SafeAuto Car Insurance Review for 2025 [Expert Evaluation]

This SafeAuto car insurance review is a favorite among high-risk drivers, with premiums starting as low as $33 per month. Specializing in non-standard insurance, SafeAuto offers state-minimum coverage with the option to add extra protection. It offers a solution that's practical and just right for each driver.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Feb 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Safe Auto Insurance

Monthly Rates

$33A.M. Best Rating:

AComplaint Level:

LowPros

- SR-22 filing

- Online chat support

- Nonstandard car insurance

Cons

- Few optional add-ons

- No new policies are available due to the Direct Auto merger

Our SafeAuto car insurance review reveals affordable coverage for high-risk drivers and those seeking basic insurance options. SafeAuto is known for its competitive rates and has built its reputation by providing cheap minimum insurance for high-risk drivers.

SafeAuto was acquired by Direct Auto Insurance in 2021. The company is now part of the National General Group under Allstate.

While SafeAuto continues to operate under its brand name, Direct Auto manages many of its policies and services. For more information, check out our Direct Auto Car Insurance Review.

SafeAuto Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.3 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 3.2 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 3.8 |

| Digital Experience | 3.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 2.5 |

| Policy Options | 2.5 |

| Savings Potential | 4.2 |

Is SafeAuto a good insurance company? This review will help determine if SafeAuto is right for you. We’ll explore its coverage options, rates, and customer reviews and compare it to other leading insurers.

Enter your ZIP code into our free comparison tool to see personalized car insurance quotes from top providers.

- SafeAuto insurance rating is 3.3

- SafeAuto car insurance rates start at $33 a month

- SafeAuto was acquired by Direct Auto in 2021

What You Should Know About SafeAuto

SafeAuto was known for providing affordable high-risk car insurance, often offering options when other insurers wouldn’t. In 2021, National General, which Allstate owns, acquired SafeAuto. This merger helped expand Allstate’s reach into the high-risk driver market, and now SafeAuto customers can benefit from Allstate’s broader network and services.

So, how much does Safe Auto insurance cost after the merger?

After the acquisition, rates for Safe Auto insurance start at just $33 per month for minimum coverage. However, SafeAuto’s rates are typically higher for younger drivers, especially those under 25 and those with a bad driving history.

On the other hand, older drivers with clean records often see much lower premiums. Below is a breakdown of SafeAuto’s average monthly rates based on age and coverage type.

SafeAuto Car Insurance Monthly Rates by Age & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $201 | $515 |

| 16-Year Old Male | $224 | $549 |

| 18-Year-Old Female | $163 | $379 |

| 18-Year-Old Male | $192 | $447 |

| 25-Year-Old Female | $58 | $154 |

| 25-Year-Old Male | $61 | $160 |

| 30-Year-Old Female | $54 | $143 |

| 30-Year-Old Male | $56 | $149 |

| 45-Year-Old Female | $51 | $133 |

| 45-Year-Old Male | $51 | $133 |

| 60-Year-Old Female | $48 | $121 |

| 60-Year-Old Male | $49 | $124 |

| 65-Year-Old Female | $52 | $136 |

| 65-Year-Old Male | $52 | $135 |

Your driving record plays a significant role in determining your SafeAuto rates. Traffic violations, such as speeding tickets or DUIs, can raise car insurance rates.

From the table, you can see that drivers with a clean record pay as little as $33 per month for minimum coverage with SafeAuto. However, if you’ve had a ticket, your car insurance premium could rise to about $42 per month, and a DUI could push it up to $67 per month.

Since the merger, SafeAuto has been able to offer more options for drivers who might have had trouble finding coverage before. Thanks to Allstate’s support, it now offers a wider variety of plans while still focusing on high-risk drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

SafeAuto Car Insurance Rates vs. Competitors

SafeAuto keeps rates affordable, particularly for those after minimum coverage. That said, if you’re a younger driver (under 25) or have a few infractions on your record, you might find that Geico and Progressive offer even better rates. These companies tend to be more affordable for younger drivers, and if you’ve got a clean driving record, they might also have a slight edge in pricing.

