Cheapest West Virginia Car Insurance Rates in 2025 (10 Most Affordable Companies)

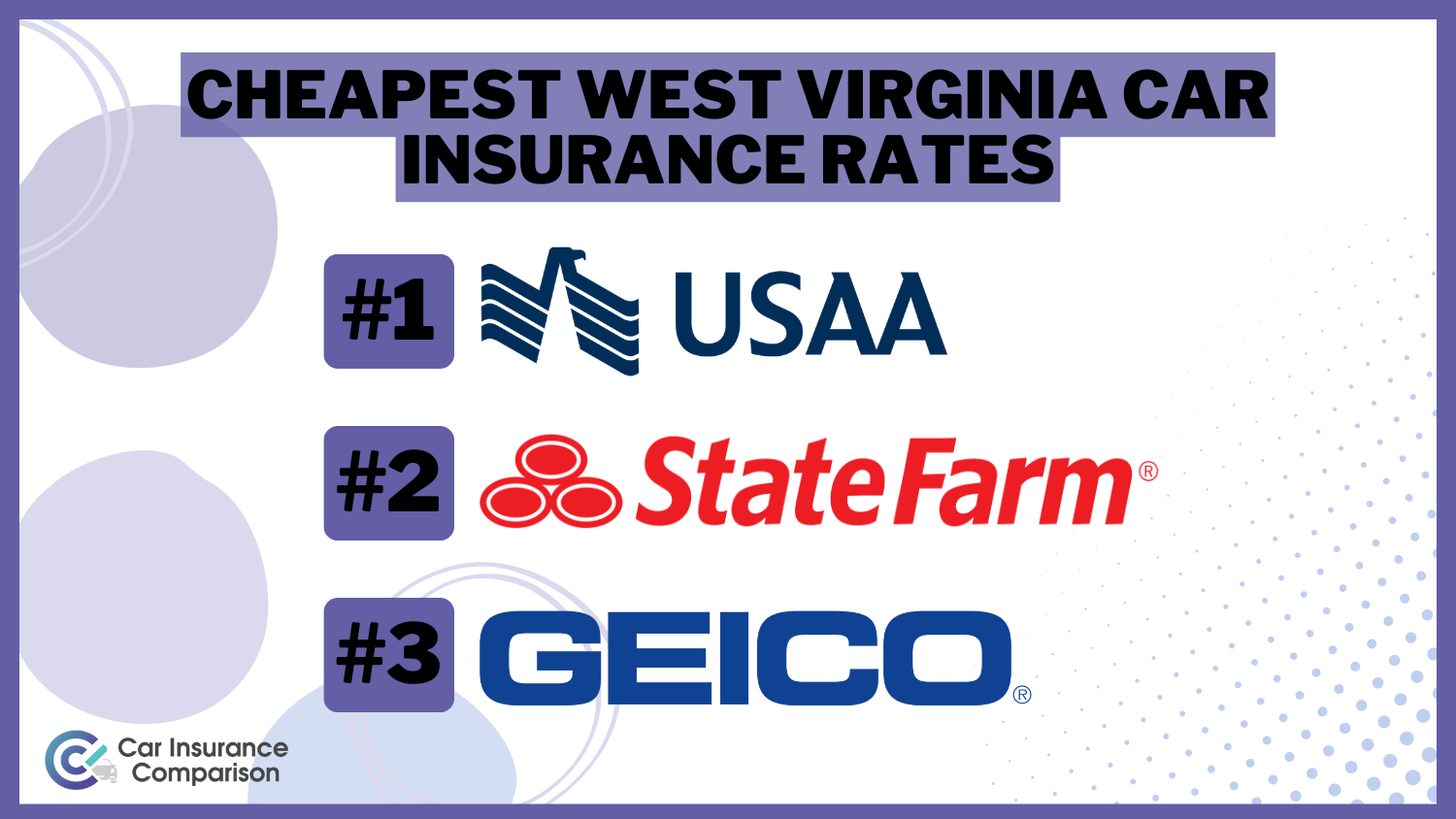

USAA, State Farm, and Geico have the cheapest West Virginia car insurance rates for most drivers. At USAA, West Virginia minimum coverage is an average of just $25/mo. West Virginia car insurance requirements mandate a minimum of 25/50/20 for bodily injury and property damage liability insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for West Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for West Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for West Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUSAA, State Farm, and Geico have the cheapest West Virginia car insurance rates.

Whether you’re traveling through the Blue Ridge Mountains or along the Shenandoah River, you will want to make sure you have the best West Virginia car insurance coverage at an affordable price.

Our Top 10 Company Picks: Cheapest West Virginia Car Insurance Rates

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $25 | A++ | Military Service | USAA | |

| #2 | $29 | B | Customer Satisfaction | State Farm | |

| #3 | $31 | A++ | Online Convenience | Geico | |

| #4 | $38 | A++ | Coverage Options | Travelers | |

| #5 | $39 | A+ | Accident Forgiveness | Nationwide |

| #6 | $41 | A+ | Snapshot Program | Progressive | |

| #7 | $43 | A | Loyalty Discounts | American Family | |

| #8 | $51 | A | Customizable Policies | Farmers | |

| #9 | $60 | A+ | Safe Driver | Allstate | |

| #10 | $72 | A | New Car | Liberty Mutual |

We know that finding coverage isn’t always easy, and there are so many questions to answer. Is car insurance cheaper in West Virginia? Who has the cheapest car insurance? What are the WV car insurance laws?

The best way to assure yourself that you’re getting the proper coverage for your situation at the best possible rates is to compare rates from the best car insurance companies in West Virginia. Enter your ZIP in our free quote tool to get started.

- USAA has the cheapest car insurance rates in West Virginia

- State Farm and Geico also offer affordable West Virginia car insurance

- Keeping a clean driving record will help drivers save on policies

#1 – USAA: Top Pick Overall

Pros

- Military Service: USAA is best for military service members and veterans. Find out more in our USAA review.

- Coverage Variety: Customers in West Virginia can buy multiple different types of protection for their vehicles.

- Multi-Policy Discount: The company also sells home or renters insurance, which can be bought with auto insurance in West Virginia for a discount.

Cons

- Restricted Eligibility: USAA eligibility is restricted to veterans, military members, and their families.

- In-Person Assistance Limited: USAA mostly operates virtually, with few local agents.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Satisfaction

Pros

- Customer Satisfaction: Customer satisfaction is mostly due to the availability of local agents in West Virginia for personalized assistance. Learn more in our State Farm review.

- Multi-Policy Discount: West Virginia customers who buy a multiple-policy package will save.

- Roadside Assistance: Paying a little extra for roadside assistance will give West Virginia drivers 24/7 help with breakdowns.

Cons

- A.M. Best Rating: A “B” rating means State Farm could improve financial management.

- Online Management is Lacking: Most changes go through local agents rather than online, so customers are limited in what they can do online.

#3 – Geico: Best for Online Convenience

Pros

- Online Convenience: West Virginia customers will find Geico’s online services convenient. Learn more by reading our Geico review.

- Affiliation Discounts: Geico has affiliation discounts, such as military discounts.

- Good Driver UBI Discount: Participating in Geico’s UBI program will earn good drivers discounted West Virginia rates.

Cons

- No Local Agents: Geico customer service is online.

- New Car Coverage Options: West Virginia customers can’t get gap coverage.

#4 – Travelers: Best for Coverage Options

Pros

- Coverage Options: West Virginia customers can purchase anything from collision insurance to roadside assistance.

- A.M. Best Rating: Travelers stands out for its high financial rating. Read more in our review of Travelers.

- IntelliDrive Discount: A UBI discount that helps good drivers in West Virginia save.

Cons

- IntelliDrive May Raise Rates: Poor participation scores could raise West Virginia rates.

- Customer Service: There is room for improvement based on ratings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide won’t raise rates for West Virginia drivers’ first accidents if they qualify for accident forgiveness.

- Flexible Policies: West Virginia customers will find policies flexible, as they can change coverages and deductibles.

- Multi-Policy Discount: Purchase an insurance package to save on West Virginia policies. Find out more in our article on Nationwide car insurance discounts.

Cons

- Customer Ratings: Service from West Virginia representatives could be improved.

- Agent Availability: West Virginia customers may be unable to find a local agent.

#6 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: West Virginia drivers may be able to save by joining the Snapshot program.

- Free Innovative Tools: Customers can use free budgeting tools and more. Learn more by visiting our Progressive review.

- Flexible Policies: West Virginia customers can adjust limits, coverages, and more.

