Texas Farm Bureau Car Insurance Review for 2025 [See Ratings & Cost Here!]

Texas Farm Bureau offers auto insurance from $42 per month, including liability, collision, comprehensive, PIP, and uninsured motorist coverage. Read our Texas Farm Bureau review to see how their local service and exclusive Drive’n Save app help Texas drivers save more with local, personalized support.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Texas Farm Bureau

Monthly Rates:

$42A.M. Best Rating:

AComplaint Level:

LowPros

- Benefits for Texas residents

- Discounts for bundling with a homeowners policy

- Excellent customer service

Cons

- Lack of add-on coverages to make policies customizable

- A lack of clear information on the company website

Explore our Texas Farm Bureau car insurance review shows rates starting at $42 per month, with prices based on age, driving history, and location.

The company offers essential coverages like liability, collision, comprehensive, personal injury protection, and uninsured motorist. Compare car insurance by coverage type to find the best option for you.

Texas Farm Bureau Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.0 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.9 |

| Customer Satisfaction | 3.9 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Founded in 1952, Texas Farm Bureau Insurance is a Texas-based company that helps local families be prepared to rely on dependable, personalized insurance and support during life’s unexpected turns.

- Texas Farm Bureau car insurance review shows rates starting at $42 per month

- Offers core coverages including liability, collision, and comprehensive

- Personalized service based on Texas drivers’ needs from local agents

Texas Farm Bureau is widely known for local service and high satisfaction. You can also enter your ZIP code into our free comparison tool to get a personalized auto insurance quote today.

Texas Farm Bureau Car Insurance Cost

Texas Farm Bureau Insurance, supported by affiliated company Texas Farm Bureau Mutual Insurance Company, provides dependable, personalized coverage tailored to meet the unique needs of Texans. Texas Farm Bureau car insurance rates vary by age, gender, and coverage level, with younger drivers, like 16-year-old males, paying the highest premiums.

Texas Farm Bureau Car Insurance Monthly Rates

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $110 | $200 |

| 16-Year-Old Male | $120 | $215 |

| 18-Year-Old Female | $95 | $180 |

| 18-Year-Old Male | $105 | $195 |

| 25-Year-Old Female | $65 | $125 |

| 25-Year-Old Male | $75 | $135 |

| 30-Year-Old Female | $58 | $110 |

| 30-Year-Old Male | $62 | $120 |

| 45-Year-Old Female | $50 | $95 |

| 45-Year-Old Male | $110 | $150 |

| 60-Year-Old Female | $45 | $85 |

| 60-Year-Old Male | $50 | $90 |

| 65-Year-Old Female | $42 | $80 |

| 65-Year-Old Male | $45 | $85 |

This reflects average car insurance rates by age and gender, where younger drivers face higher costs due to increased risk.

Age and gender affect rates since young male drivers are seen as higher risk. For example, drivers under 25 can lower costs by completing a defensive driving course.

Justin Wright Licensed Insurance Agent

An auto quote provides a personalized estimate using factors like your driving history and past insurance, helping you understand potential costs before purchasing coverage.

Texas Farm Bureau offers some of the most competitive monthly rates across all credit tiers compared to top national insurers.

Texas Farm Bureau Car Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $135 | $165 | |

| $98 | $117 | $150 | |

| $105 | $125 | $160 | |

| $88 | $105 | $140 | |

| $112 | $140 | $172 |

| $99 | $120 | $148 |

| $95 | $115 | $150 | |

| $92 | $110 | $138 | |

| $87 | $102 | $130 | |

| $80 | $95 | $125 |

Starting with competitively low rates of $87 for good credit and $130 for poor credit, it consistently outperforms larger providers like Allstate, Progressive and Liberty Mutual. This comparison demonstrates how your credit score can affect premiums and indicates why you should get a Texas Farm Bureau auto insurance quote to save potentially hundreds of dollars on premiums.

