Best Volkswagen GTI Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Geico, Progressive, and State Farm have the best Volkswagen GTI car insurance, with the lowest rate of $65/month. These providers offer their extensive discounts, including the Snapshot program, and comprehensive coverage that ensures affordability and excellent protection for your Volkswagen GTI.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Volkswagen GTI

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Volkswagen GTI

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Volkswagen GTI

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Geico, Progressive, and State Farm have the best Volkswagen GTI car insurance, with Geico emerging as the top pick overall due to its competitive rates starting at $68/month.

These companies stand out for their exceptional coverage options and extensive discounts, including the Snapshot program, which helps lower premiums further.

Our Top 10 Company Picks: Best Volkswagen GTI Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A++ Extensive Discount Geico

#2 10% A+ Snapshot Program Progressive

#3 17% B Comprehensive Coverage State Farm

#4 10% A++ Customer Service USAA

#5 12% A+ Drivewise Program Allstate

#6 12% A Customizable Policies Liberty Mutual

#7 20% A+ Vanishing Deductible Nationwide

#8 10% A+ Tailored Coverage Farmers

#9 8% A++ Financial Stability Travelers

#10 15% A+ Customer Satisfaction Amica

By considering factors like driving history and vehicle age, you can find the most affordable and comprehensive insurance for your Volkswagen GTI. For more details, check out our guide titled “Factors That Affect Car Insurance Rates.”

Need the cheapest car insurance possible? Enter your ZIP code above into our free comparison tool to find the most affordable rates for your vehicle.

- Geico is the top pick for comprehensive coverage tailored to Volkswagen GTIs

- Find the best Volkswagen GTI insurance with rates starting at just $65/month

- Choose providers with the best coverage for Volkswagen GTI needs

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums: Geico’s pricing structure makes it a budget-friendly choice for insuring your Volkswagen GTI, offering attractive rates. For a complete list, read our Geico review.

- Convenient Digital Management: Geico’s robust online platform allows Volkswagen GTI owners to easily manage their policies and access support.

- Broad Discount Opportunities: The wide array of discounts available can significantly reduce insurance costs for Volkswagen GTI drivers.

Cons

- Generic Coverage Options: Geico’s coverage plans may be less tailored specifically to the unique features of the Volkswagen GTI.

- Customer Service Challenges: Some policyholders might experience less personalized service, which can affect the resolution of issues related to Volkswagen GTI insurance.

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program Savings: The Snapshot program provides personalized savings based on driving behavior, which can be advantageous for Volkswagen GTI drivers.

- Diverse Coverage Choices: Progressive offers a range of coverage options that can be tailored to fit the specific needs of Volkswagen GTI vehicles, which you can learn about in our Progressive review.

- Innovative Discount Programs: Progressive’s innovative discounts can lead to considerable savings for Volkswagen GTI owners who meet certain criteria.

Cons

- Limited Savings Without Snapshot: Not participating in the Snapshot program might mean missing out on significant savings for your Volkswagen GTI insurance.

- Potential for Rate Increases: Comprehensive coverage options might lead to higher overall premiums for Volkswagen GTI owners.

#3 – State Farm: Best for Comprehensive Coverage

Pros

- Extensive Coverage: State Farm’s comprehensive insurance policies provide robust protection tailored for Volkswagen GTI vehicles.

- Strong Agent Network: The large network of State Farm agents offers localized, personalized support for Volkswagen GTI insurance needs.

- Stable Pricing: State Farm’s pricing remains relatively stable, offering predictability for Volkswagen GTI insurance costs. Read our State Farm review to learn what else is offered.

Cons

- Higher Premiums: State Farm may have higher premiums for newer or high-performance Volkswagen GTI models.

- Limited Discount Variety: The range of available discounts might not be as extensive for Volkswagen GTI owners compared to other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Customer Service

Pros

- Exceptional Service: USAA is highly regarded for its customer service, providing top-tier support for Volkswagen GTI insurance.

- Competitive Rates: USAA offers attractive insurance rates for Volkswagen GTI vehicles to eligible military families. Discover our USAA review for a full list.

- Generous Safe Driving Discounts: Safe driving discounts can lead to lower premiums for Volkswagen GTI owners with clean driving records.

