Cheap Car Insurance for Station Wagons in 2025 (Save Money With These 10 Companies)

Our top picks for cheap car insurance for station wagons are Geico, USAA, and State Farm. Geico has the cheapest station wagon rates, as minimum coverage averages $82/mo. Station wagons are often a popular choice for families, as they are cheaper to insure and have better gas mileage than SUVs.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Station Wagons

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Station Wagons

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Station Wagons

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsGeico, USAA, and State Farm are the top picks for cheap car insurance for station wagons.

How much station wagons cost to insure depends largely on a variety of factors. As the station wagon becomes a more popular option for individuals and families, there are more being produced, more being purchased, and, in turn, more being driven and insured. However, as to the total cost to insure a station wagon, more information must be provided than just the type of vehicle.

Our Top 10 Company Picks: Cheap Car Insurance for Station Wagons

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $82 | A++ | Online Convenience | Geico | |

| #2 | $89 | A++ | Military Benefits | USAA | |

| #3 | $97 | A++ | Customer Loyalty | State Farm | |

| #4 | $104 | A+ | Bundle Discounts | Progressive | |

| #5 | $108 | A+ | Family Plans | Nationwide |

| #6 | $115 | A | Safety Discounts | Farmers | |

| #7 | $123 | A++ | Safe Driver Benefits | Travelers | |

| #8 | $129 | A | Young Driver Focus | American Family | |

| #9 | $137 | A+ | Car Replacement | Allstate | |

| #10 | $146 | A | Customizable Coverage | Liberty Mutual |

Are you looking for car insurance rates for your station wagon? Entering your ZIP code above can help you find cheap auto insurance for station wagons in your area today.

- Geico has the cheapest car insurance for station wagons

- Station wagons have better gas mileage than sport utility vehicles

- The 6 cheapest station wagons to insure have rates of $97/mo

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Online Convenience: Easily manage your station wagon policy details online. Learn more in our Geico review.

- Roadside Assistance: Great if you have an older station wagon that might need a jump or tow.

- Good Student Discount: Great for families with teens to help maximize insurance savings on auto insurance for a station wagon.

Cons

- Local Support: Most of Geico’s services are provided over the phone or online.

- Discount Availability: Good driver discounts aren’t always available.

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers additional benefits like shopping discounts to USAA members.

- Customer Service: Read our USAA review to learn about its high ratings.

- Multi-Policy Discount: You can also purchase home insurance or renters insurance from USAA.

Cons

- Eligibility: USAA is exclusively sold to service members and veterans.

- Coverage Options: USAA doesn’t offer as many add-ons as some companies.

#3 – State Farm: Best for Customer Loyalty

Pros

- Customer Loyalty: Most State Farm customers stick with the company as a provider.

- Roadside Assistance: Great if your station wagon is older and breaks down frequently.

- Financial Reputation: The company has the highest rating from A.M. Best. Learn more in our State Farm review.

Cons

- Credit Scores: Your credit score may impact your rates for insurance on a station wagon in some states.

- Accident Forgiveness: You may not qualify for accident forgiveness due to the more stringent requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Bundle Discounts

Pros

- Bundle Discounts: Buy home or renters insurance with auto insurance to get reduced rates. Learn more in our Progressive review.

- Coverage Variety: Add specialty station wagon coverages, like custom parts insurance if you’ve made modifications.

- Budgeting Tool: This tool is free to use and helps you see how much station wagon insurance you can afford.

Cons

- UBI Rate Increases: Bad drivers may have rate increases after joining Progressive’s UBI program.

- Customer Claims: The company doesn’t have high claim satisfaction ratings.

#5 – Nationwide: Best for Family Plans

Pros

- Family Plans: Nationwide has great coverage options and discounts for families looking for station wagon insurance.

- Multiple Discounts: See what discounts are offered by reading our article on Nationwide discounts.

- Deductible Reductions: Nationwide reduces deductibles for customers who don’t file claims.

Cons

- Availability: Auto insurance is not sold in a few states in the U.S.

- High-Risk Rates: Nationwide is not the best option for drivers with multiple infractions on their driving record.

#6 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts: Get lower rates if your station wagon is equipped with safety features. Read more in our Farmers review.

- On Your Side Review: Every year, you can work with an agent to make sure your rates and coverages are still ideal.

- Roadside Assistance: Add towing and repair assistance if your station wagon breaks down.

Cons

- Claim Reviews: Customer claim satisfaction isn’t the highest rated at Farmers.

- Online Tools: You will need agent assistance for some tasks, rather than being able to do it online.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Safe Driver Benefits

Pros

- Safe Driver Benefits: Safe drivers can get lower rates through discounts and reduced deductibles.

- Coverage Options: Personalize a policy for your station wagon with add-ons. Discover more in our review of Travelers.

- Multi-Policy Discount: Keeping all your insurance products at Travelers pays off with lower rates.

Cons

- UBI Rate Increases: Poor driving habits may increase your rates in Travelers’ UBI program.

- High-Risk Rates: Travelers is less economical for station wagon owners with multiple infractions on their records.

