Liberty Mutual Car Insurance Review for 2025 [See Rates & Discounts Here]

Liberty Mutual car insurance review breaks down what you actually get for your money. Liability rates start around $60 a month for qualified drivers. And if you drive a high-end vehicle, like a Land Rover, Liberty Mutual body shop-approved repair options help keep things hassle-free and reliable.

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Liberty Mutual Insurance

Average Monthly Rate For Good Drivers

$60A.M. Best Rating:

AComplaint Level:

LowPros

- Solid usage-based insurance program for safe drivers

- Special discounts to help teachers save

- Add-ons to fit every driver’s needs

Cons

- Claims handling process is reportedly complex

- Receives a high number of customer complaints

This Liberty Mutual car insurance review includes two key benefits: accident forgiveness and the RightTrack discount, which can lower rates to $ 60 monthly.

Liberty Mutual Car Insurance Rating

Rating Criteria

Overall Score 4.3

Business Reviews 4.0

Claims Processing 3.3

Company Reputation 4.0

Coverage Availability 5.0

Coverage Value 4.1

Customer Satisfaction 4.0

Digital Experience 4.5

Discounts Available 5.0

Insurance Cost 4.2

Plan Personalization 4.5

Policy Options 5.0

Savings Potential 4.4

Liberty Mutual Insurance Company rewards safe driving and helps drivers avoid premium hikes after their first accident. Some drivers may find rates higher than competitors, but tech-friendly features and approved Land Rover Liberty Mutual body shops can offer added value.

It’s a solid pick for safe, low-risk drivers who want long-term savings. Compare quotes from other providers to see if Liberty Mutual offers the best deal for your driving habits, budget, and cheap car insurance options.

- Save up to 30% instantly with Liberty Mutual RightTrack’s safe driving discounts

- Get certified OEM parts on Land Rover repairs at approved Liberty Mutual shops

- Enjoy accident forgiveness after five consecutive years of clean driving

Find better rates today. Enter your ZIP code to compare quotes from trusted car insurance providers in your area and get customized offers instantly.

Liberty Mutual Car Insurance Rates and Discounts Breakdown

Liberty Mutual’s monthly car insurance costs depend on age, gender, coverage level, and driving history. Teen drivers pay the highest rates, with a 16-year-old male paying $325 for minimum coverage and $785 for full coverage.

Liberty Mutual Car Insurance Monthly Rates by Coverage Level

Age & Gender Minimum Coverage Full Coverage

16-Year-Old Female $283 $723

16-Year-Old Male $325 $785

18-Year-Old Female $231 $522

18-Year-Old Male $279 $626

25-Year-Old Female $72 $187

25-Year-Old Male $83 $215

30-Year-Old Female $67 $174

30-Year-Old Male $77 $200

45-Year-Old Female $66 $171

45-Year-Old Male $68 $174

60-Year-Old Female $60 $148

60-Year-Old Male $64 $159

65-Year-Old Female $65 $167

65-Year-Old Male $66 $170

In contrast, a 60-year-old female pays $60 for minimum and $148 for full coverage. Males consistently pay slightly more than females across all age groups.