Cons

- Less Flexible Policy Customization: USAA’s policy options for customizing coverage for a Volkswagen GTI may be less flexible compared to other insurance providers.

- Standardized Coverage Options: USAA’s coverage options might lack customization for the unique needs of Volkswagen GTI drivers.

#5 – Allstate: Best for Drivewise Program

Pros

- Drivewise Rewards: The Drivewise program rewards safe driving with potential discounts, benefiting Volkswagen GTI owners who practice safe driving habits.

- Comprehensive Protection: Allstate offers extensive protection plans specifically suited to Volkswagen GTI vehicles, which is covered in our Allstate review.

- Discounts for Vehicle Safety Technology: Allstate provides discounts for advanced safety features installed in Volkswagen GTI cars, enhancing affordability.

Cons

- Higher Rates Without Drivewise: If you don’t participate in the Drivewise program, you might miss out on potential savings for your Volkswagen GTI insurance.

- Complex Claims Procedures: Some Volkswagen GTI owners may find Allstate’s claims process cumbersome compared to other insurers.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies: Liberty Mutual offers flexible policy options that can be tailored to the specific needs of Volkswagen GTI drivers.

- Discounts for Safety Features: Liberty Mutual offers savings for advanced safety technologies in your Volkswagen GTI, which can reduce your premium.

- Flexible Coverage Options: Liberty Mutual’s ability to customize coverage allows for a tailored insurance plan for Volkswagen GTI owners. Find out more in our Liberty Mutual review.

Cons

- Potential for Elevated Premiums: Customizing your insurance policy extensively might result in higher premiums for your Volkswagen GTI.

- Inconsistent Customer Service Quality: Customer service experiences can vary, which might affect the support provided to Volkswagen GTI policyholders.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Benefits: Nationwide’s Vanishing Deductible program rewards safe driving by reducing your deductible over time, which is beneficial for Volkswagen GTI drivers.

- Extensive Coverage Options: Nationwide provides comprehensive coverage options to protect your Volkswagen GTI against a wide range of risks.

- Bundling Discounts Available: Bundling policies with Nationwide can make Volkswagen GTI insurance more affordable, which you can check out in our Allstate vs. Nationwide review.

Cons

- Higher Premiums for Newer GTI Models: Insurance rates for newer Volkswagen GTI models may be higher with Nationwide compared to other insurers.

- Fewer Discounts for High-Risk Drivers: Nationwide might offer fewer discounts for high-risk drivers, potentially affecting rates for some Volkswagen GTI owners.

#8 – Farmers: Best for Tailored Coverage

Pros

- Custom Coverage: Farmers provides tailored insurance plans that cater specifically to the unique needs of Volkswagen GTI owners. Read more in our review of Farmers.

- Discounts for Advanced Safety Features: Farmers offers discounts for Volkswagen GTI vehicles equipped with advanced safety features.

- Flexible Insurance Options: The range of flexible coverage options allows Volkswagen GTI drivers to select a plan that best suits their needs.

Cons

- Inconsistent Pricing: While Farmers offers customizable policies, the rates for insuring a Volkswagen GTI can vary significantly depending on your location and personal factors.

- Varied Customer Service Experience: Quality of customer service with Farmers can be inconsistent, potentially leading to challenges when managing or adjusting your Volkswagen GTI insurance policy.

#9 – Travelers: Best for Financial Stability

Pros

- Solid Financial Backing: Travelers’ strong financial stability ensures reliable coverage and claims handling for Volkswagen GTI owners.

- Broad Coverage Options: Travelers provides a range of coverage options that can be tailored to meet the needs of Volkswagen GTI vehicles.

- Safe Driving Discounts: Travelers offers discounts for safe driving, which can reduce insurance costs for Volkswagen GTI drivers, which you can read more about in our review of Travelers.

Cons

- Potentially Higher Premiums: Depending on the selected coverage, premiums for Volkswagen GTI insurance might be higher with Travelers.

- Limited Discounts for New or Young Drivers: Travelers may offer fewer discounts for newer or younger drivers, impacting insurance costs for younger Volkswagen GTI owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica is praised for excellent customer satisfaction, providing reliable service for Volkswagen GTI insurance.

