Best Volvo Car Insurance Rates in 2025 (Your Guide to the Top 10 Providers)

The best Volvo car insurance rates are from State Farm, USAA, and Allstate, with monthly rates starting around $30. These companies offer competitive prices, extensive coverage options, and excellent customer service, making them top choices for securing the best Volvo car insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Volvo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Volvo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Volvo

A.M. Best Rating

Complaint Level

Pros & Cons

The best Volvo car insurance rates are offered by State Farm, USAA, and Allstate, with monthly rates starting around $30. These companies stand out for their competitive pricing, extensive coverage options, and superior customer service.

While State Farm is often highlighted for its affordability and comprehensive car insurance plans, USAA provides excellent rates and benefits for military families.

Our Top 10 Company Picks: Best Volvo Car Insurance Rates

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 20% B Broad Coverage State Farm

![]()

#2 10% A++ Military Benefits USAA

![]()

#3 20% A+ Personalized Service Allstate

![]()

#4 22% A++ Affordable Premiums Geico

#5 15% A+ Discount Variety Progressive

#6 25% A+ Customer Satisfaction Amica

#7 10% A+ Accident Forgiveness Nationwide

#8 15% A Extensive Coverage Farmers

#9 15% A Customizable Policies Liberty Mutual

#10 10% A++

Flexible Plans Travelers

Allstate offers a range of discounts and flexible policies. Volvos, known for their safety and technology, benefit from such tailored insurance options. Comparing quotes from these top providers can help Volvo owners find the best insurance deals.

By considering multiple factors, you can ensure you get the best Volvo car insurance rates to protect your vehicle. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm offers the best Volvo car insurance rates starting at $30/month

- Compare quotes to find the best Volvo car insurance rates for your needs

- Top providers offer competitive rates and extensive coverage for Volvo drivers

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Our State Farm car insurance review shows State Farm offering significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military Discounts: USAA offers specialized discounts and benefits for military members and their families.

- Superior Customer Service: USAA is known for its exceptional customer service and claims handling.

- Financial Strength: According to our USAA car insurance review, USAA has an A++ rating from A.M. Best, indicating strong financial stability.

Cons

- Membership Restrictions: Only military members and their families are eligible for USAA insurance.

- Limited Availability: USAA’s services and discounts may not be available in all regions.

#3 – Allstate: Best for Personalized Service

Pros

- Customizable Policies: Our analysis of Allstate car insurance review reveals Allstate offering a variety of options to tailor policies to individual needs.

- DriveWise Program: Allstate’s telematics program offers discounts for safe driving habits.

- Extensive Agent Network: Allstate has a large network of agents providing personalized service.

Cons

- Higher Premiums: Allstate’s premiums can be higher compared to other insurers.

- Mixed Customer Reviews: Some customers report less satisfactory claims experiences.

#4 – Geico: Best for Affordable Premiums

Pros

- Competitive Rates: Our review of Geico car insurance review indicates Geico being known for offering some of the lowest premiums in the market.

- Easy Online Access: Geico provides user-friendly online tools for policy management and claims.

- Wide Range of Discounts: Geico offers various discounts, including for good drivers and multi-policy holders.

Cons

- Limited Agent Interaction: Geico relies heavily on online and phone services, which might lack personal touch.

- Coverage Limitations: Some customers may find Geico’s coverage options less comprehensive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Discount Variety

Pros

- Snapshot Program: Progressive offers discounts for safe driving through its telematics program.

- Diverse Discounts: The findings from our Progressive car insurance review demonstrate Progressive providing numerous discounts, including for multi-policy and continuous insurance.

- Price Comparison Tool: Progressive’s tool helps customers compare rates with other insurers.

Cons

- Average Customer Service: Progressive’s customer service ratings are generally average compared to competitors.

- High Rates for High-Risk Drivers: Premiums can be higher for drivers with a poor driving record.

#6 – Amica: Best for Customer Satisfaction

Pros

- High Customer Ratings: Amica is frequently praised for excellent customer service and satisfaction. Check and compare with our “Amica vs. Nationwide Car Insurance Comparison” for more information.

- Dividend Policies: Amica offers policies that return a portion of premiums to policyholders.

- Flexible Coverage Options: Amica provides various customizable coverage options.

Cons

- Higher Premiums: Amica’s rates can be higher than some competitors.

- Limited Online Tools: Amica’s digital tools and mobile app are less advanced compared to others.

