Best Honda CR-V Car Insurance in 2025 (Compare the Top 10 Companies)

The best Honda CR-V car insurance providers include State Farm, AAA, and Erie, offering rates starting at $40 per month. These top providers offer excellent value through reliable service and comprehensive coverage tailored for the Honda CR-V, making them standout choices for drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Honda CR-V

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Honda CR-V

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Honda CR-V

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsState Farm, AAA, and Erie are the best Honda CR-V car insurance providers, with average monthly rates starting at $40. State Farm is the top pick overall, offering the most competitive rates and comprehensive coverage for Honda CR-V owners.

Our Top 10 Company Picks: Best Honda CR-V Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 14% | B | Many Discounts | State Farm | |

| #2 | 10% | A | Online App | AAA |

| #3 | 12% | A+ | 24/7 Support | Erie |

| #4 | 15% | A++ | Military Savings | USAA | |

| #5 | 16% | A+ | Add-on Coverages | Allstate | |

| #6 | 13% | A | Local Agents | Farmers | |

| #7 | 17% | A | Customizable Polices | Liberty Mutual |

| #8 | 18% | A++ | Custom Plan | Geico | |

| #9 | 11% | A+ | Innovative Programs | Progressive | |

| #10 | 19% | A+ | Usage Discount | Nationwide |

Erie offers 24/7 customer service and a solid range of coverage options, ensuring that you receive support whenever you need it. For a comprehensive understanding, consult our article titled, “Compare New Hampshire Car Insurance Rates.”

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code above into our comparison tool today.