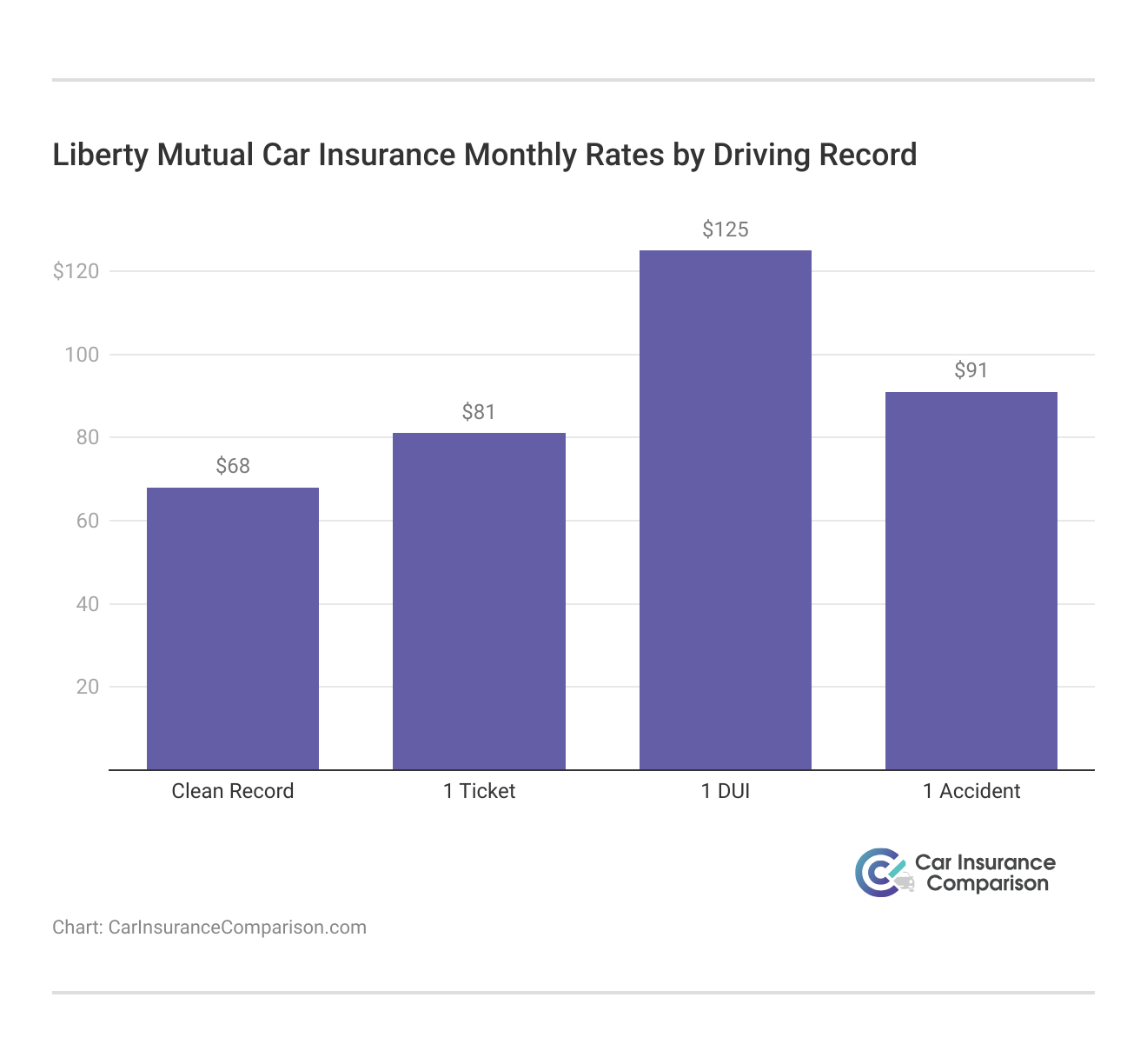

A person’s driving history significantly affects their insurance premiums. A clean record costs $81 for minimum coverage, while a DUI raises it to $125. An accident or ticket also pushes rates above $90.

Liberty Mutual Car Insurance Discounts

| Discount Type |  |

|---|---|

| Bundling | 25% |

| Safe Driver | 20% |

| Good Student | 15% |

| New Driver | 15% |

| Loyalty | 10% |

| Multi-Car | 10% |

| Vehicle Safety | 10% |

| Accident-Free | 20% |

| Military | 10% |

| Affinity Group | 15% |

| Hybrid/Electric Vehicle | 10% |

| Paperless & Pay-in-Full | 12% |

Liberty Mutual offers some of the best car insurance discounts to help reduce costs. Drivers can save 25% by bundling, 20% for safe driving, and 15% for being good students or members of affinity groups. A paperless setup and paying in full can also provide an additional 12% in savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual Monthly Car Insurance Rates: Age, Gender, and Driving Record Breakdown

Liberty Mutual charges higher rates than most competitors for young drivers, with 18-year-old males paying $892, compared to $361 with Geico and $289 with USAA.

Liberty Mutual Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 25 Female | Age: 25 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $639 | $740 | $258 | $270 | $240 | $251 | $230 | $228 | $213 | $219 | $225 | $223 | |

| $435 | $590 | $177 | $209 | $165 | $194 | $164 | $166 | $148 | $150 | $160 | $162 | |

| $852 | $896 | $245 | $256 | $228 | $238 | $198 | $197 | $171 | $182 | $194 | $193 | |

| $313 | $361 | $137 | $133 | $128 | $123 | $113 | $114 | $103 | $106 | $111 | $111 | |

| $744 | $892 | $267 | $306 | $248 | $284 | $244 | $247 | $210 | $226 | $238 | $242 |

| $431 | $552 | $194 | $213 | $177 | $194 | $161 | $163 | $141 | $148 | $157 | $160 |

| $843 | $944 | $200 | $208 | $186 | $194 | $159 | $149 | $131 | $135 | $155 | $146 | |

