How to Get Safeco Car Insurance Quotes Online in 2025 (5 Simple Steps)

Learn how to get Safeco car insurance quotes online from $86/month for clean drivers. Visit Safeco's website, provide personal information, select coverage options, compare personalized quotes, and proceed with your Safeco policy purchase. This easy process allows you to get affordable Safeco car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Feb 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

How to get Safeco car insurance quotes online is a simple process that can assist you in finding cheap coverage options that suit your needs. Fill out your information and vehicle details, then compare various quotes quickly and select the one that suits you best.

When looking for car insurance in Safeco, you can easily get a Safeco quote online by visiting their official website. The process is simple and allows you to compare different coverage options, helping you find the best policy that suits your needs and budget.

We will also study the factors affecting car insurance rates and how you could save your car from crashing into insurance.

Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

- Step #1: Visit Safeco’s Website – Go to the official Safeco Insurance website

- Step #2: Enter Personal and Vehicle Information – Provide your name and address

- Step #3: Select the Coverage Options – Choose from various coverage options

- Step #4: Customize Quote – Get a quote based on your information

- Step #5: Save or Purchase Policy – Complete the purchase online

5 Simple Steps to Get Safeco Car Insurance Quotes Online

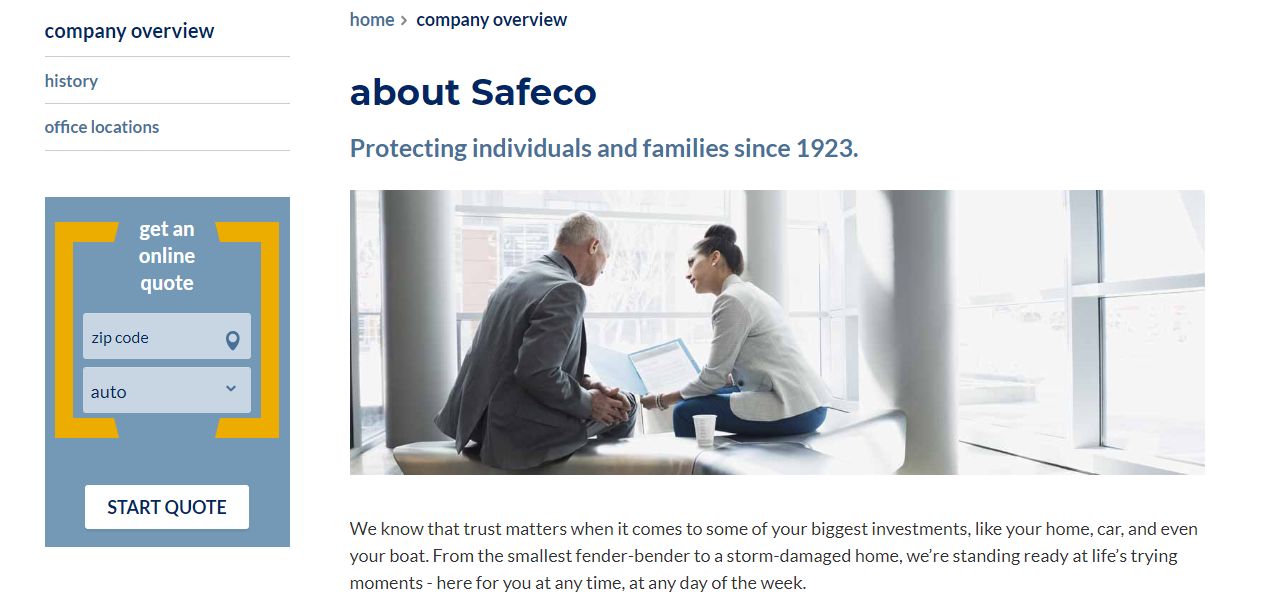

Safeco’s online quoting tool. You can compare coverage options, customize your policy to your needs, locate a plan accessible to all, and do it all in five straightforward steps. Whether you are a new customer or not, this guide focuses on how to ensure that you get Safeco car insurance quotes online quicker and more safely.

Step #1: Visit the Safeco Insurance Website

Go to the official site of Safeco Insurance and hit the Get a Quote button on the homepage. The site is user-friendly and guides you through each quoted step. In order to avoid giving your information to an unverified website, make sure you are on the official website.

Existing customers can access your account through the ‘Safeco Customer Login’ section to easily manage your policies and claims. Using Safeco Insurance’s official site, you can purchase the right car insurance quote online efficiently and securely.

Step #2: Enter Your Personal and Vehicle Information

You will need to provide accurate information such as your name, address, and date of birth to get a precise quote on car insurance. Give the other details, like your vehicle’s make, model, year, and how often you drive it.

