Cheapest New Jersey Car Insurance Rates in 2025 (Top 10 Companies for Savings!)

Get the cheapest New Jersey car insurance rates with Mercury, USAA, and Geico, offering rates as low as $29 monthly. These companies stand out for their affordability and comprehensive coverage options, making them ideal choices for budget-conscious drivers seeking reliable insurance coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jul 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

675 reviews

675 reviewsCompany Facts

Min. Coverage for New Jersey

A.M. Best Rating

Complaint Level

Pros & Cons

675 reviews

675 reviews

Company Facts

Min. Coverage for New Jersey

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for New Jersey

A.M. Best Rating

Complaint Level

Pros & Cons

For those seeking the cheapest New Jersey car insurance rates, Mercury, USAA, and Geico emerge as top contenders with rates as low as $29 per month. Among them, Mercury stands out for its affordability, comprehensive coverage, and strong customer satisfaction. Discover which provider best suits your needs with our comprehensive analysis and make a savvy choice today.

The required car insurance in New Jersey is costly, so it’s crucial to compare rates. Before shopping for cheap car insurance, know the necessary coverage and potential add-ons. Our guide covers everything about affordable car insurance, from rates to laws.

Our Top 10 Company Picks: Cheapest New Jersey Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $29 A Various Discounts Mercury

#2 $39 A++ Financial Stability USAA

#3 $47 A++ Competitive Rates Geico

#4 $60 A+ Online Tools Progressive

#5 $73 B Good Student State Farm

#6 $76 A+ Good Claims Nationwide

#7 $87 A++ Affordable Premiums Travelers

#8 $101 A+ Safe-Driving Discounts Allstate

#9 $148 A Personalized Service Farmers

#10 $178 A Customizable Policies Liberty Mutual

Use our free quote comparison tool to start shopping. Find cheap car insurance quotes by entering your ZIP code above.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Mercury: Top Overall Pick

Pros

- Lowest Premium: Mercury offers the most affordable car insurance rates in New Jersey, with monthly premiums starting as low as $29. This significant cost-saving makes it an ideal choice for budget-conscious drivers seeking the cheapest coverage available in the state.

- Discount Opportunities: Mercury provides a range of discounts such as multi-car, safe driver, and low-mileage discounts. These discounts further reduce the already low premiums, enhancing affordability for New Jersey drivers. Check out our page titled Best Mercury Car Insurance Rates to know more details.

- Basic Coverage Options: Mercury’s policies meet New Jersey’s minimum coverage requirements, including Personal Injury Protection (PIP) and liability coverage. This ensures that drivers receive essential protection at a very competitive price.

Cons

- Limited Coverage Choices: While Mercury’s low premiums are attractive, the coverage options are somewhat basic. New Jersey drivers seeking comprehensive or extensive coverage options may find Mercury’s offerings insufficient for their needs.

- Mixed Customer Service Reviews: Customer satisfaction with Mercury can be inconsistent. Some policyholders in New Jersey report difficulties with claims handling and customer support, which could be a concern for those prioritizing reliable service in addition to low rates.

#2 – USAA: Best for Financial Stability

Pros

- Exceptional Customer Service: USAA consistently receives high ratings for customer service and support. This is particularly valuable for New Jersey drivers who prioritize high-quality service and efficient claim handling, especially given the state’s high insurance rates.

- Competitive Rates: At $39 per month, USAA offers one of the lowest premiums in New Jersey. This, combined with their comprehensive coverage options, makes it a strong contender for those seeking both affordability and extensive protection.

- Robust Discounts: USAA offers numerous discounts, including those for safe driving and bundling policies. These discounts help lower overall insurance costs, making USAA a cost-effective choice for eligible military families in New Jersey. Learn more in our USAA car insurance review.

Cons

- Eligibility Limitations: USAA’s services are restricted to military personnel and their families, which excludes many New Jersey drivers from benefiting from their competitive rates and excellent service.

- Limited Physical Presence: The absence of local branches in New Jersey may be a drawback for drivers who prefer in-person interactions and support, potentially affecting those who value face-to-face customer service.

#3 – Geico: Best for Competitive Rates

Pros

- Wide Range of Discounts: Geico offers a variety of discounts, such as for good drivers and military personnel, which can significantly lower the already competitive $47 premium. This makes Geico a strong option for affordable car insurance in New Jersey.

- User-Friendly Online Services: Geico’s online platform provides easy access to policy management and claims filing. This convenience is particularly appealing to tech-savvy New Jersey drivers who prefer managing their insurance online. Learn more in our Geico car insurance review.

- Reputation for Stability: Geico’s long-standing presence and financial stability provide reassurance for policyholders. Their strong financial ratings and extensive experience ensure reliability and peace of mind for New Jersey drivers seeking affordable coverage.

Cons

- Higher Premiums for High-Risk Drivers: New Jersey drivers with poor credit or a history of accidents may face higher premiums, which could exceed the average $47 rate. This makes Geico less ideal for those considered high-risk.

- Inconsistent Claims Experience: Some customers in New Jersey report slower processing times for claims, which can be frustrating. This variability in service quality might affect drivers who require prompt assistance following an accident.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Tools

Pros

- Innovative Pricing Tools: Progressive’s Name Your Price tool allows New Jersey drivers to tailor their coverage according to their budget. This flexibility can help manage the $60 premium and make it easier to find an affordable policy that fits individual needs.

- Comprehensive Coverage Options: Progressive provides extensive coverage choices, ensuring that New Jersey drivers can find a policy that meets their specific requirements while still benefiting from competitive rates. Delve into our evaluation of Progressive car insurance review.

- Discount Opportunities: Progressive offers various discounts, including those for bundling policies and safe driving. These discounts can lower the $60 premium, making it a cost-effective option for New Jersey drivers.

Cons

- Average Customer Service Ratings: Progressive’s customer service ratings are generally positive but can vary. Some policyholders in New Jersey report dissatisfaction with claim resolutions, which might be a concern for those seeking reliable service.

- Potentially Higher Costs for Young Drivers: Younger drivers may face higher premiums with Progressive, which could negate the savings offered by the base $60 rate. This could make it less appealing for younger, budget-conscious drivers in New Jersey.

#5 – State Farm: Best for Good Student

Pros

- Strong Local Agent Network: State Farm’s extensive network of local agents in New Jersey offers personalized service and support. This local presence can be particularly beneficial for drivers seeking assistance with their insurance needs.

- Range of Products: Beyond auto insurance, State Farm offers a wide array of products including homeowners and life insurance. This variety can be advantageous for New Jersey drivers looking for comprehensive insurance coverage across different needs.

- Discount Opportunities: State Farm provides several discounts, such as for good students and safe driving, which can help reduce the $73 premium. These savings opportunities make it a viable option for cost-conscious drivers in New Jersey. Unlock details in our State Farm car insurance review.

Cons

- Higher Average Premiums: At $73, State Farm’s rates are higher compared to many competitors. This may be a drawback for drivers who are specifically seeking the cheapest car insurance options in New Jersey.

- Complex Policy Options: The wide range of coverage options available can be overwhelming. Drivers in New Jersey might find it challenging to select the best fit for their needs, potentially complicating the process of finding affordable coverage.

#6 – Nationwide: Best for Good Claims

Pros

- Diverse Coverage Options: Nationwide offers a broad range of coverage options, allowing New Jersey drivers to tailor their policies effectively. This flexibility can help drivers find affordable coverage that meets their specific needs.

- Multi-Policy Discounts: Bundling home and auto insurance with Nationwide can lead to significant savings. This makes the $76 premium more manageable for New Jersey drivers looking to reduce their overall insurance costs. Check out insurance savings in our complete Nationwide car insurance discount.

- Strong Customer Satisfaction: Nationwide generally receives positive reviews for customer service and claims handling. This strong track record provides reassurance for New Jersey drivers seeking both affordable rates and reliable support.

Cons

- Higher Base Rate: The $76 premium is relatively high compared to some competitors. This may be a concern for budget-conscious drivers in New Jersey who are focused on finding the lowest possible rates.

- Limited Availability of Local Agents: In some areas, there may be fewer local agents available. This could impact in-person support and convenience for New Jersey drivers who prefer face-to-face interactions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Affordable Premiums

Pros

- Customizable Coverage Options: Travelers offers a variety of customizable coverage options, allowing New Jersey drivers to create a policy that fits their specific needs. This flexibility is valuable for finding affordable coverage that meets individual requirements.

- Strong Claims Service: Travelers is known for efficient claims processing. This capability is important for New Jersey drivers who need timely support after an accident while looking for affordable insurance. See more details on our Travelers car insurance review.

- Multiple Discounts Available: Travelers provides numerous discounts, including for bundling policies and safe driving. These discounts can help reduce the $87 premium, making it a more affordable option for New Jersey drivers.

Cons

- Higher Premium Rates: With premiums starting at $87, Travelers’ rates are higher than many competitors. This may be less appealing for New Jersey drivers who prioritize the cheapest insurance rates available.

- Mixed Customer Service Feedback: Some policyholders in New Jersey report dissatisfaction with Travelers’ customer service. This inconsistency could be a concern for those who need reliable support while managing the costs of their insurance.

#8 – Allstate: Best for Safe-Driving Discounts

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage choices, ensuring New Jersey drivers can find a plan that meets their needs. This broad range of options is valuable for those looking for affordable yet comprehensive insurance.

- Strong Local Presence: With numerous local agents in New Jersey, Allstate provides personalized service and easy access to support. This can be advantageous for drivers who prefer in-person interactions.

- Reward Programs: Allstate’s Drivewise program offers rewards for safe driving, which can help offset the $101 premium. This program incentivizes safe driving habits and can make insurance more affordable for policyholders in New Jersey. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Premium Costs: At $101, Allstate’s premiums are among the highest. This might be a significant drawback for drivers who are specifically seeking the cheapest insurance rates in New Jersey.

