Best GMC Sierra 2500HD Car Insurance in 2025 (Find the Top 10 Companies Here)

For the best GMC Sierra 2500HD car insurance, State Farm, AAA, and Geico stand out, offering coverage at $45 per month. These providers excel due to their competitive rates, extensive coverage options, and superior customer service, making them top choices for lowering your GMC Sierra insurance cost.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for GMC Sierra 2500HD

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for GMC Sierra 2500HD

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for GMC Sierra 2500HD

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, AAA, and Geico offer the best GMC Sierra 2500HD car insurance, with rates starting at $45 per month. State Farm is the top pick for its superior coverage and value. Compare these providers to find the ideal coverage for your GMC Sierra 3500HD car insurance needs.

The article also covers ways to lower the cost of your insurance, including tips on improving your driving record, bundling policies, and increasing deductibles. By applying these strategies, you can reduce your overall expenses and get better value for your GMC Sierra 2500HD Car Insurance.

Our Top 10 Company Picks: Best GMC Sierra 2500HD Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 13% B Many Discounts State Farm

#2 15% A Online App AAA

#3 10% A++ Custom Plan Geico

#4 12% A+ Usage Discount Nationwide

#5 18% A Local Agents Farmers

#6 16% A++ Accident Forgiveness Travelers

#7 14% A+ Add-on Coverages Allstate

#8 19% A Customizable Polices Liberty Mutual

#9 11% A+ Innovative Programs Progressive

#10 17% A++ Military Savings USAA

See if you’re getting the best deal on car insurance by entering your ZIP code above.

- Learn to cut insurance costs with discounts and bundling

- State Farm leads in GMC Sierra 2500HD Car Insurance

- Explore the car insurance available for GMC Sierra policyholders

GMC Sierra 2500HD Insurance Cost

The table below offers a comparison of monthly insurance rates for minimum and full coverage from several leading insurance companies.

GMC Sierra 2500HD Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $65 $196

Allstate $71 $215

Farmers $76 $220

Geico $78 $240

Liberty Mutual $98 $290

Nationwide $45 $139

Progressive $78 $243

State Farm $55 $158

Travelers $67 $193

USAA $65 $189

You can make a more informed choice and potentially find significant savings. Be sure to consider not only the cost but also the coverage details and additional benefits each provider offers to ensure you get comprehensive protection at a competitive rate.

Understanding how different factors affect insurance rates for the GMC Sierra 2500HD can help you make more informed decisions about your coverage. GMC Sierra 2500HD car insurance rates vary by coverage type, with discounted rates at $78 per month and high deductibles costing $114. Low deductible plans are $167, while high-risk drivers pay $283, and teen drivers face the highest rates at $485 per month.

Understanding how monthly rates vary by coverage level and provider is essential for making an informed decision.

Scott W. Johnson LICENSED INSURANCE AGENT

The comparison of rates with varying deductibles and driver risk profiles provides insight into how costs can escalate with car insurance deductibles and riskier driving profiles, such as those of teen drivers.

Are GMC Sierra 2500HDs Expensive to Insure

The following table presents a detailed comparison of comprehensive, collision, liability, and total insurance rates for the GMC Sierra 2500HD and other popular trucks like the Ford F-150, Chevrolet Colorado, and Dodge Ram.

GMC Sierra 2500HD Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $31 | $37 | $21 | $102 |

| Chevrolet Silverado 2500HD | $35 | $57 | $30 | $138 |

| Chevrolet Silverado 3500HD | $35 | $55 | $34 | $138 |

| Dodge Ram | $35 | $47 | $30 | $127 |

| Ford F-150 | $31 | $39 | $27 | $110 |

| GMC Sierra 2500HD | $35 | $55 | $28 | $133 |

| GMC Sierra 3500HD | $35 | $55 | $31 | $136 |

This comparison shows that while the GMC Sierra 2500HD’s rates are competitive, there are variations among different models, which can influence your choice of vehicle and insurance provider.

To find the most affordable insurance rates for your GMC Sierra 2500HD, consider exploring different insurers, looking for discounts, and using online comparison tools to ensure you get the best value for your coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of GMC Sierra 2500HD Insurance

The GMC Sierra 2500HD trim and model you choose can impact the total price you will pay for GMC Sierra 2500HD auto insurance coverage.

Age of the Vehicle

Older GMC Sierra 2500HD models generally cost less to insure. For example, auto insurance for a 2020 GMC Sierra 2500HD costs $132, while 2010 GMC Sierra 2500HD insurance costs are $108, a difference of $24.

