State Farm Car Insurance Review for 2025 [See if They’re a Good Fit]

Check our State Farm car insurance review for the difference between rates and coverage options. Rates start at $30/month for good drivers and excellent customer service. Our review covers competitor comparisons and factors like driving records to help you decide if State Farm meets your insurance needs.

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Apr 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Farm

Average Monthly Rate For Good Drivers

$30A.M. Best Rating:

A++Complaint Level:

LowPros

- Has the third-lowest average premium among the top 10 providers

- Consistently strong financial standing and solid rankings

- Customers have a variety of online options and an easy-to-use app

Cons

- Rates can be pricey depending on where you live

- Limited add-ons available

Use our State Farm car insurance review to explore rates starting at just $30/month for good drivers, along with comprehensive coverage options.

While State Farm excels in customer service and offers a wide variety of benefits, rates can vary based on factors like driving history, vehicle type, and location.

State Farm Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Business Reviews | 5.0 |

| Claim Processing | 4.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.5 |

| Policy Options | 3.8 |

| Savings Potential | 4.3 |

Learn more about State Farm’s discounts for safe driving and bundling, and how it compares to competitors in cost and coverage. Compare car insurance by coverage type to understand the differences in policies and determine if State Farm is the right choice for you.

Stop overpaying for car insurance. Enter your ZIP code into our free quote comparison tool, and we’ll give you quotes from the best providers in your area.

- Rates for good drivers start at $30/month with competitive coverage options

- Discounts available for safe driving and bundling policies with State Farm

- State Farm excels in customer service but may not be the best choice for all drivers

State Farm Insurance Car Insurance Cost

State Farm offers reliable customer service and a simple claims process nationwide. However, for cheap car insurance, it may not be the best choice for inexperienced drivers or those with poor driving records.

State Farm also doesn’t have some discounts available at competitors, such as for federal employees and green vehicles. The key to getting the best rates is comparing quotes based on your individual circumstances and budget.

State Farm Car Insurance Rates: How Age and Coverage Impact Premiums

State Farm’s car insurance rates depend on age, gender, and coverage level. This breakdown shows how premiums vary between minimum and full coverage for different age groups, with rates generally decreasing for drivers 30 and older. Use this guide to better understand State Farm’s rate structure and find the best full coverage car insurance option for your needs.

State Farm Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $124 | $311 |

| Age: 16 Male | $146 | $349 |

| Age: 18 Female | $101 | $229 |

| Age: 18 Male | $125 | $284 |

| Age: 25 Female | $39 | $101 |

| Age: 25 Male | $42 | $111 |

| Age: 30 Female | $36 | $94 |

| Age: 30 Male | $39 | $103 |

| Age: 45 Female | $33 | $86 |

| Age: 45 Male | $33 | $86 |

| Age: 60 Female | $30 | $76 |

| Age: 60 Male | $30 | $76 |

| Age: 65 Female | $33 | $84 |

| Age: 65 Male | $33 | $84 |

As you can see, young drivers tend to pay more for coverage. While 16-year-old males pay $349 for full coverage while their female counterparts pay $311.

As people age, their rates decrease; individuals aged 30 and above pay as low as $76 for full coverage, regardless of gender. The breakdown provided offers a clear overview of how premiums change with age and coverage type, helping to explain the cost differences among drivers.

To determine what coverage you need with State Farm, start by evaluating your driving habits, vehicle value, and location. For example, drivers in high-traffic areas may benefit from full coverage, which can cost around $100-$150 per month, compared to minimum coverage, which generally costs about $30 per month. The right choice depends on how much protection you need and the risks associated with your driving environment.

Daniel Walker Licensed Insurance Agent

Knowing how age and coverage type factor into your monthly premiums with State Farm will help you choose the best policy to suit your needs. Based on this rate table, you will gain a better understanding of how your demographic factors into the cost of your auto insurance. Be sure to compare coverage options and rates to find the best deal for your situation.

