Best Cadillac DTS Car Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Geico, and Progressive are the leading choices for the best Cadillac DTS car insurance, with rates starting at $72 monthly. They offer robust coverage solutions tailored to Cadillac DTS owners, featuring local agents, extensive discounts, and flexible policy options, ensuring top-notch protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Cadillac DTS

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Cadillac DTS

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Cadillac DTS

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best Cadillac DTS car insurance is offered by State Farm, with Geico and Progressive also leading the pack with their competitive offerings for the best car insurance.

These providers distinguish themselves with robust coverage options, starting at just $72 for minimum coverage, tailored to meet the specific needs of Cadillac DTS owners.

Our Top 10 Company Picks: Best Cadillac DTS Car Insurance

| Company | Rank | Safe Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Local Agent | State Farm | |

| #2 | 22% | A++ | Extensive Discount | Geico | |

| #3 | 12% | A+ | Flexible Coverage | Progressive | |

| #4 | 10% | A+ | DriveWise Program | Allstate | |

| #5 | 30% | A++ | Competitive Rates | USAA | |

| #6 | 15% | A | Customizable Coverage | Liberty Mutual |

| #7 | 10% | A+ | Vanishing Deductible | Nationwide |

| #8 | 8% | A++ | IntelliDrive Program | Travelers | |

| #9 | 12% | A+ | Dividend Policies | Amica | |

| #10 | 10% | A+ | Customer Service | Farmers |

They provide local agent access, comprehensive discount systems, and flexible policy terms that cater to various driver needs, ensuring effective and comprehensive protection for your Cadillac DTS.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm offers top Cadillac DTS insurance, rates start at $72 per month

- Coverage options tailored for Cadillac DTS owners

- Access to discounts and local agents enhances value

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm’s vast network allows for personalized, local service, which can be invaluable for Cadillac DTS owners looking for tailored insurance advice.

- Solid Reputation: Discover our State Farm car insurance review to see how their reliability and strong customer satisfaction record provide dependable coverage for Cadillac DTS owners.

- Comprehensive Options: Provides a range of coverage options that cater well to the needs of Cadillac DTS owners, including collision and comprehensive plans.

Cons

- Higher Costs: State Farm’s extensive services and broad coverage might come at a higher price compared to budget insurers.

- Standardized Policies: While offering comprehensive coverage, some Cadillac DTS owners might find the policies less flexible compared to those of insurers specializing in luxury vehicles.

#2 – Geico: Best for Extensive Discounts

Pros

- Wide Range of Discounts: Geico offers numerous discounts that Cadillac DTS owners can benefit from, such as multi-vehicle discounts and safety feature discounts.

- Affordable Rates: View our Geico car insurance review to learn why their competitive pricing makes them a cost-effective option for insuring a Cadillac DTS.

- Quick Claims Process: Geico is praised for its efficient claims handling, which is crucial for luxury car owners who require quick service.

Cons

- Less Personalized Service: Due to its size and focus on online services, Geico might offer less personalized care compared to smaller insurers.

- Coverage Limitations: Some Cadillac DTS owners might find the coverage options less tailored to luxury vehicles.

#3 – Progressive: Best for Flexible Coverage

Pros

- Customizable Policies: Progressive offers highly flexible policies, which is beneficial for Cadillac DTS owners who may need specific coverage adjustments.

- Competitive Pricing: Explore our Progressive car insurance review to understand how their competitive rates and customizable coverage options can benefit Cadillac DTS owners.

- Strong Online Tools: Progressive’s online and mobile tools are excellent for managing policies and filing claims conveniently.

Cons

- Variable Customer Service: Customer service quality can vary widely depending on the region and the agent.

- Complexity in Policy Management: Some users may find the wide range of options overwhelming and difficult to manage without assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for DriveWise Program

Pros

- DriveWise Rewards: Allstate’s DriveWise program offers potential savings for Cadillac DTS owners who demonstrate safe driving habits, directly benefiting conscientious drivers.

- Comprehensive Support: Allstate provides robust customer support and a comprehensive suite of services, making it easier for Cadillac DTS owners to manage their policies and claims.

- Customizable Coverage: In our Allstate car insurance review, find out how their policy customization benefits luxury car owners, making it a suitable choice for Cadillac DTS coverage.

