Best GMC Sierra Car Insurance in 2025 (Your Guide to the Top 10 Companies)

For the best GMC Sierra car insurance, State Farm, Geico, and USAA lead the way with rates starting at $45 per month. These companies offer exceptional coverage and competitive pricing tailored for GMC Sierra owners. Compare quotes for safety and to find the ideal coverage for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Aug 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for GMC Sierra

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for GMC Sierra

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for GMC Sierra

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The best GMC Sierra car insurance is offered by State Farm, Geico, and USAA, with rates starting as low as $45 per month. These companies stand out for their competitive pricing and comprehensive coverage options. State Farm is our top pick overall due to its exceptional value and extensive customer service.

There is a multitude of factors that play a role in your insurance premiums, so make sure you do your homework before purchasing a GMC Sierra or any vehicle. The GMC Sierra has been an old standby for GMC since 1960.

Our Top 10 Company Picks: Best GMC Sierra Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 30% B Reliable Service State Farm

#2 25% A++ Affordable Rates Geico

#3 30% A++ Military Benefits USAA

#4 30% A++ High Satisfaction Auto-Owners

#5 30% A++ Flexible Options Travelers

#6 40% A+ Strong Reputation Nationwide

#7 30% A+ Unique Features Progressive

#8 30% A Customizable Coverage Liberty Mutual

#9 30% A Personalized Service American Family

#10 30% A+ Extensive Discounts Allstate

Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

- The type of Sierra you purchase will impact your insurance premiums

- Your demographics will impact what you pay for insurance

- How much insurance you decide to carry with play a role in your rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Affordable Monthly Rates: State Farm offers some of the best rates for GMC Sierra insurance, starting at $45 per month, making it a cost-effective choice for truck owners. More information about their rates in our State Farm car insurance review.

- Comprehensive Coverage Options: Provides a wide range of coverage options tailored to GMC Sierra owners, including collision, comprehensive, and liability coverage, ensuring robust protection.

- Strong Network of Local Agents: With a vast network of local agents, State Farm offers personalized service and support, which is advantageous for GMC Sierra owners who prefer face-to-face interactions.

Cons

- Discount Availability: State Farm’s discounts for GMC Sierra owners may be less extensive compared to some competitors, potentially limiting savings. Explore further details in our “State Farm Car Insurance Review.”

- Premium Variability: Premiums can vary significantly depending on the state, which may affect the overall affordability for GMC Sierra policyholders.

#2 – Geico: Best for Affordable Rates

Pros

- Low Premiums: As outlined in Geico car insurance review, Geico is known for offering competitive rates for GMC Sierra insurance, starting around $45 per month, making it an attractive option for budget-conscious drivers.

- Easy Online Management: Geico’s user-friendly online tools and mobile app make it easy for GMC Sierra owners to manage their policies and file claims efficiently.

- Strong Discount Program: Offers various discounts, such as safe driving and multi-vehicle discounts, which can help reduce premiums for GMC Sierra policyholders.

Cons

- Customer Service Issues: Geico has mixed reviews for customer service, which may impact GMC Sierra owners who require prompt and reliable support.

- Limited Specialized Coverage: Geico may not offer as many specialized coverage options for GMC Sierra trucks, potentially limiting customization for specific needs.

#3 – USAA: Best for Military Benefits

Pros

- Exceptional Rates for Military Members: USAA provides some of the lowest rates for GMC Sierra insurance, especially for military families, starting at $45 per month.

- Highly Rated Customer Service: Known for excellent customer service and high satisfaction ratings, USAA offers exceptional support for GMC Sierra owners. Learn more in our USAA car insurance review.

- Comprehensive Coverage Options: Offers extensive coverage options tailored to GMC Sierra vehicles, including specialized add-ons for military families.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, restricting access for non-military GMC Sierra owners.

- Higher Premiums for Non-Military: For eligible non-military individuals, USAA rates might be higher compared to other providers, which can impact affordability.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best for High Satisfaction

Pros

- Competitive Pricing: As outlined in Auto-Owners car insurance review, Auto-Owners offers competitive rates for GMC Sierra insurance, with premiums starting around $45 per month, making it a cost-effective option.