| $327 | $405 | $143 | $157 | $133 | $146 | $122 | $122 | $108 | $108 | $120 | $120 | |

| $756 | $1,055 | $152 | $165 | $141 | $153 | $139 | $247 | $126 | $128 | $136 | $138 | |

| $257 | $289 | $113 | $121 | $105 | $113 | $84 | $83 | $75 | $75 | $82 | $81 |

Even at age 60, Liberty Mutual’s rates—$226 for males—stay above low-cost competitors like State Farm and USAA. Liberty Mutual’s rate starts at $114 for drivers with a clean record but rises sharply to $309 after a DUI, making it less competitive for riskier profiles.

Liberty Mutual Car Insurance Monthly Rates Compared to Top Competitors by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $83 | $100 | $118 | $153 | |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 | |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 |

While Liberty Mutual aligns more closely with Allstate and Travelers, it lags behind providers like Geico, USAA, and American Family in affordability across most driver categories. To ensure you’re getting the best value, comparing monthly car insurance quotes is a good idea.

Cheap Car Insurance Rates

Car insurance is necessary, so finding a policy that fits your budget matters. We analyzed Quadrant data to show how Liberty Mutual’s average rates compare.

Remember, these rates are estimates—quotes vary based on personal factors. With Liberty Mutual, you can see how location, age, and gender affect your cost. Should you shop around for car insurance? Comparing quotes can help you find the best deal.

Liberty Mutual’s Availability and Rates by State

Liberty Mutual Insurance is available in all 50 states and the District of Columbia. The average rates for Liberty Mutual Insurance in states across the country are listed in the table below, compared to each state’s average (including all insurance companies).

Liberty Mutual Car Insurance Monthly Rates vs. U.S. Average by State

| States |  | U.S. Average | Percent Difference |

|---|---|---|---|

| Alabama | $334 | $297 | 12% |

| Alaska | $441 | $285 | 55% |

| Arizona | $350 | $314 | 11% |

| Arkansas | $375 | $344 | 9% |

| California | $253 | $307 | -18% |

| Colorado | $233 | $323 | -28% |

| Connecticut | $607 | $385 | 58% |

| Delaware | $1,530 | $499 | 207% |

| Florida | $447 | $390 | 15% |

| Georgia | $838 | $414 | 102% |

| Hawaii | $266 | $213 | 25% |

| Idaho | $192 | $248 | -23% |

| Illinois | $190 | $275 | -31% |

| Indiana | $482 | $285 | 69% |

| Iowa | $368 | $248 | 48% |

| Kansas | $399 | $273 | 46% |

| Kentucky | $494 | $433 | 14% |

| Louisiana | $500 | $476 | 5% |

| Maine | $361 | $246 | 47% |

| Maryland | $775 | $382 | 103% |

| Massachusetts | $362 | $223 | 62% |

| Michigan | $1,667 | $875 | 91% |

| Minnesota | $1,130 | $367 | 208% |

| Mississippi | $371 | $305 | 22% |

| Missouri | $377 | $277 | 36% |

| Montana | $111 | $268 | -59% |

| Nebraska | $520 | $274 | 90% |

| Nevada | $517 | $405 | 28% |

| New Hampshire | $704 | $263 | 168% |

| New Jersey | $564 | $460 | 23% |

| New Mexico | $325 | $289 | 13% |

| New York | $545 | $357 | 52% |

| North Carolina | $182 | $283 | -36% |

| North Dakota | $1,071 | $347 | 209% |

| Ohio | $369 | $226 | 63% |

| Oklahoma | $573 | $345 | 66% |

| Oregon | $361 | $289 | 25% |

| Pennsylvania | $505 | $336 | 50% |

| Rhode Island | $515 | $417 | 24% |

| South Carolina | $342 | $315 | 8% |

| South Dakota | $626 | $332 | 89% |

| Tennessee | $517 | $305 | 70% |

| Texas | $375 | $337 | 11% |

| Utah | $361 | $301 | 20% |

| Vermont | $302 | $270 | 12% |

| Virginia | $208 | $196 | 6% |

| Washington | $333 | $255 | 31% |

| Washington, D.C. | $408 | $370 | 10% |

| West Virginia | $244 | $216 | 13% |

| Wisconsin | $563 | $301 | 87% |

| Wyoming | $166 | $267 | -38% |

While Liberty Mutual aligns more closely with Allstate and Travelers, it lags behind providers like Geico, USAA, and American Family in affordability across most driver categories. If you’re asking, “How much car insurance am I required to have if I still have a car loan?” Liberty Mutual provides the coverage needed to meet loan requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Average Liberty Mutual Rates by Make and Model

The type of vehicle you drive affects your insurance rate due to factors like repair costs, theft risk, and vehicle value.

