Freeway Car Insurance Review for 2024 [Unbiased Evaluation]

This comprehensive Freeway car insurance review, learn about their coverage rates, starting at $126/month. The company is notable for its A- rating from the Better Business Bureau (BBB), which indicates it provides dependable protection and good customer service, supported by a strong reputation in the industry.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Certified Financial Planner

UPDATED: Nov 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

In this Freeway Car Insurance review, you’ll learn about their affordable coverage options, starting at $126 per month. We’re here to help you learn about Freeway car insurance. This review looks at important details like average car insurance rates by age and gender, the types of coverage available, customer service, and overall satisfaction.

We’ll discuss the advantages and disadvantages, including costs, how claims are managed, and other factors, so you can make a well-informed choice.

Freeway Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 3.0 |

| Claim Processing | 2.8 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.3 |

| Coverage Value | 3.0 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.8 |

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Explore Freeway car insurance’s pricing, starting at $126/month

- Review coverage options like liability, collision, and comprehensive

- Assess customer feedback, ratings, and pros and cons of Freeway car insurance

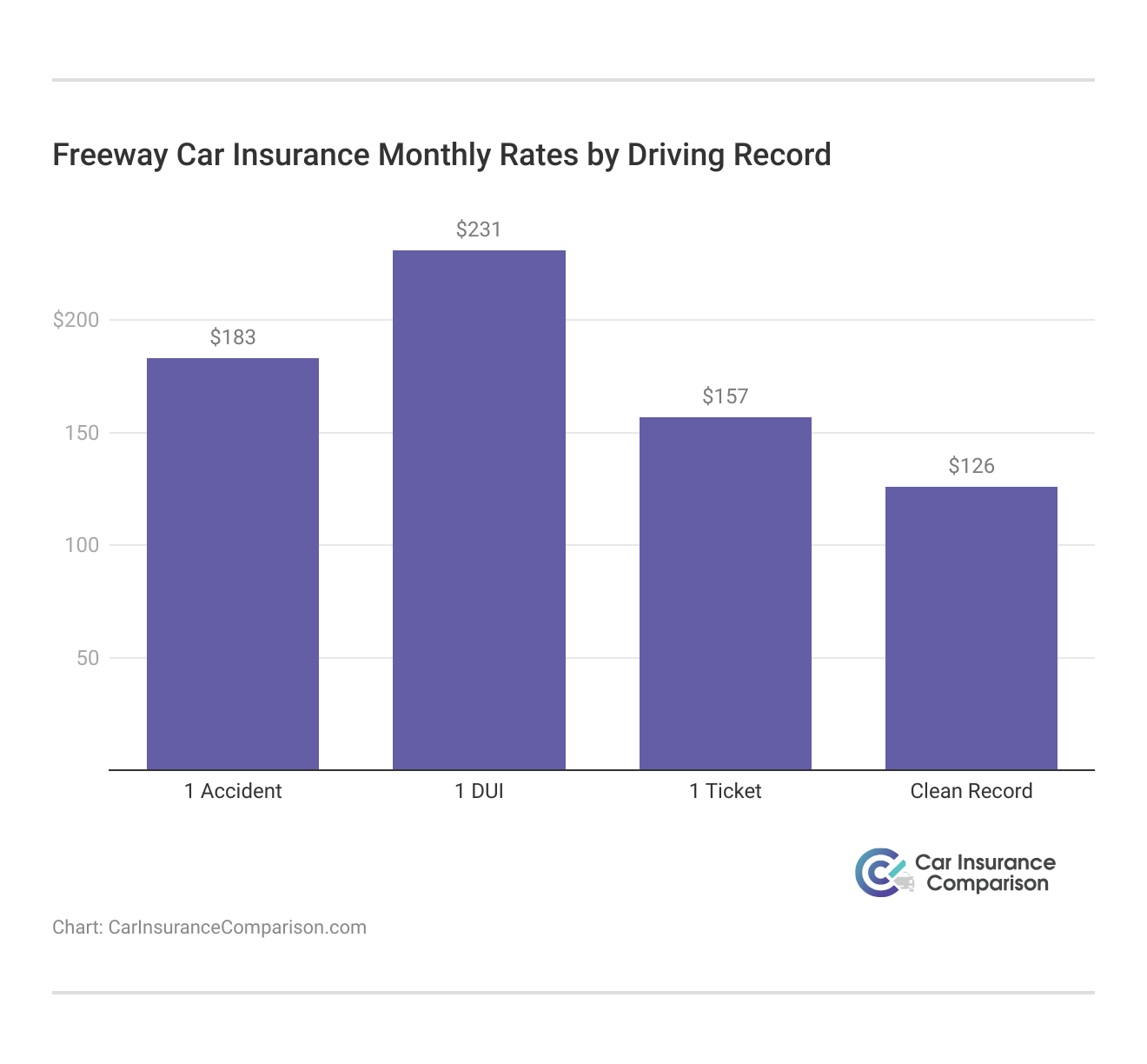

Freeway Car Insurance Rates: Age, Gender, and Driving Record

As we make decisions about car insurance, it’s important to understand how the various variables affect rates. In this guide, you’ll get a deep dive into Freeway Car Insurance monthly rates, between full coverage vs. liability car insurance, for different ages, genders, and driving records. Learn how these factors affect your premiums and what to expect to pay for your situation.

