Mercer Insurance Group Car Insurance Review [2025]

Mercer Insurance Group car insurance reviews are found under the name of their parent company, United Fire Group (UFG). The company sells personal car insurance in New York, New Jersey, and Pennsylvania, and commercial insurance in other states.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- Mercer Insurance was purchased by United Fire Group (UFG) in 2010

- UFG only offers personal car insurance in New York, New Jersey, and Pennsylvania

- UFG writes commercial car insurance in many other states.

UFG Car Insurance Rates

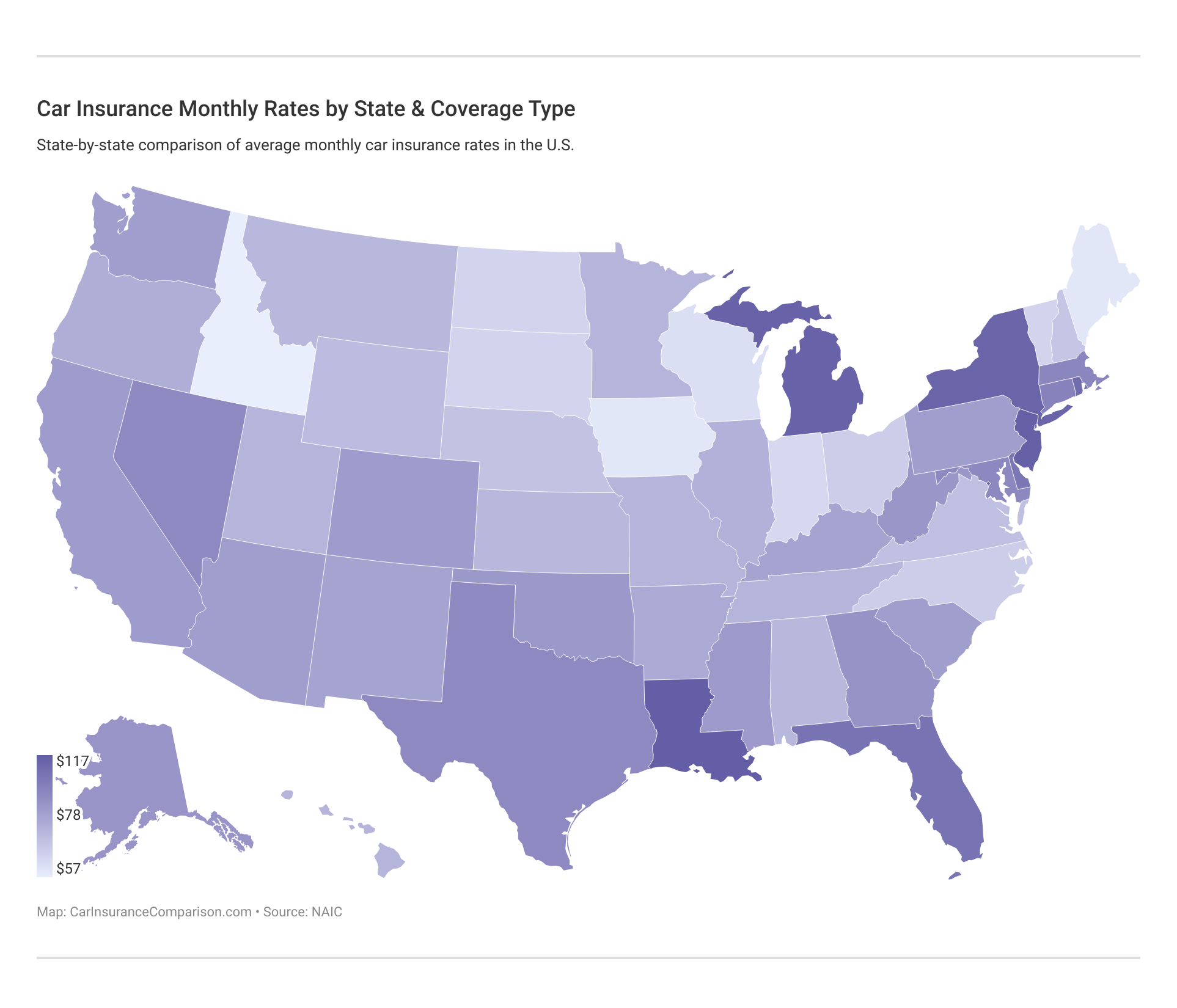

UFG provides a wide range of insurance products, which include both commercial car insurance policy and personal car insurance policies, some of which are sold under the Mercer Group name. However, the availability of the products or types of coverage is dependent on the location.UFG sells its products through agents and therefore does not offer any type of online quoting system for their products. Because of this, we are unable to provide rate information for UFG. However, you can take a look at the map below to find the average rates for full coverage insurance in your area.