- Comprehensive Coverage Choices: Provides a variety of coverage options tailored to GMC Sierra trucks, ensuring comprehensive protection against various risks.

- High Customer Satisfaction: Known for high customer satisfaction, Auto-Owners is praised for its efficient claims process and responsive support for GMC Sierra owners.

Cons

- Limited Discount Options: Auto-Owners may have fewer discount options specifically for GMC Sierra owners, potentially impacting overall savings.

- Regional Availability: Certain features and discounts may not be available in all regions, affecting GMC Sierra policyholders based on their location.

#5 – Travelers: Best for Flexible Options

Pros

- IntelliDrive Program: Travelers offers the IntelliDrive program, a usage-based insurance option that can lower premiums based on safe driving habits for GMC Sierra owners.

- Competitive Premiums: Offers competitive rates starting at $45 per month, making it an affordable choice for GMC Sierra insurance. See more details on our Travelers car insurance review.

- Customizable Coverage: Provides a range of coverage options and add-ons, allowing GMC Sierra owners to tailor their insurance policies to specific needs.

Cons

- Mixed Customer Service Reviews: Travelers has mixed feedback regarding customer service, which can be a downside for GMC Sierra owners needing consistent support.

- Claims Satisfaction Issues: Some GMC Sierra policyholders report dissatisfaction with the claims process, indicating potential delays or disputes.

#6 – Nationwide: Best for Strong Reputation

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program reduces the deductible each year a GMC Sierra owner drives claim-free, providing long-term savings.

- Affordable Rates: Offers competitive insurance rates for GMC Sierra trucks, with premiums starting at $45 per month. Check out their ratings in our complete Nationwide car insurance discount.

- Customizable Coverage: Provides a wide range of coverage options and add-ons, allowing GMC Sierra owners to tailor their insurance policies to meet their needs.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, which may affect affordability for GMC Sierra policyholders.

- Customer Service Variability: Mixed reviews on customer service responsiveness, with some GMC Sierra drivers reporting issues in receiving timely assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Unique Features

Pros

- Snapshot Program: Progressive’s Snapshot program offers usage-based discounts based on driving behavior, rewarding safe GMC Sierra drivers with personalized savings.

- Multi-Vehicle Discount: Provides a 12% discount for insuring multiple vehicles, which can lower overall GMC Sierra insurance cost for owners with more than one car.

- Wide Range of Coverage Options: Offers a variety of customizable coverage options and add-ons, catering specifically to GMC Sierra insurance needs. Learn more details in our Progressive car insurance review.

Cons

- Customer Service Concerns: Progressive has mixed reviews for customer service, which may affect GMC Sierra owners needing reliable and prompt assistance.

- Potential Rate Increases: There is potential for significant rate increases after the initial policy term, which can impact long-term affordability for insurance for GMC Sierra.

#8 – Liberty Mutual: Best for Customizable Coverage

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, helping GMC Sierra owners avoid rate increases after their first accident, providing peace of mind.

- Customizable Policies: Provides a range of add-ons and coverage options, allowing GMC Sierra owners to customize their insurance policies to meet their specific needs.

- Competitive Rates: Offers competitive premiums starting at $45 per month, making it a budget-friendly option for GMC Sierra insurance. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, which may be a drawback for GMC Sierra owners seeking more affordable options.

- Customer Service Issues: Mixed reviews on customer service, with some GMC Sierra policyholders reporting challenges in receiving adequate support.

#9 – American Family: Best for Personalized Service

Pros

- Strong Customer Support: American Family is known for its excellent customer service and support, which is beneficial for GMC Sierra owners who value responsive assistance.

- Affordable Rates: Offers competitive insurance rates for GMC Sierra trucks, starting around $45 per month, providing good value for money. More information in our American Family car insurance review.

- Comprehensive Coverage: Provides a range of coverage options tailored to GMC Sierra vehicles, ensuring robust protection and customization.

Cons

- Limited Discount Options: May not offer as many discount opportunities specifically for GMC Sierra owners compared to some competitors, which can impact overall savings.

