Cheap Car Insurance for Convertibles in 2025 (Cash Savings With These 10 Companies!)

Discover USAA, Erie, and Geico as the top providers of cheap car insurance for convertibles, starting at just $22 per month. These companies excel in competitive pricing, comprehensive coverage options, and superior customer service, making them the ideal choices for convertible owners seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Convertibles

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Convertibles

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Convertibles

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap car insurance for convertibles are USAA, Erie, and Geico, known for their competitive rates and comprehensive coverage options.

These companies stand out by balancing affordability with extensive customer support and customization features, ensuring convertible owners receive value and peace of mind. Learn more about our cheap car insurance rates.

Our Top 10 Company Picks: Cheap Car Insurance for Convertibles

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A++ Specialized Coverage USAA

#2 $23 A+ Personalized Service Erie

#3 $30 A++ Customizable Coverage Geico

#4 $33 B Personalized Service State Farm

#5 $39 A+ Competitive Rates Progressive

#6 $44 A Comprehensive Coverage American Family

#7 $45 A+ Customizable Coverage Nationwide

#8 $53 A Customizable Coverage Farmers

#9 $61 A+ Comprehensive Coverage Allstate

#10 $68 A Safe-Driving Discounts Liberty Mutual

Their policies cater specifically to the unique needs of convertible cars, addressing common concerns like theft and weather-related damage. With a focus on quality service and affordable premiums, these insurers provide the best solutions for protecting your convertible.

Before learning more about car insurance rates for convertibles, you can see the numbers. Just enter your ZIP code above and compare car insurance quotes right now.

