Cheapest North Dakota Car Insurance Rates in 2025 (Big Savings With These 10 Companies!)

Get the cheapest North Dakota car insurance rates with USAA, Geico, and State Farm, offering rates as low as $12 monthly. These companies stand out for their affordability and comprehensive coverage options, making them ideal choices for North Dakota residents seeking reliable car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jul 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for North Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for North Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for North Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

When it comes to cheapest North Dakota car insurance rates, the top contenders are USAA, Geico, and State Farm, offering rates as low as $12 monthly. USAA emerges as the top pick overall, combining affordability with superior customer service and extensive coverage options tailored for military personnel and their families.

Nobody likes to pay too much for anything, let alone, paying too much for car insurance. How to save big on car insurance in North Dakota? Our comprehensive guide has everything you need to know. Don’t pay too much—learn how to get the best rates now.

Our Top 10 Company Picks: Cheapest North Dakota Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $12 A++ Military Savings USAA

#2 $17 A++ Cheap Rates Geico

#3 $21 A+ Many Discounts Nationwide

#4 $22 B Usage Discount State Farm

#5 $24 A++ Accident Forgiveness Travelers

#6 $30 A Local Agents Farmers

#7 $31 A+ Online Convenience Progressive

#8 $38 A+ Add-on Coverages Allstate

#9 $40 A Student Savings American Family

#10 $110 A Customizable Polices Liberty Mutual

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

- Find the cheapest North Dakota car insurance rates

- Explore tailored coverage options and discounts

- Consider USAA for top-rated affordability and reliability

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Pick Overall

Pros

- Lowest Average Premiums: USAA offers the most affordable car insurance rates in North Dakota, averaging just $12 per month. This makes it the top choice for drivers seeking the lowest possible premiums in the state.

- Exclusive Military Discounts: USAA provides significant discounts for military members and their families. These exclusive savings can further lower insurance costs, making USAA an excellent option for those eligible, ensuring they benefit from the cheapest rates available.

- Exceptional Customer Satisfaction: USAA consistently receives high ratings for customer satisfaction and service quality. This reputation ensures that North Dakota drivers not only get the best rates but also experience excellent support and claims handling. Learn more in our USAA car insurance review.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members, veterans, and their families. Non-military drivers in North Dakota cannot access these low rates, which excludes a significant portion of the population from these cost savings.

- Limited Local Presence: USAA has fewer physical offices and local agents in North Dakota compared to other insurers. This might limit access to in-person support for those who prefer direct interaction with insurance professionals.

#2 – Geico: Best for Cheap Rates

Pros

- Highly Affordable Rates: Geico’s average monthly premium in North Dakota is $17, making it one of the most cost-effective options for drivers seeking cheap car insurance. Their rates are consistently competitive, offering substantial savings. Learn more in our Geico car insurance review.

- Wide Range of Discounts: Geico offers numerous discounts, including those for safe driving, good student discounts, and multi-policy bundles. These discounts can significantly lower your insurance premiums, further enhancing its affordability in North Dakota.

- Convenient Online Tools: Geico provides robust online tools and a user-friendly mobile app for managing policies and claims. This digital convenience allows North Dakota drivers to easily access and manage their insurance information, saving time and effort.

Cons

- Limited Personalization: Geico’s focus on online and phone service may lack the personalized touch of face-to-face interactions with local agents. For North Dakota drivers who value personalized advice and local expertise, this can be a drawback.

- Basic Coverage Options: Geico’s coverage options might not be as extensive as those of some competitors. This could limit customization for North Dakota drivers who need more specialized coverage beyond the standard options.

#3 – State Farm: Best for Many Discounts

Pros

- Affordable North Dakota Rates: State Farm offers competitive rates with an average monthly premium of $21 in North Dakota. This makes it a solid choice for drivers looking for economical car insurance options in the state. Unlock details in our State Farm car insurance review.

- Variety of Discounts: State Farm provides various discounts, including for safe driving, bundling policies, and low-mileage driving. These discounts help reduce premiums further, making insurance more affordable for North Dakota residents.

- Strong Local Agent Network: With a significant presence of local agents across North Dakota, State Farm offers personalized service and localized expertise. This ensures drivers receive tailored advice and support, which can lead to better insurance rates and coverage options.

Cons

- Potential for Rate Increases: State Farm may increase rates after an initial period or due to changes in driving behavior. This can affect the long-term affordability of insurance, which is crucial for North Dakota drivers seeking stable rates.

- Limited Advanced Digital Features: State Farm’s digital tools may not be as advanced as some competitors, potentially affecting the ease of managing your policy online. This can be a drawback for tech-savvy North Dakota drivers who prefer a more modern digital experience.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Usage Discount

Pros

- Reasonable Premiums: Nationwide’s average monthly premium is $22 in North Dakota, positioning it as a cost-effective option for drivers looking for affordable insurance. Their rates are competitive within the North Dakota market.

- Multiple Discount Opportunities: Nationwide offers a range of discounts, including for safe driving, bundling policies, and installing safety features in your vehicle. These can help reduce premiums, making it easier to find savings in North Dakota. Check out insurance savings in our complete Nationwide car insurance discount.

- Comprehensive Coverage Options: Nationwide provides a broad selection of coverage options, allowing drivers to customize their policies to fit specific needs. This flexibility is beneficial for North Dakota drivers who want to ensure they have the right coverage at an affordable rate.

Cons

- Higher Rates for Some Drivers: Nationwide’s rates might be higher for drivers with less-than-perfect records or those in high-risk categories. This could make it less ideal for North Dakota drivers who have had past claims or violations.

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Nationwide’s customer service. This variability could impact North Dakota drivers who value consistent and reliable support when managing their insurance policies.

#5 – Travelers: Best for Accident Forgiveness

Pros

- Affordable Rates: Travelers offers competitive rates with an average premium of $24 per month in North Dakota. This makes it a viable option for those seeking budget-friendly insurance coverage. See more details on our Travelers car insurance review.

- Discounts for Bundling: Travelers provides substantial discounts for bundling multiple policies, such as home and auto insurance. This can lead to overall savings and more affordable car insurance premiums for North Dakota drivers.

- Wide Coverage Options: Travelers offers a diverse range of coverage options, including various add-ons and endorsements. This allows North Dakota drivers to tailor their policies to meet specific needs while keeping costs manageable.

Cons

- Higher Rates for High-Risk Drivers: Travelers may have higher premiums for drivers with higher risk profiles, such as those with recent accidents or traffic violations. This can affect the affordability of insurance for North Dakota drivers with such histories.

- Less Personalized Service: Travelers primarily operates through online and phone channels, which may lack the personalized service of local agents. For North Dakota drivers who prefer face-to-face interactions, this could be a disadvantage.

#6 – Farmers: Best for Local Agents

Pros

- Moderately Priced Premiums: Farmers offers competitive insurance rates, with an average premium of $30 per month in North Dakota. This makes it a reasonably priced option for drivers looking to balance cost and coverage.

- Variety of Discounts: Farmers provides a range of discounts, including those for safe driving, bundling policies, and having anti-theft devices. These discounts can help lower insurance costs further, benefiting North Dakota drivers.

- Flexible Coverage Options: Farmers offers flexible coverage options and customizable policies to fit various needs. This flexibility allows North Dakota drivers to choose the coverage that best suits their requirements while managing costs. Learn more in our Farmers car insurance review.

Cons

- Potentially Higher Premiums for Certain Drivers: Farmers may have higher rates for drivers with poor credit scores or multiple claims. This could impact North Dakota drivers who are looking for the cheapest rates but have less-than-ideal insurance profiles.

- Complex Policy Structure: Farmers’ policy structure can be complex, with various coverage options and add-ons. This complexity might make it challenging for North Dakota drivers to fully understand their policy and ensure they are getting the best value.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Online Convenience

Pros

- Affordable Insurance Rates: Progressive offers competitive premiums with an average cost of $31 per month in North Dakota. This places it among the more affordable options for drivers seeking budget-friendly car insurance. Delve into our evaluation of Progressive car insurance review.

- Snapshot Program for Savings: Progressive’s Snapshot program rewards safe driving with potential discounts based on actual driving behavior. This can be particularly advantageous for North Dakota drivers who drive responsibly and want to reduce their premiums further.

- Diverse Coverage Options: Progressive provides a wide array of coverage options and customizable policies. This allows North Dakota drivers to tailor their insurance to meet specific needs, ensuring comprehensive protection at a reasonable cost.