Cons

- Snapshot Rate Increases: Bad drivers in West Virginia may have rate increases.

- Customer Ratings: Progressive could improve customer service representation for better ratings.

#7 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Sticking with American Family will result in lower West Virginia car insurance rates.

- Customer Reviews: Customers in West Virginia have mostly good things to say. Read more in our American Family review.

- Coverage Variety: West Virginia customers can buy roadside assistance, new car coverages, and more.

Cons

- Availability Outside West Virginia: If you move from the state, American Family may not be available in your new state.

- Online Services: Some services may be unavailable due to local agent availability.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers’ policies in West Virginia can be customized by customers.

- Multi-Policy Discount: Purchase a home and auto package to save. Learn more in our Farmers review.

- Personalized Service: West Virginia customers can get assistance from agents.

Cons

- Claim Reviews: Negative reviews from Farmers’ customers talk about slow processing.

- Digital Tools: West Virginia customers may find tools more limited.

#9 – Allstate: Best for Safe Drivers

Pros

- Safe Drivers: Allstate’s rates are best for safe West Virginia drivers, as it offers good driver discounts.

- Mileage-Based Insurance: Joining Milewise may help Allstate customers save if they travel less than 10,000 miles annually.

- Claim Satisfaction: Allstate guarantees claim satisfaction and will work to remedy the situation for unhappy customers.

Cons

- Customer Reviews: Customer satisfaction levels could be improved. Learn more in our Allstate review.

- Young Drivers: Drivers under 25 in West Virginia will have expensive rates at Allstate.

#10 – Liberty Mutual: Best for New Cars

Pros

- New Cars: Liberty Mutual has add-on coverages available that are great for new car owners in West Virginia. Learn more in our Liberty Mutual review.

- Multi-Policy Discount: Purchase a package to lower West Virginia rates.

- 24/7 Customer Representatives: West Virginia customers have access to help at any hour.

Cons

- Customer Ratings: Services could be improved at the company.

- Higher Average Rates: Liberty Mutual’s West Virginia rates are higher than other companies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest West Virginia Car Insurance Companies

Whether you are of the Hatfield bloodline or are a sprouting branch of the McCoy tree, chances are you do a fair amount of driving if you’re a resident of West Virginia. West Virginians drive about 14,283 miles each year, which is a smidge below the national average of 14,485.

Below, check out the cost of minimum and full coverage at the cheapest West Virginia companies.

West Virginia Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $162 |

| American Family | $43 | $115 |

| Farmers | $51 | $139 |

| Geico | $31 | $83 |

| Liberty Mutual | $72 | $196 |

| Nationwide | $39 | $104 |

| Progressive | $41 | $110 |

| State Farm | $29 | $79 |

| Travelers | $38 | $102 |

| USAA | $25 | $67 |

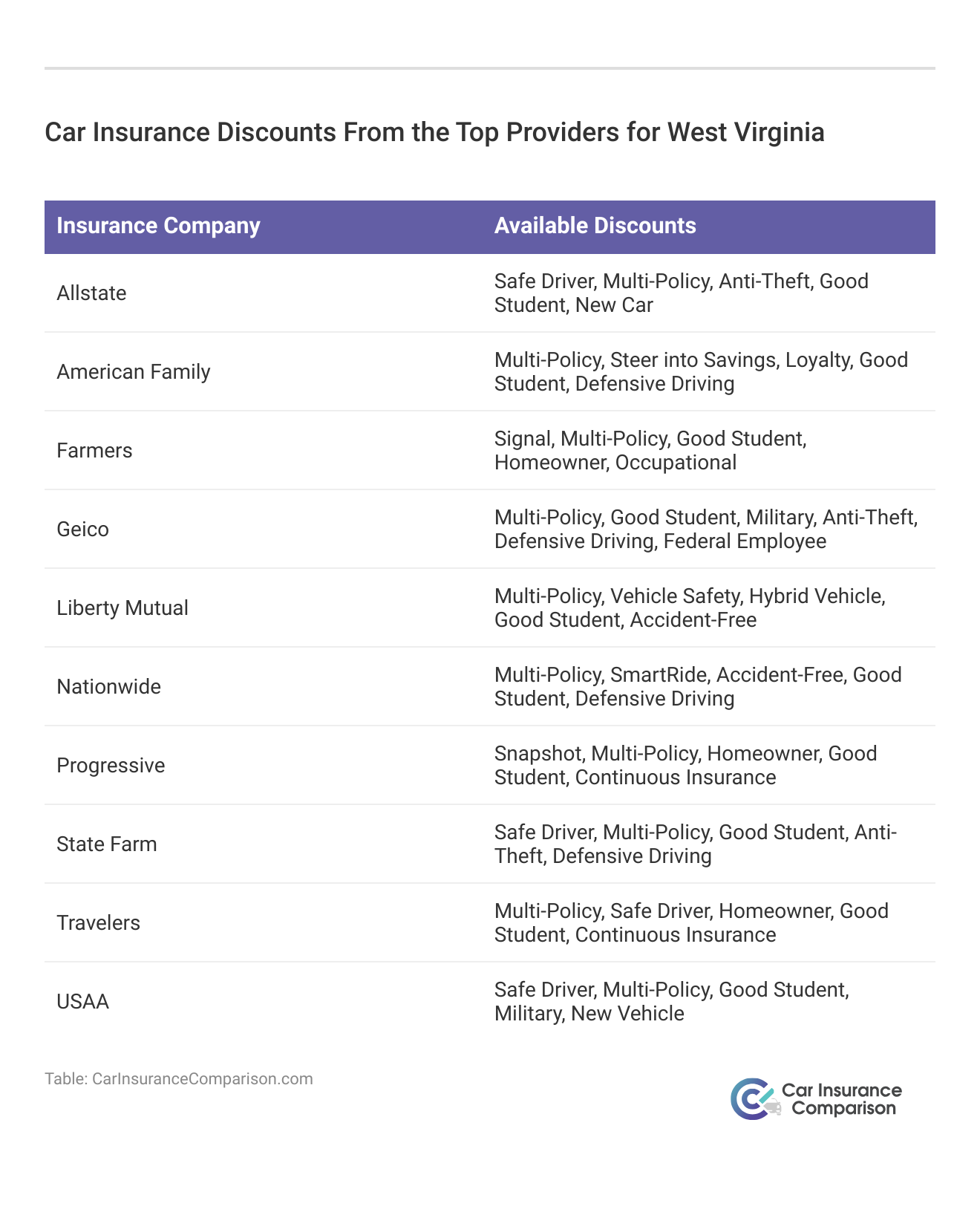

Due to having a shorter-than-average commute time, Mountain State residents are on the road less than most of their fellow drivers on the East Coast. Every mile that you drive is a mile of potential risk in the eyes of the auto insurers, however. You need the proper amount of car insurance to mitigate that risk. Discounts at these companies can also help reduce your rates on these important car insurance coverages.

If you want to discover what your rate will be at the best companies, you can get quotes directly from USAA, State Farm, and other top companies. You can also use a quote comparison tool to quickly find the cheapest West Virginia insurance rates in your area.

If wading through all the minutiae of the various regulations, requirements, and rates can be burdensome, no need to worry. We’ll help you learn what is required, what you might want, and where you can find it for the best price.

West Virginia Minimum Coverage

West Virginia is a “fault” state, meaning that it follows a traditional fault-based system when it comes to financial responsibility for property damage and injuries resulting from a crash.

Basic coverage in West Virginia increased in 2016 to a required minimum car of 25/50/20 for all motorists. This mandates that all car owners carry the following minimum levels of liability car insurance coverage:

- $25,000 for bodily injury or death per person in an accident caused by the owner of the insured vehicle

- $50,000 for total bodily injury or death per accident caused by the owner of the insured vehicle

- $20,000 for property damage per accident caused by the owner of the insured vehicle.

West Virginia does not require you to carry Uninsured/Underinsured Motorist coverage, but legislators do mandate all auto insurance companies in the state to offer consumers the optional maximum coverage of 100/300/50.

Declining to carry any form of uninsured/underinsured coverage means that you're foregoing insurance that can protect you and your passengers if the at-fault driver has no insurance or if you're the victim of a hit-and-run.

Dani Best Licensed Insurance Producer

Is it wise for any West Virginian to choose the bare minimum coverage? Maybe. Maybe not. It depends on a number of factors, such as your vehicle’s value, your budget, and other considerations.

View this post on Instagram

If you have assets or future assets that you wish to protect, you may wish to reconsider settling for only basic liability coverage or the cheapest option. Everyone has individual financial situations which will influence what insurance services they can afford, and what insurance carriers are available to them.