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Vanishing Deductible: Nationwide offers a program that reduces your deductible for safe driving. Discover more Nationwide car insurance discounts for more savings.

- Strong Financial Rating: Nationwide has an A+ rating from A.M. Best.

- Accident Forgiveness: Nationwide’s policy options include accident forgiveness.

Cons

- Higher Base Rates: Nationwide’s initial premiums can be higher than some other insurers.

- Limited Discount Options: Nationwide offers fewer discounts compared to other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Extensive Coverage

Pros

- Comprehensive Coverage: Farmers provides a wide range of coverage options including specialty coverages.

- Personalized Service: Farmers agents offer personalized service and local knowledge.

- Discount Options: Our examination of Farmers car insurance review shows Farmers offering various discounts including for safe drivers and multi-policy holders.

Cons

- Higher Premiums: Farmers’ premiums tend to be higher than average.

- Average Customer Reviews: Farmers has mixed reviews regarding customer satisfaction and claims handling.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Policy Customization: Liberty Mutual offers a wide range of customizable policy options.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness to prevent rate increases after an accident.

- Bundling Discounts: The results of our Liberty Mutual car insurance review suggests Liberty Mutual continue to excel by offering savings to customers by bundling auto with home or renters insurance.

Cons

- Higher Rates: Liberty Mutual’s premiums can be higher than some competitors.

- Mixed Claims Reviews: Some customers report dissatisfaction with the claims process.

#10 – Travelers: Best for Flexible Plans

Pros

- Flexible Coverage Options: Travelers offers a variety of flexible plans to suit different needs.

- IntelliDrive Program: Travelers’ telematics program offers discounts for safe driving.

- Strong Financial Stability: Our assessment of Travelers car insurance review illustrates Travelers boast on holding an A++ rating from A.M. Best.

Cons

- Limited Discount Variety: Travelers offers fewer discounts compared to other providers.

- Average Customer Service: Travelers’ customer service ratings are generally average.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cost of Volvo Car Insurance

How much does Volvo car insurance cost? Are Volvo expensive to insure? The average luxury car insurance policy can be significantly higher than standard coverage, but Volvos are generally affordable. The average driver pays about $148 a month for Volvo insurance, though several factors can affect your rates. Insurance companies look at the following factors when crafting your rates:

- ZIP code

- Age and gender

- Driving record

- Your vehicle

- Credit score

- Marital status

Of course, the amount of coverage you want to buy will also impact your rates. For example, you’ll pay much less if you buy the minimum car insurance required by your state than you would for full coverage Learn about minimum car insurance requirements by state. Although full coverage costs more, many Volvo drivers choose to buy it to better protect their cars.

Another factor to keep in mind is the model you buy. Some Volvo models cost much more to insure than others. Check below to see how much you might pay for Volvo insurance based on the model you buy.

Volvo Car Insurance Monthly Rates by Model & Coverage Type

| Volvo Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Volvo XC60 | $30 | $35 | $52 | $131 |

| Volvo V60 | $32 | $35 | $64 | $145 |

| Volvo S60 | $32 | $42 | $64 | $153 |

| Volvo S90 | $34 | $42 | $70 | $162 |

| Volvo XC90 | $36 | $37 | $63 | $152 |

The Volvo XC60 is one of the cheapest models to buy, with rates lower than some standard cars. Contrary to Volvo XC60 car insurance costs, the Volvo S90 has some of the highest insurance rates. While there are many reasons luxury car insurance costs more, it’s primarily because they cost more to repair or replace. A new Volvo S90 is one of Volvo’s most expensive models, which leads to higher repair and replacement costs.

Compare Volvo Car Insurance Rates by Model for Tailored Coverage

Is volvo insurance expensive? Is Volvo expensive to insure? Explore the varying insurance rates for Volvo models, including the Volvo 850, Volvo S60, Volvo S90 Recharge, Volvo V60 Recharge, Volvo XC40 Recharge, and Volvo XC90 car insurance. This concise comparison will assist you in making an informed decision about the insurance costs associated with different Volvo car models.

| Compare Volvo Car Insurance Rates by Model | |

|---|---|

| Volvo 850 | Volvo V60 Recharge |

| Volvo S60 | Volvo XC40 Recharge |

| Volvo S90 Recharge | Volvo XC90 Recharge |

| Volvo V60 Cross Country |

By understanding the insurance rates for these Volvo models, you can better gauge which vehicle aligns with your budget and coverage needs. Make an informed choice to ensure you get the best value and protection for your Volvo.

