Best Phoenix, AZ Car Insurance in 2025

State Farm, Geico, and Progressive have the best Phoenix, AZ car insurance, starting at $33 per month. Drivers get the best auto insurance in Phoenix from these companies because they offer great coverage and discount options. Whether you need minimum or full coverage, finding cheap Phoenix auto insurance is easy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Berry

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Former Licensed Insurance Producer

UPDATED: Feb 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Phoenix AZ

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Phoenix AZ

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Phoenix AZ

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGet the best Phoenix, AZ car insurance from State Farm, Geico, and Progressive, thanks to their generous discounts and flexible coverage options.

Rates vary from person to person, but State Farm has the overall lowest Arizona car insurance rates for Phoenix drivers. Phoenix drivers can save by enrolling in Drive Safe & Save, State Farm’s usage-based insurance program meant for safe drivers.

Our Top 10 Company Picks: Best Phoenix, AZ Car Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Extensive Coverage | State Farm | |

| #2 | 25% | A++ | Competitive Rates | Geico | |

| #4 | 15% | A+ | Extensive Discounts | Progressive | |

| #3 | 20% | A+ | Comprehensive Policies | Allstate | |

| #5 | 20% | A | Specialized Coverage | Farmers | |

| #6 | 15% | A | Extensive Coverage | Liberty Mutual |

| #7 | 20% | A+ | Customer Service | Nationwide |

| #8 | 15% | A | Roadside Assistance | AAA |

| #9 | 20% | A | Comprehensive Coverage | American Family | |

| #10 | 10% | A++ | Customized Policies | Travelers |

Read on to explore the best in Phoenix auto insurance. Then, enter your ZIP code into our free comparison tool to see personalized Phoenix insurance quotes.

- The average Phoenix driver pay $42 for minimum insurance

- Phoenix rates can be high due to higher traffic density and vehicle crimes

- State Farm and Geico have the cheapest Phoenix car insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

