Best Dodge Grand Caravan Car Insurance in 2025 (Top 10 Companies Ranked)

Discover the best Dodge Grand Caravan car insurance options with State Farm, Allstate, and USAA leading the pack, starting as low as $47 a month. These providers offer top-notch coverage and competitive pricing for your Dodge Grand Caravan, ensuring you get the most value for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,760 reviews

17,760 reviewsCompany Facts

Full Coverage for Dodge Grand Caravan

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 11,413 reviews

11,413 reviewsCompany Facts

Full Coverage for Dodge Grand Caravan

A.M. Best Rating

Complaint Level

Pros & Cons

11,413 reviews

11,413 reviews 6,435 reviews

6,435 reviewsCompany Facts

Full Coverage for Dodge Grand Caravan

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviews

The best Dodge Grand Caravan car insurance are State Farm, Allstate, and USAA, known for their extensive coverage and high customer satisfaction.

These companies stand out in the market by offering tailored policies that meet the specific needs of Dodge Grand Caravan owners. With their competitive rates and a range of discounts, they provide excellent value while ensuring robust protection. Read more in our guide titled “Best Dodge Car Insurance Rates.”

Our Top 10 Company Picks: Best Dodge Grand Caravan Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Many Discounts State Farm

#2 10% A+ Add-on Coverages Allstate

#3 18% A++ Military Savings USAA

#4 12% A Online App AAA

#5 17% A++ Custom Plan Geico

#6 11% A Local Agents Farmers

#7 16% A++ Accident Forgiveness Travelers

#8 14% A+ Usage Discount Nationwide

#9 19% A Customizable Polices Liberty Mutual

#10 13% A+ Innovative Programs Progressive

Each insurer has been chosen for their reliability, customer service, and overall affordability.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Robust Accident Forgiveness: Dodge Grand Caravan drivers can benefit from State Farm’s accident forgiveness policies, which help keep rates stable after an accident.

- Teen Driver Discounts: State Farm provides discounts for families with Dodge Grand Caravans that have teen drivers demonstrating safe driving habits.

- Broad Coverage: State Farm provides a range of coverage options specifically designed to meet the diverse needs of Dodge Grand Caravan owners. See the reviews and rankings in our full article titled “State Farm Car Insurance Review.”

Cons

- Coverage Limitations: Certain specific coverages for Dodge Grand Caravan might either be unavailable or come at a higher cost with State Farm.

- Claim Response Times: Some Dodge Grand Caravan owners have experienced delays in claim settlements, which can be inconvenient for those requiring prompt resolutions.

#2 – Allstate: Best for Add-on Coverages

Pros

- Tailored Add-ons: Allstate offers specific add-on coverages that enhance the protection of Dodge Grand Caravans.

- Accident Forgiveness: Dodge Grand Caravan owners can benefit from Allstate’s accident forgiveness policy, preventing rate increases after the first at-fault accident.

- New Car Replacement: If a new Dodge Grand Caravan is totaled, Allstate car insurance review provides a new car replacement.

Cons

- Higher Base Premiums: Allstate’s base premiums for Dodge Grand Caravan may be higher due to the extensive add-on options.

- Discount Limitations: Some discounts may not be as competitive for Dodge Grand Caravan compared to other insurers.

#3 – USAA: Best for Military Savings

Pros

- Military Discounts: USAA offers substantial military discounts for Dodge Grand Caravan owners who are service members.

- Family Discount: Family members of military personnel get lower rates on Dodge Grand Caravan insurance with USAA. Check out insurance savings for military members and their families in our complete guide titled “USAA Car Insurance Discounts.”

- Loyalty Discounts: Long-term USAA members with Dodge Grand Caravans benefit from loyalty discounts.

Cons

- Eligibility Restrictions: USAA’s services, including Dodge Grand Caravan insurance, are only available to military members and their families.

- Limited Physical Presence: USAA has fewer physical branches, which might affect those who prefer in-person service for their Dodge Grand Caravan insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – AAA: Best for Online App

Pros

- Convenient Mobile App: AAA offers a comprehensive online app that makes managing Dodge Grand Caravan insurance policies easy.

- Roadside Assistance: Exceptional roadside assistance services are included with Dodge Grand Caravan insurance at no extra cost. Learn more about AAA roadside assistance in our guide titled “AAA Car Insurance Review.”

- Discount Opportunities: AAA provides various discounts for Dodge Grand Caravan owners, such as safe driver and good student discounts.

Cons

- Membership Required: Dodge Grand Caravan owners must purchase AAA membership to access insurance services.

- Variable Customer Service: Customer service quality can vary significantly by region for Dodge Grand Caravan insurance.

#5 – Geico: Best for Custom Plan

Pros

- Customizable Policies: Geico offers highly customizable insurance policies for Dodge Grand Caravan to meet diverse owner needs.

- Competitive Pricing: Geico car insurance discount is known for competitive pricing on Dodge Grand Caravan insurance, even with customized features.

- Multiple Discount Options: Offers a range of discounts including multi-vehicle and defensive driving for Dodge Grand Caravan owners.

Cons

- Generic Customer Service: Geico’s customer service may feel less personalized due to its large size, affecting Dodge Grand Caravan owners.

- Claims Processing Delays: Some customers report delays in claims processing for Dodge Grand Caravan insurance.

#6 – Farmers: Best for Local Agents

Pros

- Personalized Service: Farmers provides personalized service through local agents who understand the specifics of Dodge Grand Caravan insurance.

- Coverage Options: Farmers car insurance review offers a wide range of coverage options to tailor Dodge Grand Caravan insurance according to individual needs.

- New Car Pledge: Farmers will replace a totaled new Dodge Grand Caravan with the latest model year under certain conditions.

Cons

- Higher Rates: Farmers tends to have higher insurance rates for Dodge Grand Caravan compared to competitors.

