Cheapest Louisiana Car Insurance Rates in 2025 (Top 10 Low-Cost Companies)

Erie, State Farm, and Geico are the top providers for cheapest Louisiana car insurance rates, with rates at $22/month. Erie excels in comprehensive coverage, State Farm provides competitive rates, and Geico is known for its affordability. Explore how these companies can lower your Louisiana car insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top pick overall for the cheapest Louisiana car insurance rates are Erie, State Farm, and Geico. Erie excels with comprehensive coverage and top-notch service, while State Farm offers competitive rates starting at $22/month. Geico is known for its affordability and various discounts.

This guide covers everything from rates to state laws, helping you make informed decisions to save on Louisiana car insurance. Learn more in our “What is the best car insurance?”

Our Top 10 Company Picks: Cheapest Louisiana Car Insurance Rates

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A+ | Multi-Policy Discount | Erie |

| #2 | $33 | B | Competitive Rates | State Farm | |

| #3 | $38 | A++ | Affordable Premiums | Geico | |

| #4 | $42 | A++ | Financial Stability | Travelers | |

| #5 | $43 | A+ | Innovative Usage | Progressive | |

| #6 | $47 | A | Many Discounts | American Family | |

| #7 | $48 | A+ | Comprehensive Coverage | Nationwide |

| #8 | $55 | A+ | Safe-Driving Discounts | Allstate | |

| #9 | $57 | A | Local Agents | Farmers | |

| #10 | $73 | A | Customizable Policies | Liberty Mutual |

This guide has all the car insurance information that you’d ever want to know about Louisiana: coverage and rates, car insurance providers, state laws, and lots of other stuff.

- Compare Louisiana Car Insurance Rates

- Best Winnsboro, LA Car Insurance in 2025

- Best Shreveport, LA Car Insurance in 2025

- Best Ruston, LA Car Insurance in 2025

- Best New Orleans, LA Car Insurance in 2025

- Best Leesville, LA Car Insurance in 2025

- Best Lena, LA Car Insurance in 2025

- Best Kenner, LA Car Insurance in 2025

- Best Hammond, LA Car Insurance in 2025

- Best Covington, LA Car Insurance in 2025

- Best Crowley, LA Car Insurance in 2025

- Best Bourg, LA Car Insurance in 2025

- Best Bentley, LA Car Insurance in 2025

- Best Baton Rouge, LA Car Insurance in 2025

- Best Bossier City, LA Car Insurance in 2025

- Best Lafayette, LA Car Insurance in 2025

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- Erie offers the cheapest Louisiana car insurance rates

- Explore rates, state laws, and tips to save on Louisiana car insurance

- Find out the penalties for driving without insurance in Louisiana

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Multi-Policy Discounts: Erie offers substantial savings when you bundle multiple insurance policies.

- Affordable Premiums: As mentioned in our Erie car insurance review, Erie has the lowest monthly rates, making it very cost-effective.

- A+ Rating: Erie holds a strong A+ rating from A.M. Best, indicating excellent financial stability.

Cons

- Limited Availability: Erie’s coverage is not available in all states.

- Online Tools: The online tools and resources may not be as advanced as some competitors.

#2 – State Farm: Best for Competitive Rates

Pros

- Competitive Rates: State Farm provides affordable rates that are competitive in the market.

- Customer Service: State Farm is known for its excellent customer service and local agent support.

- Bundling Discounts: Offers significant discounts when bundling multiple policies. Unlock details in our State Farm car insurance review.

Cons

- Premium Costs: Despite competitive rates, some coverage levels might still be relatively expensive.

- Limited Discounts: The range of discounts available may be less comprehensive compared to some competitors.

#3 – Geico: Best for Affordable Premiums

Pros

- Affordable Premiums: Geico offers some of the lowest premiums in the industry.

- High Customer Satisfaction: Geico consistently receives high marks for customer satisfaction.

- A++ Rating: Holds an A++ rating from A.M. Best, the highest possible rating for financial stability. Learn more in our Geico car insurance review.

Cons

- Limited Local Agents: Geico has fewer local agents, which may impact personalized service.

- Complex Claims Process: Some customers have reported a more complex claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Financial Stability

Pros

- Financial Stability: Travelers boasts an A++ rating from A.M. Best, indicating strong financial health.

- Variety of Coverage: Offers a wide variety of coverage options to meet different needs. See more details on our Travelers car insurance review.

- Discounts: Provides multiple discount opportunities for safe driving, multi-policy, and more.

Cons

- Higher Premiums: Premium rates are on the higher side compared to some competitors.

- Customer Service: Mixed reviews on customer service experiences.

#5 – Progressive: Best for Innovative Usage

Pros

- Innovative Tools: Progressive is known for its innovative usage-based insurance options.

- Wide Coverage Options: Offers a broad range of coverage options to fit various needs.

- Strong Financial Rating: Holds an A+ rating from A.M. Best, ensuring reliability. Delve into our evaluation of Progressive car insurance review.

Cons

- Higher Rates: Monthly premiums can be higher than average for some drivers.

- Complex Discounts: The discount structure can be complex and difficult to navigate.

#6 – American Family: Best for Many Discounts

Pros

- Many Discounts: Offers numerous discounts, making it easier to save on premiums.

- Customer Service: Known for strong customer service and support.

- Comprehensive Coverage: American Family car insurance review provides a wide range of coverage options.

Cons

- Availability: Not available in all states, limiting accessibility.

- Premium Costs: Rates can be higher for those without qualifying discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Offers extensive coverage options to meet diverse needs.

- Financial Strength: Holds an A+ rating from A.M. Best, indicating solid financial stability.

- Discounts: Provides a variety of discounts to help reduce premiums. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Higher Premiums: Monthly premiums can be on the higher side.

- Digital Experience: Online tools and digital experience may not be as advanced as competitors.

#8 – Allstate: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Offers significant discounts for safe driving habits.

- Local Agents: Strong network of local agents for personalized service.

- Comprehensive Coverage: Allstate car insurance review provides a variety of coverage options.

Cons

- High Premiums: Premium rates are relatively high compared to other providers.

- Mixed Reviews: Customer service reviews are mixed, with some negative feedback.

#9 – Farmers: Best for Local Agents

Pros

- Local Agents: Extensive network of local agents for personalized service.

- Customizable Policies: Offers a range of customizable policy options. Learn more in our Farmers car insurance review.

- Strong Financial Rating: Holds an A rating from A.M. Best, indicating good financial stability.

Cons

- Premium Costs: Monthly premiums are relatively high.

- Limited Discounts: Fewer discount opportunities compared to some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Offers highly customizable policy options to fit individual needs. Learn more in our Liberty Mutual car insurance review.

- Strong Financial Rating: Holds an A rating from A.M. Best, ensuring financial reliability.

- Comprehensive Coverage: Provides a wide range of coverage options.

Cons

- High Premiums: Monthly premiums are on the higher end.

- Customer Service: Mixed reviews on customer service experiences.

Louisiana Car Insurance Coverage and Rates

The table displays the monthly car insurance rates in Louisiana by coverage level and provider. Erie offers the most economical rates, with $22 for minimum coverage and $58 for full coverage, while Liberty Mutual charges the highest rates at $73 for minimum coverage and $274 for full coverage. Full coverage costs significantly more than minimum coverage across all providers, reflecting the comprehensive protection it offers.

Louisiana Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $55 | $206 |

| American Family | $47 | $176 |

| Erie | $22 | $58 |

| Farmers | $57 | $212 |

| Geico | $38 | $141 |

| Liberty Mutual | $73 | $274 |

| Nationwide | $48 | $181 |

| Progressive | $43 | $161 |

| State Farm | $33 | $124 |

| Travelers | $42 | $156 |

Geico and State Farm offer moderate rates. Geico charges $38 for minimum coverage and $141 for full coverage, while State Farm’s rates are $33 and $124, respectively. Allstate and Farmers have higher rates for both coverage levels. This data highlights the variability in insurance costs based on the provider and the level of coverage, emphasizing the need for consumers to compare rates and coverage details when selecting a car insurance policy.

Minimum Car Insurance Requirements in Louisiana

Louisiana requires drivers to maintain minimum car insurance coverage to legally operate vehicles. These requirements mandate bodily injury coverage of $15,000 per person and $30,000 per accident, alongside property damage coverage of at least $25,000.

Louisiana Car Insurance Minimum Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Coverage | $15,000 per person $30,000 per accident |

| Property Damage Coverage | $25,000 |

Liability car insurance pays anyone owed compensation when there is an accident you caused. This type of insurance covers both bodily injury and property damage to others.

Louisiana follows the typical “fault” model. This means if an accident was your fault, you’re responsible for all the damages.

Remember, these are the minimum requirements and do not cover injury, death, or damage to yourself or your own passengers.

Liability kicks in, however, no matter who is driving your car. If you’re from out of state, your minimum car insurance requirements and rates could change. Take a look.

These limits are designed to provide basic financial protection for drivers in the event of accidents, covering medical expenses and property damage costs as necessary.

Required Forms of Financial Responsibility in Louisiana

By law in Louisiana, you are required to have valid liability insurance to be able to register your car or renew your registration. If you have renewed your registration online or bought a car from a dealer and registered it, the Louisiana Office of Motor Vehicles (OMV), can verify your car insurance electronically. If you are stopped by law enforcement, you are required, by law, to show proof of insurance.