- Claims Process Complexity: Some New Jersey customers find Allstate’s claims process to be less straightforward. This complexity can lead to delays and potential frustration, particularly for those needing prompt assistance.

#9 – Farmers: Best for Personalized Service

Pros

- Flexible Coverage Plans: Farmers provides a range of flexible coverage options tailored to individual needs. This customization can help New Jersey drivers find a policy that offers the right balance of affordability and protection.

- Strong Customer Support: Known for attentive customer service, Farmers offers reliable support during claims. This quality service is beneficial for New Jersey drivers who prioritize both affordable rates and good support. Learn more in our Farmers car insurance review.

- Numerous Discount Programs: Farmers offers various discounts that can reduce the premium from the base rate of $148. Bundling policies and other discounts can help manage costs for New Jersey drivers.

Cons

- Significantly Higher Premium: With premiums starting at $148, Farmers’ rates are among the highest. This may be a concern for drivers who are focused on finding the cheapest car insurance options in New Jersey.

- Availability Issues: Some areas may have limited availability of local agents, which could affect the level of personalized service and convenience for New Jersey drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide array of coverage options, including specialized add-ons like accident forgiveness and new car replacement. This allows New Jersey drivers to customize their policies for comprehensive protection, while still managing to keep premiums competitive.

- Discount Opportunities: Liberty Mutual provides various discounts, such as those for safe driving and multi-policy bundles, which can help lower the base premium of $168. These discounts contribute to more affordable insurance for New Jersey drivers. Learn more in our Liberty Mutual car insurance review.

- User-Friendly Technology: Liberty Mutual’s online tools and mobile app make it easy for drivers to manage their policies, file claims, and access customer support. This technological convenience is particularly beneficial for tech-savvy New Jersey residents looking to simplify their insurance experience.

Cons

- Higher Premium Rates: Liberty Mutual’s base premium of $168 is among the highest in New Jersey. This could be a significant drawback for drivers who are primarily seeking the cheapest car insurance rates.

- Inconsistent Customer Service: Some policyholders report varied experiences with Liberty Mutual’s customer service, which may include longer wait times or less responsive support. This inconsistency could affect New Jersey drivers who need reliable service.

New Jersey Car Insurance Companies

When the unexpected happens, which company will meet your unique needs? It can be a challenge to make a choice when there are so many options. To help you begin to make some comparisons, our analysts compiled data for the 10 insurance companies in New Jersey with the cheapest quotes.

New Jersey Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $101 $157

Farmers $148 $231

Geico $47 $74

Liberty Mutual $178 $279

Mercury $29 $77

Nationwide $76 $119

Progressive $60 $93

State Farm $73 $113

Travelers $87 $136

USAA $39 $61

When choosing car insurance in New Jersey, it’s crucial to weigh both premium costs and coverage options to find the best fit for your needs. By comparing quotes from various providers, you can secure the protection you need at a price that works for you.

New Jersey Car Insurance Coverage and Rates

Before we get into all of the colorful options, it’s important to understand a bit of New Jersey’s history as a no-fault state and how it stacks up against other no-fault states.

Despite the plethora of options, car insurance rates in New Jersey are still one of the highest in the nation.

Later on, we will explain why the rates are so high and describe the options you have as a driver in New Jersey. For now, let’s get started with the basics.

New Jersey Statistics Summary

| New Jersey Statistics Summary | Details |

|---|---|

| Road Miles | Roadway Miles: 39,065 Vehicle Miles Driven: 75 billion |

| Number of Vehicles Registered | 5,786,113 |

| Population | 8,960,001 |

| Most popular vehicle | Honda CR-V |

| Uninsured % | 15% (ranked 14th in the nation) |

| Total Driving Related Deaths | Speeding: 120 DUI: 125 |

| Average Annual Premiums (not including PIP) | Liability: $870 Collision: $382 Comprehensive: $131 |

| Cheapest Provider | Geico |

New Jersey’s extensive road network and high vehicle registration underscore the importance of reliable car insurance. With Geico offering the most affordable rates, drivers can find competitive coverage while navigating the state’s busy highways.

Minimum Car Insurance Requirements in New Jersey

New Jersey is a “choice no-fault” state, which means drivers file claims to their own insurance companies rather than filing a liability claim or lawsuit against another driver as in at-fault states.

New Jersey Mandatory Minimum Car Insurance Coverage Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Coverage | $30,000 per person and $60,000 per accident |

| Property Damage Coverage | $25,000 per accident |

| Personal Injury Protection (PIP) | $30,000 per person and $60,000 per accident for bodily injury and $25,000 per accident for property damage |

Traditionally, no-fault insurance laws are designed to keep lawsuits out of the court system and provide the medical coverage needed after a catastrophic accident. Unlike other no-fault states, New Jersey gives drivers an opportunity to preselect their level of right to sue (also known as limited tort and full tort) in the case that they are seriously injured in an accident.

Even though it doesn’t matter who is at fault, New Jersey requires that you carry, at the minimum, the following liability amounts just in case you are sued. Liability insurance pays anyone owed compensation when you are in an accident.

- $15,000 – Covers injuries or death per person or per accident for yourself or anyone under your policy.

- $250,000 – Covers brain or spinal cord injuries for yourself or anyone under your policy.

- $5,000 – Covers property damage.

Read More: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

The first two amounts above are actually part of New Jersey’s required personal injury protection coverage, so no matter what combination of coverage options you choose, at the minimum, these three amounts of personal injury protection and property damage liability are all required. You may be wondering: Why need liability coverage if it doesn’t matter who is at fault? In New Jersey, liability insurance is beneficial if you:

- Regularly drive in another state that is at-fault

- Are in an accident (in New Jersey) with someone from an at-fault state

- Wish to retain full tort rights

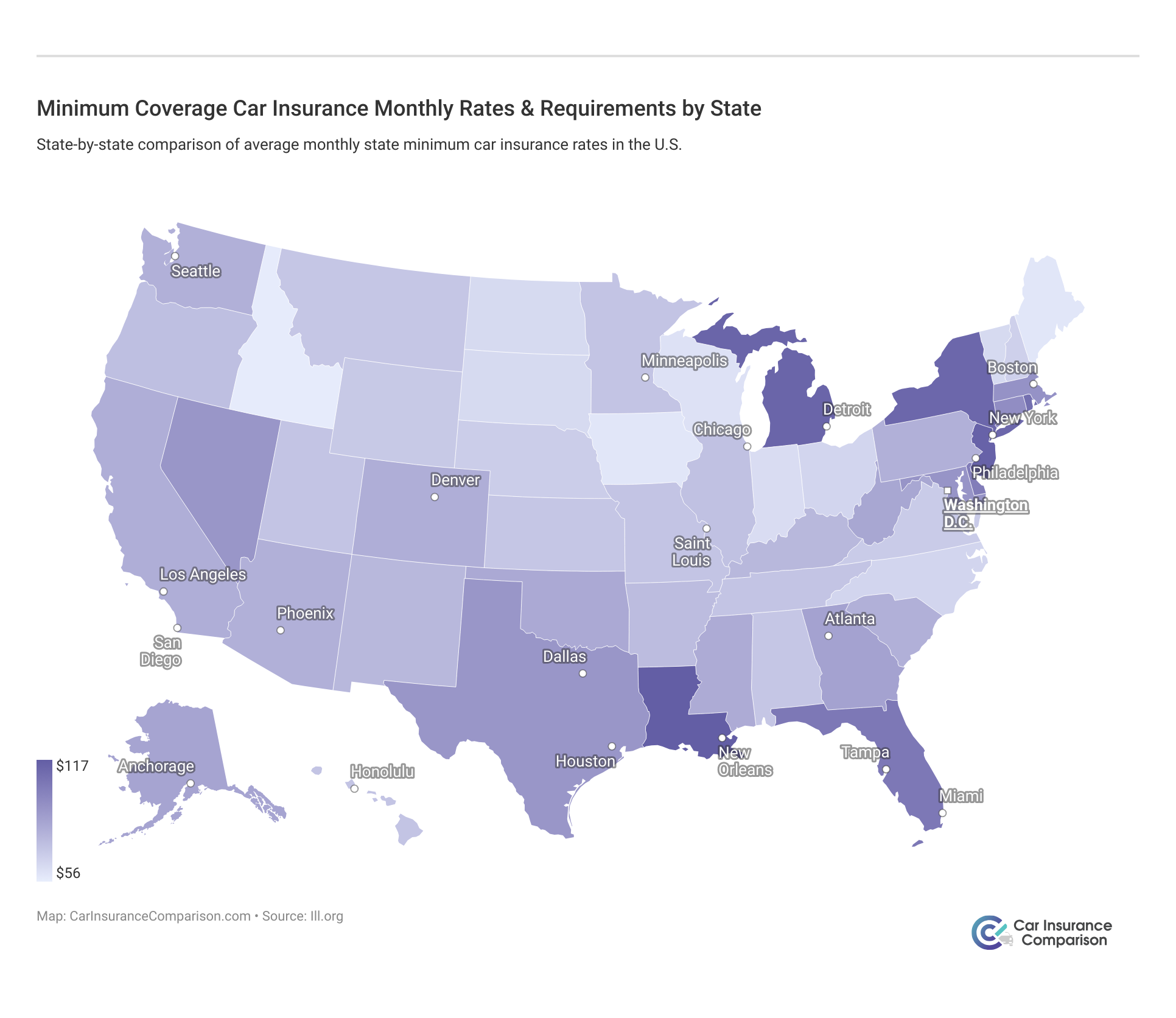

If one or all of the above scenarios could apply to you, it may be good to consider increasing the minimum liability limits beyond what is required by law. Take a look at how the minimum coverages in New Jersey compare to the rest of the U.S.

So, if it’s not liability coverage causing such high rates, then what is it? Let’s explore the three major reasons why New Jersey rates are so high. Later on, we will examine the options you have to reduce your rates.