West Virginia Minimum Coverage Requirements

| Type of Coverage | Prior to January 1, 2016 | As of January 1, 2016 | Increase |

|---|---|---|---|

| Bodily Injury Liability | $20,000 per person $40,000 per accident | $25,000 per person $50,000 per accident | $5,000 per person $10,000 per accident |

| Property Damage Liability | $10,000 per accident | $20,000 per accident | $10,000 per accident |

| Uninsured/Underinsured Motorist Coverage | Optional | Optional | Cannot be be determined |

You should increase your liability limits to the maximum optional offering of 100/300/50, and make sure you’re covered for an amount equal to the total value of your assets (Add up the dollar values of your house, your car, savings, and investments).

Please be aware that basic coverage only provides you with liability protection; It will not pay to repair or replace your car for an accident that you cause.

If you’re looking to repair or replace your car after an accident, then collision car insurance and comprehensive car insurance coverage are worth the investment. These policies come with a deductible and they pay out based on the current value of your car, not necessarily the price you might have paid for it.

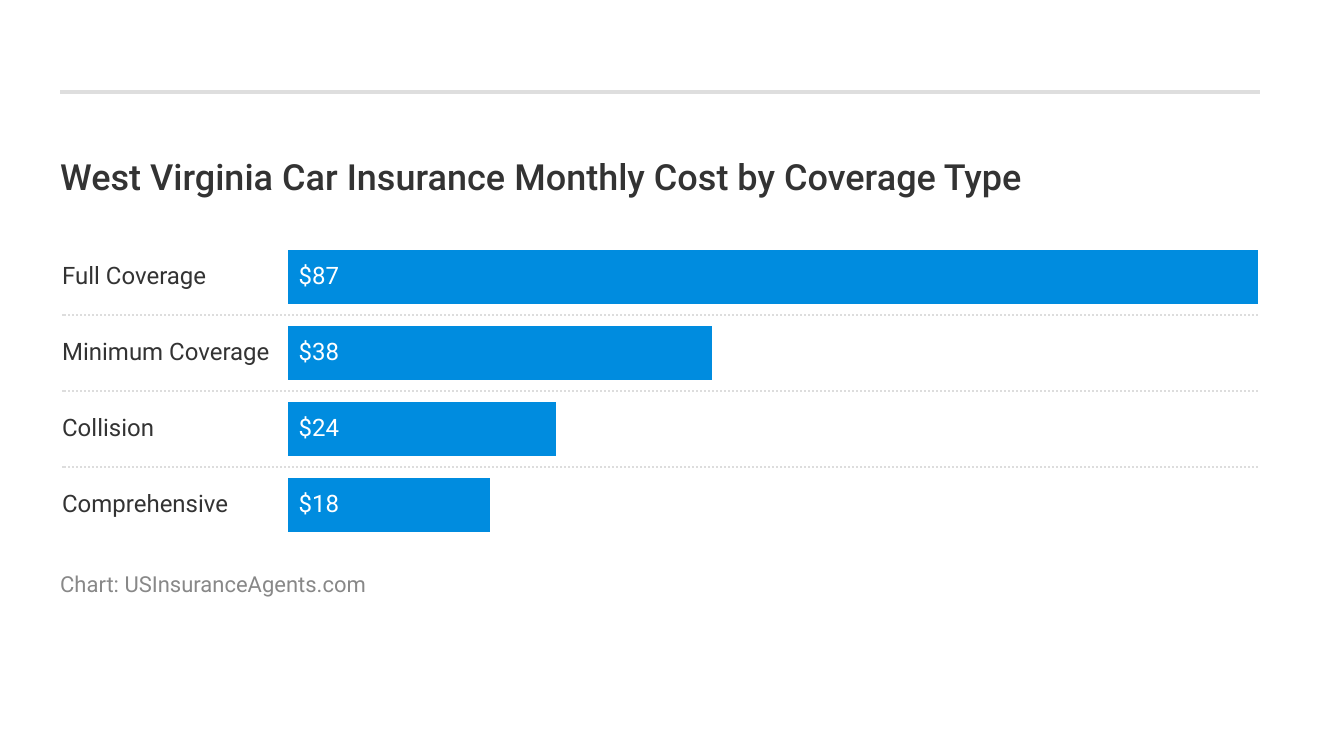

Next, we will take a look at what the average motorist in West Virginia pays for car insurance. The actual amount you will pay will vary from these amounts; however, the upcoming figures will give you a strong foundation from which you can build.

West Virginia Premiums as a Percentage of Income

When asked about his success, longevity, and wealth in the music and entertainment industry, Hip hop superproducer and entrepreneurial mogul Dr. Dre stated that “Money is easy to make, but harder to keep.”

The entertainer, born Andre Young, also claimed that “The only two things that scare me are God and the IRS.”

Both of these quotes illustrate the concept and importance of your Disposable Personal Income (DPI), which is the money you retain after taxes and other expenditures.

West Virginia Car Insurance Cost as a Percentage of Income

| Details | Data |

|---|---|

| Annual full coverage rates | $1,032 |

| Monthly full coverage rates | $86 |

| Annual income | $32,277 |

| Monthly disposable income | $2,690 |

| Premiums as a percentage of income | 3.2% |

You are mandated by law to carry at least the basic coverage in your state. However, full coverage is the best option in West Virginia. A full coverage car insurance policy includes liability, comprehensive, and collision insurance.

Here’s a peek at the average cost of each:

Let’s take a look at some important statistics about the car insurance companies themselves since we are now caught up on some important data for the individual customer.

Up first is loss ratio.

West Virginia Loss Ratio

What is loss ratio? And how exactly does it impact your rate quotes?

The insurance loss ratio is the loss to the insurance company for claims that were paid out, divided by the premiums collected. A high loss ratio means that an insurance company has too many customers filing claims, which will subsequently lead to a rise in future premiums for all consumers.

Loss ratios are measurements used by insurers to assess the profitability of their businesses or policies. A loss ratio is a single number that can be used to identify performance — the lower the number, the better the performance.

Example: Suppose the owner of a small car dealership pays $50,000 in annual premiums to insure his or her inventory. Then, a polar vortex causes $75,000 in damages, for which the business owner submits a claim. The insurer’s one-year loss ratio becomes $75,000 / $50,000, or 150 percent.

West Virginia Add-ons, Endorsements, Riders

According to the Insurance Information Institute, just over 10 percent of drivers in West Virginia don’t have insurance, which is the 32nd highest total in the United States. This stat alone should make you reconsider declining the optional (but recommended) Uninsured Motorist Coverage.

Medical Payments Coverage is optional in West Virginia. Med Pay insurance applies regardless of whether the insured or another driver was at fault. This kind of coverage can protect motorists from damage and injuries caused by the increasing collisions involving the deer population in West Virginia.

Pay-per-mile car insurance plans offered by companies like Metromile are gaining in popularity daily; however, they are currently unavailable in West Virginia.

Other usage-based car insurance programs (UBI) are active and available to residents of West Virginia. Programs like Drivewise from Allstate or Snapshot from Progressive offer discounts to drivers based on how well and how often they drive.

Additionally, there are a handful of alternative enhancements:

- Gap insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Make sure to research them to decide if any of them make sense in your circumstances.

Male Versus Female Rates in West Virginia

On September 20, 1973, Billie Jean King soundly defeated Bobby Riggs in an epic, intergender tennis match dubbed the “Battle of the Sexes” in straight sets. That triumph on the tennis court by King sounded a forceful blow for women’s rights and equality that reverberated beyond the world of athletic competition.

Unfortunately, that movement toward equality hasn’t quite reached the auto insurance industry. On average, male drivers are afforded better premium quotes than their female counterparts.

Learn more: Average Car Insurance Rates by Age and Gender

We compared rates for 25-year-old drivers with identical backgrounds, location, and driving history, using gender as the only independent variable. Here is what we found:

West Virginia Car Insurance Monthly Rates for 25-Year-Olds by Gender & Provider

| Insurance Company | Male (Age 25) | Female (Age 25) |

|---|---|---|

| Allstate | $73 | $73 |

| American Family | $45 | $53 |

| Farmers | $64 | $66 |

| Geico | $38 | $41 |

| Liberty Mutual | $72 | $79 |

| Nationwide | $46 | $50 |

| Progressive | $54 | $57 |

| State Farm | $36 | $28 |

| Travelers | $40 | $44 |

| USAA | $34 | $37 |

When we extended our research by comparing rates for 55-year-old men and women with identical driving records and demographic information, the battle for equality did not fare any better. Below, see how rates by gender in West Virginia are different.

