Cheap 4×4 Pickup Truck Insurance in 2025 (Save With These 10 Companies!)

Geico, Progressive, and State Farm offer the best cheap 4x4 pickup truck insurance with minimum coverage rates starting at $105 per month. These companies stand out for their competitive rates, comprehensive coverage options making them top choices for affordable 4x4 pickup truck insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for 4x4 Pickup Truck

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for 4x4 Pickup Truck

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for 4x4 Pickup Truck

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

The best providers for cheap 4×4 pickup truck insurance are Geico, Progressive, and State Farm. This article examines how factors like your driving record and location impact insurance rates and offers tips to save money.

Our Top 10 Picks: Cheap 4x4 Pickup Truck Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $75 A++ Competitive Rates Geico

#2 $78 A+ Online Convenience Progressive

#3 $80 B Local Agents State Farm

#4 $80 A++ Military Support USAA

#5 $85 A Customized Policies Farmers

#6 $85 A Member Benefits AAA

#7 $88 A+ Personalized Service Erie

#2 $90 A Coverage Options Liberty Mutual

#9 $95 A+ Nationwide Presence Allstate

#10 $98 A++ Flexible Plans Travelers

Finding affordable coverage for expensive trucks can be exhausting and overwhelming. That’s why we’ve created this guide to help you navigate 4×4 truck insurance and find more affordable coverage.

If you’re curious about average truck insurance costs or need to compare rates, use our free online comparison tool above.

- Geico, Progressive, and State Farm offer the best cheap 4×4 pickup truck insurance

- Driving record, location, and truck modifications impact insurance costs

- Geico stands out offering the lowest rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