Keep in mind that the numbers above are based on full coverage, so if you only need liability you may pay less for your insurance. They are also averages, which means some people will pay much less and some people will pay much more, depending on your driving history and your ZIP code.What is UFG availability by state?

In New Jersey, Pennsylvania, and New York, Mercer Insurance Company and the Mercer Insurance of New Jersey only offer commercial car insurance. Meanwhile, subsidiary Franklin Insurance Company offers personal car insurance only in limited areas.

If you happen to live in the areas being serviced by the Mercer Group (including UFG and its subsidiaries), you can also get standard personal auto loan at reasonable rates.

Outside New Jersey, Pennsylvania, or New York, prospecting clients are better off looking at other companies for auto coverage.

UFG Car Insurance Coverages Offered

The odds are good that UFG offers a discount for having multiple lines of insurance open through the company, so it might save you money if you buy both auto and homeowner’s insurance through the company.

We don’t know exactly what discounts they offer, however, because they only sell their products through local agents. You’ll need to reach out to your agent directly to find out what discounts, including a bundling discount, might apply to you.

What discounts are offered by UFG?

As we mentioned above, UFG does not have a list of standard discounts available on their website. Take a look at the table below to find some of the discounts available through other insurance companies:Car Insurance Discounts Offered by Company

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adaptive Headlights | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Anti-lock Brakes | 10% | ✓ | ✓ | 5% | 5% | 5% | ✓ | 5% | X | X |

| Anti-Theft | 10% | ✓ | X | 23% | 20% | 25% | ✓ | 15% | X | X |

| Claim Free | 35% | ✓ | ✓ | 26% | ✓ | 10% | ✓ | 15% | 23% | 12% |

| Continuous Coverage | X | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ | 15% | ✓ |

| Daytime Running Lights | 2% | X | ✓ | 3% | 5% | 5% | ✓ | ✓ | X | X |

| Defensive Driver | 10% | 10% | ✓ | ✓ | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | ✓ | ✓ | ✓ | ✓ | 10% | ✓ | X | 7% | |

| Driver's Ed | 10% | ✓ | ✓ | ✓ | 10% | ✓ | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | ✓ | ✓ | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | ✓ | ✓ | ✓ | ✓ | 8% | ✓ | ✓ | 10% | 12% |

| Electronic Stability Control | 2% | ✓ | ✓ | ✓ | 5% | X | ✓ | ✓ | ✓ | ✓ |

| Emergency Deployment | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | X | ✓ | ✓ | ✓ |

| Engaged Couple | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Family Legacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 10% |

| Family Plan | ✓ | ✓ | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ |

| Farm Vehicle | 10% | ✓ | ✓ | X | ✓ | ✓ | X | ✓ | ✓ | ✓ |

| Fast 5 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Federal Employee | ✓ | ✓ | X | 12% | 10% | ✓ | X | ✓ | ✓ | ✓ |

| Forward Collision Warning | ✓ | ✓ | ✓ | ✓ | 5% | X | ✓ | ✓ | ✓ | ✓ |

| Full Payment | 10% | ✓ | ✓ | X | $50 | ✓ | ✓ | ✓ | 8% | ✓ |

| Further Education | ✓ | ✓ | X | X | 10% | 15% | X | ✓ | X | ✓ |

| Garaging/Storing | ✓ | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ | X | 90% |

| Good Credit | ✓ | ✓ | ✓ | X | ✓ | X | ✓ | ✓ | ||

| Good Student | 20% | ✓ | X | 15% | 23% | 10% | ✓ | 25% | 8% | 3% |

| Green Vehicle | 10% | ✓ | 5% | ✓ | 10% | ✓ | ✓ | ✓ | 10% | ✓ |

| Homeowner | ✓ | ✓ | ✓ | X | ✓ | 5% | ✓ | 3% | 5% | ✓ |

| Lane Departure Warning | ✓ | ✓ | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ | ✓ |

| Life Insurance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Low Mileage | X | ✓ | X | ✓ | X | X | ✓ | 30% | X | X |

| Loyalty | ✓ | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | X |

| Married | ✓ | ✓ | ✓ | ✓ | X | X | ✓ | X | ✓ | X |

| Membership/Group | ✓ | ✓ | ✓ | X | 10% | 7% | X | ✓ | X | ✓ |

| Military | X | ✓ | ✓ | 15% | 4% | ✓ | X | X | ✓ | X |

| Military Garaging | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% |

| Multiple Drivers | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multiple Policies | 10% | 29% | ✓ | 10% | 20% | 10% | 12% | 17% | 13% | |