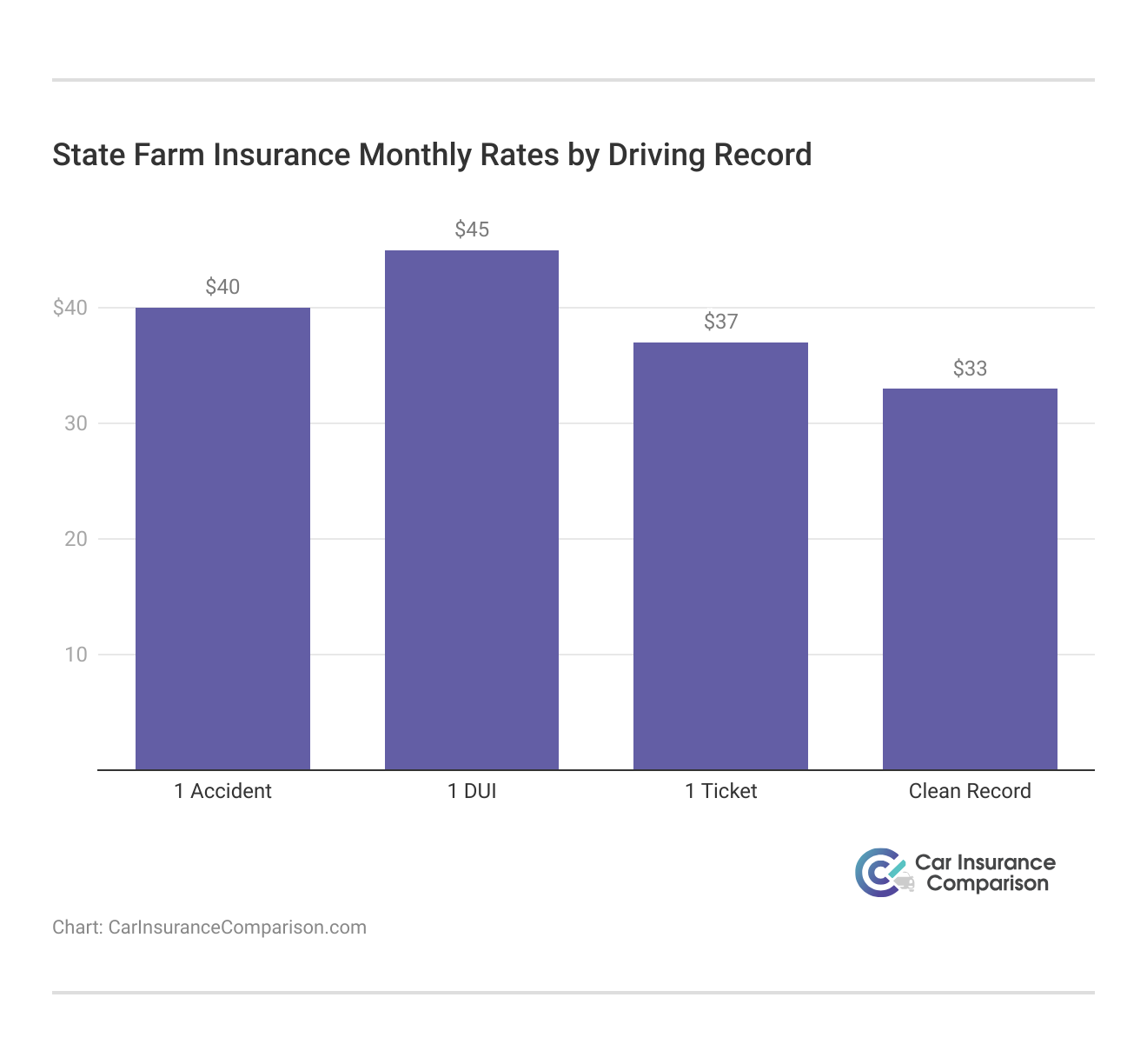

State Farm Rates by Driving History

The premium rates are lower for drivers with a clean record, while the rates are high for drivers with violations. A sure way to get cheap car insurance after a DUI is to compare the rates from several insurers.

This table shows State Farm’s monthly rates based on driving record, comparing premiums for minimum and full coverage. The drivers who have had a clean record, therefore, face the lowest rate inclusive of the ones with a case of DUI. This is telling of how driving history effects each different cost.