Cons

- Premium Pricing: Given the extensive features and benefits, Allstate’s premiums may be higher, which could be a concern for budget-conscious Cadillac DTS owners.

- Claims Process Variability: Some customers report variability in the claims process, which may affect satisfaction for those requiring consistent service.

#5 – USAA: Best for Competitive Rates

Pros

- Exceptional Rates for Eligible Members: USAA offers some of the most competitive rates for Cadillac DTS car insurance, especially for military members and their families.

- Highly Rated Customer Service: Known for exceptional customer service, USAA makes handling claims and managing policies seamless for Cadillac DTS owners.

- Comprehensive Coverage: See our USAA car insurance review to explore the comprehensive coverage options they offer, specifically tailored to protect valuable assets like the Cadillac DTS.

Cons

- Limited Eligibility: USAA’s services are only available to military members, veterans, and their families, limiting access for the general public.

- Coverage Options Can Be Overwhelming: While comprehensive, the array of options can sometimes be complex to navigate without proper guidance.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Highly Tailored Policies: Liberty Mutual stands out for offering highly customizable insurance policies, which can be precisely tailored to the needs of Cadillac DTS owners.

- Diverse Discount Options: Delve into our car insurance discounts to discover how safety features on vehicles like the Cadillac DTS can significantly lower your premiums.

- Strong Policy Management Tools: Provides excellent online and mobile tools for policy management and claims filing, enhancing user convenience.

Cons

- Inconsistent Pricing: Pricing can vary significantly based on geographic location and other factors, potentially affecting affordability.

- Customer Service Variability: Some customers report inconsistencies in customer service, which could impact the overall insurance experience for Cadillac DTS owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: According to our information on Nationwide car insurance discounts, learn how the deductible reduction feature benefits Cadillac DTS owners with safe driving records.

- Flexible Coverage Options: Offers a variety of coverage options that can be adjusted to suit the specific needs and risks associated with owning a Cadillac DTS.

- Competitive Rates: Provides competitive pricing for comprehensive and collision coverage, making it a cost-effective choice for many.

Cons

- Rate Fluctuations: Some customers experience rate increases over time, which could offset the initial benefits of lower deductibles.

- Coverage Complexity: The wide range of options can sometimes complicate the decision-making process for policyholders without extensive insurance knowledge.

#8 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program Benefits: Travelers’ IntelliDrive program tracks driving behavior for 90 days, potentially lowering rates for safe Cadillac DTS drivers.

- Wide Coverage Options: Travelers offers a variety of coverage options that cater to the diverse needs of Cadillac DTS owners, including accident forgiveness and gap coverage.

- Discount Opportunities: Based on our Travelers car insurance review, find out how their discounts for multiple policies and safety features can benefit Cadillac DTS owners.

Cons

- Program Requirement Variability: The benefits of IntelliDrive can vary greatly depending on state regulations and driving behavior, potentially limiting savings for some.

- Pricing Can Be High: Initial quotes can be higher than some competitors, which might deter those looking for the lowest starting rates.

#9 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica offers dividend policies that can return up to 20% of the premium, providing significant savings over time for Cadillac DTS insurance.

- High Customer Satisfaction: Known for excellent customer service and high satisfaction rates in handling claims and policy management.

- Robust Coverage Options: Within our guide on understanding your car insurance policy, see how comprehensive coverage options are ideal for high-value vehicles like the Cadillac DTS.

Cons

- Higher Initial Cost: While dividend policies can offer savings, the initial cost may be higher than non-dividend policies, impacting affordability.

- Limited Availability: Amica’s coverage and dividend policies are not available in all states, which may limit options for some Cadillac DTS owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Customer Service

Pros

- Exceptional Customer Service: Farmers is renowned for its customer service, providing personalized support and swift claims processing for Cadillac DTS owners.

- Customizable Policies: With our Farmers car insurance review, learn how their highly customizable policy options allow Cadillac DTS owners to tailor coverage to their specific needs.

- Variety of Discounts: Provides a range of discounts, including for multi-car policies and safety features, which can reduce insurance costs for Cadillac DTS owners.

Cons

- Premium Pricing: Farmers’ comprehensive services and customizable policies often come at a premium cost.