High Rates Factor #1: Personal Injury Protection

Remember that “no-fault” doesn’t mean that no one is ever responsible for causing an accident. Officers will always collect evidence of fault at the scene, and it could be used in a personal injury case. No-fault means that drivers must turn to their own insurance providers in the case that there are injuries, losses, and damages as a result of a car accident.

A significantly large part of your no-fault policy premium (regardless of the plan you choose) will be paid towards Personal Injury Protection (PIP) which has a maximum benefit of $250,000.

This part of your policy will cover:

- all reasonably necessary medical expenses (after a deductible and 20 percent of the first $5,000)

- $100 a week for 52 weeks, at a minimum, and additional options can be purchased

- housekeeping and yard services (up to $12 per day)

However, this basic no-fault policy will not pay for repairs to your vehicle. That is additional (optional) coverage that we will cover later. In at-fault states, personal injury protection is not included, and insurance companies charge rates that reflect only the statistical likelihood of their insureds in hitting another vehicle because they assume other drivers have insurance to cover themselves when at-fault.

New Jersey residents must pay premiums to cover, at the minimum, between $15,000-$250,000 per person, per accident, for their own personal injury protection and that of everyone in their household. The exact amount, of course, depends on the type of injury and the total number of individuals listed on your policy.PIP provides immediate care to those covered who are injured in a car accident.

After a deductible ranging between $200-$2,500 and 20 percent of the first $5,000 in medical bills is met, personal injury protection covers injuries (or loss due to injuries) year after year.

The bottom line? Your insurance company must charge rates to provide the potential of needing medical care and lost wages if you, or a family member, are seriously injured in an accident. Again, New Jersey does offer options in deductibles and various levels of PIP coverage to lower your premiums. We will explain those options a bit later.

High Rates Factor #2: Profits vs. Losses

All insurance companies in the state of New Jersey have what is called a loss ratio. A loss ratio shows how much a company spends on the types of claims to how much money they take in on premiums. A loss ratio of 60 indicates the company spent $60 on claims out of every $100 earned in premiums.

So, the closer the ratio is to 100, the more claims that are paid; however, this also shows that insurance companies are losing money. Sixty to 70 loss ratio is considered to be in the safe zone.New Jersey Car Insurance Loss Ratio by Coverage Type

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Personal Injury Protection | 73 | 71 | 76 |

| Medical Payments (Med Pay) | 67 | 58 | 80 |

| Uninsured/Underinsured Motorist | 69 | 57 | 56 |

You can see in the table above that, statewide, insurance companies in New Jersey are doing well in managing their loss ratios for PIP, Med Pay, and Uninsured/Underinsured motorists coverage.

We will cover loss ratios for specific companies later. Based on the steady ratios, it seems that both insurance companies and policyholders in New Jersey are making good choices given their options. Providing these choices is what keeps your rates and insurance companies’ profits from increasing too much and too quickly. However, it could be worse.

Looking at loss ratios for other no-fault states puts New Jersey’s high rates into a different perspective. New Jersey is one of 11 no-fault states in the US that actually provides options.

High Rates Factor #3: Increasing Cases of Auto Insurance Fraud

If 15 percent of New Jersey residents are driving around uninsured, that means that only 85 percent are willing to pay the high rates, despite the variety of options. We figure that maybe having so many options causes a great deal of confusion and frustration, so these some 868,000 drivers are enjoying the bliss of ignorance. But, what about the individuals who use their intelligence to commit insurance fraud?

It’s not just policyholders but also doctors, lawyers, and insurance agents that could be involved in fraud.

Listen to the following case which involved the partnership of several people to take advantage of auto insurance claims.

The New Jersey Attorney General’s Office of the Insurance Prosecutor handles all reports and cases of auto insurance fraud.

NJ does not take fraud lightly. In fact, in 2013, the OAG launched a campaign to educate the public about insurance fraud and how to report it.

The OAG even offers a reward to those who report a new case that ends in a conviction. They attribute a 31 percent increase in electronic submissions in 2013 to their aggressive four-month advertising campaign of over 95 million impressions in the form of outdoor ads on billboards and busses as well as on radio, online, cable TV, and even in print form.

OAG published a report in 2013 showing that from 2008 to 2013, average monthly prison sentences increase from just under one year to almost 4.5 years. The 2017 report includes descriptions of the most significant cases. And they continue to crack down on fraud cases dealing with car accidents.

New Jersey is one of only five states that mandates an auto photo inspection. This means that photographic evidence must be collected at all accident scenes.

Auto accident fraud is a crime in New Jersey. Those convicted may be sentenced up to 18 months of jail time, $10,000 in fines, and 30 days of community service. What’s the good news?

There are ways you can reduce your rates more quickly than reporting insurance fraud, but, at the end of the day, your insurance company is responsible for covering you no matter what. It’s important to understand the good and bad consequences when considering all of your options.

Cheapest Option in NJ: The Basic Policy

The “choice” part of New Jersey’s “choice no-fault” law comes into play when you consider your family dynamics and the value of your assets. If you have very few assets, it’s difficult to be sued for damages and losses beyond the minimum requirements established by New Jersey law. This is why New Jersey established a basic policy option in 1998.

New Jersey’s basic policy promised 20 percent in savings in hopes to reduce the number of uninsured motorists.

However, by 2002, the New Jersey Department of Banking and Insurance (DOBI) released a memo urging insurance providers to encourage the basic policy because only 0.22 percent of residents had signed up for it. DOBI attributed the low percent of basic plans to the lack of accurate information for drivers and providers.

The department currently clarifies on their website that the basic policy is best for those with few family responsibilities and few real assets (savings, homeownership, high salary, etc.) such as younger drivers who are just beginning work.

If you do have family members and substantial assets, choosing the basic policy will still decrease your rates significantly. But, there’s a catch. Any individual who elects the basic policy is provided with only a limited right to sue.

This means that if you are in an accident, and the other party is determined at fault, you are permitted to retain economic-only reimbursement (medical costs, loss of wages, etc.). You will not be permitted to collect for pain and suffering.

There are six exceptions to this limited right to sue as part of the basic policy: death, dismemberment; loss of a fetus; objective, significant disfigurement or scarring; displaced fractures; or permanent injury.

Basic policyholders do have the option of purchasing additional coverages such as bodily injury liability, but it is limited to a total maximum of $10,000 for all persons involved in an accident.

Other coverages basic policyholders can purchase include comprehensive car insurance and collision car insurance; however, they are not permitted to purchase uninsured or underinsured motorists coverage.

Multiple Options: The Standard Policy

The minimum coverage requirements by law can still be met with the standard policy. In the case that you wish to carry the standard policy but still meet only the minimum requirements, there are five parts of the standard plan.

- $15,000 to $250,000 per person and $30,000 to $500,000 per accident is required for bodily injury.

- $5,000 to $100,000+ is required for property damage liability, which handles damage claims to others’ property in an accident

- Up to $15,000 per person and $250,000 for brain/spinal injuries is required for personal injury protection (PIP).

- The same amounts as bodily injury and property damage liability are required for uninsured/underinsured motorist coverage.

- Any amount is optional for both collision and comprehensive coverage, with collision addressing vehicle damages from collisions with other cars or objects, and comprehensive protecting against non-collision damages such as theft, vandalism, and weather-related incidents

If you wish to carry more than the minimum coverage requirements with the Standard Plan, you have MANY optional combinations to get the exact coverage fit for you or your family. Customizing a standard policy breaks down into making four critical decisions:

- Choose your lawsuit option – limited tort or full tort

- Choose personal injury protection or health insurance as primary

- Choose full PIP benefits or medical expenses only

- Choose your PIP deductible

Customizing your Standard Plan allows you to tailor your coverage to better fit your needs. Each decision impacts your protection and potential costs, so it’s essential to evaluate your options carefully.

Choose Your Lawsuit Option

With the Standard Policy, drivers can choose limited or full tort rights. Since the purpose of having no-fault law is to keep lawsuits out of the court system, New Jersey gives drivers lower rates if they give up part of their right to sue.

- Choosing limited tort allows you to recover all medical and other out-of-pocket expenses (such as loss of wages while in recovery), but not for pain and suffering.

- Choosing full tort will ensure that you and other household members can recover all medical and other out-of-pocket expenses as well as financial compensation for pain and suffering.

As you can imagine, pain and suffering would take a great deal of the court’s time to negotiate and calculate whereas medical and out-of-pocket expenses are easily documented and calculated. By giving up your right to sue for pain and suffering, you will reduce the amount of court time needed if a suit is filed.

To note, if you choose the limited tort option, you cannot sue an insurance company. However, insurers can lose this limitation on liability for failing to act in accordance with the law. While it is unknown how many New Jersey drivers select the limited tort option, if you choose full tort, know that the bodily injury liability and the uninsured and underinsured motorists portions of your premium could increase by as much as 67 percent.

It may sound like New Jersey expects citizens to “pay for” their right to sue, but New Jersey is ahead of the curve, actually, in solving the issues that no-fault law has created over several decades of changes in the health care industry, insurance industry, and legal system.

By offering so many combinations in options, New Jersey has balanced out the burden on drivers when some states are struggling to address the issues created by no-fault law.

Case in point, Michigan, as mentioned earlier, has been working to make changes for decades while watching a socio-economic crisis snowball over many of their citizens. Michigan rates increased by 22.8 percent from 2011 to 2015 as compared to the 11 percent increase nationwide for the same time period. We are not sure if at-fault law will be considered for New Jersey to reduce rates in the future, but at least drivers currently have options.

Choose PIP or Health Insurance as Primary and a PIP Deductible

New Jersey gives the option for drivers to file medical claims from accidents to a primary provider meaning that when the primary provider benefits are exhausted, the secondary provider will cover expenses. In the case that you choose your health insurance company as your primary benefit, you will still need to select a PIP deductible amount because PIP will provide secondary benefits.

New Jersey rates decrease by as much as 34 percent when choosing health insurance as primary and a higher PIP deductible.