Louisiana accepts the following as proof of insurance or financial responsibility:

- Insurance card.

- Copy of your insurance policy.

- A copy of your policy declaration page.

- Cash/unencumbered negotiable securities worth $30,000.

- Surety bond worth $30,000.

OR a statement from your insurer that must:

- Be on your car insurance company’s letterhead.

- Be signed by your insurance agent or a representative of the company.

- Have a complete description of your vehicle.

- Have your vehicle identification number (VIN).

Being caught without proof of insurance in Louisiana can give a police officer the authority to give you a Temporary Vehicle Use Authorization, or impound your vehicle.

Premiums as Percentage of Income in Louisiana

So, how much will you have to spend in Louisiana after all the necessities are taken care of? In 2014, the monthly per capita disposable personal income in Louisiana was $3,149.

Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

The average monthly cost of car insurance in Louisiana is $113, which is almost 4 percent of the average disposable personal income.

The average Louisiana resident has $3,148 each month to buy food, pay bills etc. The car insurance bill alone deducts about $113 out of that — much more if you have a less-than-perfect driving record.

Why is getting the best deal on car insurance so important? American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With Louisiana’s DPI, that’s a whopping $630 each month. How much are you setting aside for savings?

Average Monthly Car Insurance Rates in LA (Liability, Collision, Comprehensive)

In Louisiana, drivers face varying average monthly car insurance rates depending on their chosen coverage types. These rates highlight the importance of selecting insurance options that align with both legal obligations and individual financial planning in Louisiana.

Louisiana Car Insurance Monthly Rates by Coverage Type

| Coverage Types | Rates |

|---|---|

| Collision | $35 |

| Full Coverage | $117 |

| Comprehensive | $18 |

| Liability | $65 |

The above table illustrates the most recent data provided by the leading source on the matter, the National Association of Insurance Commissioners. Expect car insurance rates in Louisiana to be significantly higher for 2019 and on.

Louisiana has seen several car insurance increases, as recently as last year.

Don’t forget: Louisiana has minimum requirements for liability coverage, but experts suggest drivers purchase more than what state law requires, especially when the state is an “at-fault” state like Louisiana.

You may be wondering: Why get more coverage than required? Louisiana has no snow, and no slippery roads to make for dangerous driving conditions (though it does have poor road conditions, ranked at the 40th worst roads in the United States). It is also a state that is highly rural, as opposed to urbanized.

Well, Louisiana tends to have more friendly judges willing to pay out more for bodily injury claims. According to USA Today, Louisiana has a large number of bad drivers making big claims and suing each other in front of friendly judges. This leads to high insurance payouts, which in turn leads to higher rates.

With this mind, in case you end up in court, you may want comprehensive coverage. We can also easily how average car insurance rates in Louisiana compare with other states. Let’s make a case and talk about the most popular coverage options to add to a basic car insurance policy.

Additional Liability Coverage in Louisiana

A loss ratio shows how much a company spends on claims to how much money they take in on premiums. A loss ratio of 60 percent indicates the company spent $60 on claims out of every $100 earned in premiums.

It is assumed that drivers in Louisiana will have uninsured or underinsured motorist coverage as state laws often mandate this type of insurance to protect motorists from financial loss in accidents where the at-fault driver lacks sufficient insurance.

“Louisiana’s uninsured motorist coverage differs from other states’ laws. Louisiana assumes that motorists have uninsured motorist coverage unless it is specifically rejected. It’s a subtle difference that becomes very important when filing a lawsuit”

Louisiana ranked 20th in the nation in 2015 for uninsured or underinsured drivers.

If you notice, loss ratios in Louisiana are high. If they go past 100 percent, it means that the insurance company is losing money, and these assumptions of having coverage might be the reasoning behind the high loss ratios for insurance companies in Louisiana. And it CAN be proven in court that you may not have rejected coverage, as Louisiana lawyer Tim Young told FreeAdvice.com:

“…we have absolutely handled cases where we’re able to show that the individual purchasing the policy never rejected such coverage. Courts will hold that they are entitled to UM or underinsured coverage unless they have specifically signed off on the rejection form.”

Long story short: if you don’t want the coverage, sign the rejection form. This ensures you officially decline the offer and avoid any future misunderstandings about your coverage preferences.

Add-ons, Endorsements, and Riders

We know getting the complete coverage you need for an affordable price is your goal.

Good news: there are lots of powerful but cheap extras you can add to your policy.

Do you know what’s crazy? Louisiana has hot summers, with temperatures reaching upward of almost and over 90 degrees.

As the weather can be wildly unpredictable, it’s best to be prepared for whatever Mother Nature throws at you.

Don’t get blown away by high car insurance premiums. Start comparison shopping today using our FREE online tool. Enter your ZIP code above to get started.

Here’s a list of other useful coverage available to you in Louisiana:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates by Age & Gender in LA

A popular myth: men pay more for car insurance. However, this myth mainly seems to hold true if you are a 17-year-old male in Louisiana. All other ages, it varies.

Different insurance providers offer varying rates, influenced by factors such as coverage options, deductibles, and individual driving records.

Louisiana Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $971 | $771 | $424 | $391 | $355 | $355 | $366 | $366 |

| Geico | $1,122 | $1,064 | $267 | $276 | $329 | $286 | $417 | $342 |

| Progressive | $1,531 | $1,377 | $403 | $396 | $323 | $347 | $314 | $290 |

| State Farm | $878 | $700 | $297 | $265 | $238 | $238 | $218 | $218 |

| USAA | $784 | $668 | $300 | $274 | $220 | $223 | $216 | $218 |

Additionally, the geographic location where the vehicle is primarily driven plays a significant role in determining premiums. Insurance companies also consider the type and age of the vehicle, as well as its safety features, when calculating rates.

Cheapest Louisiana Car Insurance Rates by ZIP Code

Where you live plays a significant role in determining the cost of your car insurance premiums. Insurance companies consider various factors related to your location to assess risk and set prices.

Louisiana Car Insurance Monthly Rates for the 25 Cheapest ZIP Codes

| ZIP Code | City | Monthly Rates | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|---|

| 71439 | Hornbeck | $361 | Allstate | $451 | USAA | $266 |

| 71443 | Kurthwood | $363 | Allstate | $451 | USAA | $248 |

| 71459 | Fort Polk | $366 | Allstate | $465 | USAA | $248 |

| 71446 | Leesville | $367 | Allstate | $465 | USAA | $248 |

| 71403 | Anacoco | $369 | Allstate | $451 | USAA | $285 |

| 71474 | Simpson | $370 | Allstate | $465 | USAA | $264 |

| 71461 | Newllano | $370 | Allstate | $465 | USAA | $264 |

| 71475 | Slagle | $373 | Allstate | $465 | USAA | $285 |

| 71075 | Springhill | $373 | Allstate | $451 | State Farm | $285 |

| 71429 | Florien | $373 | Allstate | $451 | State Farm | $284 |

| 71071 | Sarepta | $373 | Allstate | $451 | State Farm | $286 |

| 71449 | Many | $379 | Allstate | $451 | State Farm | $295 |

| 71426 | Fisher | $381 | Allstate | $451 | USAA | $296 |

| 71486 | Zwolle | $382 | Progressive | $467 | State Farm | $292 |

| 71462 | Noble | $382 | Progressive | $467 | State Farm | $295 |

| 71468 | Provencal | $383 | Allstate | $451 | USAA | $298 |

| 71016 | Castor | $383 | Allstate | $451 | State Farm | $296 |

| 71072 | Shongaloo | $383 | Progressive | $453 | State Farm | $284 |

| 71048 | Lisbon | $383 | Allstate | $451 | State Farm | $302 |

| 71001 | Arcadia | $384 | Allstate | $451 | State Farm | $300 |

| 71045 | Jamestown | $384 | Allstate | $451 | State Farm | $303 |

| 71460 | Negreet | $384 | Allstate | $451 | USAA | $296 |

| 71406 | Belmont | $384 | Progressive | $468 | USAA | $296 |

| 71068 | Ringgold | $384 | Allstate | $451 | State Farm | $309 |

| 71038 | Haynesville | $386 | Progressive | $453 | State Farm | $298 |

Hornbeck residents, depending on the ZIP code, have the cheapest monthly rates when it comes to car insurance. However, there are some areas where you will pay much more for car insurance than Hornbeck residents.