Paraphrase the information you get so that nothing wrong undercuts your quote. Understanding what information you need for a car insurance quote in hand keeps you from being held up while helping you to get a more customized estimate.

Step #3: Select the Coverage Options You Need

Depending on what you drive and how much you are willing to pay, you can choose from coverage options , including liability, collision, and comprehensive. You could also consider optional add-ons such as roadside assistance or the best rental car reimbursement coverage for additional protection. Choosing the right coverage will help you ensure you have enough protection without paying for features you do not need.

Safeco Car Insurance Monthly Rates by Driving Record

| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $86 | $163 |

| One Ticket | $88 | $190 |

| One Accident | $97 | $206 |

| One DUI | $105 | $173 |

Your driving record also plays a significant role in determining your Safeco car insurance rates. For a clean record, monthly rates range from $86 for minimum coverage to $163 for full coverage. Rates rise, in one case, by a single ticket, accident, or DUI, with full coverage running as high as $206 for an accident alone.

Step #4: Review and Customize Your Quote

Starting with Safeco involves an online quoting system that issues a rate based on the information you provide. Therefore, you will get a preliminary quote based on your information and the coverage options you choose. Change car insurance deductible amounts or coverage levels to understand how modifications affect your monthly premium costs. Find a policy that fits your budget and insurance needs.

Step #5: Save or Purchase Your Policy

Keep the last quote for future reference, or buy online if you want to proceed. You can also purchase Safeco insurance online for an easy experience. If you want questions answered or more guidance before making the policy purchase, contact a Safeco agent for help. Understanding your car insurance policy and reviewing all terms and conditions will help ensure your coverage fully meets your needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Secure Safeco Car Insurance Quotes Online

Knowing how to get Safeco car insurance quotes online simplifies finding the right policy. By visiting the Safeco website, you can enter your personal and vehicle details, surf your options regarding coverage, and even receive a personalized quote in a very short time- all within minutes.

The site will give you the actual price tailored just for you instead of using a fake estimation. The online system lets you quickly modify your coverage amounts and see how they affect your premium in real time. If you’re wondering what Safeco is, the site can provide detailed information to help you understand their offerings and how they can meet your needs.

This feature enables you to make wise choices and policies based on your requirements and budgets. Besides, Safeco’s online quoting system shows you what else is available and compares them with what you may be interested in, from basic liability coverage to complete coverage.

Safeco allows you to get reliable and cheap car insurance quickly. With a seamless and not-too-much-hassle experience, Safeco offers this effective process to drivers who want their importance to safety included in affordable and flexible coverage options.

Explore Safeco Auto Insurance Coverage Options for Every Need

Safeco offers multiple types of auto insurance coverage to meet a variety of needs, protecting drivers in many different scenarios. Liability protection will help pay for damage or injury you cause to others, and collision coverage helps pay for repairs to or replacement of your vehicle after an accident.

To begin, visit the Safeco site, and Safeco get a quote to start the process. Safeco auto insurance reviews often highlight their competitive pricing, and Safeco auto claims are generally handled efficiently. If you’re interested in additional coverage, Safeco rental car coverage ensures you’re not left without a vehicle in case of an accident.

For those researching the company, Safeco insurance reviews BBB offer insight into their overall customer service, while Safeco home insurance reviews can shed light on their offerings beyond auto insurance. For more detailed evaluations, Safeco auto insurance reviews, Consumer Reports, and Safeco insurance reviews on Reddit provide a range of opinions.

Comprehensive car insurance coverage goes beyond collisions, protecting against theft, vandalism, and weather-related damage. For added security, uninsured motorist coverage shields you from financial loss if you’re involved in an accident with an uninsured or underinsured driver.

Safeco Auto Insurance Coverage Options

| Coverage Name | What It Covers |

|---|---|

| Liability Coverage | Covers injuries & damage you cause |

| Collision Coverage | Pays for car damage from a crash |

| Comprehensive Coverage | Covers theft, fire, vandalism, disasters |

| Personal Injury Protection | Covers medical bills & lost wages |

| Medical Payments (MedPay) | Pays medical costs for you & passengers |

| Uninsured/Underinsured Motorist | Protects against uninsured drivers |

| Roadside Assistance | Towing, jump-starts, fuel, lockouts |

| Rental Car Reimbursement | Pays for rental after an accident |

| New Car Replacement | Replaces a totaled car with a new one |

| Diminishing Deductible | Lowers deductible over claim-free years |

| Custom Equipment Coverage | Covers aftermarket upgrades |

| Ride-Sharing Coverage | Covers Uber/Lyft drivers |

| Mexico Auto Insurance | Short-term coverage in Mexico |

Medical Payments (MedPay) covers medical expenses for you and your passengers after an accident, while roadside assistance provides towing and emergency services when needed. For assistance, you can contact the Safeco roadside assistance phone number. Safeco rental reimbursement car coverage ensures you’re not without transportation.