Cons

- Rates Fluctuate: Progressive’s rates may fluctuate based on driving habits or claims history, potentially affecting long-term affordability. North Dakota drivers should be aware that their premiums could change over time depending on their insurance profile.

- Complex Pricing Structure: Progressive’s pricing structure can be complex, with various factors influencing rates. This might make it difficult for North Dakota drivers to fully understand their insurance costs and compare them accurately.

#8 – Allstate: Best for Add-on Coverages

Pros

- Competitive Rates: Allstate offers competitive rates for car insurance in North Dakota, with an average premium of $38 per month. This makes it a reasonable option for those looking to manage their insurance costs effectively.

- Multiple Discount Opportunities: Allstate provides a range of discounts, including safe driving, bundling policies, and new car safety features. These discounts can lower insurance costs, making Allstate a viable choice for North Dakota drivers. Discover more about offerings in our Allstate car insurance review.

- Extensive Coverage Options: Allstate offers a broad range of coverage options and add-ons, allowing drivers to customize their policies according to their needs. This ensures that North Dakota drivers can select comprehensive coverage while keeping costs within budget.

Cons

- Higher Premiums for Some Drivers: Allstate’s rates may be higher for drivers with poor credit scores or a history of claims. This can make it less ideal for North Dakota drivers who are looking for the cheapest insurance options but have a higher risk profile.

- Mixed Reviews for Customer Service: Allstate has received mixed reviews regarding customer service, with some customers experiencing issues with claims processing and support. This variability could be a concern for North Dakota drivers who prioritize reliable customer service.

#9 – American Family: Best for Student Savings

Pros

- Reasonable Rates: As mentioned in our American Family car insurance review, American Family offers competitive car insurance rates, with an average premium of $40 per month in North Dakota. This makes it a viable option for drivers seeking cost-effective coverage in the state.

- Wide Range of Discounts: American Family provides various discounts, including those for safe driving, bundling multiple policies, and having safety features in your vehicle. These discounts help reduce overall insurance costs for North Dakota drivers.

- Customizable Coverage Options: American Family offers flexible coverage options, allowing drivers to tailor their policies to meet specific needs. This flexibility helps ensure that North Dakota drivers can find the right balance of coverage and cost.

Cons

- Higher Premiums for High-Risk Drivers: American Family may have higher rates for drivers with less-than-perfect records or high-risk profiles. This could impact the affordability of insurance for North Dakota drivers who have a history of accidents or violations.

- Limited Online Tools: American Family’s online tools and mobile app may not be as advanced as those of some competitors. This can be a disadvantage for North Dakota drivers who prefer more modern digital features for managing their policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Polices

Pros

- Discounts for Bundling: Liberty Mutual offers substantial discounts for bundling auto with other types of insurance, such as home or renters insurance. This can significantly reduce overall premiums, although their average rate of $110 is higher compared to other insurers.

- Customizable Coverage Options: Liberty Mutual provides a wide range of coverage options and add-ons, allowing for a highly customizable insurance policy. This flexibility ensures that North Dakota drivers can tailor their coverage to their specific needs, despite the higher base rate.

- Additional Coverage Benefits: Liberty Mutual offers unique benefits like accident forgiveness and new car replacement, which can enhance coverage and provide extra value. These features can be beneficial for North Dakota drivers who want added protection and value in their insurance policy. Learn more in our Liberty Mutual car insurance review.

Cons

- High Average Premiums: Liberty Mutual’s average monthly premium of $110 is significantly higher than many competitors, making it one of the more expensive options for North Dakota drivers. This higher cost may not be ideal for those seeking the cheapest insurance rates.

- Limited Discounts Compared to Competitors: While Liberty Mutual offers some discounts, it may not provide as many opportunities for savings as other insurers. This can be a drawback for North Dakota drivers looking for more ways to reduce their insurance costs.

North Dakota Car Insurance Companies

Can you really save money with a 10-minute phone call? We’ve heard this and other funny commercials from insurance companies so often we can sing their jingles by heart. Car insurance is mandatory in all 50 states except one, New Hampshire, so why do insurance providers spend so much on advertising and trying to be funny? Are they hiding something? What’s really behind the catchy jingles of most insurance companies?

North Dakota Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $38 $136

American Family $40 $145

Farmers $30 $107

Geico $17 $61

Liberty Mutual $110 $398

Nationwide $22 $77

Progressive $31 $110

State Farm $21 $76

Travelers $24 $88

USAA $12 $44

But who wants to spend time doing all of that searching? That’s why we’ve done all of the work for you and researched the best insurance carriers in North Dakota, so you can make the best choice for your situation.

We’ve looked at companies’ financial ratings, AM’s best ratings, and which companies have the most complaints. Keep reading to learn about North Dakota’s auto insurance providers.

Ratings of the Largest Car Insurance Companies in North Dakota

What does an A.M. Best rating mean? Basically, an A.M. Best rating measures the financial health of an insurance company. The table below shows the financial rating of the top auto insurance providers in North Dakota.

A.M. Best Financial Strength Ratings From the Top North Dakota Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| American Family | A |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| Travelers | A++ |

| USAA | A++ |

A good financial rating means the provider has the funds available to pay any claims. But customer service is also an important part of any company, from restaurants to car insurance companies. That’s why we’ve looked at companies with the best customer satisfaction ratings.

North Dakota’s Insurers With the Best Ratings

Country Financial ranks near the top of the list — showing that Country Financial is great at customer satisfaction. It’s good to compare different companies to each other, too. If you want to compare American Family vs. Country Financial car insurance, the latter stacks up well.

One thing to consider: cost shouldn’t be your only concern when searching for car insurance. You should also be looking at how the insurance company treats its customers and resolves claims and complaints.

Companies With the Most complaints in North Dakota

The Department of Professional and Financial Regulation collected data on complaint ratios for North Dakota’s car insurance providers. The complaint index means the following:

- Average: complaint index of one

- Better Than Average: complaint index less than one

- Worse Than Average: complaint index greater than one

Make sure to also look at a company’s customer satisfaction ratings because how a company deals with complaints is also important.

Keep in mind that a high complaint index doesn’t necessarily mean you should avoid a company.

Scott W. Johnson LICENSED INSURANCE AGENT

This ratio compares a company’s number of complaints for every 1,000 policies written, offering a clear picture of customer satisfaction and service quality. By examining these ratios, you can identify which companies are performing well and which may need improvement.

North Dakota Car Insurance Complaint Ratios by Provider

| Insurance Company | Total Complaints | Premiums | Complaint Index |

|---|---|---|---|

| Farmers | 15 | $25,000,000 | 1.02 |

| Liberty Mutual | 10 | $45,000,000 | 1.01 |

| Progressive | 18 | $55,000,000 | 0.95 |

| Allstate | 12 | $50,000,000 | 0.85 |

| Geico | 20 | $100,000,000 | 0.75 |

| Farm Bureau | 5 | $40,000,000 | 0.65 |

| CSAA | 8 | $35,000,000 | 0.09 |

| State Farm | 22 | $80,000,000 | 0.08 |

| Shelter | 4 | $30,000,000 | 0.07 |

| USAA | 6 | $65,000,000 | 0.06 |

The smaller the number, the better the company is performing compared to its competitors. A lower complaint index signifies fewer complaints relative to the number of policies written, indicating higher customer satisfaction and better service quality.

Cost of Different Annual Commutes by North Dakota Companies

At some companies, how far you drive each day influences your insurance rates. If you want to get insurance only for pleasure driving because you work from home, this is also an option.

Most company rates don’t change when the drive is shortened to a 10-mile commute, except for Geico and Allstate, both of whom have rate reductions over a $100.

Up next, a break-down of coverage level rates in North Dakota.

Number of Property and Casualty Insurance Companies in North Dakota

Understanding the landscape of property and casualty insurance companies in North Dakota is essential for consumers seeking coverage. This data distinguishes between domestic insurers, formed under North Dakota state laws, and foreign providers, which are formed under the laws of other U.S. states.

Number of North Dakota Car Insurance Companies

| Summary | Totals |

|---|---|

| Domestic | 12 |

| Foreign | 786 |

| Total | 798 |

With 12 domestic and 786 foreign property and casualty insurance companies operating in North Dakota, residents have a broad range of options for their insurance needs. This diversity ensures competitive pricing and comprehensive coverage options, helping consumers find the best policies to protect their assets.

North Dakota Car Insurance Coverage and Rates

The median household income in North Dakota in 2017 was over $61,843, and drivers, on average paid over $773 for car insurance. Now, we’re no math genius or anything, but however you work it out, consumers in the Peace Garden State are spending way too much money on car insurance.