#8 – American Family: Best for Young Driver Focus

Pros

- Young Driver Focus: American Family offers several discounts tailored to young drivers.

- Roadside Assistance: Purchase for help with breakdowns. Read more in our American Family review.

- Customer Service: Customer service is highly rated by most customers.

Cons

- Availability: Station wagon owners may not have insurance in their state.

- High-Risk Rates: Cheap rates may not be possible for DUI drivers.

#9 – Allstate: Best for Car Replacement

Pros

- Car Replacement: You can buy new car replacement coverage from Allstate in case your new station wagon is totaled.

- Pay-Per-Mile Rates: A great way to save if you rarely drive your station wagon.

- Good Driver Discount: Drivers with clean driving records will have the lowest station wagon rates.

Cons

- Young Driver Rates: Teens may want to get quotes from other companies.

- Customer Complaints: Complaints are more numerous than at Allstates’ competition. Learn more in our Allstate review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: You can customize your coverages by adjusting your deductible amounts.

- 24/7 Support: Call Liberty Mutual at any hour for help with your station wagon insurance.

- Military Discount: Service members are offered a discount at Liberty Mutual.

Cons

- High-Risk Rates: Policies aren’t as economical if station wagon owners are deemed high-risk.

- Claim Reviews: The company is not the highest rated for claims processing. Learn more in our Liberty Mutual car insurance review.

Types of Station Wagons

All station wagons have extra room in the far back of the vehicle. Several different types of station wagons that are on the market today include the Volkswagen Golf SportWagon, Volvo V60, Toyota Prius V, BMW 3-series, and the Subaru Impreza.

Read more:

Here are some of the ways that room in these types of station wagons are used:

- Additional seating

- Extra cargo space

- Both, as the car seats fold up or down depending on your individual needs

The station wagon has continued to evolve, but the traditional station wagon, such as the popular wagon used in the 1980 movie, “National Lampoon’s Vacation,” has been updated and changed to meet the new requirements of the American family.

Even the names have changed, as the term “station wagon” has been replaced by new names such as:

- Compact utility vehicle

- Crossover vehicle

- Five-door sports wagon

The term station wagon is now almost obsolete, but the original reasons that the station wagon was produced are still in play today.

Who Should Consider Station Wagons

Life in the United States requires that you and your family get around in the easiest and most efficient way possible. This starts by having a vehicle that can help you stay organized.

With additional cargo room and seating, today’s station wagons allow you to fit your entire family in the vehicle, as well as their sports gear, school bags, and other belongings. Compact utility vehicles provide the handling and gas mileage qualities of a car but also offer the convenience of having the extra room of a minivan. Compared to compact utility vehicles, station wagons typically:

- are cheaper to insure

- are cheaper to purchase

- get better gas mileage

If you require the extra room that comes with a station wagon, you may want to consider looking at many different models. If the cost of insuring a station wagon is a deterrent, it may be beneficial to look at minivans as well.

View this post on Instagram

What is important to note about these vehicles is that they are sportier and smaller than the traditional station wagon. In fact, most of the vehicles do not seat more than five people, so they are not necessarily a good choice for a large family that needs a lot of space.

Station Wagon Auto Insurance Rates

A lot depends on the type of station wagon, but generally, station wagons offer a lower insurance premium cost than other cars and trucks. Take a look below at average rates from cheap station wagon insurance companies.

Car Insurance Monthly Rates for Station Wagons by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $137 | $259 |

| American Family | $129 | $248 |

| Farmers | $115 | $227 |

| Geico | $82 | $172 |

| Liberty Mutual | $146 | $268 |

| Nationwide | $108 | $220 |

| Progressive | $104 | $211 |

| State Farm | $97 | $199 |

| Travelers | $123 | $239 |

| USAA | $89 | $186 |

The reason that station wagons are cheaper to insure is that they are safer to drive and have better safety features, which can earn you safety feature discounts.

Insurance companies often offer discounts if your car is equipped with safety features like backup cameras or anti-theft devices like a GPS tracker.