Louisiana Car Insurance Monthly Rates for the 25 Most Expensive ZIP Codes

| ZIP Code | City | Monthly Rates | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|---|

| 70117 | New Orleans | $775 | Progressive | $946 | USAA | $528 |

| 70127 | New Orleans | $771 | Progressive | $950 | USAA | $546 |

| 70128 | New Orleans | $767 | Progressive | $957 | USAA | $547 |

| 70126 | New Orleans | $763 | Progressive | $933 | USAA | $552 |

| 70129 | New Orleans | $760 | Progressive | $940 | USAA | $547 |

| 70113 | New Orleans | $757 | Progressive | $946 | USAA | $517 |

| 70145 | New Orleans | $753 | Progressive | $946 | USAA | $476 |

| 70146 | New Orleans | $753 | Progressive | $946 | USAA | $476 |

| 70116 | New Orleans | $751 | Progressive | $941 | USAA | $519 |

| 70122 | New Orleans | $745 | Progressive | $946 | USAA | $483 |

| 70148 | New Orleans | $740 | Progressive | $946 | USAA | $476 |

| 70119 | New Orleans | $738 | Progressive | $941 | USAA | $501 |

| 70139 | New Orleans | $723 | Progressive | $941 | USAA | $476 |

| 70163 | New Orleans | $712 | Progressive | $946 | USAA | $476 |

| 70130 | New Orleans | $712 | Progressive | $941 | USAA | $476 |

| 70112 | New Orleans | $712 | Progressive | $941 | USAA | $476 |

| 70170 | New Orleans | $710 | Progressive | $941 | USAA | $476 |

| 70125 | New Orleans | $705 | Progressive | $926 | USAA | $500 |

| 70114 | New Orleans | $682 | Progressive | $941 | USAA | $487 |

| 70032 | Arabi | $667 | Progressive | $935 | USAA | $467 |

| 70058 | Harvey | $660 | Progressive | $926 | USAA | $451 |

| 70131 | New Orleans | $658 | Progressive | $951 | USAA | $459 |

| 70053 | Gretna | $658 | Progressive | $921 | USAA | $455 |

| 70072 | Marrero | $655 | Progressive | $897 | USAA | $494 |

| 70043 | Chalmette | $654 | Progressive | $938 | USAA | $467 |

New Orleans boasts a significant concentration of the most expensive ZIP codes in the region. This city is home to numerous neighborhoods where property values and living costs rank among the highest.

Louisiana Car Insurance Rates by City

The table below shows which cities have the cheapest car insurance rates. Unsurprisingly, Hornbeck is the cheapest city. If you live in New Orleans, you don’t really luck out when it comes to prices on car insurance. You are paying some of the most expensive rates, with prices ranging from $7,000 – $9,000.

Louisiana Car Insurance Monthly Rates for the 25 Cheapest Cities

| City | Monthly Rate | Most Expensive Company | Most Expensive Monthly Rate | Cheapest Company | Cheapest Monthly Rate |

|---|---|---|---|---|---|

| Hornbeck | $361 | Allstate | $451 | USAA | $266 |

| Kurthwood | $363 | Allstate | $451 | USAA | $248 |

| Fort Polk | $366 | Allstate | $465 | USAA | $248 |

| Leesville | $367 | Allstate | $465 | USAA | $248 |

| Anacoco | $369 | Allstate | $451 | USAA | $285 |

| Simpson | $370 | Allstate | $465 | USAA | $264 |

| New Llano | $370 | Allstate | $465 | USAA | $264 |

| Slagle | $373 | Allstate | $465 | USAA | $285 |

| Cullen | $373 | Allstate | $451 | State Farm | $285 |

| Florien | $373 | Allstate | $451 | State Farm | $284 |

| Sarepta | $373 | Allstate | $451 | State Farm | $286 |

| Many | $379 | Allstate | $451 | State Farm | $295 |

| Fisher | $381 | Allstate | $451 | USAA | $296 |

| Zwolle | $382 | Progressive | $467 | State Farm | $292 |

| Noble | $382 | Progressive | $467 | State Farm | $295 |

| Provencal | $383 | Allstate | $451 | USAA | $298 |

| Castor | $383 | Allstate | $451 | State Farm | $296 |

| Shongaloo | $383 | Progressive | $453 | State Farm | $284 |

| Lisbon | $383 | Allstate | $451 | State Farm | $302 |

| Arcadia | $384 | Allstate | $451 | State Farm | $300 |

| Jamestown | $384 | Allstate | $451 | State Farm | $303 |

| Negreet | $384 | Allstate | $451 | USAA | $296 |

| Belmont | $384 | Progressive | $468 | USAA | $296 |

| Ringgold | $384 | Allstate | $451 | State Farm | $309 |

| Haynesville | $386 | Progressive | $453 | State Farm | $298 |

The lower insurance premiums in these cities can be attributed to factors such as lower traffic volumes, fewer accidents, and reduced risk of theft. Conversely, larger cities or those with higher traffic densities typically experience higher insurance premiums due to increased risk factors.

Louisiana Car Insurance Monthly Rates for the 25 Most Expensive Cities

| City | Monthly Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|

| New Orleans | $721 | Progressive | $935 | USAA | $495 |

| Arabi | $667 | Progressive | $935 | USAA | $467 |

| Harvey | $660 | Progressive | $926 | USAA | $451 |

| Gretna | $655 | Progressive | $913 | USAA | $455 |

| Estelle | $655 | Progressive | $897 | USAA | $494 |

| Chalmette | $654 | Progressive | $938 | USAA | $467 |

| Meraux | $649 | Progressive | $940 | USAA | $467 |

| Poydras | $612 | Progressive | $943 | USAA | $406 |

| Lafitte | $607 | Progressive | $948 | State Farm | $404 |

| Barataria | $605 | Progressive | $948 | State Farm | $394 |

| Pointe A La Hache | $605 | Progressive | $943 | USAA | $406 |

| Kenner | $604 | Progressive | $906 | USAA | $461 |

| Avondale | $596 | Progressive | $869 | Allstate | $431 |

| Belle Chasse | $596 | Progressive | $832 | USAA | $406 |

| Braithwaite | $589 | Progressive | $943 | State Farm | $393 |

| Metairie | $586 | Progressive | $913 | USAA | $434 |

| Uncle Sam | $585 | Progressive | $962 | USAA | $408 |

| Burnside | $584 | Progressive | $962 | USAA | $402 |

| Port Sulphur | $582 | Progressive | $832 | USAA | $406 |

| Elmwood | $579 | Progressive | $907 | USAA | $417 |

| Baton Rouge | $566 | Progressive | $775 | USAA | $406 |

| Pilottown | $565 | Progressive | $743 | USAA | $406 |

| Boothville | $563 | Progressive | $743 | State Farm | $399 |

| Venice | $562 | Progressive | $743 | State Farm | $396 |

| Baker | $558 | Progressive | $755 | USAA | $395 |

This detailed breakdown will help you understand how location influences car insurance premiums and assist you in finding the most cost-effective options within the state.

Compare Car Insurance Rates in Your City

Discover and compare car insurance rates in your city. Whether you reside in Baton Rouge, Crowley, Lena, Bentley, Hammond, New Orleans, Bossier City, Kenner, Ruston, Bourg, Lafayette, Shreveport, Covington, Leesville, or Winnsboro, explore the varying insurance rates to make an informed decision tailored to your location.

Louisiana Car Insurance Cost by City

By exploring these varying insurance rates, you can make a well-informed decision that suits your specific location and driving requirements.

Louisiana Car Insurance Companies

So many car insurance carriers compete for your business these days, that it can be hard to know which ones are the most reliable.

No need to worry, we’ve got you covered. Keep scrolling to find out who the 10 largest providers are across Louisiana.

The 10 Largest Louisiana Car Insurance Companies’ Financial Rating

AM Best gives insurance companies financial ratings. A good score means they are highly likely to stay solvent and have the ability to pay customer claims.

Louisiana Car Insurance Financial Ratings From the Top Providers

| Insurance Company | Financial Rating |

|---|---|

| Allstate | A+ |

| Farm Bureau | A+ |

| Geico | A++ |

| Liberty Mutual | A |

| Progressive | A+ |

| Safeway | A |

| State Farm | B |

| USAA | A++ |

There are a lot of factors that go into picking the best Louisiana car insurance company. Customer praise and complaints should be two of those factors.

Car Insurance Companies With the Best Ratings

When evaluating car insurance companies, it’s crucial to consider their ratings to ensure reliability and quality service. Companies with the best ratings often demonstrate strong customer satisfaction, financial stability, and efficient claims processing, making them favorable choices for policyholders.

By choosing a highly-rated car insurance provider, policyholders can have greater peace of mind, knowing that they are backed by a reputable and trustworthy company that prioritizes their needs and satisfaction.

Companies with Most Complaints in Louisiana

It is interesting to note that, according to this Gallup poll, Millenials are the “least likely” to be fully engaged with their auto insurance provider.

Regardless of age, it doesn’t necessarily equate to dissatisfaction. Most dissatisfaction has to do with the quality of service. According to a resident from Metairie, Louisiana, this resident was less than satisfied with his or her insurance. Bear in mind, some complaints are based on general customer satisfaction, so factor that into your final decision.

Total Complaints of Insurance Companies in Louisiana

| Insurance Company | Complaint Number |

|---|---|

| Allstate | 163 |

| Amtrust | 2 |

| Farm Bureau | 323 |

| Goauto | 25 |

| Liberty Mutual | 222 |

| Progressive | 120 |

| Safeway | 30 |

| State Farm | 1,482 |

| USAA | 296 |

If you happen to have a complaint, go to the Louisiana Department of Insurance and fill out their online forms. They offer a streamlined process to address your concerns and provide assistance in resolving any issues with your insurance provider.

Best Car Insurance Rates by Company

Finding the best option involves considering factors like coverage benefits, customer service quality, and affordability. Each insurer offers unique rates and discounts that can significantly impact overall cost and satisfaction for drivers. USAA is the least expensive in Louisiana when it comes to monthly rates for car insurance.

The most expensive company, monthly, is Allstate. Read our Allstate car insurance review for more information. Many customers find Allstate’s higher premiums justified by their comprehensive coverage options and strong customer service.