Types of Volvo Car Insurance

What types of insurance should you buy for a Volvo? Volvo drivers usually buy one of two main types of policies — minimum insurance and full coverage car insurance. Minimum insurance is the least amount of insurance your state requires before you can register your car or drive on a public road. It’s your cheapest option for insurance, but it doesn’t cover your vehicle.

The best car insurance for Volvo is full coverage, as the best full coverage car insurance offers much better protection for your car but can cost up to three times as much as minimum insurance. It’s never required by law, but drivers usually need it when they have a car loan or lease.

Volvo Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $45 $130

Amica $37 $125

Farmers $46 $135

Geico $33 $105

Liberty Mutual $48 $140

Nationwide $42 $128

Progressive $40 $120

State Farm $35 $115

Travelers $43 $127

USAA $30 $110

Most states require liability insurance before you can drive. If you buy full coverage, you’ll get the following coverage:

- Liability Insurance: Liability auto insurance coverage ensures any damage or injuries you cause in an at-fault accident. It never covers your car or medical expenses.

- Collision Insurance: If you want your insurance to help with your car repairs after an at-fault accident, you need collision car insurance.

- Comprehensive Insurance: If your car is damaged by floods, fire, animals, extreme weather, vandalism, or theft, comprehensive pays for your repairs.

- Uninsured/Underinsured Motorist Coverage: While most states require car insurance before you can drive, some drivers are underinsured. Uninsured/underinsured motorist coverage pays for your health care expenses and car repairs if someone without coverage hits you.

In addition, you can get medical payments and personal injury protection insurance to pay for health care expenses for you and your passengers.

Volvo drivers often buy more coverage beyond the basic types listed above. Popular add-ons for Volvos include rental car reimbursement, roadside assistance, and gap insurance. However, you should always make sure you need extra coverage before buying it. Adding extra coverage can significantly increase your rates. For more information, read our “How do I find out if GAP insurance is included in my car lease?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tips to Save on Your Volvo Auto Insurance

To secure the lowest rates for your Volvo, consider the following methods. One effective approach is to increase your deductible. Insurance companies allow drivers to choose their car insurance deductible, usually ranging from $500 to $2,000. Opting for a higher deductible can lower your car insurance rates, although you’ll need to pay more out-of-pocket if you make a claim.