West Virginia Car Insurance Monthly Rates for 55-Year-Olds by Gender & Provider

| Insurance Company | Male (Age 55) | Female (Age 55) |

|---|---|---|

| Allstate | $57 | $61 |

| American Family | $40 | $40 |

| Farmers | $49 | $49 |

| Geico | $29 | $31 |

| Liberty Mutual | $68 | $63 |

| Nationwide | $36 | $36 |

| Progressive | $38 | $40 |

| State Farm | $28 | $28 |

| Travelers | $36 | $35 |

| USAA | $23 | $24 |

Maybe if Serena Williams and Naomi Osaka team up to defeat the McEnroe Brothers (John and Patrick) in a doubles match, then we’ll inch closer to equal premium rate quotes for men and women drivers. The results from this research are counterintuitive, as we think of the insurance industry often giving cheaper car insurance rates to women. Auto insurance costs truly do vary state by state.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest West Virginia Insurance Rates by City

Did you know that Wheeling was once the capital of West Virginia? Having your vehicle registered in the former capital as opposed to the current capital of Charleston will save you nearly $100 annually in premiums. Take a look at West Virginia insurance rates by location below.

Top 10 West Virginia Cities With the Cheapest Full Coverage Car Insurance Monthly Rates

| City | Rates |

|---|---|

| Beckley | $90 |

| Bluefield | $86 |

| Charleston | $89 |

| Clarksburg | $78 |

| Huntington | $88 |

| Martinsburg | $74 |

| Morgantown | $78 |

| Parkersburg | $86 |

| Wheeling | $81 |

| Williamson | $108 |

Where you live will have a big impact on your rates. Drivers who live in more affordable areas will find it easy to save on auto insurance, while drivers in the most expensive cities will have to shop around more for cheap rates.

Learn more: Compare Car Insurance Rates by City

Finding the Best West Virginia Car Insurance Companies

Sifting through all of the information available for each car insurance company in order to select the most suitable one for your circumstances can be an arduous endeavor.

Where do you go to get the best rates? Who has the most competent customer service representatives? Will you qualify for any car insurance discounts or upgrades? Unlike the familiar country roads of the place you belong, finding the answers to these questions can be difficult to navigate.

We will help you to choose the company that will best suit your specific needs, whether you need additional coverage or you’re seeking a safe driver discount.

When selecting the car insurance company that you’ll ultimately give your business to, you should look for the company (or companies) that you know you can lean on.

The public’s perception of a company can sometimes be an indicator of the quality of rates it offers to its customers. We’ll show how the largest companies rate in the areas of financial stability and customer satisfaction for comparative purposes.

West Virginia Companies’ Financial Ratings

AM Best is a trusted credit rating agency. It evaluates insurance companies and grades the companies based on their financial stability.

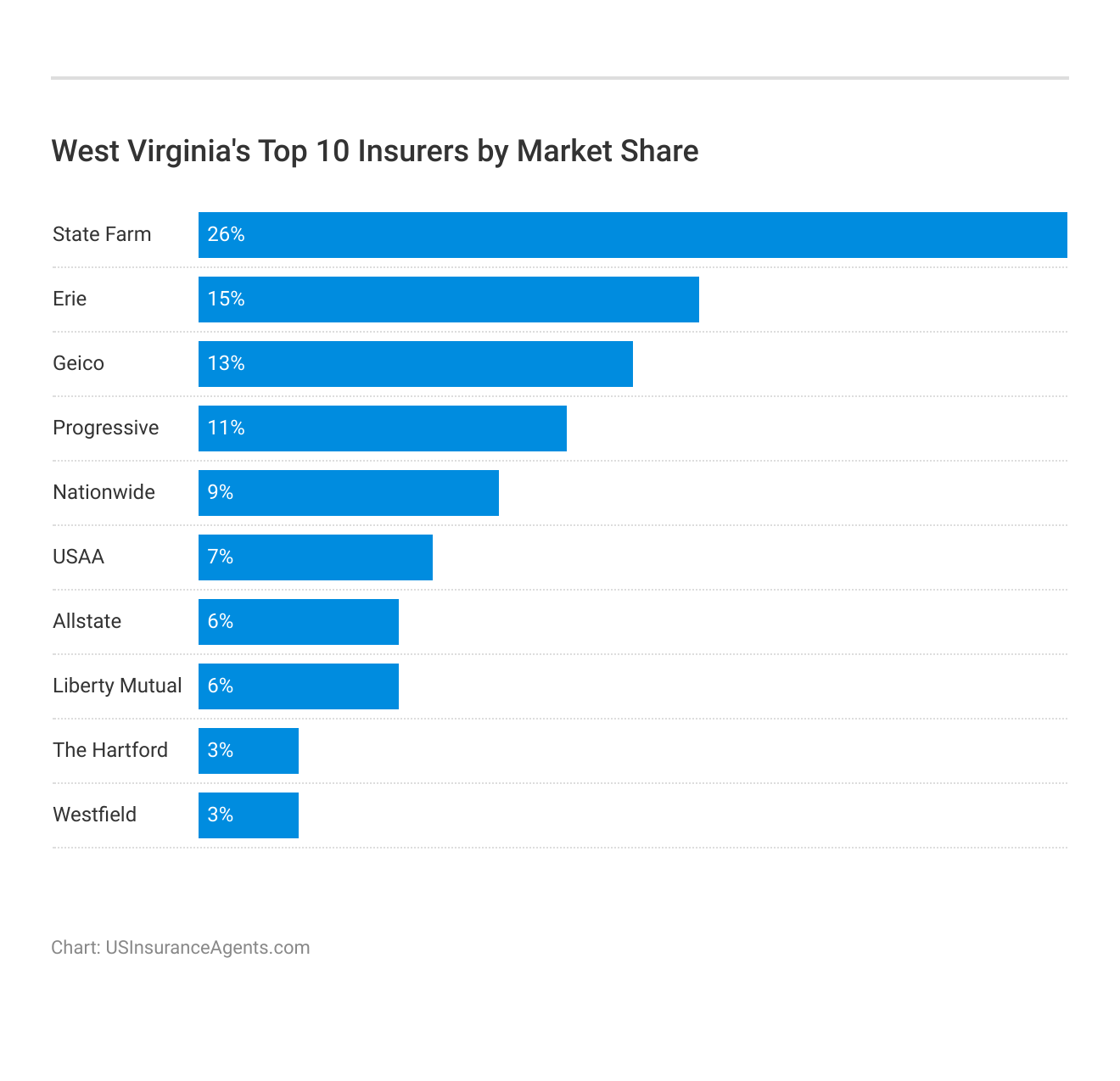

Top 10 West Virginia Car Insurance Companies by Premiums Written & Financial Strength

| Rank | Insurance Company | Premiums Written | A.M. Best |

|---|---|---|---|

| #1 | State Farm | $329,651 | B |

| #2 | Erie | $182,120 | A+ |

| #3 | Nationwide | $145,858 | A+ |

| #4 | Geico | $124,709 | A++ |

| #5 | Allstate | $92,007 | A+ |

| #6 | Progressive | $84,332 | A+ |

| #7 | Liberty Mutual | $54,356 | A |

| #8 | USAA | $48,434 | A |

| #9 | The Hartford | $38,099 | A+ |

| #10 | Westfield | $30,163 | A |

The table above shows the ten largest insurance companies in West Virginia as measured by direct premiums written with their AM Best rating.

