Best Car Insurance for Delivery Drivers in 2025 (Top 10 Companies)

Explore the best car insurance for delivery drivers with the top providers, including Progressive, State Farm, and Allstate, offering rates as low as $42/month for minimum coverage. These are the best choices for affordable and reliable protection on the road, ensuring you drive with confidence.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Delivery Driver

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews 17,760 reviews

17,760 reviewsCompany Facts

Full Coverage for Delivery Driver

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 11,413 reviews

11,413 reviewsCompany Facts

Full Coverage for Delivery Driver

A.M. Best Rating

Complaint Level

Pros & Cons

11,413 reviews

11,413 reviewsThe the best car insurance for delivery drivers from Progressive, State Farm, and Allstate starts at $42/month with discounts up to 25%. Progressive stands out as the top pick, providing tailored coverage for delivery drivers.

- Delivery Driver Car Insurance

- Best Food Truck Insurance in 2025 (Top 10 Companies)

- Cheap Walmart Delivery Car Insurance in 2025 (Top 10 Companies for Savings!)

- Best Car Insurance for Instacart Drivers in 2025 (Your Guide to the Top 10 Companies)

- Best Amazon Flex Delivery Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Cheap Pizza Hut Delivery Car Insurance in 2025 (10 Affordable Companies)

- Best Shipt Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Car Insurance for Uber Eats Drivers in 2025 (Find the Top 10 Companies Here!)

- Best Domino’s Delivery Insurance in 2025 (Top 10 Companies)

- Who is Flo from the progressive commercials?

Our Top 10 Best Companies: Best Car Insurance for Delivery Drivers

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 5% | Online Convenience | Progressive | |

| #2 | 17% | 30% | Many Discounts | State Farm | |

| #3 | 10% | 22% | Add-on Coverages | Allstate | |

| #4 | 25% | 10% | Customizable Polices | Liberty Mutual |

| #5 | 10% | 5% | Local Agents | Farmers | |

| #6 | 20% | 8% | Usage Discount | Nationwide |

| #7 | 13% | 7% | Accident Forgiveness | Travelers | |

| #8 | 29% | 12% | Student Savings | American Family | |

| #9 | 25% | 10% | Military Savings | USAA | |

| #10 | 25% | 10% | 24/7 Support | Erie |

Compare rates, discounts, and requirements to ensure you get the best coverage for your delivery endeavors. For those who find themselves in need of UberEats insurance or DoorDash car insurance, you’re probably wondering what companies provide the best car insurance, as well as what coverage you’ll need. Read on to learn more.

Find cheap car insurance quotes by entering your ZIP code above.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: In the Progressive car insurance review, it’s clear their online platform simplifies policy management and claims processing.

- Multi-Policy Discount: With a maximum discount of up to 12%, combining multiple policies can lead to significant savings.

- Low-Mileage Discount: Progressive provides up to 5% off for delivery drivers with low mileage, reducing costs for those with limited driving needs.

Cons

- Limited Add-ons: While Progressive excels in online services, the range of add-on coverages may be more limited compared to other providers.

- Regional Availability: Some specialized coverages and discounts may vary based on location, limiting options for drivers in certain regions.

#2 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm car insurance review highlights its wide array of discount options, providing drivers with flexibility to optimize savings.

- High Multi-Policy Discount: With a maximum discount of up to 17%, bundling policies with State Farm can result in substantial overall savings.

- Low-Mileage Savings: State Farm provides up to 30% off for delivery drivers with low mileage, catering to those who use their vehicles sparingly.

Cons

- Potentially Higher Base Rates: While discounts are substantial, State Farm’s base rates may be slightly higher compared to some competitors.

- Limited Online Options: State Farm’s online interface may not be as robust as other companies, potentially impacting user experience for those who prefer online management.

#3 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate excels in offering a variety of add-on coverages, allowing drivers to customize policies according to their specific needs.

- Competitive Multi-Policy Discount: With a maximum discount of up to 10%, Allstate encourages bundling policies for overall savings.

- Comprehensive Low-Mileage Discount: Allstate’s low-mileage discount of up to 22% is advantageous for delivery drivers with minimal mileage requirements.

Cons

- Higher Base Rates: In an Allstate car insurance review, base rates may be higher, affecting affordability for some drivers.

- Limited Local Presence: While Allstate provides national coverage, its local agent presence may be less extensive in certain areas.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Tailored Coverage

Pros

- Customizable Policies: The Liberty Mutual car insurance review reveals its policy flexibility, allowing delivery drivers to customize coverage.