- USAA is the top pick for cheap car insurance for convertibles

- Convertible-specific policies address risks like theft and weather damage

- Affordable options combine quality coverage with cost-efficiency

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

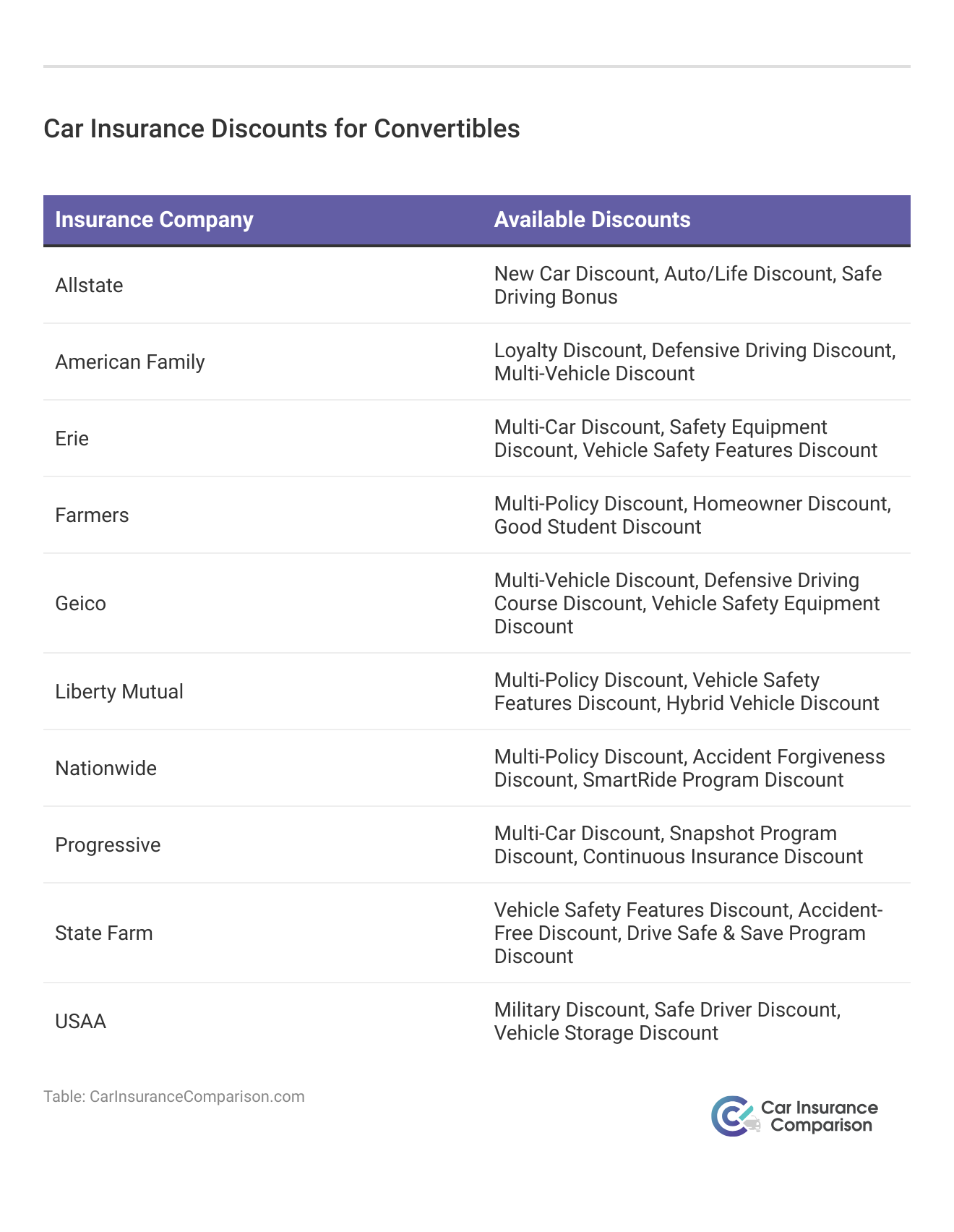

#1 – USAA: Top Overall Pick

Pros

- Competitive Pricing: Offers some of the lowest rates in the market, starting at $22. Unlock details in our USAA car insurance review.

- High Customer Satisfaction: Known for excellent customer service and claims handling.

- Military Discounts: Provides additional discounts and services for military members and their families.

Cons

- Limited Availability: Services are only available to military members, veterans, and their families.

- Fewer Physical Locations: Limited number of physical offices compared to other insurers.

#2 – Erie: Best for Personalized Service

Pros

- Personalized Policies: Tailors coverage to meet individual customer needs.

- Rate Lock Feature: Offers the possibility to lock in your premium rate. Learn more in our Erie car insurance review.

- Local Agents: Provides personalized customer service through a network of local agents.

Cons

- Limited Geographical Coverage: Only available in certain states.

- No Online Claims: The claims process is not fully online, which can be less convenient for some users.

#3 – Geico: Best for Customizable Coverage

Pros

- Affordable Rates: Competitive pricing with plans starting at $30. Discover more about offerings in our Geico car insurance review.

- Extensive Discounts: Offers a wide range of discounts including multi-vehicle, safe driver, and more.

- Robust Online Tools: Provides a user-friendly online interface and mobile app for policy management.

Cons

- Customer Service Variability: Some customers report variability in service quality.

- Standard Coverage: Basic coverage options may not include all features that competitors offer as standard.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Personalized Service

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored to different business needs. Unlock details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#5 – Progressive: Best for Competitive Rate

Pros

- Price Comparison Tool: Offers tools to compare rates and policies directly on their website.

- Name Your Price Tool: Allows customers to input their budget to find suitable policies. Delve into our evaluation of Progressive car insurance review.

- Loyalty Rewards: Progressive rewards long-term customers with lower rates and deductibles.

Cons

- Inconsistent Agent Experience: Quality and service can vary significantly between agents.

- Higher Rates for High-Risk Drivers: High-risk drivers may face significantly higher rates.

#6 – American Family: Best for Comprehensive Coverage

Pros

- Customizable Packages: Wide range of options to tailor coverage extensively. See more details on our American Family car insurance review.

- Generous Discounts: Offers multiple discounts including for safety features and loyalty.

- Strong Financial Stability: High ratings from A.M. Best, ensuring reliability in claims payment.

Cons

- Limited State Availability: Not available in all states, which can be restrictive.

- Higher Premiums Without Bundles: Premiums can be higher unless you bundle policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Customizable Coverage

Pros

- Flexible Options: Offers a variety of customizable coverage options. Check out insurance savings in our complete Nationwide car insurance discount.

- Accident Forgiveness: Includes features like accident forgiveness to prevent rate increases after a first accident.

- Free Annual Policy Review: Provides a free policy review each year to help adjust coverage as needed.

Cons

- Variable Customer Service: Some customers report inconsistent service experiences.

- Higher Premiums for Certain Policies: Some specialized policies may come with higher premiums.

#8 – Farmers: Best for Coverage Innovator

Pros

- Customizable Policies: Extensive customization options for different types of coverage.

- Dedicated Agents: Offers personalized service through dedicated agents. Learn more in our Farmers car insurance review.