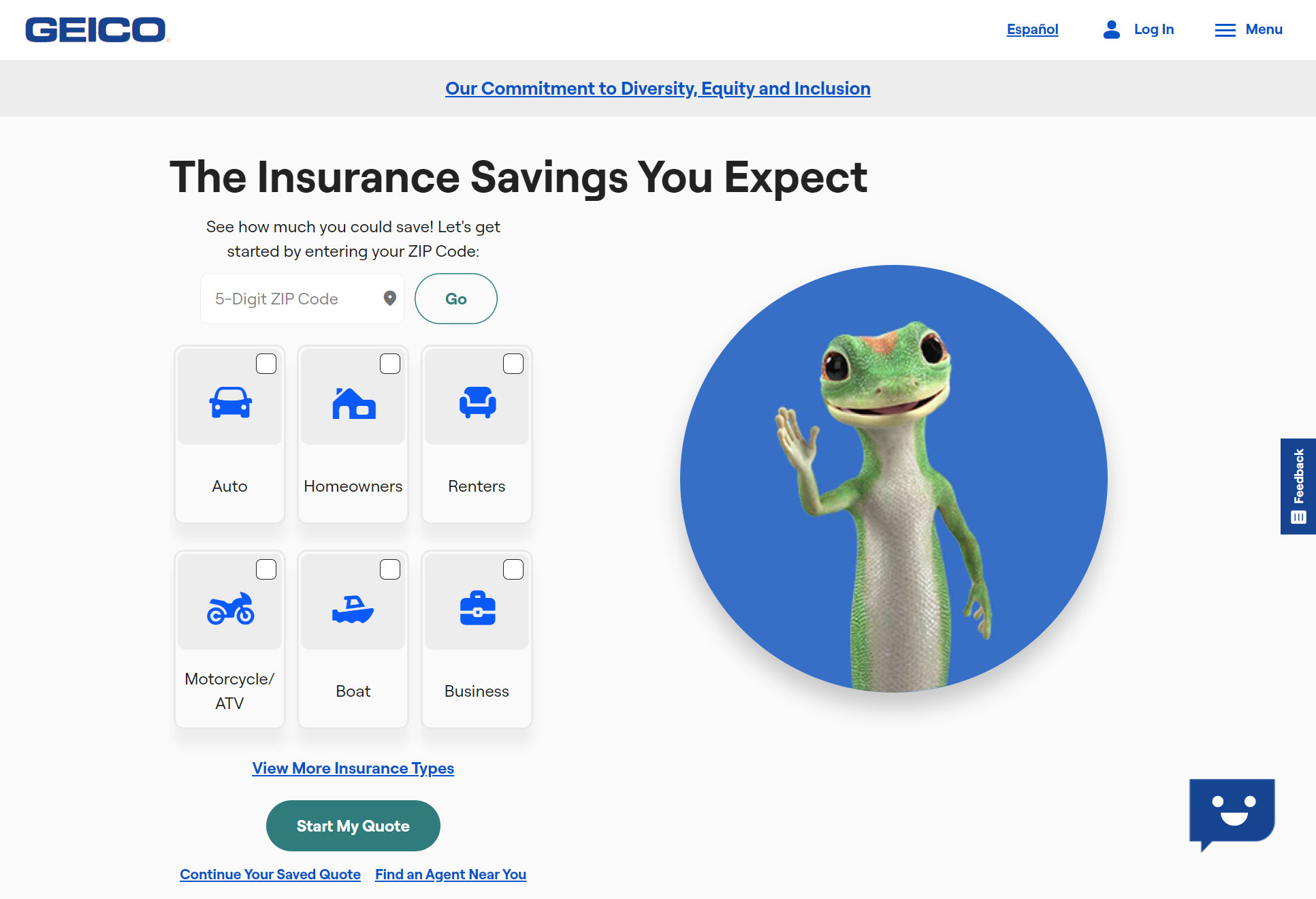

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico is well-known for offering some of the most competitive rates in the industry. Read on our “Geico car insurance review” to learn more.

- High Multi-Vehicle Discount: Provides a substantial 25% discount for insuring multiple vehicles.

- Strong Financial Stability: Holds an A++ rating from A.M. Best, indicating superior financial strength.

Cons

- Limited Local Agents: Geico primarily operates online, which may not suit customers who prefer in-person interactions.

- Standard Coverage Options: While competitive in price, Geico’s coverage options are more standard and may not be as comprehensive as some competitors.