There has to be a better way. Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

North Dakota Car Insurance Minimum Coverage Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured/Underinsured Motorist | $25,000 per person and $50,000 per accident for bodily injury |

| Personal Injury Protection (PIP) | $30,000 per person |

Okay, you’ve read the numbers, but what do they mean? What is 25/50/25?Bodily injury? Accidents? If you do, the basic coverage requirements in North Dakota which all motorists must have for liability insurance are:

- $25,000 to cover the death or injury per person

- $50,000 to cover the total death or injury per accident

- $25,000 to cover property damage per accident

Liability car insurance pays all individuals — drivers, passengers, pedestrians, etc. — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes. If you cause a wreck, liability insurance pays everyone affected by the accident.

Required Forms of Financial Responsibility in North Dakota

What is financial responsibility? Basically, financial responsibility is proof that you have North Dakota’s minimum liability coverage.

Proof of financial security can take several forms, providing flexibility and convenience for drivers. Here are a few acceptable forms of proof of financial security in North Dakota:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Picture of proof of insurance on your smartphone

State law requires every driver and owner of a vehicle to have proof of financial security at all times. This mandate helps ensure that all drivers are prepared and protected in case of an accident, safeguarding both their interests and those of other road users.

Read More: Car Insurance Binder: Explained Simply

Premiums as Percentage of Income in North Dakota

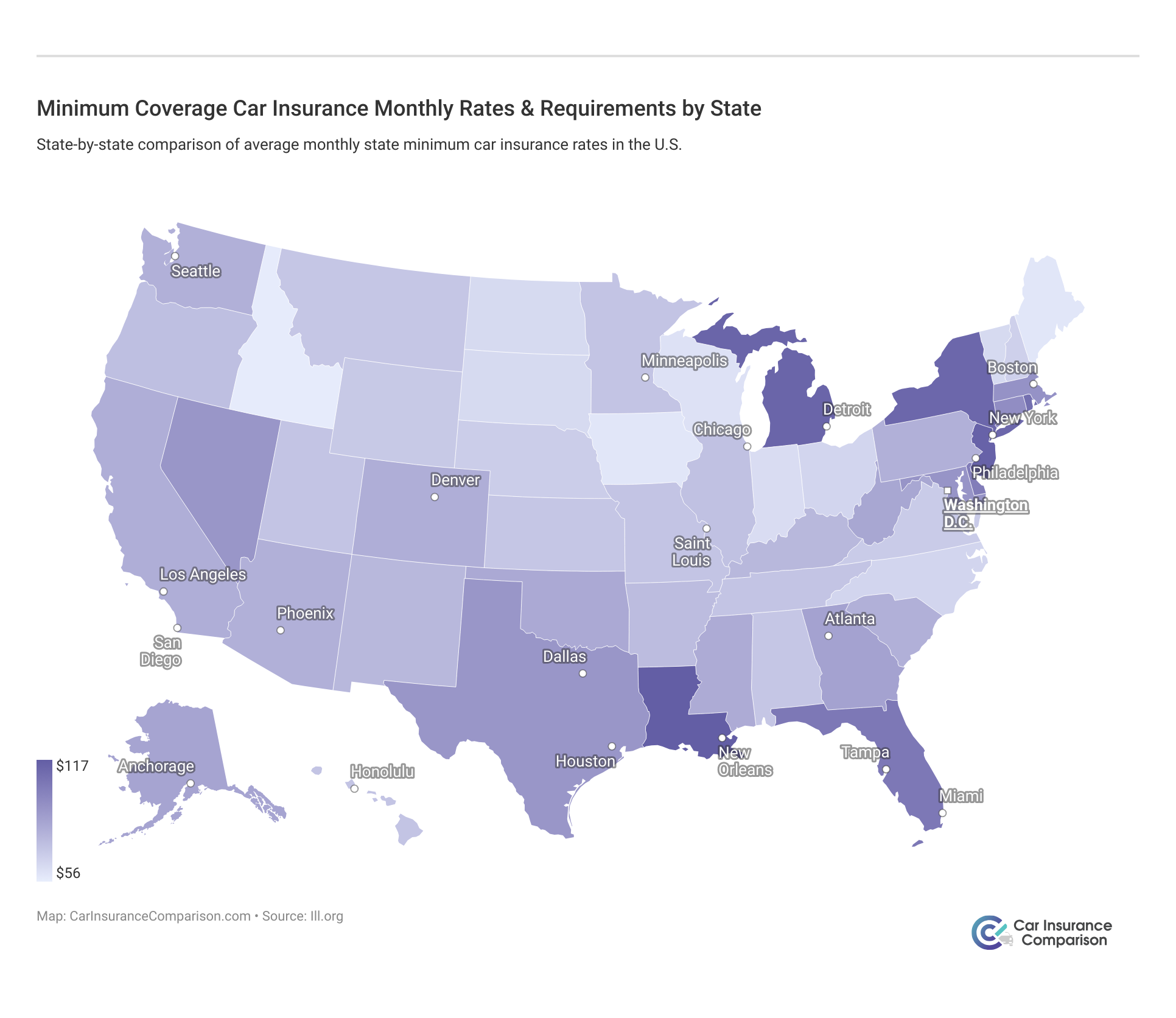

In North Dakota, the per capita disposable income is $34,041. On average, residents spend $773 a year on car insurance. To put this amount in perspective, the countrywide, monthly average for car insurance is $98. This means people in North Dakota pay less than the countrywide average.

Folks in North Dakota pay $200 less than the national average, and overall, compared to states like Michigan and New Jersey that have above average rates, that savings over time, add up to thousands of dollars.

Additional Liability Coverage in North Dakota

To gauge the financial health of insurance companies, you should look at its loss ratios. Loss ratios are explained as: the money insurance companies pay out on claims compared to the money they take in on premiums is the loss ratio.

North Dakota Car Insurance Loss Ratio by Coverage Type

| Type | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments | 63% | 68% | 77% |

| Uninsured/Underinsured Motorist Coverage | 57% | 46% | 58% |

You may want to consider adding additional coverage to your plans, to avoid paying out of pocket in the event of an accident. Without this additional coverage, medical bills and payments could reach well into the thousands of dollars for those affected by an uninsured driver.

Add-ons, Endorsements, and Riders

No one wants to be in an accident, but if you are, do you have enough protection? Have you considered adding extra coverages to your policy? Do you even know what’s out there? Choosing from a list of options can be daunting, and we know you want the best options for your family at the best price.

To help you decide, we’ve made a list of affordable options to add to your policy. Click on the selections below to learn more about them:

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Low-Mileage Discount

- Usage-Based Insurance

Any of the above coverages would be great to add to a policy, so make sure to discuss any options you are interested in with your insurance carrier.