Knowing how your driving record affects car insurance is an important aspect in decision-making. Use this breakdown to understand how at-fault accidents or DUIs will increase rates, and a clean driving record will yield savings over time.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

State Farm vs. Top Competitors: Car Insurance Rates by Age & Gender for Drivers 16-18

This article compares State Farm’s rates with top competitors in the market, including major insurers like Geico, Allstate, and Progressive, for drivers aged 16 to 18. It highlights premium variations based on age and gender, helping you choose the best provider.

State Farm Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age 16 Female | Age 16 Male | Age 18 Female | Age 18 Male |

|---|---|---|---|---|

| $280 | $300 | $260 | $290 | |

| $260 | $280 | $250 | $270 | |

| $250 | $270 | $240 | $260 | |

| $230 | $250 | $220 | $240 | |

| $290 | $310 | $270 | $300 |

| $240 | $260 | $230 | $250 |

| $260 | $280 | $250 | $270 | |

| $250 | $270 | $240 | $260 | |

| $270 | $290 | $260 | $280 | |

| $220 | $240 | $210 | $230 |

This table compares monthly car insurance rates from State Farm with those of top competitors for drivers aged 16 to 18. It highlights premium differences by age and gender, helping you see how State Farm fares against providers like Geico, Allstate, and Progressive. Compare monthly car insurance rates to make the best decision for your coverage needs.

Keep this comparison in mind to understand how the rates from State Farm compare with other major insurers for young drivers. Take this home and find the best car insurance deal for your age and gender.

Essential Vehicle and Personal Protection Coverage for Your Car and Well-Being

Key car insurance coverages that protect your vehicle and well-being include vehicle protection and personal protection. Vehicle protection covers damages from accidents, theft, or even natural disasters. Personal protection covers medical expenses and other crucial costs, providing financial security when needed.

Vehicle protection covers the damages to your car, including collision, comprehensive, and uninsured motorist coverage that will keep you financially protected against any accidents, theft, or natural disasters.

- Collision Car Insurance: Provides coverage for repairs or replacement of your vehicle after an accident, regardless of who is at fault.

- Comprehensive Car Insurance: It basically covers the cost of damages to your vehicle when such damages are not considered a collision, such as storm damage, vandalism, hitting an animal, among many others.

- Emergency Road Service:This offers emergency roadside assistance for everyday problems to get you back on the road, covering things like flat tire changes, jump starts, fuel deliveries, and lockout.

- Rental Car Reimbursement Coverage: This pays for the cost of a rental car while your vehicle is being repaired from a covered loss, ensuring you remain mobile during the repair process.

- Mechanical Breakdown Coverage: Covers repairs for vehicle components that fail due to mechanical issues, excluding normal wear and tear or improper maintenance.

Understanding car accidents, personal protection is a type of car insurance coverage designed to safeguard you and your passengers in the event of an accident. Typically, this includes medical expenses, lost wages, and other necessary costs resulting from injuries sustained in a car accident, providing the support you need during such situations.

It typically includes medical payments coverage, personal injury protection (PIP), and other benefits to cover medical expenses, lost wages, and other related costs.

- Medical Payments Coverage: Covers medical payments for you and your passengers in the event of an accident, regardless of who’s at fault.

- Personal Injury Protection: Pays your medical expenses for you and passengers in your car, plus your funeral costs and lost wages, regardless of who is at fault.

- Umbrella Policy: Extends your liability coverage beyond the limits of your standard auto or home policies, offering additional protection for various types of claims.

You can protect your vehicle and health in case of any accident by adding both vehicle protection and personal protection coverage.

Whether you need coverage for vehicle repairs, roadside assistance, or medical expenses, these options offer peace of mind and financial security in a variety of scenarios.

State Farm Insurance Review: Customer Satisfaction, Business Practices, and Pricing Insights

State Farm Insurance business ratings and consumer reviews highlights various performance metrics. J.D. Power gives State Farm a score of 877/1,000 for above-average customer satisfaction, while Consumer Reports rates it 75/100 based on positive feedback.