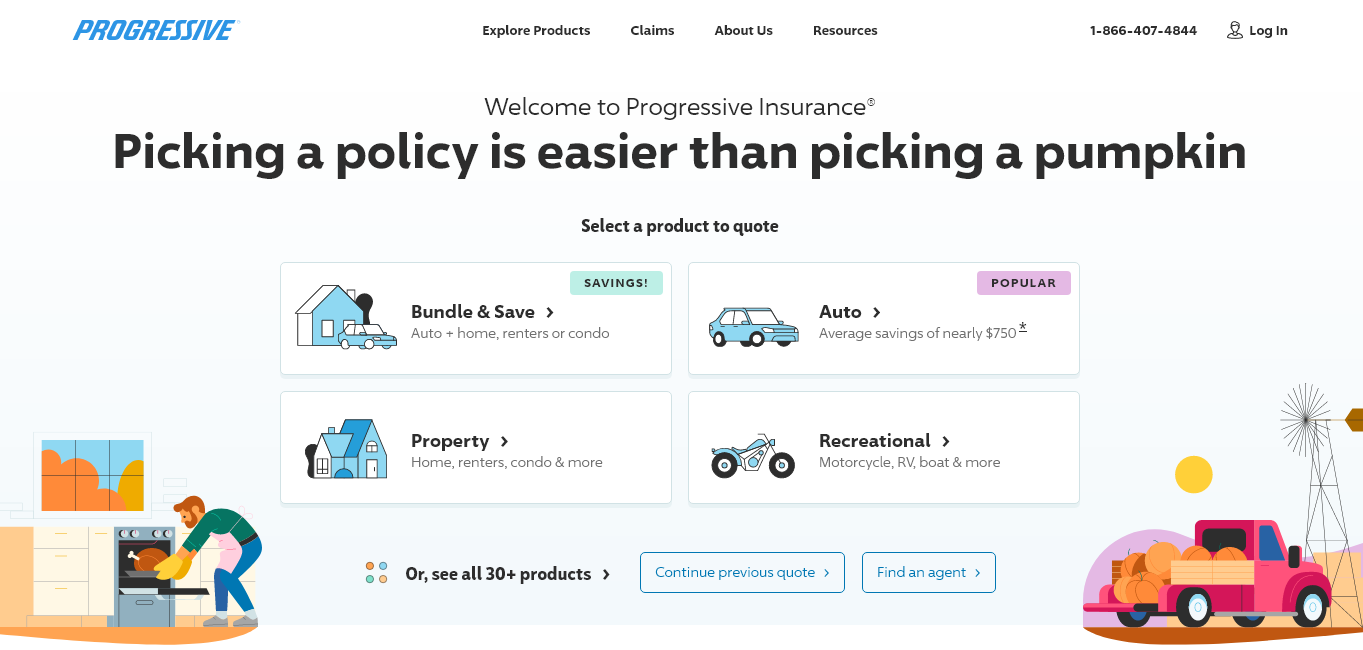

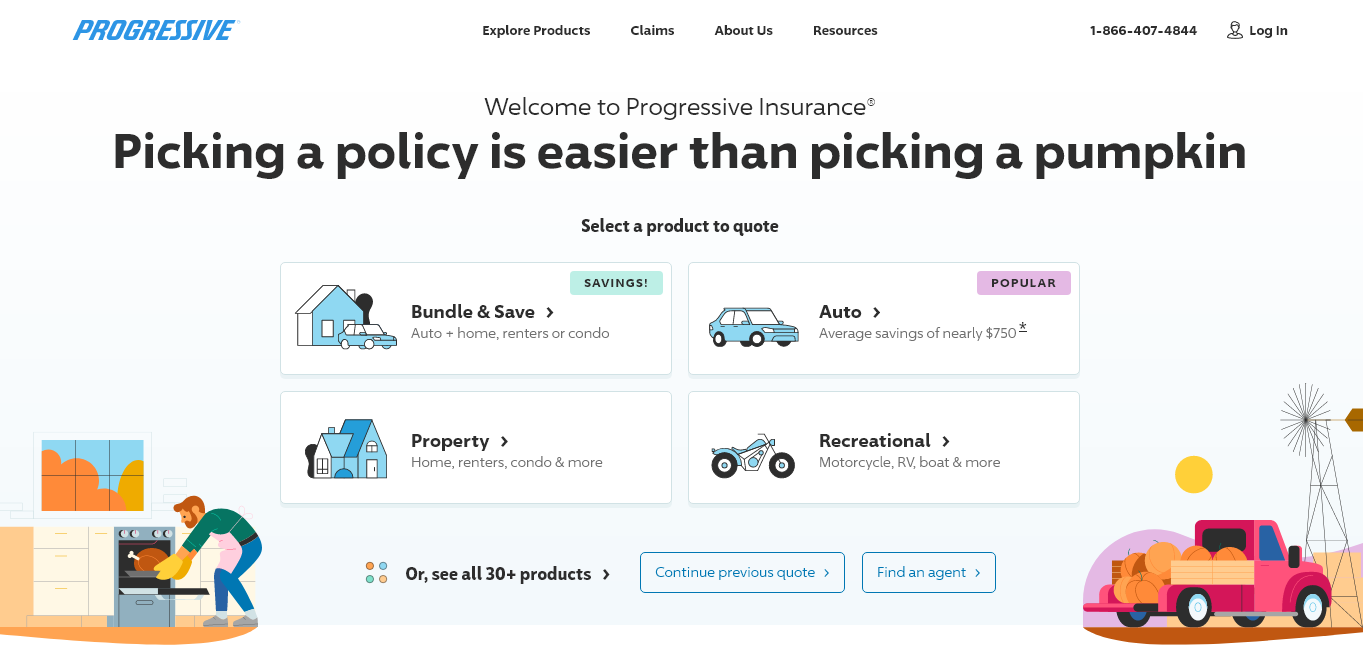

#2 – Progressive: Best for Online Convenience

Pros

- User-Friendly Online Tools: Offers a highly convenient online experience with easy-to-use tools and resources. Check our “Progressive car insurance review” for more information.

- Snapshot Program: Provides potential discounts through its Snapshot program, which rewards safe driving.

- Strong Financial Stability: Holds an A+ rating from A.M. Best, ensuring strong financial health.

Cons

- Lower Multi-Vehicle Discount: Offers a lower multi-vehicle discount (12%) compared to some competitors.

- Higher Rates for Certain Drivers: Rates can be higher for drivers with less-than-perfect records.

#3 – State Farm: Best for Local Agents

Pros

- Extensive Agent Network: Boasts a large network of local agents for personalized customer service. To learn more, read our “State Farm car insurance review“.

- High Multi-Vehicle Discount: Offers a 20% discount for insuring multiple vehicles.

- Comprehensive Coverage Option: State Farm offers a wide range of coverage options, allowing customers to tailor their policies to meet their specific needs.

Cons

- Premium Costs: Premiums might be higher compared to some direct-to-consumer insurers.

- Limited Digital Experience: Digital tools and online convenience are not as robust as some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Support

Pros

- Exclusive Military Benefits: Tailored specifically for military members and their families, offering unique benefits and discounts.

- Superior Customer Service: Known for exceptional customer service and high customer satisfaction. For more information, read our “USAA car insurance review“.

- Strong Financial Stability: Holds an A++ rating from A.M. Best, ensuring top-notch financial strength.

Cons

- Restricted Eligibility: Only available to military members, veterans, and their families.

- Limited Local Presence: Fewer local agents compared to some larger insurers.

#5 – Farmers: Best for Customized Policies

Pros

- Customized Policies: Offers highly customizable policies to meet specific needs of customers.

- High Multi-Vehicle Discount: Provides a 20% discount for insuring multiple vehicles. Read our “Farmers car insurance review” for more information.

- Strong Customer Support: Known for strong customer support and responsive service.

Cons

- Premium Costs: Premiums can be higher compared to other insurers offering similar coverage.

- Digital Tools: Online tools and resources may not be as advanced as competitors.

#6 – AAA: Best for Member Benefits

Pros

- Member Benefits: Offers extensive benefits for AAA members, including travel and roadside assistance perks.

- High Multi-Vehicle Discount: Provides a 25% discount for insuring multiple vehicles. Check our “AAA car insurance review” to gain further insights.

- Strong Customer Service: Known for strong customer service and support.

Cons

- Membership Required: Requires AAA membership to access insurance benefits, which adds an additional cost.