Freeway Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $243 | $514 |

| Age: 16 Male | $271 | $538 |

| Age: 18 Female | $218 | $487 |

| Age: 18 Male | $263 | $523 |

| Age: 25 Female | $149 | $373 |

| Age: 25 Male | $164 | $389 |

| Age: 30 Female | $123 | $342 |

| Age: 30 Male | $137 | $359 |

| Age: 45 Female | $109 | $294 |

| Age: 45 Male | $126 | $319 |

| Age: 60 Female | $102 | $286 |

| Age: 60 Male | $116 | $304 |

| Age: 65 Female | $107 | $265 |

| Age: 65 Male | $122 | $278 |

Analyzing car Insurance rates, age, gender, and driving record have a huge impact on insurance premiums. From a young driver to someone with a perfect driving history, knowing these things will allow you to choose the right coverage level and possibly save on your monthly insurance costs.

It’s always worth comparing the rates and coverage options you’ll be getting to make sure you’re getting the best deal for what you need.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Comprehensive Coverage Options With Freeway Car Insurance

Freeway car insurance provides several coverage options: liability coverage for at-fault accidents, collision coverage for vehicle damage from collisions, and comprehensive coverage for non-collision accidents (theft, fire, or natural disaster).

They also provide personal injury protection (PIP), uninsured/underinsured motorist coverage, medical payments coverage, rental reimbursement, roadside assistance, and gap insurance to cover loan or lease balances in case of total loss.

Freeway Car Insurance Business Ratings & Consumer Reviews

You may be wondering “Is freeway car insurance legit?”, you will want to look at the business ratings and consumer reviews. In this section, we look closer at Freeway car insurance’s performance across the various respected agencies. This is important because by knowing these ratings you can make the decision whether Freeway car insurance is the right choice for you.

Freeway Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 742 / 1,000 Lower-Than-Average Satisafaction |

|

| Score: A- Good Business Practices |

|

| Score: 65/100 Mixed Customer Feedback |

|

| Score: 1.2 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength |

Understanding Freeway car insurance business ratings and consumer reviews is all a matter of mixed reviews. The company does well in customer satisfaction and business practices, but claim processing and the number of complaints are issues. Below, you can see some positive customer feedback about Freeway car insurance regarding their customer service:

Read Ashley B.‘s review of Freeway Insurance on Yelp

For drivers seeking a reliable, empathetic insurer, this customer care shows that Freeway is committed to addressing needs and ensuring a smoother experience.

Read More: Where to Find Car Insurance Company Reviews

If Freeway car insurance seems like the one, the insights we have below will help you weigh the pros and cons and see if the company is the right fit.

Freeway Insurance Services America, LLC Pros & Cons

Freeway Car Insurance is a popular choice for drivers seeking affordable coverage and reliable customer service. However, like any insurance provider, it’s important to weigh the pros and cons before making a decision.

Below are some of the key benefits that could work in your favor when choosing Freeway as your insurance provider.

- Competitive Coverage Options: The coverage list at Freeway is quite comprehensive, and they provide liability, collision, comprehensive, personal injury protection, and more.

- Strong Customer Service: The customer service at Freeway has been getting positive feedback; customers think their representatives are extremely helpful and empathetic with their issues.

- Discounts and Savings: Freeway offers discounts that lower your premiums and is a good choice for cost-conscious drivers looking to save on their insurance.

Freeway car insurance may have some downsides that will affect your experience. The cons of this company show areas in which the company is lacking, and knowing these will help you decide more confidently whether or not to buy a policy.

- Mixed Claims Processing Reviews: Customers have also been less enthusiastic about Freeway’s claims processing, giving it lower ratings for how problems are handled after you’ve been in an accident.

- Higher Number of Complaints: The company has more than a fair share of complaints, which could give riders pause when they want to claim a more dependable process.

Competitive pricing, various types of coverage, and the ability to rely on good customer service are what you get from Freeway car insurance. But along with that success are mixed feedback and claims processing issues. Considering the pros and cons of this will help you decide whether Freeway is the car insurance you choose.

Read More: Collision vs. Comprehensive

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Final Take on Freeway Car Insurance

Though Freeway Car Insurance doesn’t win any awards for low rates, it combines affordable premiums with an attractive variety of coverage options and solid customer service. However, there are other areas to be concerned about, like claims processing and a higher volume of complaints.

In the end, you’ll have to decide between Freeway and the other options based on your priorities: cost saving or a smoother claims experience.

Freeway’s Auto Club is here! Our roadside assistance plans bring peace of mind, knowing you are covered in the event of a vehicle breakdown or incident. Request a free quote on our website today: https://t.co/FXmlw7pXty pic.twitter.com/shNiA9nowl

— Freeway Insurance (@Freeway_Ins) November 15, 2024

Buying car insurance is something you don’t want to do without comparing your options. Finding free car insurance quotes online will help you assess different providers and coverage levels to make sure you make a wise, informed choice that fits your needs. Freeway is a good choice if all factors, such as price, coverage, customer feedback, and so on are considered.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.