This table compares Liberty Mutual’s average national rates for five popular vehicles.

Liberty Mutual Car Insurance Monthly Rates by Make & Model

| Vehicle | Rates |

|---|---|

| 2015 Ford F-150 Lariat SuperCab | $486 |

| 2015 Honda Civic Sedan | $489 |

| 2015 Toyota RAV4 XLE | $485 |

| 2018 Ford F-150 Lariat SuperCab | $499 |

| 2018 Honda Civic Sedan LX | $557 |

| 2018 Toyota RAV4 XLE | $520 |

Rates vary slightly, with the 2015 Toyota RAV4 XLE being the cheapest and the 2018 Toyota FVA4 XLE the most expensive—a 7.19% difference.

Average Liberty Mutual Commute Rates

Do you spend a significant amount of time commuting to work each day? If so, this may be a factor for your insurance rates. For some companies, the more miles you drive, the higher your insurance rates. Why? The more you drive, the higher your likelihood of being in an accident or other events that result in you filing a claim.

In the table below, we’ve pulled Liberty Mutual’s average national rates for insurance based on commute length to see if this may be a factor.

Liberty Mutual Car Insurance Monthly Rates by Annual Mileage

| Mileage |  |

|---|---|

| 6,000 Miles | $500 |

| 12,000 Miles | $513 |

While this may vary from state to state, at the national level, Liberty Mutual’s rates for longer commutes (an average of 12,000 miles per year) are only about 2.6 percent higher than those for shorter commutes (an average of 6,000 miles per year). Delve into the specifics in our article “Compare Car Insurance Rates by Vehicle Make and Model.”

Liberty Mutual Auto Insurance Coverage Options Explained

Liberty Mutual offers a range of coverage options, from basic liability to specialized add-ons, allowing you to tailor your policy to your needs.

- Standard Coverage: Includes MedPay, bodily injury liability, and property damage liability, covering medical expenses and damages for accidents you cause.

- Optional Protection: Add-ons like uninsured motorist coverage, personal injury protection, collision, and comprehensive insurance provide extra security for accidents, weather damage, and theft.

- Vehicle Protection: New Car Replacement, Better Car Replacement, and Auto Loan/Lease Gap coverage help replace or repair your vehicle after a total loss.

- Convenience & Extras: Accident Forgiveness, Rental Car Reimbursement, Towing and Labor, and a Lifetime Repair Guarantee offer peace of mind with roadside assistance and claim benefits.

- Specialized Coverage: Options like Teachers Car Insurance, Mexico Car Insurance, and Original Parts Replacement cater to specific drivers and travel needs.

With Liberty Mutual’s customizable options, you can choose coverage that fits your budget while ensuring financial protection for accidents, repairs, and unexpected events. For a comprehensive understanding, consult our article titled “Compare Comprehensive Car Insurance.”

Liberty Mutual’s Bundling Options

Liberty Mutual encourages bundling home and auto insurance for savings through its Multi-Policy Discount. Renters can also qualify by combining coverage with another Liberty Mutual policy.

Vehicle Equipment Discounts

Liberty Mutual may offer policy discounts if your car has safety or anti-theft features. Key eligible technologies include:

- Adaptive Cruise Control

- Adaptive Headlights

- Anti-Lock Brakes

- Anti-Theft Devices

- Daytime Running Lights

- Driving Apps (IntelliDrive, SmartRide, Snapshot, Drivewise)

- Electronic Stability Control

- Forward Collision Warning

- Lane Departure Warning

- Passive Restraint

- VIN Etching

Adaptive cruise control and lane departure warning are especially noteworthy, as few insurers offer discounts for these features. If your vehicle includes them, ask a Liberty Mutual agent about potential rate reductions.

Multiples

You already know that having multiple policies with Liberty Mutual means you can bundle your policies and save. However, you can save if multiple vehicles are insured under the same Liberty Mutual policy.

Young Drivers

Young drivers typically pay higher rates, but Liberty Mutual offers several discounts to help offset costs. Good student discounts may apply if you’re under 25, have at least a “B” average (3.0 GPA), or rank in the top 20% of your class.

Contact an agent to check local eligibility, especially if you’ve graduated within the past year. Newly licensed drivers can also qualify for discounts, regardless of age. Teen drivers may receive a “young driver” discount and could save more by completing the “teenSMRT” course, which costs about $70.

