Geico vs. The General Car Insurance for 2025 [Compare Cost & Plans Here!]

When comparing Geico vs. General car insurance, Geico is the more affordable option, with minimum car insurance rates starting at $43 per month. While The General is more expensive, it may be a good choice for higher-risk drivers looking for SR-22 insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 843 reviews

843 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

843 reviews

843 reviewsWhen comparing Geico vs. The General car insurance, Geico will be the more affordable option for most drivers looking for cheap car insurance, but The General is good for drivers needing high-risk SR-22 insurance.

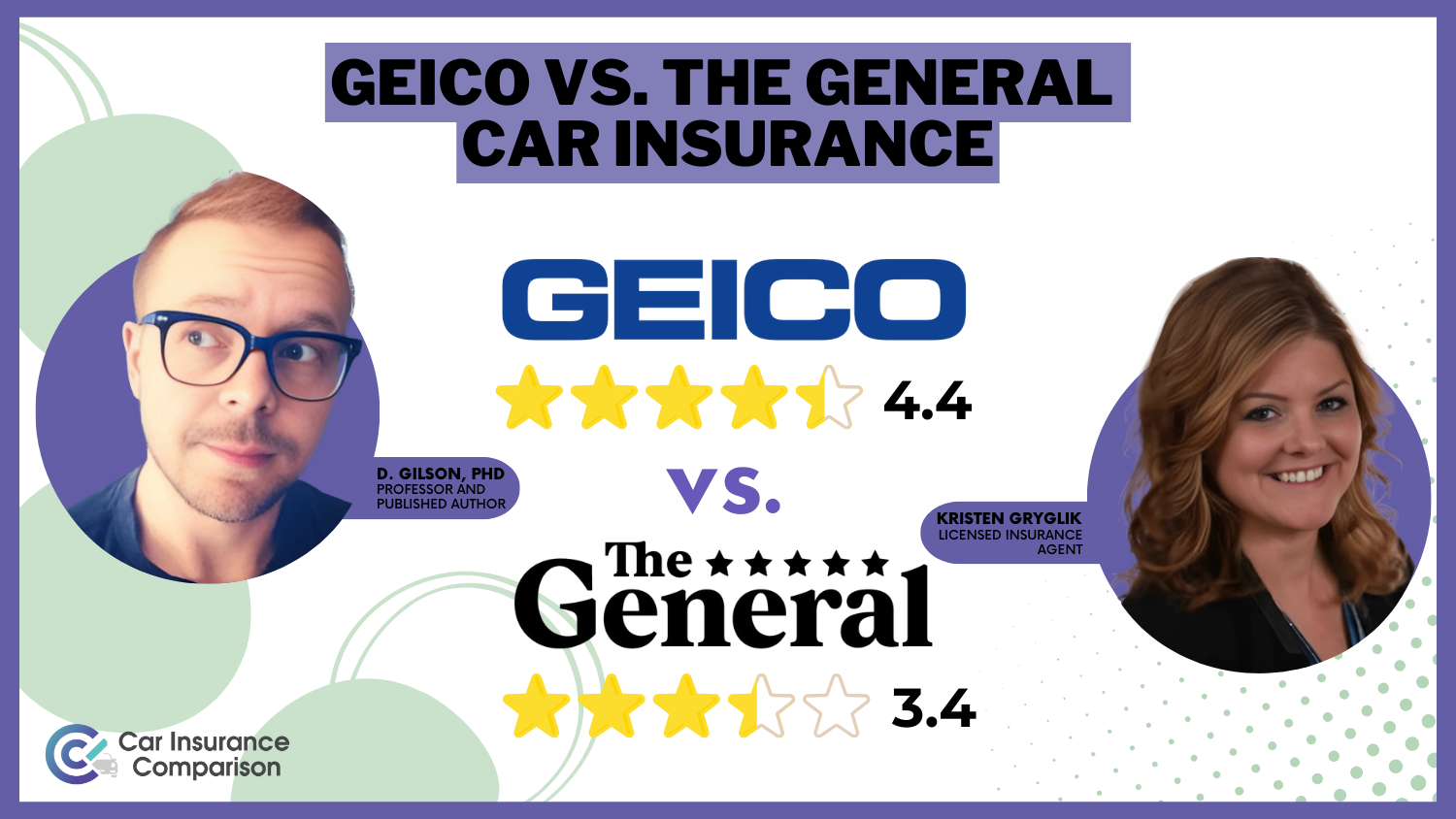

Geico vs. The General Car Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.4 | 3.4 |