SafeAuto Min. Coverage Car Insurance Monthly Rates vs. Top Competitors

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $237 | $260 | $98 | $46 | $125 | $103 | $87 | $86 | |

| $317 | $317 | $94 | $98 | $109 | $95 | $75 | $75 | |

| $114 | $125 | $51 | $50 | $71 | $56 | $42 | $42 | |

| $283 | $325 | $103 | $119 | $127 | $116 | $93 | $95 |

| $161 | $195 | $74 | $81 | $86 | $75 | $43 | $62 |

| $141 | $157 | $58 | $61 | $72 | $60 | $52 | $52 |

| $308 | $327 | $74 | $77 | $104 | $74 | $58 | $55 | |

| $124 | $146 | $55 | $60 | $57 | $53 | $47 | $47 | |

| $274 | $362 | $57 | $62 | $75 | $72 | $52 | $53 | |

| $96 | $102 | $43 | $46 | $32 | $32 | $31 | $31 |

From the table, it’s clear that SafeAuto’s rates for younger drivers — particularly males under 25 — are higher compared to competitors like Geico and Progressive. But for older drivers, especially those 45 and up, SafeAuto holds its ground pretty well, though providers like State Farm and USAA might offer a bit lower rates if you’ve been driving safely for years. See our review of USAA car insurance for more details.

SafeAuto Car Insurance Monthly Rates vs. Top Competitors by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $90 | $115 | $150 | $200 | |

| $83 | $109 | $144 | $190 | |

| $75 | $100 | $135 | $180 | |

| $88 | $112 | $147 | $195 |

| $81 | $106 | $141 | $188 |

| $80 | $112 | $149 | $198 |

| $82 | $108 | $142 | $185 | |

| $80 | $105 | $140 | $182 | |

| $79 | $104 | $138 | $180 | |

| $70 | $95 | $130 | $175 |

SafeAuto’s rates can change depending on your driving record. A single ticket might bump your rates up more than with Geico or Progressive, but if you’re dealing with a DUI or multiple accidents, SafeAuto could still be the more affordable option.

If you have a clean driving record, SafeAuto might be a good option, but it’s always worth checking out other companies to find the best deal.

SafeAuto Car Insurance Coverage Options

So, what types of coverage does SafeAuto offer? They have a range of options that can work for different situations. Here’s what they offer and how it could benefit you.

Minimum Coverage

If you just want to meet your state’s minimum car insurance requirements, SafeAuto offers affordable basic coverage.

This option works well for drivers who want to keep their costs low and don’t need extra coverage. It covers liability for bodily injury and property damage, but remember, it won’t help with vehicle damage in an accident.

Full Coverage

What is full coverage insurance, and what does it cover? Full coverage provides more protection by covering both your vehicle and others in an accident. This includes liability, collision, and comprehensive coverage.

It’s a great option for those driving newer or more expensive cars or anyone who wants broader protection, including coverage for theft, vandalism, or weather-related damages. See our ranking of the best full coverage car insurance to learn more.

Comprehensive Coverage

Comprehensive car insurance is part of full coverage but can also be purchased separately. It protects your vehicle from damage not caused by a collision — think of vandalism, weather events, or hitting an animal.

Comprehensive car insurance coverage is useful if you want protection from non-collision-related issues. Learn more about the difference between collision vs. comprehensive insurance.

Gap Insurance

If your car is totaled and you owe more than it’s worth, gap insurance can help cover the difference. It’s an excellent option for those with a new car or who have financed their vehicle, as it ensures you’re not stuck paying the remaining loan balance on a vehicle you can no longer drive. On average, gap insurance costs between $20 and $40 per year.

Read More: Gap Insurance Pricing and Coverage

SR-22 Insurance

If your license has been suspended or you’ve had a major driving violation, you might need SR-22 insurance to drive again legally. How do you file for SR-22 insurance? SafeAuto can assist you in filing an SR-22, helping you meet state requirements and get your driving privileges reinstated.

Add-Ons

SafeAuto offers add-ons that let you personalize your coverage. These add-ons let you enhance your policy to fit your specific needs. Some of the most popular ones include:

- Roadside Assistance: Does car insurance cover towing? SafeAuto’s roadside assistance does. This add-on covers services like flat tire changes, battery jumps, and towing.

