American Access Car Insurance Review for 2025 [Cost & Coverage]

Our American Access car insurance review highlights high-risk insurance plans starting at $50/month, with premiums varying based on factors like age, driving record, and coverage type. Good drivers, students, and multi-policy holders get discounts, while DUI violations result in higher rates.

Read more

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Nov 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

American Access Casualty Company

Average Monthly Rate For Good Drivers

$50A.M. Best Rating:

B+Complaint Level:

HighPros

- Competitive Monthly Rates

- Broad Coverage Options

- Strong Market Presence

Cons

- Limited State Availability

- Mixed Customer Reviews

This American Access car insurance review takes a closer look at what this high-risk car insurance company has to offer drivers with less-than-perfect driving records.

American Access Casualty Company is a subsidiary of Kemper Corporation, specializing in high-risk car insurance policies. Rates are more affordable than other non-standard providers, but coverage is only available in Arizona and Indiana.

American Access Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.3 |

| Business Reviews | 4 |

| Claim Processing | 2.9 |

| Company Reputation | 3 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3 |

| Policy Options | 2.2 |

| Savings Potential | 3.9 |

Scroll down to read detailed American Access Casualty Company reviews and customer ratings. Then compare the cheapest AZ car insurance companies and the cheapest Indiana car insurance rates to see how American Access stands up to the competition in your state.

To find cheap car insurance in all 50 states, enter your ZIP code above into our free comparison tool.

- American Access auto insurance starts as low as $50/month

- Discounts apply for good drivers, students, and multi-policy holders

- American Access insurance is only available in Arizona and Indiana

American Access Car Insurance Rates Breakdown

American Access car insurance per month depends on age, gender, and the type of coverage chosen. Teen drivers face the highest premiums — minimum coverage costs around $360/month, while full coverage car insurance can go up to $620 monthly.

American Access Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $320 | $580 |

| Age: 16 Male | $360 | $620 |

| Age: 18 Female | $260 | $500 |

| Age: 18 Male | $295 | $545 |

| Age: 25 Female | $95 | $210 |

| Age: 25 Male | $110 | $230 |

| Age: 30 Female | $85 | $190 |

| Age: 30 Male | $100 | $205 |

| Age: 45 Female | $60 | $130 |

| Age: 45 Male | $58 | $125 |

| Age: 60 Female | $52 | $115 |

| Age: 60 Male | $55 | $120 |

| Age: 65 Female | $50 | $110 |

| Age: 65 Male | $53 | $118 |

This said, as drivers reach older ages their premiums fall by a lot. Seniors 65 or older pay the best rates. Women over 65 only have to shell out $50 monthly for minimum coverage and $110 full coverage.

