Best Car Insurance Discounts in 2025 [Save 28% With These Companies]

The best car insurance discounts are for safe drivers, multi-policy holders, and good students, which can save drivers 28% on their rates. Drivers who need multiple policies, such as home and auto, can often save by bundling insurance. We'll discuss some of the biggest car insurance discounts you should ask about.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: May 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Safe driver, bundling, and good student discounts are the best car insurance discounts, as they can lower your premiums by 28%.

It’s critical to check out eligiblity requirements for discounts from the best insurance companies before deciding on coverage.

Our Top 10 Picks: Best Car Insurance Discounts

| Rank | Discount Name | Savings Potential | Who Qualifies? |

|---|---|---|---|

| #1 | Safe Driver | 28% | For drivers with no accidents |

| #2 | Multi-Policy | 24% | Bundling multiple policies together |

| #3 | Good Student | 16% | For students with good grades |

| #4 | Anti-Theft | 14% | For cars with approved anti-theft devices |

| #5 | Low Mileage | 11% | Driving fewer miles annually |

| #6 | Defensive Driving | 8% | Completing a state-approved defensive driving program |

| #7 | Loyalty | 6% | For long-term policyholders |

| #8 | Paperless Billing | 6% | Opting for online payments |

| #9 | New Car | 5% | For newly purchased vehicles |

| #10 | Paid-in-Full | 5% | Paying your premium upfront |

However, your needs may vary from the next, so it is important to compare quotes from these providers directly to determine who has the best offer.

- Amica offers the most affordable monthly rates with major discounts

- Defensive and claims-free drivers save up to 28% with Geico and Progressive

- Bundle policies for maximum savings on insurance premiums

If you’re looking for the best discount auto insurance, enter your ZIP code to compare free car insurance quotes from companies in your area today.

How Much You’ll Pay: Discounted Insurance Rates

This table features average monthly car insurance rates, minimum and full coverage, from top carriers by state. With the lowest prices for minimum coverage of $55 and complete coverage of $160, USAA earns them as the most affordable option.

Geico and State Farm also provide good choices, starting as low as $65 for minimum coverage, so they are worth looking into if you’re trying to save money on your car insurance.

Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $190 | |

| $70 | $180 | |

| $80 | $200 | |

| $75 | $185 | |

| $65 | $170 | |

| $85 | $195 |

| $70 | $175 |

| $65 | $175 | |

| $75 | $185 | |

| $55 | $160 |

Directly comparing providers and determining which options will work with your needs and budget can yield the best car insurance discounts. Use this table as a starting point, and don’t hesitate to inquire about discounts or savings programs that may reduce monthly premiums even more.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