State Farm Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: C- Below Avg. Business Practices |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: B Fair Financial Strength |

However, the BBB gives State Farm a C- for below-average business practices, and the NAIC reports more complaints than average with a score of 0.78. A.M. Best rates State Farm’s financial strength as fair with a B score.

If you’re searching State Farm Google reviews, Yelp users from Austin, TX, praise their comprehensive coverage and professional service. The user highlighted how State Farm provided better insurance at a more affordable price compared to Texas Farm Bureau, offering peace of mind with complete coverage for various risks like tree falls.

After switching to State Farm, I was impressed with their exceptional customer service and easy claims process, but my rates ended up being higher than anticipated because of my past driving history, making me realize the importance of comparing quotes regularly.

Chris Tepedino Feature Writer

State Farm scores well in customer satisfaction but faces challenges with business practices and complaints. While its financial strength is fair, bundling home and car insurance can help secure affordable rates. Consider your location and explore the best companies for bundling home and car insurance to make an informed choice.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

State Farm Car Insurance: Affordable Rates and Reliable Coverage

State Farm provide some of the lowest auto insurance quotes starting as low as $30/month for good drivers, and has superb customer service and easy claim process. It has wide coverage options, but rates can be variable based on your driving history, location and other factors that affect car insurance rates.

State Farm offers various discounts, such as multi-policy and safe driving savings, though it may not include some perks that competitors provide. While it has faced some challenges with its business practices, it continues to be a dependable option for many drivers. Be sure to compare quotes to find the best deal that suits your specific needs.

Finding affordable car insurance doesn’t have to be complicated. Just enter your ZIP code into our free comparison tool to uncover the lowest rates in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How much does State Farm car insurance cost on average?

The cost of State Farm car insurance varies widely depending on your driving history, vehicle, location, and coverage options. On average, good drivers might pay around $30 per month for a minimum coverage policy.

