Best Driver’s Education Car Insurance Discounts in 2025 [Save up to 15% With These Companies]

State Farm, Progressive, and AAA offer the best driver’s education car insurance discounts, helping drivers save up to 15% on premiums. These top providers reward teens and new drivers who complete an accredited program, approved course, or certified education, promoting safe driving with lower rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best driver’s education car insurance discounts are offered by top providers like State Farm, Progressive, and AAA, which reward safe driving with premium savings.

These companies provide discounts up to 25% for drivers completing an accredited program, approved course, or certified education.

Our Top 10 Company Picks: Best Driver's Education Car Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 15% | B | Drivers who complete an approved course | |

| #2 | 10% | A | Drivers who finish an accredited program | |

| #3 | 10% | A+ | New drivers with a certified education |

| #4 | 10% | A+ | Drivers under 25 with an approved course | |

| #5 | 7% | A | Young drivers who complete driver's ed |

| #6 | 7% | A+ | Teens who finish a recognized course | |

| #7 | 5% | A++ | New drivers with proof of course completion | |

| #8 | 5% | A | Drivers under 21 completing driver's ed | |

| #9 | 5% | A++ | Drivers with an accredited education | |

| #10 | 5% | A+ | New drivers completing an approved program |

Save more on full coverage for teen drivers while gaining valuable driving experience. Compare these providers to find the best full coverage car insurance and maximize savings.

Don’t let high insurance rates limit your options. Enter your ZIP code above to compare affordable premiums from leading providers, and start saving today.

- Find the best driver’s education car insurance discounts for teens and new drivers

- Save up to 25% by completing an accredited program or certified course

- State Farm offers top rates for safe drivers with substantial discount options

Maximize Your Savings: Top Driver’s Ed Discounts for Lower Car Insurance Premiums

Explore the best driver’s education car insurance discounts that can reduce your monthly full coverage rates. Below, we compare top providers, showcasing how much you could save on premiums by completing an approved driver’s ed course.

Best Driver's Education Car Insurance Monthly Full Coverage Rates With Discount

| Insurance Company | Monthly Rate |

|---|---|

| $120 | |

| $150 | |

| $155 | |

| $160 |

| $165 |

| $168 | |

| $170 | |

| $175 |

| $180 | |

| $185 |

Finding an affordable policy with a driver’s education discount requires knowing what company gives the best rates. Shop around and compare teen driver car insurance rates to snag the most affordable monthly car insurance payment, offsetting some of the daily cost of insuring the new driver in your home.

These discounts can save you cold, hard cash while incentivizing good driving practices, so take a moment to compare how much you could receive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Securing Driver’s Ed Discounts for Affordable Teen Car Insurance

Regarding safety and saving money on car insurance, driver’s ed may be just the ticket. Thankfully, insurance companies are known to provide terrific discounts for taking an approved driver’s ed course, which can significantly lower monthly premiums — especially for teens and new drivers. Keep reading for some tips on making the most of these discounts.

- Contact Your Insurer: Many insurers offer driver’s ed discounts, so ask if yours does. In some cases, they even require driver’s ed for teen drivers to qualify for coverage.

- Explore School-Based Options: High schools across the U.S. often provide driver’s ed for students 15 and up. While there might be a small fee due to budget cuts, it’s usually cheaper than private lessons.>

- Consider Online Driver’s Ed Programs: Options like Florida Virtual School (FLVS) offer affordable online driver’s ed courses, which are especially helpful for teen drivers needing point reductions on their licenses.

- Compare Rates for Savings: But this varies from company to company, so comparing average car insurance rates could show a perfect driver’s ed discount and find lower premiums.

- Know the Rules in Your State: In some states, teens are required to take driver’s ed before receiving their license, and this is crucial because it promotes safer driving and helps lower insurance costs.

Utilizing driver’s ed discounts will not only save your wallet but also encourage safe driving for teens and new drivers.

Taking a little time to peruse with insurers, investigate course openings, and look for rates can help release real investment funds on premiums.

