Progressive Car Insurance Review for 2025 [See if They’re a Good Fit]

Explore this Progressive car insurance review to learn how you can get coverage starting as low as $35 per month, with additional benefits like bundling and safe driver discounts. With its intuitive app and Snapshot program, Progressive excels in offering both affordability and convenience.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Progressive

Average Monthly Rate For Good Drivers

$39A.M. Best Rating:

A+Complaint Level:

LowPros

- Affordable Rates

- UBI Savings With Snapshot

- Snapshot Saves Safe Drivers

- Get Progressive Quote Online

- Robust Digital Tools

Cons

- Low Customer Loyalty

- Unexpected Rate Increases

- High Costs for Teens

In this Progressive car insurance review, Progressive stands out as one of the best options. It offers competitive rates, customizable coverage, and substantial discounts.

Progressive rates offer average rates and user-friendly tools as low as $35 a month. Learn why it’s the leading choice and how to get Progressive car insurance quotes online quickly.

Progressive Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Stop overpaying for car insurance. Our free quote comparison tool lets you shop for quotes from the top providers near you by entering your ZIP code.

- Progressive offers customizable coverage and unique discounts for all drivers

- Monthly rates start at $35 monthly, making it a budget-friendly choice

- This review highlights Progressive strengths in affordability and convenience

Progressive Auto Insurance Coverage Cost

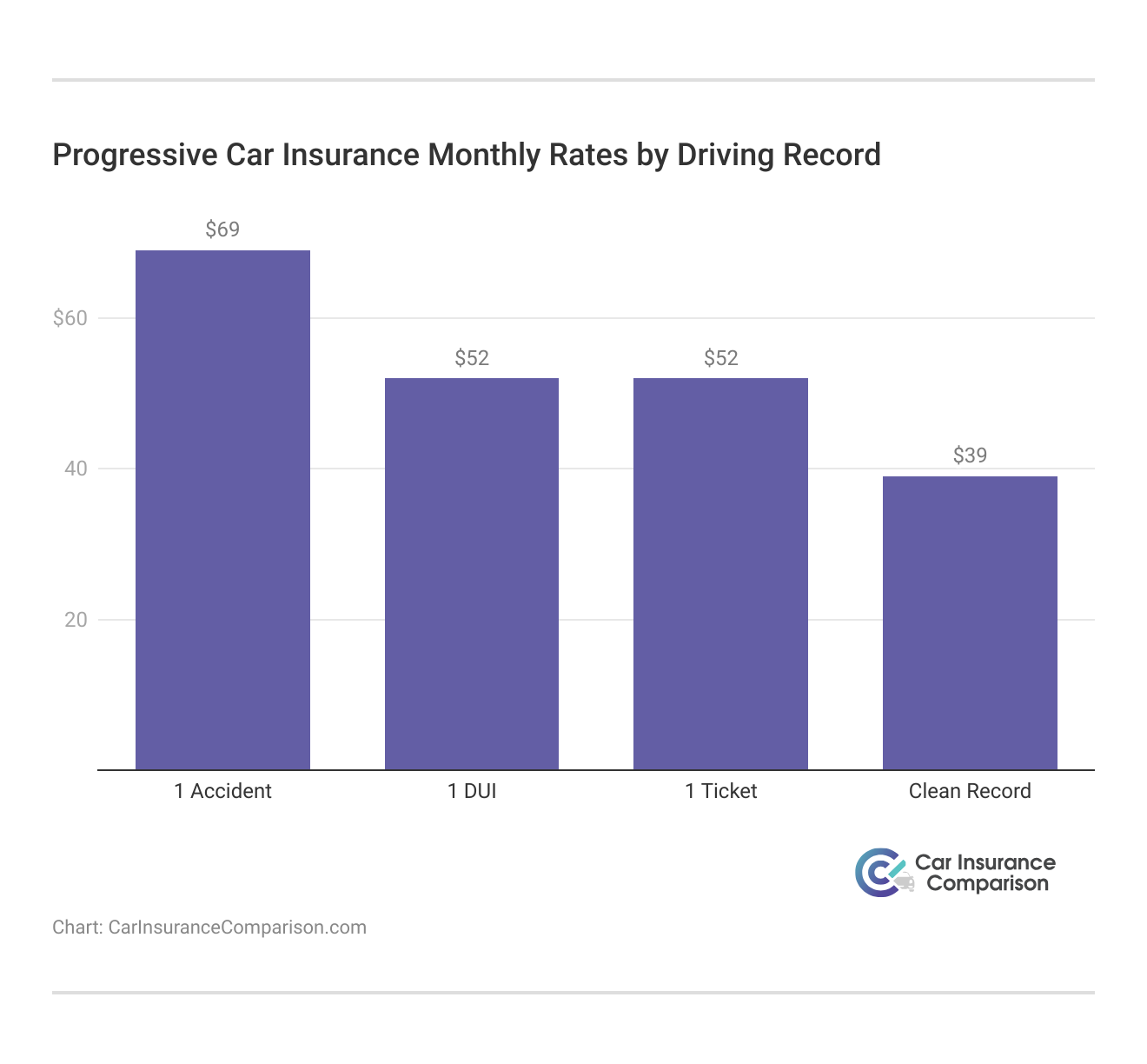

Your price quote will depend on your location, vehicle type and condition, driving record, and coverage selections. While premiums will vary, most companies offer safe-driving discounts, and many other discounts for bundling policies can drastically reduce costs.

Progressive Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $308 | $801 |

| Age: 16 Male | $327 | $814 |

| Age: 18 Female | $251 | $591 |

| Age: 18 Male | $281 | $662 |

| Age: 25 Female | $52 | $141 |

| Age: 25 Male | $54 | $146 |

| Age: 30 Female | $48 | $131 |

| Age: 30 Male | $50 | $136 |

| Age: 45 Female | $41 | $112 |

| Age: 45 Male | $39 | $105 |

| Age: 60 Female | $35 | $92 |

| Age: 60 Male | $36 | $95 |

| Age: 65 Female | $41 | $109 |

| Age: 65 Male | $38 | $103 |

Another way drivers can demonstrate safe driving practices and receive a discounted rate is through the Progressive program. This program offers various Progressive car insurance discounts to eligible customers.

For a better idea of your premium, you can get a personalized Progressive insurance quote online or from an agent to make the estimate as accurate as possible. The digital tools offered by Progressive also make the process quick and convenient for consumers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Progressive Average Cost vs. Competitors

Progressive Insurance Co. ranks well among the competition and is often among the lowest-priced options. Progressive Casualty charges higher premiums than some companies but offers more discounts and value-added features.

However, Progressive can look much better for many drivers when considering a car insurance comparison, thanks to programs like Snapshot that reward safe driving habits with personalized savings.