- Inconsistent Experience: The experience can vary greatly depending on the local agent handling the Dodge Grand Caravan insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness policies that prevent premium hikes for Dodge Grand Caravan owners after a first accident.

- Wide Coverage Options: Offers an array of coverage options tailored to the unique requirements of Dodge Grand Caravan owners.

- Hybrid/Electric Vehicle Discount: Provides discounts for Dodge Grand Caravans that are eco-friendly, reflecting modern vehicle trends. Learn more by reading our review of Travelers car insurance.

Cons

- Premium Costs: Travelers’ premiums can be higher, particularly for Dodge Grand Caravan owners without prior coverage or with previous claims.

- Complex Policy Options: The variety of choices can be overwhelming and sometimes confusing for new Dodge Grand Caravan insurance buyers.

#8 – Nationwide: Best for Usage Discount

Pros

- SmartRide Program: Nationwide offers a usage-based discount program that benefits Dodge Grand Caravan owners who drive less.

- Gap Insurance: Provides gap insurance that covers the difference between what is owed and the value of a Dodge Grand Caravan if it’s totaled. You can learn more in our guide titled “Nationwide Car Insurance Discounts.”

- Vanishing Deductible: Dodge Grand Caravan owners can benefit from Nationwide’s vanishing deductible policy that reduces the deductible for each year of safe driving.

Cons

- Varied Customer Satisfaction: Customer satisfaction can vary widely with Nationwide, depending on the region and specific Dodge Grand Caravan insurance policies.

- Rate Fluctuations: Some customers have reported unexpected rate increases during policy renewals for their Dodge Grand Caravan.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Extensive Customization: Liberty Mutual allows extensive customization of Dodge Grand Caravan insurance policies to fit various needs and budgets.

- Accident Forgiveness: Similar to other top insurers, they offer accident forgiveness to avoid rate spikes after the first at-fault incident for Dodge Grand Caravan.

- Lifetime Repair Guarantee: Liberty mutual car insurance review offers a lifetime repair guarantee on all bodywork for Dodge Grand Caravans repaired through their approved network.

Cons

- Higher Pricing Tiers: Customizable options often result in higher base rates for Dodge Grand Caravan insurance.

- Inconsistent Claims Process: Some policyholders have noted variability in the claims process speed and effectiveness for their Dodge Grand Caravan.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Progressive: Best for Innovative Programs

Pros

- Name Your Price Tool: Progressive car insurance review offers a unique tool that allows Dodge Grand Caravan owners to tailor their insurance costs based on their budget.

- Loyalty Rewards: Offers loyalty rewards, including lower deductibles and accident forgiveness for long-term Dodge Grand Caravan owners.

- Snapshot Program: Their Snapshot program adjusts rates based on actual driving behavior, beneficial for safe Dodge Grand Caravan drivers.

Cons

- Customer Service Variability: Customer service experiences can vary significantly, which might impact Dodge Grand Caravan owners.

- Policy Pricing: While innovative, some of Progressive’s programs might lead to higher premiums for Dodge Grand Caravan owners compared to conventional policies.

Monthly Insurance Rates for Dodge Grand Caravan: Minimum vs Full Coverage

Choosing the right car insurance involves understanding how different coverage levels impact your monthly premiums. Here’s a detailed look at the monthly rates for both minimum and full coverage options across various insurers for the Dodge Grand Caravan.

Dodge Grand Caravan Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $47 $145

Allstate $68 $205

Farmers $70 $202

Geico $80 $230

Liberty Mutual $82 $253

Nationwide $102 $303

Progressive $68 $197

State Farm $57 $165

Travelers $74 $224

USAA $82 $250

The table below showcases a range of monthly insurance rates provided by ten different companies. For minimum coverage, rates start as low as $47 with AAA and go up to $102 with Nationwide. On the other hand, full coverage premiums are significantly higher, with the lowest being $145 with AAA and the highest reaching $303 with Nationwide.

This variation highlights the importance of comparing insurance options to find the best fit for your budget and coverage needs. For instance, State Farm offers a balanced option at $57 for minimum and $165 for full coverage, making it a cost-effective choice among the major providers. Additional details can be found in our guide titled “Best Full Coverage Car Insurance.”