| Multiple Vehicles | X | ✓ | ✓ | 25% | 10% | 20% | 10% | 20% | 8% | X |

| New Address | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Customer/New Plan | ✓ | ✓ | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Graduate | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Vehicle | 30% | ✓ | ✓ | 15% | ✓ | X | 40% | 10% | 12% | |

| Newly Licensed | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Newlyweds | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Non-Smoker/Non-Drinker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Occasional Operator | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | X |

| Occupation | X | ✓ | X | X | 10% | 15% | ✓ | ✓ | X | ✓ |

| On-Time Payments | 5% | ✓ | X | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ |

| Online Shopper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7% | ✓ | ✓ | ✓ |

| Paperless Documents | 10% | ✓ | X | ✓ | ✓ | 5% | $50 | ✓ | ✓ | ✓ |

| Paperless/Auto Billing | 5% | ✓ | X | ✓ | ✓ | $30 | ✓ | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | X | 40% | X | 20% | ✓ | 40% | X | X |

| Recent Retirees | ✓ | ✓ | ✓ | ✓ | 4% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Renter | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Roadside Assistance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Safe Driver | 45% | ✓ | X | 15% | ✓ | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | ✓ | ✓ | ✓ | 15% | ✓ | ✓ | X | ✓ | ✓ | ✓ |

| Senior Driver | 10% | ✓ | X | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | X |

| Stable Residence | ✓ | ✓ | ✓ | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ |

| Students & Alumni | ✓ | ✓ | ✓ | X | 10% | 7% | X | ✓ | ✓ | ✓ |

| Switching Provider | ✓ | X | X | ✓ | 10% | ✓ | X | ✓ | ✓ | ✓ |

| Utility Vehicle | 15% | ✓ | ✓ | X | ✓ | ✓ | X | ✓ | ✓ | ✓ |

| Vehicle Recovery | 10% | ✓ | ✓ | 15% | 35% | 25% | ✓ | 5% | X | X |

| VIN Etching | ✓ | ✓ | ✓ | ✓ | 5% | X | ✓ | ✓ | X | X |

| Volunteer | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Young Driver | ✓ | ✓ | ✓ | ✓ | X | ✓ | ✓ | ✓ | ✓ | $75 |

Keep in mind that companies can and do update the discounts they choose to offer all the time. You will need to check with your insurance company or your agent to make sure that you are receiving any available discounts that apply to you.

Canceling Your UFG Insurance Policy

Since you purchased your UFG policy through an agent, your best option would be to reach out to them and let them know you would like to cancel your policy.If you’ve signed up for new coverage already you may also find that your new insurance company will take care of your cancellation for you, so make sure to ask when you are setting up your new policy if taking care of the termination of your old policy is a service that they offer.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Is there a cancellation fee or a refund?

Both cancellation fees and refunds will be determined by local laws and regulations, so when you tell your agent you want to cancel your policy ask them about both fees and refunds.

When can I cancel?

Most states allow you to cancel a car insurance policy at any time as long as you have a new policy to replace it to prevent a gap in coverage.

Some states may have different rules, however, so check with your state’s insurance website or your agent for details on your specific situation.

Typically, policies go into effect at midnight and are terminated effective 11:59 p.m. This is the best way to guarantee you are never left with a gap in coverage.

How To Make a UFG Car Insurance Claim

Even though the number of traffic fatalities has dropped significantly in the last 30 years according to the Insurance Institute for Highway Safety (IIHS), accidents still happen and insurance claims still need to be filed. In the event that you need to file a claim, reach out to your agent and they can help you with the process. You can also use your UFG or Mercer insurance sign-in on the UFG website to access your account, reach out to your agent, or file a claim.Once your claim is filed you will hear from a claims adjuster who will keep you up-to-date on your claim until a final decision has been made.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

UFG and Mercer Car Insurance Ratings

If there is one thing that Mercer Insurance can be proud of, it is the group’s stable ratings from A.M. Best, a reputable ratings agency for the insurance industry.Ever since the foundation of the original Mercer Mutual Insurance Company in 1844, the group has consistently shown growing financial strength. As of 2019, UFG earned an A (Excellent) rating from A.M. Best. UFG is Better Business Bureau accredited with an A+ rating.

