Freeway Car Insurance Review for 2025 [Unbiased Evaluation]

Our comprehensive Freeway car insurance review compares coverage rates starting at $102/month. Freeway auto insurance is available in all 50 states and is notable for its A- rating from the Better Business Bureau (BBB) for dependable protection, good customer service, and bilingual service agents.

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Dec 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

8 reviews

8 reviews

Freeway Car Insurance

Average Monthly Rate For Good Drivers

$102A.M. Best Rating:

BComplaint Level:

MedPros

- Strong discounts and competitive rates

- Specializes in high-risk driver coverage

- Multiple coverage options available

Cons

- Spotty claims service

- Mixed customer reviews

This Freeway car insurance review covers their policies, ratings, and affordable options, which start at $102 monthly. It caters to high-risk drivers through a network of independent agents in 50 states.

Freeway Insurance Services America covers drivers who must file SR-22 insurance after accidents, speeding tickets, or DUIs.

Freeway is perfect for people with accidents, tickets, or insurance gaps, as these individuals need flexible and affordable solutions.

Freeway Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 3.0 |

| Claim Processing | 2.8 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.3 |

| Coverage Value | 3.0 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.8 |

Get the best high-risk car insurance at the cheapest price — enter your ZIP code to shop for coverage from the top insurers in your city.

- Freeway Insurance earned a 3.2 out of 5.0 overall rating

- Freeway car insurance rates begin at $102/month

- Freeway customer satisfaction is high, but claims reviews are mixed

Comparing Freeway Car Insurance Rates by Driver

Freeway insurance rates are much higher than those of standard carriers, especially for young drivers. A 16-year-old male pays $538/month for full coverage, while teen girls pay $514 monthly.

Freeway Car Insurance Monthly Rates by Coverage Level, Age & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $243 | $514 |

| Age: 16 Male | $271 | $538 |

| Age: 18 Female | $218 | $487 |

| Age: 18 Male | $263 | $523 |

| Age: 25 Female | $149 | $373 |

| Age: 25 Male | $164 | $389 |

| Age: 30 Female | $123 | $342 |

| Age: 30 Male | $137 | $359 |

| Age: 45 Female | $109 | $294 |

| Age: 45 Male | $126 | $319 |

| Age: 60 Female | $102 | $286 |

| Age: 60 Male | $116 | $304 |

| Age: 65 Female | $107 | $265 |

| Age: 65 Male | $122 | $278 |

As drivers age, rates become more reasonable. By age 30, drivers pay about half of what teens pay, with full coverage running $342-$359 per month. Experienced drivers around 45 get the best Freeway car insurance rates.