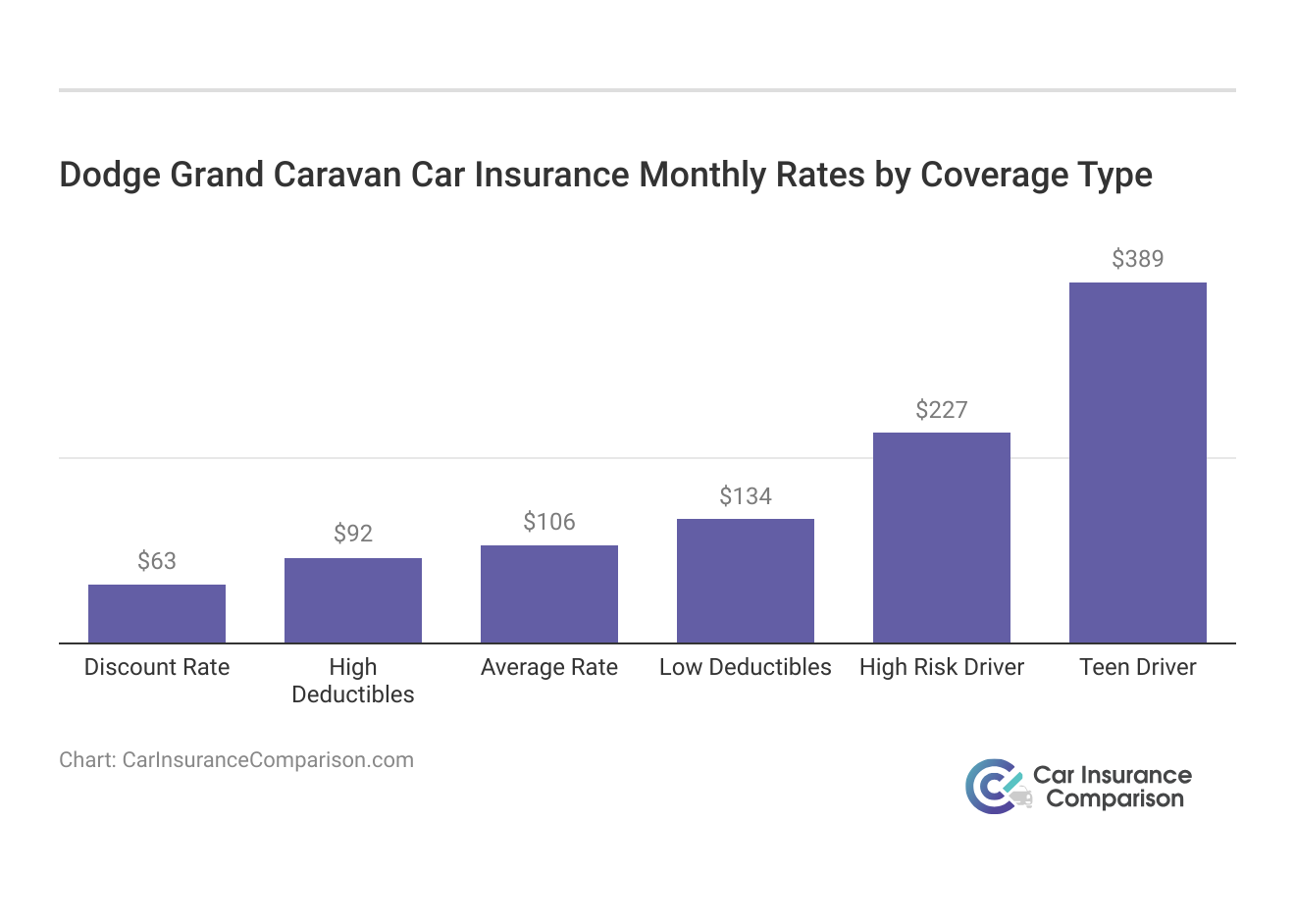

Dodge Grand Caravan Insurance Cost

The average monthly cost of car insurance for a Dodge Grand Caravan is typically around $106. This amount represents the regular monthly payment that owners are required to pay to maintain coverage.

In summary, the average cost for Dodge Grand Caravan car insurance is approximately $106 monthly. Insurance rates can vary significantly based on factors such as deductible levels and driver risk profiles, making it crucial for owners to carefully compare different policies to find the most affordable coverage. Discover insights in our article titled “What is High-Risk Car Insurance?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Dodge Grand Caravans Expensive to Insure

The chart below details how Dodge Grand Caravan insurance rates compare to other vans like the Toyota Sienna, Chrysler Pacifica, and Kia Sedona. Explore more add-on options in our article titled “Best Toyota Car Insurance Rates.”

Dodge Grand Caravan Car Insurance Monthly Rates vs. Other Vehicles

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

Dodge Grand Caravan $26 $37 $31 $106

Toyota Sienna $25 $44 $31 $113

Chrysler Pacifica $29 $44 $26 $111

Kia Sedona $24 $37 $28 $100

Honda Odyssey $23 $44 $31 $112

There are a few strategies you can use to find the cheapest Dodge insurance rates online. Consider these methods to lower your costs.

Read More: Compare Chrysler Car Insurance Rates

What Impacts the Cost of Dodge Grand Caravan Insurance

The cost of insuring a Dodge Grand Caravan is influenced by key factors such as vehicle age. Newer models typically incur higher insurance costs due to their greater value and more expensive repair needs. Similarly, the age and experience of the driver also play a crucial role; younger and less experienced drivers typically face higher rates due to a perceived higher risk of accidents.

Geographic location affects premiums as well; owners in urban areas with dense traffic and higher theft rates might see higher costs compared to those in rural settings. Additionally, a driver’s history is crucial—those with clean records usually enjoy lower premiums, whereas a history of accidents or violations can lead to increased costs.

The level of coverage chosen impacts the price too; full coverage with collision and comprehensive benefits is more expensive than basic liability car insurance. Lastly, rates can vary significantly between insurers, making it essential for Dodge Grand Caravan owners to shop around and compare offers to find the most cost-effective coverage.

Age of the Vehicle

The average Dodge Grand Caravan auto insurance rates are higher for newer models. For example, monthly auto insurance for a 2020 Dodge Grand Caravan costs approximately $106, while 2010 Dodge Grand Caravan insurance costs about $90, a difference of $16 per month.

Dodge Grand Caravan Car Insurance Monthly Rates by Model Year and Coverage Type

Model Year Comprehensive Collision Minimum Coverage Full Coverage

2024 Dodge Grand Caravan $28 $40 $30 $108

2023 Dodge Grand Caravan $27 $39 $31 $107

2022 Dodge Grand Caravan $27 $38 $31 $107

2021 Dodge Grand Caravan $26 $37 $31 $106

2020 Dodge Grand Caravan $26 $37 $31 $106

2019 Dodge Grand Caravan $25 $35 $33 $105

2018 Dodge Grand Caravan $24 $35 $33 $105

2017 Dodge Grand Caravan $23 $34 $35 $105

2016 Dodge Grand Caravan $22 $33 $36 $103

2015 Dodge Grand Caravan $21 $32 $37 $102

2014 Dodge Grand Caravan $20 $29 $38 $100

2013 Dodge Grand Caravan $19 $28 $38 $98

2012 Dodge Grand Caravan $18 $25 $38 $95

2011 Dodge Grand Caravan $17 $23 $38 $91

2010 Dodge Grand Caravan $17 $21 $39 $90

As evident from the data, the insurance costs for a Dodge Grand Caravan tend to decrease with the vehicle’s age, reflecting lower values and potentially lesser repair costs. Owners should consider the model year’s impact on car insurance premiums when choosing or renewing their auto insurance policy.