- Competitive Premiums: Amica offers competitive insurance rates specifically for Volkswagen GTI drivers, making it an attractive option. Learn more in our Amica vs. Progressive review.

- Generous Discounts for Safe Driving: Safe driving discounts with Amica can lead to reduced insurance premiums for Volkswagen GTI owners.

Cons

- Higher Costs for Younger Drivers: Amica’s rates for younger Volkswagen GTI drivers may be higher compared to some other insurers.

- Less Policy Customization: Amica may offer fewer customization options for Volkswagen GTI insurance compared to other providers.

Evaluating Insurance Costs and Discounts for the Volkswagen GTI

Choosing the right car insurance for your Volkswagen GTI involves comparing monthly rates and available discounts from different providers. This guide offers a snapshot of both the cost of minimum and full coverage and the discounts each insurer provides, helping you find the best value for your coverage needs. Check out our ranking of the top providers: Best Full Coverage Car Insurance

Volkswagen GTI Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $75 $160

Amica $71 $150

Farmers $76 $158

Geico $68 $145

Liberty Mutual $78 $165

Nationwide $74 $155

Progressive $70 $150

State Farm $72 $155

Travelers $73 $152

USAA $65 $148

Monthly car insurance rates for a Volkswagen GTI vary by provider and coverage level. For minimum coverage, rates range from $65 with USAA to $78 with Liberty Mutual. For full coverage, prices span from $145 with Geico to $165 with Liberty Mutual.