- State Farm offers the best Honda CR-V insurance with top coverage

- AAA excels in tools and support for Honda CR-V owners

- Average monthly rates from top providers are around $40

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

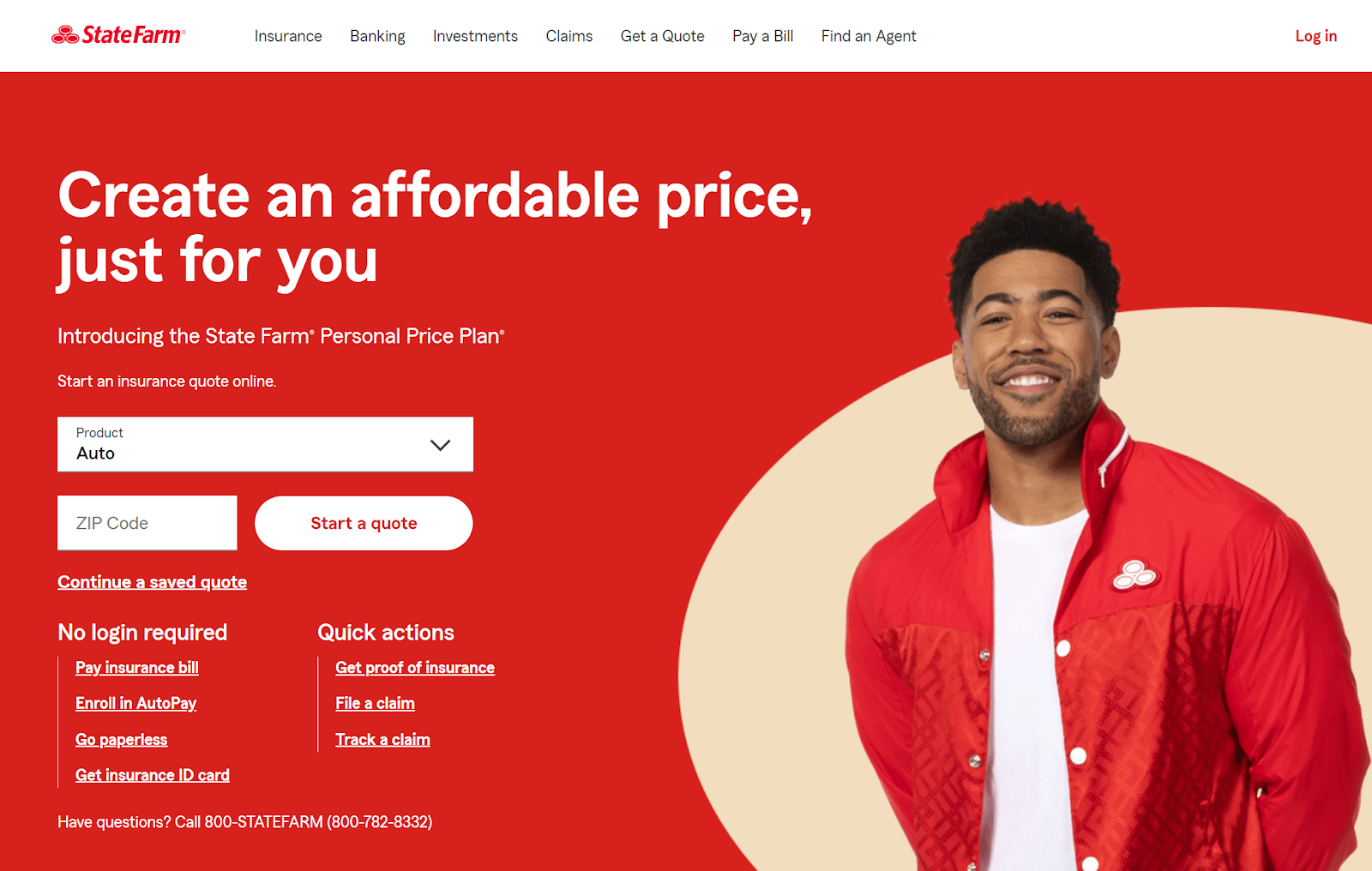

#1 – State Farm: Top Overall Pick

Pros

Pros

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options for best Honda CR-V car insurance owners, ensuring that drivers can customize their policies to meet their specific needs, including liability, collision, and comprehensive coverages.

- Affordable Monthly Rates: With rates starting as low as $52 per month, State Farm provides some of the most competitive pricing for best Honda CR-V car insurance, making it an economical choice for budget-conscious drivers. Unlock details in our State Farm car insurance review.

- Many Discounts: State Farm is known for its variety of discounts, including a 14% multi-vehicle discount, which can significantly lower the overall cost of insurance for best Honda CR-V car insurance policy holders with more than one car.

- Strong Customer Service: State Farm has a solid reputation for customer service, providing best Honda CR-V car insurance drivers with reliable support and assistance when filing claims or seeking policy information.

Cons

- Limited Multi-Vehicle Discount: The 14% multi-vehicle discount is lower compared to some competitors, potentially resulting in higher costs for Honda CR-V owners with multiple vehicles.

- Higher Premiums for Certain Drivers: May not be the most cost-effective option for younger or high-risk Honda CR-V drivers, who may face higher premiums.

- Fewer Digital Tools: Online and mobile tools are less advanced compared to other providers, which can affect ease of managing Honda CR-V insurance policies.

#2 – AAA: Best for Online App

Pros

Pros

- Online App: Features a user-friendly mobile app that allows Honda CR-V policyholders to manage their policy, file claims, and access various services, with an additional 10% multi-vehicle discount.

- Strong Reputation: A.M. Best rating of A demonstrates financial stability and reliability, providing confidence in coverage for Honda CR-V drivers.

- Discounts Available: Offers a variety of discounts including multi-vehicle and safe driver discounts, helping Honda CR-V enthusiasts to reduce overall insurance costs.

- Member Benefits: Includes additional perks such as travel and roadside assistance, enhancing the value for Honda CR-V owners.

Cons

- Limited Coverage Options: May not offer as many coverage options or add-ons for Honda CR-V insurance as some competitors, potentially limiting customization for policyholders.

- Higher Rates for Younger Drivers: Premiums can be higher for younger Honda CR-V drivers, which may be a drawback for those just starting out.

- Regional Availability: Services and benefits can vary by region, potentially affecting consistency in coverage for Honda CR-V drivers. Gain insights by reading our article titled, “AAA Car Insurance Review.”