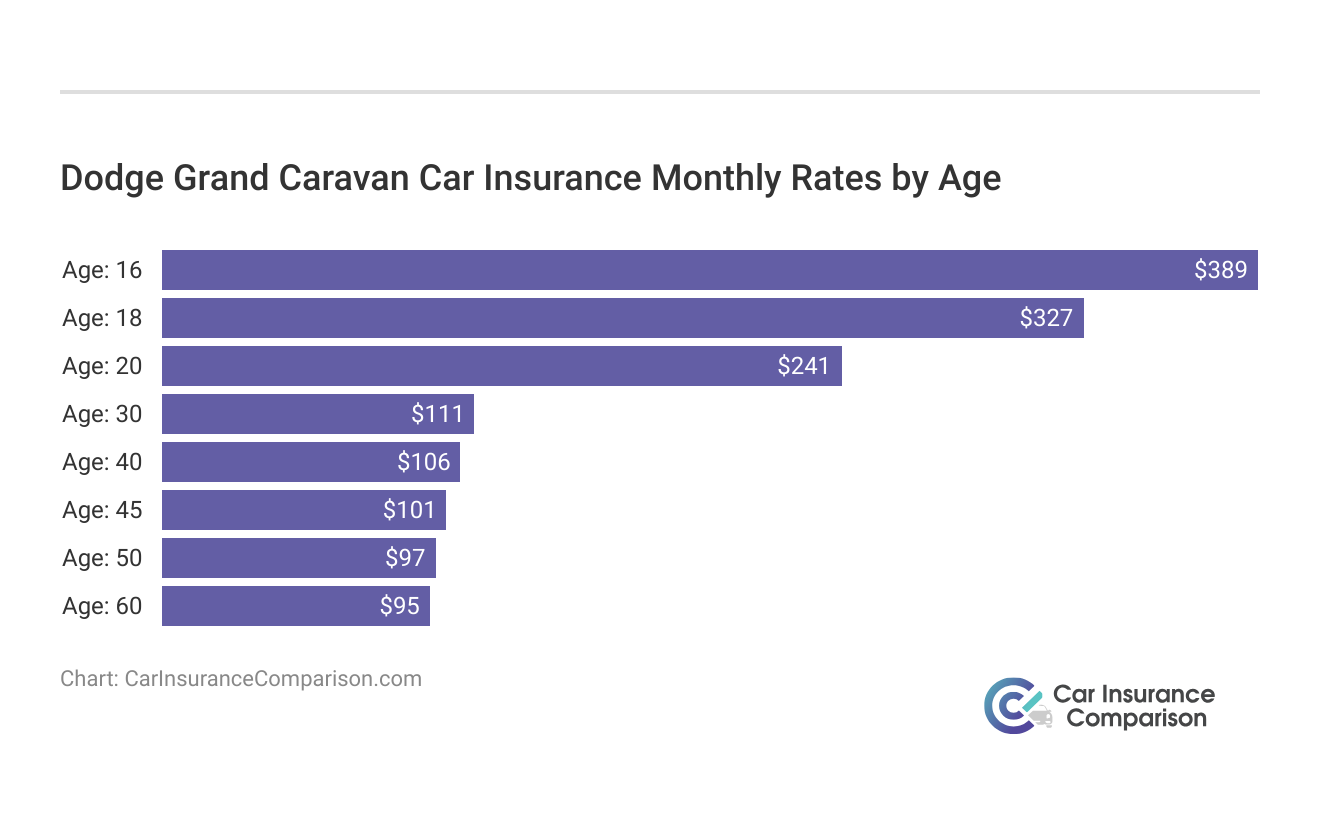

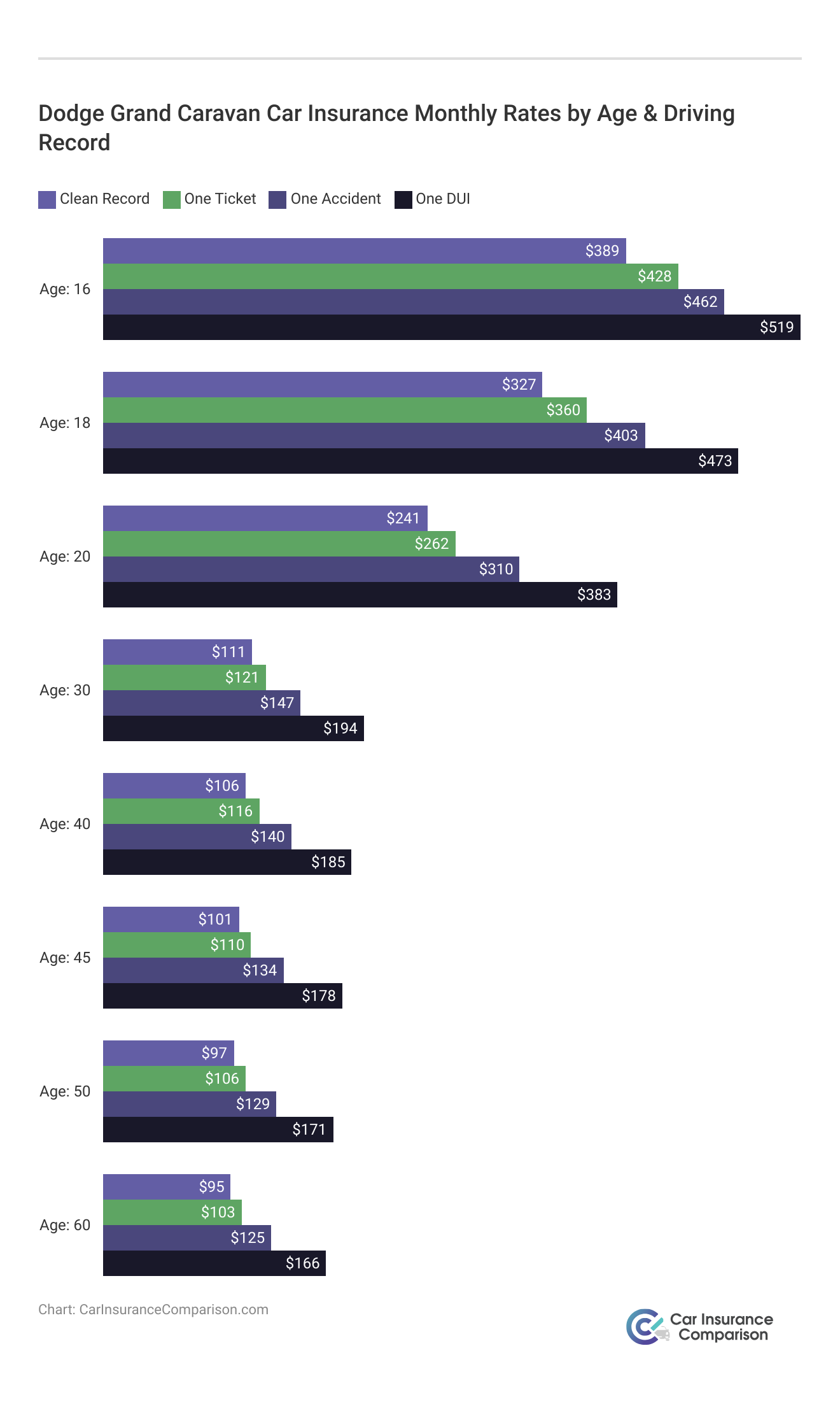

Driver Age

Driver age can have a significant effect on Dodge Grand Caravan car insurance rates. For example, 20-year-old drivers pay approximately $130 more for their Dodge Grand Caravan car insurance each month than 30-year-old drivers.

The age of the driver significantly impacts the insurance rates for a Dodge Grand Caravan, as