| Business Reviews | 4.5 | 3.5 |

| Claim Processing | 4.8 | 2.5 |

| Company Reputation | 4.5 | 3.5 |

| Coverage Availability | 5.0 | 4.5 |

| Coverage Value | 4.4 | 3.2 |

| Customer Satisfaction | 2.3 | 1.8 |

| Digital Experience | 5.0 | 3.5 |

| Discounts Available | 4.7 | 4.0 |

| Insurance Cost | 4.5 | 3.5 |

| Plan Personalization | 4.5 | 3.5 |

| Policy Options | 4.1 | 3.1 |

| Savings Potential | 4.5 | 3.7 |

| Geico | The General |

Our comprehensive Geico vs. General car insurance guide will cover everything you need to know about these two auto insurance companies, from cost and coverage to customer ratings.

Continue reading to learn whether Government Employees Insurance Company (Geico) or the General is better for you and your needs.

- The General car insurance costs $77/mo while Geico car insurance is $43/mo

- Geico has a stronger A++ financial rating compared to The General’s A rating

- The General has a higher J.D. Power score of 835 / 1,000

If you want to get auto insurance quotes from companies in your local area, enter your ZIP code in the free comparison tool above.

Car Insurance Rates at Geico vs. The General

Is Geico or The General cheaper? We’ve narrowed down The General and Geico’s rates to a national average to make it fair. Let’s examine The General and Geico prices for car insurance.

Geico vs. The General: Min. Coverage Car Insurance Monthly Rates

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $163 | $471 |

| 16-Year-Old Male | $178 | $526 |

| 30-Year-Old Female | $46 | $135 |

| 30-Year-Old Male | $47 | $141 |

| 45-Year-Old Female | $44 | $127 |

| 45-Year-Old Male | $43 | $77 |

| 60-Year-Old Female | $40 | $122 |

| 60-Year-Old Male | $41 | $124 |

Affordable Geico car insurance is available all over the United States, but The General has limited availability (Learn More: Compare U.S. Car Insurance Rates).

Based on the national average, Geico is much cheaper, making it hard to find better insurance than Geico for prices when getting quotes.

However, we want to break down rates further by age, driving record, and more, as companies base quotes on multiple factors.

Rates by Age and Gender

Determining car insurance based on gender has been banned in California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. The other 43 states haven’t banned gender-based auto insurance rates.

What’s the average Geico and The General car insurance rate based on age and gender? Let’s explore that answer in the rates shown below.

Geico vs. The General: Full Coverage Car Insurance Monthly Rates

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $425 | $1,207 |

| 16-Year-Old Male | $445 | $1,289 |

| 30-Year-Old Female | $128 | $357 |

| 30-Year-Old Male | $124 | $372 |

| 45-Year-Old Female | $114 | $333 |

| 45-Year-Old Male | $114 | $331 |

| 60-Year-Old Female | $104 | $310 |

| 60-Year-Old Male | $106 | $316 |

Geico will be more affordable than The General for younger drivers. Learn more about average car insurance rates by age and gender in our article.

Rates by Coverage Level

One of the first things you learn about insurance is the minimum requirements for car insurance. Each state has a unique requirement for auto insurance. However, the minimum requirements are covered by liability insurance.

Minimum insurance is the lowest coverage level you can purchase in your state. It allows you to legally drive, but doesn't protect your own vehicle in an accident.

Brandon Frady Licensed Insurance Producer

Medium and high coverage have more coverage limits for auto insurance. An example of medium and high coverage would 50/100/50 or 100/300/100 coverage rules. As you advance levels, you’ll pay more for car insurance. Look at how auto insurance increases for each coverage level.