- High Multi-Policy Discount: With a maximum discount of up to 25%, Liberty Mutual incentivizes combining multiple policies for increased savings.

- Diverse Coverage Options: Liberty Mutual provides a wide range of coverage options, ensuring drivers can build a policy that suits their unique requirements.

Cons

- Potentially Higher Premiums: While discounts are substantial, Liberty Mutual’s base premiums may be higher, affecting overall affordability for some drivers.

- Limited Local Presence: Liberty Mutual’s local agent network may not be as extensive, potentially impacting the accessibility of in-person assistance for some customers.

#5 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers emphasizes local agents, providing a personalized touch for delivery drivers who prefer face-to-face interactions.

- Multi-Policy Discount: In a Farmers car insurance review, bundling policies can yield savings, with discounts up to 10%.

- Nationwide Coverage: While focusing on local agents, Farmers also offers national coverage, providing accessibility for drivers across different regions.

Cons

- Limited Low-Mileage Discount: Farmers’ low-mileage discount is relatively modest, offering up to 5%, which may be less appealing for drivers with minimal mileage requirements.

- Online Experience: Farmers’ online interface may not be as advanced as some competitors, potentially affecting the user experience for those who prefer online management.

#6 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide car insurance discounts offer up to 20% for delivery drivers based on their driving habits.

- Multi-Policy Savings: With a maximum discount of up to 20%, Nationwide encourages policy bundling for increased affordability.

- Comprehensive Coverage: Nationwide offers a variety of coverage options, ensuring drivers can build a policy that aligns with their specific needs.

Cons

- Limited Local Agent Presence: Nationwide’s local agent network may not be as extensive, impacting the accessibility of in-person assistance for some customers.

- Potentially Higher Base Rates: While discounts are available, Nationwide’s base rates may be slightly higher compared to some competitors, affecting overall affordability.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers provides up to 13% discount with accident forgiveness, benefitting drivers with occasional accidents without impacting rates.

- Multi-Policy Discount: With various discount options, Travelers encourages bundling policies, leading to potential overall savings.

- National Presence: Travelers has a wide national presence, ensuring accessibility for drivers across different regions.

Cons

- Limited Usage Discount: In a Travelers car insurance review, their discount for usage-based policies is relatively modest compared to competitors.

- Online Experience: Travelers’ online platform may not be as advanced, impacting the user experience for those who prefer online management.

#8 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers substantial savings for students, with a maximum discount of up to 29%, making it an attractive option for student delivery drivers.

- Multi-Policy Discount: Bundling policies with American Family can result in significant savings, providing drivers with an opportunity for comprehensive coverage at a lower cost.

- Local Agents: In the American Family car insurance review, local agents provide personalized service for delivery drivers.

Cons

- Limited National Presence: While American Family focuses on local agents, its national presence may be less extensive compared to some competitors.

- Potential Higher Premiums: American Family’s base rates may be higher, impacting overall affordability for some drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#9 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers significant discounts for military personnel, with up to 25% savings, making it a highly attractive option for service members engaged in delivery driving.

- Multi-Policy Discount: Bundling policies with USAA can lead to substantial overall savings, providing comprehensive coverage at an affordable cost.

- Excellent Customer Support: USAA is known for its outstanding customer service, ensuring delivery drivers have reliable support when needed.

Cons

- Limited Eligibility: The accessibility of USAA car insurance review is limited to military personnel and their families, excluding the general public.

- Limited Local Presence: While USAA provides nationwide coverage, its local agent network may be less extensive, potentially affecting in-person assistance.

#10 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie car insurance review highlights its 24/7 customer support, aiding delivery drivers whenever needed.

- Multi-Policy Discount: Bundling policies with Erie can lead to significant overall savings, ensuring drivers have comprehensive coverage at an affordable cost.

- National Coverage: Erie offers nationwide coverage, providing accessibility for delivery drivers across different regions.

Cons

- Limited Online Experience: Erie’s online interface may not be as advanced, potentially impacting the user experience for those who prefer online management.

- Modest Usage Discount: Erie’s discount for usage-based policies is relatively modest compared to some competitors.