Plus, with an extensive menu of coverage options and easy-to-use digital tools, the value proposition is strengthened by offering policyholders more latitude in their insurance experience.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Progressive Coverage Options

Progressive Mutual offers a full range of coverage options with customizable policies. Popular options include:

- Liability Coverage: AED as required by the state only for accidents

- Comprehensive & Collision: Coverage for damage and the theft of your car.

- Rideshare Insurance: Used by drivers working for Uber and Lyft

- Coverage For Custom Parts: Covers parts not made by the original manufacturer.

Progressive vehicle coverage is versatile and suitable for drivers with different needs and various types of car insurance coverage. It offers flexibility and customization.

Progressive Insurance Customer Reviews

Others, like the fast claims process it offers, the mobile solid app, and transparent pricing via its Progressive insurance quote mechanism, help drivers know how much they will need to pay for their car insurance upfront by assisting them with what factors increase or decrease their rates.

Understanding your car insurance coverage is crucial for avoiding unexpected costs and maximizing savings. By comparing quotes and utilizing discounts like safe driver programs or bundling, you can get the best value while maintaining the coverage you need.

Daniel Walker Licensed Insurance Agent

Another benefit for many policyholders is the wide variety of discounts, such as bundling policies or practicing safe driving. Some consumers complain about post-accident rate hikes, claiming the increases were steeper than anticipated.

However, understanding your car insurance policy is critical to avoiding surprises. Progressive also boasts features and a hard-to-beat customer service reputation, which remains popular in every state.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Progressive Business Reviews

Business reviews highlight Progressive Auto Insurance’s strong financial stability and efficient claims processing. The company has earned high ratings for reliability, reflecting its solid standing in the industry and ability to handle claims promptly.

Combined with an A+, the second-highest rating you can achieve using the Better Business Bureau (BBB), this rating means that the company is primarily safe and respectable.

Progressive Car Insurance Business Ratings and Consumer Reviews

| Agency | |

|---|---|

| Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Feedback |

|

| Score: 1.11 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

Customers say Progressive simplifies insurance through straightforward digital tools, including a top-rated app and website. These features make calculating car insurance costs more accessible and transparent, allowing anyone to handle claims and manage coverage digitally; thus, Progressive is an excellent choice for those seeking convenience.

This Reddit post expressed frustration with Geico’s rising premiums, which increase 6-7% every billing cycle. The user found Progressive offering a similar policy for a lower price and questioned whether Progressive could be trusted and why premiums increased despite vehicle depreciation.

Is Progressive Auto Insurance Good/Reliable?

byu/plartoo inpersonalfinance

The user also wondered why premiums increase even as car values decrease, prompting a discussion on Reddit about how car insurance rates are set, the role of inflation, and whether negotiating with insurance companies could help keep costs down.