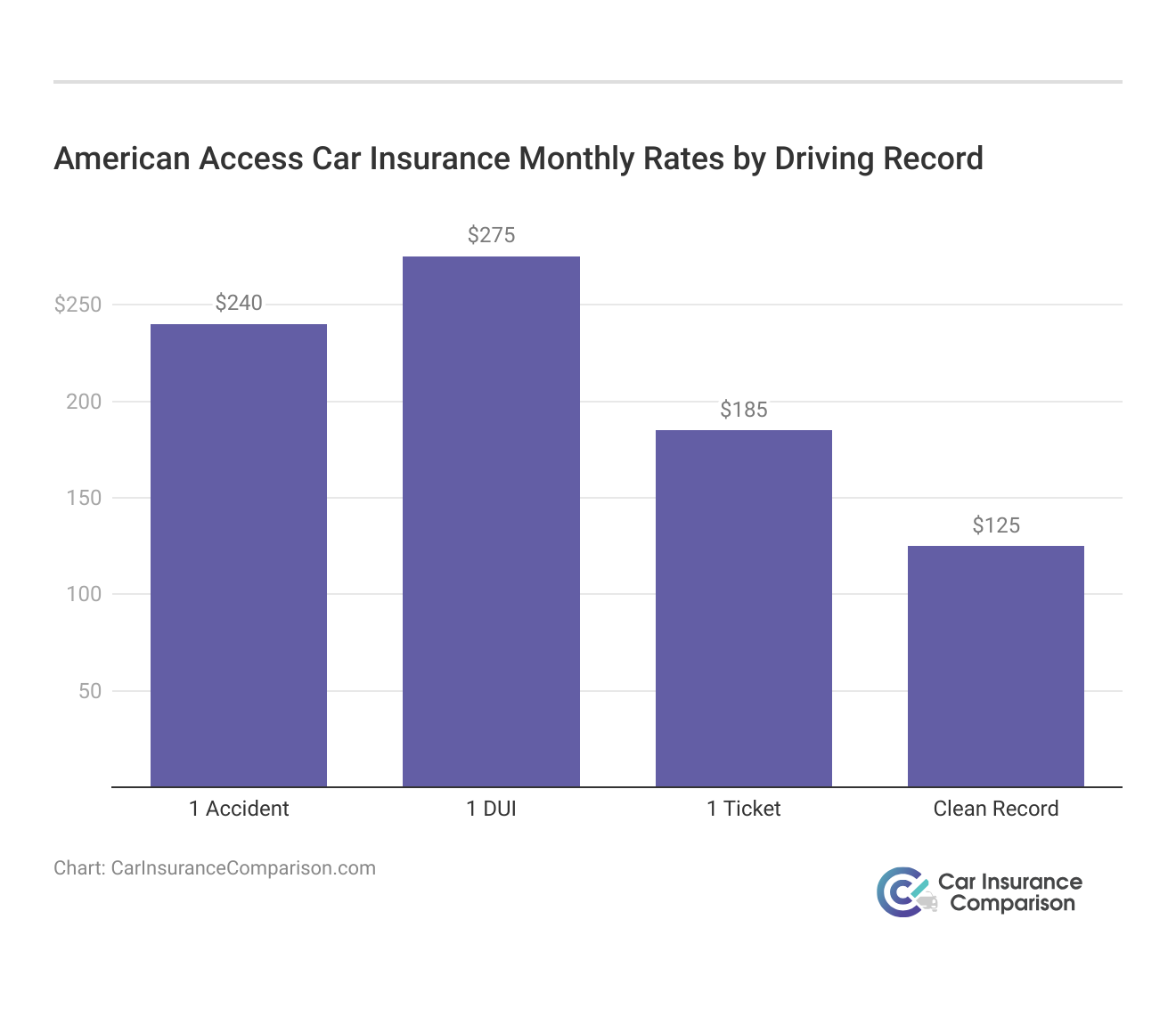

American Access sells high-risk car insurance for AZ and IN drivers who may have multiple accidents or DUIs. See how American Access adjusts its rate levels according to risk driving violations quickly increases rates.

Those with only one traffic ticket are billed at a lower rate of $185, while those who keep their record clean save the most, paying just $125 per month. For similar options, people also searched for other providers offering safe driver discounts. Find out how to get cheap car insurance after a DUI.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

American Access Car Insurance Rates vs. The Competition

American Access auto insurance rates are more expensive than popular, standard companies like Geico and State Farm. Since it takes on the financial risk of insuring high-risk drivers, American Access charges more per month.

American Access Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Age & Gender | Age: 18 Male | Age: 18 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 45 Male | Age: 45 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|---|---|

| $335 | $325 | $200 | $195 | $160 | $155 | $140 | $135 | $120 | $115 | |

| $320 | $310 | $180 | $175 | $140 | $135 | $120 | $115 | $100 | $95 |

| $270 | $260 | $160 | $155 | $130 | $125 | $110 | $105 | $95 | $90 | |

| $325 | $315 | $190 | $185 | $150 | $145 | $130 | $125 | $110 | $105 | |

| $310 | $300 | $175 | $170 | $140 | $135 | $120 | $115 | $100 | $95 |

| $315 | $305 | $185 | $180 | $145 | $140 | $125 | $120 | $105 | $100 | |

| $290 | $275 | $170 | $165 | $135 | $130 | $115 | $110 | $100 | $95 | |

| $340 | $330 | $210 | $205 | $165 | $160 | $145 | $140 | $125 | $120 | |

| $330 | $320 | $195 | $190 | $155 | $150 | $135 | $130 | $115 | $110 | |

| $280 | $270 | $165 | $160 | $130 | $125 | $110 | $105 | $95 | $90 |

Fortunately, American Access is cheaper than some of the best car insurance companies for high-risk drivers, especially for drivers with multiple incidents or claims on their records.

American Access Car Insurance Discounts Summary

American Access offers a range of car insurance discounts that can make it more affordable, especially for high-risk drivers seeking ways to lower their costs. Bundling auto insurance with other policies unlocks a 15% multi-policy discount for homeowners and renters.