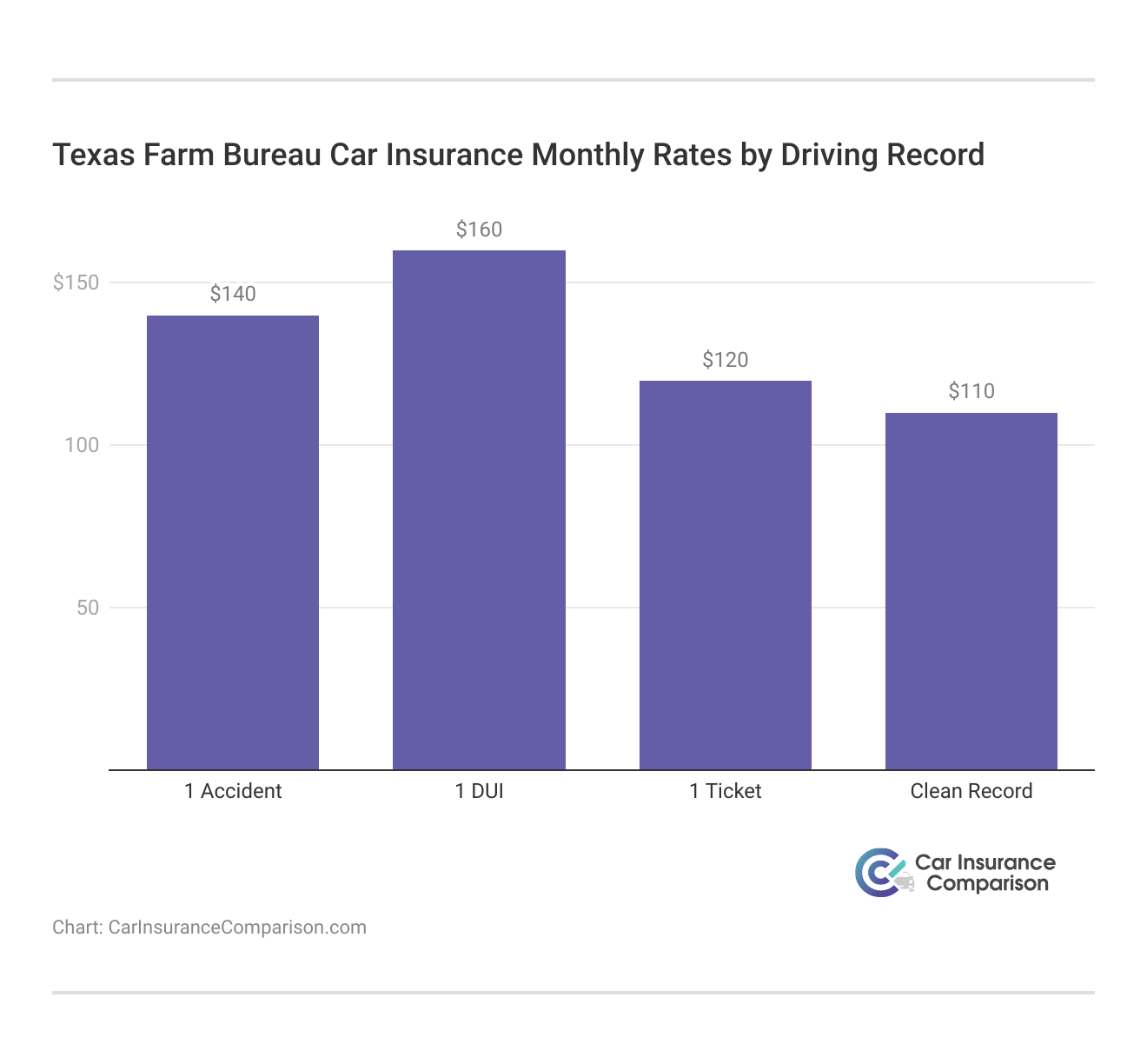

Texas Farm Bureau car insurance monthly rates are influenced significantly by your driving record. Drivers with a clean record receive the most affordable premiums, while those with a history of accidents, tickets, or a DUI can expect higher costs.

For example, best full coverage car insurance rates increase significantly after an accident or DUI. Understanding how your record affects pricing helps you estimate premiums and make informed coverage choices.

Texas Farm Bureau Insurance offers competitive monthly rates, starting at $87 for minimum coverage and $148 for full coverage, consistently beating major providers like Allstate and Liberty Mutual. Compare monthly car insurance to see how much you can save with Texas Farm Bureau.

Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $110 | $180 | |

| $98 | $165 | |

| $105 | $175 | |

| $88 | $155 | |

| $112 | $185 |

| $99 | $170 |

| $95 | $165 | |

| $92 | $160 | |

| $87 | $148 | |

| $80 | $145 |

Texas Farm Bureau is a smart option for cost-conscious drivers, as this side-by-side comparison shows how they can offer affordable options without compromising coverage.

Whether you want basic protection or full coverage, these rates show that it’s worth getting a Texas Farm Bureau auto insurance quote.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Texas Farm Bureau Car Insurance Discounts & Other Ways to Save

Texas Farm Bureau provides multiple car insurance discounts to help reduce premiums, including a bundling discount of up to 25%.

Texas Farm Bureau Car Insurance Discounts

| Discount | |

|---|---|

| Multi-Vehicle | 25% |

| Safe Driver | 20% |

| Bundling | 20% |

| Accident-Free | 20% |

| Good Student | 15% |

| Defensive Driving | 10% |

| Low Mileage | 10% |

| Anti-Theft | 10% |

| Driver's Ed | 10% |

| Membership | 5% |

As one of the best companies for bundling home and car insurance, you can save more by combining auto and home coverage, along with discounts for safe driving and accident-free records.