- Regional Variability: The availability of coverage options and discounts may vary by region, potentially affecting GMC Sierra policyholders based on their location.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Extensive Discounts

Pros

- Local Agent Network: Allstate’s network of local agents provides personalized assistance, which can be particularly helpful for GMC Sierra owners who prefer face-to-face interactions.

- Extensive Coverage Options: As mentioned in our Allstate car insurance review, Allstate offers a broad range of coverage options and add-ons, allowing GMC Sierra owners to tailor their insurance policies to their specific needs.

- Strong Financial Stability: Rated A+ by A.M. Best, indicating strong financial health and reliability, ensuring that GMC Sierra policyholders’ claims are well-supported.

Cons

- Higher Premiums: Premiums tend to be higher compared to some other insurers, potentially making it less affordable for GMC Sierra owners seeking budget-friendly options.

- Mixed Customer Service Reviews: Allstate has received mixed reviews regarding customer service, which may affect GMC Sierra owners seeking consistent support.

1500, Denali and Hybrid Sierra Cost Difference

Like with any vehicle, the make and model do play a role in figuring out what car insurance premium you need. The cost of the vehicle is a significant factor in analyzing how much your rates will be.

Generally, the more expensive the vehicle, the more expensive your rates will be.

With that stated, the Sierra 1500 is the most affordable of the three versions with a base sticker price just under $28,000. The Denali is higher end model of the Sierra and can run upwards of $55,000.

GMC Sierra Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $70 $165

American Family $62 $152

Auto-Owners $60 $150

Geico $50 $140

Liberty Mutual $68 $160

Nationwide $58 $148

Progressive $53 $143

State Farm $55 $145

Travelers $65 $155

USAA $45 $130

The Sierra Hybrid is no longer in production, but when it was, its MSRP was in the high $30,000 range. So with all things being equal, to replace a Denali is going to be, at times, more than twice the amount of replacing a Sierra 1500.

The car insurance company is not going to give the same rate to a person who drives a Denali versus one who drives a more traditional 1500 model.

Saving Insurance Premiums With Sierra Hybrid

Having any sort of hybrid car will, of course, save you money at the gas tank. But you are going to pay at the front end for this technology. With a Sierra Hybrid costing about $37,000, it will cost more to repair and replace versus a Sierra 1500 that cost you $27,000 out the door. For more information, read our article titled “When will my hybrid car start to pay for itself?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