If choosing the minimum requirements and selecting medical expenses only, you are selecting the basic policy, and premiums reduce by as much as $20 over six months. If you choose higher than minimum coverage requirements, you still have the option to choose medical expenses only. But, it’s important to understand what you are exchanging for a lower premium.

Choosing health insurance as primary means that you will have to meet your monthly deductible and co-insurance each year following injuries sustained in a car accident. Choosing PIP as primary will ensure that you pay a deductible only once for as long as you are recovering, depending on the injury.

In the case that you select coverages above the minimum requirements, you also have the option to select medical expenses only which is what the basic policy provides. Choosing medical expenses only shaves off between $7-$20 from your premium. Selecting this option means that you will give up:

- Income continuation up to $5,200

- Essential services up to $4,380

- Death benefits up to $9,580 for income continuation and essential services

- Funeral benefits up to $1,000

If you wish to take advantage of the above options for yourself and your family, you can increase them by electing to pay higher PIP rates. You may also choose if you want PIP to cover only you, all drivers, or all members of your household. It seems like we are finally approaching that 12,376th option.

Final Option: Drive Uninsured

In most states, it’s frowned upon to not carry car insurance; however, for the state of New Jersey, which ranks 14th in the country for the highest percentage of uninsured motorists (15 percent), it may be a necessity for some. However, there are major consequences.

- If you cause an accident, you (and only you) are responsible for paying for the pain, suffering and other personal hardships and some economic damages, such as lost wages.

- If you are sued, the insurer has no responsibility to provide or pay for a lawyer to represent you.

- If a judgment is entered against you, your assets will be at risk including the risk of having money deducted from your wages.

- If you have no coverage at all, and someone else is at fault in a car accident, you are not permitted to sue.

These consequences are affectionately called “No Pay, No Play” laws in New Jersey as well as nine other states in the US. The play refers to playing in the court system. Some states, such as Louisiana, don’t allow uninsured drivers to retain the first $10,000, but they are permitted to sue.

New Jersey eliminates all rights to sue if you do not maintain car insurance.

Further evidence that New Jersey doesn’t “play” around is that basic policyholders are not permitted to purchase uninsured or underinsured motorist coverage while standard policyholders are required to purchase it.

So, before you decide to join the 15 percent of residents driving without car insurance, consider saving your paycheck and preserving your right to sue. If you simply cannot afford car insurance and you have Medicaid hospitalization benefits, go to the section about the “Special Automobile Insurance Policy.”

Required Forms of Financial Responsibility in New Jersey

With your paycheck in hand and your rights in the other, be sure to put proof of insurance in your pocket.Proof of insurance is accepted in two formats – paper and electronic.

Drivers must keep proof of insurance in the vehicle or be able to produce an electronic version on a mobile device.New Jersey requires that a proof of insurance paper card be a specific size and on card stock. The card or electronic version must be made available before inspection, after an accident, when pulled over, and while going through checkpoints.

Penalties for Driving Without Insurance

New Jersey takes driving without insurance just as seriously as insurance fraud.

If you drive without insurance in New Jersey, you will be fined up to $300 and have your license suspended for one year.

The suspension may be reduced or eliminated if showing proof of insurance at the hearing. And if you didn’t learn your lesson the first time, a second conviction will provide you with a nice 14-day stay in prison, and when you get out, two years of suspension of driving privileges, up to a $5,000 fine, and 30 days of community service.

Premiums as Percentage of Income in New Jersey

How exactly (un)affordable is car insurance for New Jersey residents?Let’s find out.In 2014, the monthly per capita disposable personal income in New Jersey was $4,983.Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

New Jersey has remained in the top five highest paying states for quite some time now, but it still lags behind DC by $10,000. Some would argue this is why insurance rates are so high, but that’s not the case.

In 2014, New Jersey residents paid only 2.74 percent of their monthly DPI on car insurance, which is one half a percent higher than DC.

Even though New Jersey residents make great money and pay one of the top three highest rates for car insurance, they trail behind Michigan and Louisiana (also no-fault states) by over one percent when looking at car insurance rates as a percent of income.

Also to note, from 2012 to 2014, this percentage for New Jersey maintained around the same while Michigan’s percentage continued to swell. There’s no doubt that the multitude of options New Jersey residents enjoy helps keep this percentage lower as compared to other no-fault states.

The average New Jersey resident has $4,165 each month for living expenses. Car insurance alone will cost about $114 per month.

Remember, these amounts include only liability, collision, and comprehensive coverages. These estimates do not include personal injury protection or uninsured and underinsured motorists coverages. Use our rate-as-percent-of-income calculator below to get your own more accurate estimate.

Why is getting the best deal on car insurance so important? American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With New Jersey’s DPI, that’s about $833 each month. How much are you tucking away to savings each month?

More Options: Increasing your Limits

When you obtain a quote, you will see (or hear) all of your options in levels of coverage. Later on, we will explain how coverage levels affect your premium amount. But for now, let’s take a look at coverage levels. The lowest option (the minimum) and the highest option is listed in the table below.

Remember, each component has up to 17 options, so you can imagine the coverage amounts between the lowest and highest.

New Jersey Policy Components and Options

| Coverage Type | Lowest Amount | Highest Amount |

|---|---|---|

| Bodily Injury Liability | 15/30 | 500/500 |

| Property Damage Liability | $5,000 | $500,000 |

| Uninsured and Underinsured Bodily Injury Liability | 15/30 | 500/500 |

| Uninsured and Underinsured Property Damage Liability | $5,000 | $500,000 |

| Medical Payments | $1,000 | $10,000 |

| Additional PIP | Lost Wage: $100 per week / $10,400 max Essential Services: $12 per day / $8,670 max | Lost Wage: $700 per week / unlimited Essential Services: $20 per day / $14,600 max |

| PIP Medical Expense Limit | $15,000 | $250,000 |

| PIP Expense Deductible (higher deductible = lower rate) | $2,500 | $250 |

Some things to note is that, under no-fault law, you are essentially having to pay your insurance company in advance to cover any damage to your vehicle and property, medical expenses if injured, and lost wages while recovering. This is the case for any accident that you and/or someone else causes.

The purpose of (and opportunity to) increase your limits is to protect your assets and get the medical care you need after serious injuries. It is also available to you when you cause an accident. Some amounts you can reasonably predict; others you can’t.

For example, if you make the assumption that the majority of drivers purchase vehicles that are worth $50,000 or less, then you may choose to elect for lower property damage liability limits but still enough to cover the cost of the other driver’s vehicle if it is a total loss and you were at fault.

Choosing the right coverage levels protects your assets and ensures you receive necessary care after an accident.

Justin Wright LICENSED INSURANCE AGENT

You can calculate any and all scenarios to get the coverage you need based on the value of your assets (vehicle, home, savings, salary), your lifestyle choices, and what you feel you and your family can live on if you or one of your family members is seriously injured in a car accident and unable to work or in need of home care.

Uninsured and Underinsured Motorist Coverage in New Jersey

Recall that almost 15 percent of New Jersey drivers are uninsured. Another (likely higher) percent of drivers are underinsured, selecting only the minimum (or slightly above the minimum) requirements to keep their premiums low.

In a no-fault state like New Jersey, it becomes even more imperative to purchase uninsured and underinsured coverage so that your insurance can help you with bodily injuries and property damage you sustain from being hit by someone with little or no coverage.

New Jersey not only provides options to those who can afford at least the minimum coverage requirements. The state also has a low-cost insurance program nicknamed “Dollar a Day” insurance. This type of insurance costs $365 a year and is available to only Medicaid recipients.

The plan is described more under the section Low-Cost Coverage, but when it comes to holding the standard policy, it is important to know about how the Dollar a Day program can affect others who purchase an insurance policy. (For more information, read our “Compare Dollar-a-Day Car Insurance: Rates, Discounts, & Requirements“).

So you can see how important it is to purchase enough uninsured and underinsured motorist coverage with the standard policy. This type of coverage is required for the standard policy, but the amounts of coverage you select depend on how much your assets are worth.

For example: if an uninsured motorist hits your vehicle and causes $8,000 in damages or totals your vehicle, your uninsured motorist property damage coverage you purchased through your own insurance company will cover the damages or replacement of your vehicle.So, if you own a particularly expensive vehicle, you will want to have enough of this type of coverage to remedy such a situation.

Collision and Comprehensive Coverage in New Jersey

Much of the data we have provided up to this point did not take into consideration the value of your vehicle.That is what collision and comprehensive coverage are for. If you recall, we explained that a New Jersey no-fault policy covers just about everything in a car accident except your vehicle.If you are in an accident, regardless of who is at fault, you will need coverage to make needed repairs or replace your vehicle if it is totaled.

If the other driver has an insurance policy that meets only the minimum requirements, their policy will pay up to $5,000 in property damage repairs, but it doesn’t take much to run up $5,000 in repairs in a minor fender bender with today’s cost of parts and labor.

Collision coverage will apply when the cost of damage or replacement is higher than $5,000. Note that collision coverage has a deductible which is an amount you will have to pay out of pocket if you make a claim. You can reduce your collision coverage rate by selecting a higher deductible.

In New Jersey, you may choose a collision deductible ranging from $100 to $5,000. In some states, drivers have only two options: $500 or $1,000.

Comprehensive coverage, on the other hand, applies is if your car is stolen or damaged by a falling object, animal, fire, flood, or vandalism. These situations are otherwise known as “acts of God,” meaning you, as the driver, can’t control these occurrences.If you own a financed vehicle, collision, along with liability and comprehensive (also known as full coverage), will likely be required by your lender.

In New Jersey, you may choose a comprehensive deductible ranging from $50 to $5,000. In some states, drivers have only two options: $500 or $1,000.

If you have an older car, you may not need to purchase collision and comprehensive coverage.