- Rental Car Reimbursement: This coverage helps pay for a rental car if your vehicle is in the shop after an accident (Read More: Best Rental Car Reimbursement Coverage).

- Pet Injury Coverage: Provides coverage for your pet if they’re injured in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if someone with little or no insurance hits you.

For example, if you often travel with your pet or rely on your car daily, options like pet injury coverage or rental car reimbursement can be game-changers.

SafeAuto Car Insurance Discounts

SafeAuto makes it easy to lower the cost of your insurance with discounts of up to 20%. If you’re a careful driver, a student, or even someone who likes to go paperless, you could be looking at some decent savings.

SafeAuto Car Insurance Discounts: Ranked by Savings Potential

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Safe Driver | 20% | Maintain a clean driving record, free of accidents or violations. |

| Multi-Car | 15% | Insure multiple vehicles under the same policy. |

| Bundling | 10% | Combine auto insurance with other policies like home or renters insurance. |

| Good Student | 10% | Maintain a “B” average or higher as a full-time student. |

| Low-Mileage | 10% | Drive fewer miles annually than the average driver. |

| Anti-Theft | 5% | Equip your vehicle with approved anti-theft devices. |

| AutoPay | 5% | Set up automatic premium payments from your bank account. |

| Defensive Driving | 5% | Complete an approved defensive driving course. |

| Pay-in-Full | 5% | Pay the full premium upfront instead of monthly installments. |

| Paperless Billing | 3% | Opt into paperless billing statements and communications. |

These discounts can add up quickly, especially if you qualify for more than one. For example, combining a safe driver car insurance discount with a multi-vehicle policy could slash your monthly premium by nearly a third. And those savings only grow if you’re paying in full or switching to paperless billing.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

SafeAuto Customer Reviews

Hearing from other drivers can give you a better idea of what to expect from SafeAuto. Reviews of SafeAuto on platforms like Reddit are generally positive, with many customers praising the company for its affordable rates, especially for younger drivers with clean driving records.

Heads up challenger and charger owners, Safe Auto gives us the best insurance, they just saved me $3,000 a year

byu/americanista915 inDodge

However, not all reviews are as glowing. Some reviews mention issues with customer service, including delayed responses or difficulties with claims. However, many still appreciate the value SafeAuto provides.

If you’re concerned about customer service, you might want to check out our list of car insurance companies with the worst customer satisfaction.

SafeAuto Car Insurance Company Business Reviews

While customer reviews provide valuable insight into the experiences of real drivers, business ratings can give you a better idea of SafeAuto’s financial strength, business practices, and how they handle complaints.

SafeAuto Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 830 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 70/100 Avg. Customer Feedback |

|

| Score: 1.25 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

How do customer satisfaction ratings affect car insurance companies? SafeAuto’s ratings reveal a mixed picture. While the company offers solid financial stability with an A from A.M. Best, customer satisfaction is average at best, with a B rating from the Better Business Bureau and more complaints than typical, according to the NAIC.

The J.D. Power score shows room for improvement in customer experience, and Consumer Reports confirms that while they are affordable, customer feedback could be better.

While SafeAuto provides affordable coverage, its customer service and higher-than-average complaints should be considered when choosing an insurer. Financially, though, it’s a solid choice.

Schimri Yoyo Licensed Agent & Financial Advisor

If your priority is cost-effective coverage and you are willing to deal with a few customer service issues, SafeAuto could still be worth considering.

SafeAuto Pros and Cons

SafeAuto car insurance offers some great benefits, but there are also a few things to remember before deciding. Let’s break down the positives:

- SR-22 Filing: SafeAuto offers SR-22 filings for drivers needing to reinstate their licenses.

- Online Chat Support: You can easily get help through SafeAuto’s online chat.

- Nonstandard Car Insurance: SafeAuto is one of the best car insurance companies for high-risk drivers. It provides insurance for drivers who might not qualify for coverage with other companies.

While SafeAuto provides some good coverage options, it’s still a good idea to see if it fits you. A few cons exist before signing up for SafeAuto.

- Few Optional Add-Ons: SafeAuto’s coverage options are pretty basic, with limited extra add-ons.

- No New Policies: SafeAuto has merged with Direct Auto Insurance, so it no longer writes new policies in some areas.