Geico vs. The General Car Insurance: Monthly Rates by Coverage Level

| Company | Min. Coverage | Full Coverage |

|---|---|---|

| $43 | $114 | |

| $77 | $331 |

Geico’s car insurance rate goes up each time the coverage level progresses. The General’s auto insurance rates may increase, also. However, full coverage will offer the best protection for your vehicle (Learn More: Best Full Coverage Car Insurance).

Rates by Driving Record

Although affordable Geico car insurance is easy to find, Geico can be more expensive if you have a poor driving record. The same can be said about The General. Compare the two companies’ rates below.

Geico vs. The General: Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record |  |

|

|---|---|---|

| Clean Record | $114 | $331 |

| One Accident | $189 | $467 |

| One Ticket | $151 | $396 |

| One DUI | $309 | $607 |

Read on to learn more about how speeding tickets, accidents, and DUIs affect car insurance (Read More: Best Car Insurance for a Bad Driving Record).

Rates With One Speeding Ticket

Speeding tickets are common among drivers. Some car insurance companies don’t bother to increase their customers’ auto insurance rates. For companies that do, the increase is usually low.

However, multiple speeding tickets could significantly impact your car insurance cost. Let’s compare speeding ticket rates between Geico and The General.

Geico vs. The General Car Insurance Monthly Rates with One Speeding Ticket

| Driving Violation | ||

|---|---|---|

| Speeding ticket | $151 | $396 |

The General is private about its car insurance rates, but you find affordable Geico auto insurance quotes broadcasted across the web. Learn how traffic infractions affect car insurance rates.

Rates With One Car Accident

How about accidents? Do they affect car insurance more than speeding tickets? Let’s continue reviewing Geico and The General car insurance to find out.

Geico vs. The General Car Insurance Monthly Rates with One Accident

| Driving Violation | ||

|---|---|---|

| Accident | $189 | $467 |

As you can see, Geico’s car insurance rates increase when you have an accident. Why? Accidents cost more on an insurance claim. Car insurance companies don’t pay anything when you have a speeding ticket.

Accidents stay on your insurance history for three years.

Accidents can stay on your insurance history as well as your driving history (Read More: Understanding Car Accidents). According to the Consumer Financial Protection Bureau, C.L.U.E. collects information and reports it to insurance companies.

Rates With One DUI

DUI/DWIs can bring costly car insurance rates. Most people with DUIs/DWIs are high-risk drivers and pay car insurance equal to what some teen drivers pay, which we’ll cover later. For now, let’s compare car insurance rates that are determined by DUI.

Geico vs. The General: Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $80 | $106 | $132 | $216 | |

| $160 | $188 | $225 | $270 |

The General and Geico DUI insurance rates will be pricey. Some states have auto insurance rates much higher than the annual rate we’ve shown.

A DUI can remain on your driving record for at least five years. In some states, your DUI will stay on your driving record for a lifetime. Learn how to find cheap car insurance after a DUI.

Rates by Credit Score

According to the Federal Trade Commission, your credit score could affect your auto insurance rates. Statistics show that individuals with good credit are less likely to file a claim, so companies issue lower rates to consumers with a good or excellent credit history.

Learn More: Best Car Insurance Companies for Bad Credit

Let’s review the cost of insurance based on credit history.

Geico vs. The General: Full Coverage Car Insurance Monthly Rates by Credit Score

| Companies | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $203 | $249 | $355 | |

| $245 | $298 | $412 |

Once again, The General doesn’t have auto insurance rates for the public as much Geico. However, your credit history is a factor in The General car insurance.

Rates by Mileage

Annual mileage is the number of miles you’re estimated to travel during your auto insurance policy.

Read More: How much does mileage affect car insurance rates?

When you do personalized quotes through Geico and The General, they’ll ask you how your vehicle will be used. The less you drive, the less you should pay for car insurance. Let’s see if that’s true.

Geico vs. The General: Full Coverage Insurance Monthly Rates by Annual Mileage

| Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $264 | $272 | |

| $345 | $360 |

Geico customers can pay $100 less for car insurance when they cut their average driving habits in half. This is common in heavily populated metropolitan areas.

The General will only reveal its auto insurance rates through a personalized auto insurance quote.