demonstrated by the higher premiums younger drivers face. As drivers age and gain more experience, their insurance costs generally decrease, reflecting a lower risk profile to insurers.

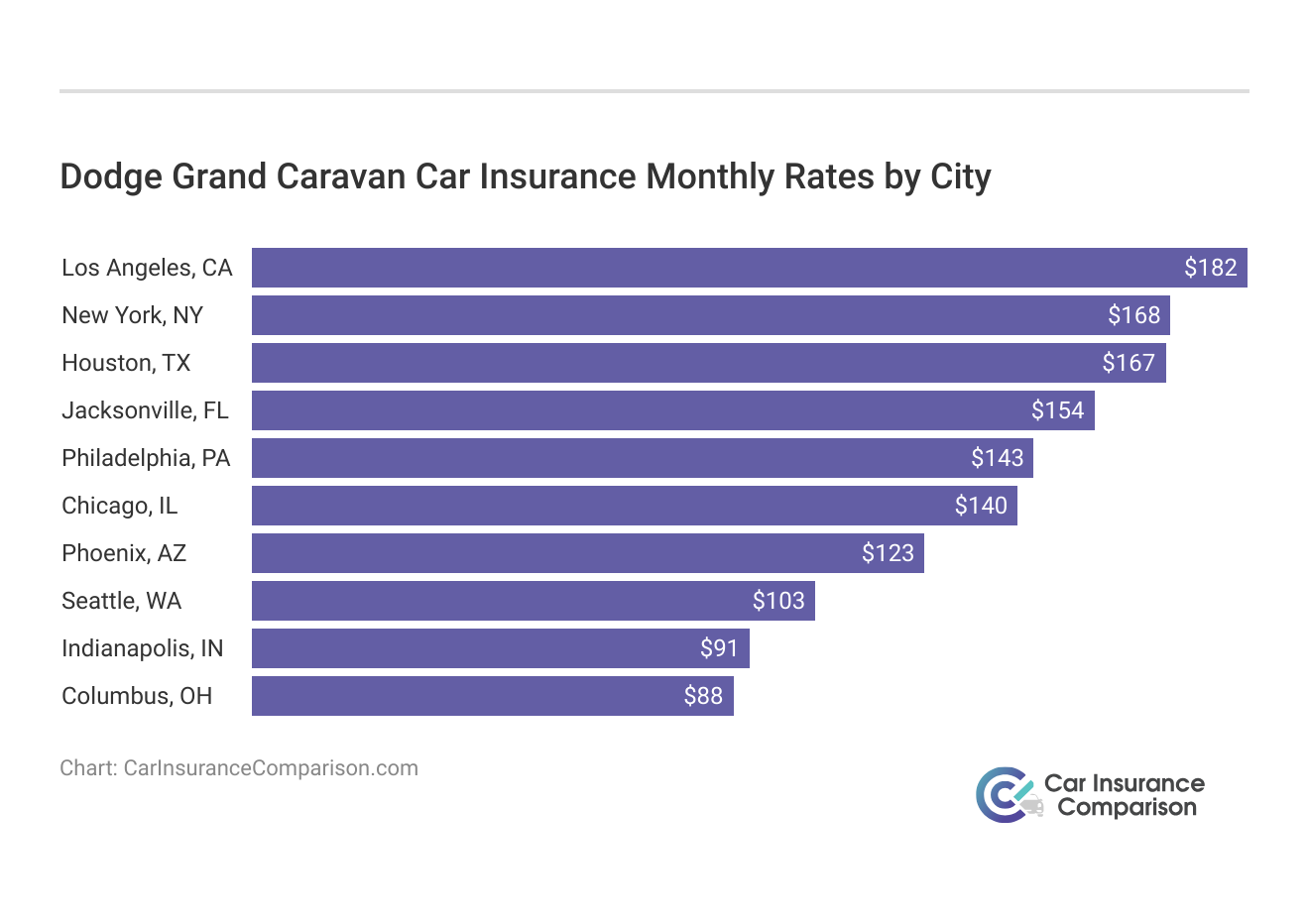

Driver Location

Where you live can have a large impact on Dodge Grand Caravan insurance rates. For example, drivers in Los Angeles may pay approximately $39 a month more than drivers in Philadelphia.