American Access Car Insurance Discounts and Potential Savings Percentages

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Anti-Theft Device Discount | 5% | Installing anti-theft devices |

| Auto-Pay Discount | 5% | Enrolling in automatic payments |

| Defensive Driving Course Discount | 10% | Completing a certified safety course |

| Good Student Discount | 10% | For students with high grades |

| Multi-Policy Discount | 20% | Bundling auto and other policies |

| New Customer Discount | 5% | For first-time policyholders |

| Pay-in-Full Discount | 10% | Paying the full premium upfront |

| Renewal Discount | 10% | Renewing policies without lapses |

| Safe Driver Discount | 15% | Maintaining a clean driving record |

| Senior Driver Discount | 10% | For older drivers meeting criteria |

Families insuring multiple vehicles can save up to 20%, and students with good grades also receive a 10% discount, helping young drivers who typically face higher premiums. Customers paying upfront can save an extra 5%. At this price point, it seems American Access is a strong option for drivers who want to pay as little as possible.

American Access Car Insurance Coverage Details

With American Access, you can choose from different car insurance options. Liability coverage is required by law and helps pay if you’re responsible for someone’s injuries or property damage in an accident.

Collision coverage handles repairs to your car after an accident, while comprehensive car insurance coverage takes care of things like theft or weather-related damage.

American Access Car Insurance Coverage Options

| Coverage Name | Description | What it Covers |

|---|---|---|

| Liability | Covers damage to others and property | Injuries and property damage claims |

| Collision | Covers your car in a collision | Vehicle repair/replacement costs |

| Comprehensive | Covers non-collision incidents | Theft, fire, and natural disasters |

| Uninsured/Underinsured Motorist | Covers accidents with uninsured drivers | Medical and repair expenses |

| Medical Payments | Covers medical costs | Medical expenses for you/passengers |

| Personal Injury Protection (PIP) | Covers injury-related expenses | Medical bills and lost wages |

| Rental Reimbursement | Covers rental car costs | Temporary rental vehicle costs |

| Roadside Assistance | Covers breakdown assistance | Towing, flat tires, and jump-starts |

Getting into an accident with a driver who doesn’t have enough insurance can be stressful, but your policy can help cover medical costs with options like PIP or medical payments. You can also add coverage for rental cars during repairs and roadside help for things like flat tires or towing. These features let you shape your policy to fit what works best for you.

In sum, American Access provides flexible coverage options, but drivers, especially those with clean records, may find it beneficial to explore other providers for the most competitive rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Customer Feedback on American Access Car Insurance

American Access auto insurance plans are a good option for high-risk drivers aiming to save. The company offers competitive rates along with discounts for students and households with multiple vehicles.

American Access targets the needs of high-risk drivers by offering customized policies that are affordable and comprehensive, ensuring that everyone has access to necessary coverage.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

On the other hand, review highlights indicate that customer feedback is more critical regarding claims processing and customer service, noting that the average claim processing time can be slow, with some customers facing long waits or difficulties reaching helpful representatives.

American Access Casualty

byu/healking inInsuranceOverall, American Access offers flexible coverage, but comparing options can help drivers, especially those with safer histories, secure the most competitive rates.

While there are areas for improvement, American Access still offers a solid choice for drivers seeking availability and affordability through assigned risk car insurance.

In Arizona and Indiana, where other insurers may charge significantly higher premiums, American Access provides a more budget-friendly option, especially for those who need basic coverage and have limited choices due to high-risk status.

American Access Car Insurance Agency Ratings

The table below outlines annual ratings and consumer feedback for American Access auto insurance. J.D. Power rates the company at 790 out of 1,000, indicating below-average customer satisfaction, while grades the Better Business Bureau (BBB) of B, signifying satisfying but mediocre business practices.

American Access Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 790/1,000 Below Avg. Satisfaction |

|

| Score: B Satisfactory Business Practices |

|

| Score: 65/100 Below Avg. Customer Feedback |

|

| Score: 3.10 More Complaints Than Avg. |

|

| Score: B+ Good Financial Strength |

Consumer Reports rates American Access 65 out of 100, indicating below-average customer feedback. The National Association of Insurance Commissioners (NAIC) also gives it a score of 3.10, indicating that the company receives more complaints than the industry average.

These numbers of scores highlight the wide variations in business operations performance, also how customer ratings for satisfaction affect car insurance companies as well specifically looking at consumer engagement.