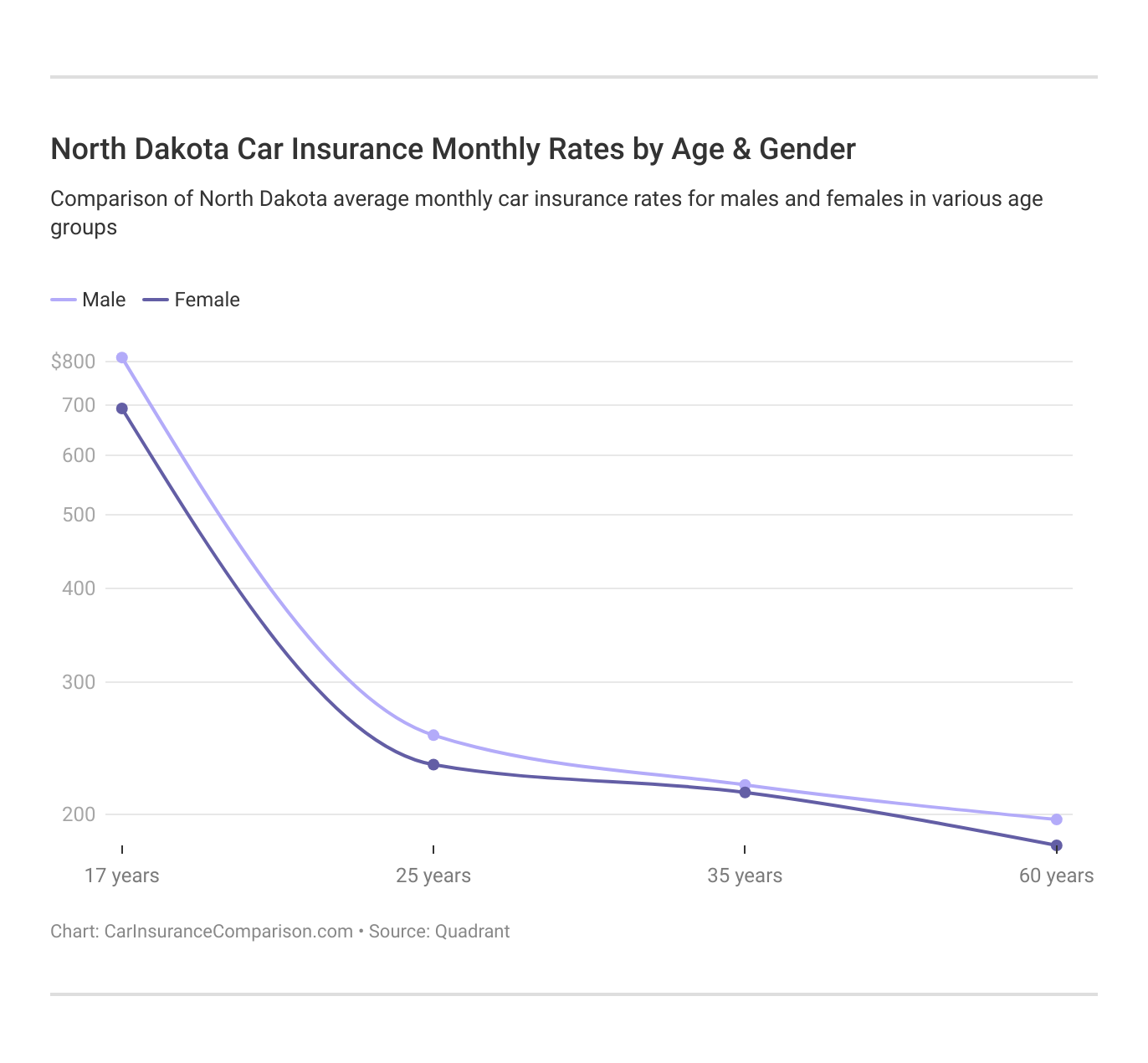

Average Monthly Car Insurance Rates by age & Gender in ND

You may be surprised to learn that gender plays a large role in deciding how much your car insurance rates are? In fact, males typically pay more than females for car insurance.

Actually, gender discrimination in car insurance rates is such a problem that California and other states banned gender discrimination and created gender-neutral insurance plans. In some cases, teen drivers pay thousands more than older drivers do for car insurance.

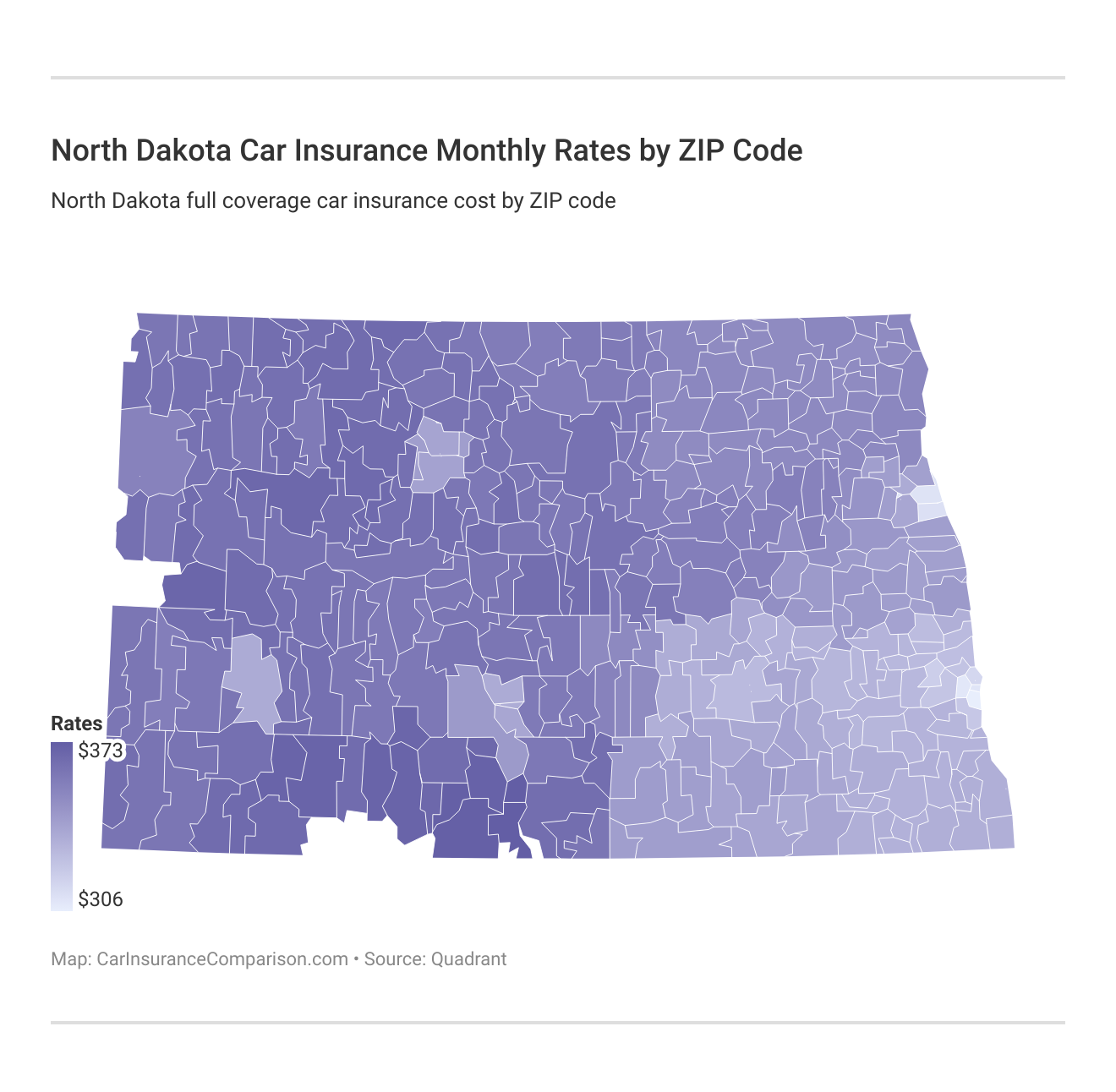

In addition to gender and age, where you live can affect your car insurance rates. We’ve collected data on the least and most expensive ZIP codes, so search to see where your ZIP code lands on the list.

You’ll also see providers’ costs next to your ZIP code, providing a helpful snapshot into what you should be paying. Folks in rural areas pay hundreds less than those in cities like Fargo and Grand Forks.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

North Dakota Laws

Do you like to dance? What about hats? Well, in North Dakota you can’t dance and wear a hat at the same time. We’re unsure if the law is applicable to professional troupes, but since most of us aren’t professional dancers, you would be better off to remove your hat, if you decide to trip the light fantastic.

Another unusual law in North Dakota states: It is prohibited for bars or restaurants to serve both beer and pretzels at the same time.

Well, darn. At Cheers, everyone may have known your name, but forget getting any pretzels in Fargo. Pass the popcorn, please. We know, state laws are confusing and vary from state to state. New residents may receive tickets for laws they didn’t know existed. We’ve done the work for you to help you uncover what the laws are, so check out our roundup of North Dakota’s driving laws.

North Dakota’s Car Insurance Laws

Insurance companies are subject to certain rules and regulations. Let’s look at some of the specific laws for consumers regarding car insurance. Insurance companies in North Dakota are not allowed to set rates anyway they see fit. All rates and rate increases are regulated by the National Association of Insurance Commissioners (NAIC).

High-Risk Insurance

Drivers in North Dakota, who have committed certain infractions such as drug or alcohol offenses, may have their driver’s license revoked. In order to purchase insurance, you will be required to obtain proof of future financial responsibility in the form of an SR-22. You must maintain this proof for three years.

North Dakota’s Windshield and Glass Repair Laws

Some insurance companies may offer broken windshield replacement with comprehensive coverage, but North Dakota laws have no regulations that are unique or specific to windshields. You may insist that your auto insurer use original manufacturer parts as a replacement after a crash, but you may be forced to pay the difference.