Progressive Insurance Pros and Cons

Progressive Insurance is one of the most popular options due to its comprehensive coverage and innovative features. Here are the biggest pros and cons when buying auto insurance from Progressive.

Pros

- Variety Of Discounts: Progressive offers many discounts to its policyholders, such as multi-policy, safe driver, and automatic payment option discounts, leading to savings on premiums.

- A Unique Snapshot Program Rewarding Safe Drivers: Their usage-based program incentivizes safer driving by offering lower rates based on your driving habits.

- Great Mobile App/Online Tools: Progressive offers a mobile app and online portal for accessing your account, which makes it easier to manage policies, file a claim, or make payment options.

Cons

- Higher Premiums Relative to Budget Insurers: Although Progressive offers numerous perks, its premiums are often higher than those of f some of the cheapest insurance companies.

- Higher Rate Increases After Claims or Accidents: This applies even to not-at-fault accidents and when the driver is not responsible.

Progressive Insurance is best for drivers seeking easy-to-use technology, customizable options, and discounts. However, when you compare car insurance by coverage type, you may find that in some post-claim cases, this can result in higher premiums.

Progressive Insurance Review: Coverage and Discounts

Progressive offers excellent value with its full coverage options, flexible discounts, and strong reliability. One standout feature is Snapshot, a usage-based program that rewards safe driving. Their Milewise telematics program also boosts savings for good drivers, and the mobile app makes managing your policy easy and convenient.

Selecting the right car insurance involves balancing affordability with sufficient coverage to protect against potential risks. Use tools like usage-based programs and comparison platforms to personalize your policy and uncover savings tailored to your driving habits.

Chris Abrams Licensed Insurance Agent

Although some of its rates are higher than those offered by companies, Progressive’s strategies and customer-friendly tools make it a popular auto insurance option.

However, you can still find savings by exploring ways to lower the cost of your insurance, such as bundling policies or using the Snapshot program. A potential drawback for shoppers is the likelihood of rate increases after a claim or accident. Finding cheap car insurance quotes is easy. Enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Progressive a good auto insurance company?

Yes, Progressive is known for its competitive rates, innovative tools like Snapshot, and reliable customer service, making it a popular choice for many drivers. For more clarity, see our comparison of car insurance rates by vehicle make and model.

What are Progressive employee benefits?

Progressive provides its employees with comprehensive benefits, including health insurance, retirement plans, paid time off, and wellness programs.

What is Progressive’s Snapshot program, and how does it work?

Snapshot is Progressive’s usage-based insurance program that rewards safe driving. It tracks driving behavior through a mobile app or a plug-in device and offers discounts for drivers who maintain safe driving habits.

How much is Progressive car insurance?

Progressive car insurance costs vary based on location, driving history, and coverage options. You can get a personalized quote online to find out the exact price. Learn more by exploring our car insurance basics.

What do Progressive Direct insurance reviews say?

Progressive Direct Insurance receives positive reviews for its ease of use, affordable rates, and effective claims handling. However, some customers report rate increases after filing claims. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Does Progressive offer any special discounts for new drivers or students?

Progressive discounts good students and young drivers who maintain clean driving records. Other discounts may be available depending on specific circumstances.

Is Progressive Insurance reliable?

Yes, Progressive is considered reliable. Its strong financial backing and high customer satisfaction rating ensure that claims are handled efficiently. To gain deeper insights, read our difference between collision and comprehensive coverage.

Does Progressive offer gap insurance coverage?

Yes, Progressive provides gap insurance, which covers the difference between the car’s current value and the amount still owed on the loan or lease if the vehicle is totaled.

What happens to my Progressive premium if I’m involved in an accident?

After an accident, your premium may increase depending on the fault and the type of claim. However, Progressive offers accident forgiveness for eligible customers to prevent premiums from rising after the first at-fault accident.

Explore your car insurance options by entering your ZIP code and finding which companies have the lowest rates.

What makes auto insurance with Progressive a good choice?

Auto insurance with Progressive is a great choice due to its customizable coverage, excellent mobile app, affordable rates, and the convenience of managing policies online. Review our overview of the pros and cons of cheap car insurance companies.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Jabunn1987

Progressive refuses to change

KLA-169

You may not get your full refund.

Bio Or

progressive insurance review

fedoria7

DO NOT HONOR CLAIMS WILL DENY YOU INSTANTLY

FlyntRock78

Horrible customer service

Leah_p

The worst

RFK

Get lost Flo

Ace_1

This insurance [REDACTED WORD]

KobuSosho

Random charge after I already paid premium in full

Suegoo

Worst insurance company and customer service.