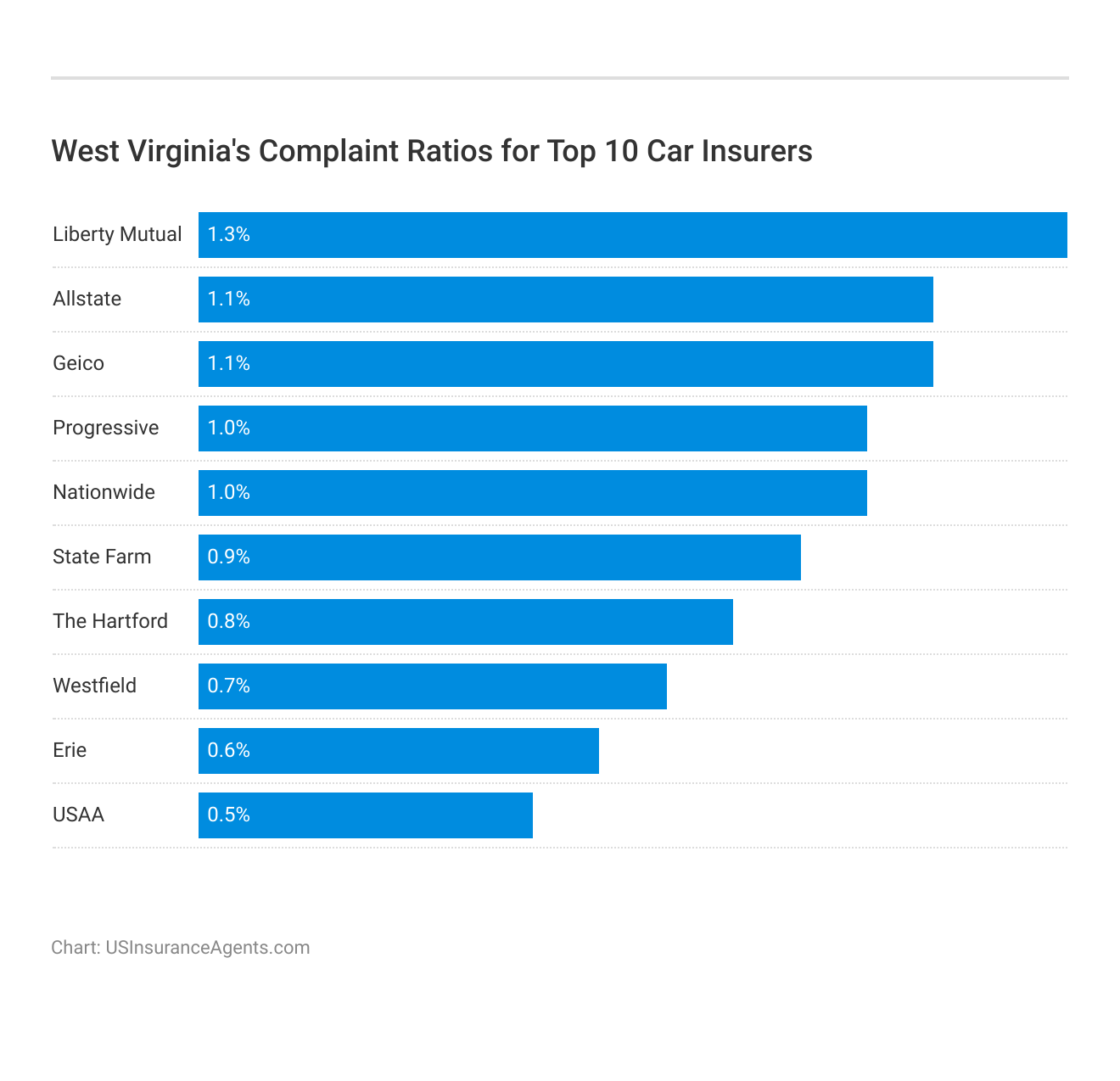

Companies in West Virginia With the Least and Most Complaints

West Virginia permits customers to file a complaint both electronically or by paper application. The complaint ratio is how many complaints a company receives per one million dollars of business.

Due to the sheer volume of business they conduct, a large insurance company will have more complaints than a smaller company; thus, what matters more than the number of complaints is the complaint ratio. These are the companies that had the best complaint ratios in the state.

West Virginia Car Insurance Complaint Ratios: The Best and Worst Providers

| Insurance Company | Best Complaint Ratio | Insurance Company | Worst Complaint Ratio |

|---|---|---|---|

| Travelers | 0.09 | Liberty Mutual | 5.95 |

| Farmers | 0 | The Hartford | 4.68 |

| State Farm | 0 | CSAA Insurance | 3.97 |

| Allstate | 0 | IMT Insurance | 3.45 |

| USAA | 0 | Infinity | 2.03 |

| Erie | 0 | State Auto | 1.74 |

| Progressive | 0 | Safeway | 1.6 |

Trust is essential in any long-lasting relationship. Mutual satisfaction has to be a priority for both parties. One hundred percent satisfaction is a lofty and elusive goal. When a customer has a negative experience with an insurance company, he or she can file a complaint. Those complaints, warranted or not, are factored into a company’s complaint ratios.

Read more:

Complaint Ratios for West Virginia’s 10 Largest Auto Insurers

This chart gives a visual representation of how the top car insurance companies in West Virginia compare with one another in terms of complaint ratios.

For more information on this topic, take a look at the most recently released annual report from the state insurance commissioner.

West Virginia Car Insurance Rates by Company

Below is a list of the most expensive and cheapest car insurance companies in West Virginia by their average premiums.

Top 10 Most Affordable and Most Expensive Car Insurance Companies in West Virginia

| Cheapest Companies | Monthly Rate | Most Expensive Companies | Monthly Rate |

|---|---|---|---|

| American National Property & Casualty | $49 | Allstate | $125 |

| Encompass | $53 | Esurance | $128 |

| Erie Insurance | $36 | First Liberty | $108 |

| Garrison Property & Casualty | $41 | Liberty | $228 |

| Hartford Of The Midwest | $49 | Liberty Mutual | $171 |

| Metropolitan | $34 | Motorists Mutual | $103 |

| Property & Casualty Insurance Company Of Hartford | $43 | Peak Propery & Casualty | $175 |

| Trumbull | $47 | Progressive | $127 |

| Twin City Fire Insurance | $51 | Westfield Insurance Company | $100 |

| USAA | $22 | West Virginia Nationall Auto | $133 |

Bear in mind that sometimes, a more expensive company is still affordable for good drivers with clean driving records. Likewise, a cheap company may be expensive for poor drivers. The only way to know for sure which company is most affordable for you is to get auto insurance quotes and compare.

Read more: Encompass Car Insurance Discounts

Largest Car Insurance Companies in West Virginia

Have you been up and back on the Appalachian Trail in search of a licensed auto insurer? You’ve got 812 options from which to pick. Of all those companies, 19 of them are homegrown talent. But the bulk of them, 793 to be exact, are based out of the state of West Virginia.

Whether you go with a locally based company or an out-of-state option, the best way to guarantee you’re getting the most suitable coverage at the most competitive prices is to shop around.

You should make a habit of comparing West Virginia car insurance quotes every six months to a year. You can only miss potential opportunities to cut the cost of your auto insurance if you decide to forego comparison shopping. There is more to gain than there is to lose when you look around.

Knowledge of your state’s regulations for the road (and applying that knowledge) is powerful enough to help save you money on your car insurance premiums.

Let’s take a look at the laws of the land to keep you knowledgeable and to ensure your dollar will go further when purchasing insurance.

How Much Auto Insurance Costs in West Virginia

Delve into the specifics of car insurance costs in West Virginia cities like Durbin, Kingwood, Liberty, Romney, Weirton, and Williamson.

West Virginia Auto Insurance Cost by City

The citywise analysis above provides valuable insights into the factors shaping car insurance rates, helping you make informed decisions about coverage tailored to your specific location in the Mountain State.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Automobile Insurance Fraud in West Virginia

Did you know that fraud accounts for roughly 10 percent of operating costs for the insurance industry as a whole? Why does that matter to you as a consumer?

That 10 percent that insurance companies use to investigate, combat, and pay to fraudulent claims is essentially 10 percent of your premiums that are wasted.

And if those fraud numbers continue to escalate, it is more likely that the insurance will pass on some of that cost to you as the consumer in the form of increased premiums.

If companies didn’t have to waste your premium dollars on false claims, you could see a reduction in the rates you pay.

There are two classifications of fraud: hard and soft.

- Hard Fraud: A purposefully fabricated claim or accident

- Soft Fraud: A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime no matter how you slice it. Even the “little, white lie” you tell to get a lower rate, such as lying about your address, can lead to harmful consequences. That kind of willful misrepresentation of facts is called known as “rate evasion” and is $16 billion annual expense to auto insurers.

Read more: Can you legally use a different address to get cheaper car insurance?

If you suspect insurance fraud, you can report it through the Office of the Inspector General (OIG) Fraud Unit.

West Virginia Car Insurance Laws

No need to list every insurance law in West Virginia. We’ll go over some of the most important ones that all West Virginians should know.

Learn more: How do you find car insurance coverage requirements in your state?

Car insurance companies in West Virginia have a lot of latitude to set the premium rates they will offer to consumers.

“Open competition” is the capitalistic process in which rates are formed; however, if the insurance commissioner decides that rates are excessive or could be harmful to the company’s solvency, he or she will step in and adjust those figures.