Best Commute Rates in Louisiana

It is interesting and of note that Progressive and Allstate offer the same monthly rates, no matter the commute. This consistency can be advantageous for drivers who have variable commuting distances, as they can rely on a predictable monthly insurance cost.

Louisiana Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $473 | $500 |

| Geico | $503 | $523 |

| Progressive | $617 | $623 |

| State Farm | $372 | $391 |

| USAA | $352 | $374 |

Commute times are not the only factors considered when increasing or decreasing rates. Insurance companies also take into account factors such as driving history, vehicle type, age of the driver, and geographic location when determining premiums.

By comparing rates across different insurers and considering specific commute needs, drivers can make informed decisions that prioritize both savings and reliable insurance protection.

Best Coverage Rates in Louisiana

Best Credit History Rates in Louisiana

In Louisiana, understanding how credit history affects car insurance rates is crucial for finding the best premiums. Drivers with excellent credit can often secure lower insurance rates compared to those with poorer credit scores due to perceived lower risk by insurers.

Louisiana Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $166 | $197 | $296 |

| American Family | $116 | $136 | $203 |

| Farmers | $140 | $161 | $269 |

| Geico | $82 | $100 | $148 |

| Liberty Mutual | $177 | $226 | $355 |

| Metromile | $72 | $90 | $120 |

| Nationwide | $120 | $133 | $166 |

| Progressive | $109 | $138 | $206 |

| State Farm | $91 | $118 | $200 |

| Travelers | $114 | $138 | $193 |

Having good credit pays off if you are a USAA or a State Farm customer, as they offer the best rates. Those with poor credit can still find good rates at USAA, though it is almost doubled from if you have good credit.

Best Driving Record Rates in Louisiana

Drivers with clean records typically enjoy lower monthly rates, reflecting insurers’ confidence in their lower risk of accidents and claims.

Louisiana Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $160 | $225 | $188 | $270 |

| American Family | $117 | $176 | $136 | $194 |

| Farmers | $139 | $198 | $173 | $193 |

| GAINSCO | $91 | $188 | $163 | $228 |

| Geico | $80 | $132 | $106 | $216 |

| Liberty Mutual | $174 | $234 | $212 | $313 |

| Nationwide | $115 | $161 | $137 | $237 |

| Progressive | $105 | $186 | $140 | $140 |

| State Farm | $86 | $102 | $96 | $112 |

| Travelers | $99 | $139 | $134 | $206 |

| USAA | $59 | $78 | $67 | $108 |

| U.S. Average | $119 | $173 | $147 | $209 |

USAA has the best rates if you have a perfect and clean driving record. However, they only serve military members, veterans, and their families, so not everyone is eligible for their services.

Read more: What are the DUI insurance laws in Louisiana?

The 10 Largest Car Insurance Companies in Louisiana

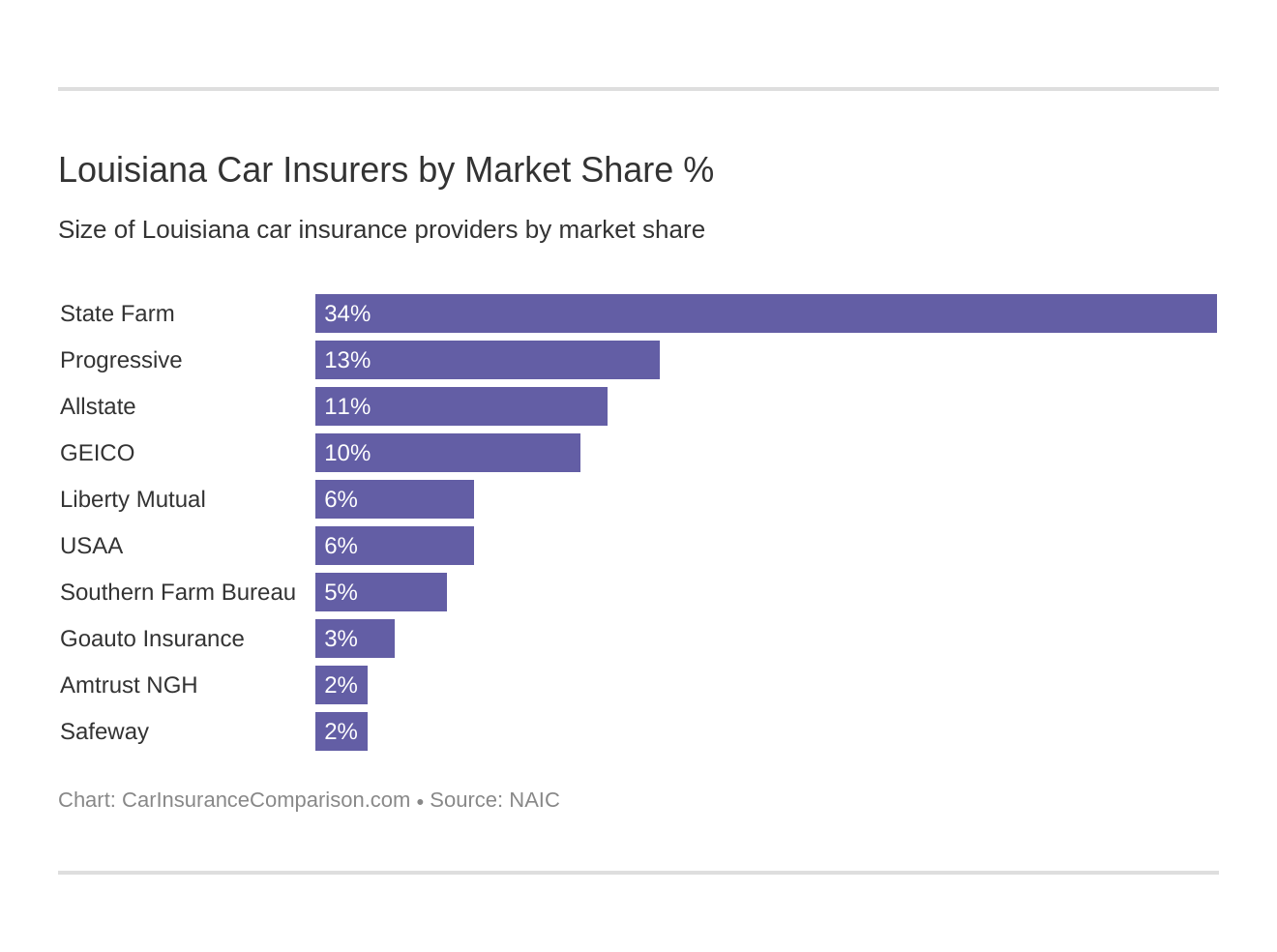

Geico maintains a significant presence with 9.59% of the market, while Liberty Mutual and USAA capture 5.63% and 5.52%, respectively. Rounding out the top ten are Farm Bureau, Goauto, Amtrust, and Safeway, each contributing to the state’s insurance market with varying market shares ranging from 3.21% down to 1.62%.

Ten Largest Car Insurance Companies in Louisiana by Market Share

| Rank | Insurance Company | Market Share |

|---|---|---|

| #1 | State Farm | 33.57% |

| #2 | Progressive | 13.37% |

| #3 | Allstate | 11.15% |

| #4 | Geico | 9.59% |

| #5 | Liberty Mutual | 5.63% |

| #6 | USAA | 5.52% |

| #7 | Farm Bureau | 5.13% |

| #8 | Goauto | 3.21% |

| #9 | Amtrust | 2.32% |

| #10 | Safeway | 1.62% |

This diversity provides Louisiana drivers with a range of options when choosing car insurance policies tailored to their needs and preferences.

Number of Car Insurance Providers in Louisiana

Understanding the number of car insurance providers available helps consumers navigate choices to find policies that best fit their needs and budget.

Total of Insurers in Louisiana

| Property and Casualty Insurance | Total Providers |

|---|---|

| Domestic | 14 |

| Foreign | 822 |

| Total | 836 |

And when it comes to domestic versus foreign insurers in Louisiana, there are 34 domestic insurers compared to 819 foreign insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laws in Louisiana

In order to keep your car insurance rates low, you have to know the laws in your state so you’re not blindsided by a fine.

Don’t worry. We’re here to help.

Keep reading to learn about the laws specific to the state of Louisiana.

Louisiana’s State Laws

Car insurance laws vary from state to state, and Louisiana is no different.

State laws for insurance are determined under Title 22, otherwise known as the Louisiana Insurance Code.

High-Risk Insurance

Drivers with a history of accidents or traffic violations may find themselves unable to purchase coverage from an auto insurance carrier. This is where a type of insurance known as high-risk insurance comes into play.

But, don’t fret.

The Louisiana Automobile Insurance Plan was created to provide automobile insurance coverage to eligible risks who seek coverage and are unable to obtain such coverage through the voluntary market.

Low-Cost Insurance

Louisiana does not have any special low-cost programs for people who don’t have insurance. It is up to you, as the consumer, to shop around for the lowest rate. You can’t afford to NOT have insurance.

Windshield Coverage

In terms of windshield coverage, Louisiana does not have any laws specific to this. Insurers may use non-OEM aftermarket parts if mentioned on the estimate. Also, it’s important to note that the maximum comprehensive deductible (what you can claim on this) is $250.