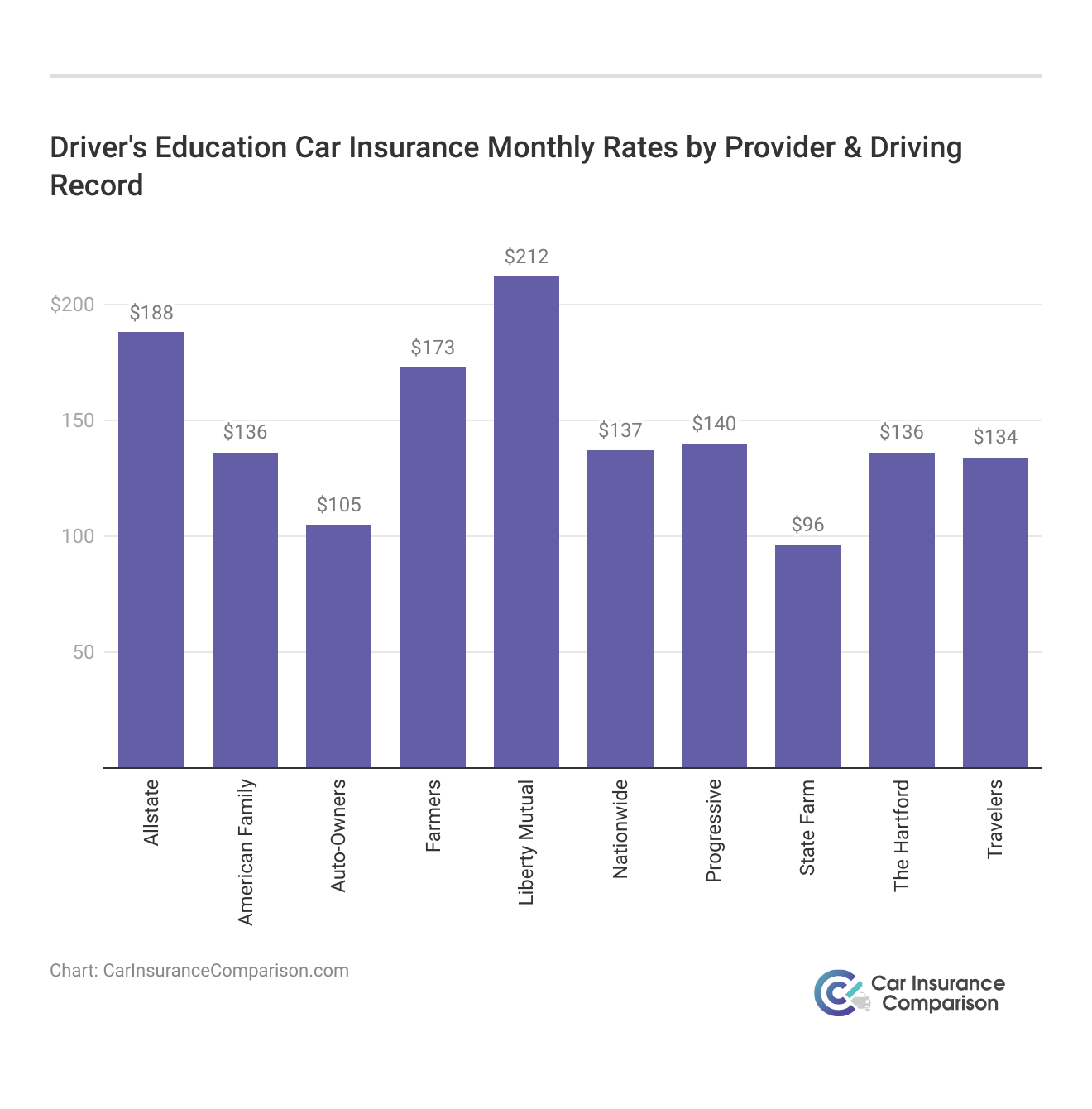

Driver’s Ed Savings: Monthly Car Insurance Rates by Provider and Driving Record

For anyone looking to save on monthly car insurance, driver’s ed discounts really help teens and new drivers who want to save. Take a look at these monthly rates by leading providers and see how much cash you can save with the best car insurance for new drivers over 21 using your own complimentary quote.

Looking at these rates side by side shows just how valuable driver’s ed can be for reducing your insurance premiums. With this info, you’re ready to find the best provider for your needs and start saving on monthly car insurance costs.

Save Big on Car Insurance With Driver’s Ed and Defensive Driving Discounts

If you’re looking to save on car insurance, taking a driver’s education course can save you money on car insurance. Not only does it make you a more confident driver, but many insurance companies, such as Progressive, offer a popular driver’s ed insurance discount specifically for those who complete these courses.

You may be wondering, how much does driver’s ed save you on insurance? You could save 5%-20% on your premium, depending on your insurer and location.

Or, in other words, these courses offer valuable car insurance education that has a way to make money and also relates to security too. For new or young drivers, an insurance discount for driver’s ed can make a big difference in premium costs. This discount on insurance for driver’s ed helps to offset the typically higher rates for younger drivers.