GMC Sierra 2500HD Car Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| 2024 GMC Sierra 2500HD | $34 | $60 | $31 | $138 |

| 2023 GMC Sierra 2500HD | $34 | $58 | $30 | $137 |

| 2022 GMC Sierra 2500HD | $34 | $57 | $29 | $136 |

| 2021 GMC Sierra 2500HD | $34 | $56 | $28 | $135 |

| 2020 GMC Sierra 2500HD | $35 | $55 | $28 | $133 |

| 2019 GMC Sierra 2500HD | $37 | $53 | $27 | $131 |

| 2018 GMC Sierra 2500HD | $38 | $52 | $26 | $130 |

| 2017 GMC Sierra 2500HD | $39 | $51 | $25 | $130 |

| 2016 GMC Sierra 2500HD | $41 | $49 | $24 | $128 |

| 2015 GMC Sierra 2500HD | $42 | $47 | $23 | $126 |

| 2014 GMC Sierra 2500HD | $43 | $44 | $22 | $123 |

| 2013 GMC Sierra 2500HD | $43 | $41 | $21 | $120 |

| 2012 GMC Sierra 2500HD | $43 | $37 | $20 | $115 |

| 2011 GMC Sierra 2500HD | $43 | $34 | $19 | $111 |

| 2010 GMC Sierra 2500HD | $44 | $32 | $18 | $109 |

The GMC Sierra 2500HD offers competitive insurance rates compared to other trucks, with a total monthly cost of $132. While it is slightly higher than the Ford F-150 and Chevrolet Colorado, it remains more affordable than the GMC Sierra 3500HD and Chevrolet Silverado 3500HD.

To find the best deals, compare comprehensive car insurance coverage options from various providers. Exploring discounts and policy bundling can further help reduce your insurance costs.

Driver Age

Driver age significantly influences the insurance rates for a GMC Sierra 2500HD. Younger drivers typically face higher premiums due to perceived higher risk, while more experienced drivers often benefit from lower rates.

The following section outlines how insurance costs vary by driver age, highlighting the substantial difference in monthly premiums between younger and older drivers.

GMC Sierra 2500HD Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $485 |

| Age: 18 | $389 |

| Age: 20 | $301 |

| Age: 30 | $139 |

| Age: 40 | $133 |

| Age: 45 | $128 |

| Age: 50 | $121 |

| Age: 60 | $119 |

As illustrated, younger drivers, particularly teens and those in their early twenties, face significantly higher premiums compared to older, more experienced drivers. This underscores the importance of age-related factors in determining insurance costs and can guide you in making informed decisions to potentially reduce your premiums.

Driver Location

Your location plays a crucial role in determining your GMC Sierra 2500HD insurance rates. Insurance premiums can vary widely based on local factors such as traffic conditions, crime rates, and regional insurance regulations. The table below compares insurance rates across several U.S. cities, demonstrating how location impacts your overall insurance costs.

GMC Sierra 2500HD Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $175 |

| Columbus, OH | $110 |

| Houston, TX | $208 |

| Indianapolis, IN | $113 |

| Jacksonville, FL | $192 |

| Los Angeles, CA | $227 |

| New York, NY | $210 |

| Philadelphia, PA | $178 |

| Phoenix, AZ | $154 |

| Seattle, WA | $129 |

For instance, drivers in Los Angeles face significantly higher costs compared to those in Phoenix. This highlights the importance of considering your geographical location when evaluating insurance options and looking for ways to mitigate higher costs through strategic choices.

Your Driving Record

The following section details how different driving records impact insurance rates, with a focus on the differences in costs based on clean records versus those with violations or accidents.

GMC Sierra 2500HD Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $485 | $534 | $624 | $704 |

| Age: 18 | $389 | $428 | $507 | $586 |

| Age: 20 | $301 | $327 | $373 | $431 |

| Age: 30 | $139 | $151 | $174 | $201 |

| Age: 40 | $133 | $144 | $166 | $192 |

| Age: 45 | $128 | $139 | $160 | $185 |

| Age: 50 | $121 | $132 | $152 | $178 |

| Age: 60 | $119 | $129 | $148 | $173 |

Drivers with clean records benefit from lower rates, whereas those with speeding tickets or accidents experience considerably higher costs. The importance of maintaining a clean driving record is to help keep insurance premiums manageable.