#3 – Erie: Best for 24/7 Support

Pros

Pros

- 24/7 Support: Provides round-the-clock customer service and claims support for Honda CR-V policyholders, with a 12% multi-vehicle discount, ensuring help is available whenever needed.

- High A.M. Best Rating: A+ rating indicates strong financial health and stability, providing dependable coverage for Honda CR-V owners. Elevate your knowledge with our article entitled, “Erie Car Insurance Review.”

- Comprehensive Coverage: Offers a wide range of coverage options including rental car coverage, meeting diverse needs for Honda CR-V enthusiasts.

- Personalized Service: Known for personalized customer service through local agents, providing tailored assistance for Honda CR-V drivers.

Cons

- Limited Discounts: Fewer discount options for Honda CR-V insurance compared to other major insurers, which might limit potential savings for policyholders.

- Higher Premiums: May have higher premiums for certain Honda CR-V drivers or vehicle types, potentially affecting affordability.

- Regional Focus: Primarily available in the Eastern and Midwestern U.S., which may limit availability and consistency of service for Honda CR-V owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Savings

Pros

Pros

- Military Savings: Offers special discounts and benefits for military members and their families, including a 15% multi-vehicle discount for Honda CR-V drivers, making it a great choice for the military community.

- Excellent A.M. Best Rating: A++ rating reflects exceptional financial stability and reliability, providing top-notch coverage for Honda CR-V policyholders.

- Top Customer Satisfaction: Highly rated for customer service and satisfaction, ensuring a positive experience for Honda CR-V enthusiasts.

- Comprehensive Coverage: Provides extensive coverage options and benefits, including unique perks for military families with Honda CR-V insurance.

Cons

- Eligibility Restrictions: Insurance is only available to military members and their families, limiting access for civilians seeking Honda CR-V insurance.

- Higher Premiums for Non-Military: Not an option for civilians or non-military families, which may exclude a large portion of potential Honda CR-V owners.

- Limited Nationwide Availability: Coverage and service may not be available in all areas, affecting accessibility for Honda CR-V drivers. Unlock details in our USAA car insurance review.

#5 – Allstate: Best for Add-on Coverages

Pros

Pros

- Add-on Coverages: Provides an extensive range of add-on coverages and customizable options for Honda CR-V insurance, with a 16% multi-vehicle discount, allowing policyholders to tailor their coverage to specific needs.

- Strong Financial Stability: A.M. Best rating of A+ indicates strong financial health and reliability, ensuring dependable coverage for Honda CR-V drivers. Discover more about offerings in our Allstate car insurance review.

- Wide Network of Agents: Broad network of agents offers personalized service and support for Honda CR-V owners, making it easier to get assistance when needed.

- Customizable Policies: Offers many options to tailor Honda CR-V insurance to individual needs and preferences, providing flexibility and control for policyholders.

Cons

- Higher Premiums for Some Drivers: Premiums may be higher for younger or high-risk Honda CR-V drivers, which could be a drawback for certain individuals.

- Limited Discounts for Low-Risk Drivers: Discount options might be less generous for low-risk Honda CR-V owners, potentially affecting overall savings.

- Complex Policy Details: Coverage options and discounts can be complex to navigate, making it challenging for Honda CR-V enthusiasts to understand all available benefits.

#6 – Farmers: Best for Local Agents

Pros

Pros

- Local Agents: Provides personalized service through a network of local agents, with a 13% multi-vehicle discount, ensuring tailored assistance for Honda CR-V drivers.

- Customizable Coverage: Offers a range of coverage options and add-ons for Honda CR-V insurance to fit various needs and preferences, allowing flexibility.

- Strong Community Presence: Known for local involvement and community support, enhancing the overall customer experience for Honda CR-V enthusiasts.

- Variety of Discounts: Includes multiple discount opportunities such as for safe driving and bundling policies, helping to lower costs for Honda CR-V owners.

Cons

- Higher Premiums for Newer Drivers: May have higher premiums for new or younger Honda CR-V drivers, which could be a disadvantage for those just starting out.