- Coverage Limitations: Some coverage options may be limited compared to other insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best for Personalized Service

Pros

- Personalized Service: Known for providing highly personalized service and tailored coverage options.

- Strong Financial Stability: Holds an A+ rating from A.M. Best, ensuring financial strength.

- High Customer Satisfaction: Consistently high ratings in customer satisfaction surveys. To learn more, read on our “Erie car insurance review“.

Cons

- Limited Availability: Not available in all states, limiting accessibility for some customers.

- Digital Tools: Online resources and digital tools may not be as robust as larger insurers.

#8 – Liberty Mutual: Best for Coverage Options

Pros

- Comprehensive Coverage Options: Offers a wide range of coverage options to suit different needs.

- High Multi-Vehicle Discount: Provides a 25% discount for insuring multiple vehicles. To gain further insights, read our “Liberty Mutual car insurance review“.

- Strong Financial Stability: Holds an A rating from A.M. Best, indicating strong financial health.

Cons

- Premium Costs: Premiums can be higher compared to other insurers.

- Customer Service: Customer service ratings are mixed, with some customers reporting dissatisfaction.

#9 – Allstate: Best for Nationwide Presence

Pros

- Extensive Network: Offers a wide network of agents and service centers nationwide.

- High Multi-Vehicle Discount: Provides a 25% discount for insuring multiple vehicles. Check on our guide titled “Allstate car insurance review” to learn more.

- Strong Financial Stability: Holds an A+ rating from A.M. Best, ensuring financial strength.

Cons

- Premium Costs: Premiums can be higher compared to some competitors.

- Claims Process: Some customers report issues with the claims process, citing delays and complications.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Flexible Plans

Pros

- Flexible Coverage Plans: Offers highly flexible plans that can be tailored to individual needs.

- Strong Financial Stability: Holds an A++ rating from A.M. Best, reflecting superior financial strength.

- Discount Opportunities: Provides various discount opportunities, including for safe driving and multiple policies. For more information, check our “Travelers car insurance review“.

Cons

- Lower Multi-Vehicle Discount: Offers a lower multi-vehicle discount (8%) compared to competitors.

- Customer Service: Customer service ratings are mixed, with some customers experiencing issues.

Car Insurance Rates for 4×4 Trucks

The average rates for 4×4 pickup trucks are $144/month. There are a lot of factors involved, and each truck will be very different. It’s somewhat easier to determine the average cost of car insurance for a given make and model, as those numbers are out there and readily available.

What exactly is a 4×4? The terms 4×4, 4-wheel drive (4WD), and all-wheel drive (AWD) include dozens of different makes and models. According to fueleconomy.gov they also have different gas mileages.

4x4 Pickup Truck Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $85 $160

Allstate $95 $175

Erie $88 $155

Farmers $85 $170

Geico $75 $150

Liberty Mutual $90 $165

Progressive $78 $160

State Farm $80 $155

Travelers $98 $160

USAA $83 $145

Vehicles that have been modified by their owners to add certain off-road accessories may also fall into this category. The only way to get an accurate price is on a case-by-case basis.

The Ford F-150 is one of the most popular makes and models of 4x4s. If you’re wondering how much car insurance would cost for a Ford F-150, there are a few different annual averages to compare.