Does Safeco cover rental cars? Yes, it helps pay for a rental while your vehicle repairs after a covered accident. While your vehicle is undergoing repairs, gap coverage eliminates any depreciation loss, allowing you to cover the difference between the value of your car and the remaining balance of your loan. These flexible coverage options are just some of what Safeco offers to ensure you have all the coverage you want.

For those with a rather unique vehicle need, customers even explore Safeco classic car insurance reviews. So when it comes to Safeco affordability, plenty of people wonder, “Why is Safeco insurance so cheap?” For others, the answer is in their customizable plans and multitude of discounts.

Top Safeco Auto Insurance Discounts to Save on Premiums

Safeco offers discounts to customers to lessen the prices of auto premiums while providing full coverage. The most well-known offer is a multi-policy discount, which is bundled with auto insurance and homeowners’ or renters’ insurance policies.

A safe driver car insurance discount rewards those with a clean driving record, while a vehicle safety discount is available for cars equipped with anti-theft devices.

Drivers who maintain good grades can take advantage of a good student discount, and those who drive fewer miles annually may qualify for a low-mileage discount. Safeco offers a paid-in-full discount for insured customers who pay their upfront premiums and thus save more.

A good student discount can reduce premiums by up to 20% for students with a B average, rewarding responsible behavior. Always check with your provider for available discounts.

Brad Larson Licensed Insurance Agent

A new car discount is also available for drivers with newer vehicles as they are less likely to have an accident. Safeco insurance quotes offer a range of discounts to help you save on auto insurance while maintaining reliable coverage.

- Multi-Policy Discount: Save by bundling auto insurance with other Safeco policies like home or renters insurance.

- Safe Driver Discount: For drivers who have a clean driving record, recognizing safe driving habits.

- Good Student Discount: For young drivers on the honor roll, encouraging safe habits.

- Low-Mileage Discount: Earn a discount if you drive fewer miles annually, reflecting lower risk.

These can help Safeco customers reduce their premium while still obtaining the coverage they need.

Learn how to get Safeco car insurance quotes online, because Safeco is an excellent choice for drivers looking for affordable car insurance with no coverage compromises.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Getting Safeco Car Insurance Quotes Online

The three case studies show how Safeco competes with other car insurance companies for various categories of drivers with its rates and coverage options. By understanding how to get Safeco car insurance quotes online, they could find the plans that suit their needs.

- Case Study #1 – John’s Safeco Car Insurance Quote Comparison: A cautious driver from California, John checked out Safeco’s online auto insurance rates against other providers. He realized Safeco offered not only affordable premiums by providing coverage options that fit him but also became the best choice he had found for car insurance.

- Case Study #2 – Anne’s Experience with Safeco’s Local Agents: Anne from New York sought the services of a local independent agent, which she preferred. Anne teamed up with an agent who knew her stuff, and together, they went through the quoting process so the agent could help select the best coverage for her situation.

- Case Study #3 – Jason’s Savings with Safeco’s Discounts: Jason, a Texas driver on a budget, was trying to cut how much he paid in premiums for his car insurance. After an extensive survey of what all the providers offered, Safeco would soon prove valuable to his discounts.

Safeco’s flexibility in meeting individual customer needs and its ability to price aggressively have made it a clear choice for drivers looking for affordable, quality car insurance coverage.

Getting Safeco car insurance quotes online helps you compare coverage, premiums, and discounts. Adjusting your coverage or bundling policies can lower your premium, offering a more tailored and affordable option.

Chris Tepedino Feature Writer

Safeco offers a range of developing customized options to meet the unique needs of drivers. That makes it a great choice for those in search of a cost-affordable, but still reliable on-road shield.

Easy Steps to Get Safeco Car Insurance Quotes Online

Getting a Safeco car insurance quote online is a straightforward process that allows you to quickly receive a Safeco insurance quote online tailored to your needs. When you request a Safeco insurance auto quote, you’ll get a precise Safeco insurance estimate based on your driving history, coverage preferences, and more.

Spend the time to compare car insurance by coverage type to ensure you’re getting the best value for your policy. You’ll get personalized Safeco auto insurance quotes that suit your individual needs. It’s an easy process to compare coverage options, fine-tune policy features, and shop prices — all from your home.

