AAA Car Insurance Review for 2025 (Uncover Rates and Discounts Here)

Use this AAA car insurance review to compare rates and options. Good drivers can expect to pay as low as $29 for average monthly rates on flexible 12-month AAA offers regional perks, claim-free and multi-vehicle discounts, and reliable coverage, making it a smart choice for affordability and flexibility.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

AAA

Average Monthly Rate For Good Drivers

$29A.M. Best Rating:

AComplaint Level:

LowPros

- Roadside assistance plans

- Membership benefits

- Flexible coverage options

Cons

- Annual membership fee

- Availability varies by region

AAA car insurance review starts at $29/month. If you are a good driver, affordable combined with great benefits, AAA offers 12-month flexible policies, benefits from regional clubs, and discounts such as claim-free and multi-vehicle discounts.

Affordable, customizable coverage and flexible payment options make AAA a solid choice. Compare car insurance by coverage type to find inexpensive, reliable options that suit your needs.

AAA Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.5 |

| Claims Processing | 3.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.0 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 4.4 |

| Savings Potential | 4.3 |

Even using some aspects of the excellent driver price per value, High 12-month flexible policies, benefits to region club, and stack discounts.

Look for cheaper premiums. Enter your ZIP code above to be matched with the right provider for you and your price range.

- AAA car insurance review highlights rates starting at $29/month for good drivers

- Flexible 12-month policies and regional perks offer added convenience

- AAA is a top pick for discounts, including claim-free and multi-vehicle savings

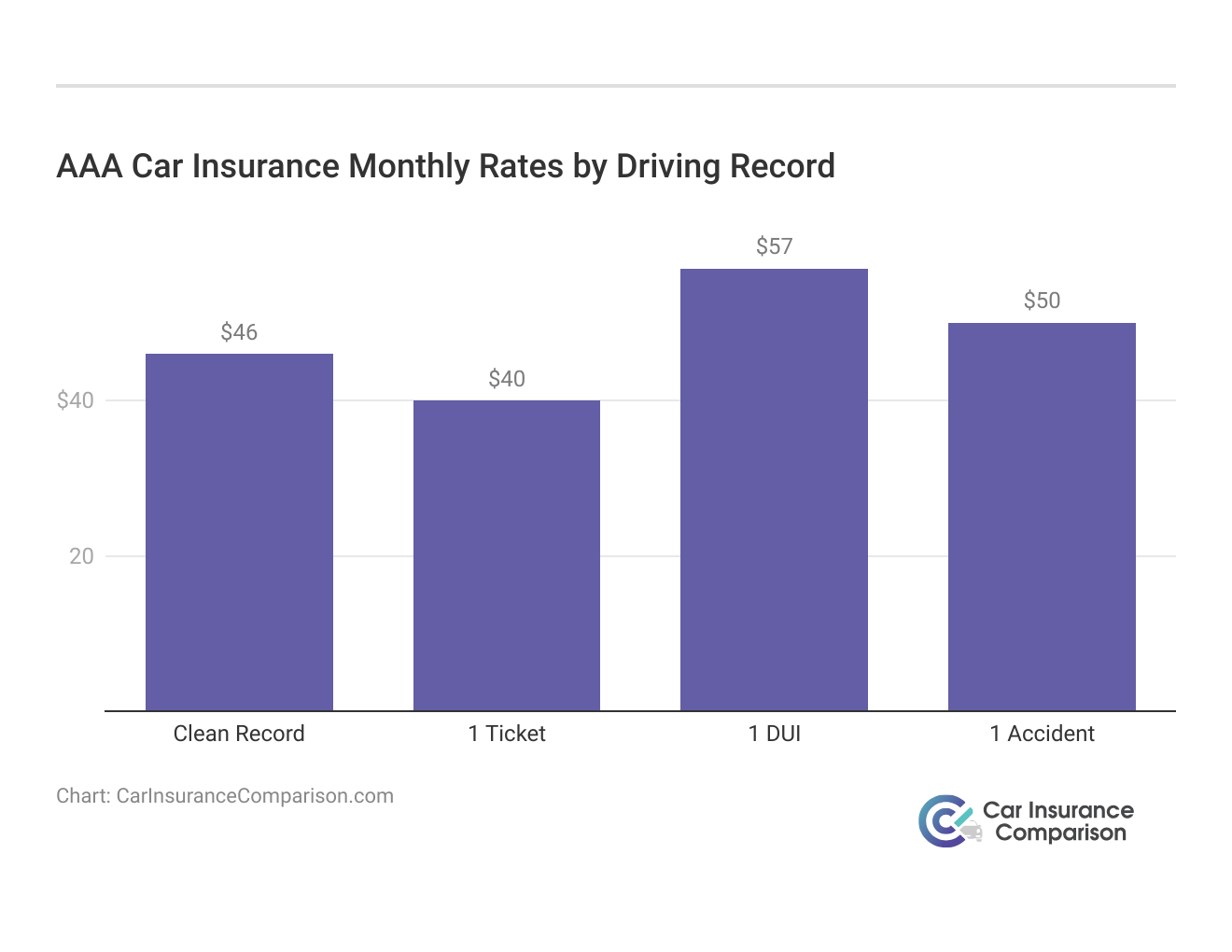

AAA Car Insurance Monthly Rates by Age & Gender: Find Your Best Fit

The following monthly rate chart from AAA car insurance illustrates how premiums differ by age and gender for minimum and full coverage. AAA offers plans that differ based on demographic factors, making it simple to select budget-friendly monthly coverage starting at just $33 monthly.