Rates by Vehicle Make and Model

Vehicle make and model year can affect your car insurance rates. The most significant factor in determining auto insurance by car make and model is the Manufacturer’s Suggested Retail Price (MSRP).

According to Kelley Blue Book, the MSRP is the price the manufacturer suggests to dealers or private sellers for new vehicles.

Geico and The General are both insurance companies that follow this rule. The only difference is the price. Let’s review some sample rates.

Geico vs. The General Car Insurance Monthly Rates by Car Make and Model

| Car Make and Model |  |

|

|---|---|---|

| 2015 Ford F150 Lariat | $258 | $340 |

| 2015 Toyota RAV4 XLE | $258 | $330 |

| 2018 Toyota RAV4 XLE | $278 | $360 |

| 2018 Ford F150 Lariat | $278 | $370 |

The General allegedly has cheaper rates than Geico, but they’re not publicly displayed as much as Geico’s sample rates.

Read more: Compare Car Insurance Rates by Vehicle Make and Model

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Coverage Options at Geico and The General

For this section, we’ll explore what coverages are available for Geico and The General. The General reports what they offer to potential customers on their website and other places on the internet, but they provide the same coverages as Geico. Let’s examine the coverage options.

Geico vs. The General Car Insurance Coverages

| Coverage |  |

|

|---|---|---|

| Bodily Injury Liability | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Emergency Road Service | ✅ | ✅ |

| Mechanical Breakdown Insurance | ✅ | ❌ |

| Medical Payments Coverage (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ❌ |

| Property Damage Liability | ✅ | ✅ |

| Rental Car Insurance | ✅ | ✅ |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | ✅ | ✅ |

Geico has a few more options to add to a car insurance policy than The General. Geico is one of the most popular and cheapest auto insurance companies in the nation.

Read More: How much car insurance coverage do I need for a new car?

Geico auto insurance is available across the nation. Also, Geico car insurance is known for its affordable rates and extensive car insurance coverage. However, The General is only available in 25 states. When compared to Geico insurance, The General car insurance may have some competition.

Geico vs. The General Car Insurance Overview

| Summary |  |

|

|---|---|---|

| Year Founded | 1936 | 1963 |

| Headquarters | 5260 Western Avenue, Chevy Chase, MD 20815 | 2636 Elm Hill Pike, Suite 100, Nashville, TN 37214 |

| Availability | All 50 U.S. states | Available in 47 states; not available in Alaska, Hawaii, or Michigan |