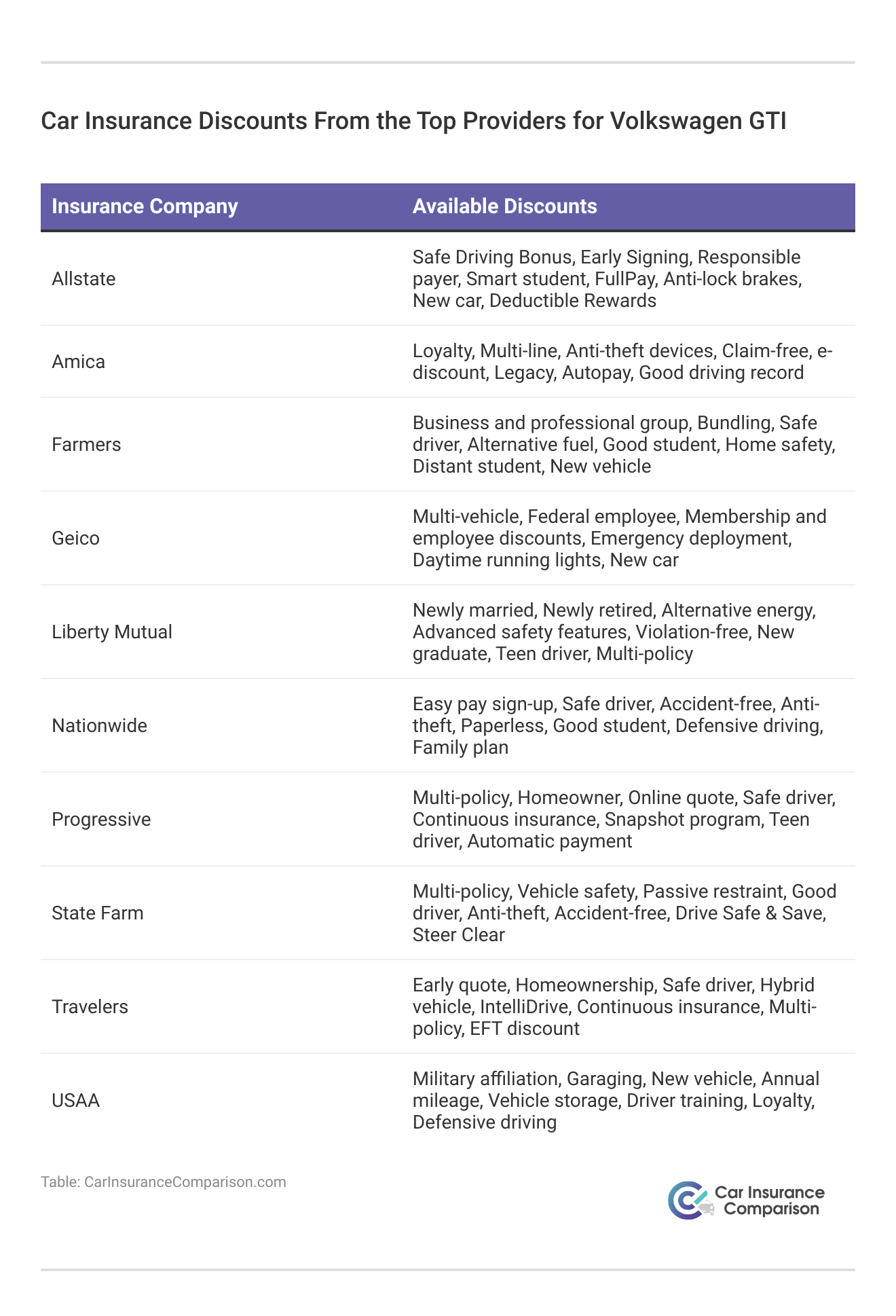

If you own a Volkswagen GTI, you can benefit from a variety of car insurance discounts offered by leading providers. Companies like Allstate, Amica, and Farmers offer savings for factors such as safe driving, anti-theft devices, and bundling policies. Geico and Liberty Mutual provide discounts for new cars, good driving records, and safety features.

Nationwide and Progressive emphasize discounts for accident-free records, multi-policy holders, and good students. State Farm and Travelers offer savings for vehicle safety and continuous insurance, while USAA provides discounts for military affiliation and defensive driving. Each provider has tailored discounts to help you save on your premium.

Volkswagen GTI: Insurance Rates Explained

Understanding the monthly insurance rates for a Volkswagen GTI can help you make informed decisions about your coverage options. Here’s a breakdown of the average costs associated with different coverage types and driver profiles. For an in-depth look, check out our thorough guide titled “Compare Car Insurance by Coverage Type.”

Volkswagen GTI Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $115 |

| Discount Rate | $68 |

| High Deductibles | $99 |

| High Risk Driver | $246 |

| Low Deductibles | $145 |

| Teen Driver | $421 |

By comparing these rates, you can better assess your insurance needs and budget effectively. Whether you’re looking for discounts or managing higher costs, knowing these figures helps you find the right balance for your Volkswagen GTI insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Insurance Costs for the Volkswagen GTI

When comparing car insurance rates for the Volkswagen GTI to other popular models, understanding the monthly costs across different coverage types can help you make an informed decision.

Read more: Volkswagen Car Insurance Rates

Volkswagen GTI Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Volkswagen GTI | $22 | $45 | $38 | $119 |

| Honda Civic | $18 | $40 | $35 | $104 |

| Toyota Corolla | $18 | $41 | $36 | $106 |

| Ford Focus | $19 | $43 | $37 | $108 |

| Subaru WRX | $23 | $48 | $39 | $121 |

| Mazda 3 | $20 | $43 | $38 | $113 |

The Volkswagen GTI’s monthly insurance rates are $22 for comprehensive, $45 for collision, $38 for minimum, and $119 for full coverage. It is priced higher than the Honda Civic and Toyota Corolla but lower than the Subaru WRX.

Understanding What Impacts Volkswagen GTI Insurance Premiums

Insurance costs for a Volkswagen GTI can vary based on several factors, including the car’s performance, safety features, and your personal driving history. Understanding these factors can help you manage and potentially lower your insurance premiums. To learn more, check out our resource, “16 Ways to Lower the Cost of Your Insurance.”

Understanding Your Vehicle’s Age

Insuring a Volkswagen GTI can lead to varying monthly rates based on the model year and chosen coverage type. This overview presents a snapshot of insurance costs for different GTI model years, detailing the rates for comprehensive, collision, minimum, and full coverage options. For more information, check out our detailed resource titled “Collision vs. Comprehensive: What is the difference?”

