Nationwide Car Insurance Review for 2025 [Customer & Financial Ratings]

Nationwide car insurance reviews are usually positive, with customers praising the company’s On Your Side review, customer service, and discounts. With rates starting at $39 per month, Nationwide is also affordable. However, Nationwide car insurance quotes are not favorable for high-risk drivers.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Nationwide

Average Monthly Rate For Good Drivers

$39A.M. Best Rating:

A+Complaint Level:

LowPros

- Affordable premiums for most drivers

- On Your Side review

- Generous discounts

Cons

- Higher rates for high-risk drivers

- Complaints about policy renewals

As one of the largest names in the auto insurance industry, Nationwide car insurance reviews generally appreciate this company’s coverage options, discounts, and benefits.

Known for its “On Your Side” promise, Nationwide provides personalized service and flexible policies to meet individual needs.

Nationwide is also an excellent choice for cheap car insurance, with rates starting at just $39 per month.

Nationwide Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.5 |

| Business Reviews | 4.5 |

| Claim Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4 |

| Digital Experience | 4.5 |

| Discounts Available | 5 |

| Insurance Cost | 4.4 |

| Plan Personalization | 4.5 |

| Policy Options | 4.7 |

| Savings Potential | 4.6 |

Read on to learn more about Nationwide car insurance, including how many discounts you might be eligible for and all your coverage options. Then, enter your ZIP code into our free comparison tool to see how personalized Nationwide quotes compare with other companies.

- Nationwide car insurance costs are some of the lowest in the nation

- Customers appreciate Nationwide’s On Your Side policy review

- Most Nationwide car insurance ratings are positive

Nationwide Car Insurance Rates

Nationwide car insurance quotes aren’t usually the cheapest in the country, but it can be affordable for most drivers with safe habits and low mileage. To get an idea of how much Nationwide auto insurance costs, take a look at the rates below.

Nationwide Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $161 | $411 |

| Age: 16 Male | $195 | $476 |

| Age: 18 Female | $131 | $303 |

| Age: 18 Male | $167 | $387 |

| Age: 25 Female | $52 | $136 |

| Age: 25 Male | $57 | $150 |

| Age: 30 Female | $48 | $124 |

| Age: 30 Male | $53 | $136 |

| Age: 45 Female | $43 | $113 |

| Age: 45 Male | $44 | $115 |

| Age: 60 Female | $39 | $99 |

| Age: 60 Male | $41 | $104 |

| Age: 65 Female | $43 | $111 |

| Age: 65 Male | $43 | $112 |

Of course, these rates are averages. Many factors affect your insurance rates, so you might see many different prices when you get a personalized quote. For example, if you compare car insurance rates by state, your quotes might be cheaper.

Other factors that impact your insurance rates include your age, marital status, and the type of car you drive. Comparing quotes with multiple companies ensures you’ll get the lowest rates, no matter what your situation is.