Other Factors That Determine Car Insurance Rates in New Jersey

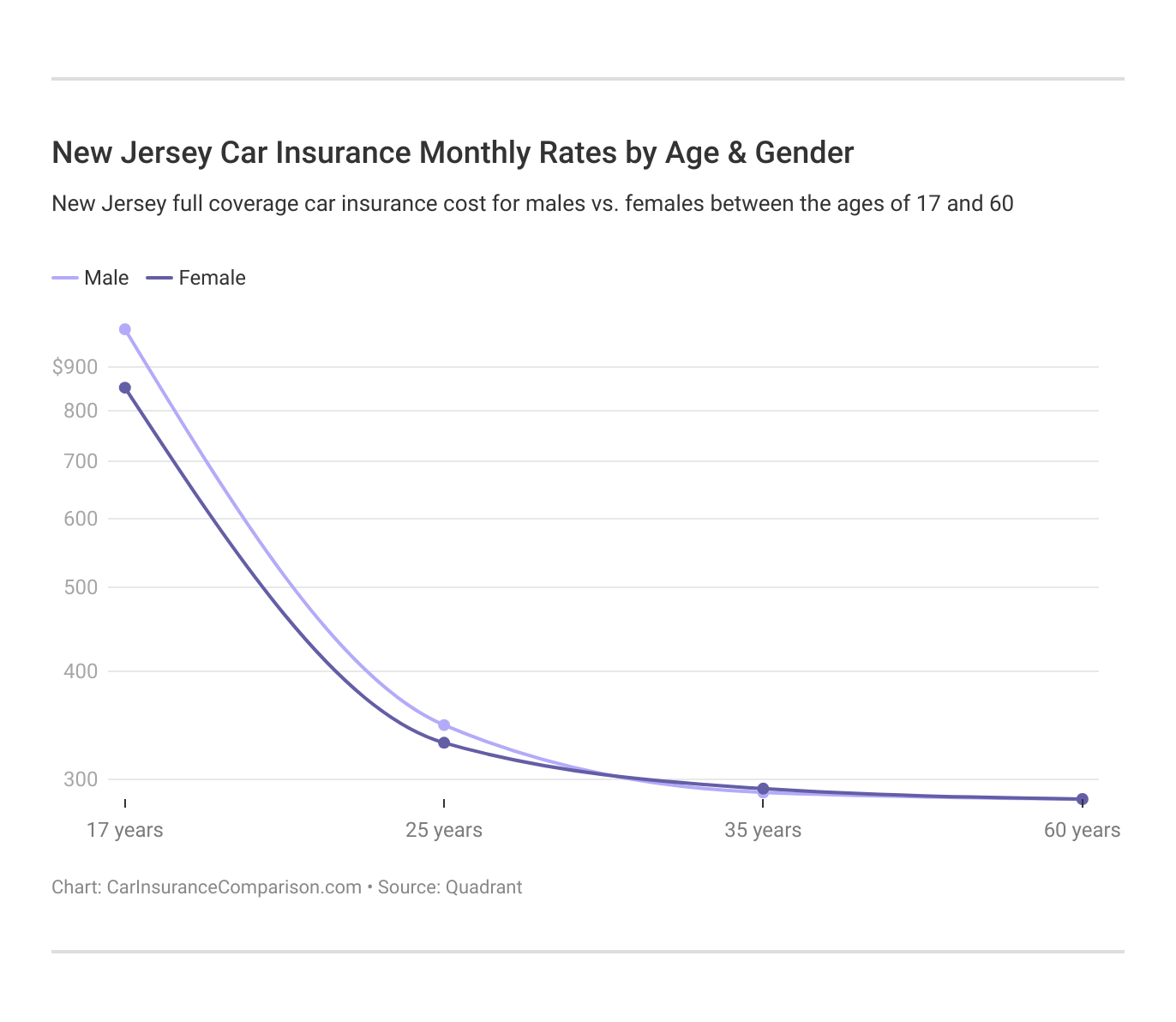

Just when you thought New Jersey car insurance rates couldn’t get any higher, there are characteristics unique to you that may increase or decrease your rate quotes.We will first examine basic demographics such as gender, age, and marital status. A little later on, we will look at credit scores, driving record, and commute miles for individual car insurance companies.

Average Monthly Car Insurance Rates by Age & Gender in NJ

Most are under the impression that men pay higher rates than women. That’s not entirely true in New Jersey’s case. Six states, most recently California, have outlawed charging different insurance rates based on gender and/or marital status.

Our researchers found that the two most influential factors that go into rate calculations are age and the specific carrier. Let’s see how these demographics factor into rates for New Jersey residents.

Demographic and Insurance Carrier

Age, gender, marital status, and many other factors go into calculating your rate. To give you an idea of how these few variables affect rates, we provide a table below showing the cheapest average rates for New Jersey’s insurance carriers.

New Jersey Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $250 | $230 | $125 | $122 | $101 | $101 | $101 | $101 |

| Foremost Insurance | $270 | $250 | $190 | $170 | $120 | $110 | $105 | $105 |

| Geico | $150 | $140 | $62 | $63 | $51 | $51 | $51 | $51 |

| Liberty Mutual | $300 | $280 | $225 | $201 | $201 | $201 | $201 | $201 |

| Progressive | $275 | $255 | $195 | $175 | $110 | $100 | $95 | $95 |

| State Farm | $200 | $190 | $95 | $85 | $67 | $67 | $67 | $67 |

| St. Paul Protective | $260 | $240 | $180 | $160 | $100 | $95 | $85 | $85 |

You will see that age affects rates to a great extent; after all, we do become more experienced and mature drivers as we age. If you have a teen driver in your home, Geico may be the best option for your family.

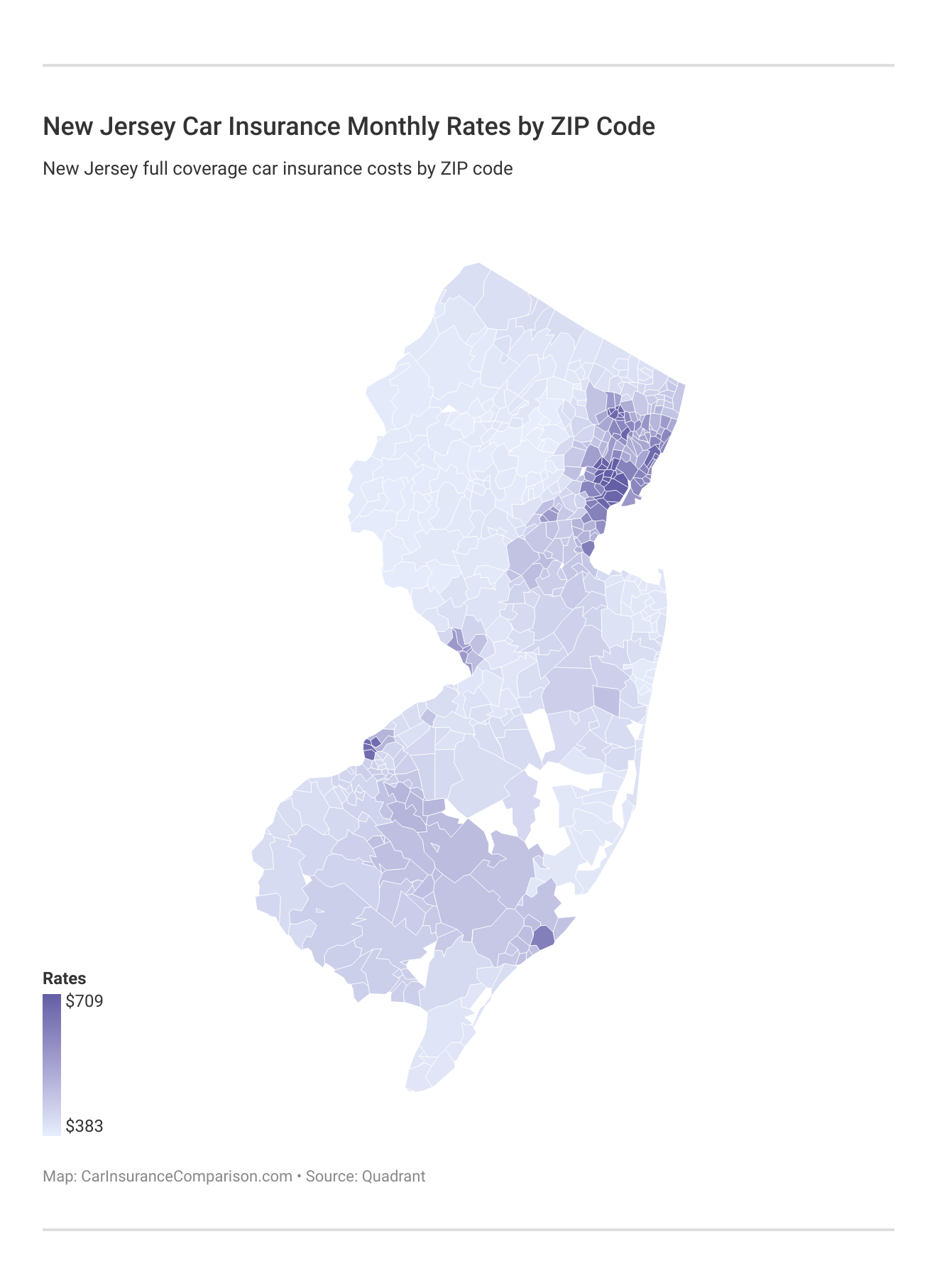

New Jersey car insurance rates can vary significantly by zip code, reflecting local risk factors and demographics. It’s essential for drivers to compare rates in their specific area to secure the best coverage at the lowest price.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