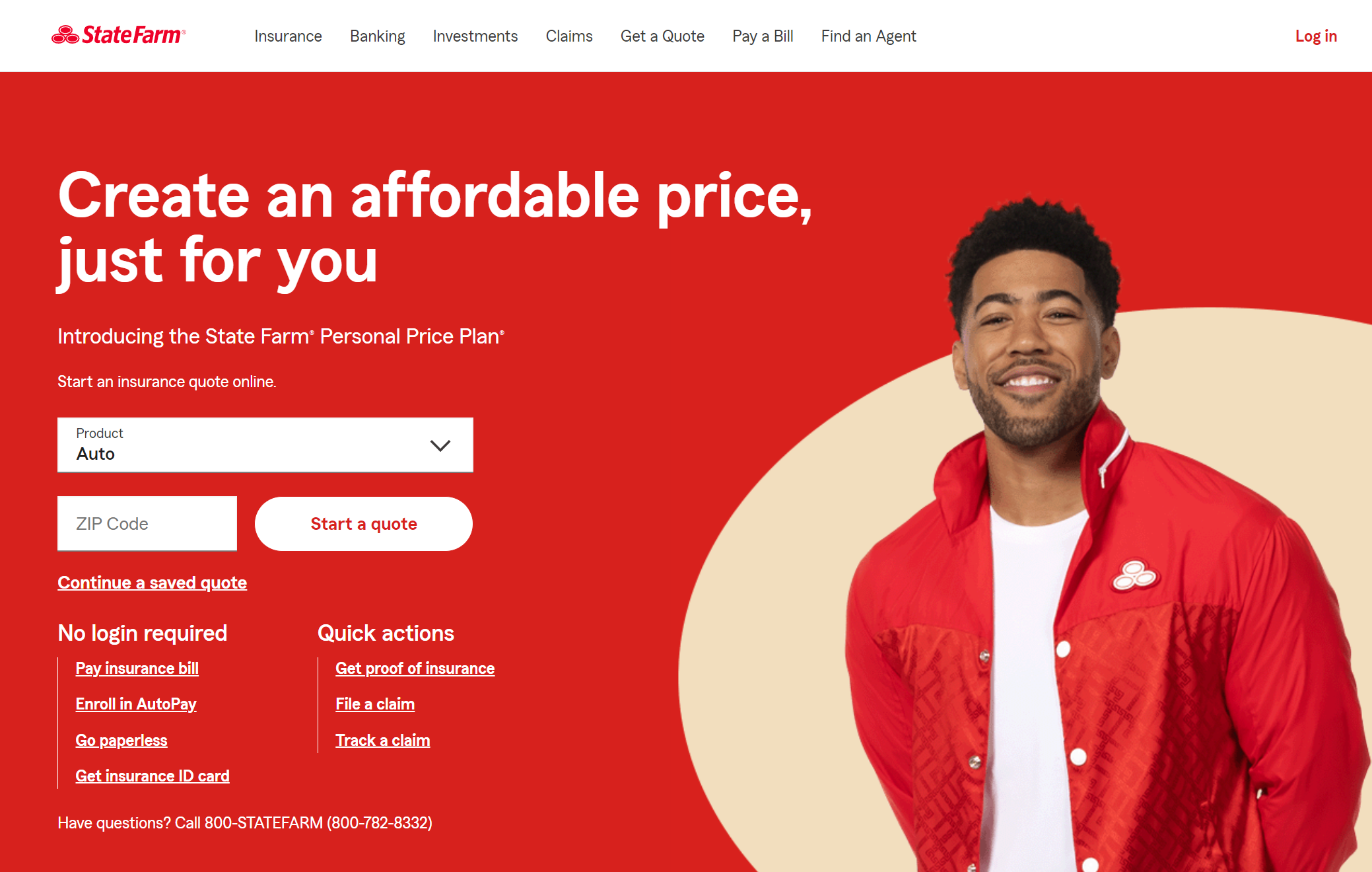

How can I get a State Farm auto insurance quote?

To get a free auto insurance quote with State Farm, you can either go through their site, pick up your phone and call a local agent, or download your app. To obtain an accurate quote, be prepared to provide information about your car, driving history and coverage preferences.

To find the best comprehensive car insurance quotes, just enter your ZIP code into our free comparison tool today.

What factors affect my State Farm auto insurance quote?

Your State Farm auto insurance quote is determined by your driving record, age, car type, and coverage level. The average car insurance rates by age and gender may also impact your premium, as younger drivers tend to be charged higher auto insurance rates. Safe driver and policy bundling discounts may also lower your quote even more.

Can I manage my State Farm insurance online?

Yes, State Farm offers an accessible online portal for you to manage your policy and pay bills, file claims, and more. You may also download their mobile app for more convenience.

How much does State Farm car insurance cost per month?

Like most car insurance carriers, State Farm rates are not set and adjust based on your driving history, age, state and selected coverage. Pricing will vary, but good drivers can expect to pay about $30 a month on average, so you should get a quote for a better idea of how much you can save.

Do State Farm employees receive discounts on car insurance?

Yes, State Farm employees may be eligible for special discounts on car insurance as part of their benefits package. These discounts, including some of the best car insurance discounts, can vary depending on the location and other company-specific factors.

What is the cost of full coverage insurance with State Farm?

The cost of full coverage insurance with State Farm depends on several factors, including your driving history, vehicle type, and location. On average, full coverage can range from $100 to $150 per month, but exact rates are best determined through a quote based on your specific details.

Will State Farm insure a car that isn’t in my name?

State Farm may insure a vehicle that is not registered in your name, but the policyholder must have insurable interest in the car. This typically means you need to have some financial stake in the vehicle, such as being a family member or having the car as part of a lease agreement.

What does comprehensive coverage from State Farm include?

State Farm’s comprehensive auto insurance covers non-collision incidents like theft, vandalism, weather damage, and animal collisions. It also offers best anti-theft car insurance discounts for vehicles with anti-theft devices, helping lower premiums.

Is State Farm expensive compared to other auto insurance providers?

Although State Farm’s rates are competitive, they depend on information such as your driving history, age, and location. But State Farm has among the lowest rates for drivers with a clean record. That being said, it is always a good idea to shop around for quotes from multiple providers to make sure you’re getting the best deal possible.

How does State Farm determine its auto insurance rates?

State Farm bases much of its auto insurance pricing on factors like your driving record, make and model of your vehicle, where you live and even your credit rating. Younger drivers and those with violations may find higher premiums, while more experienced drivers could enjoy lower rates.