Automobile Insurance Fraud in Louisiana

The Louisiana Automobile Theft and Insurance Fraud Prevention Authority (LATIFPA) “combats motor theft, insurance fraud, and other criminal acts.”

Insurance fraud is a felony in the state of Louisiana. This serious crime can result in severe penalties, including hefty fines and imprisonment, as the state strives to maintain the integrity of its insurance system.

In 2008, the Coalition Against Insurance Fraud estimated that insurance fraud costs Americans at least $80 billion monthly, nearly $79 a month per family.

According to the Louisiana Department of Insurance, the penalty for insurance fraud, whether it’s hard (deliberate criminal acts) or soft (little white lies), is severe:

“A person convicted of insurance fraud can be sent to jail for up to five years, with or without hard labor, and/or fined up to five thousand dollars for each count of insurance fraud.”

The department emphasizes that even minor misrepresentations can result in criminal charges and a permanent record. This stringent approach aims to deter fraudulent activities and maintain the integrity of the insurance system.

Statute of Limitations

A statute of limitations is the limit on the amount of time you have to bring a lawsuit to court. Different states have different statutes of limitations for personal injury and property damage matters.

If you are ever in an auto accident involving extensive injuries and damages, you need to know your rights in the matter.

Louisiana CC 3492 states you have up to one year following an accident to file charges in court.

Louisiana’s Vehicle Licensing Laws

Now, we all know that you can’t drive a car without a license. Let’s find out what Louisiana’s mandatory vehicle licensing laws are.

Penalties for Driving Without Insurance

Louisiana has strict rules for driving without insurance. If you knowingly drive without insurance, you are subject to fines of $500 to $1,000. You’re also subject to having your driving privileges suspended and revoked for up to 180 days.

If you falsely claim to have insurance, your license can be revoked anywhere from 12-18 months.

With a law known as “No Pay, No Play”, you are prohibited from collecting the first $25,000 in property damages and the first $15,000 in personal injuries (regardless of who causes the accident) if you are uninsured.

Teen Driver Laws

Teens are at a higher risk of being involved in an auto accident and are up to 50 percent MORE likely to be in an accident in the first month of driving alone. With teen drivers and licensing teen drivers, Louisiana takes the following precautions:

Teen Driving Laws in Louisiana

| Teen Driving Laws in Louisiana | Requirements #1 | Requirements #2 | Requirements #3 |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15 | NA | NA |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 6 months | Have a minimum supervised driving time of 50 hours, 15 of which must be at night | Have a minimum age of 16 |

| Nighttime restrictions midnight-5 a.m. secondary enforcement | 11 p.m. - 5 a.m. | no more than one passenger younger than 21 between the hours of 6 pm-5 am | NA |

These laws aim to promote safety by imposing restrictions on nighttime driving, passenger limits, and cell phone use to mitigate the risks associated with inexperienced drivers.

Older Driver License Renewal Procedure

Renewing a driver’s license for older adults involves specific procedures tailored to ensure road safety and compliance with state regulations.

Older Driver and General Population License Renewal Procedure in Louisiana

| License Renewal | Proof of vision required | Mail or online renewal permitted |

|---|---|---|

| Every 6 years | 70 years and older | No for 70 years and older |

Understanding these renewal processes helps older drivers navigate requirements such as vision tests or additional assessments effectively.

New Residents

If you are about to make the move to Louisiana, here’s what you need to know:

- You need to register your out-of-state car with the OMV.

- You need to obtain a Louisiana driver’s license.

- You need to register to vote in your new county.

If you’re active duty military stationed in Louisiana, you may be exempt from these requirements.

Vehicle Negligent Injury

When it comes to Louisiana and their negligence laws, the state follows a comparative negligence system. This means that in cases of vehicle negligent injury, the fault can be distributed among multiple parties based on their degree of responsibility.

Under R.S. 14:30.1 of Louisiana driving law, vehicle negligent injury is inflicting any injury by an operator of any motor vehicle, aircraft, water-craft, or other means of conveyance when the offender is under the influence of alcohol or drugs and/or the offender’s blood alcohol concentration is 0.10 percent or more. Penalties for violations of these Louisiana traffic laws include fines of not more than $1,000 or imprisonment for not more than six months, or both.

Under this system, a victim’s compensation can be reduced by their percentage of fault in the accident. For instance, if a person is found to be 20% at fault for the accident, their compensation would be reduced by 20%. Louisiana’s negligence laws aim to ensure a fair distribution of liability and encourage safer driving practices among all road users.

Louisiana’s Rules of the Road

Now, before you get out on the open road in the Pelican State, you need to know the rules so you can stay safe and keep your car insurance rates down.

Fault vs. No-Fault

The first thing to know is that Louisiana follows a traditional fault-based system when it comes to financial responsibility for losses stemming from a crash: that includes car accident injuries, lost income, vehicle damage, and so on.

Keep Right and Move Over Laws

Louisiana is one of the few states that does have Keep Right laws. According to RS 32:71, you must keep right except to pass. You also must move right if blocking overtaking traffic.

Maximum posted speed limits are 75 mph on rural interstates, 70 mph on urban interstates, 70 mph on limited access roads, and 65 mph on all other roads.

Car Seat and Cargo Area Laws

All children five years and younger or less than 60 pounds must be restrained in a child safety seat. This requirement ensures the safety of young passengers by providing proper restraint in case of a collision.

Violation of Louisiana’s child seat law may not only put the child in danger, but could result in a fine of $100.

Using a child safety seat significantly reduces the risk of injury or death in the event of an accident. Children 6 years old and up who weigh 60 pounds or more are allowed to sit in all seats with no preference for the rear seat.

Louisiana imposes restrictions on who can ride in pickup truck cargo areas. There are gaps in coverage if you are 12 years of age on a non-interstate highway; if you are in a parade moving less than 15 mph, or if there is an emergency that requires you to be in the cargo area.

Ridesharing

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance policies that align or exceed the minimum coverages dictated by state law. Drivers rarely carry their own commercial insurance coverage. There are a few options for drivers in Louisiana if they wish to carry rideshare insurance.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS), advanced driver assistance systems (ADAS) have significantly reduced the number of accidents on highways.

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

However, the integration of these technologies also raises questions about insurance policies and liability in the event of a system failure or malfunction. Currently, Louisiana has no restrictions on autonomous vehicles.

Louisiana’s Safety Laws

But wait, there’s more. Let’s dig deeper into Louisiana’s safety laws to protect you on the open road.

DWI Laws

Louisaina’s laws for driving while intoxicated are just as strict in adjacent states. Penalties for DWI in Louisiana include hefty fines, potential jail time, and mandatory participation in substance abuse programs.

Louisiana DUI Penalties

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| License suspension | One year Two years for high BAC | Two years Four years for high BAC | Three years | Vehicle seized |

| Fine | $300 - $1000 + $100 reinstatement fee | $750 - $1000 +$200 reinstatement fee | $2000 + $300 reinstatement fee | $5000 + $300 reinstatement fee |

| Jail time | 48 hours in jail + up to six months in jail OR fine; up to two years probation | At least 48 hours | One to five years with or without hard labor | 10-30 years, two years served w/o suspension or parole + home incarceration for at least one year |

| Other | 30 hours reeducation, 32+ hours community service, half must be street garbage pickup | possible 30 days community service +reeducation requirements of 1st DUI | 30 days community service, evaluation for addictive disorder, IID, probabation and home incarceration for any part of suspended sentence | 40 days community service |

Additionally, repeat offenders face increasingly severe consequences, such as extended license suspensions and longer incarceration periods. The state also employs strict measures such as ignition interlock devices for offenders to prevent further violations.

Marijuana-Impaired Driving Laws

There are no marijuana-specific impaired driving laws in the state of Louisiana.

Distracted Driving Laws

In Louisiana, “192 people were killed from 2011 – 2015 because of some distraction either inside or outside the vehicle, and another 26,977 people were injured,” according to the Louisiana Highway Safety Commission. In an image from the LHSC, it says there are three types of distracted driving:

Louisiana has enacted legislation that bans texting for all drivers (which is a primary offense), hands-free usage in school zones, and no cell phone usage (including hands-free) for drivers under the age of 16.

Enforcement of these laws varies by jurisdiction, with some areas implementing strict measures and others focusing on public awareness campaigns. The primary goal is to enhance road safety by reducing the number of accidents caused by distracted driving.

Louisiana: Fascinating Facts You Need to Know

Do you want to know how safe it really is for drivers in Louisiana?

Well, the data our researchers found might surprise you.

Let’s take a look-see…

Vehicle Theft in Louisiana

The rise in thefts has prompted authorities to increase surveillance and implement more stringent security measures. Here are the top ten types of stolen cars in Louisiana:

Louisiana Vehicle Theft in 2023

| Vehicle | Year | Number of Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2006 | 671 |

| Ford Pickup (Full Size) | 2006 | 584 |

| GMC Pickup (Full Size) | 2006 | 253 |

| Toyota Camry | 2007 | 224 |

| Dodge Pickup (Full Size) | 2003 | 222 |

| Nissan Altima | 2014 | 215 |

| Honda Accord | 2008 | 209 |

| Chevrolet Impala | 2008 | 177 |

| GMC Yukon | 2003 | 125 |

| Chevrolet Tahoe | 2007 | 114 |

Knowing the most commonly stolen vehicles can help owners take extra precautions to protect their cars. Installing anti-theft devices, parking in well-lit areas, and staying vigilant are crucial steps in safeguarding your vehicle.