Ford F-150 Car Insurance Monthly Rates by Trim & Coverage Level

| Ford F-150 Trim | Minimum Coverage | Full Coverage |

|---|---|---|

| F-150 XL Regular Cab 2WD | $105 | $627 |

| F-150 STX Regular Cab 2WD | $112 | $670 |

| F-150 XL Super Cab 2WD | $112 | $670 |

| F-150 XLT Regular Cab 2WD | $112 | $670 |

| F-150 STX Super Cab 2WD | $112 | $670 |

| F-150 XL Crew Cab 2WD | $115 | $687 |

| F-150 XLT Super Cab 2WD | $115 | $687 |

| F-150 STX Regular Cab 4WD | $115 | $687 |

| F-150 XL Regular Cab 4WD | $115 | $687 |

| F-150 FX2 Super Cab 2WD | $115 | $687 |

| F-150 XLT Crew Cab 2WD | $115 | $687 |

| F-150 XL Super Cab 4WD | $115 | $687 |

| F-150 XLT Regular Cab 4WD | $115 | $687 |

| F-150 XL Crew Cab 4WD | $117 | $704 |

| F-150 STX Super Cab 4WD | $117 | $704 |

| F-150 XLT Super Cab 4WD | $117 | $704 |

| F-150 FX2 2WD | $125 | $748 |

| F-150 Lariat Super Cab 2WD | $125 | $748 |

| F-150 Lariat Crew Cab 2WD | $125 | $748 |

| F-150 FX4 Super Cab 4WD | $125 | $748 |

| F-150 XLT Crew Cab 4WD | $125 | $748 |

| F-150 FX4 4WD | $125 | $748 |

| F-150 Lariat Crew Cab 4WD | $125 | $748 |

| F-150 SVT Raptor Super Cab 4WD | $125 | $748 |

| F-150 Lariat Super Cab 4WD | $125 | $748 |

| F-150 Lariat Crew Cab Platinum 2WD | $132 | $791 |

| F-150 Lariat Crew Cab Harley 2WD | $132 | $791 |

| F-150 Lariat King Ranch 2WD | $132 | $791 |

| F-150 Lariat King Ranch 4WD | $135 | $808 |

| F-150 Lariat Crew Cab Harley 4WD | $135 | $808 |

| F-150 Lariat Crew Cab Platinum 4WD | $135 | $808 |

Read more: Compare Ford Car Insurance Rates

Notice all of the different trim variations for this make and model alone, and it should be readily apparent why getting precise figures on 4×4 truck averages can be so difficult. The trim on the F-150 ranges from the low end of $105 per month to the high end of $135 per month.

It is also noteworthy that this table shows rates for a 40-year-old male with a clean driving record. Speeding tickets and other violations would naturally elevate rate averages.

4×4 Truck Liability Car Insurance Rates

While we can’t say how much liability coverage is for 4×4 trucks specifically, we can see the average rates by state on this table.

Liability Car Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $31 |

| Alaska | $46 |

| Arizona | $41 |

| Arkansas | $32 |

| California | $39 |

| Colorado | $40 |

| Connecticut | $53 |

| Delaware | $65 |

| Florida | $70 |

| Georgia | $41 |

| Hawaii | $38 |

| Idaho | $28 |

| Illinois | $36 |

| Indiana | $31 |

| Iowa | $24 |

| Kansas | $29 |

| Kentucky | $43 |

| Louisiana | $61 |

| Maine | $28 |

| Maryland | $50 |

| Massachusetts | $49 |

| Michigan | $60 |

| Minnesota | $37 |

| Mississippi | $36 |

| Missouri | $33 |

| Montana | $32 |

| Nebraska | $29 |

| Nevada | $54 |

| New Hampshire | $33 |

| New Jersey | $72 |

| New Mexico | $39 |

| New York | $65 |

| North Carolina | $30 |

| North Dakota | $24 |

| Ohio | $31 |

| Oklahoma | $37 |

| Oregon | $46 |

| Pennsylvania | $41 |

| Rhode Island | $60 |

| South Carolina | $41 |

| South Dakota | $24 |

| Tennessee | $33 |

| Texas | $42 |

| Utah | $39 |

| Vermont | $28 |

| Virginia | $34 |

| Washington | $47 |

| Washington, D.C. | $52 |

| West Virginia | $42 |

| Wisconsin | $30 |

| Wyoming | $27 |

| U.S. Average | $41 |

Next up, we’re going to look at comprehensive and collision truck insurance rates by state. Both collision coverage and comprehensive coverage are separate from liability, so they would come with their own price tags and requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

4×4 Truck Comprehensive and Collision Car Insurance Rates

Often, owners of heavy-duty trucks will pay for additional coverage, even more than what is usually required from the state that they live in, because of the risk involved with owner a larger vehicle.

Comprehensive and collision car insurance rates for 4×4 trucks vary as much as liability, based on the location.

Collision Car Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $25 |

| Alaska | $30 |

| Arizona | $22 |

| Arkansas | $25 |

| California | $30 |

| Colorado | $22 |

| Connecticut | $29 |

| Delaware | $25 |

| Florida | $21 |

| Georgia | $27 |

| Hawaii | $25 |

| Idaho | $17 |

| Illinois | $24 |

| Indiana | $20 |

| Iowa | $17 |

| Kansas | $21 |

| Kentucky | $21 |

| Louisiana | $33 |

| Maine | $21 |

| Maryland | $28 |

| Massachusetts | $30 |

| Michigan | $32 |

| Minnesota | $18 |

| Mississippi | $25 |

| Missouri | $22 |

| Montana | $21 |

| Nebraska | $19 |

| Nevada | $24 |

| New Hampshire | $23 |

| New Jersey | $30 |

| New Mexico | $22 |

| New York | $30 |

| North Carolina | $22 |

| North Dakota | $19 |

| Ohio | $21 |

| Oklahoma | $25 |

| Oregon | $18 |

| Pennsylvania | $26 |

| Rhode Island | $31 |

| South Carolina | $21 |

| South Dakota | $17 |

| Tennessee | $24 |

| Texas | $28 |

| Utah | $21 |

| Vermont | $23 |

| Virginia | $22 |

| Washington | $21 |

| Washington D.C. | $37 |

| West Virginia | $27 |

| Wisconsin | $17 |

| Wyoming | $23 |

| U.S. Average | $24 |

Now, let’s take a look at state averages for comprehensive coverage.

