Cheap Walmart Delivery Car Insurance in 2025 (Top 10 Companies for Savings!)

Cheap Walmart delivery car insurance is essential for drivers, with Geico, AAA, and Travelers offering the best rates. Geico stands out with the lowest monthly rate at $30 per month. These companies provide affordable coverage and great service, helping Walmart delivery drivers save money and stay protected.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Walmart Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Walmart Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Walmart Delivery

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

Delivering groceries is the next big trend in delivery work, but you will need Walmart delivery insurance to do so.

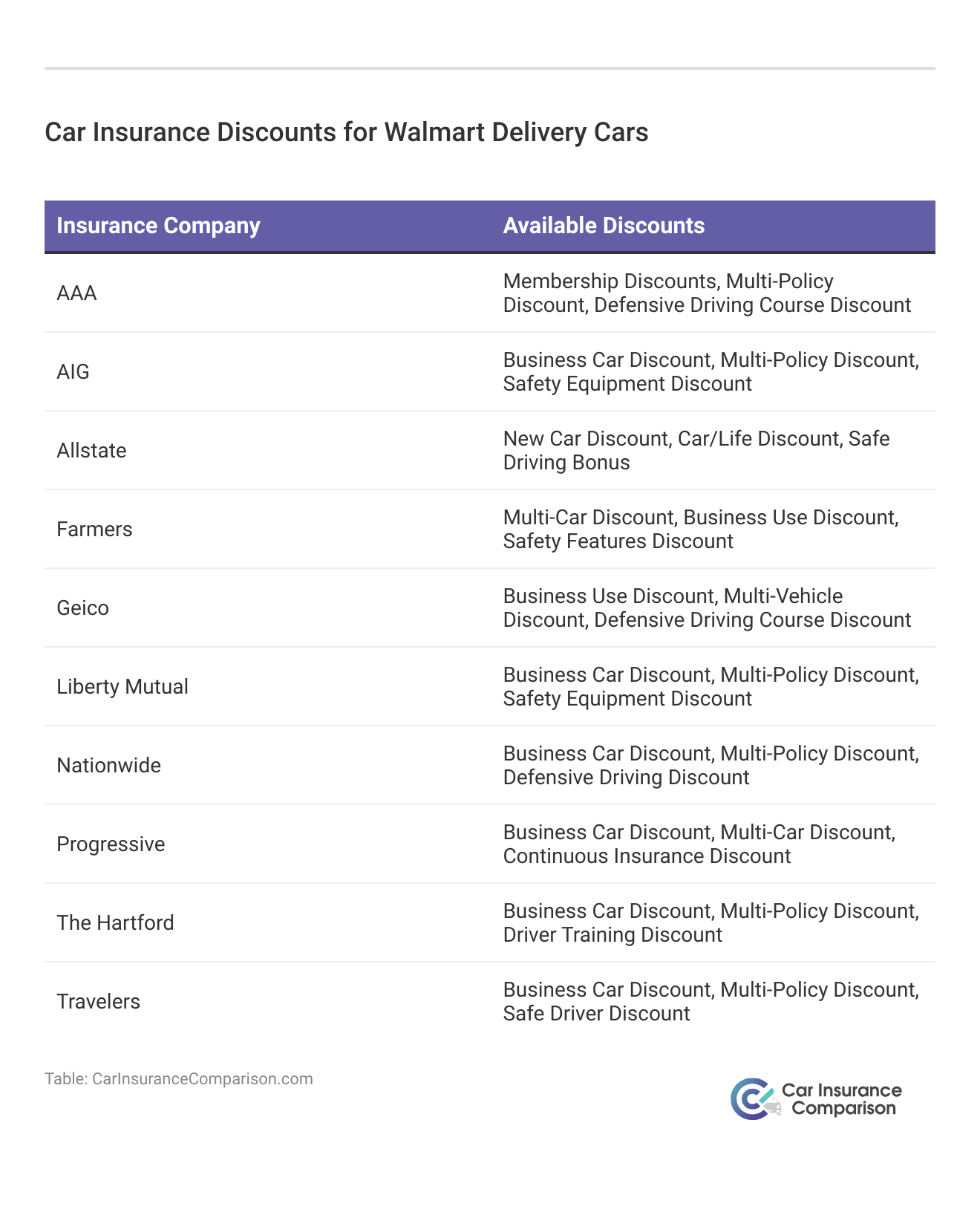

Our Top 10 Company Picks: Cheap Walmart Delivery Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $30 A++ Competitive Rates Geico

#2 $32 A Extensive Coverage AAA

#3 $37 A++ Flexible Coverage Travelers

#4 $39 A+ Customizable Coverage Progressive

#5 $43 A+ Competitive Rates The Hartford

#6 $45 A+ Budget-Friendly Premiums Nationwide

#7 $53 A Customizable Coverage Farmers

#8 $61 A+ Budget-Friendly Premiums Allstate

#9 $68 A Comprehensive Coverage Liberty Mutual

#10 $70 A+ Specialized Coverage AIG

Keep reading to learn how to keep your car covered while you are on the clock and what cheap car insurance options available for delivery drivers. Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

- Walmart delivery car insurance is not offered directly through Walmart

- Without coverage, Walmart delivery drivers are liable for all accident costs at work

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Offers affordable options like hybrid policies. Discover more about offerings in our Geico car insurance review.