Analysis of Coverage Rates for Delivery Drivers

Average Monthly Car Insurance Rates for Delivery Driver

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Progressive | $42 | $111 |

| State Farm | $45 | $120 |

| Allstate | $58 | $156 |

| Liberty Mutual | $75 | $200 |

| Farmers | $60 | $158 |

| Nationwide | $37 | $98 |

| Travelers | $88 | $228 |

| American Family | $47 | $126 |

| USAA | $73 | $193 |

| Erie | $52 | $138 |

For full coverage, Nationwide maintains a competitive rate of $98, contrasting with Liberty Mutual’s highest cost of $200. These rates showcase the varying affordability and value among insurance providers catering to delivery drivers. For additional details, explore our comparison of rates, discounts, and requirements for Domino’s Pizza car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Discover the Best Insurance for Delivery Drivers

In the dynamic realm of delivery driving, having the right insurance coverage is a non-negotiable aspect of ensuring a secure and successful venture. Our top 10 picks for delivery driver car insurance in 2024 are curated to address the specific needs of drivers engaged in services like UberEats, DoorDash, and others.

From Progressive’s online convenience to State Farm’s diverse discounts and Allstate’s expertise in add-on coverages, these recommendations are backed by a thorough analysis of factors influencing rates and coverage options. For further details, explore our Walmart Delivery Car Insurance guide, which covers rate comparisons, discounts, and requirements.

Progressive stands out as the top choice for delivery driver car insurance, offering seamless online convenience and tailored rideshare policies that complement personal coverage for comprehensive protection during active delivery services.

Dani Best Licensed Insurance Producer

In the competitive landscape of insurance providers, Progressive stands out as an online convenience leader. With tailored rideshare insurance policies, they seamlessly complement personal auto coverage, offering protection during active delivery services. State Farm, recognized as a diverse discounts dynamo, extends a broad array of discounts to delivery drivers, ensuring personalized coverage options across their extensive network.

Allstate, an expert in add-on coverages, provides the flexibility needed for drivers using their vehicles for both personal and business purposes. For an in-depth exploration of coverage rates and insights, our comprehensive table compares quotes from these industry-leading companies. Your journey to reliable delivery driver car insurance starts with these top picks.

The Best Overall Car Insurance for Delivery Drivers

USAA was recently ranked as the best overall by J.D. Power, particularly for its availability in all states as well as its excellent customer service. The downside is that it’s only available to retired and active-duty military personnel and their spouses and children.

When it comes to availability and flexibility, Allstate is also a strong overall choice. The option of add-ons to your personal auto insurance policy may help you avoid having to purchase a different policy if you have a commercial vehicle for private use.

The Best Car Insurance for Delivery Drivers with Small Businesses

Erie allows small business owners to add a business usage option to their personal auto insurance, something not all companies offer. These add-ons are perfect for small business owners and free-lance delivery drivers since they won’t need two policies for a vehicle that is used for both personal and business activities.

The downside is that its policies are not available in all states and its online footprint is pretty small.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Best Car Insurance for Food Delivery Drivers

Progressive’s rideshare insurance policies make it an excellent choice for food delivery drivers and other rideshare drivers, such as Uber or Lyft. For further details, check out our comparison of rates, discounts, and requirements for Uber Eats Car Insurance.

Its policies are purchased in addition to your personal auto insurance and cover you while you are in “app on” mode. The only downside is that the rideshare policies aren’t as widely available as other Progressive products. As of 2022, the service is only offered in 34 states.

Delivery Drivers Might Require Various Types of Coverage

It’s important to find out what coverage is required by law for delivery drivers in your state and industry.

For example, in some states, like Michigan, delivery drivers who use a personal vehicle need two policies, a no-fault personal auto insurance policy and a commercial policy. Therefore, depending on the state, your options for proper coverage might be:

- Two policies, encompassing both personal and commercial coverage

- Personal auto insurance with one or more add-ons for commercial use

- Personal auto insurance with a rideshare policy

Learn more about commercial car insurance companies. Be sure to talk with your agent or broker to make sure you are properly covered in case of an accident.