Risky/Harmful Driving Behavior

The best way to stay safe while driving is to always keep your eyes on the road and stay aware of common risky driving issues in your state.

Let’s delve into this a bit further.

Traffic Fatalities

Only three cities in Louisiana topped the list for most traffic fatalities: New Orleans, Shreveport, and Baton Rouge. It makes sense, as they are the three biggest cities in Louisiana.

Traffic Fatalities by Person Type

Analyzing traffic fatalities by person type provides crucial insights into road safety dynamics. By examining statistics across categories such as pedestrians, cyclists, and vehicle occupants, we can better understand the specific risks and preventive measures needed to reduce fatalities on our roads.

Risky & Harmful Behavior in Louisiana

| Person Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 760 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 488 |

| Motorcyclist Fatalities | 96 |

| Pedestrian Fatalities | 111 |

| Bicyclist and Other Cyclist Fatalities | 22 |

In rural areas, the number of traffic fatalities was lower than in urban areas (though not by much): 369 in rural areas versus 390 in urban areas.

Fatalities by Crash Type

Fatalities by crash type provide critical insights into the most prevalent causes of road accidents and their severity. Analyzing this data helps in identifying high-risk scenarios and implementing targeted safety measures to mitigate these risks.

Fatalities by Crash Type in Louisiana

| Crash Type | Number |

|---|---|

| Single Vehicle | 440 |

| Involving a Large Truck | 102 |

| Involving Speeding | 177 |

| Involving a Rollover | 204 |

| Involving a Roadway Departure | 421 |

| Involving an Intersection (or Intersection Related) | 141 |

Understanding these statistics can help policymakers and drivers alike prioritize safety measures and accident prevention strategies.

Five-Year Trend for the Top 10 Counties

5 Year Trend for the Top 10 Counties in Louisiana

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| East Baton Rouge Parish | 41 | 50 | 43 | 52 | 65 |

| Orleans Parish | 53 | 50 | 50 | 55 | 44 |

| Calcasieu Parish | 24 | 24 | 36 | 47 | 38 |

| Caddo Parish | 29 | 40 | 36 | 27 | 36 |

| Tangipahoa Parish | 26 | 22 | 36 | 40 | 31 |

| St. Tammany Parish | 20 | 22 | 26 | 23 | 30 |

| Terrebonne Parish | 22 | 19 | 16 | 20 | 29 |

| Ascension Parish | 23 | 23 | 19 | 21 | 28 |

| Jefferson Parish | 22 | 24 | 26 | 34 | 28 |

| Ouachita Parish | 22 | 23 | 21 | 20 | 28 |

Analyzing these trends can provide valuable insights into regional growth patterns, investment opportunities, and community resilience over time.

Fatalities Involving Speeding by County

Fatalities Involving Speeding by County in Louisiana

| County | Fatalities |

|---|---|

| Acadia Parish | 2 |

| Allen Parish | 0 |

| Ascension Parish | 7 |

| Assumption Parish | 1 |

| Avoyelles Parish | 0 |

| Beauregard Parish | 0 |

| Bienville Parish | 0 |

| Bossier Parish | 4 |

| Caddo Parish | 9 |

| Calcasieu Parish | 6 |

| Caldwell Parish | 2 |

| Cameron Parish | 0 |

| Catahoula Parish | 0 |

| Claiborne Parish | 0 |

| Concordia Parish | 0 |

| De Soto Parish | 2 |

| East Baton Rouge Parish | 5 |

| East Carroll Parish | 0 |

| East Feliciana Parish | 4 |

| Evangeline Parish | 2 |

| Franklin Parish | 1 |

| Grant Parish | 1 |

| Iberia Parish | 2 |

| Iberville Parish | 1 |

| Jackson Parish | 0 |

| Jefferson Davis Parish | 1 |

| Jefferson Parish | 3 |

| La Salle Parish | 0 |

| Lafayette Parish | 5 |

| Lafourche Parish | 11 |

| Lincoln Parish | 2 |

| Livingston Parish | 8 |

| Madison Parish | 1 |

| Morehouse Parish | 0 |

| Natchitoches Parish | 0 |

| Orleans Parish | 7 |

| Ouachita Parish | 6 |

| Plaquemines Parish | 1 |

| Pointe Coupe Parish | 2 |

| Rapides Parish | 4 |

| Red River Parish | 2 |

| Richland Parish | 1 |

| Sabine Parish | 1 |

| St. Bernard Parish | 1 |

| St. Charles Parish | 4 |

| St. Helena Parish | 1 |

| St. James Parish | 0 |

| St. John the Baptist Parish | 1 |

| St. Landry Parish | 2 |

| St. Martin Parish | 7 |

| St. Mary Parish | 1 |

| St. Tammany Parish | 10 |

| Tangipahoa Parish | 14 |

| Tensas Parish | 0 |

| Terrebonne Parish | 11 |

| Union Parish | 0 |

| Vermilion Parish | 0 |

| Vernon Parish | 6 |

| Washington Parish | 4 |

| Webster Parish | 1 |

| West Baton Rouge Parish | 4 |

| West Carroll Parish | 1 |

| West Feliciana Parish | 0 |

| Winn Parish | 2 |

Understanding these statistics can aid in identifying high-risk areas and informing targeted interventions to enhance road safety measures.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Analyzing fatalities in crashes involving alcohol-impaired drivers by county provides critical insights into regional traffic safety trends.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County in Louisiana

| County | Fatalities |

|---|---|

| Acadia Parish | 4 |

| Allen Parish | 0 |

| Ascension Parish | 7 |

| Assumption Parish | 0 |

| Avoyelles Parish | 3 |

| Beauregard Parish | 1 |

| Bienville Parish | 0 |

| Bossier Parish | 3 |

| Caddo Parish | 14 |

| Calcasieu Parish | 12 |

| Caldwell Parish | 1 |

| Cameron Parish | 1 |

| Catahoula Parish | 0 |

| Claiborne Parish | 0 |

| Concordia Parish | 0 |

| De Soto Parish | 1 |

| East Baton Rouge Parish | 19 |

| East Carroll Parish | 0 |

| East Feliciana Parish | 2 |

| Evangeline Parish | 3 |

| Franklin Parish | 2 |

| Grant Parish | 2 |

| Iberia Parish | 2 |

| Iberville Parish | 2 |

| Jackson Parish | 1 |

| Jefferson Davis Parish | 2 |

| Jefferson Parish | 6 |

| La Salle Parish | 1 |

| Lafayette Parish | 5 |

| Lafourche Parish | 5 |

| Lincoln Parish | 2 |

| Livingston Parish | 4 |

| Madison Parish | 1 |

| Morehouse Parish | 1 |

| Natchitoches Parish | 0 |

| Orleans Parish | 16 |

| Ouachita Parish | 8 |

| Plaquemines Parish | 1 |

| Pointe Parish | 3 |

| Rapides Parish | 2 |

| Red River Parish | 2 |

| Richland Parish | 1 |

| Sabine Parish | 2 |

| St. Bernard Parish | 0 |

| St. Charles Parish | 2 |

| St. Helena Parish | 6 |

| St. James Parish | 1 |

| St. John the Baptist Parish | 0 |

| St. Landry Parish | 7 |

| St. Martin Parish | 6 |

| St. Mary Parish | 3 |

| St. Tammany Parish | 6 |

| Tangipahoa Parish | 7 |

| Tensas Parish | 0 |

| Terrebonne Parish | 13 |

| Union Parish | 0 |

| Vermilion Parish | 2 |

| Vernon Parish | 3 |

| Washington Parish | 2 |

| Webster Parish | 3 |

| West Baton Rouge Parish | 5 |

| West Carroll Parish | 0 |

| West Feliciana Parish | 1 |

| Winn Parish | 0 |

Understanding these statistics can inform targeted interventions and policies aimed at reducing alcohol-related accidents and improving road safety across different counties.

Teen Drinking and Driving

Teen drinking and driving remains a critical concern due to its potential for severe consequences. This risky behavior not only endangers the lives of young drivers but also poses a significant threat to other road users.

Teens and Drunk Driving in Louisiana

| Teens and Drunk Driving | Info |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 1.3 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 32 |

| DUI Arrests (Under 18 years old) Total Per Million People | 28.73 |

Understanding the factors influencing this behavior and effective prevention strategies are essential to mitigate risks and ensure safer road conditions for young drivers.

EMS Response Time

EMS response time is a critical factor in emergency healthcare, directly impacting patient outcomes and safety. Timely arrival of emergency medical services can significantly influence the effectiveness of medical intervention and care provided to individuals in distress.

EMS Response Times in Louisiana: Rural vs Urban

| Type | Time of Crash to Notification | Arrival | Arrival at Scene to Hospital | Time of Crash to Hospital |

|---|---|---|---|---|

| Rural | 5 minutes | 14 minutes | 45 minutes | 1 hour, 3 minutes |

| Urban | 4 minutes | 8 minutes | 33 minutes | 35 minutes |

Both rural and urban areas in Louisiana have fast EMS Notification times. It is in all the other categories where they greatly differ.

Transportation

If you live in Louisiana, chances are you live in a two-car, or more, household, drive alone to work, and spend a hefty amount of your day commuting.

