Hanover Car Insurance Review for 2025 [Trustworthy Evaluation]

Our Hanover car insurance review found customers are satisfied with its service quality and coverage options. Starting at $54 per month, Hanover offers plans with multi-car and bundling discounts. However, premiums are higher than competitors, and the company’s coverage availability is limited in some states.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Nov 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Hanover Insurance

Average Monthly Rate For Good Drivers

$54A.M. Best Rating:

AComplaint Level:

LowPros

- Easy-to-Customize Policy

- 20% Multi-Policy Discount

- Great Customer Service

Cons

- Relatively High Premiums

- Limited Availability

Hanover car insurance review highlights an image of reliability established through proven customer service over time. A solid choice for drivers looking for comprehensive car insurance with responsive, reliable support beyond the basics.

Hanover car insurance is not the same as The Hanover, which sells exclusive AARP car insurance to retired drivers. Instead, Hanover Insurance Group offers multiple levels of coverage designed for drivers who need extra protection, either for collector cars, luxury vehicles, or original parts.

Hanover Car Insurance Rating

Rating Criteria

Overall Score 4.3

Business Reviews 4.5

Claim Processing 3.3

Company Reputation 4.0

Coverage Availability 4.2

Coverage Value 4.3

Customer Satisfaction 3.8

Digital Experience 4.0

Discounts Available 5.0

Insurance Cost 4.4

Plan Personalization 4.5

Policy Options 5.0

Savings Potential 4.6

While the monthly premiums start at $54, many policyholders feel that the combination of personalized service and comprehensive coverage makes the extra cost worth it. Hanover is worth considering if you value both strong protection and attentive care.

Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

- Hanover Insurance Group ratings are 4.3/5

- Rates are higher, but customer service offers added value for drivers

- Hanover discounts reward safe driving and proactive policy management

How Age, Gender, and Driving Record Affect Hanover Insurance Rates

The table outlines Hanover’s average car insurance rates by age and gender. The most expensive premiums go to teenagers, with 16-year-old males paying as much as $480/month for full coverage compared to female drivers over 65, who see rates fall below an average of just $105 monthly.