Comprehensive Car Insurance Monthly Rates by State

| States | Rates |

|---|---|

| Alabama | $12 |

| Alaska | $12 |

| Arizona | $15 |

| Arkansas | $15 |

| California | $8 |

| Colorado | $13 |

| Connecticut | $11 |

| Delaware | $9 |

| Florida | $9 |

| Georgia | $13 |

| Hawaii | $8 |

| Idaho | $9 |

| Illinois | $10 |

| Indiana | $10 |

| Iowa | $14 |

| Kansas | $19 |

| Kentucky | $11 |

| Louisiana | $17 |

| Maine | $8 |

| Maryland | $12 |

| Massachusetts | $11 |

| Michigan | $12 |

| Minnesota | $14 |

| Mississippi | $16 |

| Missouri | $14 |

| Montana | $17 |

| Nebraska | $17 |

| Nevada | $10 |

| New Hampshire | $9 |

| New Jersey | $10 |

| New Mexico | $14 |

| New York | $13 |

| North Carolina | $10 |

| North Dakota | $19 |

| Ohio | $9 |

| Oklahoma | $17 |

| Oregon | $7 |

| Pennsylvania | $11 |

| Rhode Island | $10 |

| South Carolina | $14 |

| South Dakota | $19 |

| Tennessee | $11 |

| Texas | $16 |

| Utah | $9 |

| Vermont | $10 |

| Virginia | $11 |

| Washington | $9 |

| Washington, D.C. | $19 |

| West Virginia | $16 |

| Wisconsin | $11 |

| Wyoming | $19 |

| U.S. Average | $45 |

Read more: Compare Alabama Car Insurance Rates

How the Value of 4×4 Trucks Affect Car Insurance Rates

Remember, when it comes to insurance for trucks, there are a lot of factors involved. Some of the factors include how often the truck is used for transportation and your previous driving records. To learn more, read our “Do all car insurance companies check your driving records?”

This is something to keep in mind if you are in the market for a 4×4 truck, as they require more durable and expensive parts. For instance, the MSRP of a 2020 Ford F-150 is $34,735 for a regular cab version. In short, a 4×4 is more expensive.

An affordable truck is unfortunately going to be a smaller one. With a luxury truck, your insurance provider is going to have to potentially pay out more against any claims that are filed.

How 4×4 Thefts Affect Car Insurance Rates

Theft is a factor that increases comprehensive coverage rates. Unfortunately, 4x4s are quite prone to theft. The National Insurance Crime Bureau’s annual report in 2018 found that full-size Ford pickups ranked third on the top ten stolen vehicles in the United States.

Learn More: Best Ford Car Insurance Rates

Should you be interested in what is considered a popular vehicle, you’ll want to know that your truck is going to be safe at night in your garage or driveway.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Claims and Losses on 4×4 Trucks

Let’s explore how certain 4×4 trucks fare against comparable makes and models in terms of insurance claims.

4×4 Truck Bodily Injury and Property Damage Loss Statistics

What are the loss statistics for bodily injury and property damage liability car insurance claims for 4×4 trucks?

The following table details loss statistics for the Chevy Silverado 1500 in its various forms in comparison to other trucks in its class. This table includes loss statistics for property damage and bodily injury. If there is a negative percentage, the vehicle suffered fewer losses than its counterparts in the same class. In short, a negative percentage is good.

Chevrolet Silverado Property Damage & Bodily Injury Car Insurance Loss Percentages

| Chevrolet Silverado Model | Property Damage Loss | Bodily Injury Loss |

|---|---|---|

| Chevrolet Silverado 1500 | 35% | 36% |

| Chevrolet Silverado 1500 4WD | -8% | NA |

| Chevrolet Silverado 1500 Crew Cab | 13% | 4% |

| Chevrolet Silverado 1500 Crew Cab 4WD | 10% | -12% |

| Chevrolet Silverado 1500 Extended Cab | 40% | 31% |

| Chevrolet Silverado 1500 Extended Cab 4WD | 6% | -16% |

As you can see, bodily injury loss statistics for the Chevy Silverado 1500 4WD are not available. With that being said, bodily injury losses were fairly low for the Chevy Silverado 1500 crew cab 4WD and the ext. cab 4WD. For property damage, the Chevy Silverado 1500 crew cab 4WD and ext. cab 4WD were both slightly higher than other vehicles in its class. Read more about the best Chevrolet car insurance rates.

4×4 Truck Bodily Comprehensive and Collision Loss Statistics

What are the loss statistics for comprehensive and collision car insurance claims for 4x4s trucks? Let’s take a look at another table, this time for collision and comprehensive loss ratios.

Ford F-150 Collision & Comprehensive Car Insurance Loss Percentages

| Ford F-150 Model | Collision Loss | Comprehensive Loss |

|---|---|---|

| Ford F-150 | -36% | -41% |

| Ford F-150 4WD | -45% | -35% |

| Ford F-150 SuperCab | -22% | -18% |

| Ford F-150 SuperCab 4WD | -36% | -21% |

| Ford F-150 SuperCrew | -27% | -6% |

| Ford F-150 SuperCrew 4WD | -28% | 2% |

According to these stats, the Ford F-150 fared very well in comparison to similar trucks. For collision, its loss ratio was lower by 45 percent, while its comprehensive loss ratio was lower by 35%.