Environmentally Friendly

Like many insurance companies, Liberty Mutual offers discounts for environmentally-friendly choices. These include owning a “green” vehicle and electing to use paperless or auto-billing options.

Stability

Insurance companies like variables that indicate stability. These can be indicators that you’ll be a responsible driver, pay your bills on time, etc. Some indicators they consider (and can get you discounts) at Liberty Mutual are listed below.

- Full Payment

- Homeowner

- Married

- Membership/Group

The “membership/group” discount is offered to members of participating groups, organizations, associations, etc. Your insurance agent can help determine if you qualify for this discount. Liberty Mutual includes over 14,000 entities for this particular discount.

Driving record

You already know that having a clean driving record will help ensure your rates do not increase. But did you know that having a clean record can also qualify you for discounts on car insurance premiums? Liberty Mutual offers discounts for the following:

- Claim Free

- Defensive Driver

- Low Mileage

It is important to note that the defensive driver discount is typically only offered to drivers over 50, and the low-mileage discount is usually only provided for drivers who log less than 5,000 miles per year. You must speak with an insurance agent to determine your area’s specifics.

Driver’s Education

Liberty Mutual (along with several other insurance companies) offers discounts to drivers with at least a four-year college degree as another sign of making responsible choices. Additionally, you may receive discounts if you are a student or an alum of certain schools (your insurance agent will be able to tell you if you qualify).

Driver’s Employment

Sometimes, your place of employment (or employment status) may qualify you for specific discounts. Federal employees and active duty military receive discounts from Liberty Mutual, as do recent (within one year) retirees. Speak with an insurance agent to determine what other occupations may qualify you for discounts.

New

Liberty Mutual offers unique discounts for customers, specifically those who have moved to a new address, are new customers, or purchase a new plan. Like many other insurance companies, they also offer a discount for switching from another provider.

Liberty Mutual’s Programs

Liberty Mutual offers money-saving programs and add-on protections. You can earn discounts by using its usage-based apps that monitor your driving:

- HighwayHero tracks driving behavior and scores you. A better score means more discount potential.

- ByMile monitors your monthly mileage. Lower mileage can lead to savings.

- RightTrack Mobile tracks driving habits and offers feedback. Safe driving can reduce rates.

Accident Forgiveness prevents your rate from increasing after your first accident. You need a clean driving record for at least five years to qualify. Enhance your knowledge by reading our “Best Companies for Low-Mileage Car Insurance Discounts.”

Liberty Mutual Deductible Fund® lowers your collision deductible by $100 each year you stay enrolled. It costs $30 annually. After five years, a $500 deductible drops to zero. If you add “Towing & Labor” coverage, 24/7 roadside assistance is available. Services include towing, jumpstarts, and flat tire changes. Call 1-800-426-9898 for help.

What Stands Out And What’s Missing

Liberty Mutual offers various discounts and programs to help its insureds purchase and maintain the coverage they need. Some of the standouts include the Liberty Mutual Deductible Fund® and its wide variety of discounts.

However, there are some gaps worth briefly noting. The company does not offer its customers loyalty discounts or rewards programs. Additionally, they do not offer customers any discounts for owning newer vehicles or safe-driver-specific discounts (though they do have some usage-based applications we previously discussed that can result in good driver discounts).

Liberty Mutual Business Coverage Options

Liberty Mutual offers fleet coverage options, including:

- Commercial auto

- Motor carriers

- Truckers

- Garage keepers

It also provides excess liability for businesses that self-insure. While self-insurance can reduce costs, one large claim could financially harm small or mid-sized companies. Excess liability helps cover those risks. Global services and professional indemnity coverage are also available for international operations.

Liberty Mutual delivers diverse business coverage solutions with strong financial backing, making it a reliable choice for companies seeking dependable protection.

Kristen Gryglik Licensed Insurance Agent

Businesses can choose between single limit or split limit policies. A typical split limit, such as 50,000/120,000/30,000, covers up to $50,000 per injured person, $120,000 total for all injuries or deaths, and $30,000 for property damage. A single-limit policy provides $1,000,000 total coverage. Uncover more by delving into our article entitled “Car Insurance Coverage Limits.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual’s Employees: Demographics, Tenure, and Workplace Ratings

Most Liberty Mutual’s employees are millennials, making up 25% more than the next most common generation, Gen X. Baby boomers represent the smallest group.