The Drive’n Save App helps you save even more by tracking your driving habits and rewarding you with discounts for safe behavior behind the wheel. There are several smart strategies that can help you save more on your premiums. Here are some of the best ways to maximize your discounts:

- Bundle Policies: Save on your insurance with bundling discounts up to 25%, and enjoy streamlined service with auto and home insurance in one policy.

- Maintain a Clean Driving Record: Texas Farm Bureau offers lower rates to drivers with no accidents or violations, making safe driving a smart way to save.

- Use the Drive’n Save App: Enroll in Texas Farm Bureau’s telematics program to get personalized discounts based on your real-time driving behavior.

- Take Driver Safety Courses: Texas Farm Bureau offers discounts for drivers who complete defensive driving or young driver training programs.

- Improve Your Credit Score: Like most insurers, Texas Farm Bureau uses credit as a rating factor—better credit often means lower monthly rates.

Students and young drivers can benefit from good student and driver training discounts, while other savings are available for low mileage, anti-theft devices, and active Texas Farm Bureau membership.

These discount opportunities make Texas Farm Bureau an affordable and rewarding choice for Texas drivers.

Texas Farm Bureau Car Insurance Coverage Options for Drivers and Vehicles

Texas Farm Bureau Insurance provides customizable, reliable auto insurance coverage with premiums to fit your needs as a Texas driver.

- Liability Coverage: Protects against the financials of bodily injury or property damage to others in an accident you cause.

- Personal Injury Protection (PIP): Helps pay for medical and non-medical expenses for you and your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance, covering injuries and property damage.

- Medical Payments Coverage: Covers necessary medical expenses that are incurred by you and your guests due to an auto accident.

- Death Indemnity Coverage: Provides financial compensation to your family in the event of a fatal accident involving you or a covered family member.

Whether you’re looking for protection for yourself, your passengers, or your vehicle, the available coverages provide peace of mind on and off the road.

- Collision Coverage: Covers damage to your car from collision with another vehicle or object.

- Comprehensive Coverage: Covers non-collision damage like theft, vandalism, fire, hail, or falling objects.

- Rental Coverage: Assists with expenses for a rental car while your car is being repaired after a covered loss.

- Roadside Assistance Coverage: Provides help if your vehicle breaks down due to reasons like a flat tire, dead battery, or lockout.

With flexible options and dedicated local agents, Texas Farm Bureau Insurance ensures that you’re not only covered but also supported every step of the way.

From basic coverages to extra conveniences, these policies were designed for Texas drivers. Without a good understanding your car insurance policy, it can be hard to make sure you have the right coverage for how you drive.

Texas Farm Bureau Car Insurance Ratings, Reviews, and Customer Satisfaction

Texas Farm Bureau Insurance earns strong business ratings and positive consumer reviews across multiple trusted agencies. It holds an impressive J.D. Power score of 890 out of 1,000 for customer satisfaction and an A+ rating from the Better Business Bureau for excellent business practices.

Texas Farm Bureau Car Insurance Business Ratings and Consumer Reviews

| Agency | |

|---|---|

| Score: 890 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback |

|

| Score: 0.75 Fewer Complaints |

|

| Score: A Excellent Financial Strength |

Consumer Reports gives it a solid 78 out of 100, reflecting positive customer feedback, while the NAIC complaint index of 0.75 indicates fewer complaints than the industry average. With an A rating from A.M. Best, Texas Farm Bureau also demonstrates strong financial stability and reliability.

Texas Farm Bureau offers coverage options you would expect with any auto insurance policy, and the company does not offer many add-on options to customize your coverage. Still, Texas Farm Bureau has an exceptional reputation for customer service and satisfaction.

Comment

byu/NierStellar from discussion

inInsurance

The user shares a positive experience with Texas Farm Bureau car insurance, noting much lower rates compared to Allstate. They appreciated the smooth transition and cheap car insurance pricing after being dropped by their previous insurer, even without filing any claims.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Texas Farm Bureau Insurance Pros and Cons: Coverage, Discounts, Service

With a focus on the needs of Texans, Texas Farm Bureau Insurance provides coverage and service tailored to drivers and homeowners from the prairie to the border.

- Tailored for Texas Residents: Texas Farm Bureau Insurance is made for Texas with coverages designed for the state’s risks and regulations.

- Bundling Discounts: Customers can save by bundling auto insurance with other policies like homeowners insurance, making it a cost-effective choice for those with multiple coverage needs.

- Excellent Customer Service: The company is consistently recognized for its strong customer satisfaction, with high ratings from agencies like J.D. Power and the BBB, and praise for responsive, personalized service.

Texas Farm Bureau Insurance offers valuable bundling discounts and consistently earns praise for its customer support.

Bundle auto and home insurance with Texas Farm Bureau and use the Drive’n Save app to lower your rates based on safe driving habits.