Yet even with this much authority, these companies must adhere to the regulations and expectations set by the National Association of Insurance Commissioners (NAIC), which acts as a self-regulatory governing body. Drivers must also adhere to the laws set to them by the state of West Virginia.

West Virginia High-Risk Insurance

West Virginia State Code states that an individual may be considered a substandard risk if:

- They have a record of traffic accidents;

- Have a record of traffic law violations;

- Have undesirable occupational circumstances

- Have any other valid underwriting consideration

In many other states in the US, an SR-22 car insurance form is mandatory for motorists deemed substandard or high-risk after having committed serious moving violations, insurance violations, or after the suspension of a license in order to be reinstated.

However, there is no such requirement in West Virginia to obtain an SR-22 form.

While an SR-22 form isn’t a requirement in West Virginia in order to reinstate driving privileges, you will still need to meet other requirements. The requirements will vary based on the nature of the offense.

Depending on the severity of the crime and conviction, you may be required to serve a period of incarceration and have your license revoked temporarily before you can reapply for a new license. Plus, you may be responsible for both court fines and reinstatement fees.

You can track and monitor what type of offenses will earn you points on your license by checking the DMV’s Point System.

In West Virginia, the following violations may lead to your license being revoked or suspended:

- Point accumulation according to the DMV Point System.

- Falsely obtaining a license.

- Driving with a suspended or revoked license.

- Failure to drive according to the restrictions on your license.

- Failing to pay any type of court fees or court-ordered payment (such as child support).

- Driving without insurance.

- Failure to provide proof of insurance.

- DUI offenses, such as driving with a blood alcohol content (BAC) over the legal limit, or refusing to test for BAC.

- Leaving an accident scene that resulted in personal injury or death.

- Failing to satisfy any civil judgment made against you due to your involvement in an accident.

- Negligent homicide or manslaughter involving a motor vehicle.

Note: This list is representative and by no means exhaustive.

Car insurance companies in West Virginia can refuse high-risk car insurance or coverage to substandard drivers like motorists with poor driving records.

If you are having a difficult time finding car insurance on the open market, you may apply for insurance through the West Virginia Automobile Insurance Plan (WVAIP), which helps guarantee that all licensed drivers have access to car insurance.

West Virginia Windshield Coverage Law

West Virginia mandates that for all cars less than three years old insurers must use original equipment manufacturers (OEM) replacement parts for broken windshield car insurance unless the consumer agrees in writing.

Read more: Does car insurance cover broken car windows?

West Virginia Vehicle Licensing Laws

When rumbling through the multitude of country roads, make sure your vehicle is registered and that you can brandish proof of insurance. Otherwise, you might suffer some costly consequences. The penalties for driving without insurance in West Virginia are as follows:

West Virginia Penalties for Driving Without Insurance

| Penalty | First Offense | Second Offense |

|---|---|---|

| Fine | $200 to $5,000 – $200 penalty reinstatement fee if no proof of insurance | $200 to $5,000 fine and/or 15 days to one year in jail if second offense occurs within five years |

| License Suspension | 30 days with reinstatement fees, unless there's proof of insurance | 90 days and registration revoked until proof of insurance |

Don’t risk driving without insurance; the penalties will cost much more than buying auto insurance. Companies also raise rates for drivers who have lapses in insurance, raising future costs as well.

West Virginia Statute of Limitations

If you are in an accident, you can’t wait ten years to file a claim. The statute of limitations for filing a claim in West Virginia is as follows:

West Virginia Statute of Limitations

| Coverage | Years |

|---|---|

| Property Damage | Two years |

| Personal Injury | Two years |

If you’re in an accident, it is vital to file as soon as possible. Most companies make it simple to file a claim, with some companies even allowing customers to file a claim online.

West Virginia Driver’s Licensing Laws

It is important to follow the laws in West Virginia for driver’s licenses.

Read more: How do I get car insurance if I’ve lost my license?

West Virginia Teen Driver License Laws

West Virginia utilizes a Graduate Driver’s Licensing (GDL) program. These laws were implemented to reduce fatalities and lower injuries and have been proven to result in safer highways and roadways.

New drivers who participate in the GDL system must reach various milestones before they are allowed to graduate to a less restrictive license level, and eventually, receive a full unrestricted license.

Teen drivers must also provide a valid Driver’s Eligibility Certificate, which is issued by the local school board and proves the teen driver’s attendance.

There are three levels of driving permissions available for teens in West Virginia. They are Instruction Permit (Level 1), Intermediate License (Level 2), and Class E License (Level 3).

- Instruction Permit: An instruction permit is valid until the young driver reaches the age of 18. After the person turns 18, they have 30 days to complete the road skills examination, which is required to qualify for the Intermediate License. If the Level 1 permit expires, the teen driver must reapply for a permit and hold it in good standing without a traffic conviction for at least 180 days before applying for an Intermediate License.

- Intermediate License: Teen drivers between the ages of 16 – 18 who have completed all the Instruction Permit requirements are eligible for an Intermediate License. To apply for a Level 2 License, the teen driver must complete either a driver’s education course approved by the State Department of Education or 50 hours of behind-the-wheel experience certified by a parent or legal guardian.

- Class E License: Teens in West Virginia are eligible to apply for a Level 3 License once they’ve turned 17, have completed a driver’s improvement program, have earned a valid Driver’s Eligibility Certificate or proof of having completed school, have a clean driving record for the one year prior to submitting their applications, and have submitted the applications with all necessary licensing fees.

All teenage applicants for a driver’s permit must have parental consent when submitting their applications unless they are married, in which case parental consent is waived.

West Virginia Licensing System for Young Drivers

| Restrictions | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Age | 15 | 15 1/2 – must have held an Instruction Permit for a minimum of six months prior | 16 – must have held an Intermediate License for a minimum of six months prior |

| Passengers | No more than two passengers and must be supervised by a licensed adult | First six months or until age 18 – no passengers younger than 20 Second six months – no more than one passenger younger than 20 | All restrictions lifted when 17 AND have license for 12 months or 18 (whichever comes first) |

| Hours | Under age 18 – no driving between 10 p.m. and 5 a.m. | All restrictions lifted when 17 AND have license for 12 months or 18 (whichever comes first) | All restrictions lifted when 17 AND have license for 12 months or 18 (whichever comes first) |

| Cell Phone Use | Handheld ban Texting prohibited for all drivers | Handheld ban Texting prohibited for all drivers | Handheld ban Texting prohibited for all drivers |

| Pre-requisites | If under 18, must provide a valid Driver's Eligibility Certificate, which is issued by the local school board and proves attendance record | 50 total hours supervised driving, 10 must be at night | Must have Driver's Eligibility Certificate and clean driving record for up to a year prior |

Once a teenager has completed the requirements for getting a driver’s license, the next step is finding teen driver car insurance.

West Virginia Older Driver License Renewal

When it comes to its driving laws, West Virginia can never be accused of ageism. Older drivers in the Mountain State must renew their licenses every eight years, just like the rest of the general population.

All motorists in West Virginia must renew their licenses every eight years. All must show proof of adequate vision at the time of renewal. And all are eligible for online renewal, every other renewal period.

Older motorists must also show proof of adequate vision at every renewal and are eligible to renew online every other renewal, just like every other motorist.

West Virginia New Resident Licensing

New residents of West Virginia may have lots of questions about how and when to apply for a new license. According to the DMV:

A new resident who does not have possession of the out-of-state license or if it has expired, must obtain a certified driving record, dated no more than 30 days from the date of the application, from the state in which they were previously licensed.

If your out-of-state license is suspended or revoked, you cannot be licensed in West Virginia until you receive clearance in the Problem Driver Points System (PDPS).

It is illegal to drive in West Virginia with a suspended or revoked license. All applicants must be verified with the PDPS. It is important to confirm that you are not under suspension in any other jurisdiction before attempting to obtain a license in West Virginia.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

West Virginia Rules of the Road

West Virginia is a fault state, meaning that the driver at fault in an accident is responsible for paying for damages done to the other party. This is also commonly referred to as a tort state.

Learn more: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

West Virginia Keep Right and Move Over Laws

West Virginia law requires that you keep to the right, to the right if driving slower than the average speed of traffic around you. Driving in the left lane is only permissible when passing or when turning left.

Move Over laws mean exactly what they say: a motorist should move his/her vehicle over whenever approaching a stopped emergency vehicle with its lights on.

“If possible with regard to safety and traffic conditions, slow down and change lanes whenever possible for all law enforcement, emergency vehicles, first responders and tow trucks when they are flashing their lights.”