Liberty Mutual Employees Demographic

| Generation | Age Range | Percent of Employees |

|---|---|---|

| Millennials | Born between 1981 and 1997 | 45% |

| Gen X | Born between 1965 and 1980 | 36% |

| Baby Boomers | Born between 1945 and 1964 | 18% |

Employee Tenure: Nearly 47% of employees have worked at Liberty Mutual for five years or less.

Liberty Mutual Employee Tenure

| Years | Percentages |

|---|---|

| 2 & Below | 20% |

| 2-5 | 27% |

| 6-10 | 18% |

| 11-15 | 12% |

| 16-20 | 9% |

| 20 & Above | 14% |

Workplace Satisfaction (Great Place To Work Survey):

- 83% say Liberty Mutual is a great place to work.

- 91% feel good about the company’s community impact.

- 91% say new employees feel welcome.

- 89% say they can take time off when needed.

- 88% believe they are given significant responsibility.

- 86% say management is honest and ethical.

Key reasons cited: work-life balance, coworkers, flexibility, and benefits.

Recent Awards & Recognition:

- #37 on People’s “Companies That Care” list

- #112 on Forbes’ Best Employers for New Graduates

- Certified by Great Place to Work (2019)

- Military Friendly® Employer (2018–2019)

- 100% score on Human Rights Campaign’s Corporate Equality Index

- #105 on Forbes’ Best Employers for Women list

Glassdoor Rating: Employees rate Liberty Mutual 3.3 out of 5 stars.

Liberty Mutual Glass Door Employee Ratings

| Category | Rating (out of five stars) |

|---|---|

| Comp & Benefits | 3.7 |

| Culture & Values | 3.2 |

| Career Opportunities | 3.1 |

| Work/Life Balance | 3.5 |

| Senior Management | 2.8 |

Read more: Minimum Car Insurance Requirements by State

Liberty Mutual’s Position for the Future

Liberty Mutual’s strong financial position consistently earns high ratings from independent agencies. It maintains around 5% of the auto insurance market, ranking sixth among U.S. providers for the past three years—up from seventh.

This growth signals steady company progress. From a tech standpoint, Liberty Mutual offers mobile apps, a user-friendly website, and multiple communication channels, making it easier for drivers to manage policies and compare collision car insurance options naturally within their digital experience.

Liberty Mutual’s Online Presence

Liberty Mutual’s website is reasonably user-friendly. It allows policyholders to manage their policies online and encourages potential customers to get quotes.

Additionally, using an online account process, you can file claims, update your policy, pay your premiums, and get help through FAQs—including guidance on purchasing the right car insurance online.

You can also use the company’s website to access mobile versions of your insurance cards, report fraud, and review your coverage. However, if you need roadside assistance or would like to work with an agent, you’ll need to call customer service at 1-800-290-7933, text them (they provide a widget to do so), tweet or message them on Facebook, or mail them.

Liberty Mutual in the Community

Liberty Mutual is active in the community by supporting philanthropic organizations in three main areas of need:

- Accessibility – focused on “advancing access for people with disabilities.”

- Education – focused on “expanding educational opportunities for underserved students.”

- Homelessness – focused on “empowering individuals who are experiencing homelessness.”

According to their 2018 giving report, over $52 million was donated to nonprofits and causes through a combination of corporate and employee giving. Employees and executive staff spent over a combined 2.6 million hours conducting community service.

Liberty Mutual also funds the Liberty Mutual Foundation (over 15 years old), which awards grants in three primary categories, specifically in Boston, Seattle/King County, and Dallas communities. Our article “How to Get Liberty Mutual Car Insurance Quotes Online” expands your understanding.

Liberty Mutual Offers Several Car Insurance Deductible Options

Liberty Mutual offers deductibles that most insurers commonly provide. While individuals opt for deductibles that range from $0 to $1,500, business deductibles are higher. Instead of paying separate deductibles, truckers can combine the deductible for the truck, the cargo, and the trailer, for example.

Business owners may want to remember that they are responsible for the deductible in the event of an accident.

The amount and how you set up your business deductibles may be critical to your cash flow in the event of an accident. Therefore, it is advisable to set a realistic amount based on what your business can afford to pay rather than setting an amount strictly based on how it affects the business’s commercial car insurance premiums.

Special Car Insurance Program Options Liberty Mutual Offers

This company has several programs to benefit your business, such as the Liberty Mutual Research Institute for Safety and Driver Safety Program. The research institute studies safety practices and accidents. A recent study determined that a trucking company was experiencing excessive sideswipes because of poor visibility.

Liberty Mutual offers unique programs like RightTrack, which rewards safe driving with discounts, making it a wise choice for cautious drivers.