The location of a driver plays a pivotal role in determining the insurance rates for a Dodge Grand Caravan, with cities like Los Angeles and New York showing significantly higher costs than places like Philadelphia. This variability underscores the importance of considering geographical factors when budgeting for car insurance.

Your Driving Record

Your driving record can have an impact on the cost of Dodge Grand Caravan auto insurance. Teens and drivers in their 20’s see the highest jump in their Dodge Grand Caravan car insurance with violations on their driving record. Explore our analysis of the guide titled “Compare Teen Driver Car Insurance Rates.”

Your driving record significantly influences your Dodge Grand Caravan insurance costs, particularly for younger drivers in their teens and 20s, who may face steep rate increases with any violations. Maintaining a clean driving record is crucial as accidents and violations can dramatically escalate insurance expenses across all age groups.

Dodge Grand Caravan Safety Ratings

The safety ratings of your Dodge Grand Caravan directly influence your auto insurance rates. Consult the detailed breakdown below for further details.

Dodge Grand Caravan Safety Ratings

Test Rating

Small overlap front: driver-side Poor

Small overlap front: passenger-side Marginal

Moderate overlap front Good

Side Good

Roof strength Good

Head restraints and seats Good

The safety ratings of the Dodge Grand Caravan, ranging from poor to good across various tests, significantly impact its insurance rates. Understanding these ratings can help you anticipate the cost implications and ensure you’re adequately prepared for them.

Dodge Grand Caravan Crash Test Ratings

Poor crash test ratings for the Dodge Grand Caravan could lead to higher insurance rates for the vehicle. Insurers often adjust premiums based on safety assessments.

Dodge Grand Caravan Crash Test Ratings

Vehicle Tested Overall Frontal Side Rollover

2024 Dodge Grand Caravan MV FWD 4 stars 4 stars 5 stars 4 stars

2023 Dodge Grand Caravan MV FWD 4 stars 4 stars 5 stars 4 stars

2022 Dodge Grand Caravan MV FWD 4 stars 4 stars 5 stars 4 stars

2021 Dodge Grand Caravan MV FWD 4 stars 4 stars 5 stars 4 stars

2020 Dodge Grand Caravan MV FWD 4 stars 4 stars 5 stars 4 stars

2019 Dodge Grand Caravan VAN FWD Later Release 4 stars 4 stars 5 stars 4 stars

2019 Dodge Grand Caravan VAN FWD Early Release 4 stars 4 stars 5 stars 4 stars

2018 Dodge Grand Caravan VAN FWD 4 stars 4 stars 5 stars 4 stars

2017 Dodge Grand Caravan VAN FWD 4 stars 4 stars 5 stars 4 stars

2016 Dodge Grand Caravan VAN FWD 4 stars 4 stars 5 stars 4 stars

Despite concerns about crash test ratings potentially raising insurance costs, the Dodge Grand Caravan consistently achieves 4-star ratings across multiple years, indicating robust safety. This strong performance in safety tests may help mitigate some of the potential increases in insurance rates.

Dodge Grand Caravan Safety Features

The more safety features you have on your Dodge Grand Caravan, the more likely it is that you can earn a discount. The Dodge Grand Caravan’s safety features include:

- Driver and Passenger Air Bags

- Head and Side Air Bags

- 4-Wheel ABS and Disc Brakes

- Stability and Traction Control

- Brake Assist and Daytime Lights

Equipping your Dodge Grand Caravan with advanced safety features not only enhances protection but can also significantly reduce insurance costs through discounts. Features like air bags, ABS, and stability control demonstrate a commitment to safety that insurers often reward with lower premiums. Check out our guide titled “Electronic Stability Control Car Insurance Discounts” for cheap coverage.

Dodge Grand Caravan Insurance Loss Probability

The Dodge Grand Caravan’s insurance loss probability varies for each form of coverage. The lower percentage means lower Dodge Grand Caravan auto insurance rates; higher percentages mean higher Dodge Grand Caravan car insurance rates.

Dodge Grand Caravan Insurance Loss Probability

Category Probability

Collision -21%

Property Damage 4%

Comprehensive -19%

Personal Injury 8%

Medical Payment 8%

Bodily Injury 7%

The insurance loss probability for the Dodge Grand Caravan significantly affects its insurance rates, with categories like collision and comprehensive showing negative percentages, thereby potentially reducing premiums. Conversely, categories such as personal injury, medical payment, and bodily injury, which exhibit positive loss rates, can increase the cost of insuring a Dodge Grand Caravan.

Dodge Grand Caravan Finance and Insurance Cost

Financing and insuring a Dodge Grand Caravan involves assessing the combined monthly costs of loan payments and insurance premiums. The finance terms, such as loan duration, interest rate, and down payment, along with the vehicle’s purchase price, directly influence the monthly loan payments. Explore more ways to save in our guide titled “How do I find out when my car insurance payment is due?”

Insurance costs vary based on factors like coverage level, driver’s age, driving history, and location. To manage these expenses effectively, prospective owners should compare both financing options and insurance quotes to find a balance that fits their budget. This approach helps ensure an informed purchase, aligning coverage needs with financial capabilities.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Dodge Grand Caravan Insurance

Drivers can end up saving more money on their Dodge Grand Caravan car insurance rates by employing any one of the following strategies.

- Ask about loyalty discounts.

- Ask for a Dodge Grand Caravan Discount if you have college degree or higher.