Automobile Insurance Fraud in North Dakota

What is automobile insurance fraud? Automobile insurance fraud is a serious issue that affects both insurance companies and policyholders. In North Dakota, like elsewhere, this fraudulent activity can lead to significant financial losses and legal consequences. Here, we outline the key aspects of automobile insurance fraud.

- Creating a claim for damages or injuries that never occurred (such as faking an accident)

- Adding “extra” costs onto a claim that is legitimate

Committing insurance fraud is not only unethical but also illegal. In North Dakota, perpetrators of insurance fraud can face severe penalties, including fines and jail time.

Statute of Limitations

In North Dakota, you have 6 years to file a claim for personal injury or property damage resulting from a car accident. It’s essential to act within this timeframe to ensure your right to seek compensation is preserved.

North Dakota Statue of Limitations

| Limitations | Years |

|---|---|

| Personal Injury | 6 Years |

| Property Damage | 6 Years |

Adhering to the statute of limitations is crucial for successfully pursuing a claim. Be proactive and consult a legal expert to navigate the process effectively.

North Dakota’s Vehicle Licensing Laws

We all love the feeling of being on the open road, windows down, enjoying the sights, sounds, and smells of our favorite places.

Whether you’re heading to see the original roughrider’s legacy on display at Teddy Roosevelt National Park or traveling to Bismarck to check out the urban scene, you’ll want to make sure those lights you see in your rearview mirror are the Northern Lights and not from a police officer pulling you over for speeding, or worse, driving while uninsured.

Penalties For Driving Without Insurance

If you are arrested for driving without insurance in North Dakota, you can be fined $1500 or more and/or spend 30 days in prison for the first offense. You can also have 14 points assessed against your license and possible suspension. Drivers must obtain proof of insurance with a notation on their license for one year which requires a $50 fee.

If you have been involved in an accident or pulled over, law enforcement will ask to see your insurance information, such as a car insurance certificate. Here are two acceptable ways:

- Insurance Card

- Electronic Proof of Insurance

Don’t risk incurring these penalties, make sure you have the required minimum coverage for your situation. North Dakota is one of the states that now allow drivers to use their smartphone to show proof of insurance.

Teen Driver Laws

At age 14, teens can obtain a learner’s license by passing vision and written tests. With this license, they must be accompanied by a licensed driver and can only drive in their parent or guardian’s car during restricted hours.

North Dakota Teen License Requirements

| Type | Age | Prerequisites | Passenger | Driving |

|---|---|---|---|---|

| Learner's License | 14 | Pass vision and written tests | Licensed driver must accompany | Driving allowed only in parent/guardian's car; restricted hours |

| Intermediate License | 15-16 | 12 months for <16; 6 months or until 18 for 16 | Licensed driver must accompany | Same as Learner's License |

| Unrestricted License | 16 | Pass all tests | None | None |

After teenagers have gone through the mandatory learner’s license period and met all the requirements, they can apply for a regular or restricted license.

Older Driver License Renewal Procedures

All residents in North Dakota who maintain a valid driver’s license must renew that license every six years up to age 78. Older residents, 78 and over must renew their license every four years. The general population can renew their license online or through the mail every other renewal. Residents, 65 and older must renew their license in person at the DMV.

New Resident Licensing

Are you a newly transplanted resident to North Dakota? You may have many questions about what is required of you to get an Iowa license. The North Dakota DOT has a step-by-step guide to answer all your vehicle registration and licensing questions as someone new to the state. All applicants must provide adequate proof of vision at each renewal.

North Dakota Rules of the Road

We all should follow the rules, but if you’re new to the Peace Garden State, there may be laws you’re unfamiliar with. That’s why we’ve assembled a list of several important laws to help keep you in good standing and on the road.

Fault vs. No-Fault

North Dakota is a no-fault state when it comes to car insurance. That means, after a car accident, your own basic no-fault (also called “personal injury protection” or “PIP”) coverage pays for your medical bills and certain other out-of-pocket losses, regardless of who caused the accident.

Seat Belt and Car Seat Laws

All passengers in the front seat of a vehicle driven in North Dakota must be wearing a seat belt. Additionally, children 18 years and younger are required to be properly restrained no matter where they are sitting. Currently, there are no restrictions in North Dakota regarding the riding in the cargo areas of pickup trucks. Read about whether a seat belt ticket will affect car insurance so you don’t lose money.

Keep Right and Move Over Laws

North Dakota traffic laws mandate that you must keep right when traveling slower than the average speed of traffic around you. According to AAA:

State law requires drivers approaching a stationary emergency vehicle displaying flashing lights, including wreckers and highway maintenance vehicles, traveling in the same direction, to vacate the lane closest if safe and possible to do so, or slow to a safe speed.

Speed Limits

Every state has different speed limits, and violating North Dakota’s speed limits may result in tickets and fines. Below are North Dakota’s maximum speed limits for different road types:

North Dakota Speed Limits

| Road Type | Speed Limit |

|---|---|

| Rural | 70 mph |

| Urban | 25-35 mph |

| Limited Access Roads | 75 mph |

| Other Roads | 55 mph |

Data shown above are North Dakota’s maximum speed limits for different road types. Adhering to these limits not only helps in avoiding legal penalties but also plays a vital role in ensuring the safety of all road users.

Ridesharing in North Dakota

You may be familiar with ridesharing companies like Lyft and Uber. If you want to rideshare, there are no state-mandated requirements for rideshare car insurance coverage, so be sure and check with your local provider for any additional coverage you may need.

Automation on the Road in North Dakota

What is automation? IIHS defines it as the following:

Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. One example is adaptive cruise control, which maintains a set speed.

Presently, North Dakota hasn’t yet begun addressing automation on the road.

Safety Laws

Up next, we take a closer look at the safety laws in North Dakota, so you can arrive alive. Please don’t drink and drive.

Impaired-driving Laws in North Dakota

Driving while impaired has disastrous results for everyone involved, that’s why strict laws are in place to prevent such tragedies.

In North Dakota alone, drunk driving caused 46 deaths in 2017. Each state differs in how they address drunk driving and therefore have different penalties.

The penalties get worse with each subsequent offense. Please don’t drink and drive.

Marijuana Impaired Driving Laws

As for marijuana-impaired driving in the state of North Dakota, the state has a ZERO tolerance policy for THC and metabolites.

Distracted Driving Laws in North Dakota

Text messaging is prohibited for all drivers and carries a $100 fine. North Dakota has implemented the Vision Zero Plan which uses data to identify areas of improvement through education, roadway safety enhancements, and policy decisions. Next, we delve into some facts about North Dakota you might not know.

North Dakota Can’t-Miss Facts

Now that you have a good understanding of North Dakota state laws, let’s dive into some facts that you might not know. While insurance is important, it’s also crucial to know what to keep your eyes out for on the road.

We’ve laid out everything you need to know about the risk factors in North Dakota, from vehicle theft to crash reports, so you can drive safely and enjoy your time on the road.

Vehicle Theft in North Dakota

Analyzing the number of vehicle thefts in North Dakota provides insights into the relative safety and risk of different areas.

Top 10 North Dakota Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Hyundai Elantra | 2017 | 48 |

| Hyundai Sonata | 2013 | 43 |

| Kia Optima | 2015 | 30 |

| Chevrolet Silverado 1500 | 2018 | 24 |

| Kia Soul | 2021 | 21 |

| Honda Accord | 1997 | 21 |

| Honda Civic | 2000 | 20 |

| Ford F-150 | 2019 | 16 |

| Kia Forte | 2019 | 16 |

| Kia Sportage | 2020 | 16 |

Where you live also plays a role in the number of vehicle thefts. The FBI created a 2013 report on North Dakota’s vehicle thefts by cities, which are listed below.

Top 10 North Dakota Car Thefts by City

| City | Total |

|---|---|

| Fargo | 1,500 |

| Bismarck | 1,200 |

| Grand Forks | 950 |

| Minot | 800 |

| West Fargo | 650 |

| Dickinson | 400 |

| Mandan | 350 |

| Williston | 300 |

| Jamestown | 200 |

| Wahpeton | 150 |

This information can be useful for residents, law enforcement, and policymakers in developing targeted strategies to prevent theft and enhance community safety.

Dangers on the Road In North Dakota

Accidents happen, and up next we’re going to show you statistics for different kinds of accidents in North Dakota.