Comparing quotes from SafeAuto and other insurers can help ensure you get the best deal on your car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

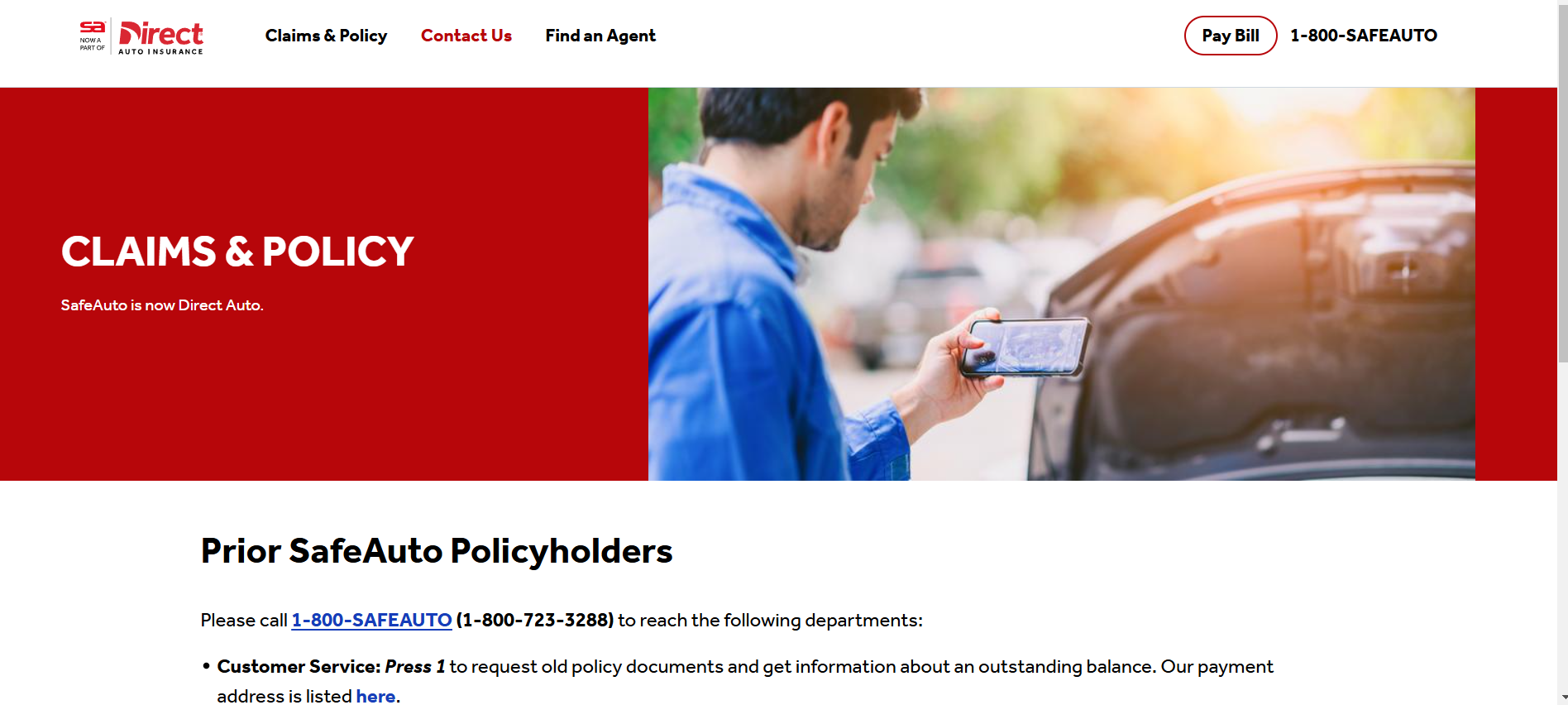

SafeAuto Claims Handling

Now that SafeAuto has transitioned to Direct Auto, how do you file a car insurance claim with them? For claims related to your old SafeAuto policy, call 1-800-SAFEAUTO (1-800-723-3288) and press 3.

This line is available 24/7 to assist with both new and existing claims. For Direct Auto claims, you can use their mobile app or website to file a claim quickly and easily.