- Policy Complexity: The wide array of options and endorsements can be overwhelming for those new to car insurance or unfamiliar with the specifics of insuring a luxury vehicle like the Cadillac DTS.

Monthly Insurance Rates for Cadillac DTS by Provider

This table provides a detailed overview of the monthly car insurance rates for a Cadillac DTS, breaking down the costs between minimum and full coverage options offered by various insurance providers.

Cadillac DTS Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $195 |

| Amica | $73 | $170 |

| Farmers | $78 | $190 |

| Geico | $74 | $180 |

| Liberty Mutual | $79 | $200 |

| Nationwide | $77 | $185 |

| Progressive | $76 | $185 |

| State Farm | $78 | $190 |

| Travelers | $76 | $180 |

| USAA | $72 | $175 |

To compare monthly car insurance, consider that companies such as Allstate, Geico, and State Farm offer rates ranging from $72 to $80 for minimum coverage and from $170 to $200 for full coverage. This comparison allows owners to assess the most cost-effective insurance provider for their needs.

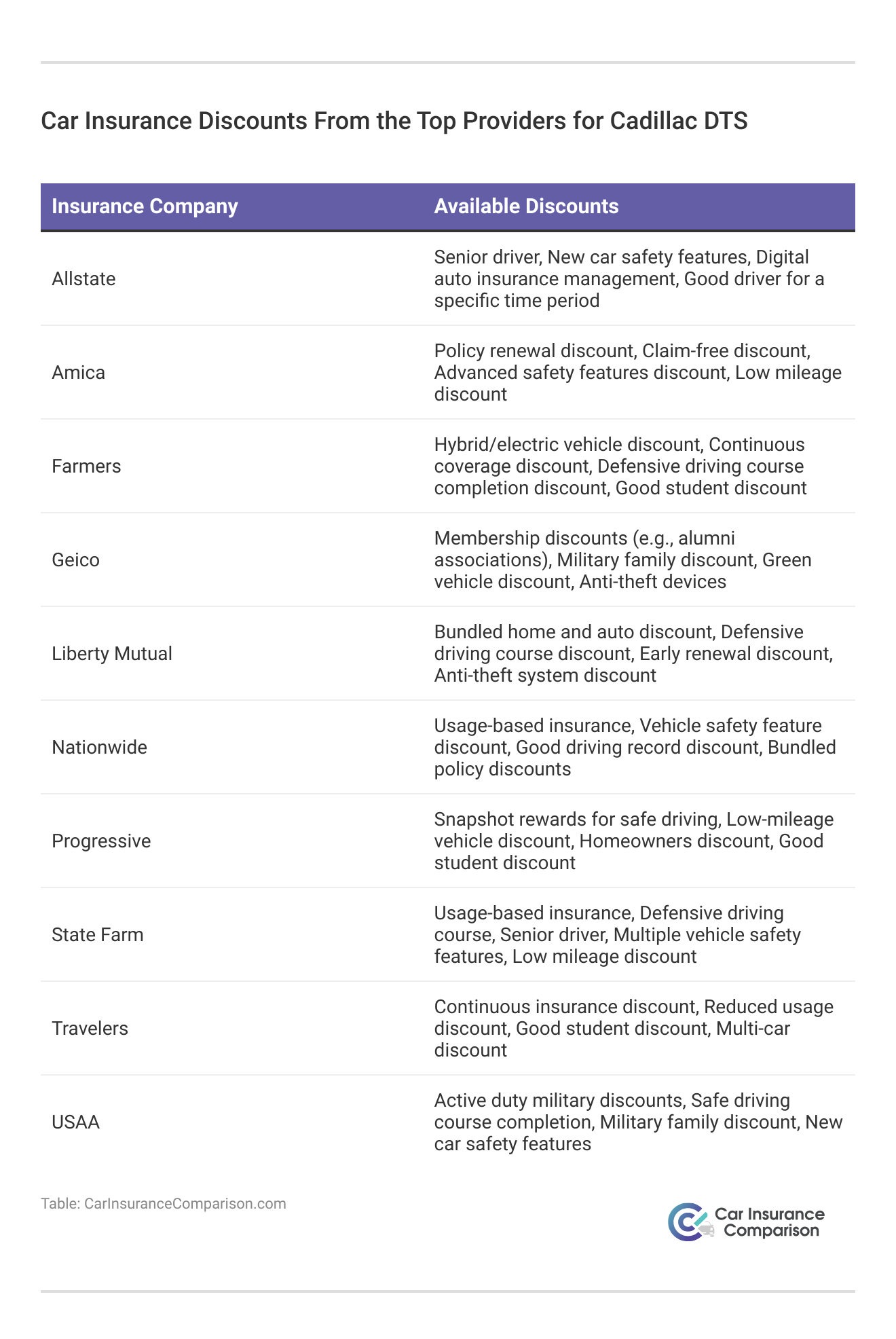

A various discounts offered by insurance companies like Allstate, Geico, and USAA for policies such as those for the Cadillac DTS. Each company provides unique discounts including senior driver reductions, safe driving rewards, and discounts for anti-theft devices and vehicle safety features. These options help consumers reduce insurance costs based on their circumstances and vehicle features.

Key Factors Influencing Cadillac DTS Insurance Costs

Cadillac car insurance rates are influenced by environmental, personal, and vehicle-related factors. Rates vary based on location; high-crime or accident-prone areas may increase premiums, while safer areas tend to lower them. Personal factors affecting rates include age, gender, driving history, and credit score.

State Farm leads the pack in Cadillac DTS insurance, offering unmatched value and comprehensive coverage tailored for luxury car owners.

Dani Best Licensed Insurance Producer

Younger drivers and those with poor driving records or bad credit are typically charged higher rates. Vehicle-related considerations involve the potential replacement cost if your car is totaled or stolen. Insuring a newer, more expensive model like the Cadillac DTS can be costlier, encouraging some to opt for older models to reduce premiums. Each of these elements plays a crucial role in determining the insurance costs for your vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Impact of Driving Records on Cadillac DTS Insurance Costs

The bar chart illustrates how driving records affect Cadillac DTS insurance premiums across different age groups. It shows three categories: drivers with a clean record, those with one speeding ticket, and those with both speeding and accidents.