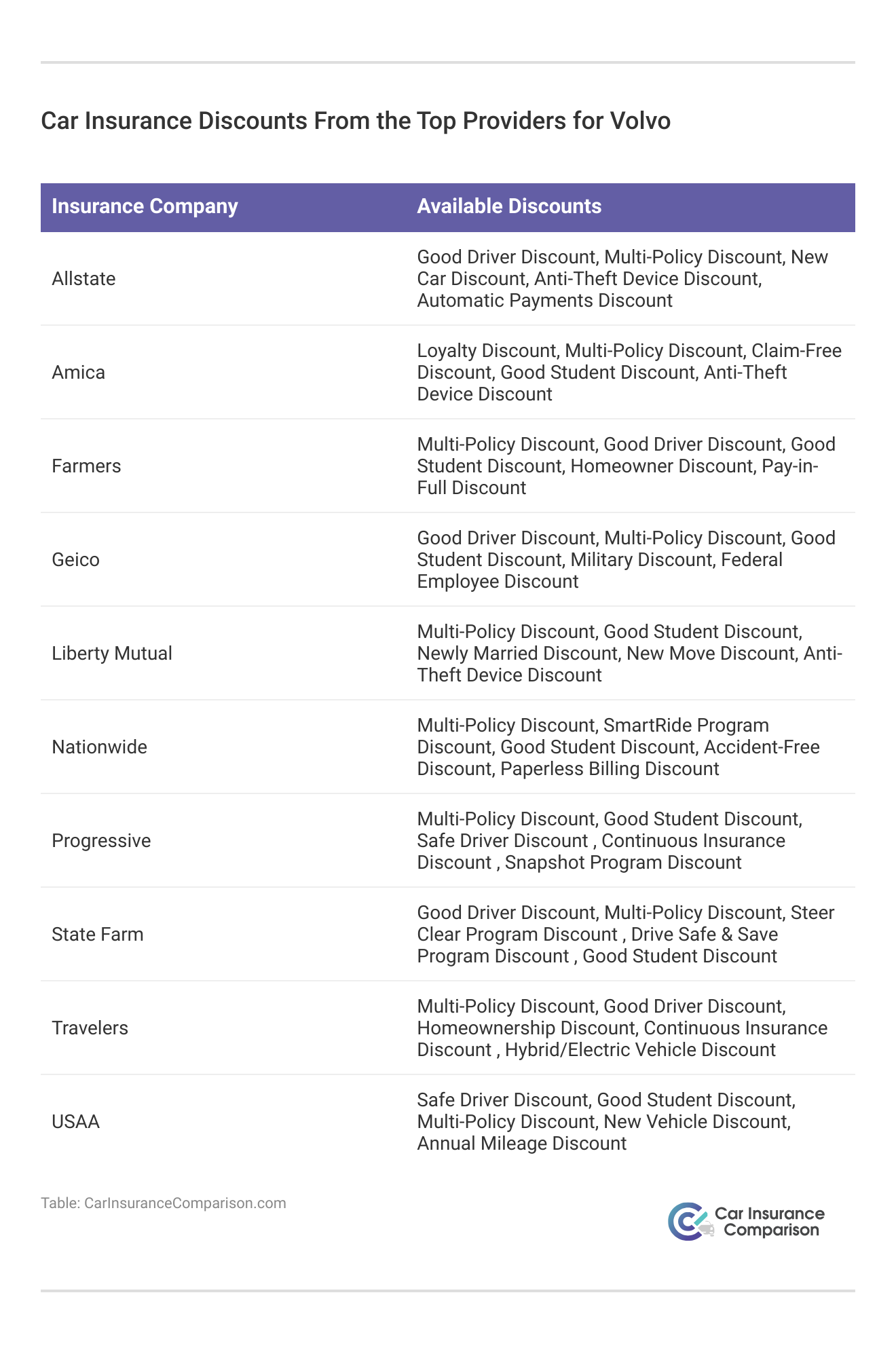

Another method is to look for discounts. Many insurance companies offer various car insurance discounts to help drivers save money. Evaluating the number and type of discounts a company offers is crucial when selecting an insurance provider.

Enrolling in telematics can also lead to savings. Usage-based auto insurance programs reward safe drivers with lower rates. However, if you frequently speed, drive late at night, or accumulate a high mileage, this option might not be beneficial for you.

Ensuring your car is equipped with safety features can also reduce your Volvo insurance cost. Vehicles with devices like GPS tracking and audible alarms often receive lower insurance quotes. Researching available safety features discounts is worthwhile.

Maintaining a clean driving record is another key factor. Drivers with incidents on their records typically pay higher insurance premiums. Even a single speeding ticket can increase your rates by 25%, as car insurance companies closely monitor driving records.

Additionally, lowering your coverage might be advantageous, especially for drivers with older Volvos. An insurance representative can assist in determining the appropriate amount of coverage for your needs.

While these tips can help you save on insurance, comparing quotes remains the most effective method to find affordable Volvo car insurance rates. Insurance companies consider the same factors but use unique formulas to determine rates, making it difficult to predict which company will offer the cheapest rates without obtaining a personalized quote.

While the tips above will help you save, comparing quotes is the best way to find affordable Volvo car insurance rates. Companies look at the same factors but use unique formulas to craft rates. Estimating which company will have the cheapest Volvo car insurance rates for you without getting a personalized quote is challenging.

Find the Best Volvo Insurance Today

As a brand known for safety and technology, Volvo drivers tend to enjoy lower rates than many other luxury brands. Some models — including the XC60 — have lower insurance rates than some standard cars. Others cost more but have lower insurance rates than comparable luxury vehicles.

Although Volvo insurance rates are affordable, you’re not stuck with the first Volvo car insurance quote you find. There are plenty of ways to save on your Volvo insurance, but one of the most important is to compare Volvo car insurance rates. You’ll likely overpay for your car insurance if you don’t compare car insurance quotes from as many companies as possible.

Case Studies: Exploring Volvo Car Insurance Success Stories

As Volvo owners navigate the realm of car insurance, they seek reliable coverage that safeguards their investments. Here are insightful case studies showcasing how Volvo drivers achieved optimal insurance solutions tailored to their needs and circumstances.