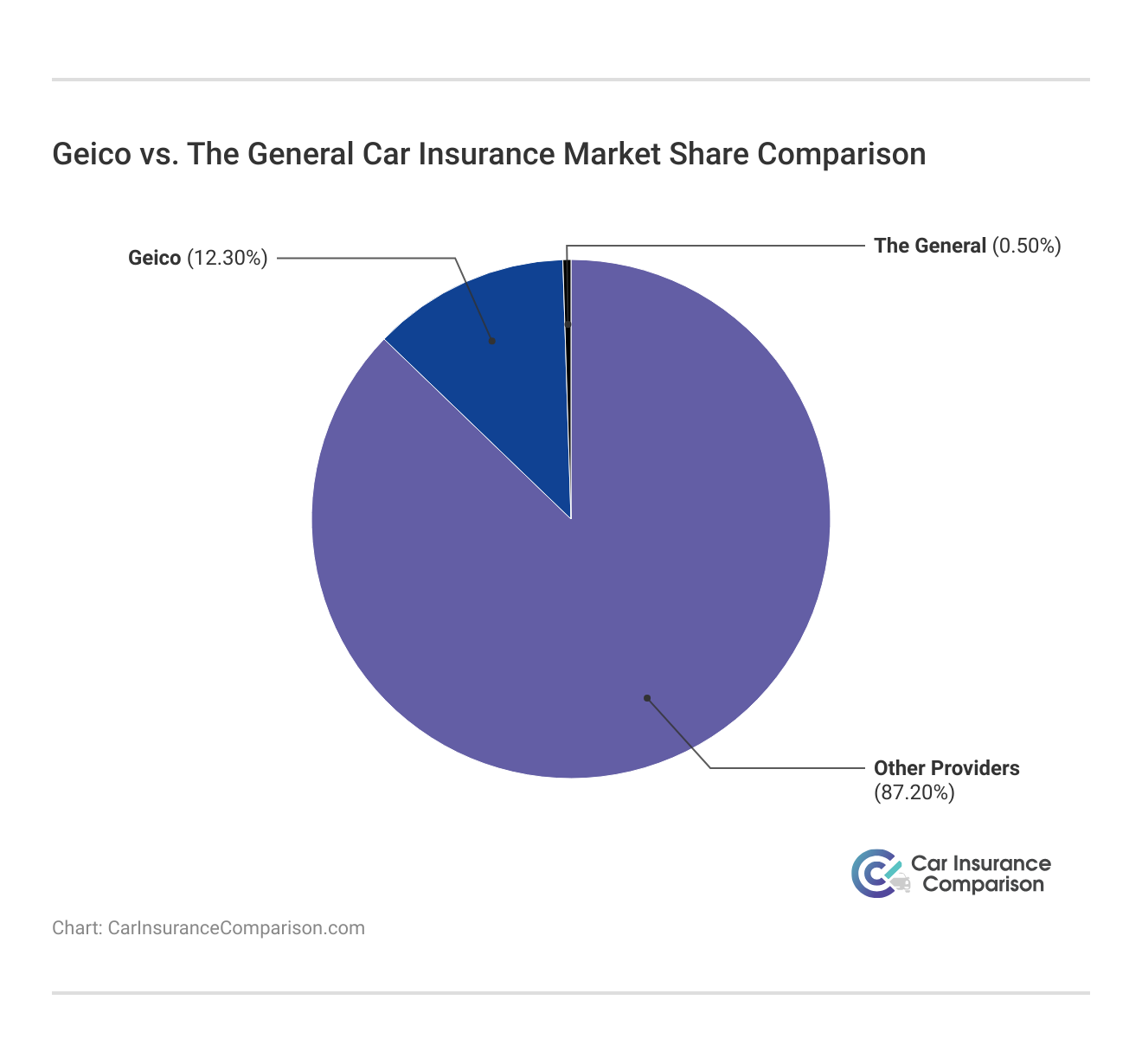

| Direct Premiums Written | $42.9 billion (2024) | $750 million (2024) |

| Market Share | 12.6% (2024) | Approximately 0.24% (2024) |

| Ownership | Subsidiary of Berkshire Hathaway | Acquired by Sentry Insurance for $1.7 billion in January 2025 |

| Specialization | Standard auto insurance for a broad range of drivers | Non-standard auto insurance, focusing on high-risk drivers |

| Notable Endorsements | Known for the Geico Gecko and other advertising campaigns | Endorsed by Shaquille O'Neal in various advertising campaigns |

The General auto insurance rates aren’t broadcasted as much Geico’s. Therefore, potential customers may want to get The General car insurance quotes directly from The General.

However, we’ve managed to find the average annual of The General car insurance company. You may be close to a decision, but there’s a little more we want to go over before you grab a quote from Geico and The General.

Discounts at Geico and The General

The best car insurance discounts are the key to saving hundreds of dollars on car insurance per year. Geico is known for its discounts, but what about The General? Do they rival Geico’s discounts? We collected the available discounts from Geico and The General.