American Access Car Insurance Pros and Cons

American Access provides flexible car insurance policies which allow you to find the right level of coverage, especially if you’re a high-risk driver looking for lower rates.

- Customizable Policy Options: By using criteria such as age, driving history, and type of vehicle, drivers can get a policy that fits their needs.

- Discount Programs: American Access has plenty of discounts available for good drivers, students, multi-policy holders, and with multiple vehicles in the household.

- Competitive Rates for High-Risk Drivers: American Access provides cheap rates for drivers with accidents, DUIs, or need to file for SR-22 insurance.

Despite these benefits, most drivers may have difficulty finding American Access car insurance nearby or options to browse nearby locations. Other potential downsides also come with choosing American Access:

- Average Customer Service: Other reviews point to bad customer service, like slow claims processing and poor communication.

- Limited Availability: Affordable American Access high-risk car insurance is only available in two states: Indiana and Arizona.

American Access is a good option for drivers who want some flexibility from their car insurance and are looking for discount opportunities, but high-risk drivers may want to check rates with other providers to be sure they are getting the best deal.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Get Streamlined High-Risk Car Insurance With American Access

Our American Access car insurance review finds affordable high-risk insurance options for young adults, seniors, and multi-vehicle households who have accidents or claims on their records. American Access creates flexible insurance plans to accommodate long-term needs.

American Access Insurance can be particularly competitive for drivers over 25, who typically see lower rates due to their decreased risk profile compared to teenage drivers.

Brandon Frady Licensed Insurance Agent

American Access Casualty Company meets the needs of high-risk drivers with few insurance options seeking adaptable, affordable coverage. It’s supported by Kemper Corporation, a guaranteed-approval car insurance company.

The biggest downside to American Access insurance is it’s only available in Arizona and Indiana. If you need to find cheap high-risk auto insurance in your state, enter your ZIP code below to get free insurance quotes from affordable companies near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is American Access part of Kemper’s insurance?

Yes, American Access is part of Kemper Corporation. The acquisition by Kemper has expanded its reach and enhanced its offerings, especially in community-focused insurance.

How do I cancel my Kemper auto insurance?

To cancel your Kemper auto insurance, contact their customer service directly via phone or email, or visit your local agent, and provide the necessary policy information.

How do I file a claim with American Access?

When filing a car insurance claim with American Access, you should contact its claims department directly through the official website or phone. When initiating the call, it would be best to keep your policy number and accident details ready.

Is Kemper good insurance?

Kemper is considered to have good financial strength with a B+ rating from A.M. Best. However, customer satisfaction ratings can vary, so comparing reviews with other insurance offerings is wise.

What was the old name of Kemper Insurance Company?

Formerly known as Unitrin, Inc., this business is now Kemper Corporation. In 2011, the company changed all its trademarks to Kemper Corporation in order of having a single brand identity.

What type of insurance is Kemper?

Kemper offers various insurance products, including auto and life insurance. It provides multiple types of car insurance coverage for personal and commercial insurance needs.

What happened to Kemper Insurance?

Kemper Insurance is still operational and has expanded its offerings through acquisitions like that of American Access Casualty Company. Kemper continues to serve a wide range of high-risk insurance needs.

Find the best car insurance quotes by entering your ZIP code below into our free comparison tool today.

Who owns Kemper car insurance?

Kemper Auto Insurance is owned by Kemper Corporation, a diverse company that offers auto, home, life, and health insurance products under various subsidiaries.

How does American Access handle claims for high-risk drivers?

American Access specializes in providing car insurance specifically tailored for drivers considered high-risk, including those with multiple traffic violations, accident records, or DUIs. Given that high-risk drivers are more likely to file claims, American Access has implemented a straightforward, user-friendly claims process designed to deliver prompt and fair support.

They know they can count on responsive and reliable claims assistance when needed, especially important with car insurance for high-risk drivers, who may face higher costs after an accident or other incidents.

What is the other name for Kemper Insurance?

The other name for Kemper Insurance was Unitrin, Inc. Kemper underwent a rebranding in 2011 when it changed its name from Unitrin to Kemper Corporation. This rebranding unified the brand and helped consolidate its identity across various insurance and financial services markets.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

July_Sanchez

Don't waste your money!

dlw1962

Looking for something new

PaganRebel

Beware

Assassin38

Unprofessional

vado34

good insurance

patzy876

Always reliable.

richomnns

I'm Staying

andrekkevv

Smooth

Dugierachael92

Low prices

Farming2016

Great deals