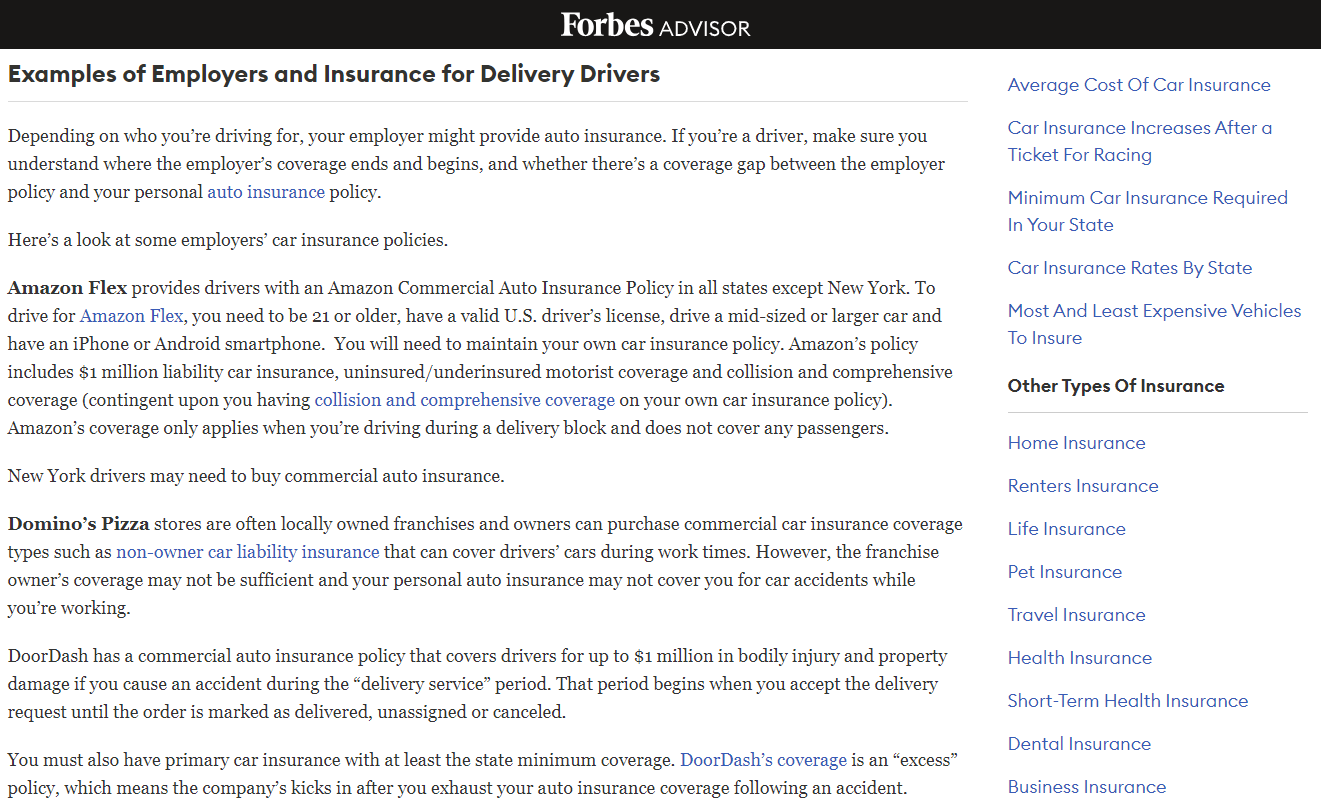

The Company You Drive for Provides Insurance

Some delivery platforms or companies provide drivers with insurance as part of the sign-on package. Some examples are:

- Amazon Flex: Amazon provides its freelance drivers with insurance in every state except New York. Amazon Flex car insurance coverage is dependent on you having your own auto insurance policy already. It only covers you when you’re delivering, and the coverage does not include passengers.

- DoorDash: While they are out delivering, DoorDash auto insurance covers its drivers with a commercial policy. However, Doordash liability insurance and other coverage only kicks in once the driver’s personal insurance is exhausted.

- UberEats: Company car insurance for UberEats drivers is similar to the car insurance for Doordash drivers, but the benefits are a little more extensive. For example, some drivers may qualify for collision and comprehensive coverage, and others may even qualify for coverage between deliveries.

Other companies require drivers to purchase their own insurance and maintain legal compliance:

- GrubHub: Drivers for GrubHub are required to purchase their own insurance, including any commercial coverage required by law.

- InstaCart: Drivers for InstaCart sign an agreement saying they are responsible for insuring their own vehicle. (For more information, read our “Instacart Car Insurance: Compare Rates, Discounts, & Requirements“).

Whether the company you drive for offers insurance or not, you are responsible to make sure your coverage is adequate and compliant. So do your research and read the fine print carefully so that you don’t end up paying damages out of pocket.

Keep in mind that the food industry may require other types of insurance as well, so get familiar with local and state laws.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Delivering Solutions: Real-Life Case Studies in Driver Insurance Success

Delve into a series of compelling case studies illuminating the journey of delivery drivers as they navigate the complex landscape of insurance. Discover firsthand accounts of challenges overcome, solutions found, and the vital role insurance plays in safeguarding their livelihoods.

- Case Study #1 – Optimizing Savings:Sarah, a seasoned delivery driver, found the perfect solution with Progressive’s rideshare insurance policies. Tailored coverage seamlessly complemented her personal auto insurance, optimizing savings and providing necessary protection during active delivery hours, resulting in significant cost reduction.