Does State Farm insurance cover rental cars?

State Farm provides rental car coverage as an add-on for your auto insurance policy. This coverage helps pay for a rental car if your vehicle is damaged or in the shop after a covered incident. Understanding your car insurance policy is important to ensure that you have the right coverage in place. Be sure to check your policy for specifics.

What are the reviews for State Farm’s Drive Safe and Save program?

The Drive Safe and Save program by State Farm aims to encourage safe driving by offering discounts based on driving habits. Reviews often point out that the app monitors the driving habits thus giving a good discount for careful drivers. But some users express concerns about the app’s data accuracy and the size of the discount.

What are common State Farm reviews and complaints from customers?

Many State Farm reviews highlight excellent customer service and reliable coverage, but complaints often center around high premium increases and the claims process. While most customers have positive experiences, some report dissatisfaction with rate hikes and claim handling delays.

What types of coverage are included in a State Farm car insurance policy?

State Farm provides various coverage types such as liability, collision, comprehensive, and uninsured motorist coverage. How to compare collision car insurance you may also purchase your policy with additional coverage options for extra protection, including rental car reimbursement and roadside assistance.

How does State Farm determine car insurance costs?

State Farm’s insurance costs consider several factors, like your driving history, type of vehicle, where you live, your age, and your coverage amount. For drivers with clean records, rates can be relatively low, but costs can increase if you have traffic violations or live in an area with high accident rates.

What does State Farm’s mechanical breakdown insurance cover?

State Farm’s mechanical breakdown insurance pays for repairs to your vehicle if it breaks down as a result of mechanical failure, and provides warranty-like coverage. This can be added to your policy to help pay for repairs not covered under most auto insurance.

Does State Farm provide comprehensive insurance coverage?

Yes, State Farm offers comprehensive coverage for damage to your vehicle from incidents like theft, vandalism, or natural disasters. Compare comprehensive car insurance options to find the best protection for your needs.

Does State Farm provide a rental car during repairs?

Yes, State Farm offers rental car reimbursement coverage as part of their auto insurance policies. If your car is being repaired due to a covered claim, this coverage can help pay for the cost of renting a car while your vehicle is in the shop.

What do State Farm insurance reviews on the BBB say?

State Farm has a mixed reputation on the Better Business Bureau (BBB) with some complaints regarding slow claims processing and customer service issues. Despite this, many customers appreciate the company’s overall financial stability and broad coverage options, with the BBB rating reflecting both positive and negative experiences.

Is State Farm good at paying claims?

State Farm generally has a solid reputation for paying claims, with many customers praising the streamlined process. However, some individuals report claim denials or delays. To file a car insurance claim with State Farm, simply contact your agent or use their mobile app for a quicker resolution. Be sure to review your policy to ensure all needs are met for faster processing.

Is State Farm a good homeowners insurance company?

State Farm is considered a top-tier homeowners insurance company by many policyholders. They offer a range of coverage options, including liability, dwelling, and personal property coverage. However, some State Farm reviews indicate that their rates can be higher than competitors, so it’s crucial to compare quotes and find the best deal.

What do customers say about State Farm’s roadside assistance service?

State Farm’s roadside assistance is generally well-reviewed for its convenience and reliability. Services as broad as towing, battery jump-starts and tire changes are provided in a timely manner, exactly what customers look for.

After an at-fault accident, you’ll likely pay higher car insurance rates, but you can get the cheapest coverage if you use our free quote comparison tool today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

StateFarmAgentComplaint

IRRESPONSIBLE INSURANCE AGENT

JSmithElCajon

Incompetent [REDACTED NAME] [REDACTED NAME] of State Farm

SJF

Loyalty doesn’t pay with Statefarm they could careless

Chopper407

Two thumbs down for the claims department.

trailrunner87

Excellent Insurance Experience with State Farm

Ann_Smith

To "Insure" a downfall

romomy

Ridiculous Rate Increases

Jen Anders

State Farm Insurance review

LHN

Personal article policy

Love2sing_

Customer Concerns or Customer Loyalty Mean Nothing