- Educational Resources: Provides ample resources to help customers understand their coverage.

Cons

- Higher Cost: Generally higher rates compared to some competitors.

- Complexity of Policy Options: The wide range of options can be confusing for some customers.

#9 – Allstate: Best for Broad Coverage

Pros

- Multi-Policy Discounts: Significant discounts are available for bundling different types of insurance.

- Comprehensive Options: Broad array of coverage options, including pet insurance and identity theft.

- Claims Satisfaction Guarantee: Offers a guarantee of satisfaction with the claims process. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Pricing: Generally higher prices, especially for single-policy holders.

- Less Competitive for Auto: May not offer the most competitive rates specifically for auto insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Safe-Driving Discount

Pros

- Safe Driver Discounts: Offers discounts for safe drivers and new car owners. Read up on the Liberty Mutual car insurance review for more information.

- Accident Forgiveness: Includes accident forgiveness to help prevent premium increases.

- Online Policy Management: Strong online tools for managing policies and filing claims.

Cons

- Higher Premiums: Rates can be higher, especially without discounts.

- Complex Claims Process: Some customers report a more complex claims process compared to competitors.

Convertible Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $61 $160

American Family $44 $117

Erie $23 $58

Farmers $53 $139

Geico $30 $80

Liberty Mutual $68 $174

Nationwide $45 $115

Progressive $39 $105

State Farm $33 $86

USAA $22 $59

For maximum coverage, USAA offers the lowest rate at $22, followed closely by Erie at $23, making them highly competitive options for those seeking substantial coverage. On the other end, Liberty Mutual demands the highest premium at $68. For full coverage, which is more comprehensive, the rates increase accordingly.

USAA remains the most economical with a monthly rate of $59, while Liberty Mutual again stands out as the most expensive at $174. This tier includes Farmers and Allstate, charging $139 and $160 respectively, reflecting a significant range in what different insurers charge for more complete protection packages.

These numbers emphasize the need to evaluate and compare rates while grasping the various coverage options each insurer offers to identify the cheapest convertible to insure that best suits your needs.

Learn more: Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements

How Much Does Car Insurance for a Convertible Cost

What is the average cost of insurance for a convertible? Are convertibles typically more costly to insure? Let’s first examine the national average for annual car insurance rates to understand how much is insurance for a convertible and whether does insurance cover convertible tops.

Standard vs. Convertible Car Insurance Monthly Rates by Coverage Type

| Coverage | Rates |

|---|---|

| Liability | $43 |

| Collision | $25 |

| Comprehensive | $12 |

| Full coverage | $80 |

| Convertible | $200 |

These rates include premiums for all vehicles and drivers, including those considered high-risk for insurers. The national average is about $950 a year, but rates vary dramatically for drivers. What factors affect car insurance rates? Where you live, what your credit history looks like, and even your age and gender are all factors in how an insurance provider calculates your rates.

Does a convertible cost more to insure? The presence of a retractable roof can significantly influence convertible insurance rates, making it challenging to provide an exact figure for coverage costs.

Partly, this is because the amount you’ll pay for auto insurance depends on how much the actual car costs. The MSRP will be a major contributor to cost, and you can see below that the MSRP varies considerably for different convertibles. Here’s a small sample of what you can get in different price ranges.

Convertible MSRP and Fair Market Range

| Convertibles | MSRP | Fair Market Range |

|---|---|---|

| 2019 Fiat 500C | $19,485 | $16,682–$18,053 |

| 2020 Ford Mustang | $33,265 | $29,828–$32,017 |

| 2018 Rolls-Royce Dawn Convertible | $358,350 | $354,766–$361,933 |

| 2018 Lamborghini Aventador | $468,242 | $463,559–$472,924 |

| 2021 BMW 4 Series Convertible | $53,100 | $49,500–$52,700 |

| 2021 Audi A5 Cabriolet | $50,400 | $47,200–$50,100 |

| 2021 Jaguar F-Type Convertible | $64,700 | $60,500–$64,300 |

| 2022 Mazda MX-5 Miata Convertible | $32,650 | $30,100–$32,200 |

| 2021 Mini Cooper Convertible | $28,400 | $26,000–$28,200 |

| 2021 Chevrolet Camaro Convertible | $43,500 | $40,000–$42,800 |

| 2022 Mercedes-Benz E-Class Cabriolet | $71,950 | $68,500–$71,200 |

| 2022 Porsche 911 Carrera Cabriolet | $114,000 | $109,500–$113,000 |

It wouldn’t make a lot of sense to pay the same amount for insurance coverage for a Fiat 500C as a Lamborghini Aventador; the latter is worth 23 times as much as the former. Your insurance company has to take into account how much they might have to pay out if your car is damaged severely or even totaled.