- Strong Customer Service: Easy claims process and good reputation.

- Variety of Discounts: Includes multi-policy and safe driver discounts.

Cons

- Limited Coverage Options: Not as many specialized add-ons compared to others.

- Less Comprehensive Add-Ons: May offer fewer specialized endorsements.

#2 – AAA: Best for Extensive Coverage

Pros

- Established Brand: Excellent roadside assistance and member benefits.

- Member Discounts: Loyalty rewards and discounts available. See more details on our AAA car insurance review.

- Strong Customer Service: Local agent support and good reputation.

Cons

- Higher Premiums: Rates can be higher compared to competitors.

- Limited Availability: Dependent on membership and regional availability.

#3 – Travelers: Best for Flexible Coverage

Pros

- Wide Range of Coverage: Includes unique endorsements and options.

- Financial Stability: Strong financial ratings and stability.

- Multi-Policy Discounts: Competitive rates for bundling policies.

Cons

- Higher Costs: May not always be the cheapest option. See more details on our Travelers car insurance review.

- Mixed Customer Service: Some reports of issues with claims and service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Customizable Coverage

Pros

- Name Your Price® Tool: Personalized quoting for affordability. Delve into our evaluation of Progressive car insurance review.

- Discounts: Includes Snapshot® program and other savings.

- Online Experience: Strong online and mobile app for management.

Cons

- Higher Rates for Some: Rates can be higher for certain demographics.

- Limited Agent Availability: Less local agent presence compared to others.

#5 – The Hartford: Best for Competitive Rates

Pros

- AARP Insurance: Specializes in insurance for AARP members.

- Financial Stability: Strong ratings and stability. Discover more insights in our The Hartford car insurance discounts.

- Bundling Options: Discounts for combining home and auto policies.

Cons

- Limited Availability: Primarily available through AARP membership.

- Higher Premiums: Rates may be higher for non-AARP members.

#6 – Nationwide: Best for Budget-Friendly Premiums

Pros

- Coverage Options: Wide range of options and discounts.

- Customer Service: Highly-rated service and claims handling.

- Multi-Policy Discounts: Savings for bundling policies. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Higher Premiums: Costs can be higher compared to regional insurers.

- Limited Availability: Availability may be limited in some states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Coverage

Pros

- Personalized Service: Local agents and personalized attention.

- Coverage Options: Offers a variety of options and discounts. Learn more in our Farmers car insurance review.

- Financial Stability: Strong financial stability and customer service.

Cons

- Higher Premiums: Rates may be higher compared to competitors.

- Regional Availability: Limited availability in certain regions.

#8 – Allstate: Best for Budget-Friendly Premiums

Pros

- Coverage Options: Wide range of options and add-ons.

- Safe Driving Rewards: Innovative tools like Drivewise®.

- Financial Stability: Strong ratings and stability.

Cons

- Higher Premiums: Costs may be higher compared to some competitors.

- Limited Agent Availability: Less local agent presence in some areas. Discover more about their availability in our Allstate car insurance review.

#9 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Wide Coverage Options: Offers a variety of coverage options and discounts.

- Technology and Tools: Provides innovative tools for policy management.

- Strong Financial Stability: High financial ratings and stability.

Cons

- Higher Premiums: Rates may be higher compared to some competitors. Read our Liberty Mutual car insurance review for more information.

- Mixed Customer Service: Some customers report issues with claims and service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – AIG: Best for Specialized Coverage

Pros

- Global Reach: Offers insurance solutions on a global scale.

- Customized Coverage: Tailored policies to fit specific needs.

- Financial Strength: Strong financial stability and ratings.

Cons

- Higher Premiums: Premiums can be higher compared to other insurers.

- Limited Availability: Availability may be restricted in certain regions. (Read more: How do I get car insurance when moving to the USA?)

Walmart Insurance Offerings for Their Delivery Drivers

Walmart delivery uses an app called Spark and works very similar to DoorDash and other on-demand delivery services. Walmart Spark delivery driver reviews are varied; however, there are some benefits.