Scott W. Johnson Licensed Insurance Agent

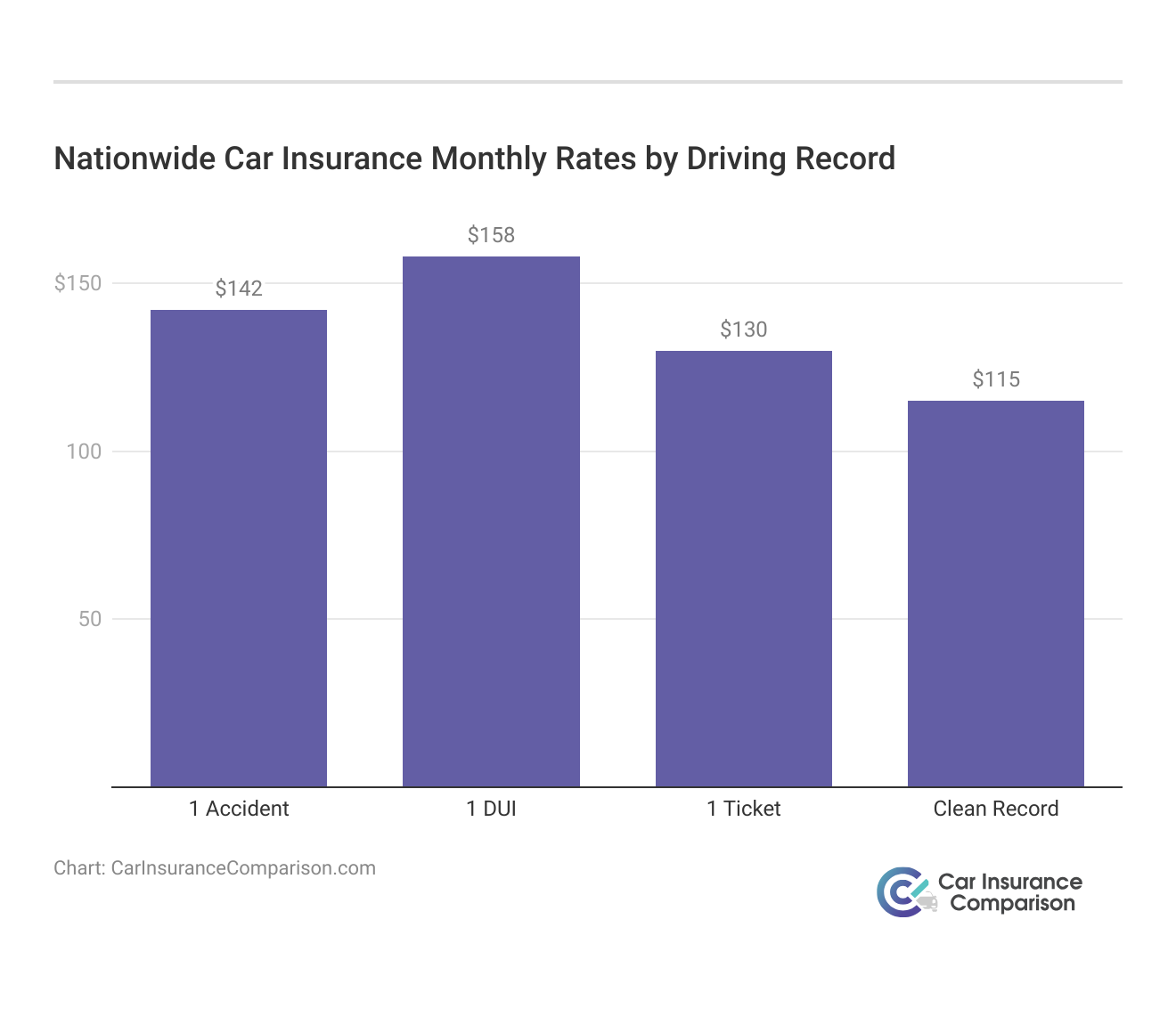

Another important factor is your driving record. Drivers with multiple speeding tickets, at-fault accidents, or a DUI on their record can pay double or more for insurance compared to people with clean records. Take a look below to see average Nationwide car insurance rates by driving record.

Nationwide auto insurance rates aren’t the cheapest if your record isn’t perfect, but it still earns a spot as one of the best car insurance companies for high-risk drivers.

Nationwide auto insurance reviews say this company is usually affordable, but you should compare Nationwide with other top providers to make sure you get a good price.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comparing Nationwide Car Insurance Rates With Top Providers

When you need to save, looking at a car insurance company comparison is one of the easiest ways to find cheap coverage. Check below to compare Nationwide auto insurance rates with some of the top providers.

Nationwide and Top Competitors: Minimum vs. Full Coverage Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $39 | $98 | |

| $43 | $108 | |

| $47 | $125 | |

| $51 | $133 | |

| $55 | $140 |

| $45 | $110 |

| $49 | $138 | |

| $36 | $95 | |

| $50 | $120 | |

| $48 | $130 |

Comparing car insurance quotes from multiple companies is the most important of all the things you can do to find coverage that meets your budget.

Luckily, getting personalized quotes is easy. Simply visit the Nationwide site and fill out the quote request form. It takes about 10 minutes, and you’ll need information like your VIN and driver’s license number.