Also, not all convertibles are fancy sports cars — take the Volkswagen Beetle for example.

So, what is the cheapest convertible to insure?

If you’re considering buying a sports car convertible, but you’re looking at vehicles on the lower end of the cost spectrum, like the Ford Mustang, your rates will increase but not exponentially. For instance, Mustang convertible insurance costs between $200 and $500 more each year.

If you’re thinking about a more expensive sports car, such as a Jaguar, you could pay over $1,000 more each year for your car insurance. If you aren’t sure of the value of the vehicle you own or might buy, you can check the Kelley Blue Book website.

Read more:

- Compare Fiat Car Insurance Rates

- Compare Lamborghini Car Insurance Rates

- Compare Two-Door Car Insurance Rates

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Is a Hard-Top Convertible Less Expensive to Insure Than a Soft-Top Convertible

In general, you’re going to pay less for insurance for your hard-top convertible. The reason for this is that a soft-top convertible is considered to be at a higher risk of being broken into. All a would-be thief would have to do is get a sharp knife and cut open the top of your car.

Does car insurance cover convertible tops? If the damage comes from vandalism or something other than normal wear and tear, it should be covered. What do I do if my car is broken into? Make sure to notify authorities and your car insurance company.

However, it’s important to note that, in most cases, the difference between the costs for these two options is minimal, around $50–$100 a year. If you break that down into a monthly payment plan, you’re talking about $4–$8 a month more for your soft-top convertible.

And, if you ever need to replace the top, hopefully, you have comprehensive coverage (For more information, read our “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements”). Otherwise, it can easily cost you over $1,000 for a replacement part, not including labor, an estimate from the Convertible Top Guys.

Here are the cheapest convertibles you could own and their costs over a five-year period, assuming you drive about 15,000 miles per year.

Cheapest Convertibles to Own

| Convertible | Cost to Own |

|---|---|

| 2019 Fiat 500c | $37,100 |

| 2019 Jeep Wrangler (Sport 2dr 4x4) | $39,557 |

| 2019 Volkswaon Beatle (2.0T S 2dr convertible) | $40,058 |

This includes what you’d be paying for the actual convertible in payments and insurance premiums, along with your upkeep and repair costs, like oil changes.

How Does Convertible Car Insurance Differ From Other Types of Car Insurance

The IIHS tracks insurance losses for each type of car insurance, so you can see just how some convertibles compare to other vehicles.

Collision car insurance covers losses from getting into a car accident, especially if you’re found at fault and have to pay for your own car’s repairs. So, how do convertibles stack up against other cars?

Convertible Average Car Insurance Collision Losses

| Convertible Make & Model | Average Collision Losses |

|---|---|

| Ferrari 488 GTS | 375% |

| Rolls Royce Dawn | 315% |

| Fiat 500 | -44% |

| BMW Z4 Roadster | 270% |

| Audi A5 Cabriolet | 225% |

| Jaguar F-Type Convertible | 310% |

| Ford Mustang Convertible | 200% |

| Chevrolet Camaro Convertible | 185% |

| Mazda MX-5 Miata Convertible | 150% |

| Mini Cooper Convertible | 130% |

As you can see, there’s a big difference between the insurance costs of the Fiat and the Rolls Royce, just like their prices. The Fiat 500, which is one of the cheapest convertibles you can own, has a substantially better-than-average collision loss.

That means that insurers didn’t have to pay out as many claims or as much money per claim. But, both the Rolls Royce and the Ferrari had substantially worse than average losses. Their MSRPs are also through the roof, comparatively. You can see the correlation.

Read more: Compare Rolls-Royce Car Insurance Rates

Related to that, take a look below at how large losses were for comprehensive auto coverage.