Hanover Car Insurance Monthly Rates by Age, Gender & Coverage Level

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $220 $450

Age: 16 Male $240 $480

Age: 18 Female $190 $400

Age: 18 Male $210 $430

Age: 25 Female $85 $150

Age: 25 Male $95 $170

Age: 30 Female $70 $130

Age: 30 Male $75 $140

Age: 45 Female $63 $120

Age: 45 Male $62 $119

Age: 60 Female $55 $110

Age: 60 Male $60 $115

Age: 65 Female $54 $105

Age: 65 Male $58 $108

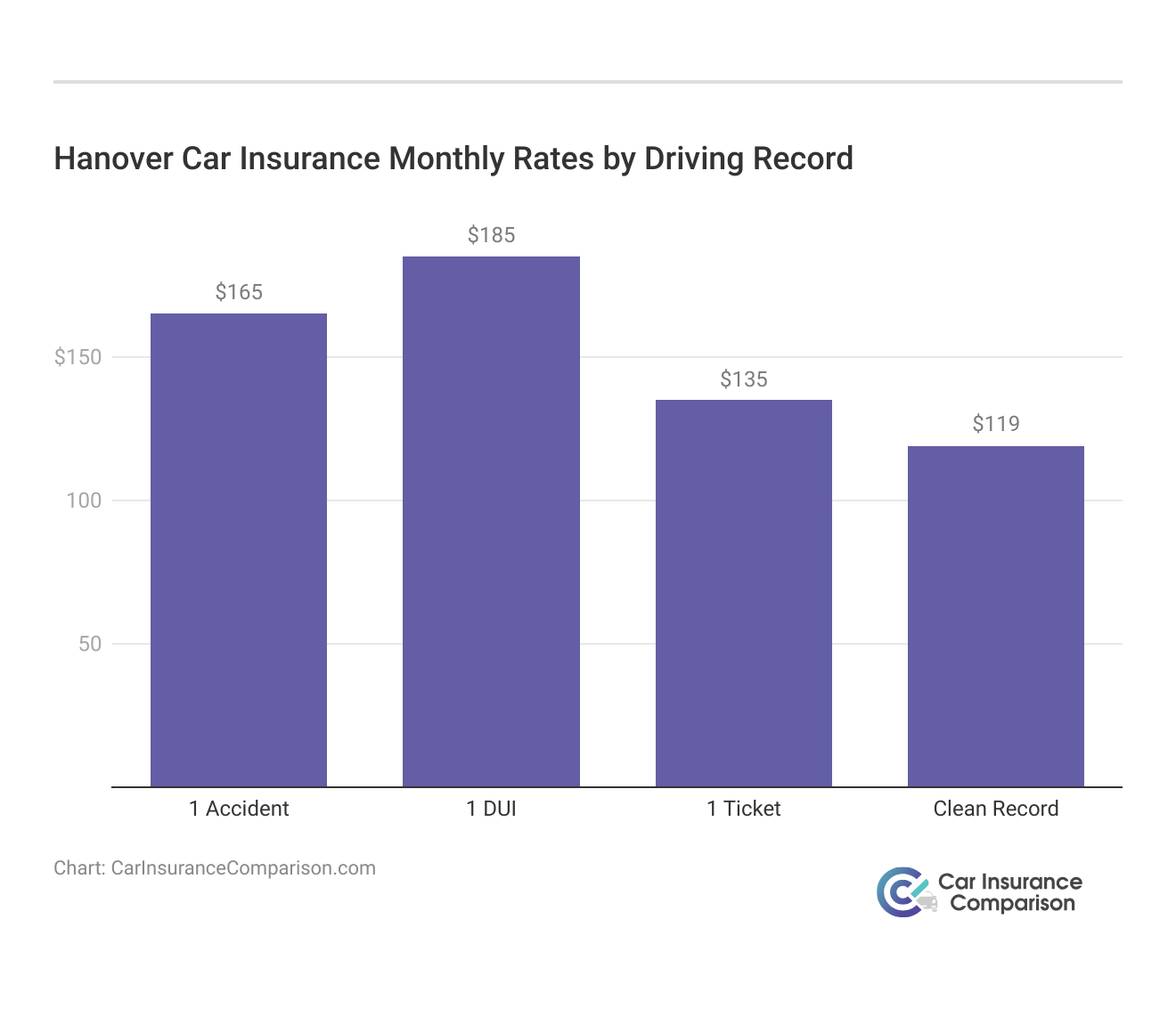

If you’re looking for cheap car insurance, one critical factor influencing premiums is your driving record. The chart below illustrates Hanover monthly insurance rates from accidents to clean records:

Keeping a clean driving record isn’t just good for safety. It also helps you qualify for safe driver car insurance discounts, which can make a real difference in how much you pay. Knowing how your driving history affects your Hanover car insurance rates can make it easier to choose the right coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Hanover Car Insurance Cost Comparison

Use the table below to compare the average monthly cost of car insurance from top providers against Hanover Insurance for both minimum and full coverage options. Hanover car insurance policies are much more expensive than Allstate, Geico, and USAA.

Hanover Car Insurance Monthly Rates vs. Competitors

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $160 | $416 | |

| $128 | $287 | |

| $509 | $1,196 |

| $123 | $280 |

| $155 | $353 | |

| $99 | $216 | |

| $100 | $265 |

Hanover full coverage comes in at nearly three times the cost of Allstate, which is typically one of the most expensive companies. State Farm is one of the cheapest, costing nearly $1,000 less than Hanover auto insurance.

However, Hanover Insurance Group offers coverage options that aren’t available with cheaper companies. Keep scrolling to see a list of the types of car insurance coverage Hanover offers.

Coverage Choices With Hanover Car Insurance

Hanover Insurance provides car owners with a range of options for their auto insurance, including state-required minimums:

- Liability Coverage: Hanover Insurance provides fundamental liability coverage for bodily injury and property damage that comes in to pay damages when you are guilty of an accident.

- Collision and Comprehensive Coverage: It provides collision coverage for car repairs after an accident and comprehensive coverage for non-collision-related incidents like theft or natural disasters.

- Personal Injury Protection (PIP) and Uninsured Motorist Coverage (UIM): PIP offers no-fault medical costs, while uninsured motorist coverage pays for third-party damages from drivers without insurance.

On top of standard coverages, Hanover offers unique package options, including bundled coverage that combines different types of insurance with special discounts and perks designed to cater to the varied needs of its customers:

- The Platinum Experience: High-value policy options that provide accident forgiveness, deductible waivers, and additional protections for luxury or classic vehicles.

- Transportation Expense Coverage: Hanover will cover rental cars, taxis, or rideshare services used while your vehicle is being repaired after an accident or claim.

- Original Equipment Manufacturer (OEM) Parts: Hanover ensures you will get original parts if your vehicle needs to be repaired after a claim.

Classic and vintage auto coverage is another area of focus for the company. Hanover serves collector car owners with specialized policies, offering coverage to consider like agreed-value and spare parts protection to safeguard hard-to-find antique components.