Then, fill out quote request forms from other companies to compare rates. If you don’t want to take the time to visit individual sites, you can use an online quote-generating tool to see rates from multiple companies at once.

Nationwide Car Insurance Options

Nationwide offers a variety of car insurance types to meet just about any need on the road. That includes everything you need to meet the requirements in your state and a full coverage policy. That includes:

- Liability Insurance: Liability car insurance coverage covers damage you cause to others in an accident, including damage to vehicles or property and injuries.

- Comprehensive Coverage: Comprehensive insurance covers damage to your vehicle outside of accidents. This includes things like fire, vandalism, natural disasters, and hitting an animal.

- Collision Insurance: Liability insurance doesn’t cover your vehicle. If you want help paying for damages to your car after an accident, you need collision car insurance.

- Uninsured/Underinsured Motorist Insurance: If you want protection against drivers with insufficient coverage, you need uninsured/underinsured motorist insurance.

- Medical Payments/Personal Injury Protection Insurance: Medical payments and personal injury protection (PIP) insurance cover medical bills for you and your passengers, regardless of who caused the accident.

Aside from the basic types of insurance, Nationwide offers a variety of add-ons. Add-ons are completely optional, but they can add tremendous value to your policy and help you out during an emergency.

When you shop at Nationwide, you’ll have access to a variety of valuable insurance add-ons. These add-ons include the following options:

- Accident Forgiveness: You can purchase accident forgiveness car insurance to prevent your first at-fault accident from increasing your Nationwide rates.

- Roadside Assistance: Nationwide’s roadside assistance plan will send help when you’re stranded with a flat tire, dead battery, or other common emergencies.

- New Car Replacement: If your car is three years old or newer, Nationwide will replace your vehicle with the same model year if you total it.

- Rental Car Reimbursement: If your car is stuck at the mechanic after a covered accident, Nationwide will pay for your rental while you wait.

- Vanishing Deductible: Sign up for the vanishing deductible program to reduce your deductible by $100 for every year you spend claims-free, up to a maximum of $500.

While add-ons are a great way to customize your policy, you should only purchase what you might use. Adding more coverage to your policy will increase your rates.

An additional perk you can get for free is the Nationwide On Your Side review. Take advantage of this annual review to go over your policy with a Nationwide representative to make sure you’re not paying for coverage you no longer need.

Nationwide Car Insurance Discounts

Nationwide insurance reviews and consumer reports are generally positive, but one area it doesn’t compete as well in is discounts. Currently, Nationwide only offers 11 total discounts.

Nationwide’s car insurance discounts can be split into two categories: policy discounts and driver discounts. Policy discounts include:

- Multi-Policy Bundling: You’ll save on each policy if you purchase renters or home insurance with Nationwide.

- EasyPay: Get a one-time discount for signing up for automatic payments from your bank account when you purchase a Nationwide policy.

- Anti-Theft Devices: If your vehicle has certain anti-theft devices, such as an audible alarm, you’ll get an automatic discount.

- Paperless Billing: Doing good for the environment also earns you a discount. Select paperless billing to earn a small amount of savings.

Nationwide driver discounts are savings you can earn once you meet specific eligibility requirements. Driver discounts at Nationwide include the following:

- Safe Driver: Stay accident and traffic-violation-free for at least five years to qualify for Nationwide’s safe driver discount.

- Good Student: Full-time students under the age of 24 can save on their insurance by maintaining at least a B average.

- Defensive Driver: Older drivers can earn a discount by taking a defensive driving class. Before you take the class, make sure to check with a Nationwide representative to see if it qualifies.

- Accident-Free: Nationwide adds an additional 10% savings to your policy for as long as you stay accident-free. To qualify, you’ll need to be accident-free for at least five years.

- Affinity: Nationwide works with a variety of organizations and workplaces to offer special discounts.

Nationwide coverage is almost always an affordable option, but taking advantage of discounts can help you save even more.

SmartRide by Nationwide

If you’re looking for the best car insurance companies for usage-based insurance, Nationwide is an excellent choice. SmartRide is Nationwide’s usage-based insurance program that allows safe drivers to lower their coverage by up to 40%.