- Case Study #2 – Customized Coverage: Part-time delivery driver John found an ideal match in State Farm, which offered diverse discounts and personalized coverage options. He tailored his policy to fit his needs, saving on premiums while aligning with his part-time delivery commitments.

- Case Study #3 – Flexibility and Add-Ons:Lisa, a delivery driver using her vehicle for both personal and business purposes, found Allstate’s expertise in add-on coverages and policy customization ideal. Allstate’s flexible options provided peace of mind by covering both personal and business use, showcasing the importance of flexibility for drivers.

Join us as we explore these real-world narratives, offering invaluable lessons for drivers seeking optimal coverage and protection. For further details, explore our information on whether car insurance provides coverage for food delivery vehicles.

Final Thoughts on Car Insurance for Delivery Drivers

Finding the best car insurance for delivery drivers is part of making sure your business is protected and is operating in compliance with local and state laws. You’ll need to shop around and see whether you need two policies or just purchase the applicable add-ons.

And even if the company you drive for offers insurance coverage, you are still ultimately responsible for making sure your coverage is adequate and legally compliant. For further details, explore how your personal auto insurance extends coverage to your vehicle used for food delivery.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

Do I need specific car insurance as a delivery driver?

Yes, as a delivery driver, you typically need a commercial auto insurance policy rather than a personal auto insurance policy. Commercial auto insurance provides coverage specifically tailored for business use, including delivery services. It is important to have the appropriate coverage to protect yourself, your vehicle, and the goods you are delivering.

What types of coverage are typically included in commercial auto insurance for delivery drivers?

Commercial auto insurance for delivery drivers typically includes liability coverage, which covers damages and injuries to others if you are at fault in an accident. It may also include comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and coverage for cargo or goods being transported. The specific coverage options and limits can vary depending on the insurance provider and policy.

For more details, explore our Pizza Hut Car Insurance: Compare Rates, Discounts, & Requirements.

Are there any discounts available for delivery drivers’ car insurance?

Some insurance companies offer discounts specifically for delivery drivers. These discounts may include safe driving discounts, discounts for completing driver training courses, multi-policy discounts if you have other insurance policies with the same provider, or discounts for vehicles equipped with safety features. It’s important to inquire with insurance providers about available discounts that may apply to your situation.

What are the requirements for obtaining car insurance as a delivery driver?

Requirements for obtaining car insurance as a delivery driver may vary among insurance providers. However, common requirements include:

- Possession of a valid driver’s license.

- Compliance with any age restrictions or experience requirements set by the insurance company.

- Providing accurate information about your vehicle, driving history, and delivery business details.

- Meeting any specific underwriting guidelines and criteria set by the insurance provider.

Can I use my personal car insurance for delivery purposes?

In most cases, personal car insurance policies do not cover delivery activities. Using your personal vehicle for delivery without proper coverage may result in denied claims and policy cancellation. It’s important to inform your insurance provider about your delivery activities and obtain the appropriate commercial auto insurance coverage to ensure you are adequately protected while working as a delivery driver.

What factors should I consider when choosing the best auto insurance for delivery drivers?

When choosing car insurance for delivery drivers, take into account aspects like coverage choices, expenses, available discounts, reputation of customer service, and any particular demands from your delivery platform or employer.

What are the key features of the best car insurance for DoorDash drivers?

The optimal insurance for DoorDash drivers should provide extensive coverage encompassing liability protection, vehicle coverage, goods in transit coverage, and any additional coverage mandated by your delivery platform.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What are some important considerations when comparing options for the best delivery driver insurance?

When assessing choices for car insurance for deliveries, take into account elements like coverage caps, deductible amounts, exclusions, supplementary add-ons or enhancements, and the convenience of submitting claims and obtaining assistance from customer service.

Does the best insurance for food delivery drivers offer coverage for accidents while on the job?

Indeed, the optimal food insurance for delivery drivers should offer coverage for incidents happening during the course of delivery duties. This coverage usually encompasses liability protection, collision coverage, and medical expense coverage

Does Allstate cover DoorDash?

Allstate provides commercial car insurance policies explicitly tailored for delivery drivers. It’s crucial to consult with an Allstate agent to fully understand the specific coverage options available for commercial auto insurance for delivery drivers, including those in food delivery services like DoorDash.

Does State Farm cover food delivery drivers?

Yes, State Farm offers commercial auto insurance policies that may cover food delivery drivers. These policies are designed to provide coverage for business use of vehicles, including food delivery services. It’s advisable to discuss your specific needs with a State Farm agent to ensure you have adequate coverage for your delivery driver insurance policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.