Volkswagen GTI Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Volkswagen GTI | $23 | $47 | $39 | $121 |

| 2023 Volkswagen GTI | $23 | $46 | $39 | $120 |

| 2022 Volkswagen GTI | $23 | $46 | $39 | $120 |

| 2021 Volkswagen GTI | $22 | $45 | $39 | $120 |

| 2020 Volkswagen GTI | $22 | $45 | $38 | $119 |

| 2019 Volkswagen GTI | $21 | $45 | $38 | $119 |

| 2018 Volkswagen GTI | $21 | $44 | $38 | $118 |

| 2017 Volkswagen GTI | $20 | $44 | $38 | $118 |

| 2016 Volkswagen GTI | $20 | $43 | $38 | $118 |

| 2015 Volkswagen GTI | $20 | $43 | $37 | $117 |

| 2014 Volkswagen GTI | $21 | $44 | $38 | $115 |

| 2013 Volkswagen GTI | $20 | $41 | $38 | $112 |

| 2012 Volkswagen GTI | $19 | $37 | $38 | $108 |

| 2011 Volkswagen GTI | $18 | $34 | $38 | $103 |

| 2010 Volkswagen GTI | $17 | $32 | $39 | $101 |

Insurance rates for the Volkswagen GTI vary by model year and coverage type. Recent models like the 2024 GTI have higher premiums, with full coverage around $121, while older models like the 2010 GTI cost less, with full coverage at $101. Comprehensive and collision rates also decrease with older models.

By examining these rates, you can better understand how the age of your Volkswagen GTI and the level of coverage impact your insurance premiums. Whether you’re looking for budget-friendly options or comprehensive protection, knowing these details can help you make an informed decision about your car insurance.

Age and Driving: Exploring the Impact of Driver Age

Rates can vary widely depending on the driver’s age, reflecting differences in risk and driving experience. Understanding these variations can help you gauge how insurance costs might change as you age. For more details, check out our report titled “Learning About High-Risk Car Insurance.”

Volkswagen GTI Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $422 |

| Age: 20 | $262 |

| Age: 30 | $120 |

| Age: 40 | $115 |

| Age: 45 | $110 |

| Age: 50 | $105 |

| Age: 60 | $103 |

Monthly insurance rates for a Volkswagen GTI vary significantly by age. For a 16-year-old, the cost is around $620, while it drops to $103 for a 60-year-old. Rates decrease progressively from $422 at age 18 to $105 at age 50, reflecting a general trend of lower premiums with increased age and driving experience.

Geico stands out with the lowest rates and best discounts for Volkswagen GTI insurance, ensuring excellent value for drivers.

Daniel Walker Licensed Insurance Agent

Insurance costs for a Volkswagen GTI decrease as drivers age, with the lowest rates typically available for those over 50. By knowing these age-related trends, you can better plan for and manage your insurance expenses over time.

Vehicle Location Update

Insurance premiums for a Volkswagen GTI can differ significantly depending on the city where you live. Factors such as local traffic conditions, crime rates, and regional risk assessments play a role in shaping these costs. By exploring how insurance rates vary across different cities, you can better understand how your location impacts your monthly premiums.

Volkswagen GTI Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $197 |

| New York, NY | $182 |

| Houston, TX | $181 |

| Jacksonville, FL | $167 |

| Philadelphia, PA | $155 |

| Chicago, IL | $152 |

| Phoenix, AZ | $134 |

| Seattle, WA | $112 |

| Indianapolis, IN | $98 |

| Columbus, OH | $96 |

Your Vehicle History Report

Insurance costs for a Volkswagen GTI are affected by both age and driving history. Younger drivers generally face higher premiums, and having infractions like accidents or DUIs can significantly increase rates. To learn more, check out our handbook titled “Cheap Car Insurance After a DUI.”

Volkswagen GTI Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $800 | $1,100 | $770 |

| Age: 18 | $422 | $610 | $830 | $530 |

| Age: 20 | $262 | $410 | $620 | $350 |

| Age: 30 | $120 | $180 | $290 | $160 |

| Age: 40 | $115 | $170 | $280 | $150 |

| Age: 45 | $110 | $165 | $275 | $145 |

| Age: 50 | $105 | $160 | $270 | $140 |

| Age: 60 | $103 | 155 | $260 | $135 |

Insurance rates for a Volkswagen GTI vary by age and driving history. Younger drivers pay more, with a 16-year-old facing up to $1,100 with a DUI. Rates decrease with age and infractions, so a 30-year-old with a clean record pays $120, while one with a DUI pays $290.

Understanding how age and driving history impact your Volkswagen GTI insurance can help you better anticipate and manage your costs. By maintaining a clean driving record and noting the changes in premiums as you age, you can work towards more affordable insurance rates.