AAA Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $172 | $445 |

| Age: 16 Male | $189 | $465 |

| Age: 18 Female | $140 | $328 |

| Age: 18 Male | $162 | $378 |

| Age: 25 Female | $40 | $107 |

| Age: 25 Male | $41 | $110 |

| Age: 30 Female | $37 | $99 |

| Age: 30 Male | $38 | $103 |

| Age: 45 Female | $33 | $88 |

| Age: 45 Male | $46 | $86 |

| Age: 60 Female | $29 | $76 |

| Age: 60 Male | $30 | $77 |

| Age: 65 Female | $33 | $86 |

| Age: 65 Male | $32 | $84 |

Whether you’re a new driver or more experienced, AAA offers affordable monthly rates, with average car insurance rates by age and gender, giving you the flexibility to choose the best fit for your needs.

Review these monthly choices to find low-cost, dependable coverage from AAA that is customized to fit your specific needs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

AAA Car Insurance Rates vs. Top Competitors: Find the Best Fit by Age & Gender

Comparing AAA car insurance monthly rates to top competitors gives a clear view of how age and gender can impact premiums across providers.

AAA Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $328 | $378 | $99 | $103 | $88 | $86 | $86 | $84 |

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $113 | $114 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $136 | $136 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $167 | $170 |

| $303 | $387 | $124 | $136 | $113 | $115 | $111 | $112 |

| $591 | $662 | $131 | $136 | $112 | $105 | $109 | $103 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $84 | $84 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $96 | $97 | |

| $180 | $203 | $74 | $79 | $59 | $59 | $58 | $57 |

From young drivers to seniors, this comparison highlights where AAA stands on affordability and how it stacks up against options like State Farm, Geico, and the best Allstate car insurance discounts for various age and gender groups.

When comparing AAA’s monthly rates to those of other large insurers, we found that the American Automobile Association holds a competitive position across numerous demographics.

AAA Car Insurance: Savings & Benefits Unlocked

When it comes to saving on car insurance, AAA has several discounts that keep costs down while ensuring you get solid coverage. Here are five ways AAA helps members like you save:

- Claim-Free Discount: Safe drivers enjoy discounts when they have a record free of claims. Knowing how to file a car insurance claim is important, but if you can avoid it, keeping claims off your history can lead to significant savings over time.

- Multi-Vehicle Discount: Have more than one car? AAA gives a discount when you insure them all under one policy—ideal for families or households with multiple drivers.

- Bundling Discount: Combine car insurance with other AAA policies, like home or renters, for an extra price break. It’s an easy way to simplify your insurance and save.

- Good Driver Discount: Good drivers get great rates, starting as low as $29 a month in some cases, so those safe driving habits truly pay off.

- Flexible Payment Options: AAA knows budgets vary, so they offer payment plans to suit your schedule. Choose from monthly, quarterly, or annual payments for convenience.

Such discounts and options aid AAA beyond mere car insurance—they help turn practical, reliable coverage into a reality. From bundling to adding more cars on a policy or just a clean driving record and low miles, AAA’s discounts fit right in line with your needs.

Get reliable coverage that keeps costs low when you choose AAA so you can be sure on the road and in your wallet. AAA is as sensible of an option as it gets if you want to save some dollars while staying protected.

AAA Auto Insurance: Coverage and Benefits for Drivers Everywhere

AAA auto insurance provides coverage for drivers nationwide. In California, AAA auto coverage is popular for its reliable, flexible protection and broad service network, making AAA auto insurance California a go-to for many drivers seeking dependable support on the road.

AAA also makes it easier to save with their discounts—an AAA auto insurance discount can offer real savings if you qualify. With tailored plans like AAA auto insurance in Missouri and AAA auto insurance in Oklahoma.

For any claims, keeping the AAA auto insurance claims phone number on hand is essential for fast, direct assistance from the AAA auto insurance company.