Convertible Car Insurance Comprehensive Losses

| Convertible Make & Model | Average Comprehensive Losses |

|---|---|

| Rolls Royce Dawn convertible | 1917% |

| Mercedes-Benz S Class AMG convertible 4WD | 589% |

| Porsche 911 Turbo convertible 4WD | 461% |

| BMW 4 Series convertible | 320% |

| Audi A5 convertible | 275% |

| Jaguar F-Type convertible | 410% |

| Ford Mustang convertible | 250% |

| Chevrolet Camaro convertible | 240% |

| Mazda MX-5 Miata convertible | 220% |

| Mini Cooper convertible | 200% |

The IIHS reports insurance losses by make and model, including the Rolls Royce Dawn convertible which has a comprehensive loss of an astounding 1,917 percent worse than average. This number is a combination of how many claims were made and how much each paid claim cost the insurer.

USAA consistently offers the most affordable rates for maximum and full coverage on convertibles.

Brad Larson Licensed Insurance Agent

With such a massive number, you have to wonder why it’s so much worse than other cars. Some of that is certainly the fact that a 2018 Rolls Royce Dawn convertible retails for $358,350, so each claim is going to be inflated. It’ll cost the insurance company more to fix any damage. But, that’s also going to take into account theft, which is covered by comprehensive insurance.

Convertibles are much easier to break into than a normal car as we’ve already discussed, especially soft-tops.

The truth is that convertible car insurance doesn’t differ much from car insurance for any other vehicle. When you purchase car insurance from an insurance company, you’ll find that they typically offer specialty coverage for sports cars insurance and vehicles like:

- Motorcycles

- RVs

- Boats

- Jet Skis

- Snowmobiles

- Classic Cars

However, amongst those specialty insurance options, you will not find an option for convertible cars. This doesn’t mean that you don’t want to consider a specialty insurance company for your car. For example, a convertible Ferrari, which can cost as much as $200,000, is a car that you might want to insure with a specialty company that provides luxury car insurance only.

While there are plenty of insurance companies, such as State Farm, Allstate, and so on, that insure high-end cars, often you pay more through these companies because you are risk-sharing with other drivers.

Often, specialty companies will choose not to insure high-risk drivers in an effort to keep what will already be high insurance rates down.

Should I Keep Higher Levels of Insurance for My Convertible Car

How much insurance you keep on your convertible should be based on the value of your car plus the requirements from your lender and the state minimum requirements where you live. The table below shows these requirements, as compiled by the Insurance Information Institute.

Car Insurance Minimum Coverage Limits by State

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury and property damage liablity | 25/50/25 |

| Alaska | Bodily injury and property damage liablity | 50/100/25 |

| Arizona | Bodily injury and property damage liablity | 15/30/10 |

| Arkansas | Bodily injury, property damage liablity, and personal injury protection | 25/50/25 |

| California | Bodily injury and property damage liablity | 15/30/5 |

| Colorado | Bodily injury and property damage liablity | 25/50/15 |

| Connecticut | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/20 |

| Delaware | Bodily injury, property damage liablity, and personal injury protection | 25/50/10 |

| Florida | Property damage liablity, and personal injury protection | 10/20/10 |

| Georgia | Bodily injury and property damage liablity | 25/50/25 |

| Hawaii | Bodily injury, property damage liablity, and personal injury protection | 20/40/10 |

| Idaho | Bodily injury and property damage liablity | 25/50/15 |

| Illinois | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/20 |

| Indiana | Bodily injury and property damage liablity | 25/50/25 |

| Iowa | Bodily injury and property damage liablity | 20/40/15 |

| Kansas | Bodily injury, property damage liablity, and personal injury protection | 25/50/25 |

| Kentucky | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/25 |

| Louisiana | Bodily injury and property damage liablity | 15/30/25 |

| Maine | Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, and MedPay | 50/100/25 |

| Maryland | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 30/60/15 |

| Massachusetts | Bodily injury, property damage liablity, and personal injury protection | 20/40/5 |

| Michigan | Bodily injury, property damage liablity, and personal injury protection | 20/40/10 |

| Minnesota | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 30/60/10 |

| Mississippi | Bodily injury and property damage liablity | 25/50/25 |

| Missouri | Bodily injury, property damage liablity, and Uninsured Motorist | 25/50/25 |

| Montana | Bodily injury and property damage liablity | 25/50/20 |

| Nebraska | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| Nevada | Bodily injury and property damage liablity | 25/50/20 |

| New Hampshire | Financial responsibility (None required) | 25/50/25 |

| New Jersey | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 15/30/5 |

| New Mexico | Bodily injury and property damage liablity | 25/50/10 |

| New York | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/10 |

| North Carolina | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 30/60/25 |