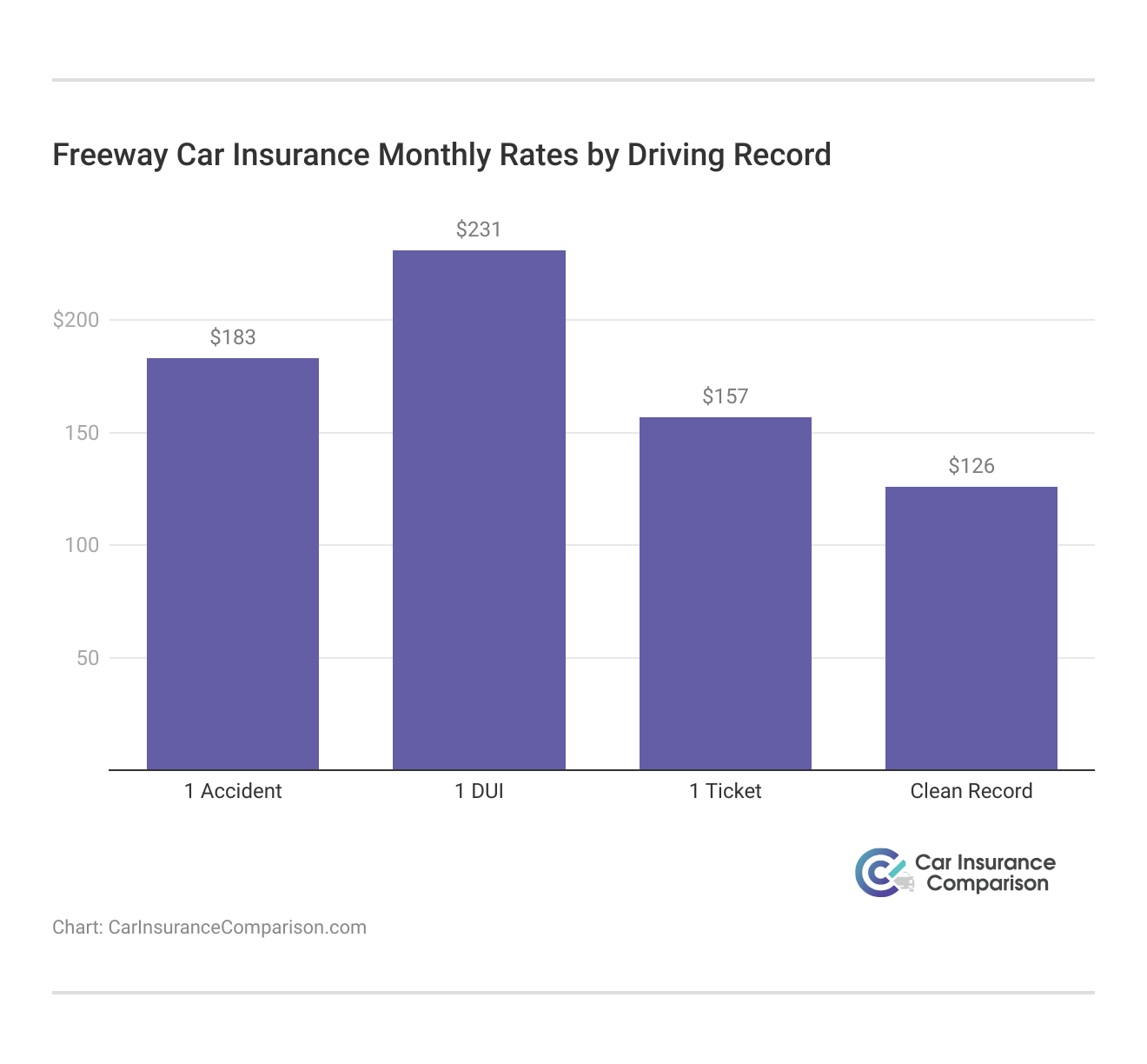

Freeway Insurance costs more than standard companies, but it won’t raise rates nearly as high for offenses like speeding tickets and DUIs.

Freeway Insurance Services America caters to high-risk drivers through a network of independent agents in 50 states.

Scott W. Johnson Licensed Insurance Agent

Drivers with DUIs pay only $100 more per month for full coverage, while a speeding ticket only increases monthly rates by $40 on average.

The difference with Freeway is that, unlike most companies, they’re willing to insure high-risk drivers at a cheaper rate. If you’re searching for cheap car insurance after a DUI, Freeway’s rates start at $231 monthly for minimum coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Freeway Car Insurance Company Comparison

Is Freeway insurance cheap? Freeway Insurance Services sits in the middle to upper range of the insurance price spectrum. For example, young drivers (under 18) have rates of $480–$550 per month that beat out pricey carriers like Progressive ($591–$662/month) but are double Geico’s monthly rates ($220–$254).

Freeway Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $136 | $136 | |

| $480 | $550 | $155 | $165 | $145 | $150 | $140 | $145 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $310 | $335 | $140 | $150 | $135 | $147 | $125 | $130 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $167 | $170 |

| $303 | $387 | $124 | $136 | $113 | $115 | $111 | $112 |

| $591 | $662 | $131 | $136 | $112 | $105 | $109 | $103 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $84 | $84 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $96 | $97 | |

| $180 | $203 | $74 | $79 | $59 | $59 | $58 | $57 |

Freeway full coverage car insurance is more expensive than most companies, but if you have accidents or insurance lapses on your record, Freeway could be a competitive option.