Volkswagen GTI: A Comprehensive Review of Safety Ratings

When evaluating the safety of the Volkswagen GTI, its performance in crash tests and safety features provides valuable insights. The GTI excels in several critical areas, offering a high level of protection for its occupants. To gain insights, consult our guide titled “Understanding Car Accidents.”

Volkswagen GTI Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Acceptable |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Volkswagen GTI boasts strong safety ratings across various categories. It receives a “Good” rating for small overlap front (driver-side), moderate overlap front, side impact, roof strength, and head restraints and seats. The passenger-side small overlap front rating is “Acceptable,” reflecting overall solid safety performance.

Volkswagen GTI Safety Ratings: Crash Test Performance Insights

The Volkswagen GTI has consistently performed well in crash tests, showcasing strong safety features across various categories. Its impressive ratings reflect the vehicle’s commitment to protecting occupants in different types of collisions. For a full overview, check out our resource titled “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

Volkswagen GTI Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Volkswagen GTI | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Volkswagen GTI | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Volkswagen GTI | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Volkswagen GTI | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Volkswagen GTI | 5 stars | 4 stars | 5 stars | 4 stars |

The Volkswagen GTI consistently earns a 5-star overall crash test rating, excelling in side and frontal impacts, and achieving 4 stars in rollover tests. This demonstrates the vehicle’s strong safety performance across recent models.

Exploring the Advanced Safety Features of the Volkswagen GTI

Equipping your Volkswagen GTI with advanced safety features not only enhances your driving experience but can also help reduce your insurance premiums. To enhance your understanding, explore our resource titled “Safe Driver Car Insurance Discounts.”

- Driver Air Bag

- 4-Wheel ABS

- Electronic Stability Control

- Traction Control

- Blind Spot Monitor

By investing in these crucial safety features, you can both protect yourself on the road and potentially reduce your insurance costs. The Volkswagen GTI’s advanced safety technology underscores its commitment to both safety and affordability.

Evaluating Insurance Loss Risk for Volkswagen GTI

The Volkswagen GTI’s insurance loss ratio varies between different coverage types. While some types of insurance loss ratios are higher for the Volkswagen GTI, others are more favorable and lead to lower insurance rates.

Volkswagen GTI Auto Insurance Loss Probability by Coverage Type

| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | 30% |

| Property Damage | -6% |

| Comprehensive | 14% |

| Personal Injury | 28% |

| Medical Payment | 24% |

| Bodily Injury | 42% |

Loss probabilities for Volkswagen GTI insurance differ by coverage type. Bodily injury has the highest rate at 42%, while collision is 30%. Comprehensive, personal injury, and medical payment rates are 14%, 28%, and 24%, respectively. Property damage shows a negative loss rate of -6%. For details, see our report titled “What is uninsured motorist property damage?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding the Financial and Insurance Costs of Owning a Volkswagen GTI

When financing a Volkswagen GTI, insurance costs are an important consideration. The total expense includes not just the monthly loan payments but also the insurance premiums required to protect your investment.

Understanding how different factors, such as coverage type and driver profile, impact these costs can help you budget effectively and ensure you have the right protection while managing your financial commitments. For a comprehensive analysis, refer to our detailed guide titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Smart Strategies for Reducing Your Volkswagen GTI Insurance Costs

Finding ways to reduce your Volkswagen GTI insurance costs can make a significant difference in your overall expenses. From adjusting where you live to leveraging discounts for younger drivers, there are several strategies to help you save on your premiums. Explore these tips to find out how you can lower your insurance rates while still maintaining comprehensive coverage.

- Relocate to a Cheaper Area: Relocate to a place where expenses, including housing and daily costs, are generally cheaper.

- Take Advantage of Referral Fees: Earn money or discounts by referring others to a service or product.

- Vehicle Discounts: Inquire if discounts are available for vehicles used on farms or ranches.

- Save Money on Young Driver: Reduce insurance costs for a young driver by providing evidence of good academic performance.

- Opt for Liability Coverage: Choose a basic insurance plan that covers only damages to others if you drive an older model of the Volkswagen GTI, as it’s typically less expensive.

By applying these tips, you can potentially reduce your Volkswagen GTI insurance costs and make your premiums more manageable.