| North Dakota | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/25 |

| Ohio | Bodily injury and property damage liablity | 25/50/25 |

| Oklahoma | Bodily injury and property damage liablity | 25/50/25 |

| Oregon | Bodily injury, property damage liablity, personal injury protection, and uninsured motorist/underinsured motorist | 25/50/20 |

| Pennsylvania | Bodily injury, property damage liablity, and personal injury protection | 15/30/5 |

| Rhode Island | Bodily injury and property damage liablity | 25/50/25 |

| South Carolina | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| South Dakota | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| Tennessee | Bodily injury and property damage liablity | 25/50/15 |

| Texas | Bodily injury, property damage liablity, and personal injury protection | 30/60/25 |

| Utah | Bodily injury, property damage liablity, and personal injury protection | 25/65/15 |

| Vermont | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/10 |

| Virginia | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/20 |

| Washington | Bodily injury and property damage liablity | 25/50/10 |

| Washington D.C. | Bodily injury, property damage liablity, and Uninsured Motorist | 25/50/10 |

| West Virginia | Bodily injury, property damage liablity, and uninsured motorist/underinsured motorist | 25/50/25 |

| Wisconsin | Bodily injury, property damage liablity, uninsured motorist, and MedPay | 25/50/10 |

| Wyoming | Bodily injury and property damage liablity | 25/50/20 |

Typically, you want to carry more insurance than the minimum required by your state. However, you don’t want to pay extra for insurance that you may never use.

According to the Insurance Information Institute, most people don’t carry enough insurance on their vehicles. They aren’t talking about the minimums required by each state; they’re talking about enough insurance to cover the cost of an accident. Finding that right balance can be tough, but it’s important to do so.

Your insurance is designed to protect other drivers financially should you be the cause of an accident.

If your insurance comes up short, you’ll have to pay the difference out of pocket or prepare to be sued in court. It’s very important to note that your car insurance does not cover the cost of the items that you carry around in your car. If you have a high-end media system for when your kids are in the car or a world-class stereo system, it’s your homeowners or renter’s insurance that covers the loss of personal items in your vehicle.

If you want to know the price of carrying different levels of insurance, the easiest way to do this is to get a car insurance quote. Comparing car insurance rates from different companies will help you keep your costs down.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Convertibles Safe

There’s no doubt that convertibles are cool. You’re often going to be paying more for the luxury, but it’s really nice to be able to put the top down on a gorgeous, sunny day and just crank the tunes and let your hair get tangled up (sometimes, it’s worth it).

But, what about safety? How much more dangerous are convertibles, and is this a reason not to buy a convertible?

For the most part, the Insurance Institute for Highway Safety (IIHS) finds that convertibles are just as safe as standard vehicles — with one exception. And that exception is rollover crashes.

It makes sense that this could be an issue, as there would be nothing between you and the ground if the car flipped over.

Rollover vs. Non-Rollover Car Crash Fatalities

| Year | Rollover Fatalities | Percent of All Crash Fatalities | Non-Rollover Fatalities | Percent of All Crash Fatalities |

|---|---|---|---|---|

| 2014 | 2,818 | 22% | 9,725 | 78% |

| 2015 | 3,004 | 23% | 10,316 | 77% |

| 2016 | 3,124 | 22% | 10,933 | 78% |

| 2017 | 3,007 | 22% | 10,895 | 78% |

| 2018 | 2,649 | 20% | 10,489 | 80% |

| 2019 | 2,758 | 21% | 10,313 | 79% |

| 2020 | 2,941 | 21% | 10,964 | 79% |

| 2021 | 2,961 | 20% | 11,310 | 80% |

| 2022 | 2,682 | 19% | 11,444 | 81% |

| 2023 | 2,695 | 19% | 11,352 | 81% |

You can see that rollover crashes account for 20 percent or more of vehicular fatalities, so it’s already a scary number. When you remove the top of the car, it gets scarier. Without that sheet of metal between you and the outside world, there’s a higher likelihood of injury in a rollover. You’re also susceptible to whatever debris is flying around, plus your risk of expulsion from the vehicle is greater.

While death rates aren’t necessarily higher in convertibles, it’s still safer to be in a car with a normal roof.

That said, your convertible might actually be a little safer in other ways. The IIHS has been testing convertibles for a decade, and they now know just how the body types react differently to a crash. Check out the video below.

Heavier cars are generally safer in a crash. In a collision of two vehicles, the heavier one will exude the greater force onto the lighter car. It will also get less pushback, meaning there’s less momentum that gets transferred onto the occupants in the heavier car. Learn more by reading our guide titled “Understanding Car Accidents.”