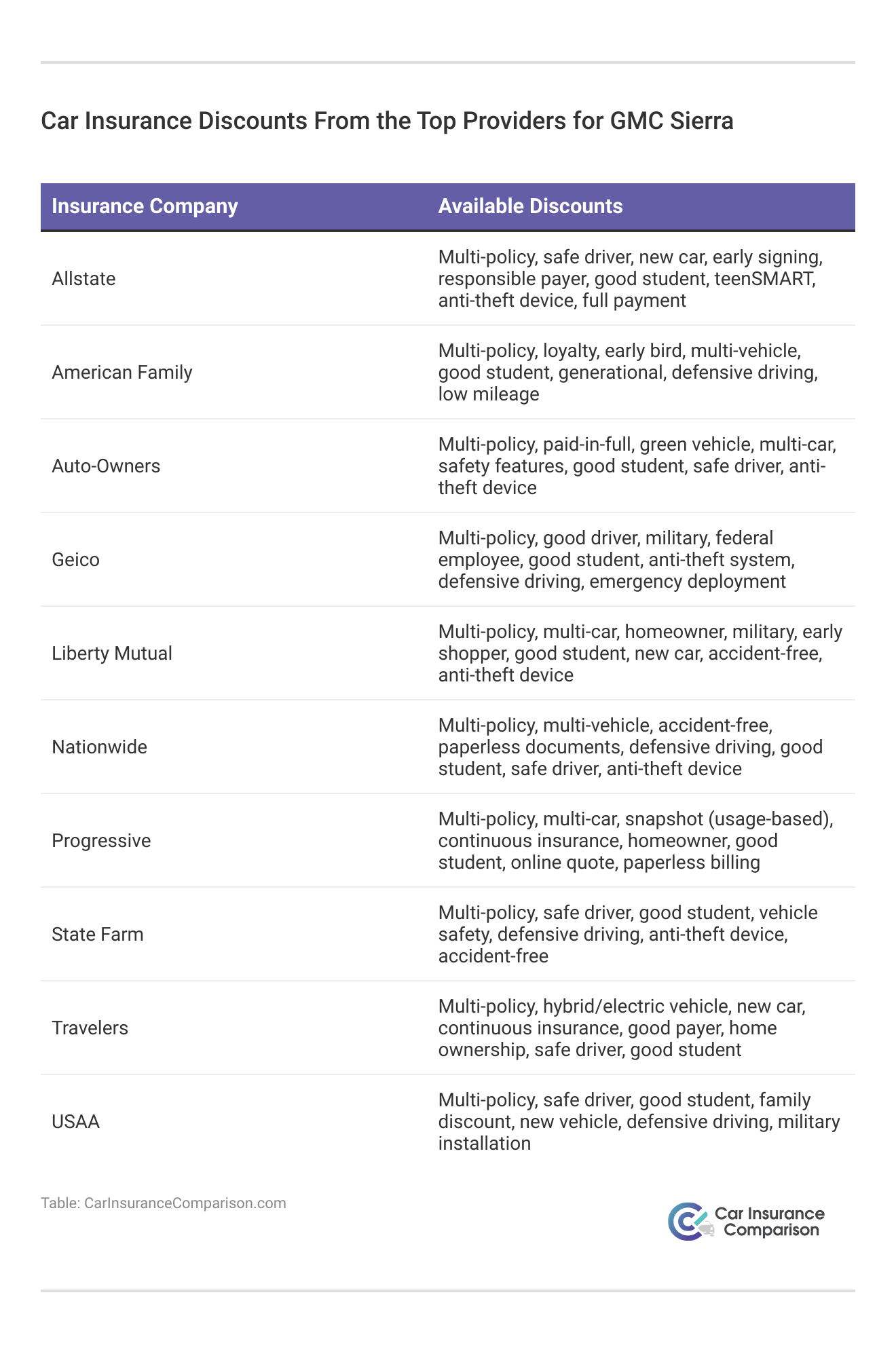

Types of Insurance Discounts for the GMC Sierra

Yes, there are some discounts that many of the reputable car insurance companies will offer. By having air bags and motorized seatbelts in your GMC (which many models offer or you will be able to upgrade to them) you may be able to get a discount on your car insurance policy.

Having anti-lock brakes, which again are standard on your GMC Sierra, will provide you with another insurance discount. Anti-theft devices also provide you with lower premiums. GMC with its partnership with OnStar is usually seen as an anti-theft system by numerous insurance carriers. See table below:

GMC is trying to work out even better deals with insurance carriers to give the owners of their vehicles more of an incentive to keep OnStar with their vehicle. Read our article titled “What cars will increase the cost of insurance?”

Right now, almost half the owners of vehicles with OnStar don’t renew due to the pricey annual fee for the service (about $299). And those that do keep OnStar after the first year only renew for the second year about 60% of the time.

Safety Factors to With Your Car Insurance Premiums

The GMC Sierra has stellar marks when it comes to overall safety ratings and reviews by independent testing organizations. GMC is mentioned in our article titled “Safest Cars in America.”

The GMC Sierra receives a 5-star rating (out of 5) with driver side frontal and rear impact testing, a 5-star rating for passenger side frontal and rear impact testing, and a 4-star rating for roller safety testing.

When testing the GMC Sierra, IIHS found the vehicle to rate Good (their highest rating) for 13 out of the 19 factors they test for.

Brad Larson LICENSED INSURANCE AGENT

And IIHS (Insurance Institute for Highway Safety) as stated on their website is “an independent, nonprofit, scientific, and educational organization dedicated to reducing the losses — deaths, injuries, and property damage — from crashes on the nation’s highways.”

They are the premier agency when it comes to determining the safety of all vehicles. They primarily focus on high speed frontal and side collision results, as well as seat head restraints and protection in regards to neck injuries and overall impact.

The Sierra rated Acceptable (their second highest rating) for five of the 19 factors tested by the institute. And only one factor (rear passenger torso) had a Marginal rating (the 3rd of the 4th rung of their rating scale).