Whether it’s leveraging discounts or adjusting your coverage, these strategies can help you find significant savings and ensure you’re getting the best value for your insurance. To broaden your understanding, check out our resource “How do you lower your car insurance deductible?”

Top-Rated Insurance Plans for Volkswagen GTI

Who is the best company for Volkswagen GTI insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Volkswagen GTI insurance coverage. Many of these companies offer discounts for security systems and other safety features that the Volkswagen GTI offers.

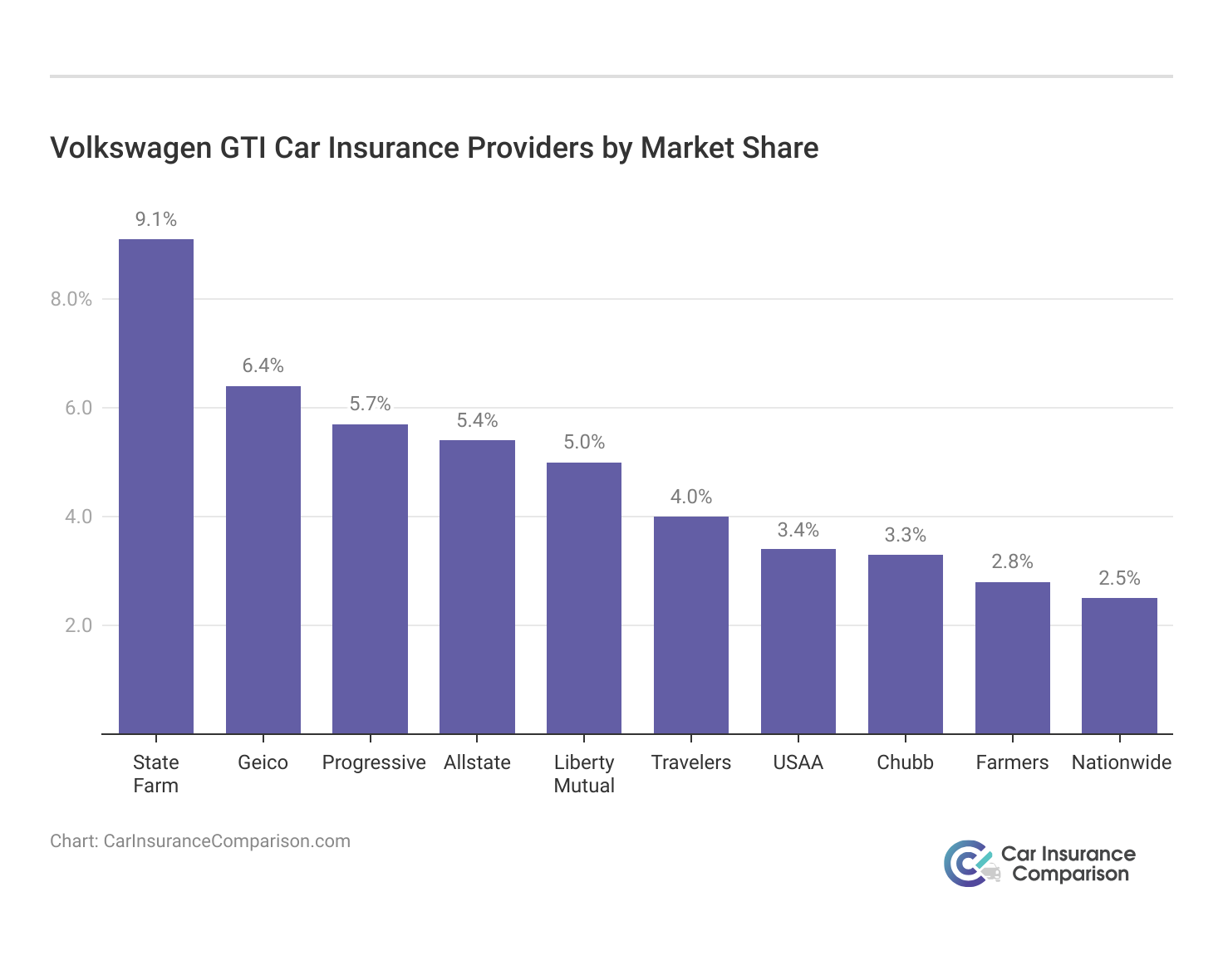

Top Volkswagen GTI Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

The leading insurance providers for Volkswagen GTI, ranked by market share, include State Farm with the highest premiums written at $66 million, followed by Geico and Progressive, each holding a 6% market share.