- Limited Digital Tools: Online and mobile tools may not be as advanced as other insurers, affecting ease of managing Honda CR-V insurance policies. Read up on Farmers car insurance review for more information.

- Inconsistent Customer Service: Service quality can vary depending on the local agent, leading to varying customer experiences for Honda CR-V policyholders.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

Pros

- Customizable Policies: Provides a range of customizable policy options for Honda CR-V insurance, with a 17% multi-vehicle discount, allowing policyholders to tailor coverage to their specific needs.

- Strong A.M. Best Rating: A rating indicates good financial stability and reliability, ensuring dependable coverage for Honda CR-V owners.

- Discounts for Safety Features: Offers discounts for safety features and anti-theft devices, helping to lower premiums for Honda CR-V drivers.

- Flexible Payment Plans: Provides various payment options to fit different budgets, making it easier for Honda CR-V enthusiasts to manage their insurance costs.

Cons

- Higher Premiums for Some Drivers: Premiums can be higher for high-risk Honda CR-V drivers, which might affect affordability.

- Complex Discount Structure: Discounts can be complex and harder to understand, potentially complicating the savings process for Honda CR-V policyholders.

- Regional Variations: Service and discount availability may vary by region, impacting consistency and accessibility for Honda CR-V drivers. See more details on our Liberty Mutual car insurance review.

#8 – Geico: Best for Custom Plan

Pros

Pros

- Custom Plan: Allows for highly customizable insurance plans for Honda CR-V drivers, with an 18% multi-vehicle discount, enabling policyholders to create a policy that fits their unique needs.

- Excellent A.M. Best Rating: A++ rating reflects strong financial stability and reliability, providing confidence in coverage for Honda CR-V owners.

- User-Friendly Digital Tools: Advanced online and mobile tools for managing Honda CR-V insurance, making it easier for policyholders to handle their insurance needs.

- Wide Range of Discounts: Includes discounts for safe driving, bundling, and more, helping to reduce overall insurance costs for Honda CR-V enthusiasts. Learn more in our complete guide, “Geico Car Insurance Review.”

Cons

- Higher Premiums for Certain Models: Insurance rates can be higher for some Honda CR-V models, potentially affecting affordability for policyholders.

- Customer Service Variability: Customer service experiences can vary depending on the representative, leading to inconsistent service quality for Honda CR-V drivers.

- Limited Local Agent Availability: Primarily an online-based company with fewer local agents, which might limit personal service options for Honda CR-V policyholders.

#9 – Progressive: Best for Innovative Programs

Pros

Pros

- Innovative Programs: Offers innovative insurance programs such as Snapshot, with an 11% multi-vehicle discount, providing unique ways for Honda CR-V owners to save on premiums.

- Strong A.M. Best Rating: A+ rating indicates strong financial stability and reliability, ensuring dependable coverage for Honda CR-V policyholders. Delve into our evaluation of Progressive car insurance review.

- Customizable Coverage Options: Provides a variety of coverage options and add-ons for Honda CR-V insurance to fit diverse needs and preferences.

- Discounts for Safe Driving: Offers several discounts for safe driving and bundling policies, helping to lower overall insurance costs for Honda CR-V enthusiasts.

Cons

- Higher Premiums for New Drivers: May have higher rates for new or inexperienced Honda CR-V drivers, which could be a disadvantage for young drivers.

- Complex Policy Options: The range of options and discounts can be overwhelming and complex, making it challenging for Honda CR-V policyholders to choose the best coverage.

- Customer Service Variability: Service quality can vary depending on the representative, leading to inconsistent customer experiences for Honda CR-V drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Usage Discount

Pros

Pros

- Usage Discount: Offers a usage-based discount program, with a 19% multi-vehicle discount, providing savings for Honda CR-V drivers based on how they use their vehicle.

- Strong A.M. Best Rating: A+ rating indicates good financial health and stability, ensuring reliable coverage for Honda CR-V owners.

- Customizable Coverage: Provides a variety of coverage options tailored to individual needs, allowing for flexibility and personalization for Honda CR-V policyholders.