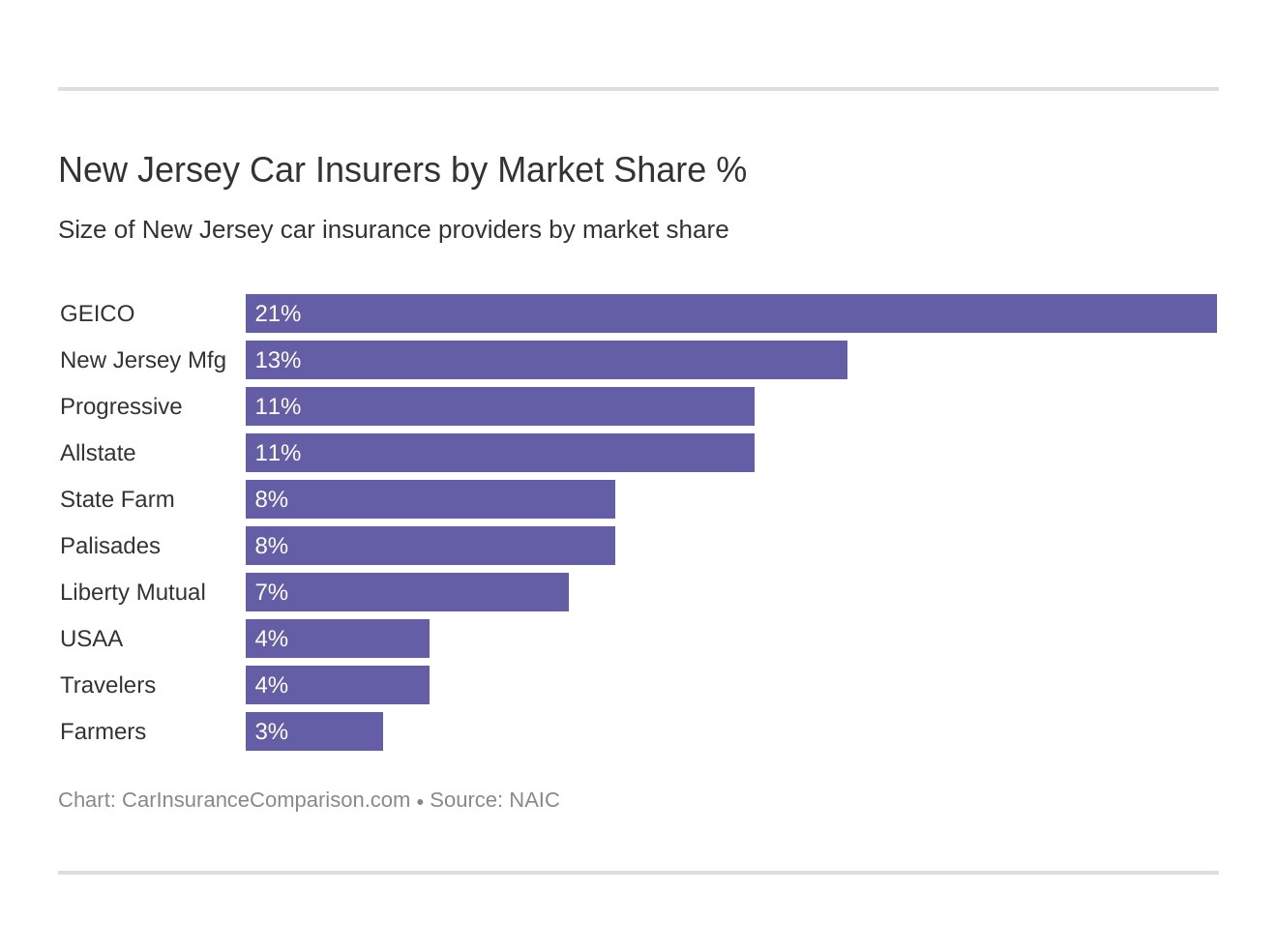

The Largest Car Insurance Companies in New Jersey

Before we get to the cheapest rates, let’s take a look at the largest car insurance companies in New Jersey. The national market share is mostly dominated by four select companies; however, we have listed the largest companies in New Jersey here (as of 2017) to provide you with more options relative to your own state.

The table below displays the market share percentage, total direct premiums written, and loss ratios. The table is sorted by market share; however, you can sort as you like.

New Jersey Total Direct Premiums Written by Company

| Insurance Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate | $839,883 | 53% | 11% |

| Farmers | $233,314 | 80% | 3% |

| Geico | $1,580,844 | 70% | 21% |

| Liberty Mutual | $544,321 | 64% | 7% |

| New Jersey Manufacturers | $993,945 | 66% | 13% |

| Palisades | $601,852 | 61% | 8% |

| Progressive | $856,484 | 59% | 11% |

| State Farm | $629,485 | 65% | 8% |

| Travelers | $284,191 | 60% | 4% |

| USAA | $294,678 | 71% | 4% |

Remember, these are the loss ratios for all coverage types combined and are for the largest companies, not those with the cheapest rates.

Car Insurance Companies With the Best Ratings

A.M. Best is a third-party entity that provides ratings of companies’ credibility and financial outlook, making it an excellent resource for narrowing down your car insurance options. These ratings reflect the financial stability and reliability of insurance providers, helping you choose a company that can meet its obligations to policyholders.

A.M. Best Financial Strength Ratings From the Top New Jersey Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| New Jersey Manufacturers | A+ |

| Palisades | A- |

| Progressive | A+ |

| State Farm | B |

| Travelers | A++ |

| USAA | A++ |

Taking into consideration customer satisfaction ratings is as important as financial stability. While A.M. Best ratings provide insight into a company’s financial health, customer satisfaction scores give you a sense of the service quality and overall experience you can expect. Combining these two aspects will help you select a car insurance provider that offers both dependable coverage and excellent customer service.

Companies With Most Complaints in New Jersey

We’ve looked at the positive ratings for financial stability and car insurance company customer satisfaction ratings. Now it is time to review the negative aspect of ratings: customer complaints.We took the same ten companies and located their complaint ratios compared to their direct premiums written. So just because a company has the most customers in your state doesn’t necessarily mean those customers are satisfied.

New Jersey releases complaint ratios each year, and 2017 data is their most recent that is published. The table is sorted based on the company name.

New Jersey Total Complaints by Company

| Insurance Company | Complaint Index | Total Complaints | Monthly Premiums |

|---|---|---|---|

| Liberty Mutual | 1.25 | 62 | $142 |

| Farmers | 1.18 | 58 | $188 |

| Travelers | 1.03 | 60 | $142 |

| Progressive | 0.95 | 55 | $182 |

| State Farm | 0.96 | 57 | $179 |

| Palisades | 0.9 | 52 | $145 |

| Geico | 0.86 | 50 | $130 |

| Allstate | 0.82 | 45 | $191 |

| USAA | 0.3 | 15 | $109 |

| New Jersey Manufacturers | 0.21 | 10 | $110 |

A company with a complaint index lower than 1.0 has fewer complaints than average, and a company with a complaint index higher than 1.0 has more complaints than average.

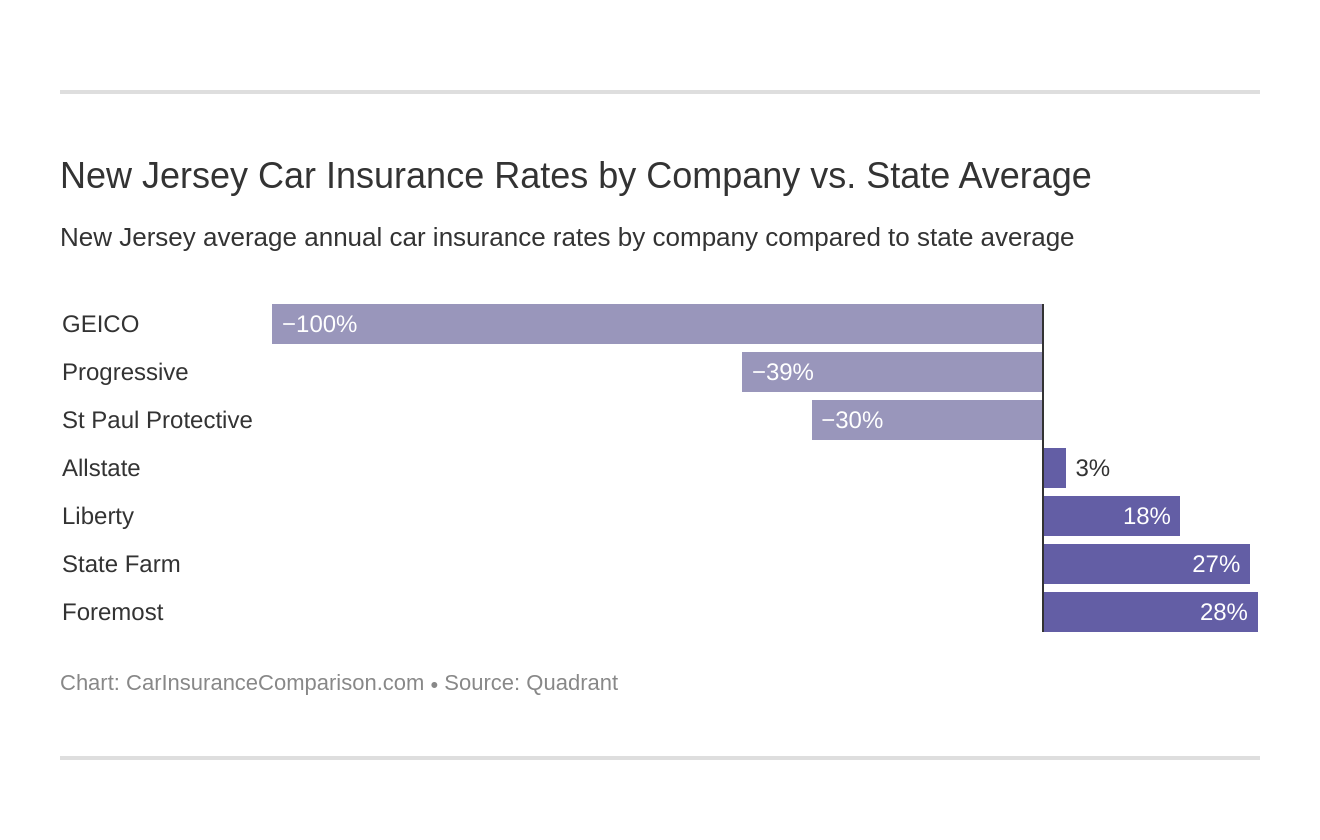

New Jersey Car Insurance Rates by Company

In this section, we cover the average monthly rates for the top seven companies in New Jersey with the cheapest rates based on unique factors to you: your commute, driving record, and chosen coverage level.