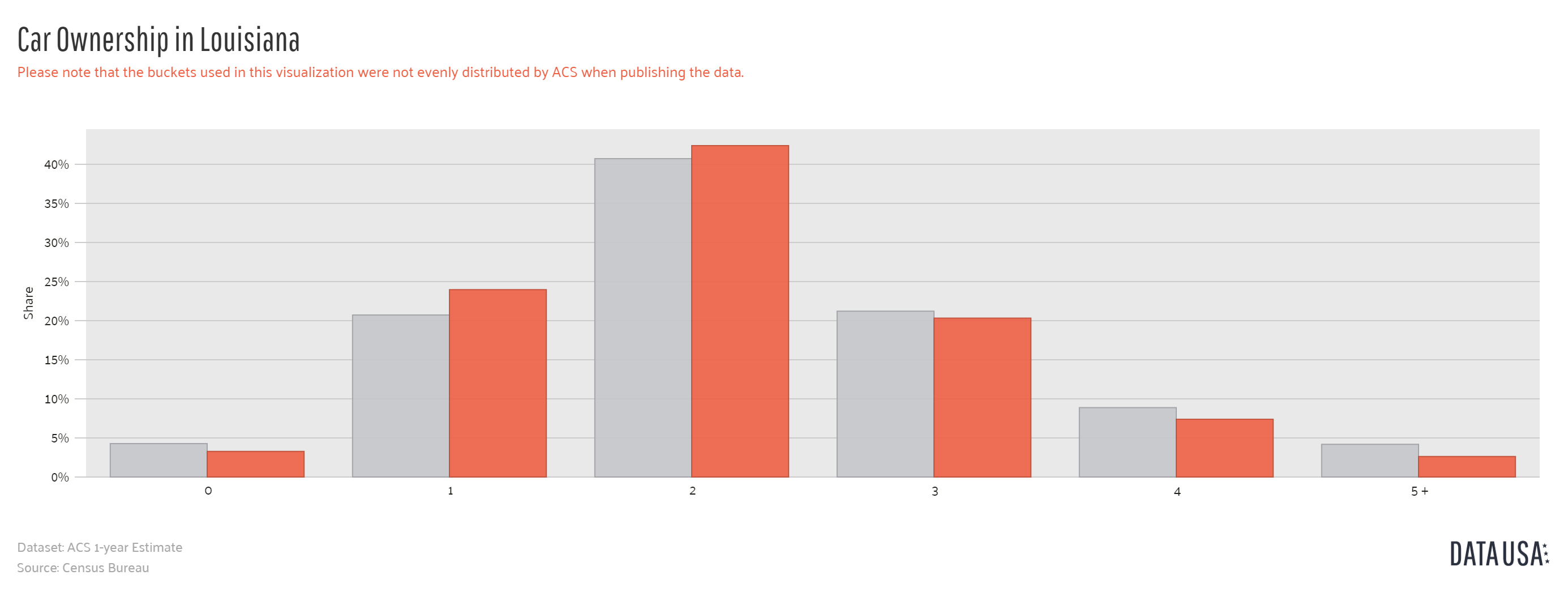

Car Ownership

Car ownership in Louisiana is a significant aspect of daily life for many residents. The state’s expansive geography, with its mix of urban and rural areas, makes having a personal vehicle essential for commuting, running errands, and exploring the diverse landscapes.

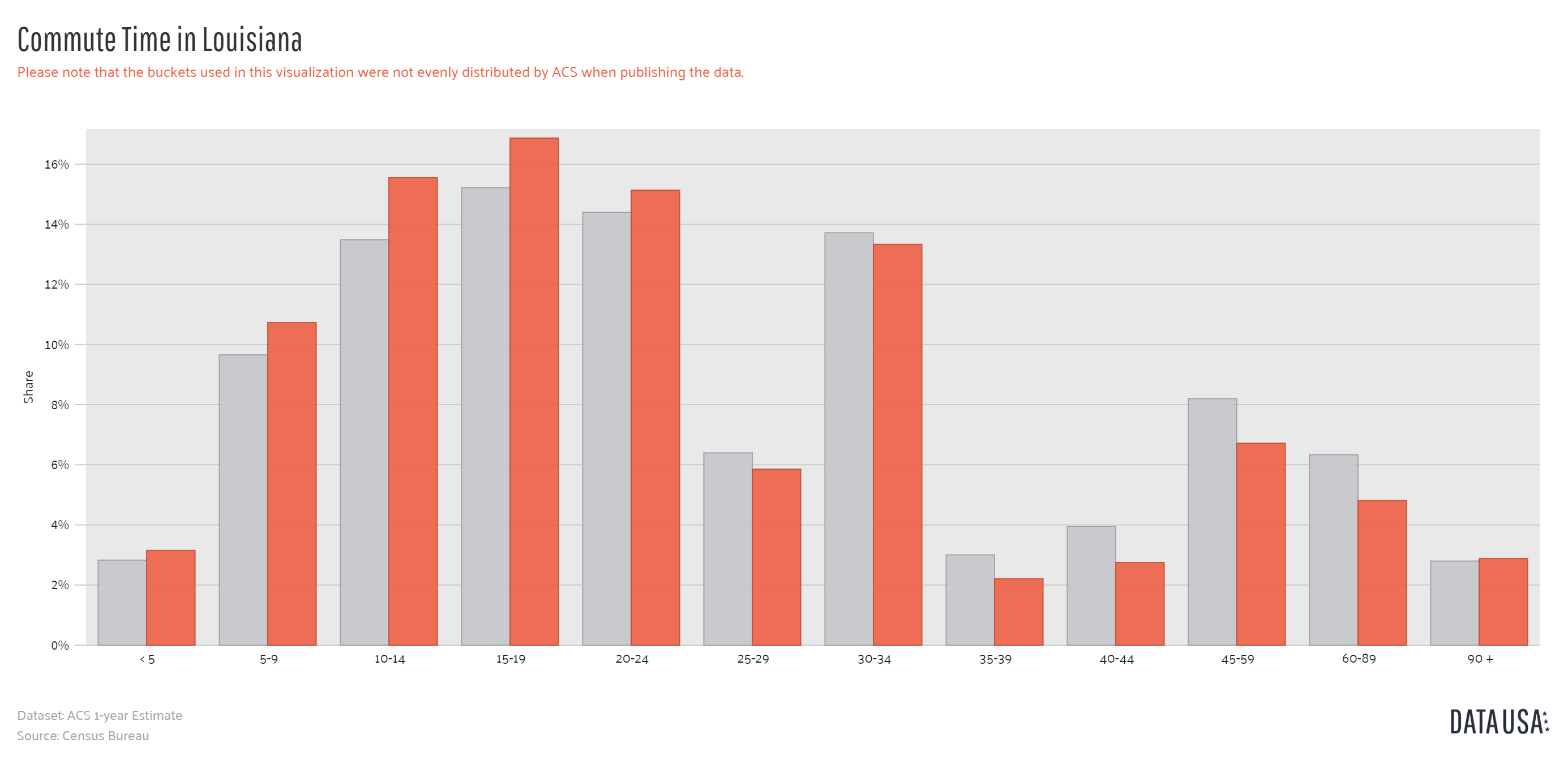

Commute Time

Commute time in Louisiana can vary significantly depending on the region and the specific circumstances of the commuter. Understanding the typical commute time in Louisiana is essential for residents and businesses to plan their daily schedules effectively and to mitigate the stress and time lost in transit.”

With an average commute time of 24.2 minutes, Louisiana ranks below the national average of 25.3 minutes, but not by much. Some Louisiana residents–2.88 percent, to be exact–suffer through a “super commute” — spending in excess of 90 minutes in the car.