- Case Study 1 – Sarah’s Volvo XC60: Sarah, an enthusiastic Volvo XC60 owner, diligently researched insurance options, ultimately securing a comprehensive policy that aligned with her vehicle’s safety features and her budget constraints.

- Case Study 2 – David’s Volvo S60: David, proud owner of a Volvo S60, discovered specialized car insurance discounts for Volvo drivers, leveraging incentives for safety features and low-mileage usage to significantly reduce his insurance premium without compromising coverage quality.

- Case Study 3 – Emily’s Volvo XC90: Emily, navigating her Volvo XC90 ownership, collaborated closely with an insurance agent to craft a personalized policy, incorporating tailored add-ons like roadside assistance and rental car reimbursement to ensure comprehensive protection aligned with her individual needs.

These case studies demonstrate the diverse strategies Volvo drivers employ to secure optimal insurance coverage. Whether through meticulous research, leveraging specialized discounts, or crafting personalized policies, Volvo owners can navigate the insurance landscape with confidence, safeguarding their vehicles and enjoying peace of mind on the road.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Conclusion: Securing the Best Insurance for Your Volvo

In conclusion, securing the best car insurance for your Volvo entails evaluating factors such as coverage options, pricing, and customer service from reputable providers like State Farm, USAA, and Allstate. Understanding your Volvo model’s specific insurance needs and exploring available discounts can help mitigate costs while ensuring comprehensive coverage that aligns with your budget and driving habits.

By taking proactive measures and conducting thorough research, Volvo drivers can confidently protect their vehicles and enjoy peace of mind on the road for years to come. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Are Volvos expensive to insure?

Whether Volvo car insurance is more expensive depends on the car you compare it to. Volvos cost a little more to insure than most standard cars but have affordable rates compared to similar luxury brands.

Which car insurance plan is best?

The insurance plan that works best for your Volvo depends on several factors. However, many Volvo drivers choose to buy full coverage to better protect their expensive, luxury cars.

Does Volvo offer insurance?

Volvo offers a Care by Volvo subscription service, which includes insurance for you and eligible members in your household. It also provides drivers with scheduled maintenance, excess wear protection, and roadside assistance. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Is a Volvo XC90 insurance expensive?

The Volvo XC90 insurance cost has an average rate of $152 a month, which is a little more expensive than the average Volvo driver pays.

How do factors like ZIP code and credit score affect Volvo car insurance rates?

Factors like ZIP code and credit score can impact Volvo car insurance rates as insurance companies assess the risk associated with the location and creditworthiness of the driver, which can affect car insurance rate.

Are there any specific safety features or technologies in Volvos that can help reduce insurance rates?

Volvos’ advanced safety features and technologies, such as GPS tracking, audible alarms, and driver assistance systems, can potentially lead to lower insurance rates by reducing the risk of accidents and theft.

Are Volvo s60 expensive to insure?

Full coverage insurance for a Volvo S60 is an average of $153/mo.

What is the average Volvo car insurance price?

The average Volvo car insurance price is approximately $148 per month, though this can vary based on factors like the specific make and model, coverage level, and individual driver details.

How can I get a Volvo insurance quote?

You can get a Volvo insurance quote by entering your ZIP code into a comparison tool online, which will provide quotes from various top insurance companies.

Are there any specific Volvo car insurance reviews available?

Yes, you can find Volvo car insurance reviews on various insurance comparison websites and forums where customers share their experiences with different providers.

What is the Volvo S90 insurance cost?

The Volvo S90 insurance cost is typically higher due to its classification as a luxury vehicle, with monthly rates around $170 depending on coverage and other factors.

Is Volvo classic car insurance available?

Yes, Volvo classic car insurance is available for older models considered to be classics. This type of insurance often includes agreed value coverage, which can be beneficial for preserving the value of a classic car.

What is the Volvo Ex30 insurance cost?

The Volvo Ex30 insurance cost can vary based on coverage options and individual driver profiles. Generally, new models like the Ex30 may have higher rates due to the cost of repairs and replacement parts.

What factors influence Volvo S60 insurance cost?

The Volvo S60 insurance cost is influenced by various factors including the model year, driver’s age and location, driving record, coverage options, and deductible chosen. These factors can significantly impact the premium rates offered by insurance companies.

How does Volvo car insurance in the UK compare?

Volvo car insurance UK can vary widely but generally includes similar considerations such as model, driver history, and coverage needs. It is recommended to compare quotes from several UK insurers to find the best rates. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.