- Discounts for Multiple Policies: Offers discounts for bundling home and auto insurance, helping to reduce overall costs for Honda CR-V enthusiasts.

Cons

- Higher Rates for Some Drivers: May have higher premiums for certain risk profiles, which could affect affordability for Honda CR-V owners.

- Limited Digital Tools: Online tools and mobile apps may not be as advanced as other insurers, potentially impacting the ease of managing Honda CR-V insurance policies.

- Regional Variability: Availability and quality of coverage can vary by region, affecting consistency and accessibility for Honda CR-V drivers. Check out insurance savings in our complete Nationwide car insurance discount.

Honda CR-V Insurance Cost

The average cost of auto insurance for a Honda CR-V is approximately $95 per month. Insurance rates can vary based on factors such as the vehicle’s model, driving history, and location. Generally, newer models may have higher insurance premiums compared to older ones due to advancements in technology, safety features, and repair costs.

Other factors influencing Honda CR-V insurance rates include your driving record, coverage options, and available discounts. For example, maintaining a clean driving record and bundling multiple insurance policies can help reduce overall premiums.

Honda CR-V Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $59 | $181 |

| Allstate | $70 | $203 |

| Erie | $71 | $220 |

| Farmers | $61 | $177 |

| Geico | $87 | $244 |

| Liberty Mutual | $65 | $197 |

| Nationwide | $59 | $174 |

| Progressive | $71 | $223 |

| State Farm | $52 | $142 |

| USAA | $40 | $128 |

Additionally, the Honda CR-V’s safety features and reliability ratings often play a significant role in determining insurance rates. Vehicles equipped with advanced safety systems and a strong track record for reliability are generally associated with lower insurance costs. Ensuring your Honda CR-V is equipped with these features can contribute to more favorable insurance rates.

Let’s examine how these factors affect insurance rates for different Honda CR-V models and explore ways to potentially lower your costs. Expand your understanding with our article entitled, “Multiple Policy Car Insurance Discounts.” By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Ways to Save on Honda CR-V Insurance

Although it might seem like your Honda CR-V car insurance rates are fixed, there are different ways to lower car insurance rates that you can consider. One effective strategy is to park your Honda CR-V in a secure location, such as a garage or private driveway, which can reduce your premiums. Additionally, paying your insurance upfront rather than in monthly installments can often result in savings.

View this post on Instagram

You should also explore potential discounts available for farm and ranch vehicles and check for organization-based discounts through alumni associations or employers. Comparing insurance companies after moving can reveal better rates based on your new location.

Moreover, maintaining a clean driving record and adjusting your coverage to match your needs—such as increasing deductibles or opting for less comprehensive coverage—can further help in lowering your premium. Regularly reviewing and updating your policy ensures that you get the best rates for your Honda CR-V.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Importance of Adequate Honda CR-V Insurance Coverage

Insurance is vital for CR-V owners to protect against unexpected events. To find the best policy, compare options and look for companies offering car insurance discounts. Thorough research and checking insurance company websites will help you find a budget-friendly option.

State Farm offers the best Honda CR-V car insurance with monthly rates starting at just $52, making it an unbeatable choice for affordability and coverage.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Just as you would research a car or bank, applying the same diligence to selecting an insurance provider is important. Seeking advice from family and friends about their experiences can also be beneficial. Honda’s CR-V is designed with safety in mind, but having the right insurance ensures additional peace of mind for you and your family.

When evaluating insurance options, consider not only the cost but also the coverage details, such as liability limits, comprehensive and collision coverage, and any additional perks or services. Each insurance company may offer different levels of protection and customer support, so understanding these aspects will help you choose a policy that best meets your needs and provides the most value.

Top Honda CR-V Insurance Companies

When searching for the top car insurance company for Honda CR-V insurance rates, consider factors beyond just the monthly premium. Major insurance providers offer various coverage options and discounts that can impact the overall cost. Leading companies include State Farm, AAA, and Erie, each offering distinct benefits for Honda CR-V owners.