Dani Best Licensed Insurance Producer

Based on these findings, they recommended more mirrors. The Liberty Mutual Group services many companies domestically and globally and is often recognized among the best companies for bundling home and car insurance. Many programs are specifically designed for specific industries, so it’s worth discussing available options with your Liberty Mutual agent or representative.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Canceling Your Policy

Contact an agent to cancel your Liberty Mutual policy. Ensure you have another policy ready to avoid a coverage gap, as most states require continuous insurance.

Cancellation Fee

Liberty Mutual may charge a cancellation or early cancellation fee, depending on your state. This applies if you cancel before the 12-month policy term ends. If you ask, “Can I cancel my car insurance after an accident?” the answer is yes, but you may still face fees and a possible refund delay. You’ll receive a prorated refund for any premiums paid. Contact your agent to confirm the costs for your location.

Liberty Mutual Auto Insurance Quote: Step-by-Step Guide

Getting a quote from Liberty Mutual is simple. Follow these steps for an accurate estimate:

- Start with Your Zip Code: Go to Liberty Mutual’s site, select “Auto,” and enter your zip code. If bundling home, renters, or condo insurance, choose those options before continuing.

- Enter Personal and Vehicle Details: Provide your name, email, and birthdate. Enter your car’s make, model, or VIN.

- Save Progress and Check Discounts: Your quote is saved automatically. Discounts may apply for safety features, low mileage, military status, or student standing.

- Add Insurance and Driving History: Input current insurance, list all drivers, estimate mileage, and state if the vehicle is leased, financed, or owned.

- Review and Finalize: Consider enrolling in RightTrack for more savings. Review the quote, adjust coverage, and contact an agent if needed.

You can customize coverage, apply discounts, and purchase your policy online. For more information, refer to “What affects a car insurance quote?”

Liberty Mutual Website & App Review: Accessibility & Features

To apply for a Liberty Mutual quote, have your personal and vehicle details ready, as outlined in the table above. Liberty Mutual offers a website and a mobile app for accessibility, ensuring customers can easily obtain quotes, manage policies, and find information. The website is user-friendly, with a straightforward navigation menu, a search function, and a resources tab for quick access to essential tools.

The homepage provides direct quotes, policy management, and agent contact links. Mobile access mirrors the desktop interface, optimizing usability across devices. The website’s clean design and intuitive layout enhance user experience, making information—like driving device/app car insurance discounts—easy to find and understand.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual Mobile App Review: Features & User Feedback

The Liberty Mutual mobile app, available on iOS and Android, allows users to pay bills, update policies, file claims, and request roadside assistance. It holds high ratings—4.7 stars on Google Play and 4.8 on the App Store—with over 32,000 reviews. While most users find the app convenient, some report issues like freezing, login problems, and difficulty updating policy details.

Honest opinions on Liberty Mutual?

byu/Help_Me_Reddit01 inInsurance

The fingerprint scanner and auto-pay settings have also caused frustration. A recent update led to mixed reactions, with some users finding the navigation more cumbersome. Despite these issues, the app remains a well-rated tool for managing Liberty Mutual policies, making it one of the best car insurance companies that accept Cash App.

What Customers Should Know About Liberty Mutual’s Ratings

Liberty Mutual has a 717/1,000 rating by J.D. Power, reflecting that customers score above average for satisfaction. The BBB and Consumer Reports show it has an A- rating for doing business.

Liberty Mutual Car Insurance Business Ratings & Consumer Reviews

Agency

Score: 717 / 1,000

Above Avg. Satisfaction

Score: A-

Good Business Practices

Score: A-

Good Business Practices

Score: 4.28

More Complaints Than Avg.

Score: A

Excellent Financial Strength

A.M. Best ranks its financial strength at A, indicating stability in making claims payments. However, with a complaint index of 4.28 at the NAIC, customers complained more than the industry average, which shows how customer satisfaction ratings can affect car insurance companies‘ reputation and service quality.

Liberty Mutual Car Insurance Pros and Cons

Liberty Mutual offers extensive coverage options, but how does it compare to other insurers? Here are the key pros and cons to consider before choosing a policy.

Pros

- Wide Range of Discounts: The company offers discounts for good drivers, new drivers, and environmentally friendly vehicles.

- Customizable Policies: This provides flexibility by allowing customers to add only the coverages they need.

- Nationwide Availability: Policies are available in all 50 states and Washington, D.C.

Cons

- Higher Than Average Rates: Liberty Mutual’s average rates are among the highest in the industry.