GMC Sierra 2500HD Safety Features

Insurance companies often offer discounts for vehicles equipped with modern safety technologies that help prevent accidents and enhance overall safety. The following list details the key safety features available on the GMC Sierra 2500HD that may qualify you for lower insurance rates.

- Park Assist: Front and rear sensors for parking assistance.

- Rear Camera Mirror: Enhanced visibility with a rear camera mirror.

- Blind-Spot Monitors: Alerts for vehicles in blind spots.

- Rear Cross-Traffic Alerts: Warnings for cross-traffic while reversing.

- Collision and Lane Warnings: Forward-collision warnings with automatic braking and lane departure alerts.

Equipping your GMC Sierra 2500HD with advanced safety features not only enhances your driving experience but can also lead to reduced insurance premiums.

GMC Sierra 2500HD Reducing Insurance Costs

There are several ways you can save even more on your GMC Sierra 2500HD car insurance rates. Take a look at the following five tips:

- Reduce modifications on your GMC Sierra 2500HD.

- Compare GMC Sierra 2500HD quotes for free online.

- Save money on young driver GMC Sierra 2500HD insurance by mentioning grades or GPA.

- Check your GMC Sierra 2500HD policy carefully to ensure all information is correct.

- Consider using a tracking device on your GMC Sierra 2500HD.

From minimizing vehicle modifications to leveraging discounts for young drivers and utilizing tracking devices, each strategy contributes to more affordable insurance coverage.

Regularly comparing quotes and verifying your policy details ensures that you are not overpaying for your insurance and helps you stay on top of potential savings.