How to Lower Your GMC Sierra Car Insurance Premiums

To further optimize your GMC Sierra car insurance premiums, consider several additional factors beyond just choosing the right insurer. Your age, driving record, and the amount and type of coverage you purchase can significantly impact your rates.

Additionally, the age of your vehicle, along with discounts such as good student, safe driver, multiple policy, and early signing discounts, can help lower your premiums. By taking these elements into account, you can better manage and potentially reduce your insurance costs while ensuring that you have the appropriate coverage for your GMC Sierra.

Read More: Does driving less affect car insurance rates?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Get a Car Insurance Quote for a GMC Sierra

Consumers can get car insurance rate comparison for the GMC Sierra in exactly the same manner as they would any other car.

Going online to a car insurance rate comparison portal such as this one, calling a car insurance company, or meeting with a broker are the most convenient methods of obtaining car insurance rate information and comprehensive car insurance coverage on the GMC Sierra.

Rates for the GMC Sierra will often differ from car insurance provider to car insurance provider, so it is a good idea to compare pricing information carefully. Read our article titled “Where can I easily finding quick car insurance quotes?” for more information.

It is not necessary to be the owner of a GMC Sierra to get quotes. If you are a licensed driver, you will be able to give the model of the GMC Sierra on which you want rate information.

How GMC Sierra Owners Get a Low Quote

Purchasing only the state minimum amount of car insurance for the GMC Sierra is the most effective means of keeping auto insurance rates down.

You will need to consider your lifestyle, as well as the risk that buying liability auto insurance coverage presents before making an ultimate decision. GMC Sierra drivers are able to get the same discounts on car insurance as other motorists.

This means that signing up and completing defensive driving classes, equipping your vehicle with standard safety features, and working close to your home can save you money on insurance for your GMC Sierra.

Owning a GMC Sierra that is at least a few years old also puts some consumers at an advantage. As their vehicles depreciate in value, car insurance becomes less expensive.

Another way to get better insurance rates for the GMC Sierra is to add another driver that has a spotless driving record onto your policy.

Before purchasing the GMC Sierra, you need to compare car insurance quotes. Start by typing your ZIP code below.

Frequently Asked Questions

Do the different versions of the GMC Sierra affect insurance rates?

Yes, more expensive versions like the Denali have higher rates than the more affordable Sierra 1500. Read our article titled “Best GMC Denali Car Insurance” for more information.

Will a Sierra Hybrid save on insurance premiums?

No, the hybrid technology can lead to higher premiums due to its higher repair/replacement costs.

Are there discounts for GMC Sierra owners?

Yes, safety features like airbags, anti-lock brakes, and anti-theft devices can qualify for discounts.

Do safety ratings affect premiums?

Yes, the Sierra’s high safety ratings can help lower insurance premiums. For more information, read our article titled “Safety Features Car Insurance Discounts.”

How can I get a quote for GMC Sierra insurance?

Enter your ZIP code below to compare quotes instantly and find the cheapest insurance available.

What factors influence GMC Sierra insurance rates?

Insurance rates for a GMC Sierra are influenced by various factors including the vehicle’s model year, trim level, safety features, and overall value. Other factors like your driving history, location, and credit score also play a significant role.

Can my driving record impact my GMC Sierra insurance premiums?

Yes, your driving record is a major factor in determining your insurance premiums. A clean driving record can help lower your rates, while a history of accidents or traffic violations can increase them.

Read More: Do all car insurance companies check your driving records?

Are there specific insurance requirements for the GMC Sierra?

Insurance requirements for the GMC Sierra are typically the same as for other vehicles. However, if you are financing or leasing the truck, your lender or leasing company may have additional coverage requirements.

How does my location affect my GMC Sierra insurance rates?

Your location can impact your insurance rates due to factors such as local traffic conditions, crime rates, and weather-related risks. Urban areas with higher traffic and crime rates often have higher premiums compared to rural areas.

Can I reduce my GMC Sierra insurance costs by bundling policies?

Yes, many insurance companies offer discounts if you bundle multiple policies, such as auto and home insurance. This can help reduce your overall insurance costs for your GMC Sierra. Enter your ZIP code below to get personalized insurance quotes tailored to your needs and budget.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.