Read More: Driving Without Insurance: Avoid Lapses in Coverage for Lower Rates

Comprehensive Coverage Options With Freeway Car Insurance

Make sure you know what coverage Freeway offers before you pick a policy. As do most insurers, they provide both required and optional protection for your vehicle and financial security.

- Liability Insurance: Covers injuries and property damage you cause to others.

- Personal Injury Protection: Covers medical expenses regardless of fault.

- Uninsured/Underinsured Motorist: Protects you if a driver with no or insufficient insurance hits you.

Beyond basic protection, Freeway offers collision coverage for accident repairs, comprehensive for theft and weather damage, plus extras like roadside assistance and gap insurance for financed or leased vehicles.

Before you buy Freeway car insurance, check coverage needs and state requirements. Basic liability will likely meet your state minimums, but you may want to pay extra in order to obtain comprehensive financial protection for your vehicle if you’re ever involved in an incident.

Ways to Save With Freeway Insurance

Want to save some money on your Freeway car insurance? The company has several substantial discounts that can bring down your premium costs immensely. Explore the various ways you can save with Freeway Insurance:

Freeway Car Insurance Discounts by Savings Potential

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Multi-Vehicle | 25% | Insure multiple cars |

| Safe Driving | 25% | No accidents/violations |

| Good Student | 15% | Maintain "B" average |

| Bundling | 14% | Bundle policies |

| Defensive Driving Course | 10% | Complete course |

| Paid-in-Full | 9% | Pay full premium |

| Military | 8% | Active/former military |

| Senior | 7% | Age 55+ drivers |

| Auto-Pay | 5% | Set up auto-pay |

| Low-Mileage | 5% | Drive fewer miles |

| Professional Organization | 4% | Member of organization |

| Anti-Theft Device | 3% | Install anti-theft |

Find out which Freeway car insurance discounts you qualify for and how you can pair them to save the most money. For additional strategies on reducing your insurance costs, check out our guide on how to lower your car insurance rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Freeway Insurance Services America Reviews & Ratings

Is Freeway insurance good? Check out Freeway Insurance’s business ratings and consumer reviews for a closer look at its performance. These ratings allow you to decide whether Freeway auto insurance is the right choice for you:

Freeway Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 742 / 1,000 Lower-Than-Average Satisafaction |

|

| Score: A- Good Business Practices |

|

| Score: 65/100 Mixed Customer Feedback |

|

| Score: 1.2 Avg. Complaints |

|

| Score: B Fair Financial Strength |

The company performs well in keeping customers happy and following good business practices. However, handling claims and dealing with complaints are problems. Below, some positive feedback from a customer about Freeway Insurance on Yelp is shown꞉

For drivers seeking a reliable, empathetic insurer, this customer care review on Yelp shows that Freeway is committed to addressing needs and ensuring a smoother experience.

Read More: Where to Find Car Insurance Company Reviews

Freeway Insurance Services America, LLC Pros & Cons

Freeway auto insurance is a popular choice for high-risk drivers seeking affordable coverage and reliable customer service. Below are some of the key benefits that could work in your favor when choosing Freeway as your insurance provider:

- Competitive Coverage Options: The coverage list at Freeway is quite comprehensive, and it provides liability, collision, comprehensive, personal injury protection, and more.

- Strong Customer Service: The customer service at Freeway has been getting positive feedback; customers think their representatives are extremely helpful and empathetic with their issues.

- Discounts and Savings: Freeway offers discounts that lower your premiums and is a good choice for cost-conscious drivers looking to save on their insurance. (Read More: Best Car Insurance Discounts)

Freeway car insurance may have some downsides that will affect your experience. This list of cons shows areas where the company is lacking:

- Mixed Claims Processing Reviews: Customers have also been less enthusiastic about Freeway’s claims processing, giving it lower ratings for how problems are handled after you’ve been in an accident.