Fatal Crashes by Weather Condition and Light Condition

Weather and light conditions significantly impact driving safety and can contribute to the likelihood of fatal crashes. The following table provides a breakdown of fatal crashes in North Dakota by weather condition and light condition:

ND Fatal Crashes by Weather Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 36 | 7 | 27 | 7 | 1 | 78 |

| Rain | 0 | 0 | 3 | 0 | 0 | 3 |

| Snow/Sleet | 5 | 0 | 1 | 1 | 0 | 7 |

| Other | 1 | 0 | 1 | 0 | 1 | 3 |

| Total | 43 | 8 | 37 | 9 | 8 | 105 |

The data on fatal crashes in North Dakota by weather condition highlights that most accidents occur during daylight hours, with normal weather conditions being the most common.

Fatalities (All Crashes) by County

The distribution of car crash fatalities across different regions can provide valuable insights into road safety challenges. Below are the ten counties in North Dakota with the most car crash fatalities in the past three years.

Top 10 North Dakota Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Mckenzie | 12 | 15 | 14 |

| Rolette | 8 | 10 | 9 |

| Cass | 18 | 20 | 22 |

| Mountrail | 10 | 12 | 11 |

| Grand Forks | 15 | 17 | 18 |

| Stark | 9 | 11 | 10 |

| Ward | 14 | 16 | 15 |

| Williams | 13 | 14 | 13 |

| Bottineau | 7 | 8 | 7 |

| Burleigh | 20 | 22 | 21 |

By analyzing fatalities by county, we can identify high-risk areas and prioritize efforts to improve road safety and reduce the number of fatal crashes in North Dakota.

Fatalities by Roadway

Below, we present a ten-year comparison of traffic fatalities on urban versus rural roadways in North Dakota, highlighting the differences in fatality rates between these two types of areas.

North Dakota Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 68 |

| Urban | 39 |

The disparity in fatality rates between urban and rural roadways can help in developing tailored strategies to enhance road safety and reduce fatalities across different types of road environments.

Fatalities by Person Type

Different types of vehicles and their occupants are affected differently in traffic incidents. The table below details the number of fatalities in North Dakota by person type over the years:

North Dakota Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Passenger Car | 42 |

| Light Truck - Pickup | 30 |

| Light Truck - Utility | 20 |

| Light Truck - Van | 10 |

| Large Truck | 5 |

| Other/Unknown Occupants | 8 |

| Total Occupants | 115 |

The type of crash can also play a role in fatality rates, underscoring the need for targeted safety measures for each vehicle category.

Fatalities by Crash Type

The nature of a crash significantly influences its severity and the likelihood of fatalities. Here is an overview of traffic fatalities in North Dakota categorized by crash type:

North Dakota Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Single Vehicle | 55 |

| Involving a Large Truck | 21 |

| Involving Speeding | 25 |

| Involving a Rollover | 15 |

| Involving a Roadway Departure | 50 |

| Involving an Intersection (or Intersection Related) | 17 |

| Total Fatalities (All Crashes) | 107 |

Understanding these categories helps in identifying high-risk scenarios and implementing appropriate safety measures. Up next, we have a five-year trend for North Dakota’s top-10 counties that have the highest fatality rates.

Fatalities Involving Speeding by County

Speeding is a major contributing factor to traffic fatalities, and understanding its impact at the county level can help in formulating targeted interventions. Below, are listings by county of the most speed-related fatalities in North Dakota.

North Dakota Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Adams | 2 | 3 | 4 |

| Barnes | 3 | 4 | 5 |

| Benson | 1 | 2 | 3 |

| Billings | 2 | 3 | 4 |

| Bottineau | 3 | 4 | 5 |

| Bowman | 1 | 2 | 3 |

| Burke | 1 | 2 | 3 |

| Burleigh | 7 | 8 | 9 |

| Cass | 10 | 12 | 14 |

| Cavalier | 1 | 2 | 3 |

| Dickey | 2 | 3 | 4 |

| Divide | 1 | 2 | 3 |

| Dunn | 3 | 4 | 5 |

| Eddy | 1 | 2 | 3 |

| Emmons | 2 | 3 | 4 |

| Foster | 1 | 2 | 3 |

| Golden Valley | 1 | 2 | 3 |

| Grand Forks | 5 | 6 | 7 |

| Grant | 1 | 2 | 3 |

| Griggs | 1 | 2 | 3 |

| Hettinger | 1 | 2 | 3 |

| Kidder | 2 | 3 | 4 |

| Lamoure | 1 | 2 | 3 |

| Logan | 1 | 2 | 3 |

| Mchenry | 2 | 3 | 4 |

| Mcintosh | 1 | 2 | 3 |

| Mckenzie | 8 | 9 | 10 |

| Mclean | 2 | 3 | 4 |

| Mercer | 1 | 2 | 3 |

| Morton | 4 | 5 | 6 |

| Mountrail | 3 | 4 | 5 |

| Nelson | 1 | 2 | 3 |

| Oliver | 1 | 2 | 3 |

| Pembina | 1 | 2 | 3 |

| Pierce | 1 | 2 | 3 |

| Ramsey | 1 | 2 | 3 |

| Ransom | 2 | 3 | 4 |

| Renville | 1 | 2 | 3 |

| Richland | 3 | 4 | 5 |

| Rolette | 2 | 3 | 4 |

| Sargent | 1 | 2 | 3 |

| Sheridan | 1 | 2 | 3 |

| Sioux | 1 | 2 | 3 |

| Slope | 1 | 2 | $3 |

| Stark | 5 | 6 | $7 |

| Steele | 1 | 2 | $3 |

| Stutsman | 3 | 4 | $5 |

| Towner | 1 | 2 | $3 |

| Traill | 2 | 3 | $4 |

| Walsh | 3 | 4 | $5 |

| Ward | 7 | 8 | $9 |

| Wells | 1 | 2 | $3 |

| Williams | 8 | 9 | $10 |

The distribution of speed-related fatalities by county can help in implementing targeted speed enforcement and public education campaigns to address this critical issue and enhance road safety.

Alcohol-Impaired Fatalities by County

Check out the table below to see fatalities in crashes involving alcohol-impaired drivers with a BAC over .08. This data highlights the impact of impaired driving across various counties in North Dakota.

North Dakota DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Adams | 1 | 2 | 3 |

| Barnes | 2 | 3 | 4 |

| Benson | 1 | 2 | 3 |

| Billings | 1 | 2 | 3 |

| Bottineau | 2 | 3 | 4 |

| Bowman | 1 | 2 | 3 |

| Burke | 1 | 2 | 3 |

| Burleigh | 5 | 6 | 7 |

| Cass | 8 | 10 | 12 |

| Cavalier | 1 | 2 | 3 |

| Dickey | 2 | 3 | 4 |

| Divide | 1 | 2 | 3 |

| Dunn | 3 | 4 | 5 |

| Eddy | 1 | 2 | 3 |

| Emmons | 1 | 2 | 3 |

| Foster | 1 | 2 | 3 |

| Golden Valley | 1 | 2 | 3 |

| Grand Forks | 4 | 5 | 6 |

| Grant | 1 | 2 | 3 |

| Griggs | 1 | 2 | 3 |

| Hettinger | 1 | 2 | 3 |

| Kidder | 1 | 2 | 3 |

| Lamoure | 1 | 2 | 3 |

| Logan | 1 | 2 | 3 |

| Mchenry | 1 | 2 | 3 |

| Mcintosh | 1 | 2 | 3 |

| Mckenzie | 6 | 7 | 8 |

| Mclean | 2 | 3 | 4 |

| Mercer | 1 | 2 | 3 |

| Morton | 3 | 4 | 5 |

| Mountrail | 2 | 3 | 4 |

| Nelson | 1 | 2 | 3 |

| Oliver | 1 | 2 | 3 |

| Pembina | 1 | 2 | 3 |

| Pierce | 1 | 2 | 3 |

| Ramsey | 1 | 2 | 3 |

| Ransom | 2 | 3 | 4 |

| Renville | 1 | 2 | 3 |

| Richland | 3 | 4 | 5 |

| Rolette | 2 | 3 | 4 |

| Sargent | 1 | 2 | 3 |

| Sheridan | 1 | 2 | 3 |

| Sioux | 1 | 2 | $3 |

| Slope | 1 | 2 | $3 |

| Stark | 4 | 5 | $6 |

| Steele | 1 | 2 | $3 |

| Stutsman | 3 | 4 | $5 |

| Towner | 1 | 2 | $3 |

| Traill | 2 | 3 | $4 |

| Walsh | 3 | 4 | $5 |

| Ward | 5 | 6 | $7 |

| Wells | 1 | 2 | $3 |

| Williams | 6 | 7 | $8 |

Addressing alcohol-impaired driving requires a combination of strict enforcement, public awareness, and community involvement. This county-specific data provides a foundation for targeted interventions to reduce alcohol-related fatalities and improve road safety.