Insurance costs increase dramatically with violations and accidents, particularly for younger drivers. For instance, if you’re wondering how much does a moving violation affect car insurance, consider that insurance rates for a 20-year-old with speeding and accidents can exceed $4,000. This highlights the significant financial impact of driving behavior on insurance costs.

Cadillac DTS Safety Features

The Cadillac DTS is equipped with several safety features that not only enhance occupant protection but may also lead to lower car insurance premiums, showcasing how safety features car insurance discounts can be beneficial. These features include driver and passenger airbags, front and rear head airbags, and front side airbags.

State Farm stands out with a 95% customer satisfaction rating, making it the top choice for Cadillac DTS insurance due to its superior service and tailored policies.

Michelle Robbins Licensed Insurance Agent

The vehicle is also designed with 4-wheel anti-lock braking system (ABS), 4-wheel disc brakes, brake assist, electronic stability control, daytime running lights, child safety locks, and traction control. Collectively, these features contribute to the vehicle’s safety credentials, potentially reducing insurance costs due to lowered risk of injury and damage in the event of an accident.

Comprehensive Guide to Insuring the Cadillac DTS

When insuring a Cadillac DTS, several key elements should be considered to navigate the complexities of car insurance effectively. The cost of insurance is influenced by factors such as the vehicle’s age, model year, and safety features, which can affect comprehensive, collision, and liability car insurance coverage costs. For instance, older DTS models generally have lower insurance costs.

Driver-specific factors like age, driving history, and location significantly impact premiums. Younger drivers typically face higher rates due to perceived inexperience, whereas older drivers enjoy lower costs. Geographic location also plays a crucial role; residents in high-risk areas may see increased rates.

data-media-max-width=”560″>

Look no further than Ben Carr State Farm agency for exceptional car insurance!🏆

☎️Call (415)-569-2277 to speak with a State Farm agent today and experience the difference for yourself.. #StateFarm #Insurance #Coverage #bencarragency #carinsurance pic.twitter.com/B2WUk4G6xJ

— Ben Carr (@MyAgentBenCarr) May 15, 2024

The Cadillac DTS’s safety ratings and features can also lead to discounts. Understanding these variables will help DTS owners make informed decisions about their car insurance, ensuring they receive the best possible coverage tailored to their needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Smart Strategies for Lowering Cadillac DTS Insurance Costs

To effectively reduce insurance premiums for a Cadillac DTS, owners can employ several strategic approaches, illustrating how traffic infractions affect car insurance. Maintaining a clean driving record free from accidents and traffic violations significantly lowers risk profiles and, subsequently, insurance costs.