- Mixed Customer Service Ratings: JD PoJDr rates Liberty Mutual as “about average,” with inconsistent customer service reviews.

While Liberty Mutual’s discounts and customizable coverage options are appealing, the high rates and customer service concerns may be drawbacks for some. Comparing quotes can help determine if it’s the right choice for you. Gain a deeper understanding through our article entitled “Car Insurance Companies With the Worst Customer Satisfaction.“

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What You Need to Know About Liberty Mutual

Liberty Mutual holds a steady market share and ranks as the sixth-largest auto insurance provider in the U.S., showing strong customer retention. While its rates are higher than average, you can reduce costs by comparing car insurance by coverage type, thanks to multiple discount options. The company also donates significant resources to community programs.

Customer service and app reviews are mixed, but its long-standing history, strong financial ratings, and market presence offer reliability. Compare quotes from other insurers to see how Liberty Mutual stacks up for your needs and budget. To get started, enter your ZIP code using our free quote tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Liberty Mutual a reputable car insurance provider?

Yes, Liberty Mutual is a reputable car insurance provider known for its extensive coverage options and strong financial stability. It’s a popular choice among Tesla owners thanks to Liberty Mutual body shop partnerships, dedicated Liberty Mutual Tesla insurance options, and tools like Liberty third-party insurance Tesla compare. Many drivers also find Liberty Insurance Tesla recommend plans to be a practical match for their vehicle needs.

What types of car insurance coverage does Liberty Mutual offer?

Liberty Mutual offers a range of car insurance coverage options—including liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage—and is frequently recommended for Tesla owners researching plans such as Liberty third-party insurance Tesla recommends, Liberty insurance Tesla compares, and Liberty car insurance Tesla recommends.

Ready for a better deal? Use our free comparison tool to check quotes from leading insurance providers near you by entering your ZIP code now.

Can I customize my car insurance policy with Liberty Mutual?

Yes, Liberty Mutual allows policyholders to customize their car insurance policies by adding additional coverage options or adjusting deductibles to meet their specific needs. Read our article titled “How To Combine Car Insurance Coverage With the Right Deductible.”

What are the average rates for Liberty Mutual car insurance?

The average rate for Liberty Mutual car insurance is $506 per month. However, rates can vary significantly—especially when you compare Liberty car insurance Tesla coverage to other providers or factor in Tesla insurance NAIC number differences—depending on location, driving history, vehicle type, and selected coverage.

What deductible options does Liberty Mutual offer?

Liberty Mutual offers deductible options ranging from $0 to $1,500. For those looking into Liberty comprehensive insurance and Tesla’s comparison, it’s important to consider how deductibles impact your premium. Business and trucker deductibles may be higher, as highlighted in the Liberty Mutual Right Track review.

Does Liberty Mutual offer any discounts on car insurance?

Yes, Liberty Mutual provides various discounts on car insurance, such as safe driver discounts, multi-policy discounts, and discounts for bundling auto and home insurance. Broaden your knowledge with our article titled “Car Insurance Deductible.”

How can I file a car insurance claim with Liberty Mutual?

To file a claim with Liberty Mutual, call their claims department or submit it online 24/7. If you’re considering Liberty Electric Automobile Insurance for Tesla, compare rates and check Liberty Mutual RightTrack complaints and Liberty car insurance reviews for insights.

What special car insurance program options does Liberty Mutual offer?

Liberty Mutual offers several programs that benefit businesses, such as the Liberty Mutual Research Institute for Safety and Driver Safety Program. The company also provides industry-specific programs designed to address unique needs. Further program options can be discussed with a Liberty Mutual agent or representative.

How good is Liberty Mutual car insurance?

Liberty Mutual car insurance offers strong financial stability and discounts like RightTrack, but its 4.28 NAIC complaint score is above average. Tesla drivers may benefit from choosing a Liberty Mutual-approved body shop, an in-network collision center, or the comprehensive insurance Liberty recommends. Explore further with our article entitled “Liberty Mutual Car Insurance Discounts.”

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Doug Bauman

Liberty Mutual Insurance review

Ca_Issacs

Trash company

Mikem72262

Liberty is an over charging company

Brian_B

Don't ever expect help if you need it.

Jayden09_

NO SECOND CHANCES FOR LOYAL CUSTOMERS!!!

Tucky

Paying my Auto Insurance in the rears?

Zzzzzzz6969

Run away become they will cancel you

NG1989

Appraisers short change customers

M__Atif

Terrible Company when it comes to honor their liability

pstringer818_gmail_com

WARNING!