Santa Fe offers good fuel efficiency for its class. The exact mileage varies by model year and engine type, but recent models typically achieve around 20-25 miles per gallon (mpg) in combined driving.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.