Opting for higher deductibles can also decrease monthly premiums for Cadillac DTS pro car insurance, though it increases out-of-pocket expenses in the event of a claim. It’s beneficial to regularly review and compare insurance quotes from various providers to ensure competitive pricing.

Taking advantage of discounts for safety features, such as airbags and anti-lock brakes, which the DTS is equipped with, can further reduce rates. Bundling auto insurance with other policies like home insurance often leads to more savings. Implementing these strategies allows Cadillac DTS owners to manage their insurance expenses more effectively while maintaining adequate coverage.

Concluding Insights on Insuring the Cadillac DTS

A variety of factors influence Cadillac car insurance rates and coverage options. Owners of this luxury sedan can navigate these complexities by understanding how elements like vehicle age, driver demographics, location, and safety ratings impact premiums.

Adopting proactive strategies such as maintaining a clean driving record, leveraging discounts, and comparison shopping for policies are vital for managing costs effectively. Ultimately, the goal is to secure comprehensive insurance that fits the budget and adequately protects the investment in a Cadillac DTS, ensuring peace of mind for the road ahead.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

Is car insurance higher on a Cadillac?

Yes, car insurance for a Cadillac DTS is typically higher than for non-luxury cars due to its classification as a luxury vehicle, which often incurs higher repair costs and has a higher value.

To gain further insights, consult our comprehensive guide titled “Compare Car Insurance Rates by Vehicle Make and Model” for a quick overview.

Does the life expectancy of a Cadillac DTS influence its insurance rates?

Yes, the durability of a Cadillac DTS can affect insurance rates; a vehicle known for longevity may have lower comprehensive and collision coverage costs over time.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

How does the maintenance cost of a Cadillac DTS affect its insurance?

Higher maintenance costs for the Cadillac DTS can lead to higher insurance premiums because insurers may anticipate higher claims costs for repairs.

To learn more, explore our comprehensive resource on insurance titled “Car Insurance Claims” for essential details.

How does being a luxury car impact the Cadillac DTS’s insurance costs?

As a luxury car, the Cadillac DTS typically has higher insurance costs due to the more expensive parts and repairs, as well as the increased risk of theft.

Does the Cadillac DTS’s requirement for premium fuel affect insurance costs?

While fuel type itself doesn’t directly impact insurance rates, the higher operational costs associated with premium fuel can indirectly influence the total cost of ownership, which insurers might consider when determining premiums.

Are repair costs for Cadillacs reflected in their insurance premiums?

Yes, higher repair costs for Cadillacs, including the DTS, are often reflected in higher insurance premiums, particularly for collision and comprehensive coverage.

For a thorough understanding, refer to our detailed analysis titled “Compare Collision Car Insurance” for complete insights.

Does the performance of the Cadillac DTS influence its insurance rates?

Yes, the powerful performance of the Cadillac DTS can lead to higher insurance rates due to the perceived risk of high-speed driving and the potential for more severe accidents.

How did the discontinuation of the Cadillac DTS affect insurance costs?

The discontinuation of the Cadillac DTS can affect insurance costs by potentially increasing premiums due to the reduced availability of parts and specialized service expertise.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

How does high mileage on a Cadillac DTS affect car insurance rates?

Higher mileage on a Cadillac DTS can lead to slightly lower insurance rates as the vehicle’s value depreciates, but it might also increase rates if the risk of mechanical failures is considered by insurers.

To enhance your understanding, explore our comprehensive resource on insurance titled “How much does mileage affect car insurance rates?” for key insights.

What year of Cadillac DTS is most cost-effective for insurance?

Typically, older models of the Cadillac DTS are less expensive to insure than newer models due to lower replacement values, but very old models might lack safety features that could provide discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.