Loss Statistics for PIP and MedPay for 4×4 Trucks

This next table shows the loss ratios for personal injury protection (PIP) and MedPay.

Ford F-150 Personal Injury Protection (PIP) and Medical Payments (MedPay Car Insurance Loss Percentages)

| Ford F-150 Model | PIP Loss | MedPay Loss |

|---|---|---|

| Ford F-150 | -31% | -35% |

| Ford F-150 4WD | -58% | -44% |

| Ford F-150 SuperCab | -26% | -30% |

| Ford F-150 SuperCab 4WD | -45% | -46% |

| Ford F-150 SuperCrew | -25% | -22% |

| Ford F-150 SuperCrew 4WD | -45% | -46% |

Astonishingly enough, every model of the F-150 was lower in insurance losses than comparable vehicles in terms of MedPay and PIP. For more information, read more in our comprehensive guide called “What are the pros and cons of PIP insurance?”

Safety Ratings for 4×4 Trucks

A vehicle’s safety ratings are an important factor in rate determination, as insurers want their clients to drive safely. Not all 4×4 trucks are built the same. For example, the Ford F-150, one of the more popular 4x4s, is a half-ton light-duty pickup. For more information, read our article titled “Compare Ford F-150 Car Insurance Rates“.

The size and class of a 4×4 truck can vary significantly, impacting both its safety ratings and insurance rates. Insurers consider these ratings to assess risk and determine appropriate coverage costs, making it essential for 4×4 truck owners to understand how their vehicle compares to others in terms of safety.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparison of 4×4 Truck Safety to Other Vehicles

The safety rating of a particular vehicle is one aspect that determines your car insurance rates. You can find out what the Insurance Institute for Highway Safety’s ratings are for any given vehicle.

Vehicles that have higher safety ratings will, as a result, lower car insurance rates. The opposite is also true.

When it comes to 4×4 vehicles, safety ratings are especially important where side-impact and rollovers are concerned. By their very nature, 4×4 trucks are intended to be used in off-road scenarios, which increase the risk of certain types of accidents. Since side-impact collisions and rollovers are the most common in off-road driving, these are the two most important safety factors to consider.

A good number of 4×4 owners purchase their vehicles with no intention of ever taking them off-road. In such cases, drivers may purchase their vehicles because they live in a state with typically rough winters, and the 4×4 helps them navigate winter snows more easily.

That’s why 4×4 owners are typically asked by their insurance companies if they intend to take their vehicles off-road. Those who do have a higher potential for accidents and claims than those who don’t. With that, off-road car insurance is more expensive.

It may seem logical for 4×4 owners to claim they won’t go off-road to get lower rates, but it’s unwise. Insurers often add clauses excluding off-road damage if customers state they’ll only drive on highways. If you say you won’t go off-road, insurers will hold you to it.

If you do decide to go off-road, the insurance company will undoubtedly want to know what type of driving that entails.

The riskier your off-road behavior is, the higher your car insurance rates will be. In some cases, if it’s risky enough, you may even have to search for a specialty car insurance company in order to get the coverage you need. Whatever you do, be honest about your intentions to ensure that you receive the best coverage.

Often, 4×4 owners who intend to take their vehicles off-road will modify them by adding high-performance car parts. If this is something you plan to do, it is important that you understand the difference between replacement value and agreed value car insurance.

Geico offers the best overall 4x4 pickup truck insurance with minimum coverage rates starting at $105 per month, thanks to their competitive rates and comprehensive coverage options.

Michelle Robbins Licensed Insurance Agent

Replacement value is what most drivers have. It simply means that if your vehicle is totaled, the insurance company will pay out an amount equal to what it would cost you to replace the vehicle with one of similar make and model year. Replacement value is determined by the Kelley Blue Book or NADA value.

Agreed value car insurance will cover what it would cost to replace your vehicle as is, including the high-performance parts you have added. You and your insurance company will have to inspect the vehicle and agree on its new value with the additions you have made, hence the term “agreed value.”

If you plan on purchasing this type of insurance, it is important to keep all receipts for high-performance parts. That is the only way to prove their worth.

Don’t forget about our comparison tool, which will help you to compare quotes from various companies.

Read more: Compare Four-Wheel Drive vs. Two-Wheel Drive Car Insurance Rates

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are 4×4 trucks more expensive to insure than regular cars?

Generally, insuring a 4×4 truck can be more expensive than insuring a regular car. Several factors contribute to this, including the higher cost of 4×4 trucks, their potential for off-road use, and their larger size and power. Additionally, trucks may have higher repair and replacement costs.