Teen Drinking and Driving

In 2016, North Dakota law enforcement arrested 26 teenagers (under the age of 18) for drunk driving. This number places North Dakota as the 10th worst state in the U.S. for underage drinking and driving. Below are the facts concerning underage (under 21 years old) drinking-related fatalities:

- 2.4 fatalities per 100,000 people in North Dakota

- 1.2 fatalities per 100,000 people national average

These statistics underscore the urgent need for heightened awareness, education, and enforcement efforts to combat underage drinking and driving in North Dakota. Addressing this issue is crucial to improving road safety and protecting the lives of young drivers and the wider community.

EMS Response Time

If you or someone you know is in an accident, you want help to arrive as FAST as possible. Below are the average EMS response times for rural and urban areas in North Dakota:

ND EMS Response Times

| Location | Notification | Arrival |

|---|---|---|

| Rural | 7 | 14 |

| Urban | 14 | 5 |

hese insights are essential for improving emergency response strategies and ensuring timely medical assistance, which can significantly impact survival rates and outcomes for crash victims in North Dakota.

Transportation in North Dakota

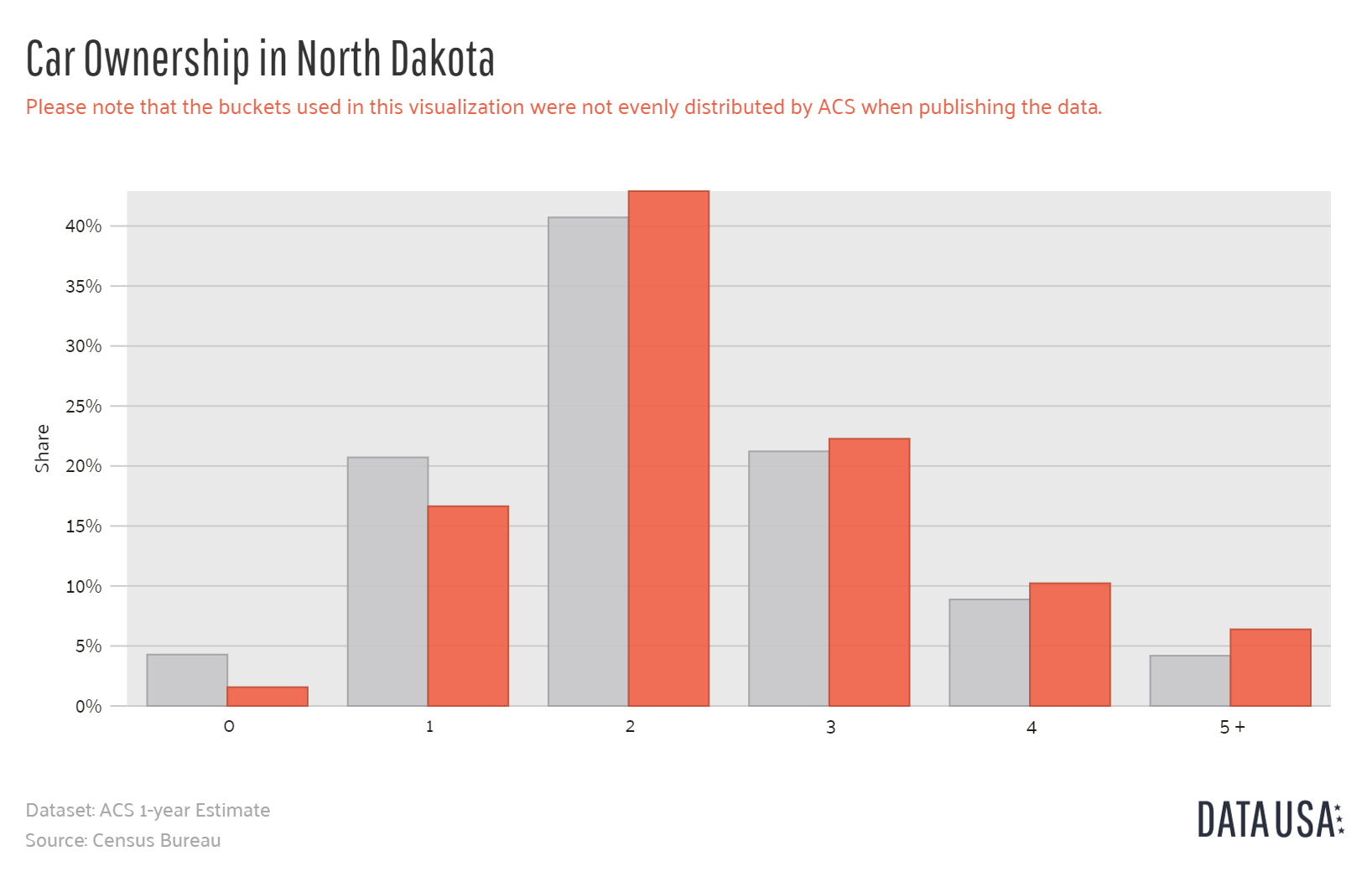

When you drive through your neighborhood, do you ever notice how many cars are sitting in your neighbors’ driveways? Usually, we can tell if someone is visiting by that extra car parked outside the house. The average household in North Dakota has two cars.

Understanding car ownership patterns helps in planning infrastructure and transportation services to meet the needs of residents. These insights are essential for developing policies that enhance mobility and reduce congestion in North Dakota.

Commute Time

The average commute time in North Dakota is 16.5 minutes, which is shorter than the national average of 25.3 minutes. The chart below represents the commute times in North Dakota compared to the national average. Now, let’s take a look at methods of commuter transportation in North Dakota

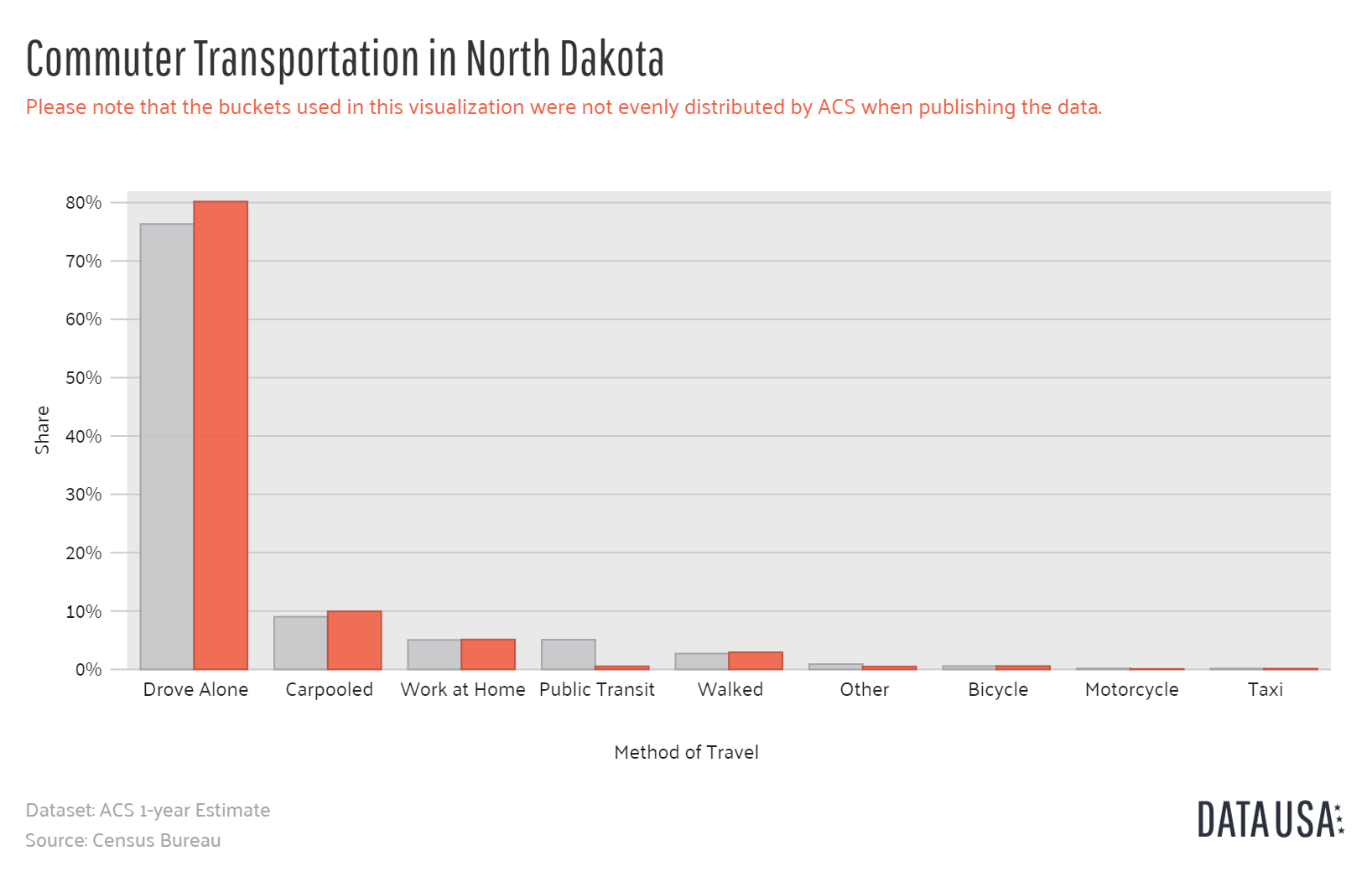

Commuter Transportation

The methods of transportation used by commuters reflect the availability and efficiency of different travel options. The chart below illustrates the various modes of commuter transportation in North Dakota:

As in most states, the most common transportation method is driving alone to work, followed by carpooling and working from home. Now that you’ve read through this comprehensive guide, and know everything there is to know about buying car insurance in North Dakota, it’s time to hit the road. Enter your ZIP code below to get a free quote comparison.

Frequently Asked Questions

How can I compare car insurance quotes in North Dakota?

To compare car insurance quotes in North Dakota, start by gathering necessary information about your vehicle, including make, model, and year, as well as personal details like your driver’s license number and driving history.

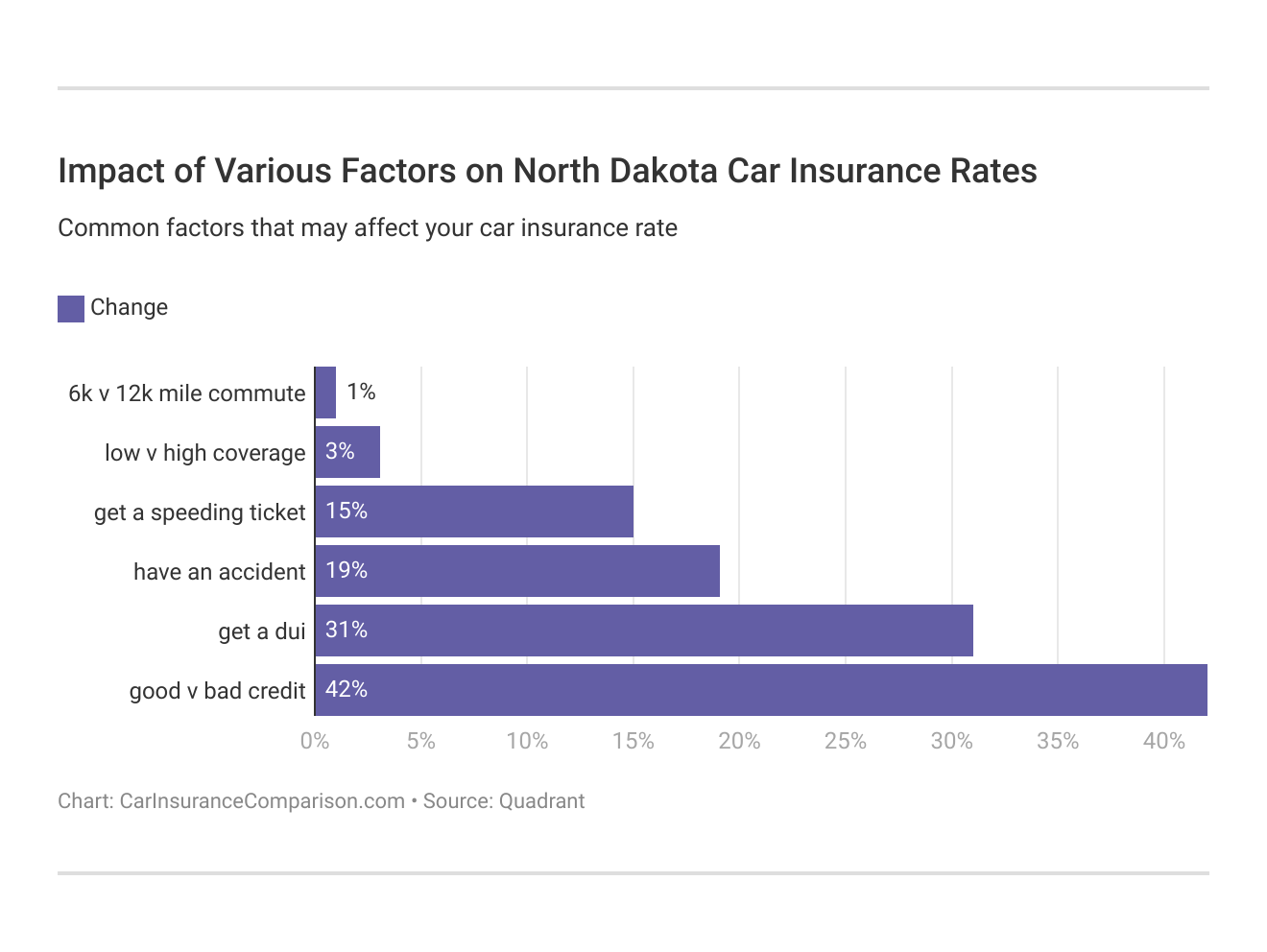

What factors influence car insurance rates in North Dakota?

Several factors influence car insurance rates in North Dakota, including age, gender, marital status, driving record, claims history, vehicle type, safety features, annual mileage, credit history, ZIP code, and chosen coverage limits and deductibles.

Are there any specific car insurance requirements in North Dakota?

In North Dakota, drivers must meet specific car insurance requirements mandated by the state. These include $25,000 bodily injury liability coverage per person, $50,000 bodily injury liability coverage per accident, $25,000 property damage liability coverage, $30,000 underinsured/uninsured motorist coverage per person, and $60,000 underinsured/uninsured motorist coverage per accident.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

What additional coverage options should I consider in North Dakota?

In addition to mandatory coverage, consider optional coverage such as collision (for vehicle damage from collisions), comprehensive (for non-collision incidents like theft or vandalism), medical payments (for accident-related medical expenses), rental car reimbursement (to cover rental costs during vehicle repairs), and roadside assistance (for breakdowns and emergencies).

Read More: Do I need the additional car insurance coverage options?

How can I lower my car insurance premiums in North Dakota?

To potentially lower your car insurance premiums in North Dakota, maintain a clean driving record, bundle policies with other insurance types like homeowners or renters insurance, inquire about available discounts such as for safe driving or multi-policy, consider raising deductibles (if financially feasible), install safety features in your vehicle, and compare quotes from different insurers to ensure competitive rates.

What should I do if I move to North Dakota from another state?

If you move to North Dakota from another state, you’ll need to update your car insurance to comply with North Dakota’s requirements. Contact your current insurance provider to see if they operate in North Dakota or find a new insurer that offers coverage in the state. Notify the North Dakota Department of Transportation (NDDOT) of your new address within 10 days of moving.

Are there any penalties for driving without insurance in North Dakota?

Yes, driving without insurance in North Dakota can result in fines, license suspension, and potential vehicle impoundment. Additionally, you may be required to file an SR-22 form to prove financial responsibility before your license and vehicle registration can be reinstated.

How can I renew my car insurance policy in North Dakota?

To renew your car insurance policy in North Dakota, contact your insurance provider before your current policy expires. Review your coverage needs and any changes in circumstances that may affect your premium. Your insurer will typically send you a renewal notice with details on how to proceed, but it’s wise to initiate the process a few weeks in advance to avoid gaps in coverage.

What happens if my car is totaled in North Dakota?

If your car is deemed a total loss in North Dakota due to an accident or other covered incident, your insurance company will typically offer a settlement based on the actual cash value (ACV) of your vehicle minus any deductible. You can negotiate the settlement if you believe the offer is too low.

Can I insure a leased or financed car differently in North Dakota?

If you lease or finance a car in North Dakota, your leasing company or lender will likely require you to maintain specific coverage types and limits, often including collision and comprehensive insurance. This ensures their financial interest in the vehicle is protected in case of damage or loss.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.