- Be picky about who drives your Dodge Grand Caravan.

- Move to the countryside.

- Consider using a tracking device on your Dodge Grand Caravan.

By leveraging strategies like asking for loyalty discounts, inquiring about specific Dodge Grand Caravan discounts for college graduates, and being selective about who drives your vehicle, you can significantly reduce your car insurance rates.

Additionally, relocating to a less populated area or installing a tracking device on your Dodge Grand Caravan could lead to further savings.

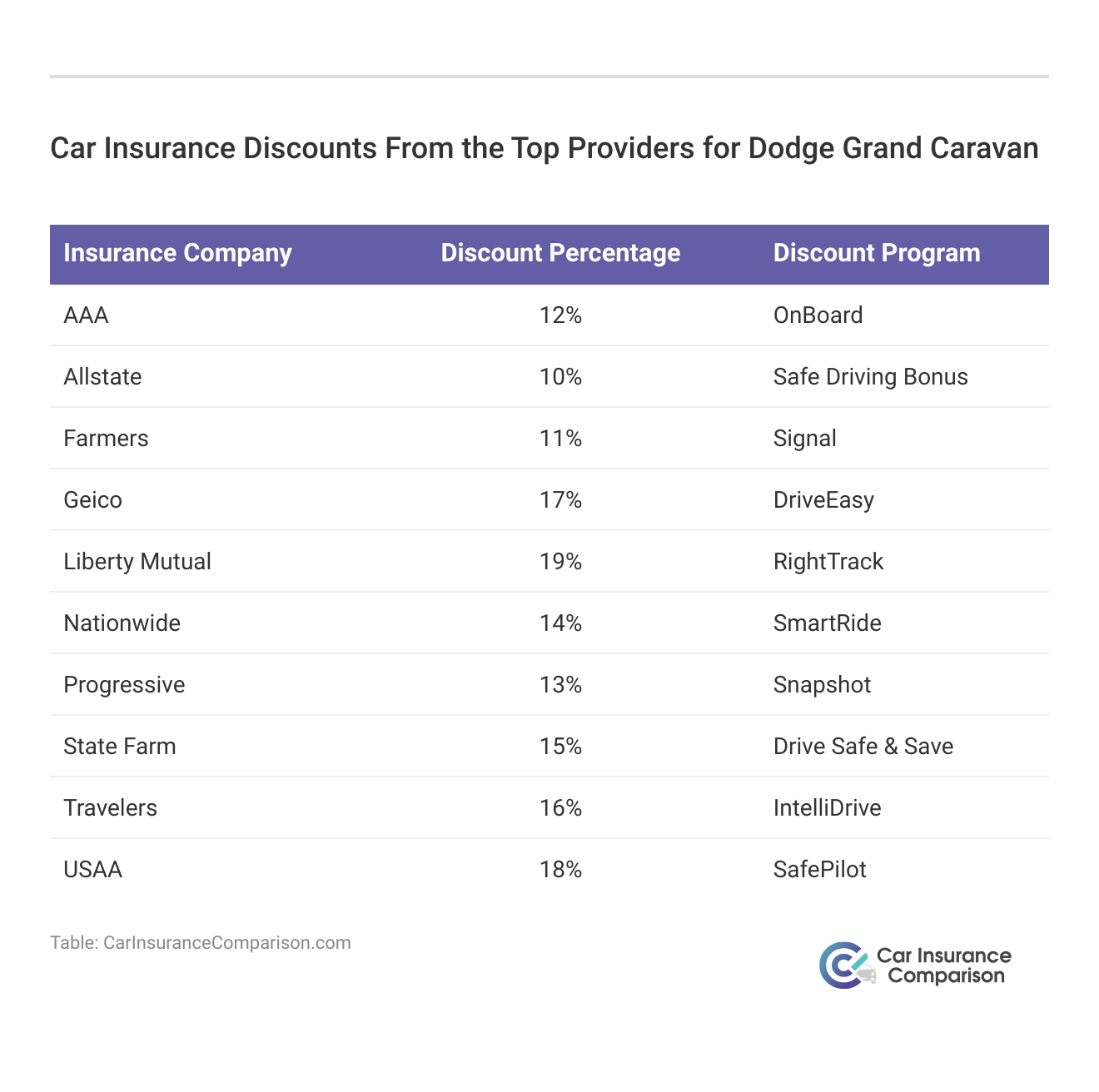

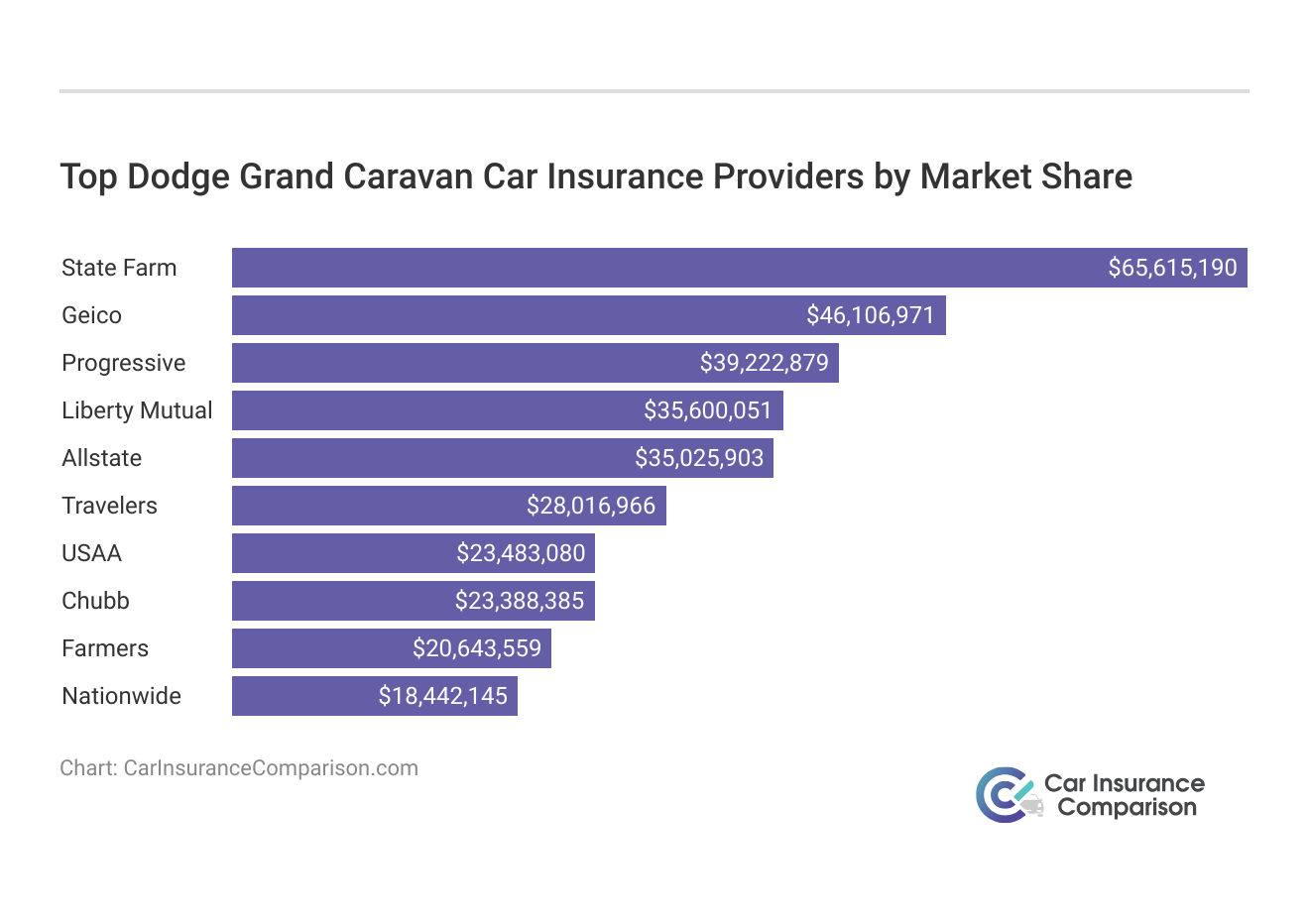

Top Dodge Grand Caravan Insurance Companies

Which auto insurance company offers the best rates for Dodge Grand Caravan? The rates you receive can vary based on numerous factors, but several leading companies provide auto insurance for the Dodge Grand Caravan, ranked by market share. Additionally, many insurers offer discounts for Dodge Grand Caravans with security systems and other safety features.

Top Dodge Grand Caravan Insurance Companies

Rank Insurance Company Premium Written Market Share

#1 State Farm $65.6 million 9.3%

#2 Geico $46.1 million 6.6%

#3 Progressive $39.2 million 5.6%

#4 Liberty Mutual $35.6 million 5.1%

#5 Allstate $35 million 5%

#6 Travelers $28 million 4%

#7 USAA $23.4 million 3.3%

#8 Chubb $23.3 million 3.3%

#9 Farmers $20.6 million 2.9%

#10 Nationwide $18.4 million 2.6%

To secure the best rates for Dodge Grand Caravan insurance, consider top insurers like State Farm, Geico, and Progressive, which lead the market in coverage. Our auto insurance experts share more in our article titled “Progressive Name Your Price Tool Review.”

These companies not only offer competitive rates but also provide discounts for safety features that enhance the value and security of the Dodge Grand Caravan.

Compare Free Dodge Grand Caravan Insurance Quotes Online

Finding the right insurance for your Dodge Grand Caravan doesn’t have to be a challenge. By comparing quotes online, you can easily see how the top providers stack up against each other in terms of coverage options and pricing.