Chris Tepedino Feature Writer

With a community-focused model, it is a top choice for independent and regional drivers who want personalized and local coverage solutions.

- Website Transparency: The company’s website provides scant information about policy features, and because it doesn’t support online quoting, it could prove tiresome to tech-savvy customers.

- Texas-Only Availability: Coverage is limited to residents of Texas, so it doesn’t provide options for those planning to move out of state or looking for multi-state coverage.

While Texas Farm Bureau Insurance excels in service and regional expertise, it may fall short for those needing coverage beyond state lines. To explore more options, compare car insurance rates by state for the best coverage.

For Texans seeking local support and tailored protection, though, it remains a reliable and reputable option.

Texas Farm Bureau Car Insurance: A Smart Choice for Affordable Rates

Texas Farm Bureau car insurance review features low beginning rates of $42, excellent local representative assistance, as well as helpful discounts for combining policies to save a lot more. Most personalized for Texas drivers, and well suited to cover a community.

However, limited digital tools, few customizable add-ons, and Texas-only availability may be drawbacks for some policyholders. Compare comprehensive car insurance options to see how Texas Farm Bureau stacks up against other providers and find the best coverage for your needs.

Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Texas Farm Bureau Insurance a good option for Texas drivers?

Yes, Texas Farm Bureau Insurance is highly rated for customer satisfaction, affordable rates, and personalized service tailored specifically for Texas residents.

What do customers highlight in Texas Farm Bureau group car insurance reviews?

Many of the reviews cite strong customer service, competitive pricing, and the advantages of working with local agents who know the needs of Texas drivers.

Compare insurance rates today by simply entering your ZIP code into our free comparison tool.

Do Texas Farm Bureau insurance reviews recommend it for young or high-risk drivers?

Reviews suggest that while rates can be higher for young or high-risk drivers, Texas Farm Bureau is one of the best car insurance for high-risk drivers. Discounts like safe driving programs and driver training can help lower costs over time.

Are Texas Farm Bureau membership dues mandatory to get insurance?

Yes, you must be a member of the Texas Farm Bureau to purchase insurance through Texas Farm Bureau Insurance.

Does the Farm Bureau Driveology review mention privacy concerns?

Some Farm Bureau Driveology review feedback notes privacy as a concern, as the program collects driving data, but Farm Bureau outlines how data is used and stored securely.

Is Farm Bureau Insurance expensive for young or new drivers?

Young drivers may face higher rates, but they can lower costs with the best car insurance discounts, like good student or driver training discounts.

Can I make policy changes over the phone with Texas Farm Bureau?

Yes, call 800-266-5458 to speak with a customer service agent who can assist with updates to your policy.

When does Texas Farm Bureau rental car coverage apply?

Rental car coverage only activates when your vehicle is in the shop for repair after a covered loss, like an accident or theft.

Can I use Texas Farm Bureau rental car discounts for personal travel or vacations?

Rental car discounts typically apply when your insured car is being repaired, not for personal or vacation rentals. For cheap rental car insurance, you may be able to add affordable coverage to your policy for rental cars.

How do I cancel my Texas Farm Bureau car insurance policy?

To cancel your policy, contact your local agent or call customer service. You may need to complete a cancellation form and submit it via email or fax.

Can I file a Texas Farm Bureau claim through a mobile app?

Currently, Texas Farm Bureau does not allow claims to be filed through a mobile app. Claims must be filed online or by phone.

Can I customize my full coverage policy with Texas Farm Bureau?

Yes, while customization is limited, you can add options like roadside assistance, best rental car reimbursement coverage, and medical payments coverage to enhance your policy and ensure you’re covered during repairs.

Is Texas Farm Bureau full coverage required by law in Texas?

No, full coverage is not legally required. Only liability insurance is mandatory in Texas, but full coverage is recommended for newer or financed vehicles.

How often is the Texas Farm Bureau Insurance rating updated?

The Texas Farm Bureau Insurance rating is updated annually to reflect any changes in financial strength, customer satisfaction, and business practices, ensuring accurate and current information.

What factors influence Texas Farm Bureau rates?

Texas Farm Bureau rates are influenced by factors that affect car insurance rates, including age, driving history, location, and coverage type. Younger male drivers typically face higher premiums due to perceived risk.

Do reviews for Texas Farm Bureau Insurance mention any drawbacks?

Texas Farm Bureau Insurance does not have the extensive quoting and online tools of other companies, according to some reviews. It only offers coverage in Texas, so out-of-state drivers have few alternatives.

Can I buy Texas Farm Insurance online without visiting an agent?

Yes, you can purchase Texas Farm Insurance online. However, if you prefer personalized assistance, you can always contact an agent to walk you through your coverage options.

Use our free quote comparison tool to find the cheapest coverage in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.