Brandon Frady Licensed Insurance Agent

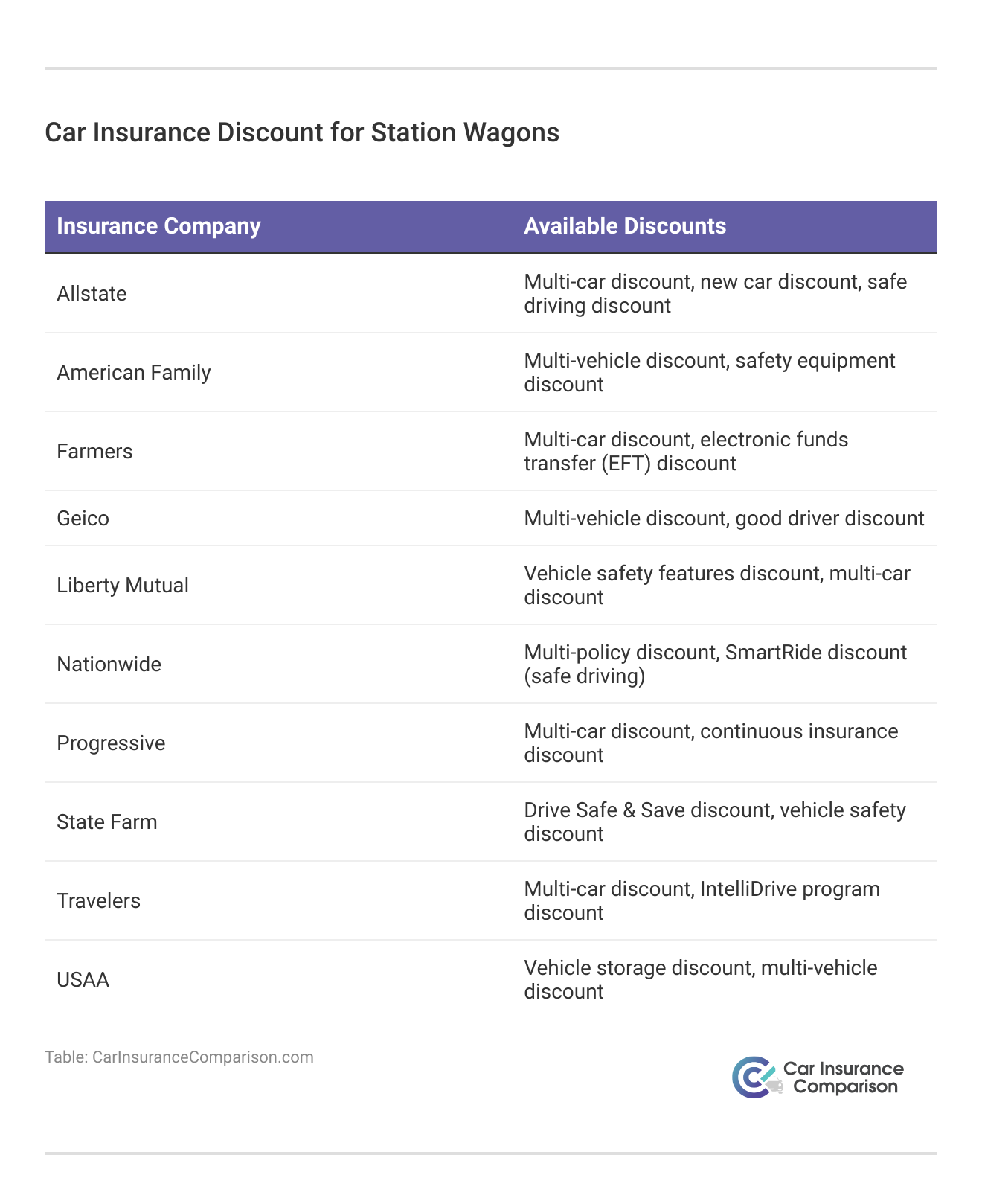

Take a look below at the discounts offered at affordable station wagon companies.

Station wagons are some of the safest cars in America because they’re a little larger than other cars on the road but not so large that the vehicle can cause a lot of damage in a car accident. However, we recommend still getting quotes from cheap companies like Geioc to get a better idea of what your rates would be for your station wagon.

Typically, station wagons are not popular cars targeted by auto thieves and are less expensive to repair when they do get damaged, making them more affordable to insure.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Final Word on Cheap Station Wagon Insurance

Minivans and station wagons are some of the least expensive vehicles to insure. However, you will still have to take your time comparing rates and coverages at companies to find the best deal (learn more: How do you get competitive quotes for car insurance?).

Are you looking for a new station wagon and trying to get car insurance rates? Start today by entering your ZIP code below!

Frequently Asked Questions

What types of station wagons are available?

Popular station wagon models include Volkswagen Golf SportWagon, Volvo V60, Toyota Prius V, BMW 3-series, and Subaru Impreza.

Why should I choose a station wagon?

Station wagons offer extra space for both passengers and cargo, making them convenient for families and activities.

Are station wagons expensive to insure?

No, station wagons generally have lower insurance premiums on the different types of car insurance coverage due to their safety features and lower risk factors.

How do station wagon insurance costs compare to other vehicles?

Station wagons and minivans tend to have lower insurance wagon costs compared to other types of cars or trucks.

Can you provide specific insurance rates for station wagons?

Individual station wagon auto insurance rates vary, but station wagons are generally among the least expensive vehicles to insure.

Who has the cheapest car insurance for a station wagon?

Geico has the cheapest average rates for most station wagons. Try our comparison tool to compare auto insurance quotes today.

What is the best car insurance for station wagons?

Full coverage is usually the best option for most station wagon owners (learn more: Best Full Coverage Car Insurance).

What are estate car insurance deals?

If the policyholder dies, the auto insurance will stay in place so the station wagon is covered by insurance until the estate is taken care of.

Who is cheaper, Geico or Progressive?

Geico has cheaper station wagon car insurance than Progressive.

Is Allstate cheaper than Geico?

No, Geico is usually cheaper than Allstate. Learn more in our Geico vs. Allstate car insurance comparison.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.