So, does driver’s ed help with insurance costs? Absolutely. Not only does taking an approved course demonstrate your commitment to safe driving, but it can also qualify you for safe driver car insurance discounts, saving you a substantial amount of money.

State Farm offers a valuable driver’s education discount, helping new drivers save on car insurance while learning essential safe driving skills.

Daniel Walker Licensed Insurance Agent

For those still wondering, does drivers ed reduce insurance or does driving school lower insurance—the answer is typically yes. Many insurers offer a driver education discount that’s applied upon course completion, making it easier for both young and experienced drivers to benefit from these cost-saving programs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Best Driver’s Ed Discounts for Affordable Teen Insurance

Finding the right car insurance may sometimes feel daunting, and getting the price you need for newcomers or teen drivers can be even more challenging. Is it cheaper to purchase car insurance online? Often, things will be much simpler—and more affordable—if you can promote safe driving through driver’s education and defensive driving discounts.

Many large carriers, such as State Farm, Progressive, and AAA Realty, offer discounts of up to 15% off or higher with the proper course. These savings are more than just monetary rewards—they invest in better driving practices that ultimately serve other road users.

To discover these opportunities, compare estimates from leading companies to see how far you can save. You can find dramatically lower rates for drivers willing to take the time and effort to learn from their mistakes with just a little research.

Ready to compare driver’s ed car insurance discount quotes? Enter your ZIP code now to buy car insurance with a driver’s ed discount.

Frequently Asked Questions

Which insurance company offers the most discounts for young drivers?

Insurance companies have many discounts available for young drivers, such as good student, safe driving, and driver’s education. If a provider uncommonly offers cheap coverage, allow it to be available — carriers like Geico and State Farm usually do have wide-ranging discount opportunities.

What qualifies as a good driver discount for students?

A good driver discount is typically awarded to students with clean driving records. Some insurers also offer it to students who complete driver’s education courses to promote safe driving habits. Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

What is the best car insurance for students enrolled in driver’s education?

Student discounts — including good-student and driver’s ed discounts — are often among the best car insurance for students. Thankfully, some providers, such as Nationwide and Allstate car insurance review, provide programs for student drivers.

How does the paid-in-full discount work for car insurance?

The second type is a paid-in-full discount as soon as one pays his whole insurance premium in advance. This option can lower the total insurance price tag and is especially useful for student budgets.

Which company provides the best car insurance coverage for young drivers?

Companies like Progressive and USAA are known for providing affordable and comprehensive insurance for young drivers, especially when they complete driver’s education and qualify for discounts.

Can you get a discount on car insurance with driver’s education?

Various insurers provide student discounts on the completion of driver courses. Students can save on Car Insurance Premium: What is it and how does it work? by demonstrating a foundational understanding of safe driving practices to receive these discounts.

Which insurance company is best for students looking to save?

Providers like Geico and Liberty Mutual often offer competitive rates and numerous discounts for students, including good student discounts and driver’s education completion discounts.

What is the cheapest car to insure as a learner driver?

Insurance on cars with lower repair costs and less expensive overall to insure, such as the Honda Civic or Toyota Corolla tend to be offered at cheaper rates for learner drivers.

What is considered a good discount percentage on car insurance?

Aside from the factors mentioned above, a reasonable discount percentage for students probably will fall between 10% and 25%, based on how much school grades affect car insurance rates, insurer discounts for good grades and safe driving, or after the driver’s education is completed.

What is the best-used car for a student driver?

Reliable and safe options like the Ford Fusion, Toyota Camry, and Honda Accord are ideal for students. These affordable, durable cars often come with lower insurance rates.

Who offers the cheapest car insurance for young drivers in California?

Geico, Progressive, and Mercury Insurance are known for offering competitive rates in California, especially for young drivers who complete driver’s education.

What defines a good cost driver in auto insurance?

In auto insurance, a good-cost driver describes things such as a clean driving record, driver’s education, and safety features, as well as car insurance discounts that help to reduce costs.

What are typical discount rates for students’ car insurance?

Discount rates vary by provider, but students can typically expect 5% to 20% savings for discounts like driver’s education, good student, and safe driver discounts.

What qualifies as an insurance discount for student drivers?

An insurance discount for student drivers may be based on academic performance, completion of driver’s education, or maintaining a clean driving record, helping to reduce premium costs. Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

What is the price paid for an insurance policy, and how can students reduce it?

The cost of insurance premiums, or the price of a policy, is determined by age, area of residence, and driving record. Does the age of a car make a difference on car insurance? This number can be reduced by taking driver’s education, good student discounts, and choosing vehicles that don’t go fast.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.