West Virginia Speed Limits

Every state has different speed limits on its roads that drivers must follow. The speed limits on West Virginia’s roads are listed in the table below.

West Virginia Speed Limits

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Driving above the speed limit will result in a ticket in West Virginia. Make sure to pay attention to posted speed limits and drive carefully in bad weather to avoid an accident.

West Virginia Seat Belt Laws

Seat belt laws in West Virginia require front-seat passengers eight years old and older to wear a seat belt. All other passengers between the ages of eight and 17 must also wear a seat belt. A violation is not a primary offense.

Not wearing a seat belt by itself cannot be a cause for your getting pulled over but should you be stopped for some other traffic violation, you can be ticketed for failure to wear a seat belt. The minimum fine is $25.

West Virginia Car Seat Laws

All children seven years old or younger and less than four feet, nine inches tall are required to be seated in a child safety seat. West Virginia law states no preference for rear-facing car seats.

West Virginia Ridesharing

As of now, State Farm, Progressive, USAA, and Geico are the only auto insurers in West Virginia offering rideshare car insurance specifically for ride-sharing.

West Virginia Automation on the Road

Currently, West Virginia has no laws or testing or deployment of any automation on the road.

West Virginia Safety Laws

The Governor’s Highway Safety Program (GHSP) exists to encourage, promote, and support highway safety throughout West Virginia. The Traffic Safety Resource Prosecutor is another valuable resource that provides safety training, education, and technical support to West Virginians.

West Virginia DUI Laws

According to West Virginia DUI insurance laws, The Blood-Alcohol Content (BAC) limit is 0.08 percent; the High BAC limit is 0.15 percent.

West Virginia DUI Penalties

| Penalty Type | First DUI | Second DUI | Third and Subsequent DUIs |

|---|---|---|---|

| Revoked License | 15 days | One year | One year |

| Imprisonment | No minimum, but up to six months | Six to 12 months of jail | One to three years |

| Fine | $100–$500 | $1000–$3000 | $3000 –$5000 |

| Other | IID possible | IID required | IID required |

The first two offenses are misdemeanors and every subsequent offense will be a felony. After a second offense, an Ignition Interlock Device (IID) will be required.

West Virginia Drug-impaired Driving Laws

West Virginia has a marijuana-impaired limit of THC per se (3 nanograms).

Vehicle Theft in West Virginia

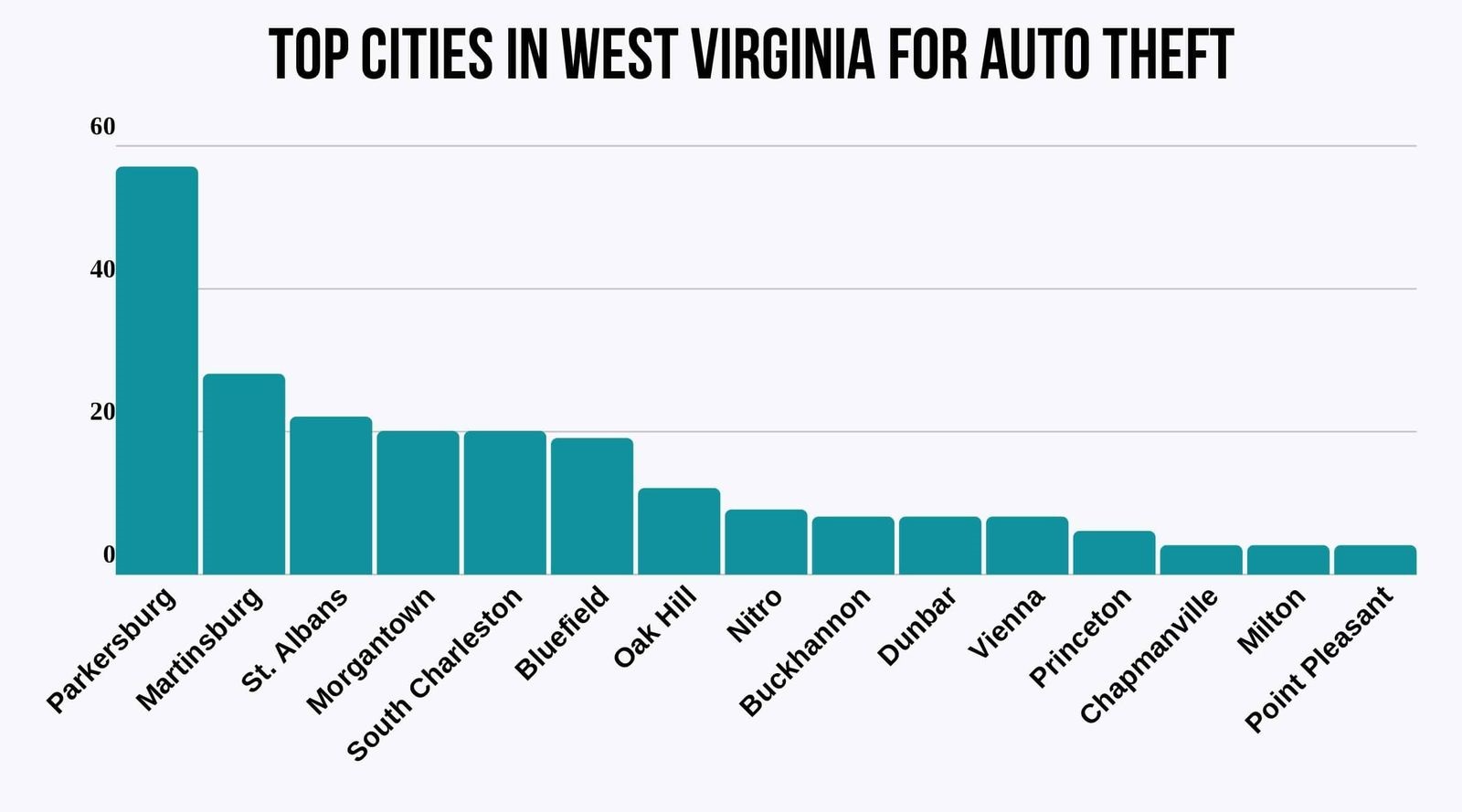

Auto theft is a major problem for consumers. The one whose property is pilfered isn’t the only victim; customers all over a given municipality are penalized with higher premiums when the frequency of auto theft increases. However, having anti-theft devices in your car can earn you an anti-theft car insurance discount, which can help lower rates.

Top Cities for Stolen Vehicles in West Virginia

Auto theft is more common in some cities than in others. The chart below shows the top cities for auto theft within the state.

If you live in one of these cities, make sure to install anti-theft devices in your car. You will also get a discount at most companies for having these devices.

Top 10 Stolen Vehicles in West Virginia

Have you ever wondered if the vehicle you’re currently driving makes you more attractive to car thieves? Check out the table below to find out.

Top 10 Vehicles for Auto Theft in West Virginia

| Model | Number of Thefts |

|---|---|

| 2003 Ford Pickup (Full Size) | 87 |

| 2000 Chevrolet Pickup (Full Size) | 76 |

| 1996 Jeep Cherokee/Grand Cherokee | 36 |

| 2003 Dodge Pickup (Full Size) | 29 |

| 1999 Chevrolet Pickup (Small Size) | 29 |

| 2006 Chevrolet Impala | 24 |

| 2014 Toyota Camry | 20 |

| 1995 Ford Taurus | 19 |

| 2011 GMC Pickup (Full Size) | 18 |

| 2002 Chevrolet Cavalier | 17 |

Own a vehicle that’s on our list? There are a few things you can do. Parking in a safe spot and having anti-theft devices will help deter thieves.

Risky and Harmful Driving Behavior in West Virginia

Bad driving not only results in higher rates, but it also puts others on the road at risk.

Learn more: Best Car Insurance for a Bad Driving Record

For your information, we’ve compiled a list of all driving-related fatalities in West Virginia.

West Virginia Fatalities Involving Speeding by County

Speeding on West Virginia roads is dangerous, and there are a number of fatalities each year in West Virginia from speeding. Take a look at the data below.