Geico vs. The General Car Insurance Discounts Available

| Discount Types |  |

|

|---|---|---|

| Accident-Free | 22% | X |

| Affinity/Alumni or Membership | 10% | 10% |

| Airbag | 5% | 5% |

| Anti-Lock Brakes | 5% | 5% |

| Anti-Theft Device | 22% | 15% |

| Bundling | 25% | 18% |

| Continuous Insurance | 5% | 5% |

| Current Insurance Provider | 5% | 5% |

| Daytime Running Lights | 3% | X |

| Defensive Driving Course | 15% | 10% |

| Driver Training | 5% | 5% |

| Electronic Stability Control | 5% | 5% |

| Emergency Deployment | 25% | X |

| Federal Employee | 8% | 5% |

| Good Credit | 8% | 6% |

| Good Student | 15% | 20% |

| Homeowner | 6% | 5% |

| Military | 15% | X |

| Motor Club Membership | 5% | 5% |

| Multi-Vehicle | 25% | 25% |

| No Lapse in Coverage | 5% | 5% |

| Online Quote/Sign-Up | 5% | 5% |

| Passive Restraint | 40% | 40% |

| Pay-in-Full | 10% | 25% |

| Preferred Payment Method | 5% | 5% |

| Prior Insurance Carrier | 5% | 5% |

| Professional/Organizational Affiliation | 10% | 10% |

| Safe Driver | 26% | 15% |

| Seat Belt Usage | 15% | 10% |

| Senior Driver | 5% | 5% |

Geico and The General have a similar number of discounts. Both offer discounts if you bundle insurance types, and a good student discount for younger drivers.

However, the percentage amount could vary between the two companies. Discount percentages may depend on the number of years you’ve been with either company.

See what The General or Geico car insurance discounts you may qualify for before you sign up.

Usage-Based Insurance Programs

Geico’s usage-based program known as DriveEasy, can be used through a customer’s smartphone — no telematics needed (Read more: Geico DriveEasy Review). Telematics is a device that plugs in the OBD-port of your vehicle.

The General doesn’t have a usage-based auto insurance program, but the company does have a mobile app.

Customer Reviews of Geico and The General

Customer ratings can go from refreshing to anxious in a matter of minutes. Each customer review will vary, and the only sure way to know a car insurance company’s service is to sign up.

Read More: How do customer satisfaction ratings affect car insurance companies?

However, overall ratings can give you an idea of how the company performs for customers. Read the Reddit thread below to see what consumers think of Geico.

Some Geico customers like the affordability of the company, while others say they found cheaper rates elsewhere.

As for The General, take a look at customers sharing their reviews in the Reddit thread below.

When it comes to reviews, The General is in the race with Geico, as they both have mixed ratings and customer satisfaction.

The sections below will explore financial strength ratings and customer satisfaction reviews from some of the web’s top agencies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Business Ratings of Geico vs. The General

Take a look at the multiple business ratings of Geico and The General below.

Insurance Business Ratings & Consumer Reviews: Geico vs. The General

| Agency |  |

|

|---|---|---|

| Score: 692 / 1,000 Avg. Satisfaction | Score: 835 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 68/100 Avg. Customer Feedback |

|

| Score: 0.52 Fewer Complaints Than Avg. | Score: 1.15 Avg. Complaints |

|

| Score: A++ Superior Financial Strength | Score: A Excellent Financial Strength |

| Aa1- | A2 |

| AA+ | N/A |

The “A” rating with A.M. Best indicates an “Excellent” rating. The “++” indicates a prime score, which means the company has a superior ability to respond to customers’ obligations while maintaining a financially stable outlook.

Read More: Car Insurance Companies With the Worst Customer Satisfaction

Geico’s J.D. Power Circle ratings are about average, and they have an “A+” with the Better Business Bureau (BBB). The General doesn’t have any ratings with J.D. Power. However, The General does have an NAIC complaint index of 1.21, which is higher than the average complaint index and better than Geico’s index.

Financial Strength

Financial strength ratings are grades given to businesses, big and small, that participate in financial strength and credit ratings from company review agencies worldwide. A.M. Best, Moody’s, and S&P are three of the most credible rating agencies. Here are the financial ratings for Geico and The General.

Geico vs. The General Car Insurance Financial Strength Ratings

| Financial Strength Ratings Agencies | ||

|---|---|---|

| A++ | A |

| Aa1- | A2 |

| AA+ | N/A |

Geico managed to get reviews from all three agencies, while The General only participated in A.M. Best and Moody’s.

Moody’s “A” rating shows the same results, except its ratings review the company’s credit risk. Anything in the “A” range shows a low risk of credit. It doesn’t affect your credit history (Learn More: Best Car Insurance Without a Credit Check).

A good financial risk rating means the company has a history of paying its bills on time, such as paying off claims.

Dani Best Licensed Insurance Producer

The General didn’t appear to participate in S&P ratings. We searched the web for results but couldn’t locate it. However, Geico has an S&P rating. It’s on the same level as the other two and reports an “AA+” rating, which means a stable outlook for Geico’s finances.