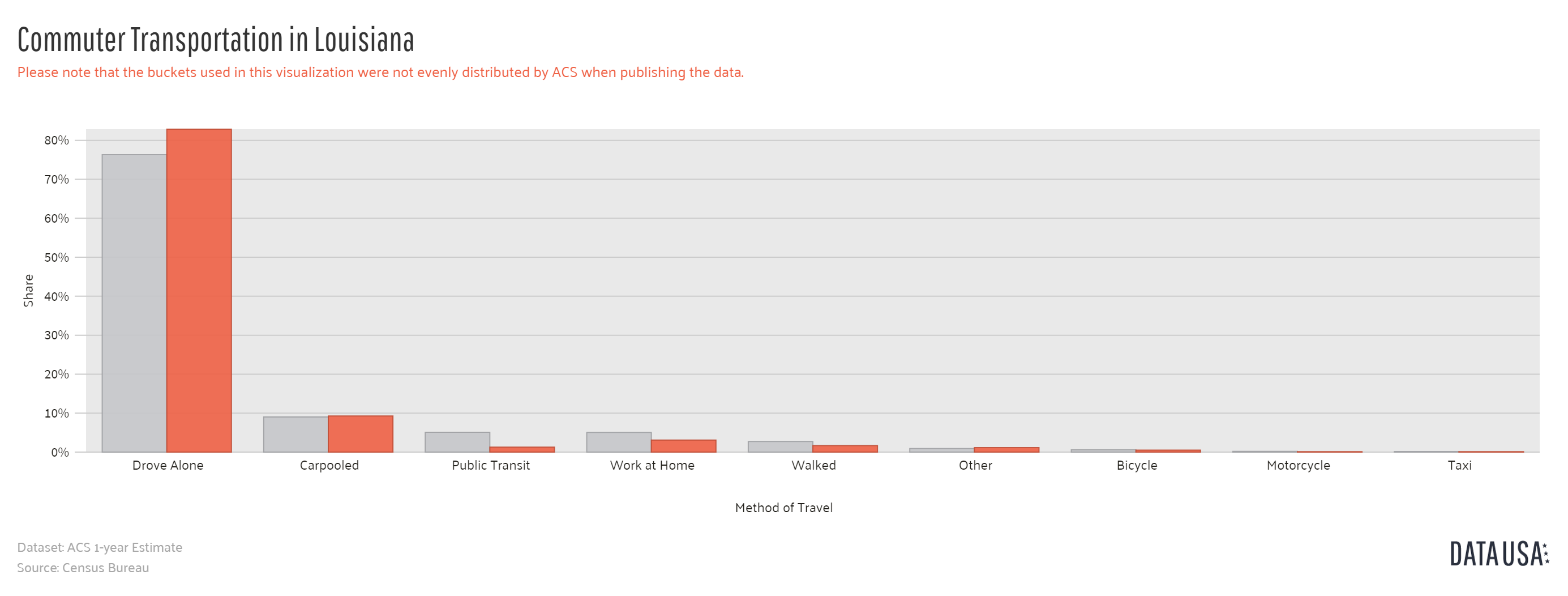

Commuter Transportation

Commuter transportation in Louisiana offers a variety of options to meet the needs of its residents. The state boasts an extensive network of highways and interstates, facilitating convenient travel by car.

Most people in Louisiana like to drive in to work alone, with carpooling the second most popular option. This preference for solo commuting is driven by the convenience and flexibility it offers, allowing individuals to adhere to their own schedules.

Traffic Congestion

Is traffic a major problem in Louisiana?

According to the INRIX Scorecard, a traffic study that ranks cities globally in terms of worst traffic congestion, the only city to make it to the list is New Orleans, ranked at 137 in the world for worst traffic, and 73 hours lost in congestion. That is fewer hours lost in congestion than in 2017, where 156 hours were lost in congestion. However, the ranking for worst traffic went up five spots: 142 in 2017 versus 137 in 2018.

Au revoir. We hope this guide for Louisiana car insurance has helped you.

Case Studies: Navigating the Cheapest Louisiana Car Insurance Rates

Explore real-life examples of finding the cheapest Louisiana car insurance rates. These case studies highlight strategies to secure affordable and comprehensive coverage from top providers like Erie, State Farm, and Geico.

- Case Study #1 – Young Driver Secures Affordable Coverage: Sarah, a 22-year-old recent college graduate, chose State Farm, which offered her a competitive rate of $22/month due to her clean driving record and good student discount. She now enjoys affordable premiums with comprehensive coverage.

- Case Study #2 – Family Finds Comprehensive Insurance With Erie: The Johnson family, with two vehicles and teenage drivers, chose Erie for comprehensive coverage and discounts for bundling multiple vehicles. They secured a robust plan with significant savings.

- Case Study #3 – High-Risk Driver Benefits From Geico’s Affordable Rates: Mark, a driver with a less-than-perfect record, chose Geico for its affordable premiums and various discounts. He now has a policy that accommodates his situation without compromising on coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum car insurance requirements in Louisiana?

In Louisiana, the minimum car insurance requirements are as follows:

- $15,000 bodily injury liability per person

- $30,000 bodily injury liability per accident

- $25,000 property damage liability per accident

Meeting these minimum requirements ensures you are legally covered but consider additional coverage for better protection.

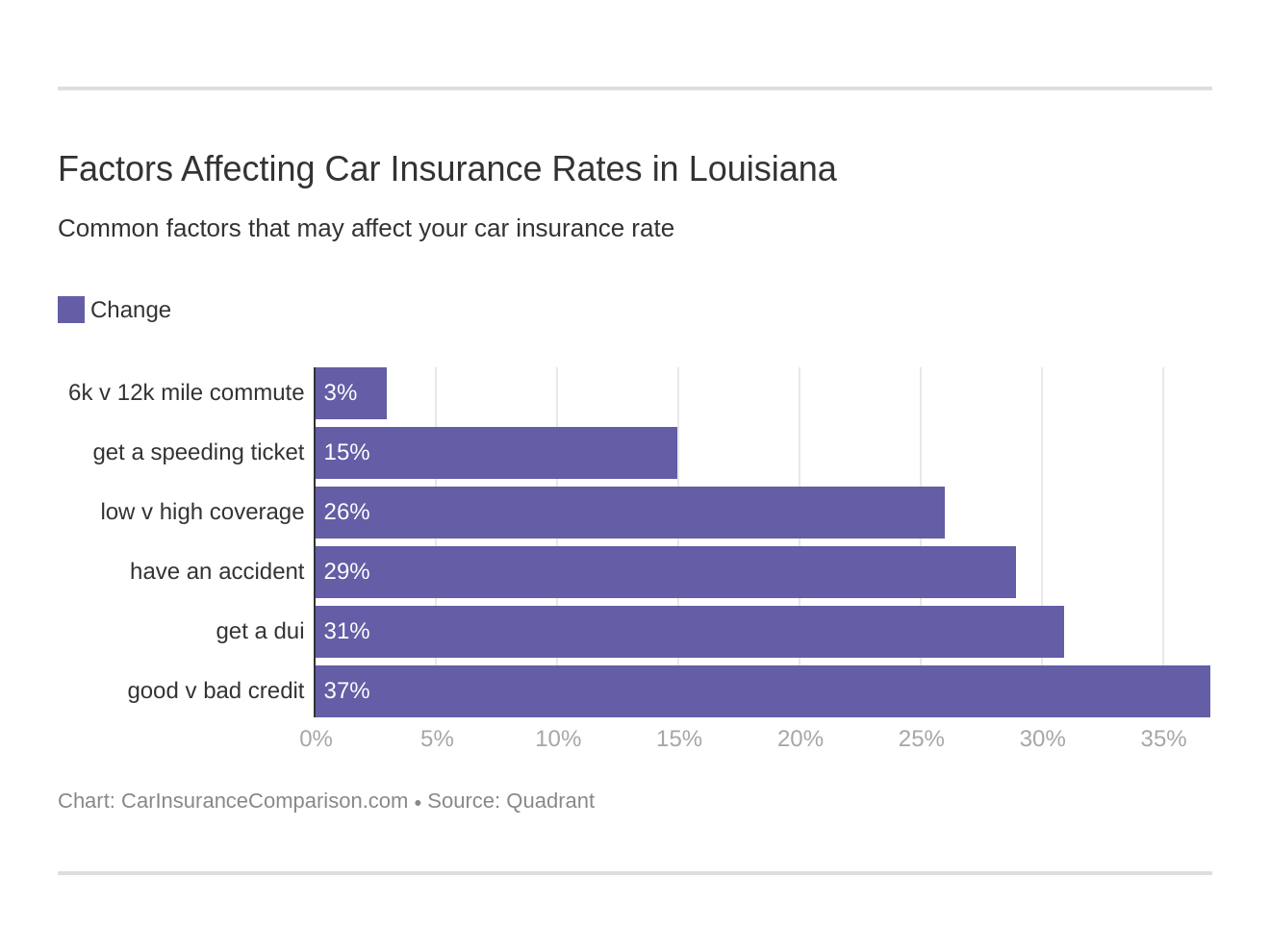

What factors can affect car insurance rates in Louisiana?

Several factors can impact car insurance rates in Louisiana, including driving record, age and gender, vehicle type, location, credit history, and coverage options. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What additional coverage options should I consider in Louisiana?

Consider additional coverage options such as uninsured/underinsured motorist coverage, comprehensive coverage, collision coverage, medical payments coverage, and personal injury protection (PIP).

How can I find affordable car insurance in Louisiana?

To find affordable car insurance, shop around for quotes, bundle policies, maintain a good driving record, increase deductibles, ask about discounts, and consider usage-based insurance.

What steps should I take after a car accident in Louisiana?

After a car accident, check for injuries, report the accident to the police, exchange information, document the scene, notify your insurance company, and seek legal advice if necessary.

What is the best company for cheapest Louisiana car insurance rates?

Erie is considered the best company for affordable and comprehensive car insurance in Louisiana, offering competitive rates and excellent service. Discover more through our guide “Compare Comprehensive Car Insurance.”

What are the penalties for driving without insurance in Louisiana?

Penalties for driving without insurance in Louisiana include fines ranging from $500 to $1,000, license suspension for up to 180 days, and potential impoundment of the vehicle.

How does Louisiana’s “No Pay, No Play” law affect uninsured drivers?

Louisiana’s “No Pay, No Play” law prevents uninsured drivers from collecting the first $25,000 in property damages and the first $15,000 in personal injuries, regardless of who caused the accident.

What discounts are available for car insurance in Louisiana?

Common discounts available in Louisiana include multi-policy, safe driver car insurance discount, good student, low mileage, and usage-based insurance discounts.

Why is it important to have more than the minimum required coverage in Louisiana?

Having more than the minimum required coverage provides better financial protection in case of severe accidents, lawsuits, or damages that exceed the minimum coverage limits. Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.