The leading companies for Dodge Grand Caravan insurance include State Farm, Geico, and Progressive. Each of these providers offers competitive rates and a variety of discounts that can benefit Dodge Grand Caravan owners, such as reductions for safe driving and vehicle safety features. Discover more about offerings in our guide titled “Geico vs. The Hartford Car Insurance Comparison.”

With competitive rates starting as low as $57 for minimum coverage, State Farm offers unmatched value for Dodge Grand Caravan owners.

Scott W. Johnson Licensed Insurance Agent

Start by entering your information to receive tailored quotes that reflect your specific needs and location. This way, you can make an informed decision, ensuring that you get comprehensive coverage at the most affordable price. Remember, the best policy offers the most value, not just the lowest price. Compare options today to secure the right insurance for your Dodge Grand Caravan.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Does driver age affect insurance rates?

Yes, driver age plays a role in insurance rates. For example, 20-year-old drivers may pay about $130 more per month than 30-year-old drivers.

Get more details in our guide titled “Best Car Insurance for New Drivers Over 21.”

Does driver location affect insurance rates?

Yes, the location where you live can have a significant impact on Dodge Grand Caravan insurance rates.

How does the driving record affect insurance rates?

Having violations or accidents on your driving record can increase the cost of Dodge Grand Caravan insurance.

Do safety features affect insurance rates?

Yes, having safety features on your Dodge Grand Caravan can potentially earn you a discount on insurance.

See what discounts are available in our guide titled “Safety Features Car Insurance Discounts.”

Are there ways to save on Dodge Grand Caravan insurance?

Yes, you can save on Dodge Grand Caravan insurance by asking about loyalty discounts, having a college degree or higher, being selective about who drives the vehicle, and considering the use of a tracking device.

Can having a college degree or higher education level help lower Dodge Grand Caravan insurance rates?

Yes, some insurance companies offer discounts to Dodge Grand Caravan owners with a college degree or higher education level.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.