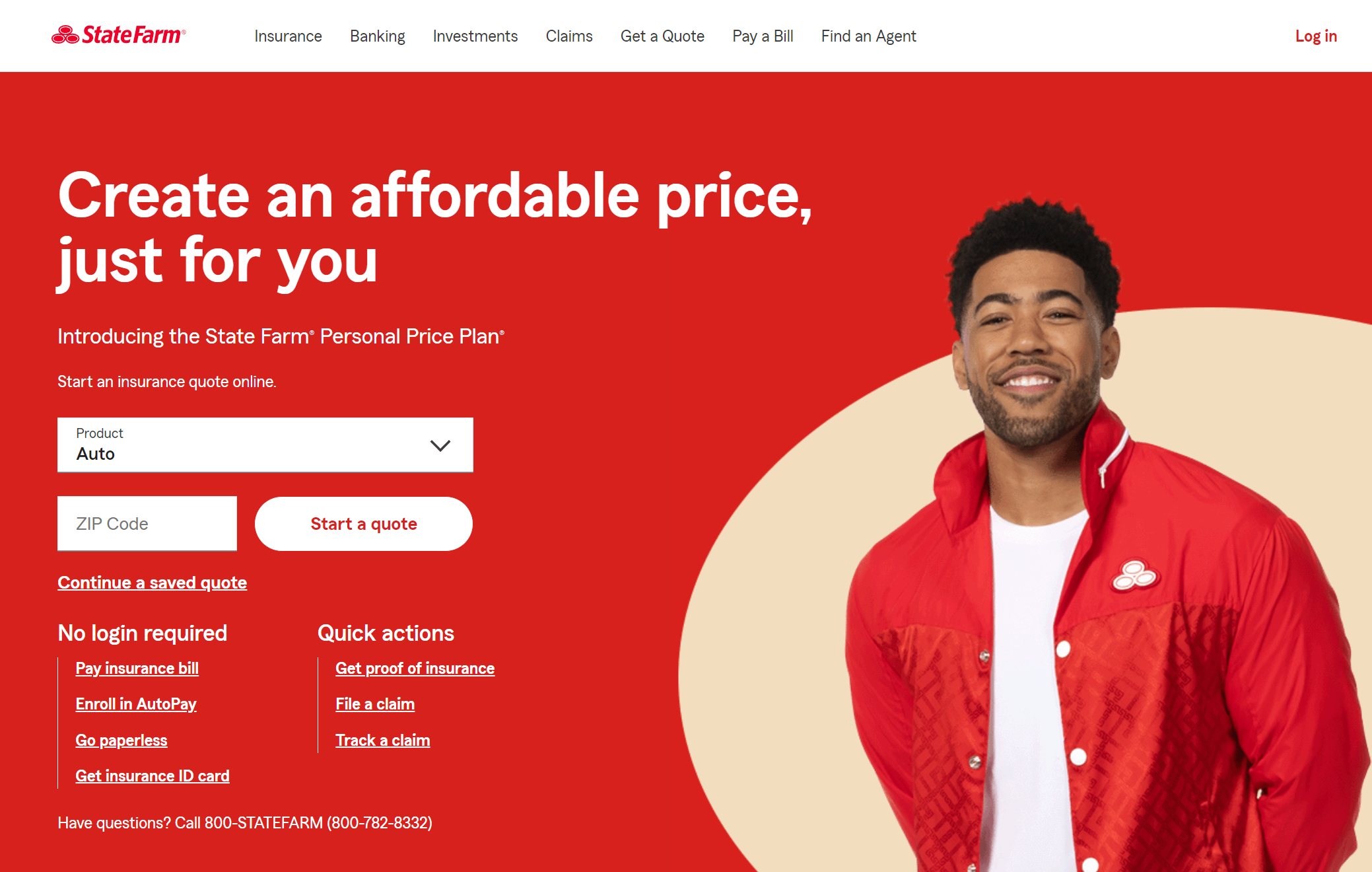

#1 – State Farm: Top Pick Overall

Pros

- Local Phoenix Agents: State Farm’s strong local presence in Phoenix with its agents ensures personalized service and assistance tailored to Arizona’s unique driving and insurance needs.

- Excellent Customer Service: State Farm receives excellent customer service reviews from its Phoenix customers. See what they have to say in our State Farm car insurance review.

- Policy Discounts: With 13 discounts, finding affordable Phoenix auto insurance is usually a simple task.

Cons

- Some drivers pay more. State Farm offers cheap car insurance in Phoenix, AZ, but teens and drivers with a DUI will likely pay much higher rates.

- Unpredictable Rate Increases: Many Phoenix drivers report unexpected rate increases, even when nothing had changed about their situation.

#2 – Geico: Best for Tech-Savvy Drivers

Pros

- Digital Tools: Manage your policy, make payments, and start claims easily with Geico’s convenient mobile app and website.

- Competitive Rates: Geico has some of the cheapest car insurance in Phoenix, especially if you have a speeding ticket or an at-fault accident on your driving record.

- Government Discounts: If you work for the government, you may qualify for Geico’s government discount. Explore all of Geico’s discount options in our Geico car insurance review.

Cons

- Limited Agents: With its focus on digital tools, it should come as no surprise that Geico has fewer agents than some of its competitors.

- Customer Service Varies: It may offer affordable car insurance rates in Phoenix, AZ, but Geico’s customer service ratings aren’t always positive.

#3 – Progressive: Best for High-Risk Phoenix Drivers

Pros

- Low Rates: Progressive usually has low rates, but high-risk drivers in particular can find affordable car insurance in Phoenix, AZ.

- Name Your Price Tool: Looking for low car insurance rates in Phoenix, AZ? Progressive’s Name Your Price tool will tell you exactly how much coverage you can get based on your monthly budget.

- Snapshot: If you consistently practice safe driving habits, you can save up to 30% by enrolling in Progressive’s UBI program Snapshot. Learn more about Snapshot in our Progressive car insurance review.

Cons

- Unexpected Rate Increases: Many Phoenix drivers report unexpected rate increases from Progressive, even when nothing about their situation changed.

- Customer Loyalty Struggles: Progressive may offer low-cost car insurance in Phoenix, but the company struggles to retain customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Network of Agents: Find the best car insurance in Phoenix, AZ, with the help of one of Allstate’s friendly insurance agents located throughout the city.

- UBI Programs: Allstate offers two UBI programs – Drivewise and Milewise. See which is best for your needs in our Allstate car insurance review.

- Diverse Coverage Options: If you have room in your budget for more coverage, Allstate offers a variety of great insurance add-ons. Choose from add-ons like rideshare insurance and accident forgiveness.

Cons

- Higher Premiums: Allstate’s car insurance rates in Phoenix, AZ, may be low on average, but many drivers see much higher prices.

- Discount Limitations: Allstate offers 12 discounts to help Arizona drivers save, but you’ll need to check with a representative. Some discounts listed on the Allstate website may not be available in Phoenix.

#5 – Farmers: Best for Experienced Phoenix Representatives

Pros

- Longstanding Phoenix Presence: Farmers has been providing insurance to Phoenix drivers for a long time. Its experience in the Phoenix area helps Farmers offer excellent coverage.

- Personalized Service: Get personalized help on your insurance by contacting one of Farmers’ many Phoenix agents.

- Discount Selection: Farmers offers a whopping 23 discounts to help you save. Explore all your discount options in our Farmers car insurance review.

Cons

- Limited Online Tools: If you want a more modern experience in your car insurance for Phoenix, AZ, Farmers might not be the right company for you. It lacks many of the digital tools other companies offer.

- Varied Customer Service: Some Farmers customers leave nothing but glowing recommendations for the company, while others warn you’ll find better coverage elsewhere.

#6 – Liberty Mutual: Best for Unique Coverage Options

Pros

- 24/7 Support: Liberty Mutual strives to offer the best insurance in Phoenix, AZ, by maintaining a 24/7 customer service support line.

- Better Car Replacement Coverage: Liberty Mutual offers several unique coverage options so you can maximize your coverage. Its better car replacement coverage is one of the most valuable options.

- Digital Self-Service: Buy coverage and start claims online with Liberty Mutual’s excellent digital tools.

Cons

- Below-Average Customer Service: Liberty Mutual’s customer service experience gets below-average ratings. See what customers have to say about it in our Liberty Mutual car insurance review.

- Limited Availability in Rural Areas: It’s easy to get car insurance quotes in Phoenix, AZ, but drivers in smaller, surrounding communities might be better served at another company.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for UBI Savings

Pros

- Unique Coverage: Nationwide sets itself aside as one of the best car insurance companies in Phoenix, AZ, with its unique coverage options. Popular options include the total loss deductible waiver and the vanishing deductible.

- SmartRide: Save up to 40% on your policy by enrolling in SmartRide, Nationwide’s UBI program.

- Great Discount Opportunities: Nationwide offers 11 discounts to help you find the cheapest car insurance in Phoenix. You can also see what car insurance discounts Nationwide offers to save even more.

Cons

- Digital Tool Availability: Nationwide relies on local agents to sell policies and offer support. If you want to do most of your insurance managing online, Nationwide might not be the best choice.

- Less Competitive Rates: Nationwide isn’t the most expensive provider, but it doesn’t offer the cheapest auto insurance quotes in Phoenix, AZ, either.

#8 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance Plans: With three separate roadside assistance plans, AAA has coverage that can meet any need.

- Discounts for AAA Members: AAA membership comes with discounts on things like travel packages and hotel rooms.

- Superb Customer Service: AAA receives excellent reviews for its customer service experience. To see what customers have to say about AAA, read our AAA car insurance review.

Cons

- Membership Fees: AAA’s annual membership fees add to the overall price of its car insurance in Phoenix, AZ. However, most membership plans cost between $59 and $129 per year.

- Limited Coverage Options: Although it offers a few valuable choices, AAA does not have as large of a selection of add-ons as its competitors.

#9 – American Family: Best Customer Service

Pros

- Customer Service: American Family’s emphasis on customer service makes it a strong choice for drivers looking for affordable insurance quotes in Phoenix.

- Solid Coverage Options: Get the best car insurance for Phoenix to match your specific needs with American Family’s add-ons. A popular option for Phoenix drivers is American Family’s rideshare insurance.

- Generous Discounts: There are 18 American Family discounts to help you get Phoenix, AZ, cheap car insurance. Explore your discount options in our American Family car insurance review.

Cons

- Average Rates: Despite having ample discounts, American Family’s Phoenix insurance quotes tend to stick closely to the national average.

- Slow Claims: American Family’s representatives work hard to get good customer service reviews. One area they struggle with most is their claims resolution speed.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best Selection of Discounts

Pros

- IntelliDrive: Travelers’ UBI program IntelliDrive can help you save up to 30% on your insurance.

- Customization Options: Add coverage like new car replacement insurance and rideshare coverage to maximize your Arizona policy. Explore all your coverage options in our Travelers car insurance review.

- Solid List of Discounts: Worried you won’t qualify for IntelliDrive savings? There are 12 more discounts to help you save with Travelers.

Cons

- Limited Local Agents: Travelers doesn’t have as many local agents in Phoenix as other competitors.

- Rates can be high. Travelers offers some of the best auto insurance in Phoenix,AZ, but not the cheapest rates. Phoenix drivers with DUIs pay some of the highest rates with Travelers.

Car Insurance Rates in Phoenix, AZ

Finding cheap car insurance for women or men in Phoenix is usually easy for the average driver. Arizona car insurance rates generally stick close to the national average, with many drivers able to find significant savings.

Check below to see how much you might pay for car insurance from our top Phoenix, AZ companies.

Phoenix, AZ Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $86 |

| $61 | $160 | |

| $43 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 |

The high number of drivers and cars on the roads causes car insurance agents to charge high rates because of the increased risk for auto accidents.

Drivers in Arizona have the privilege of paying some of the lowest auto insurance rates in the country, but drivers in Phoenix may not have that luxury.

Because of the number of accidents that occur in Phoenix, the average rate that residents pay for their auto insurance can be higher.

Drivers who would like to receive lower rates have the option of comparing quotes from other insurance companies—they are not required to purchase their insurance from one specific company. You can start comparing rates by filling out quoted request forms on individual websites, like the one below.

Drivers who compare rates may choose to refuse to renew one policy and purchase another if they can receive a better Arizona car insurance deal elsewhere. To save time, you can skip filling out individual quote request forms by entering your ZIP code into our free comparison tool.

Phoenix, AZ Car Insurance Rates by Age and Gender

How do age, gender, and marital status affect Phoenix, AZ car insurance rates? Every Phoenix, Arizona car insurance company weighs these factors differently, so check out the comparison rates.

Phoenix, AZ Monthly Auto Insurance Rates by Age and Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 18-Year-Old Female | $290 | $575 |

| 18-Year-Old Male | $325 | $650 |

| 25-Year-Old Female | $255 | $510 |

| 25-Year-Old Male | $290 | $575 |

| 35-Year-Old Female | $250 | $500 |

| 35-Year-Old Male | $275 | $550 |

| 45-Year-Old Female | $250 | $495 |

| 45-Year-Old Male | $265 | $525 |

| 55-Year-Old Female | $210 | $415 |

| 55-Year-Old Male | $230 | $460 |

| 65-Year-Old Female | $190 | $365 |

| 65-Year-Old Male | $210 | $395 |

The cost of car insurance is more expensive for boys than for girls for a variety of reasons, but it all comes down to statistics. Male drivers are more likely to drive under the influence, engage in road rage, and perform other reckless driving habits, which leads to more accidents.

Phoenix, AZ Car Insurance Rates by Credit Score

Your credit affects car insurance costs in Phoenix, AZ. If your credit is good, you may be able to get a good credit discount. Compare credit history car insurance rates in Phoenix from top companies for good, fair, and poor credit.

Phoenix, AZ Car Insurance Monthly Rates by Credit Score

| Insurance Company | Bad | Fair | Good |

|---|---|---|---|

| $175 | $145 | $115 |

| $150 | $130 | $110 | |

| $145 | $125 | $105 | |

| $155 | $135 | $115 | |

| $135 | $115 | $95 | |

| $140 | $120 | $100 |

| $142 | $122 | $102 |

| $138 | $118 | $98 | |

| $130 | $110 | $90 | |

| $152 | $132 | $112 |

Although it’s not a quick-fix option, improving your credit score will lower your car insurance rates. Insurance companies typically reevaluate your situation when your policy is due for renewal, but you can always ask an agent to look over your plan immediately if you’ve made significant changes to your credit.

Phoenix, AZ Car Insurance Rates by Driving Record

Your driving record is one of the biggest factors affecting car insurance costs. Your driving history impacts your car insurance rates — drivers with traffic violations typically see more expensive rates. Compare bad driving record car insurance rates in Phoenix, AZ to rates for a clean record with top companies.

Phoenix, AZ Monthly Auto Insurance Rates by Driving Record

| Insurance Company | Clean Record | 1 Speeding Ticket | 1 Accident | 1 DUI |

|---|---|---|---|---|

| $105 | $108 | $133 | $148 |

| $139 | $188 | $225 | $270 | |

| $86 | $136 | $176 | $194 | |

| $80 | $173 | $198 | $193 | |

| $160 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $117 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 |

If you have traffic violations on your record, make sure to avoid future tickets or accidents. Traffic violations clear off your driving record after a period. If you avoid additional infractions, your car insurance rates will return to normal.

Arizona Car Insurance Rates by City

Below, you can find the cheapest Phoenix, AZ auto insurance company. You might then ask, “How do those rates compare against the average Arizona auto insurance company rates in other cities?” We cover that as well.

Arizona Monthly Auto Insurance Rates by City

| City | Minimum Coverage | Full Coverage |

|---|---|---|

| Chandler | $52 | $145 |

| Flagstaff | $66 | $160 |

| Gillbert | $45 | $135 |

| Mesa | $50 | $145 |

| Peora | $55 | $150 |

| Phoenix | $44 | $138 |

| Scottsdale | $45 | $137 |

| Surprise | $55 | $153 |

| Tempe | $45 | $140 |

| Tucson | $40 | $133 |

Phoenix drivers pay more than many other cities because of higher traffic, more vehicle crimes, and more accidents. It’s always important to compare your car insurance rates no matter where you live, but Phoenix residents can especially benefit from comparing monthly car insurance payments in their area.

Phoenix, AZ Car Insurance Rates vs. Top U.S. Cities

Which city you live in will have a major effect on car insurance. That’s why it’s essential to compare Phoenix, Arizona against other top US metro areas’ auto insurance rates.

As you can see, Phoenix can be quite reasonable compared to other cities. It can be much harder to find affordable Texas, New York, or California car insurance compared with Arizona, so Valley residents have something to be thankful for.

Factors That Affect Car Insurance Rates in Phoenix, AZ

What are the factors that affect car insurance rates in Phoenix, AZ? There are several reasons why Phoenix car insurance may be different from surrounding cities. Take a look at what affects car insurance rates in Phoenix, Arizona.

- Car Theft: Higher rates of car thefts in the Phoenix area significantly increase rates.

- Commute Times: The longer the average driver spends in traffic, the more likely they are to get into an accident.

- Traffic: Traffic density also affects car insurance rates. People are flocking Arizona and the greater Phoenix area, which means more drivers on the road.

- Accidents: More drivers on the road leads to more accidents, which significantly increases insurance rates.

- Vandalism: Vandalism is covered by comprehensive car insurance, so areas with more vandalism reports pay higher rates.

While there’s little you can do to offset the risks associated with living in Phoenix, making sure you keep your driving record clean and finding discounts can help keep your insurance rates low.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance in Phoenix, AZ

Every driver must carry the minimum car insurance required by the state in Phoenix, AZ. Take a look at the Arizona car insurance requirements.

The liability coverage is the same for everyone and sometimes, people believe that the price that every car insurance company will quote every applicant will be the same, but this isn’t the case.

The minimum limits are set, but insurance companies are entitled to develop different risk profiles for different groups of people.

When clients file several claims, insurance companies will be susceptible to paying a lot of money to repair these clients’ vehicles. Therefore, those who have had a history of filing several claims pay the most for their premiums.

Some insurance companies are willing to only insure the safest people who have the best driving records that don’t show that they have collected too many points.

Insurance companies can make an exception and sell someone who has had several at-fault accidents a policy, but they will require these particular drivers to assume most of the risk by paying more money every year.

Consequences of Driving Without Car Insurance in Arizona

In order to register a vehicle or renew the registration, drivers in Phoenix need to present the Department of Motor Vehicles with proof of mandatory liability coverage.

Drivers must carry the proof inside their vehicles when they are driving so it will be available if they are ever stopped because of a moving violation. Being caught without proof of insurance can lead to fines, license suspension, higher car insurance rates, and even jail time.

Scott W. Johnson Licensed Insurance Agent

People who can’t provide proof of insurance when they are stopped will have their licenses suspended. It will be much more difficult to find cheap car insurance for drivers with suspended licenses. Reinstating a license also requires fees that can amount to $10 or even be as high as $200.

Make sure to check the car insurance laws and make sure you are properly obeying them.

Best Car Insurance Coverage Options in Phoenix, AZ

Car insurance companies in Phoenix, AZ, sell insurance to meet several different obligations for making repairs after an accident.

Liability coverage is required for a Phoenix policy, but several other types of optional insurance are also good ideas for drivers in Phoenix to purchase.

Liability coverage is not for the policyholder’s vehicle — it only covers damage and injuries you cause.