Market Share of Geico vs. The General

When it comes to market share, Geico towers over The General. Geico has a market share of almost 13 percent in the United States insurance industry, while The General has a market share of 0.5 percent.

See what affordable car insurance coverage options could be available in your local area with our free quote tool. Whether you are interested in comparing Geico vs. Farmers or Allstate vs. The General, getting quotes will help you narrow down your options (Read More: How to Purchase the Right Car Insurance Quote Online).

Geico Pros and Cons

Pros

- Widespread Availability: Geico is available in all U.S. States, so you can keep it as your provider even after a move.

- DriveEasy Program: Earning a good Geico DriveEasy score range will lower your monthly rates.

- Great Financial Management: Geico has the highest possible rating from A.M. Best, an A++.

Cons

- Lacks Gap Coverage: Geico doesn’t sell gap insurance, which is a useful coverage for new car owners (Learn More: Compare Gap Insurance).

- May Not Insure Some Drivers: Part of the reason Geico is able to keep rates so affordable is by ensuring good drivers. High-risk drivers may not be able to get coverage at Geico.

The General Pros and Cons

Pros

- Insures High-Risk Drivers: The General is known for insuring drivers who need high-risk SR-22 insurance (Read More: Learning About High-Risk Car Insurance).

- Discount Options: The General has several discounts for drivers, such as a bundling discount.

- Roadside Assistance: You can purchase a roadside assistance policy from The General for 24/7 help.

Cons

- Higher Rates: The General is more expensive on average than Geico, so it may not be the best for affordability.

- Not Sold in Every State: The General is not available in a handful of states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Geico vs. The General: Which company is the best?

Deciding whether Geico vs. The General car insurance is the best is up to you. Establish what your needs are as a customer. If you’re not sure where to start, consider what you can afford (Read More: What happens if I can’t afford my car insurance?). New cars and financed cars will need full coverage car insurance.

If you found more qualities about the companies, use them in your decision to get an insurance policy. However, you should take a look at other options in your area, no matter whether you are comparing Geico vs The Hartford or The General vs. Allstate, as it will help you find the best deal on coverage. Compare quotes today with our free tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is The General or Geico better?

When comparing The General vs. Geico, Geico has a higher rating from A.M. Best, with an A++ rating compared to The General’s A rating. Geico is also more widely available than The General.

Which car insurance company, Geico or The General, has wider availability?

Geico is available across the nation, while The General is only available in 25 states.

Are Geico and The General affordable car insurance companies?

Yes, both Geico and The General offer affordable car insurance rates in most states. Geico’s rates start at $43 per month, and The General’s rates start at $77 per month. The General and Geico full coverage prices will be a little higher (Read More: Compare Full Coverage vs. Liability Car Insurance).

Is The General cheaper than Geico on average?

Geico is cheaper than The General. Geico’s rates start at $43 per month, compared to $77 per month at The General.

How do speeding tickets and accidents affect car insurance rates for Geico and The General?

Both Geico and The General increase car insurance rates for speeding tickets and accidents, as accidents cost more on an insurance claim.

Is there Geico travel insurance?

Yes, Geico offers travel insurance for customers looking for trip coverage. You can also get travel car insurance if you are planning on driving.

Which car insurance company, Geico or The General, offers more coverage options?

Geico offers a few more coverage options compared to The General, providing customers with additional choices for their car insurance policies.

Does a Geico quote affect your credit score?

Getting a quote from Geico General Insurance Company will not affect your credit score. However, Geico may use your credit score to determine rates.

Who owns The General?

American Family Insurance acquired The General Automobile Insurance Services Inc.. Learn more about American Family in our American Family car insurance review.

Who has car insurance cheaper than Geico?

Geico is one of the cheapest companies on the market, especially when you compare it to pricier companies like Allstate vs. Geico or Geico vs. National General. To find rates that are cheaper than Geico’s, enter your ZIP in our free quote tool.

Is The General car insurance good or bad?

The General can be a good choice of car insurance provider for high-risk drivers. It has an A rating from A.M. Best for financial stability.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.