State Farm is known for comprehensive coverage and excellent customer service, with discounts for safe driving and bundling policies. AAA provides competitive rates and benefits like roadside assistance. Erie is recognized for strong customer service and coverage options, though premiums may be higher.

Impacts on the Cost of Honda CR-V Insurance

Insuring your Honda CR-V can be a significant expense, but understanding the factors that affect your insurance premiums can help you manage these costs more effectively.

- Consider Age: Younger drivers, especially those aged 20, pay significantly more—around $116 more per month than 30-year-olds. To get the best rates, compare insurance policies tailored to your specific age group.

- Evaluate Location: Where you live matters. For example, drivers in Los Angeles pay about $52 more per month than those in Phoenix. Location-based comparisons can help you find more affordable rates.

- Review Your Driving Record: A clean driving record generally lowers insurance costs. Violations, especially for teens and drivers in their 20s, lead to the highest rate of increases.

- Leverage the Honda CR-V’s Safety Ratings: The CR-V has high safety ratings, with “Good” scores in various categories from the Insurance Institute for Highway Safety. These safety ratings typically help reduce your insurance premiums.

- Understand Coverage Types and Loss Probabilities: Different insurance coverage types have varying loss probabilities, impacting overall rates. Evaluating these factors can help you choose the most cost-effective coverage for your CR-V.

By considering factors like age, location, driving record, safety ratings, and coverage types, you can strategically navigate the insurance landscape. This approach allows you to make informed choices that could lead to significant savings on your Honda CR-V insurance. For additional insights, refer to our “Best Car Insurance By Age.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Summary: Best Honda CR-V Car Insurance

The best Honda CR-V car insurance options are offered by top providers like State Farm, AAA, and Erie. State Farm stands out with affordable monthly rates starting at $52 and a 14% multi-vehicle discount. AAA offers comprehensive roadside assistance and member-exclusive discounts, while Erie provides competitive rates and accident forgiveness.

These companies excel in customer service, financial strength, and customizable coverage options, ensuring Honda CR-V owners can find an insurance plan that meets their needs. To find the best policy, it’s essential to compare car insurance by coverage, rates, and discounts. Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin

Frequently Asked Questions

How much does Honda CR-V car insurance cost?

On average, full coverage costs around $95/month, while liability-only coverage costs around $38/month. Older models are cheaper to insure. Explore further in our article titled, “How much does car insurance cost for a Honda CR-V?“

What does Erie offer for Honda CR-V owners needing insurance support?

Erie provides excellent 24/7 support for Honda CR-V owners. Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What factors affect Honda CR-V insurance rates?

Factors include the age of the vehicle, driver’s age, location, driving record, and safety features of the CR-V.

How can I save on Honda CR-V insurance?

Compare quotes online, look for discounts like group discounts, and maintain a good driving record. Delve into the specifics in our article called, “Compare Honda Car Insurance Rates.”

Are Honda CR-Vs expensive to insure compared to other crossovers?

Insurance rates may vary. It’s best to compare quotes to find the most affordable option.

How do safety ratings and features impact insurance rates?

Good safety ratings and advanced features can lower insurance costs, while poor ratings may increase rates.

What is the average monthly rate for Honda CR-V insurance?

The average monthly rate for Honda CR-V insurance is approximately $95. Enhance your knowledge by reading our article entitled, “Average Car Insurance Rates by Age and Gender.“

Which insurance company is recommended for the best Honda CR-V coverage?

State Farm is recommended for offering the best overall Honda CR-V car insurance coverage.

What is recommended for Honda CR-V insurance coverage?

Comprehensive and collision coverage are recommended to ensure the best protection for a Honda CR-V.

How can Honda CR-V owners lower their insurance premiums?

Honda CR-V owners can lower their premiums by using discounts, maintaining a clean driving record, and opting for higher deductibles. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Where can I compare Honda CR-V insurance rates?

You can compare Honda CR-V insurance rates by entering your ZIP code into our free comparison tool for the best options. Uncover more by delving into our article entitled, “How do you get an Erie car insurance quote online?“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros