Best Lincoln Car Insurance Rates in 2025 (Compare the Top 10 Companies)

State Farm, Geico, and Progressive have the best Lincoln car insurance rates. With prices starting at $78 per month, Lincoln drivers will appreciate the high-quality luxury car insurance these companies offer. Get the lowest Lincoln insurance quotes by finding discounts and enrolling in a UBI program.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jun 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Lincoln

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Lincoln

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Lincoln

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Lincoln car insurance rates come from State Farm, Geico, and Progressive.

State Farm is our top pick for affordable Lincoln car insurance. While you should always learn how to compare multiple free car insurance quotes, State Farm usually offers the cheapest Lincoln auto insurance quotes.

Our Top 10 Company Picks: Best Lincoln Car Insurance Rates

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Many Discounts | State Farm | |

| #2 | 15% | A++ | Cheap Rates | Geico | |

| #3 | 10% | A+ | Online Convenience | Progressive | |

| #4 | 12% | A+ | Add-on Coverages | Allstate | |

| #5 | 15% | A | Customizable Polices | Liberty Mutual |

| #6 | 19% | A | Local Agents | Farmers | |

| #7 | 17% | A+ | Usage Discount | Nationwide |

| #8 | 12% | A++ | Military Savings | USAA | |

| #9 | 15% | A+ | 24/7 Support | Erie |

| #10 | 13% | A | Student Savings | American Family |

Read through Lincoln auto insurance reviews below to find the perfect luxury car insurance for your car. Then, enter your ZIP code into our free comparison tool to see how much you might pay.

- As luxury cars, Lincolns come with higher average insurance rates

- Most Lincoln owners buy more than minimum coverage to keep their cars protected

- State Farm and Geico have the best Lincoln coverage

- Compare Lincoln Car Insurance Rates

- Best Lincoln Navigator Car Insurance in 2025 (Find the Top 10 Companies Here)

- Best Lincoln MKZ Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Car Insurance for Lincoln Town Cars in 2025 (Top 10 Companies Ranked)

- Best Lincoln MKX Car Insurance in 2025 (Check Out the Top 10 Companies)

- Best Lincoln Mark LT Car Insurance in 2025 (Top 10 Companies Ranked)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Multi-Policy Discounts: Get significant savings on State Farm auto insurance quotes for Lincolns by insuring multiple vehicles or bundling home insurance.

- Customizable Policies: State Farm offers a variety of ways to customize your policy to get the perfect auto insurance for Lincolns.

- Strong Customer Service: State Farm reviews usually mention high customer satisfaction and claims processing efficiency. Read more about what customers say in our State Farm car insurance review.

Cons

- Limited Luxury Coverage: State Farm’s options for tailored coverage for luxury features may be limited.

- Discount Restrictions: Some State Farm discounts have strict restrictions. For example, discounts for low mileage may not apply to frequent drivers.

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Base Rates: Geico makes its mark as having some of the best Lincoln insurance quotes by offering affordable premiums.

- Good Driver Discounts: Earn substantial savings for being a safe driver with Geico’s good driver discount. Explore all of Geico’s 16 discounts in our Geico car insurance review.

- Digital Tools: Geico offers convenient online tools and a mobile app for managing policies and claims.

Cons

- Repair Shop Restrictions: Geico’s preferred repair shops might not specialize in Lincoln vehicles.

- Policy Customization: There are fewer options for customizing coverage for high-end Lincoln features with Geico coverage.

#3 – Progressive: Best for Digital Insurance Options

Pros

- Snapshot Program: Save up to 30% on your insurance with Progressive’s usage-based insurance (UBI) program, Snapshot. See how Snapshot works in our Progressive car insurance review.

- Variety of Discounts: Progressive offers 13 discount options, including multi-car and continuous insurance discounts.

- Comprehensive Online Tools: Use Progressive’s robust digital tools to manage your Lincoln insurance.

Cons

- Mixed Customer Service Reviews: Progressive provides inconsistent experiences as reported by customers.

- Claims Process: Some Lincoln owners report slower claims processing times.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best UBI Savings

Pros

- New Car Replacement: New car replacement coverage from Allstate replaces totaled Lincolns with a new car of the same make and model.

- Safe Driving Rewards: Lower your Lincoln car insurance quotes with Allstate’s discount for maintaining a good driving record.

- Drivewise and Milewise: Allstate offers two telematics programs — Drivewise and Milewise. Drivewise offers a discount of up to 40% for safe driving, while Milewise is a low-mileage plan.

Cons

- Higher Rates: Allstate is often more expensive than competitors. Check out our Allstate car insurance review to learn more about Lincoln insurance prices.

- Mixed Claims Satisfaction: Customers report varying levels of satisfaction when it comes to Allstate’s claims handling.

#5 – Liberty Mutual: Best Selection of Coverage Options

Pros

- Customized Coverage: Liberty Mutual offers tailored policies for high-end Lincoln features.

- New Car Replacement: Purchase new car replacement coverage to ensure you get a new car if your Lincoln is totaled.

- Accident Forgiveness: Liberty Mutual will forgive your first at-fault accident and not increase your rates when you purchase this add-on. Explore all your add-on options in our Liberty Mutual car insurance review.

Cons

- Customer Service: Many drivers leave Lincoln insurance reviews that report inconsistent levels of customer service from Liberty Mutual.

- Average Rates: Liberty Mutual isn’t the most expensive option for coverage, but it also doesn’t have the cheapest Lincoln car insurance either.

#6 – Farmers: Best for Mechanical Breakdown Coverage

Pros

- Mechanical Breakdown Coverage: Buy this Farmers add-on for help covering the cost of repairs for Lincoln vehicles.

- Generous Discounts: Farmers offers 23 discounts to help you find cheap Lincoln car insurance. Explore all your discount opportunities in our Farmers car insurance review.

- Customizable Policies: Farmers offers flexibility in tailoring policies to get Lincoln MKC auto insurance and coverage for other models.

Cons

- Higher Premiums: Farmers is usually an affordable option, especially if you’re looking for cheap Lincoln MKT town car car insurance. However, sometimes rates can be much higher.

- Complex Discount Eligibility: Some Farmers discounts have stringent eligibility criteria, which makes it harder to save on Lincoln MKS auto insurance and coverage for other models.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible: Earn deductible decreases with every year of safe driving, up to $500 off.

- Multi-policy Discounts: Get significant savings when you bundle insurance policies. Check all of Nationwide’s car insurance discounts to see how you can save.

- Strong Financial Stability: Nationwide’s high rating of A+ from A.M. Best means you’ll have reliable claims payments and company stability.

Cons

- Limited Discounts: Although it offers affordable Lincoln automobile insurance, Nationwide lacks the large selection of discounts other companies have.

- Coverage Limitations: Certain high-end Lincoln features might not be covered under basic Nationwide policies.

#8 – USAA: Best for Active or Retired Military Members

Pros

- Affordable Prices: USAA offers some of the lowest prices in the insurance market. See how they consistently offer cheap coverage in our USAA car insurance review.

- Superior Customer Service: High satisfaction ratings and efficient claims processing make USAA one of the best choices for car insurance.

- Comprehensive Coverage Options: USAA offers a wide range of coverage options tailored to Lincolns.

Cons

- Eligibility Restrictions: You need to be a member to buy USAA car insurance, and only active/retired military members and their families can become members.

- Limited Local Offices: USAA has fewer physical locations for in-person assistance.

#9 – Erie: Best Customer Service Provider

Pros

- Comprehensive Coverage: Whether you need Lincoln Continental car insurance or MKC coverage, Erie’s insurance options offer enough coverage for luxury cars.

- Rate Lock: Purchase this affordable add-on to prevent premium increases unless changes are made to the policy.

- Customer Service: Erie has a well-earned reputation for offering stellar customer service. See how Erie offers a personalized insurance experience in our Erie car insurance review.

Cons

- Regional Availability: Erie currently sells insurance in just 12 states, mostly on the eastern seaboard.

- Limited Online Tools: Erie has fewer digital tools and online services compared to competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Fast Claims Processing

Pros

- Bundling Discounts: American Family offers 18 discounts to choose from, but you can get special savings when bundling policies.

- Costco Policies: Warehouse members can save on their auto insurance by purchasing a policy from Costco, which is managed by American Family.

- Claims Processing: American Family consistently gets good reviews for how quickly it resolves claims.

Cons

- Limited Availability: American Family is only available in 19 states. See if you can buy coverage in our American Family car insurance review.

- Coverage Gaps: Some Lincoln-specific features might not be fully covered under standard American Family policies.

Finding Affordable Lincoln Car Insurance Rates

While the average driver pays about $156 a month for Lincoln car insurance, the exact amount you’ll pay depends on several factors.

Brand-new Lincolns usually cost more to insure than older models. Your insurance rates will also depend on whether or not you purchase full coverage. Minimum coverage insurance might suit you better if your car is older, but it won't offer your Lincoln much protection.

Kristen Gryglik Licensed Insurance Agent

Below is a table comparing full coverage and minimum coverage rates from a few different companies.

Lincoln Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $91 | $191 |

| American Family | $99 | $192 |

| Erie | $94 | $179 |

| Farmers | $89 | $178 |

| Geico | $98 | $198 |

| Liberty Mutual | $96 | $183 |

| Nationwide | $81 | $171 |

| Progressive | $86 | $175 |

| State Farm | $78 | $195 |

| USAA | $85 | $187 |

Your rates will also change based on the model you drive. Although you’ll pay higher insurance rates, Lincolns are usually more affordable than other luxury brands. For example, by comparing Porsche car insurance, we found that drivers pay about 30% more than they would for Lincoln coverage.

How Coverage Levels Affect Lincoln Car Insurance Rates

Since Lincolns are luxury cars and Lincoln car costs match, owners usually want to buy the utmost protection. Full coverage costs more than minimum insurance, but the extra protection for your Lincoln is usually worth it. Even older, used Lincoln owners should consider buying additional coverage to protect their top-notch vehicles.

This blue, we can’t take our eyes off of you. 😍🩵 What would you name this classic Lincoln? #TBT pic.twitter.com/1CnVTu2WiH

— Lincoln (@LincolnMotorCo) May 16, 2024

Before you decide how much coverage to buy, you should understand what the different types cover. For example, liability is required by most states, and you can often compare liability car insurance rates to see which company offers the lowest prices. Learn about the basic types of insurance below:

- Bodily Injury Liability: Your bodily injury liability insurance covers injuries you cause to other drivers, their passengers, and bystanders in an at-fault accident.

- Property Damage Liability: The second half of liability insurance covers damage you cause to other people’s property, including cars and buildings.

- Collision Coverage: Liability insurance does not cover your car after an at-fault accident. If you want help with your car repairs, you’ll need collision insurance. You can learn about what collision insurance covers here.

- Uninsured/Underinsured Motorist: Just because most states require insurance doesn’t mean everyone follows the law. Uninsured motorist insurance protects you from drivers without enough coverage.

- Medical Payments/Personal Injury Protection: Health care bills can get expensive quickly after an accident. If you add medical payments or personal injury protection insurance, your healthcare expenses will be covered after an at-fault accident.

- Comprehensive Coverage: If your car is damaged by fire, floods, theft, vandalism, animals, or extreme weather, comprehensive insurance will pay for your repairs. Comparing comprehensive car insurance across various insurance companies can show you the average market prices.

Many Lincoln drivers choose to increase the coverage on their policy beyond the basic types. Most companies offer add-ons so drivers can customize their policies. While the add-ons you can buy will depend on the company you shop with, popular choices include rental car reimbursement, roadside assistance, and gap insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Other Factors Affecting Lincoln Car Insurance Rates

When you shop for Lincoln car insurance, the following factors will affect your insurance rates:

- Driving History: Your driving record plays a crucial role in your insurance rates. Drivers with clean records pay less than those with speeding tickets or at-fault accidents.

- Credit Score: Unless you live in Massachusetts, Hawaii, or California, insurance companies can use your credit score to determine your rates. Drivers with higher credit scores pay less for insurance.

- Age and Gender: Men and young drivers are more likely to drive recklessly, get into accidents, and file other claims, so they pay more for insurance.

- Marital Status: Married people file fewer claims than single, divorced, and widowed people, so they usually pay a little less for their car insurance.

- Location: Some states pay more for car insurance than others, primarily because they have higher traffic or crime rates, extreme weather risks, or more accidents.

Lincoln might be a luxury brand, but the same factors affect its car insurance as those affecting coverage for standard vehicles, including the model you drive. The type of car you drive significantly impacts your car insurance rates, and you’ll find that Lincoln Navigator car insurance rates are more expensive than the smaller MKX and MKC models.

Tips to Find the Cheapest Lincoln Car Insurance Rates

As luxury cars, Lincolns usually have much higher insurance rates than standard vehicles. You don’t have to settle for the first price you see, however — use the tips below to find the lowest Lincoln auto insurance payments possible:

- Practice Safe Driving: The safer you drive, the less likely you will pay higher insurance rates. Speeding tickets, reckless driving charges, and DUIs can double and sometimes triple your rates.

- Raise Your Deductible: Your deductible is the portion you must pay after a claim before your insurance kicks in. Choosing a large deductible will lower your rates, but you’ll have to pay more if you need to make a claim.

- Keep Your Car Safe: If you park your Lincoln in a safe spot every night, you’ll likely pay less for insurance. Lincolns also come with excellent safety features, which help keep your rates down.

- Enroll in Telematics: Finding the best usage-based insurance companies can help low-mileage, safe drivers save. If you drive late at night or regularly speed, you should probably skip usage-based insurance.

- Look for Discounts: You should look at how many discounts a company offers before you sign up. Some of the best discounts to find are for being a safe driver, bundling policies, and paying for your entire policy at once.

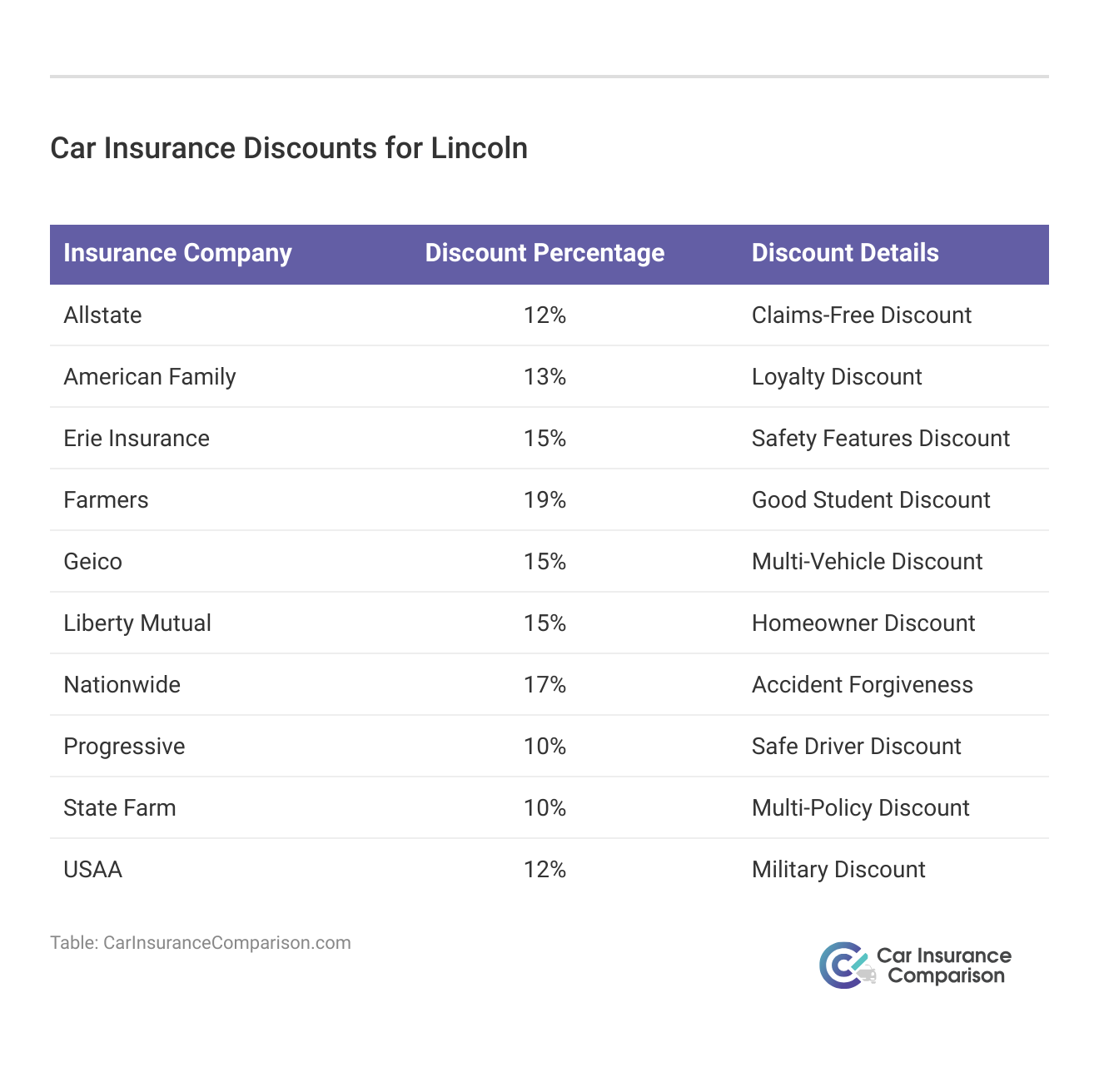

One easy way to find affordable car insurance for Lincolns is to find discounts. Most companies offer at least a few ways to save on your insurance, and finding a company that offers savings you qualify for is crucial. Take a look below to see a few discounts our top companies offer.

Since luxury cars have higher insurance rates, finding the right company is vitally important. Although companies like Geico, State Farm, and Progressive are usually the cheapest companies on the market, you might find lower rates elsewhere. To figure out how much you might pay for your insurance, you can fill out quote request forms on the websites of companies you’re interested in.

If that sounds too time-consuming, you can always use a quote comparison tool to compare multiple rates at the same time.

Find the Cheapest Lincoln Car Insurance Rates Today

Lincolns offer drivers a luxury ride at prices a bit more affordable than many of its competitors. Since Lincolns usually have low repair and replacement costs, you’ll probably see affordable car insurance rates. While Lincoln rates tend to be low, you can always find better prices by finding car insurance discounts, choosing the right coverage, and comparing quotes.

Comparing quotes is one of the most important ways to keep your insurance rates low. Lincolns deserve the best coverage possible, and comparing quotes is the only way to find it. Enter your ZIP code into our free comparison tool below to start browsing Lincoln auto insurance quotes today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are Lincolns expensive to insure?

Compared to the national average, Lincoln car insurance rates are more expensive but still cheaper than other luxury brands.

Why are Lincolns so expensive to insure?

Whether Lincoln insurance is expensive depends on your point of view. Lincolns cost more to insure than standard coverage, but they tend to be more affordable than comparable luxury brands.

Should you get classic car insurance for a Lincoln?

If your Lincoln is at least 20 years old, classic car insurance may be the best choice for you. While you should always do a classic car insurance comparison to make sure it would fit your Lincoln, the best classic car insurance companies offer unique coverage options for older Lincolns.

Which company offers the most affordable Lincoln car insurance rates?

The company with the cheapest insurance for your Lincoln depends on several factors. State Farm, Geico, and Progressive are often the cheapest options for insurance, but you’ll need to compare quotes to be sure.

Which companies have the best Lincoln car insurance rates?

The companies with the best Lincoln car insurance rates are State Farm, Geico, and Progressive. However, you might find that a different company has cheaper rates for you. Enter your ZIP code into our free comparison tool to find which company has the lowest rates for you.

Is the Lincoln Continental expensive to insure?

Since Lincoln discontinued sales of the model, Lincoln Continental car insurance rates are relatively low, especially if you compare car insurance rates across the U.S.

Why is Lincoln discontinuing the MKZ?

Lincoln discontinued the MKZ in the U.S. in 2020 due to decreased sales, and you could get lower Lincoln MKZ car insurance rates driving an older model.

Are Lincolns expensive to maintain?

Compared to standard vehicles, Lincoln will cost more to maintain due to its luxury status. However, the maintenance cost of a Lincoln is cheaper than European luxury makes like BMW and Audi, which leads to cheaper insurance rates.

Are there any Lincoln car insurance discounts?

Yes, there are various discounts that may be available for Lincoln car insurance. Common discounts include:

- Multi-Policy Discount: Bundling your Lincoln car insurance with other policies, such as home or renters insurance, can lead to discounted rates.

- Safe Driver Discount: Maintaining a clean driving record with no accidents or traffic violations may qualify you for lower premiums.

- Anti-Theft Device Discount: Installing anti-theft devices in your Lincoln can help lower insurance rates.

- Good Student Discount: If you’re a student with good grades, you may qualify for a discount on your car insurance. The best car insurance companies for students can help you find affordable Lincoln insurance.

- Mature Driver Discount: Older drivers who have completed a defensive driving course may be eligible for discounted rates.

Most discounts apply automatically to your account when you sign up, but a representative can always double-check that you’re getting every savings you qualify for.

What luxury brands have the cheapest car insurance rates?

Lincoln, along with Lexus, MINI, and Volvo, all have lower car insurance rates than comparable luxury brands like Cadillac and Mercedes.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.