Whether you’re a new or switching customer, getting Safeco car insurance quotes online is a quick and easy way to find the right coverage at the best price. This digital process saves time, reduces stress, and helps you make an informed decision.

See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

How accurate is a Safeco online quote compared to the final policy?

A Safeco online quote provides a preliminary estimate based on your input information. While this quote is generally accurate, the final policy premium may vary depending on further details, such as the results of a background check or any additional discounts or adjustments applied by Safeco. Always review your final policy to confirm the premium before purchasing.

Can I receive a Safeco auto quote without speaking to an agent?

You can receive a Safeco auto quote online without speaking to an agent. On Safeco’s website, enter your personal information and vehicle details and select your coverage options. The online tool will generate a customized quote based on your provided information, allowing you to make adjustments and finalize the quote at your convenience.

Ready to find affordable car insurance? Use our free comparison tool to get started.

Can I use a Safeco online quote tool to customize my coverage?

Safeco’s online quote tool lets you customize your coverage by adjusting deductibles, liability limits, and optional coverages. After entering your details, you can see how changes affect your car insurance premium, helping you tailor the policy to your needs.

How do I compare an Erie vs Safeco quote?

To compare an Erie vs Safeco quote, request quotes from both providers using the exact vehicle and personal details. Then, review the coverage options, premiums, deductibles, and discounts to determine which policy best fits your needs.

How does Geico stack up against Safeco in terms of car insurance?

Geico and Safeco offer affordable rates, but Geico often shines with its digital experience and extensive discount options, while Safeco provides more personalized customer service and additional coverage options.

What car insurance discounts does Safeco offer?

Safeco offers discounts like multi-policy, safe driver, low mileage, good student, and vehicle safety feature discounts. Be sure to explore these, including the best low-mileage car insurance discount, when getting a quote to maximize your savings.

How do I access my Safeco insurance card online?

To access your Safeco insurance card online, log in to your Safeco account through their website or mobile app. Once logged in, navigate to the “Documents” section to view, download, or print your insurance card. This convenient feature ensures you have your insurance information on hand when needed.

How can I save money with Safeco’s safe driving rewards?

Safeco has a program called telematics with safe driving rewards, which tracks your driving and then gives you better premiums based on safe driving and good habits.

How does Safeco compare to Infinity for car insurance?

Infinity and Safeco offer competitive coverage, with Safeco known for its discounts and Infinity catering more to high-risk drivers. Compare rates to find the best car insurance for high-risk drivers and determine which option suits your needs.

How does AAA compare to Safeco for car insurance?

AAA and Safeco offer excellent customer service, but AAA may be a better fit for members seeking roadside assistance and discounts on other services. In contrast, Safeco offers a broader variety of auto insurance discounts.

Does Safeco offer roadside assistance?

Yes, Safeco does offer a roadside assistance add-on. These include towing, battery jump-starts, flat tire changes, and more, in case of emergencies.

How do I file a claim with Safeco Insurance?

To file a claim with Safeco, visit their website or call 1-800-332-3226. Provide accident details, photos, and a police report if needed. You can also use their mobile app for easy submission and tracking. Understanding car accidents and reporting quickly helps expedite the process.

What should I do if I have issues accessing my Safeco account for bill payments?

If you are having trouble logging into your Safeco account for billing, input the correct login information on their bill payment page. You can still log in to your account with your existing information, but if that doesn’t work or you get locked out, you can reset your password or contact Safeco customer service directly at 1-800-332-3226.

What is Safeco Insurance’s official name?

Safeco Insurance is officially a subsidiary of Liberty Mutual Insurance. As a part of Liberty Mutual, Safeco offers customers a wide range of auto, home, and business insurance products across the United States.

How does Safeco’s accident forgiveness program work?

Safeco’s accident forgiveness program helps drivers avoid premium increases after their first at-fault accident if they meet eligibility criteria, like a claims-free record. Compare accident forgiveness car insurance to see how this feature can provide peace of mind without drastically raising your rates.

How can I log in to Safeco Insurance’s bill pay portal?

To pay your bill online, go to the Safeco website and select the Login option. Enter your login ID and password. If you do not have an account, tap or click “Create Account.” After logging in, you will be able to view your bill, make payments, and manage preferences for your account safely.

How can I contact Safeco insurance for support or claims?

To contact Safeco Insurance, call their customer service or claims support line using their website’s Safeco insurance phone number. Have your policy details ready for a smoother process. You can also use their 24/7 claims reporting system online or via their mobile app for urgent issues.

Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.