To enroll in SmartRide, you’ll have to download the Nationwide app or install the plug-in device in your car. Once you’re ready, SmartRide tracks behaviors like hard braking, rapid acceleration, night driving, and how many miles you drive.

Unlike some of its competitors, Nationwide guarantees that your rates won't increase from signing up for SmartRide, no matter how risky your driving habits are.

Dani Best Licensed Insurance Producer

The safest drivers can save up to 40%, but the average driver earns a discount of about 22%. No matter how risky your driving habits are, Nationwide never uses SmartRide data to increase rates.

SmartMiles by Nationwide

Aside from an excellent UBI program, Nationwide is also one of the best car insurance companies for a low-mileage discount. SmartMiles is Nationwide’s pay-per-mile insurance program built to help low-mileage drivers find more affordable coverage.

Your monthly premium with SmartMiles is calculated based on two prices. The first is a monthly fee you pay no matter how many miles you drive. The second is a per-mile fee, usually just a few cents.

For example, if your monthly fee is $35, your per-mile fee is $0.07, and you drive 600 miles in a month, your premium would be $77.

With SmartMiles, your daily mileage is capped at 250 miles, so you can still take road trips without having to worry about outrageous fees.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Nationwide Car Insurance Customer Reviews

When it comes to customer reviews, Nationwide has traditionally had a good reputation. However, more customers are reporting negative experiences with the company than ever before.

To start with the positives, Nationwide customer service ratings are strong. Most customers agree that Nationwide is excellent at paying claims. They also love the options Nationwide offers for policy customization.

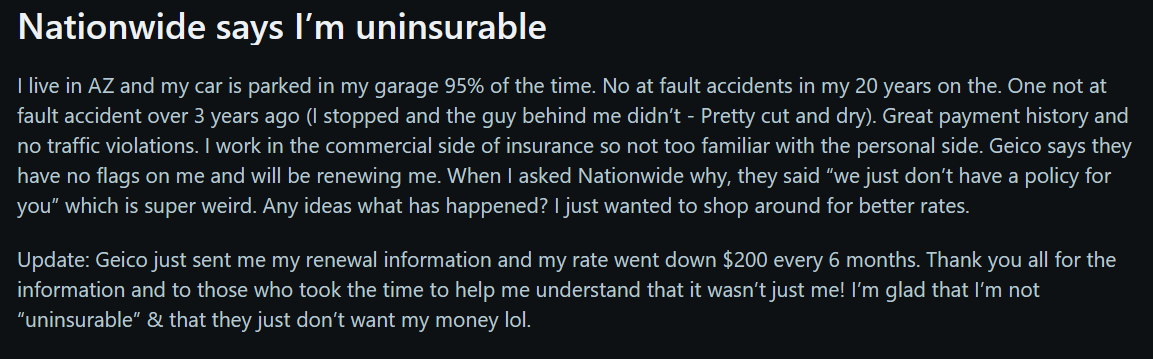

However, Nationwide appears to be canceling policies at a much higher rate, particularly home insurance. Check out this Reddit user’s experience trying to renew their Nationwide car insurance policy.

Unfortunately, this Reddit user’s experience doesn’t seem to be uncommon. Nationwide might have low rates, but you should consider the risk of being denied coverage before you sign up for a policy.

Nationwide Car Insurance Business Reviews

Nationwide is considered one of the best car insurance companies in the U.S., and its third-party ratings play a role in its reputation. Third-party rating companies generally leave positive ratings for Nationwide auto insurance reviews. To see how Nationwide scores, check the ratings below.

Nationwide Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 855 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Business Practices |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 0.78 Fewer Complaints |

|

| Score: A+ Superior Financial Strength |

Third-party reviews may seem confusing at first — especially if it’s your first time buying car insurance — but understanding what they mean can help you pick the best policy. For example, the A.M. Best rating for Nationwide indicates that you won’t have to worry about your claims being paid.

Other important ratings to look at include J.D. Power, which ranks insurance companies using consumer satisfaction data, and the NAIC, which tracks how many complaints a company receives.