But first, let’s look at the cheapest average rates by company overall, compared with the state averages.

We know New Jersey rates will be higher than other states on average, but some companies will have better rates than others even if it is by only $50 per year. As you can see in the chart above, Geico and Progressive have the best rates compared to the state average.

Commute Rates in New Jersey

Explore the cost of commuting in New Jersey with rates from various insurance providers. This section compares the monthly costs for a 10-mile and a 25-mile daily commute.

New Jersey Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $475 | $523 |

| Farmers | $635 | $699 |

| Geico | $228 | $251 |

| Liberty Mutual | $558 | $614 |

| Progressive | $331 | $364 |

| State Farm | $611 | $672 |

| Travelers | $355 | $391 |

Commute times are generally a fairly small factor when it comes to increasing your rates. These commute rates can help you make informed decisions about your insurance provider, ensuring you get the best value for your mileage needs.

If you have a long commute, getting a policy with Farmers, Progressive, or Travelers is a good option because all of these companies don’t charge more for a longer commute.

How Much Auto Insurance Costs in New Jersey

Explore auto insurance rates in New Jersey cities. Gain insights into the dynamics shaping car insurance rates in your locale for informed decision-making.

New Jersey Car Insurance Cost by City

Use this comparison to find the best rates and coverage options in Colonia, Morris Plains, East Brunswick, Paterson, East Orange, and South Orange, ensuring you get the most value for your insurance needs.

Driving Laws in New Jersey

Car insurance laws vary from state to state, and New Jersey is no different, as we have seen already. In this section, we cover more laws associated with car insurance.

High-Risk Insurance

The state of New Jersey has established the New Jersey Personal Automobile Insurance Plan (NJPAIP) to assist those who are finding it difficult to purchase coverage from a carrier in the competitive market due to denial of coverage. You may qualify for the program if you meet one or more of the following criteria:

- Newly licensed drivers and young teen drivers often face higher premiums due to their lack of experience.

- Drivers living in high-risk urban areas may see increased rates based on local accident and theft statistics.

- Those previously covered by high-risk auto insurance companies or under SR22 filing typically encounter higher costs.

- A history of late payments or poor credit can negatively impact insurance premiums.

- Drivers with several recent traffic violations or accidents will likely face elevated rates due to perceived risk.

The New Jersey Personal Automobile Insurance Plan (NJPAIP) serves as a valuable resource for those facing difficulties obtaining coverage in the competitive market. If you meet any of the listed criteria, consider exploring this program to secure the necessary auto insurance, ensuring you stay protected and compliant with state requirements.

Low-Cost Insurance

As mentioned earlier, New Jersey has a program for only Medicaid recipients who have hospital benefits called the Special Automobile Insurance Policy (NJSAIP), or dollar a day car insurance. It is called the “Dollar a Day” policy because it costs $360 a year if you pay up-front, or $365 if you pay in two installments.

This insurance policy will cover up to $250,000 in emergency treatment. It also has a death benefit of $10,000.If you think you may qualify for this plan, read the frequently asked questions on the DOBI website.

Windshield Coverage

New Jersey law does not require insurance companies to provide windshield repair or replacement, but it is an option through purchasing comprehensive coverage with a standard repair deductible of $750.

Statute of Limitations in NJ

A statute of limitations is the limit on the amount of time you have, from the time of an accident, to bring a lawsuit to court. Most states differentiate time limits for personal injury and property damage matters. However, New Jersey combines the two, and you have two years to file for the lawsuit for both personal injury and property damage.

Comparative Negligence

New Jersey is a “modified comparative fault” state. This statute is used to settle cases in which the injured party is partially at fault. The amount in damages will be reduced if an injured party is found to share the blame. In this case, the plaintiff’s damages award is reduced by a percentage equal to his or her share of fault. If the injured party is found to be 50 percent or more at fault, there is no recovery for damages.

Vehicle Licensing Laws

Let’s look at what licensing requirements are in place in New Jersey for different groups of people. Understanding these laws ensures compliance and safety on New Jersey roads. Always stay informed about the latest updates to maintain a valid driver’s license.

Teen Driver Laws

Navigating the New Jersey Teen Driving Laws is crucial for young drivers and their guardians. This section outlines the specific licensing stages, age restrictions, and rules designed to promote safe driving habits among teens.

New Jersey Teen Driving Laws

| License Type | Age Requirements | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 16 with driver education; 17 without | One passenger besides supervising driver; waived for 21+ | 11 p.m.-5 a.m.; waived for 21+ |

| Provisional License | 17 and 6 months; shorter for 21+ | Same as Learner's Permit | 11 p.m.-5 a.m. |

| Full License | 17; restrictions lift at 18 or after 12 months | Lifted after 12 months or at 21 | Lifted after 12 months or at 21 |

Adhering to these guidelines helps teen drivers gain experience while ensuring their safety and the safety of others on the road. Stay aware and drive responsibly.

Older Driver License Renewal Procedure

The renewal process for driver’s licenses in New Jersey includes specific considerations for older drivers. This section details the procedures and options available to the general population and those aged 70 and older.

New Jersey Older Driver and General Population License Renewal Procedure

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License Renewal Cycle | 4 years | 2 or 4 years (personal option) |

| Mail or Online Renewal Permitted | Yes, unless a new photo is required (stored picture valid for up to 4 years) | Yes, unless a new photo is required (stored picture valid for up to 4 years) |

| Proof of Adequate Vision Required | Every 10 years | Every 10 years |

Regularly renewing your license and meeting the vision requirements ensures you remain a safe and legal driver. Keep up to date with these procedures to maintain your driving privileges.

New Residents

If you plan to relocate to New Jersey, there a few things you need to know to transfer your out-of-state license and register your vehicle. Before you visit a motor vehicle location, collect forms of identification to meet a total of six identification points.

Once you surrender your out-of-state license, you will be issued a four year New Jersey license. If you are 21, you must complete the Graduated Driver License (GDL) program requirements.

As for your vehicle, you will have 60 days from the date you move to transfer your title and registration. Visit a motor vehicle location with ID, title, and proof of insurance. You will complete a few forms and pay a fee based on if you own or finance your vehicle. New Jersey currently has been granted an extension until October 2019 to enforce REAL ID requirements.

Rules of the Road in New Jersey

Knowing the basic driving laws of New Jersey will ensure your safety and keeping your rates from increasing. Ready?

Keep Right and Move Over Laws

All drivers in New Jersey must keep right except to pass on the left or turn left. Move over laws usually always apply to emergency vehicles; however, in New Jersey, this applies to any vehicle with flashing lights including tow trucks and highway maintenance vehicles. Drivers must move over completely or slow down if moving over is not possible.

Speed Limits

Maximum posted speed limits are 65 mph on rural interstates, 55 mph on urban interstates, 65 mph on limited access roads, and 55 mph on all other roads.

Carseat and Cargo Area Laws

Any child younger than two and less than 30 lbs must be in a rear-facing infant seat. From this age and weight, a child must ride in a rear-facing or forward-facing child safety seat until the age of four and 40 lbs. From age four and 40 lbs to age eight and 57 inches tall, a child must ride in a forward-facing child safety seat or booster seat.

The state of New Jersey does have a preference for the rear seat, if available, for children under the age of 7 and less than 57 inches. If a child must ride in the front seat or in a safety seat in the front seat, the air bag must be disabled.

However, when a child reaches the age of eight and exceeds 57 inches tall, he or she may use an adult seat belt. Some states permit those who are younger than 16 to ride in cargo areas in the case of parades, for example. New Jersey, on the other hand, permits only employees engaged in work duties to ride in the back of a pickup truck.

Ridesharing

Rideshare services like Uber require that all their drivers maintain their own car insurance policies that meet at least the minimum coverages requirements. However, if a driver wishes to obtain special coverage for this role, Farmers and USAA offer specialized rideshare coverage.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS), “Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

New Jersey is one of ten states that have at least have laws that authorize a study, define key terms, and/or authorize funding; however, as of May 2019, no additional information is provided regarding additional regulations.

New Jersey’s Safety Laws

Two basic practices that ensure your safety and the safety of others in New Jersey is to buckle up and obey the speed limits. Other laws exist to prevent impaired or reckless driving.

DUI Laws

New Jersey DUI insurance laws require a blood alcohol level of 0.08 percent or higher to be cited with driving under the influence (DUI). Unlike other states, in New Jersey, driving under the influence is considered a violation and not a crime with a lookback period of 10 years.

New Jersey DUI Penalty

| DUI Penalty | First Offense | Second Offense | Third Offense |

|---|---|---|---|

| License Suspension | BAC 0.08-0.99: 3 months BAC 0.10-0.14: 7 months-1 year BAC 0.15+: 7 months-1 year + IID | 2 years + IID | 10 years + IID |

| Imprisonment | BAC 0.08+: up to 30 days | 48 hours - 90 days | 180 days |

| Fine | BAC 0.08-0.99: $250-$400 BAC 0.10-0.14: $300-$500 BAC 0.15+: $300-$500 $3,505 in fees and surcharges | $500-$1,000 + $3,555 in fees and surcharges | $1,000 + $5,055 in fees and surcharges |

| Other | 12-48 hours in IDRC | 12-48 hours in IDRC | Up to 90 days Community Service; 12-48 hours in IDRC |

However, New Jersey does impose infractions on drunk drivers based on their blood alcohol level for their first offense. Any offenses proceeding the first does not differentiate for blood alcohol level.