However, insurance rates are determined by multiple factors such as your location, driving history, coverage options, and the specific make and model of your 4×4 truck. It’s advisable to compare insurance quotes from different providers to find the best coverage at the most competitive rates.

What types of coverage should I consider for my 4×4 truck?

When insuring your 4×4 truck, it’s important to consider the following types of coverage:

- Liability Coverage: This coverage is typically required by law and helps protect you financially if you cause an accident that results in injury or property damage to others.

- Collision Coverage: This coverage helps pay for repairs or replacement if your truck is damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage provides protection against non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you’re involved in an accident with a driver who has insufficient or no insurance.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers resulting from an accident, regardless of fault.

- Personal Injury Protection (PIP): PIP coverage, required in some states, covers medical expenses, lost wages, and other related costs resulting from an accident.

However, ensure you really need the coverage, since your rates will be higher with more coverage.

How can I save money on insurance for my 4×4 truck?

Here are some tips to help you save money on insurance for your 4×4 truck:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Increase Your Deductible: Choosing a higher deductible can lower your premiums, but ensure you can afford the deductible amount if you need to make a claim.

- Maintain a Good Driving Record: Avoid traffic violations and accidents to keep your insurance rates low and potentially qualify for safe driver discounts.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider for potential discounts.

- Ask About Discounts: Ask your insurance provider about available discounts such as safe driver discounts, multi-vehicle discounts, or discounts for safety features on your 4×4 truck.

- Evaluate Coverage Needs: Regularly review your insurance policy to ensure you have the appropriate coverage for your 4×4 truck. Remove any unnecessary coverage options.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance programs that monitor your driving habits. Safe driving behavior can lead to potential discounts.

Check our “best usage-based car insurance companies” to learn more.

Do I need special insurance for off-road use of my 4×4 truck?

Yes, if you plan to use your 4×4 truck for off-road activities, it’s important to consider additional insurance coverage. Standard auto insurance policies typically do not cover off-road use or damage that occurs while engaging in off-road activities.

However, some insurance companies offer specialized coverage options specifically designed for off-road vehicles. These policies may provide coverage for damages, theft, or liability related to off-road use. Contact your insurance provider to discuss your off-road intentions and explore the available coverage options to ensure you have the appropriate protection for your off-road adventures.

Are modifications to my 4×4 truck covered by insurance?

Modifications made to your 4×4 truck, such as lift kits, aftermarket bumpers, or larger tires, may not be automatically covered by your standard insurance policy. It’s crucial to inform your insurance provider about any modifications you’ve made or plan to make to your vehicle.

Failure to disclose modifications could potentially result in denied claims or limited coverage. Some insurance companies offer specialized coverage options for modified vehicles. Consider discussing your modifications with your insurance provider to understand if additional coverage is needed to protect the value of your customized 4×4 truck.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Will my 4×4 truck insurance cover towing and off-road recovery?

It depends on the specific terms and coverage of your insurance policy. Standard auto insurance policies often include roadside assistance coverage, which may provide towing services if your 4×4 truck becomes disabled. However, coverage for off-road recovery, such as getting stuck or stranded during off-road activities, is typically not included in standard policies.

Some insurance companies offer optional coverage for off-road recovery or specialized policies that cater to off-road enthusiasts. Review your policy or contact your insurance provider to understand the extent of coverage for towing and off-road recovery and consider additional coverage if necessary.

Does the age of my 4×4 truck affect insurance rates?

Yes, the age of your 4×4 truck can impact insurance rates. Generally, newer vehicles tend to have higher insurance rates due to their higher value and repair costs. As a 4×4 truck ages, its value decreases, which can lead to lower insurance premiums. However, other factors such as the make and model, safety features, and theft rates associated with your specific truck can also influence rates. It’s advisable to compare insurance quotes from different providers to determine how the age of your 4×4 truck may affect your insurance premiums.

Can I get insurance for a vintage or classic 4×4 truck?

Yes, insurance coverage for vintage or classic 4×4 trucks is available. These vehicles often require specialized insurance coverage to account for their unique value and collectible status. Vintage or classic car insurance policies typically provide coverage options tailored to the specific needs of these vehicles, including agreed value coverage, which ensures that the vehicle is insured for its appraised value.

If you own a vintage or classic 4×4 truck, consult with insurance providers specializing in classic car insurance to discuss the available coverage options for your vehicle. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

How does the age of my 4×4 truck affect insurance rates?

The age of your 4×4 truck can impact insurance rates, with newer vehicles generally having higher rates due to their higher value and repair costs. As a truck ages, its value decreases, which can lead to lower insurance premiums.

Do I need special insurance for off-road use of my 4×4 truck?

Yes, if you plan to use your 4×4 truck for off-road activities, it’s important to consider additional insurance coverage. Standard auto insurance policies typically do not cover off-road use or damage that occurs during off-road activities.

To gain further insights, read more in our article titled “Understanding Your Car Insurance Policy.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.