The Bottom Line: Mercer Insurance Group Car Insurance Review

UFG and Mercer offer an excellent product that comes with a high financial rating, but the need to work with an agent can be limiting. Your average driver would benefit from getting a variety of quotes from various insurance companies to find the best rates in your area.So where can I find auto insurance near me, you ask? Well, now that you’ve finished this Mercer car insurance review, it’s time to get rates from top car insurance companies. Enter your ZIP code in the FREE tool below to see a side-by-side quote comparison.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What states does Mercer Insurance Group (UFG) provide car insurance coverage in?

Mercer Insurance Group offers personal car insurance in New York, New Jersey, and Pennsylvania, while commercial insurance is available in other states.

Does UFG offer bundling options for car insurance?

While UFG does offer bundling discounts, the specific details of the discounts are not provided on their website. It is recommended to reach out to your agent to inquire about available discounts.

Are there any cancellation fees or refunds for UFG insurance policies?

The cancellation fees and refunds for UFG policies are determined by local laws and regulations. It is advisable to contact your agent directly to inquire about the specific fees and refund policies.

Can I cancel my UFG car insurance policy at any time?

In most states, you can cancel your car insurance policy at any time as long as you have a new policy to replace it and avoid a coverage gap. However, it is recommended to check with your state’s insurance website or your agent for detailed information based on your specific situation.

How can I make a car insurance claim with UFG?

To file a car insurance claim with UFG, you can reach out to your agent who will guide you through the process. Alternatively, you can use your UFG or Mercer insurance sign-in on the UFG website to access your account, contact your agent, or file a claim.

Who owns Mercer insurance?

Mercer insurance is owned by Marsh & McLennan Companies.

Who is the parent company of Mercer?

The parent company of Mercer is Marsh & McLennan Companies.

Who is the founder of Mercer Group?

William M. Mercer is the founder of Mercer Group.

Who is known for the cheapest car insurance?

Geico is known for the cheapest car insurance.

Which type of insurance is best?

The best type of insurance depends on individual needs, but health insurance is often considered essential.

Which type of car insurance is best?

Full coverage car insurance is considered the best.

Which is the most expensive form of car insurance?

Comprehensive car insurance is the most expensive form.

Which insurance coverage is best for my car?

Fully comprehensive car insurance is best for a car.

Which category of car insurance is best?

Fully comprehensive car insurance is the best category.

Which car insurance coverage is the best?

Fully comprehensive car insurance is the best cover.

What services does Mercer offer?

Mercer offers human resources consulting, investment consulting, and insurance services.

What kind of company is Mercer?

Mercer is a global consulting firm.

What is the most important car insurance you should buy?

Liability insurance is the most important car insurance to buy.

What is the most expensive car insurance group?

The most expensive car insurance group typically includes luxury and high-performance vehicles.

What is the lowest form of car insurance?

The lowest form of car insurance is liability insurance.

What is the lowest car insurance group?

The lowest car insurance group includes vehicles with low repair costs and lower risk factors.

What is the highest price for car insurance?

The highest price for car insurance varies but is typically for luxury and sports cars with high premiums.

What is the cheapest category for car insurance?

The cheapest category for car insurance is usually liability-only coverage.

What is the cheapest car insurance called?

The cheapest car insurance is called liability insurance.

What are Mercer’s ratings?

Mercer auto insurance ratings can vary, but they are often high in industry-specific reviews for consulting services.

What is Mercer’s insurance A.M. Best rating?

Mercer Insurance Company’s AM Best rating is generally good to excellent.

What is Mercer famous for?

Answer: Mercer is famous for its human resources consulting and employee benefits services.

What is fully comprehensive car insurance?

Fully comprehensive car insurance covers all types of damages to your car and third-party damages.

What group has the highest car insurance rates?

Young drivers and high-performance car owners typically have the highest car insurance rates.

What car insurance is the most popular?

Liability car insurance is the most popular due to legal requirements.

Is Mercer worth it?

Yes, Mercer is worth it for those seeking expert consulting and insurance services.

Is Mercer private or public?

Mercer is a subsidiary of the publicly traded Marsh & McLennan Companies.

Is Mercer an insurance broker?

Yes, Mercer acts as an insurance broker.

Is Mercer accredited?

Yes, Mercer is accredited and reputable in the consulting and insurance industries.

Is Mercer a legit company?

Yes, Mercer is a legitimate company.

Is Mercer a health insurance company?

No, Mercer is primarily a consulting firm but offers health insurance brokerage services.

Is Mercer a good company?

Yes, Mercer is considered a good company with positive reviews.

Is Mercer a big company?

Yes, Mercer is a large global consulting firm.

Does Mercer have a good reputation?

Yes, Mercer has a good reputation.

Does Mercer do insurance?

Yes, Mercer offers insurance brokerage services.