These packages aim to provide enhanced security and peace of mind. Whether you need basic insurance or a more extensive plan, Hanover gives you the flexibility to select coverage that aligns with your lifestyle and budget.

Hanover Insurance Discount and Savings Breakdown

The table shows Hanover car insurance discounts based on driver profile and coverage type. The biggest savings go to drivers who insure multiple vehicles for a 25% discount, and homeowners and renters can get a 20% bundling discount.

Hanover Car Insurance Discounts & Savings Potential

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Multi-Vehicle | 25% | Insure multiple cars on the same policy |

| Multi-Policy | 20% | Combine your auto and home insurance policies |

| Anti-Theft Device | 15% | Install an approved anti-theft system |

| New Car | 15% | Insure a car that is less than 3 years old |

| Safe Driver | 15% | Maintain a clean driving record |

| Defensive Driving Course | 10% | Complete an approved defensive driving course |

| Early Signing | 10% | Purchase your policy before your current one ends |

| Good Student | 10% | Maintain a B average or better in school |

| Pay-in-Full | 10% | Pay your premium in full upfront |

| Paperless Billing | 5% | Opt for electronic billing and documentation |

Other competitive Hanover car insurance discounts include 15% for anti-theft devices and an additional 10% if you pay your premiums online. While most other companies will only give discounts of 5% for these types of things, Hanover offers significant savings to help cut its pricey premiums when you combine coverage to maximize savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

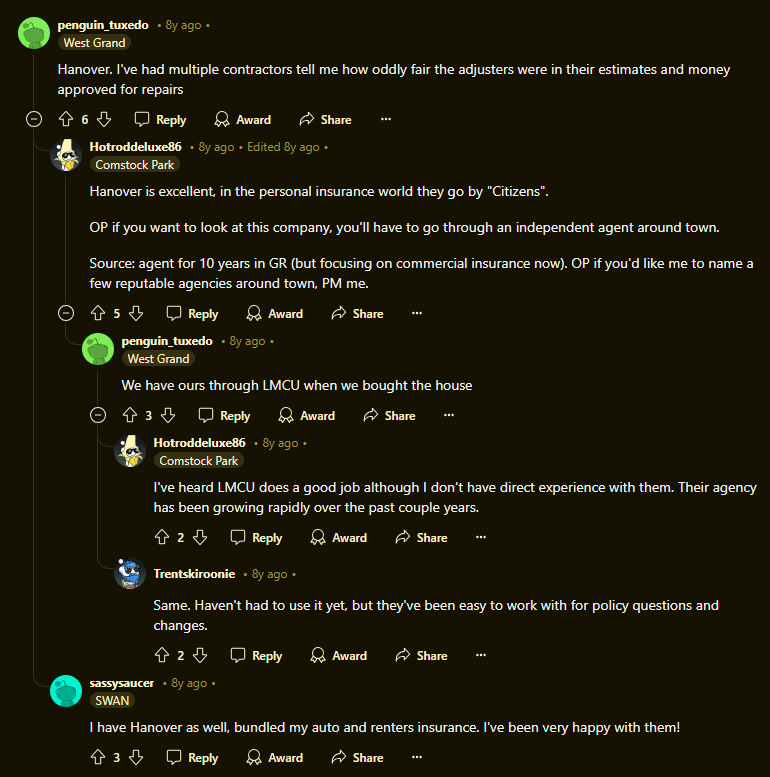

Hanover Car Insurance Customer Insights

Hanover car insurance customer reviews are mixed. By and large, Hanover generally scores very well on customer service and policy-level coverage options. Learn how customer satisfaction ratings affect car insurance.

Hanover car insurance excels with its tailored coverage options and exceptional customer service, making it a premium choice for those seeking dependable and comprehensive insurance solutions.

Dani Best Licensed Insurance Producer

Numerous Hanover reviews highlight the professionalism of local agents, emphasizing they offer clear-cut information for customers and agents when it comes to purchasing policies and making claims.

However, other reviewers do mention that some rivals can price their premiums higher for classic cars. On the other hand, their loyal customers value high-value coverage, personalized service, and continuity over cost savings and pay more.

Hanover Insurance Ratings and Reviews Roundup

Hanover is no where near the worst car insurance companies for customer service. J.D. Power rated Hanover 835 out of 1,000 with a “better than most” customer satisfaction score. It has an excellent financial strength rating of ‘A’ from the Better Business Bureau (BBB), demonstrating solid customer service and best business practices.