For example, Walmart Spark delivery driver pay is weekly, and the app offers bonuses for deliveries done during high-demand periods.

Car Insurance Monthly Rates for Walmart Delivery Cars by Coverage Level

Insurance Company Minimum Coverage Full Coverage

AAA $32 $86

AIG $70 $120

Allstate $61 $160

Farmers $53 $139

Geico $30 $80

Liberty Mutual $68 $174

Nationwide $45 $115

Progressive $39 $105

The Hartford $43 $113

Travelers $37 $99

However, if the app and Walmart do not offer insurance for their drivers, which means drivers will need to buy Walmart delivery insurance elsewhere.

Read more: Best Car Insurance for Delivery Drivers

Kinds of Car Insurance for Walmart Delivery Driver

Delivery drivers need commercial car insurance to maintain coverage while they are at work.

Delivery companies like Walmart and DoorDash require drivers to maintain personal insurance.

However, according to the Insurance Information Institute, this insurance will not offer coverage if you get into an accident while using your car for work purposes.

Instead, you will need to buy a separate form of coverage from a Walmart delivery insurance company.

There are three main coverage options for delivery drivers looking for commercial policies:

- Commercial endorsements

- Hybrid car insurance

- Commercial car insurance policies

Luckily, every major car insurance company offers some form of commercial coverage, so it is not difficult to find a policy that works for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Most Affordable Walmart Delivery Insurance Option for Delivery Drivers

When you’re driving delivery, the most important thing is saving money, which means finding affordable Walmart delivery insurance rates is essential.

To that end, there are two options that keep the most money in your pocket, where it belongs.

The first option is to add a commercial endorsement to your personal car insurance policy. These are very affordable, usually requiring you to add less than $10 to your existing monthly bill.

The second option is to get a hybrid policy, like the Geico Rideshare policy. Walmart delivery insurance quotes for hybrid policies are often more expensive than a traditional personal policy.

To learn more about this company, read our Geico car insurance review.

However, they are far more affordable paying for both a commercial and personal policy separately.

No matter how you decide you want to insure your car, it is important that you purchase commercial coverage.

Driving without this insurance will put you on the hook for the cost of any car repairs and medical bills if you do get into an accident while on the clock.

Are you ready to purchase commercial Walmart delivery insurance? Enter your ZIP code below, and we will help you find the right policy from the right provider at the right price in minutes.

Frequently Asked Questions

Does Walmart offer insurance to their delivery drivers?

No, Walmart does not provide insurance to its delivery drivers. They are required to purchase a commercial insurance policy to maintain coverage while making deliveries.

What kind of car insurance do I need as a Walmart delivery driver?

As a Walmart delivery driver, you need commercial car insurance. Personal insurance policies do not provide coverage for accidents that occur while using your car for work purposes.

What are the most affordable options for Walmart delivery insurance?

The two most affordable options for Walmart delivery insurance are adding a commercial endorsement to your personal policy or getting a hybrid commercial-personal policy. These options help save money while providing the necessary coverage.

Find cheap car insurance quotes by entering your ZIP code below.

Where can I find commercial Walmart delivery insurance?

Every major car insurance company offers commercial coverage. You can compare quotes from different providers to find the right policy at the right price.

What are the risks of driving without Walmart delivery insurance?

Driving without commercial insurance while making deliveries for Walmart can leave you responsible for the costs of car repairs and medical bills in case of an accident. It’s important to have the proper coverage to protect yourself and your vehicle.

How can I find cheap Walmart delivery car insurance?

You can find cheap Walmart delivery car insurance by comparing quotes from different insurance providers. Look for companies that offer affordable hybrid policies or discounts for delivery drivers.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Can I save money on car insurance as a Walmart delivery driver?

Yes, by comparing quotes and selecting policies with lower premiums and relevant discounts, such as multi-policy or safe driver discounts, Walmart delivery drivers can save money on their car insurance.

Read more: Car Insurance Discounts: Compare the Best Discounts

Is commercial car insurance necessary for Walmart delivery drivers?

Yes, Walmart delivery drivers need commercial car insurance to ensure coverage while making deliveries. Personal insurance policies typically do not cover accidents that occur while using the vehicle for work purposes.

Do I need special insurance as a Walmart delivery driver?

Yes, Walmart delivery drivers need commercial car insurance to ensure they are covered while making deliveries. Personal insurance policies typically do not cover accidents that occur while using your vehicle for work purposes.

Does Walmart provide insurance for their delivery drivers?

No, Walmart does not offer insurance to their delivery drivers. Drivers are responsible for purchasing their own commercial insurance policy to maintain coverage while working.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.