Good customer satisfaction shows in AAA auto insurance ratings, and AAA auto insurance reviews often praise their roadside assistance and smooth claims experience, making it a strong choice for reliable coverage and various types of car insurance coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Inside AAA Car Insurance: An In-Depth Look at Ratings and Real Customer Feedback

AAA car insurance company ratings and customer reviews can give you a good sense of what this provider is like to work with. AAA has scored about as well as possible with the J.D. Power rating of 823 out of 1,000 for customer satisfaction and received an A rating from the Better Business Bureau for its service quality.

AAA Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 823 / 1,000 Avg. Satisfaction |

|

| Score: A Great Rating |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

AAA earns a Consumer Reports score of 74, reflecting strong customer satisfaction, while its NAIC score of 0.58 shows fewer-than-average complaints—key factors to consider when understanding your car insurance premium: what it is and how it works.

AAA also boasts a stellar financial profile with an A.A.M. Best rating, so the organization is an excellent option for safe car insurance.

Comment

byu/Just_Operation_4284 from discussion

inauto

AAA car insurance claims are backed by solid AAA ratings across several trusted institutions and prove that when it comes to satisfaction, complaints, and finances—AAA is more than just roadside service. This information is helpful in gauging whether AAA offers the coverage and reputation you want from an insurance company.

AAA Car Insurance: Affordable Rates and Reliable Coverage

For those interested in some cheap car prices but, more importantly, with a reliable service, AAA car insurance offers several excellent features for driving needs.

From safe driver car insurance discounts and multi-vehicle coverage to flexible payment plans that keep your coverage hassle-free, AAA provides effective options designed for convenience on the road.

With monthly rates starting at $29, AAA offers reliable coverage and valuable perks that make it a top choice for smart drivers.

Dani Best Licensed Insurance Producer

From service to coverage options, AAA sets out to make sure your process is simple, meaning you’ll have the help you need on and off the road.

A quick rate comparison and a glance at what AAA has to offer may be the difference between life-changing insurance coverage that fits your lifestyle. To that end, cheers to safe, smart driving.

Want to compare car insurance companies? Input your ZIP code below and see which one can provide the coverage you seek.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is AAA’s insurance company rating, and why is AAA more expensive?

AAA holds a high rating for customer service, but it may be more expensive due to added benefits like roadside assistance, which can justify the higher premiums for members.

Who is the best car insurance provider, and how does AAA compare?

The best car insurance provider depends on individual needs, but AAA is competitive due to its comprehensive plans and nationwide roadside services, making it a strong choice for those prioritizing these features. Affordable car insurance rates are just a click away. Enter your ZIP code using our free quote tool below to find the best policy for you.

Is AAA the same as car insurance, or does it offer additional services?

With monthly rates starting at $29, AAA offers reliable coverage and the best car insurance discounts, Along with membership perks like roadside assistance and travel discounts beyond standard insurance offerings.

What is the best AAA coverage, and what does AAA stand for?

AAA, or the American Automobile Association, offers various coverage levels, with Premier and Plus plans providing broader benefits, ideal for frequent travelers needing extensive roadside support.

What is the AAA rating, and how does it rank among the top 5 insurance companies?

AAA generally receives favorable ratings, often noted for customer satisfaction. While not a traditional insurer, AAA’s policies are well-regarded, especially when compared to other top insurers in customer service.

What are the benefits of using AAA, and what are AAA’s policies?

AAA members enjoy emergency roadside assistance, travel discounts, and the best rental car reimbursement coverage, with policies that offer standard auto insurance and additional options like rental reimbursement and comprehensive road service coverage.

What is the average AAA budget for members, and how much is the cheapest AAA membership?

The average budget for AAA varies by region and coverage, but basic membership starts around $50 annually, providing access to discounts and emergency assistance.

What are the benefits of AAA member insurance, and what does AAA offer beyond standard coverage?

Car insurance is just the start of AAA member insurance — member perks include emergency roadside assistance, travel savings, and trip planning. This rounded-out value proposition makes AAA member insurance a tempting prospect for members whose needs are not met by base-level coverage options.

Who are the top 5 insurance companies, and where does AAA rank in customer satisfaction?

Companies like State Farm, Geico, and Allstate are often among the top five insurers. AAA is not a traditional insurer, but its customer satisfaction is generally high among members. If you want a broader overview, explore our business insurance resource, which is titled State Farm car insurance discounts.

Which company provides the best car insurance, and does AAA offer competitive rates?

The best car insurance depends on individual needs, but AAA’s policies are competitive, especially considering the added benefits that can make it cost-effective for those who value roadside assistance. Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Sally Ayres

AAA review

sally_a

Crooks

Teezee

Don’t buy triple AAA

Tia_15

DON'T CALL AAA IF THE CRASH ISN'T YOUR FAULT!!!!!!!

cordarei

inefficient claims

tom_pop

Breach of Trust -- Raises Premium Without Notifying Consumer

CCADE

Excellent, Fast Professional & Friendly Service

vintagemx465

Home Owners Insurance

Always_Cold

Good customer service

kathleenl1963

Best Insurance Ever