Drivers who cause accidents will have nothing for their own bodily injuries and car repair bills if they only have liability.

In this case, they can purchase several other types of auto insurance including:

- Personal Injury Protection (PIP): This pays for doctor’s visits, hospital bills, and lost wages.

- Collision: This pays to fix the policyholder’s car or purchase a new one if it’s totaled in a collision.

- Comprehensive: This pays to fix the policyholder’s vehicle damaged in a way other than through collision.

- Uninsured Motorist Bodily Injury: This pays medical bills when hit by a motorist without insurance.

- Underinsured Motorist Bodily Injury: This pays bills if you’re hit by a motorist who doesn’t have enough insurance.

The best types of car insurance coverage for you depends on your vehicle. If you have a new or expensive vehicle, full coverage including everything listed above might be best. If your car is older, you can save with minimum insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Get the Best Phoenix, AZ Car Insurance Today

Comparing car insurance quotes is not something that people only need to do once. A good time to compare rates is when insurance companies raise your insurance — you can compare multiple car insurance quotes online for free easily to find the best coverage.

Another time that everyone needs to see if another insurance company can offer them better rates is about four weeks before their current insurance policies are about to expire.

Take your current coverage and compare it to the rates that other companies will offer for the same exact coverage.

We can help you save money by comparing and finding cheap rates for car insurance for you! Enter your ZIP code today and start saving.

Frequently Asked Questions

What factors can affect car insurance rates in Phoenix, AZ?

Understanding your car insurance policy in Arizona is usually simple. Car insurance rates in Phoenix, AZ can be influenced by various factors, including your driving record, age, gender, type of vehicle, annual mileage, credit history, coverage limits, deductible amount, and the insurance company’s pricing structure.

Are car insurance rates higher in Phoenix, AZ compared to other cities?

Car insurance rates can vary from city to city, and while Phoenix, AZ may have its own unique factors, such as higher population density or specific risks, it’s important to compare rates across multiple locations to get an accurate comparison.

Are car insurance rates in Phoenix, AZ higher or lower than the national average?

Car insurance rates in Phoenix, AZ may vary compared to the national average. While it’s difficult to generalize, factors such as population density, traffic congestion, and local risks can impact insurance rates in a specific area. It’s recommended to compare local rates to the national average to assess the relative cost.

How can I find the best car insurance rates in Phoenix, AZ?

To find the best car insurance rates in Phoenix, AZ, consider these steps:

- Shop around and obtain quotes from multiple insurance companies.

- Keep your driving record clean. If you do get points on your license, learn how to get rid of car insurance points.

- Compare coverage options and policy features.

- Check for discounts you may be eligible for.

- Review customer reviews and ratings of insurance providers.

- Consider working with an independent insurance agent who can help you find competitive rates.

Are there any specific insurance companies known for offering competitive rates in Phoenix, AZ?

Specific insurance companies known for offering competitive rates in Phoenix, AZ can vary based on individual circumstances. It’s advisable to consider well-established insurance providers that operate in the area and have a good reputation for customer service and competitive pricing.

Examples of such companies may include Allstate, Farmers Insurance, Geico, Progressive, and State Farm.

Are there any discounts available to lower car insurance rates in Phoenix, AZ?

Yes, several discounts may be available to help lower car insurance rates in Phoenix, AZ. These can include safe driving discounts, multi-policy discounts, good student discounts, discounts for certain vehicle safety features, low-mileage car insurance discounts, and more. It’s worth checking with your insurance provider to see which discounts you may qualify for.

How else can I lower my car insurance rate in Phoenix, AZ?

In addition to inquiring about available discounts, other common strategies include maintaining a clean driving record, bundling insurance policies with the same provider, and increasing deductibles.

What are the minimum insurance requirements in Arizona?

Arizona requires a 25/50/15 liability plan. In Arizona, you only need liability — extra coverage like collision coverage or comprehensive insurance are not required by law.

Is it illegal to drive in Arizona without car insurance?

Yes, Arizona state law requires all drivers to carry insurance before driving on a public road. Failure to carry enough insurance can result in fines, vehicle impoundment, license suspension, and even jail.

Is it cheaper to insure a car in Arizona or California?

Although rates vary, drivers in Arizona typically pay less for their insurance than Californians. However, you should always compare rates to find the best prices no matter where you live. Enter your ZIP code into our free tool to see how much your insurance might cost.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laura Berry

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Former Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.