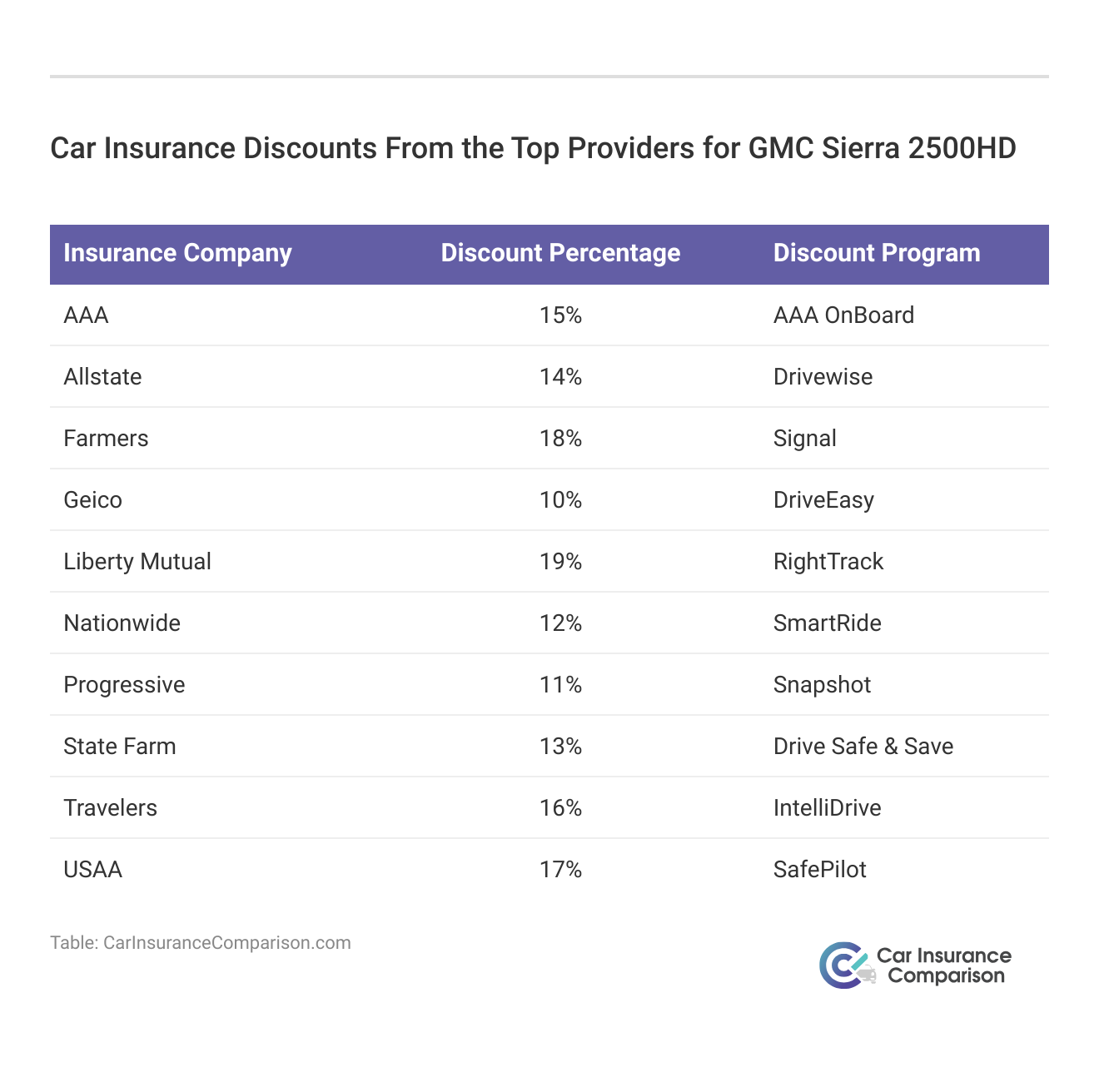

These discounts from top insurance providers for GMC Sierra 2500HD offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Read More: Best Car Insurance for Modified Cars

GMC Sierra 2500HD Prime Insurance Companies

Who is the best auto insurance company for GMC Sierra 2500HD insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering GMC Sierra 2500HD auto insurance coverage (ordered by market share).

Top GMC Sierra 2500HD Car Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Allstate | $39.2 million | 5% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Many of these companies offer discounts for security systems and other safety features that the GMC Sierra 2500HD offers. Save on your GMC Sierra 2500HD car insurance rates by taking advantage of our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the average insurance rates for a GMC Sierra 2500HD?

The average insurance rates for a GMC Sierra 2500HD typically vary based on factors like coverage level and driver profile. While exact costs can differ, it’s important to compare quotes from multiple insurers to find the best rate for your situation.

How much does insurance for a teenage GMC Sierra 2500HD driver cost?

Insurance for a teenage GMC Sierra 2500HD driver is generally higher due to the increased risk associated with younger drivers. Teens often face significantly higher premiums compared to more experienced drivers. Get comparisons in our article titled “Compare Teen Driver Car Insurance Rates.”

What factors affect GMC Sierra 2500HD insurance costs?

Several factors can influence GMC Sierra 2500HD insurance costs, including the vehicle’s age, the driver’s age, location, driving record, and the level of coverage chosen. Each of these factors plays a role in determining your overall insurance premium.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Are GMC Sierra 2500HDs expensive to insure?

Compared to other trucks, GMC Sierra 2500HD insurance rates can be somewhat higher. However, insurance costs are relative and can be managed by comparing rates and finding discounts tailored to your vehicle and driving profile.

How can I save on GMC Sierra 2500HD insurance?

There are different ways to lower car insurance rates for your GMC Sierra 2500HD insurance, consider strategies such as practicing safe driving, comparing quotes from various insurers, opting for higher deductibles, bundling insurance policies, and asking about available discounts.

Does the age of the GMC Sierra 2500HD affect insurance rates?

Yes, the age of your GMC Sierra 2500HD can impact insurance rates. Generally, older models may have lower insurance premiums compared to newer ones due to reduced replacement costs and other factors.

How does my location influence GMC Sierra 2500HD insurance costs?

Your location significantly affects your GMC Sierra 2500HD insurance costs. Areas with higher traffic congestion, crime rates, or regional insurance regulations can result in higher premiums. Comparing rates by city can help you find more affordable options.

How does my driving record impact GMC Sierra 2500HD insurance rates?

Your driving record plays a crucial role in determining your GMC Sierra 2500HD insurance rates. Drivers with clean records generally pay lower premiums, while those with violations or accidents may face higher costs.

Read More: Do all car insurance companies check your driving records?

What safety features on the GMC Sierra 2500HD can lower insurance rates?

Equipping your GMC Sierra 2500HD with advanced safety features like front and rear park assist, blind-spot monitors, and automatic emergency braking can potentially qualify you for discounts. Insurance companies often reward vehicles with enhanced safety technology.

What should I consider when comparing GMC Sierra 2500HD insurance quotes?

When comparing GMC Sierra 2500HD insurance quotes, consider not only the premium costs but also the coverage options, deductible amounts, and any additional benefits or discounts each insurer offers. This comprehensive approach will help you find the best value for your insurance needs.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.