Marijuana-Impaired Driving Laws

As of May 2019, New Jersey does not have any specific laws regarding marijuana impairment while driving.

Distracted Driving Laws

All distracted driving laws in New Jersey are primarily enforced which means you can be pulled over for violating these laws.Handheld devices and texting are banned for all drivers.

All learner’s permit holders and all intermediate license holders are not permitted to use a cellphone. New Jersey takes these laws seriously.

New Jersey: Fascinating Facts you Need to Know

How safe is it to drive in New Jersey? Well, the data our researchers found might surprise you. Let’s examine the statistics of theft and fatalities from risky driving behavior.

Vehicle Theft in New Jersey

Here are the top stolen cars in New Jersey and the cities with the highest vehicle theft rates. Understanding these trends can help you take preventive measures to protect your vehicle.

Top 10 New Jersey Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Honda Accord | 2017 | 541 |

| Honda Civic | 2018 | 457 |

| Dodge Caravan | 2020 | 390 |

| Nissan Sentra | 2019 | 360 |

| Ford Pickup (Full Size) | 2021 | 340 |

| Nissan Altima | 2017 | 330 |

| Jeep Cherokee/Grand Cherokee | 2019 | 320 |

| Toyota Camry | 2018 | 310 |

| Nissan Maxima | 2016 | 290 |

| Ford Econoline E350 | 2015 | 280 |

Understanding the most commonly stolen vehicles in New Jersey can help drivers make informed decisions about their car security. By taking preventive measures, such as installing anti-theft devices, you can reduce the risk of vehicle theft.

New Jersey Car Thefts by City

| City | Total |

|---|---|

| Newark | 3,120 |

| Elizabeth | 1,050 |

| Paterson | 780 |

| Jersey City | 762 |

| Irvington | 560 |

Vehicle theft remains a significant concern in New Jersey, especially in certain cities. Staying informed and implementing security measures can help reduce the risk of becoming a victim of car theft.

Risky/Harmful Driving Behavior

Keeping your eyes on the road and staying aware of common risky driving behaviors is the best way to stay safe while driving.

Weather and Light Condition Fatalities

Explore how weather and light conditions impact traffic fatalities in New Jersey. This data highlights the importance of adapting your driving to different conditions.

New Jersey Traffic Fatalities by Weather Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 235 | 166 | 86 | 29 | 0 | 516 |

| Rain | 21 | 26 | 8 | 3 | 0 | 58 |

| Snow/Sleet | 3 | 1 | 1 | 0 | 0 | 5 |

| Other | 0 | 4 | 2 | 2 | 0 | 8 |

| Unknown | 1 | 2 | 0 | 0 | 1 | 4 |

| Total | 260 | 199 | 97 | 34 | 1 | 591 |

Adapting your driving to weather and light conditions can significantly reduce the risk of accidents. Always drive cautiously and stay aware of your surroundings.

Traffic Fatalities

This section provides an overview of traffic fatalities in New Jersey for 2023, including various types of fatalities and the total number of incidents.

New Jersey Traffic Fatalities by Driver Type

| Type | Total |

|---|---|

| Traffic Fatalities | 624 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 331 |

| Motorcyclist Fatalities | 83 |

| Drivers Involved in Fatal Crashes | 865 |

| Pedestrian Fatalities | 183 |

| Bicyclist and other Cyclist Fatalities | 17 |

Understanding the statistics behind traffic fatalities can help promote safer driving practices. Stay informed and always prioritize safety on the road.

Traffic Fatalities by Person Type

Discover the breakdown of traffic fatalities by person type in New Jersey. This data highlights the different groups affected by traffic incidents.

New Jersey Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Occupants (Enclosed Vehicles) | 340 |

| Motorcyclists | 83 |

| Non-Occupants | 32 |

Awareness of how different road users are impacted by traffic incidents can inform better safety measures and personal driving habits. Stay safe and considerate of all road users.

Fatalities by Crash Type

This section details the types of crashes that result in fatalities in New Jersey, providing insights into the most common and dangerous crash scenarios.

New Jersey Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Single Vehicle | 380 |

| Involving a Large Truck | 54 |

| Involving Speeding | 120 |

| Involving a Rollover | 72 |

| Involving a Roadway Departure | 266 |

| Involving an Intersection (or Intersection Related) | 197 |

Recognizing the most dangerous types of crashes can help you adopt safer driving habits and avoid risky situations. Drive responsibly to reduce the risk of fatal accidents.

Five-Year Trend for the Top 10 Counties

Examine the five-year trend of traffic fatalities in the top 10 counties in New Jersey. This data shows how fatality rates have changed over time in different regions.

New Jersey Car Crash Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Atlantic County | 40 | 42 | 44 |

| Burlington County | 50 | 54 | 55 |

| Camden County | 65 | 68 | 72 |

| Essex County | 80 | 84 | 88 |

| Gloucester County | 45 | 47 | 50 |

| Middlesex County | 75 | 79 | 80 |

| Monmouth County | 60 | 63 | 66 |

| Morris County | 35 | 37 | 39 |

| Ocean County | 62 | 58 | 64 |

| Union County | 55 | 57 | 60 |

Understanding long-term trends in traffic fatalities can guide efforts to improve road safety. Stay informed about your county’s statistics to contribute to a safer community.

Fatalities Involving Speeding by County

This section highlights the fatalities involving speeding by county in New Jersey over the past five years. It underscores the impact of speeding on road safety.

New Jersey Speeding Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Atlantic | 10 | 12 | 13 |

| Bergen | 12 | 15 | 16 |

| Burlington | 15 | 18 | 19 |

| Camden | 18 | 20 | 21 |

| Cape May | 6 | 7 | 8 |

| Cumberland | 8 | 10 | 11 |

| Essex | 24 | 25 | 27 |

| Gloucester | 11 | 13 | 14 |

| Hudson | 9 | 11 | 12 |

| Hunterdon | 4 | 5 | 6 |

| Mercer | 7 | 9 | 10 |

| Middlesex | 19 | 22 | 24 |

| Monmouth | 20 | 21 | 23 |

| Morris | 10 | 12 | 13 |

| Ocean | 14 | 17 | 18 |

| Passaic | 12 | 14 | 15 |

| Salem | 5 | 6 | 7 |

| Somerset | 8 | 10 | 11 |

| Sussex | 6 | 7 | 8 |

| Union | 11 | 13 | 14 |

| Warren | 5 | 6 | 7 |

Speeding significantly increases the risk of fatal accidents. Always adhere to speed limits and drive at safe speeds to protect yourself and others.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Explore the fatalities in crashes involving alcohol-impaired drivers by county in New Jersey. This data emphasizes the deadly consequences of drunk driving.

New Jersey DUI Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Atlantic | 7 | 9 | 10 |

| Bergen | 12 | 14 | 15 |

| Burlington | 12 | 14 | 15 |

| Camden | 15 | 17 | 18 |

| Cape May | 4 | 5 | 6 |

| Cumberland | 6 | 7 | 8 |

| Essex | 22 | 24 | 25 |

| Gloucester | 10 | 12 | 13 |

| Hudson | 11 | 12 | 13 |

| Hunterdon | 2 | 3 | 4 |

| Mercer | 8 | 10 | 11 |

| Middlesex | 18 | 20 | 21 |

| Monmouth | 16 | 18 | 19 |

| Morris | 8 | 9 | 10 |

| Ocean | 11 | 13 | 14 |

| Passaic | 9 | 11 | 12 |

| Salem | 3 | 4 | 5 |

| Somerset | 6 | 8 | 9 |

| Sussex | 5 | 6 | 7 |

| Union | 14 | 16 | 17 |

| Warren | 4 | 5 | 6 |

Driving under the influence is a leading cause of fatal accidents. Stay responsible and never drive while impaired to ensure the safety of everyone on the road.

Teen Drinking and Driving

Learn about the impact of alcohol-impaired driving among teens in New Jersey. This section provides data on fatalities and DUI arrests involving young drivers.

New Jersey Teens and Drunk Driving

| Teens and Drunk Driving | Data |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 0.3 |

| Higher/Lower Than National Average (1.2) | lower |

| DUI Arrest (Under 18 years old) | 129 |

| DUI Arrests (Under 18 years old) Total Per Million People | 65 |

| US Rank of Under 18 DUI Arrests | 32nd |

Teen drinking and driving is a serious issue that requires attention and education. Encourage safe driving habits among teens to prevent tragic accidents and save lives.

EMS Response Time

This section compares EMS response times in rural and urban areas of New Jersey. Understanding these times can highlight areas for improvement in emergency services.

New Jersey EMS Response Times by Location

| Location | Time of Crash to EMS Notification | EMS Notification to EMS Arrival |

|---|---|---|

| Rural | 4 minutes | 13 minutes |

| Urban | 5 minutes | 8 minutes |

Timely EMS response is crucial in saving lives after an accident. Continued efforts to improve response times can enhance the overall safety and effectiveness of emergency services in both rural and urban areas.

Transportation

If you live in New Jersey, chances are you own one or two cars for your household, drive alone to work, and spend 10-34 minutes commuting.

Commute Time

With an average commute time of 30.6 minutes, New Jersey ranks above the national average of 25.3 minutes. That means 5.42 percent of New Jersey residents suffer through a “super commute” spending in excess of 90 minutes in the car.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Final Word on Comparing New Jersey Car Insurance Rates

New Jersey car insurance can be expensive, especially if you choose to add on additional coverages besides the basics. The good news is that taking the time to compare New Jersey car insurance rates will help you get a better rate.

If you want to get started on finding the best New Jersey car insurance, take a look at our free comparison tool. It will help you compare rates from companies in New Jersey to get the cheapest rate.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

How can I compare car insurance rates in New Jersey?

To compare car insurance rates in New Jersey, gather your vehicle and driving information, research reputable insurers, request quotes, compare coverage options and costs, and select the policy that best fits your budget and needs.