Hanover Insurance Business Ratings & Consumer Reviews

Agency

Score: 835/1,000

Above Avg. Satisfaction

Score: A

Excellent Customer Service

Score: 78/100

Good Customer Feedback

Score: 0.80

Avg. Complaints

Score: A

Excellent Financial Strength

Consumer Reports gives Hanover a score of 78 out of 100, reflecting strong customer feedback. The National Association of Insurance Commissioners (NAIC) notes an average complaint score of 0.80, while A.M. Best rates them an ‘A’ for excellent financial stability.

Hanover Car Insurance Pros and Cons

The wide variety of tailored solutions, along with attentive customer service, makes Hanover car insurance a great option for different kinds of automobile cover setups.

- Customizable Coverage Options: The firm offers customizable coverage options and plans so that customers get exactly what they need out of their policy with full protection.

- Responsive Customer Support: Hanover Insurance Group reviews praise its agents for timely responses and expert knowledge of the auto insurance market.

- Discount Opportunities: Hanover offers a number of pricing discounts, such as those for safe driving and multi-car policies, which can lead to significant savings.

Hanover auto insurance is also a solid choice if you need unique policy options to protect high-value or collector vehicles. Even though Hanover car insurance is reliable, the cost seems to be on the higher side, and it is not available in most states, so it may not suit everyone.

- Higher Premiums: Hanover car insurance costs are higher than the competition, even for luxury or classic auto policies.

- Limited State Availability: Hanover only offers services in a handful of states and does not serve many parts of the country.

If you search it in your coverage area, Hanover offers tailored protection and customer service. Start doing your car insurance company comparison online to see which is right for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Hanover Car Insurance Coverage & Quality Service

Our Hanover car insurance review shows a slew of coverage options for drivers who need more comprehensive insurance. While Hanover insurance claims may take time to process and premiums can be a little steep, customer reviews tend towards responsiveness and high-end professionalism.

data-media-max-width=”560″>

Unfortunate events can happen. We’re here to help. Contact us at any time to report a claim. pic.twitter.com/KtCOZIgJ00

— Hanover Insurance (@The_Hanover) July 22, 2024

This is why Hanover can be a good option for people who value comprehensive coverage over cost. This underscores the need to know how to file a car insurance claim in order to have the smoothest experience possible.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Who is the parent company of Hanover Insurance?

The Hanover Insurance Group, Inc. is an independent, publicly traded company. It is listed on the New York Stock Exchange under the ticker symbol THG and does not have a parent company.

Does Hanover do car insurance?

The company offers liability, collision, and comprehensive coverages as well as specialty packages, including The Platinum Experience, to help personalize car insurance. Learn more about the coverage in your car insurance policy.

Is Hanover a good company?

Hanover Insurance is a highly rated insurer, with an “A” rating from A.M. Best for financial strength. The company has a reputation for excellent customer service and a wide selection of insurance products.

How many locations does Hanover Insurance have?

Hanover Insurance has 36 office locations across the United States.

Does Hanover offer life insurance?

Hanover Insurance primarily offers property and casualty insurance, including auto, home, and business insurance. It doesn’t offer life insurance.

Does Hanover car insurance have accident forgiveness?

Yes, Hanover Insurance Group offers accident forgiveness as part of its Platinum Experience option and to safe drivers who remain accident-free for at least 36 months. Discover the benefits of this perk by learning how much a minor accident affects car insurance rates.

Does Hanover offer gap insurance?

Hanover offers gap insurance, which helps cover the difference between the actual cash value of a totaled car and the amount still owed on its financing or lease. Customers should consult their insurance agent for details on gap insurance pricing and coverage.

How long has Hanover Insurance been around?

Hanover Insurance has been around since 1852. The company was originally established in Manhattan as the Hanover Fire Insurance Company. Over the years, it has expanded its offerings, focusing primarily on property and casualty insurance.

What is the A.M. Best rating for Hanover car insurance?

The Hanover Insurance Group is rated “A” (Excellent) by A.M. Best and has a Long-Term Issuer Credit Rating of “A+”. Insurance strength ratings of A2 also show a very strong capacity to meet policyholder and contract obligations.

Is Hanover a national carrier?

No, Hanover auto insurance is only available in 30 states, and access is regional, so it may not be available in your city. Enter your ZIP code below to find cheap car insurance in your state.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

mtcory

Slow and poor service.

Lpetrey

Lazy and poorly run

Adik

Bad customer Seevce

Charlton_insurance

Auto and home Insurance purchase

David_1688

Great company, great services.

Chuck_Truza_

Fast, Professional Service

ccstangle

Happy with auto insurance policy

Oldgoldwinger

When all prices were in, I went with Hanover Ins. Group .

JacksonDad

Great Customer Service

14for14

Trustworthy