- Higher Number of Complaints: Freeway insurance complaints have more than a fair share, which could give riders pause when they want to claim a more dependable process.

Competitive pricing, various types of coverage, and the ability to rely on good customer service are what you get from Freeway Insurance Services America.

If you're a high-risk driver, Freeway Insurance is one of the few providers that keeps rate increases relatively low for offenses like DUIs and speeding tickets.

Brad Larson LICENSED INSURANCE AGENT

However, along with that success are mixed feedback and claims processing issues. Considering the pros and cons of this will help you decide whether Freeway is the best car insurance company for you.

Key Takeaways on Freeway Car Insurance

This Freeway car insurance review finds affordable premiums, an attractive variety of coverage options, and solid customer service. However, there are other areas to be concerned about, like claims processing and a higher volume of complaints.

Freeway Insurance is a good choice if all factors, such as price, coverage, and customer feedback, are considered. In the end, it’s the best option for high-risk drivers who need SR-22 insurance. Finding free car insurance quotes online will help you assess different providers and coverage levels to make sure you make a wise, informed choice that fits your needs.

Freeway’s Auto Club is here! Our roadside assistance plans bring peace of mind, knowing you are covered in the event of a vehicle breakdown or incident. Request a free quote on our website today: https://t.co/FXmlw7pXty pic.twitter.com/shNiA9nowl

— Freeway Insurance (@Freeway_Ins) November 15, 2024

Buying car insurance is something you don’t want to do without comparing your options. Enter your ZIP code to begin comparing cheap car insurance companies near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Can I trust Freeway Insurance?

Yes, Freeway Insurance is legitimate, offering various coverage options, but concerns about claims processing and complaints should be considered.

Is Freeway Insurance a real insurance company?

Yes, Freeway Insurance is a real insurance company. It operates as Freeway Insurance Services America, LLC, providing car insurance and other coverage options across the United States.

How long has Freeway Insurance been around?

Freeway Insurance was founded in 1987, giving it over three decades of experience in the insurance industry.

What is the most trusted car insurance company?

Companies like State Farm, USAA, and Geico are often regarded as the best car insurance companies due to customer satisfaction ratings, financial stability, and efficient claims processing.

What is another name for Freeway Insurance?

Freeway Insurance operates under its legal name, Freeway Insurance Services America, LLC. Finding cheap Freeway car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Does Freeway Insurance work with Progressive?

Yes, Freeway Insurance partners with other insurance companies, including Progressive, to offer policies and coverage options to its customers.

Who is the CEO of Freeway Insurance?

The CEO of Freeway Insurance is Cesar Soriano.

Is Freeway Insurance a third-party company?

Freeway Insurance is primarily an insurance broker, which means it connects customers with various third-party insurance providers to find the best coverage.

How much does it cost to buy a Freeway Insurance franchise?

The cost of a Freeway Insurance franchise can vary, but estimates suggest it starts around $50,000, depending on location and credit history.

What is the cheapest car insurance in California other than Freeway?

Geico, Progressive, and State Farm are among the insurers who provide the cheapest California car insurance rates, though rates depend on your personal profile.

Which car insurance company has the most complaints?

According to consumer reviews and regulatory data, companies like Allstate and Liberty Mutual often appear in lists with higher complaint ratios. However, this can vary by state and individual experience.

Is it worth it to shop around for insurance?

Absolutely. Shopping around helps you compare rates and coverage options. Our free online comparison tool below allows you to compare Freeway auto insurance quotes instantly— just enter your ZIP code to get started.

How often should you switch auto insurance?

It’s recommended to review your car insurance policy annually or after any major life changes, such as moving, buying a new car, or adding a driver.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

At what point is car insurance not worth it?

Car insurance is legally required in most states, but dropping full coverage in favor of liability-only coverage might make financial sense for older cars with low market value.

Read More: Cheap Car Insurance for Older Vehicles

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.