Is buying a convertible a good idea? It depends on what you’re going for. Convertibles are generally slower than their non-convertible counterparts. However, they are nicer on a sunny day.

USAA leads the market with the lowest monthly premiums, making it the best choice for convertible insurance.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Also, note that he says the area with the windows gets reinforcement in order to be safer. Because of the additional risks to drivers, insurance rates will be higher. With greater risk comes more claims paid out, so the insurer will want to offset that with higher premiums.

Now that you know more about car insurance rates for convertibles, you can compare car insurance rates online right now by entering your ZIP code below.

Frequently Asked Questions

Will modifications to my convertible car affect my insurance rates?

Yes, modifications that enhance performance, alter appearance, or increase value may lead to higher insurance premiums. It’s crucial to inform your insurer about any modifications for proper coverage and claims processing.

For additional details, explore our comprehensive resource titled “Best Car Insurance for Modified Cars.”

Do I need additional coverage for my convertible’s soft top or hard top?

Typically, a standard auto insurance policy covers both soft-top and hard-top convertibles without requiring additional coverage specific to the top type.

Does the color of my convertible car affect my insurance rates?

No, the color of your car does not typically affect your insurance rates. Insurers mainly consider factors like make, model, safety features, driving record, and personal information.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Will adding safety features to my convertible car lower my insurance rates?

Yes, installing safety features like anti-lock brakes, airbags, and security systems can potentially lower your insurance rates by reducing the risk of accidents and theft.

Can I get insurance for a classic or vintage convertible car?

Yes, many insurance companies offer specialized coverage for classic or vintage convertible cars to address their unique needs and provide agreed-upon value and collectible component coverage.

To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

What factors affect convertible car insurance rates?

Convertible car insurance rates are influenced by the model, age of the vehicle, driver’s history, and the level of coverage selected.

Is convertible auto insurance different from standard car insurance?

Convertible auto insurance typically includes the same basic coverage options as standard car insurance, but premiums may be higher due to the perceived risk associated with convertibles.

What should I consider when buying insurance for open-top vehicles?

When insuring open-top vehicles, consider factors like the vehicle’s safety features, the cost of potential repairs, and whether additional coverage for theft and weather-related damage is needed.

Are convertibles more expensive to insure?

Yes, convertibles are often more expensive to insure due to their higher repair costs and increased risk of theft.

Learn more in our “Is it cheaper to purchase car insurance online?”

Do convertibles cost more to insure?

Generally, convertibles do cost more to insure because they are considered high-risk vehicles due to their design and performance features.

Is convertible car insurance more expensive?

Convertible car insurance can be more expensive than insurance for non-convertible vehicles, reflecting the higher cost of repairs and the potential for theft.

Is insurance higher on convertibles?

Insurance is typically higher on convertibles compared to standard vehicles due to their vulnerability and the higher value of these cars.

Do convertibles have higher insurance?

Yes, convertibles usually have higher insurance rates because of their exposure to risks like theft and damage.

To learn more, explore our comprehensive resource on “Common Ways Cars Are Stolen.”

What is the insurance rate for a convertible?

The insurance rate for a convertible varies based on the make, model, age of the car, and the driver’s history, but it is generally higher than for non-convertible vehicles.

Which low-insurance convertible cars are available?

Convertibles like the Ford Mustang and Mazda MX-5 Miata typically offer lower insurance rates compared to more luxury-oriented models.

Is car insurance more expensive for convertibles?

Car insurance is usually more expensive for convertibles due to higher repair costs and the increased likelihood of theft.

What are the cheapest convertible cars to insure?

Some of the cheapest convertible cars to insure include the Fiat 500 Convertible and the Mini Cooper Convertible.

Access comprehensive insights into our guide titled “Best Fiat Car Insurance Rates.”

Where can I find cheap insurance for convertible cars?

To find cheap insurance for convertible cars, it’s best to compare quotes from multiple insurers who may offer different rates and discounts for convertibles.

How do insurance rates on convertibles compare to other cars?

Insurance rates on convertibles are often higher than on other cars due to their high cost, repair complexity, and risk of theft.

What should I know about insurance on convertibles?

When insuring convertibles, be aware that these vehicles might carry higher premiums due to increased repair costs and higher theft rates, and it’s wise to look for specific coverages that protect against these risks.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.