Choose SafeAuto for Reliable Insurance and Affordable Rates

This SafeAuto car insurance review highlights both the affordability SafeAuto offers to high-risk drivers and the limited coverage options that may not suit everyone. Even though SafeAuto merged with Direct Auto in 2021, they still offer the same reliable and responsive service you expect. Their commitment to great support hasn’t changed at all.

Drivers needing SR-22 filings or struggling to find coverage elsewhere can benefit most from SafeAuto’s specialized policies. Its convenient online chat support stands out, allowing customers to get help quickly without long wait times.

While SafeAuto has a lot to offer, we recommend comparing a few different car insurance providers to find the best coverage at the best price. Enter your ZIP code into our free comparison tool to compare the cheapest car insurance companies near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How do I file a claim with SafeAuto?

To file a claim with SafeAuto after its merger with Direct Auto, call 1-800-SAFEAUTO (1-800-723-3288) and press 3 to reach the 24/7 claims department. This line is available for both new and existing SafeAuto car insurance claims.

How can I get SafeAuto insurance quotes?

To get a SafeAuto insurance quote, visit its website and enter your ZIP code to start the process. You can also call SafeAuto’s customer service for personalized quotes based on your driving history and coverage needs.

Who did SafeAuto merge with?

Three common questions drivers ask are: “Is SafeAuto owned by Allstate?”, “Did National General buy SafeAuto?” and “Did Allstate buy SafeAuto?” The answer ties them all together. SafeAuto was acquired by Allstate through its subsidiaries Direct Auto and National General in June 2021.

This merger allowed SafeAuto to integrate into National General’s non-standard auto insurance operations, enhancing its ability to serve drivers seeking state-minimum coverage across multiple states.

Read More: Allstate Car Insurance Review

How long has SafeAuto been in business?

SafeAuto was founded in 1993, making it over 30 years old.

What is a SafeAuto called now?

Why did SafeAuto change its name? After the acquisition by Allstate, SafeAuto continues to operate under the SafeAuto brand name.

What states does SafeAuto cover?

SafeAuto operates in 20 states across the U.S., including:

- Oregon

- Ohio

- Indiana

- Kentucky

- Georgia

- Pennsylvania

- South Carolina

- Tennessee

- Louisiana

- Mississippi

- Illinois

- Missouri

- Arizona

- Oklahoma

- Kansas

- Virginia

- Texas

- California

- Alabama

- Colorado

If you don’t live in one of these states, enter your ZIP code into our free comparison tool to see which companies have the cheapest rates in your area (Read More: Compare Car Insurance Rates by State).

How do I contact SafeAuto car insurance customer service?

What is the SafeAuto car insurance phone number? To contact SafeAuto car insurance customer service, call 1-800-723-3288 and press 1 to speak with a representative. The representative will assist you with your policy or billing questions.

Where is SafeAuto headquarters?

SafeAuto’s headquarters is located at 4 Easton Oval, Columbus, Ohio 43219.

What is the SafeAuto car insurance number?

The SafeAuto car insurance number is 1-800-SAFEAUTO (1-800-723-3288), where you can access customer service or file claims related to your policy.

Where can I find SafeAuto car insurance reviews?

To learn about customer experiences with the company, you can find SafeAuto car insurance reviews on consumer feedback platforms, Reddit discussions, and car insurance comparison charts on review websites like this one.

What happened to SafeAuto Insurance?

SafeAuto Insurance is still around, but it merged with Direct Auto in June 2021 when Allstate acquired the company. Although the SafeAuto name remains, its services are now supported by Allstate’s network.

Who owns SafeAuto?

SafeAuto is owned by Allstate. After the merger, the brand became part of Allstate’s portfolio through its subsidiaries, Direct Auto and National General. This means customers still enjoy the same affordable coverage, now backed by Allstate. If you’re curious about National General and its car insurance rates, check out our National General Car Insurance Review.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UNHAPPYasH3ll

-10 ✨ needed

tttt10

Horrible company

TRE21

Affordable car insurance

Bonza

Great company

Tarza

Really good company

rstriegel

Stay Away From Safeauto Insurance Company

catehartman

Good for SR-22

Tabycat1113

Great company for new drivers

Jayb30853

Problems with company

lisagaetano13

Safe auto a safe decision