Geico offers the most competitive rates and extensive discounts for Volkswagen GTI owners, making it the top choice for affordable car insurance.

Michelle Robbins Licensed Insurance Agent

Other notable companies are Allstate and Liberty Mutual, both capturing a 5% share. These top insurers collectively shape the landscape of Volkswagen GTI insurance, reflecting their prominence in the market. To learn more, check out our guide titled “Car Insurance Market Value: Explained Simply.”

Market share data shows State Farm leads in Volkswagen GTI insurance, with Geico and Progressive following. Other key providers include Allstate and Liberty Mutual, highlighting the range of options available for GTI owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Get and Compare Free Quotes for Volkswagen GTI Insurance

For Volkswagen GTI insurance, top providers include Geico, Progressive, and State Farm, with Geico offering the most competitive rates starting around $68/month. Insurance costs can vary based on vehicle age, driver age, location, and driving record. For more insights, dive into our detailed guide titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Younger drivers typically face higher premiums, and urban areas usually have higher rates. Discounts are available for safe driving, bundling policies, and having advanced safety features. To find the best rates, use a comparison tool and explore available discounts.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Frequently Asked Questions

How much does insurance for a Volkswagen GTI typically cost?

The cost of insuring a Volkswagen GTI can vary based on factors like the driver’s age, location, driving history, and coverage level.

What is the insurance cost for a 16-year-old driving a Volkswagen GTI?

Insurance for a 16-year-old driving a Volkswagen GTI can be quite expensive due to the high risk associated with young drivers. On average, a 16-year-old might face insurance premiums around $620 per month. The cost can be reduced by taking advantage of discounts for good grades or completing a defensive driving course.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Do insurance rates for a Volkswagen GTI vary based on the model year?

Yes, insurance rates for a Volkswagen GTI can vary based on the model year. Newer models generally have higher premiums due to their higher value and repair costs, while older models may cost less to insure.

How much does insurance cost for an 18-year-old with a Volkswagen GTI?

An 18-year-old can expect to pay around $422 per month for insurance on a Volkswagen GTI. Premiums tend to decrease with age and experience, so rates are typically lower than for a 16-year-old but still higher compared to older drivers.

Where can I get insurance quotes for a Volkswagen GTI?

You can obtain insurance quotes for a Volkswagen GTI by using online comparison tools. By entering your ZIP code into these tools, you can compare rates from multiple insurance providers to find the best deal.

Are there specific discounts available for Volkswagen GTI insurance?

Yes, many insurance providers offer discounts for Volkswagen GTI owners, such as discounts for safe driving, anti-theft features, bundling policies, and having a clean driving record. Some companies also offer discounts for new cars and good students.

For a deeper dive, check out our detailed report titled “Anti-Theft Car Insurance Discounts.”

How can I find the best insurance rates for my Volkswagen GTI?

To find the best insurance rates for your Volkswagen GTI, compare quotes from several insurance companies, look for discounts related to safe driving and vehicle safety features, and consider factors such as your driving history and location.

What factors affect the cost of Volkswagen GTI insurance?

Several factors can affect the cost of Volkswagen GTI insurance, including the driver’s age, driving history, location, vehicle model year, and coverage level. Insurance providers also consider safety features and claims history.

How can I reduce the insurance cost for a Volkswagen GTI?

To reduce insurance costs for a Volkswagen GTI, consider increasing your deductible, maintaining a clean driving record, taking advantage of discounts, and comparing quotes from different providers to find the most competitive rates.

To discover more, check out our in-depth guide on insurance titled “Do all car insurance companies check your driving records?”

Is it possible to get affordable insurance for a Volkswagen GTI if I’m a young driver?

While insurance for a young driver, such as a 16 or 18-year-old, tends to be higher, you can still find affordable options by comparing quotes, looking for discounts, and choosing a higher deductible. Additionally, completing a defensive driving course and maintaining good grades may help reduce premiums.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.