Michelle Robbins Licensed Insurance Agent

Whether you want Nationwide comprehensive car insurance or a bare minimum policy, looking at these ratings will help you decide if this is the right company.

Nationwide Pros and Cons

Like all insurance companies, Nationwide car insurance has pros and cons. When you buy a policy from Nationwide, you can look forward to the following perks:

- Wide Range of Coverage Options: Nationwide offers a variety of coverage options, including standard plans and specialized add-ons like accident forgiveness and vanishing deductibles.

- Strong Customer Service: Nationwide auto insurance quotes include access to the company’s excellent customer service specialists and the On Your Side review.

- Generous Discounts: Take advantage of Nationwide auto insurance discounts to increase your savings.

While Nationwide auto insurance costs are low and the customer service is excellent, there are some things to be aware of. These include:

- Renewal Issues: Many Nationwide customers have reported being dropped from their insurance, especially if they bundle car insurance with a homeowners policy.

- Higher Premiums for Some Drivers: Nationwide is usually affordable, but that might not be the case if you need high-risk car insurance.

Keeping these pros and cons in mind can help you decide if Nationwide is the right choice for your auto insurance needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

See if Nationwide is Right for You Today

Our Nationwide car insurance review discussed its robust selection of coverage options and discounts, but you’ll have to decide if it’s the right company based on the type of policy you need and the cost of insurance near you. Learning how to compare multiple free car insurance quotes before you decide on a policy can help you save.

However, with a solid reputation and commitment to personalized service, Nationwide is worth considering if you’re looking for dependable car insurance coverage tailored to your needs. Enter your ZIP code into our free comparison tool below to start comparing auto insurance companies today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Nationwide a good insurance company?

Yes, Nationwide is well-regarded for its wide coverage options, solid customer service, and various discounts, making it a reputable choice for auto insurance.

How much is Nationwide car insurance per month?

The average monthly cost of Nationwide car insurance varies. However, it typically starts at $39 per month for minimum insurance and $99 for full coverage. Many factors affect car insurance rates, so you should compare personalized quotes to find the best prices.

What is the Nationwide On Your Side review?

The On Your Side review is a free, personalized annual check-in service offered by Nationwide to help customers update their policies and ensure they have the right coverage.

Is Nationwide car insurance cheaper than Progressive?

Pricing can vary by driver and location, but Nationwide is often more expensive than Progressive, especially for drivers with clean records or those looking for low-cost options. Read our Progressive car insurance review to see how Nationwide and Progressive compare.

Is Nationwide car insurance cheap for teens?

Nationwide offers some discounts for teen drivers, but like most insurers, its rates for younger drivers tend to be higher due to their increased risk profile. However, Nationwide is one of the best car insurance companies for teen drivers because of its excellent coverage options.

Does Nationwide have usage-based insurance?

Yes, Nationwide offers usage-based insurance through its SmartRide and SmartMiles programs, which reward safe or low-mileage driving with discounts.

How do you file a Nationwide car insurance claim?

You can file a Nationwide claim online, through their mobile app, by calling their claims department, or by contacting your local agent. Nationwide makes it easy to file a car insurance claim with these user-friendly options.

Is Nationwide car insurance good at paying claims?

Nationwide has a strong reputation for handling claims efficiently and fairly, and many customers report positive experiences in claim resolution.

Does Nationwide sell other types of insurance?

Yes, Nationwide offers a variety of other insurance products, including home, renters, life, and pet insurance.

How many states does Nationwide sell car insurance in?

Nationwide provides auto insurance in all 50 states across the U.S. To see how much Nationwide car insurance costs in your state, enter your ZIP code into our free comparison tool.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

brycelefevre

Long phone wait times

Wareagle256205

Is Nationwide REALLY on your side?

Danielle202

Best Insurance Company

Purple1992_

Great service and worth the money

Lawanda

Delighted to have auto insurance and roadside assistance.

Anna5N

Nationwide is the best

Jencorbin

Nationwide really is on your side

Adelbert

In Nationwide I Trust

RD2371

Misleading adice

JealousGull

Staying with another 10+ years