West Virginia Traffic Fatalities Speed by County

| County | 2015 | 2016 | 2017 |

|---|---|---|---|

| Barbour | 0 | 0 | 1 |

| Berkeley | 4 | 4 | 3 |

| Boone | 0 | 0 | 0 |

| Braxton | 2 | 1 | 0 |

| Brooke | 0 | 0 | 0 |

| Cabell | 6 | 1 | 1 |

| Calhoun | 0 | 0 | 1 |

| Clay | 1 | 2 | 0 |

| Doddridge | 0 | 0 | 2 |

| Fayette | 2 | 1 | 2 |

| Gilmer | 0 | 2 | 3 |

| Grant | 2 | 2 | 1 |

| Greenbrier | 0 | 1 | 1 |

| Hampshire | 1 | 1 | 1 |

| Hancock | 1 | 1 | 2 |

| Hardy | 0 | 0 | 1 |

| Harrison | 3 | 1 | 4 |

| Jackson | 2 | 1 | 2 |

| Jefferson | 2 | 3 | 2 |

| Kanawha | 8 | 4 | 13 |

| Lewis | 3 | 4 | 0 |

| Lincoln | 1 | 0 | 0 |

| Logan | 2 | 1 | 3 |

| Marion | 3 | 5 | 1 |

| Marshall | 2 | 0 | 2 |

Drivers who speed are more likely to lose control of their vehicle or hit objects. Drivers in West Virginia should take care to follow the posted speed limits and drive carefully in bad weather, which will lower the changes of being in an accident.

West Virginia Fatalities by DUI by County

Some counties have high DUI fatality rates. Harrison and Kanawha are two of the worst counties in West Virginia for DUI fatalities.

West Virginia Fatalities Involving DUI by County

| County | 2015 | 2016 | 2017 |

|---|---|---|---|

| Barbour | 0 | 2 | 1 |

| Berkeley | 2 | 3 | 2 |

| Boone | 0 | 0 | 0 |

| Braxton | 3 | 0 | 0 |

| Brooke | 0 | 0 | 1 |

| Cabell | 3 | 3 | 7 |

| Calhoun | 0 | 0 | 0 |

| Clay | 1 | 0 | 0 |

| Doddridge | 0 | 0 | 0 |

| Fayette | 3 | 0 | 0 |

| Gilmer | 0 | 2 | 0 |

| Grant | 0 | 0 | 1 |

| Greenbrier | 2 | 1 | 1 |

| Hampshire | 1 | 3 | 1 |

| Hancock | 0 | 1 | 0 |

| Hardy | 2 | 0 | 0 |

| Harrison | 5 | 2 | 6 |

| Jackson | 2 | 1 | 1 |

| Jefferson | 4 | 3 | 1 |

| Kanawha | 7 | 7 | 6 |

| Lewis | 2 | 1 | 1 |

| Lincoln | 0 | 0 | 2 |

| Logan | 2 | 1 | 3 |

| Marion | 0 | 3 | 1 |

| Marshall | 1 | 1 | 2 |

A few counties in West Virginia managed to have zero DUI fatalities in some years. Still, for the most part, every county in West Virginia has suffered some fatalities from DUI driving.

West Virginia Fatality Rates Rural Versus Urban

Both rural and urban areas have their dangers. In our table below, you can see the fatalities in rural and urban locations in West Virginia.

West Virginia Traffic Fatalities Ten-Year Trend by Roadway Type

| Roadway Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 217 | 223 | 206 | 218 | 235 | 215 | 183 | 195 | 169 | 91 |

| Urban | 200 | 137 | 153 | 137 | 184 | 184 | 200 | 214 | 222 | 60 |

Urban crashes are more likely to occur from crashes with other vehicles. Rural crashes can occur from speeding, animal collisions, and more.

West Virginia Fatalities by Person Type

Not all West Virginia fatalities are car occupants. Pedestrians, cyclists, and motorcyclists also contribute to the fatalities.

West Virginia Traffic Fatality by Person Type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Vehicle Occupant | 247 | 202 | 192 | 186 | 218 |

| Motorcyclist | 24 | 26 | 32 | 29 | 26 |

| Pedestrian | 28 | 19 | 19 | 24 | 26 |

| Bicyclist and Other Cyclist | 0 | 2 | 1 | 1 | 3 |

Whether you are a cyclist or a driver, make sure to keep your eyes open for others on the road. Drivers should follow state laws by driving within the speed limit and yielding to pedestrians.

West Virginia EMS Response Time

Curious how fast help can reach you in West Virginia? EMS response times vary depending on West Virginia residents’ location.

West Virginia EMS Response Time

| West Virginia Location Type | Time of Crash to EMS Notification | Notification to Arrival | Arrival at Scene to Hospital Arrival | Time of Crash to Time of Hospital Arrival |

|---|---|---|---|---|

| Rural | 8.98 | 16.16 | 39.61 | 55.00 |

| Urban | 5.36 | 10.22 | 29.23 | 42.48 |

Naturally, urban locations have slightly better EMS response times as hospitals are closer than in rural areas. Still, the rural EMS times aren’t that much more than in urban areas.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

West Virginia Transportation

Where does West Virginia rank in commute time? How does rush-hour traffic compare to the rest of the nation? What methods do they use to get to work? We’ll answer those questions and more.

In West Virginia, 41.7 percent of households own two cars. That is a little higher than the national average of 40.3 percent.

Workers in West Virginia have a shorter average commute time than the normal US worker (25.3 minutes). Additionally, 3.3 percent of the workforce in West Virginia have “super commutes” in excess of 90 minutes.

A majority of West Virginians also drive to work alone — 83.3 percent. Only 8.57 percent of workers carpooled during their daily commute.

Learn more: Does car insurance cover carpooling?

The Bottom Line: Cheapest West Virginia Car Insurance Rates

USAA, State Farm, and Geico have the best West Virginia car insurance rates for drivers. You now have comprehensive knowledge of what you need for insurance, ways to lower the cost of your insurance, and how to safely obey the traffic laws governing your great state of West Virginia.

Enter your ZIP code below to compare West Virginia car insurance rates online to ensure the vehicle that takes you home to the place where you belong has the proper coverage at rates that are almost heaven.

Frequently Asked Questions

How much is car insurance in West Virginia?

The cost of car insurance in West Virginia can vary depending on several factors, including your age, driving record, location, and the type of coverage you choose. It’s best to get quotes from different insurance companies to find the most accurate price for your specific situation.

Who has the cheapest car insurance in West Virginia?

The cheapest car insurance provider in West Virginia can vary depending on individual circumstances. It’s recommended to compare quotes from multiple insurance companies to find the best rates for your specific needs. Find cheap West Virginia car insurance quotes today by entering your ZIP in our free quote tool.

What are the car insurance laws in West Virginia?

In West Virginia, car insurance is mandatory. The minimum liability coverage required by law is 25/50/20, which means you must have at least:

- $25,000 for bodily injury or death per person

- $50,000 for total bodily injury or death per accident

- $20,000 for property damage per accident

Not carrying the required liability insurance in West Virginia is illegal. Luckily, liability insurance is affordable at most companies (learn more: Compare Liability Car Insurance: Rates, Discounts, & Requirements).

Do I need uninsured/underinsured motorist coverage in West Virginia?

Uninsured/underinsured motorist coverage is not required by law in West Virginia, but it is highly recommended. This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Should I choose the bare minimum coverage?

The decision to choose the minimum coverage or additional coverage depends on your personal financial situation and the value of your assets. If you have assets to protect, it’s generally advisable to increase your liability limits and consider additional coverage options.

What is the loss ratio, and how does it impact my rates?

The loss ratio is a measure used by insurance companies to assess their profitability. It is calculated by dividing the amount paid out in claims by the premiums collected. A high loss ratio indicates that the insurance company has had a high number of claims, which may result in higher premiums for policyholders in the future. Need to file a claim? Learn how in our article on how to file a car insurance claim.

What are some optional add-ons or endorsements for car insurance in West Virginia?

Some optional add-ons or endorsements for car insurance in West Virginia include:

- Gap insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

You do not have to add all of these coverages to your insurance policy.

Are there differences in car insurance rates between male and female drivers in West Virginia?

On average, male drivers may receive better premium quotes than female drivers in West Virginia. However, individual circumstances such as age, driving record, and location can also affect insurance rates.

What factors can affect car insurance rates in West Virginia?

Several factors can affect car insurance rates in West Virginia, including:

- Age

- Driving record

- Location

- Type of vehicle

- Coverage options

- Deductibles

- Credit history

- Annual mileage

Some of these factors are outside of your control, but shopping for West Virginia auto insurance quotes will help you find the best rates (learn more: How do you get competitive quotes for car insurance?).

Which companies have the best car insurance in West Virginia?

The best car insurance company for you will depend on your specific needs and preferences. It’s recommended to research and compare the financial stability and customer satisfaction ratings of different insurance companies to find the one that suits you best.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.