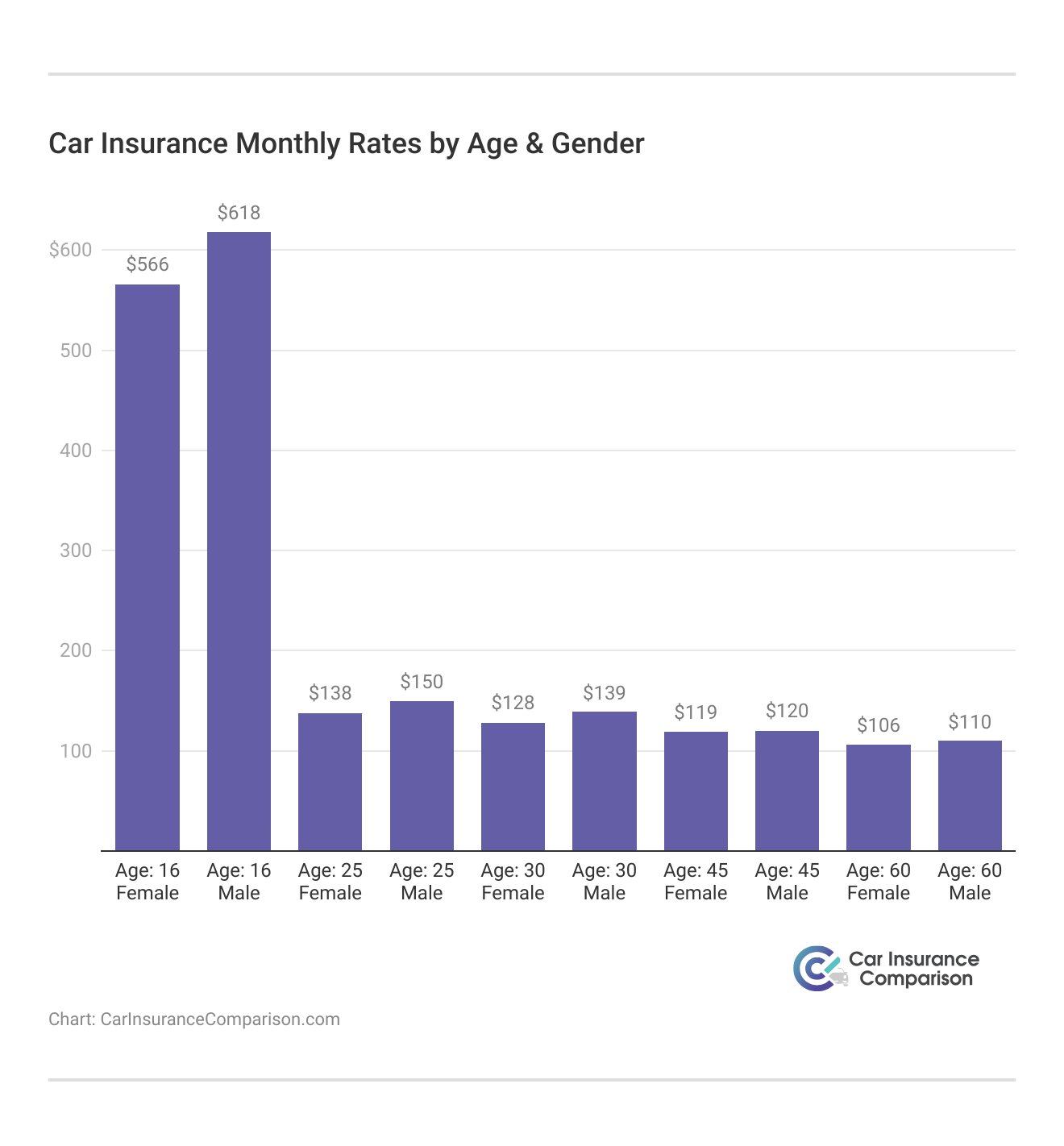

How Your Age and Gender Influence Car Insurance Costs

This graph clearly shows how much you will have to pay for car insurance in relation to average rates by age and gender.

After reviewing this chart, it’s evident that car insurance rates can vary widely with age and gender. Younger males typically pay more, but rates tend to become more favorable over time.

If these figures prompt questions about your own car insurance payments, it could be beneficial to contact your insurer to discuss how your age or gender impacts your rates and what you might do to lower your costs.

How Driving Mistakes Inflate Your Car Insurance Bills

Check this list of monthly car insurance rates from a number of individual companies. You will see what premiums you face with a clean driving record, as opposed to the much larger insurance costs once you have an accident, DUI, or ticket on your record.

So it is very simple, listing which infractions, such as car insurance after a DUI, will cost you money, along with the dollar amounts for each situation.

Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $98 | $130 | $155 | $105 | |

| $95 | $125 | $150 | $102 | |

| $93 | $120 | $145 | $100 | |

| $100 | $135 | $160 | $108 | |

| $92 | $115 | $140 | $98 | |

| $90 | $110 | $135 | $95 |

| $91 | $115 | $140 | $96 |

| $85 | $100 | $120 | $90 | |

| $87 | $105 | $130 | $92 | |

| $105 | $140 | $170 | $110 |

This overview shows why keeping a clean driving record is crucial for your finances. Each incident, be it an accident, DUI, or ticket, can lead to a significant jump in your monthly insurance bill.

If you’re seeing higher rates due to past infractions, now might be a good time to look into different insurance options or talk to your current provider about what steps you can take to reduce your payments.

Know When to Protect Your Vehicle

To secure the best car insurance deal, it’s important to understand when you need physical property damage coverage for your vehicle. This typically includes collision and comprehensive coverage.

Most states require liability insurance, which includes bodily injury and property damage coverage, but collision and comprehensive coverage are optional. However, if your vehicle is financed, your lender will likely require these coverages.

Additional coverage options such as personal injury protection (PIP), accident forgiveness, and uninsured/underinsured motorist coverage (UM/UIM) are available but will increase your monthly premiums. Carefully consider which types of coverage you truly need.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Independent Information to Get the Best Deals

Once you find car insurance options within your budget, look at which companies provide those rates. Be careful with any quote that is way lower than the rest. Research the company carefully, as unusually low rates may signal problems.

Evaluate each company you’re considering by checking their financial strength ratings from independent insurance rating organizations such as Weiss Ratings or A.M. Best. These ratings indicate whether a company is trustworthy and can honor its financial commitments.

When choosing car insurance, always compare policy features and deductibles alongside premiums to ensure you're getting the best value for your money.

Jeffrey Manola Licensed Insurance Agent

It’s important to know how an insurer performs with its actual customers. Previously, people relied on word-of-mouth for such insights, but today, satisfaction ratings significantly impact car insurance companies. These ratings are available online or from sources like J.D. Power and Associates, which publishes an annual auto insurance customer satisfaction report.

This information will aid you in determining whether a company meets your needs. An ideal policy can be found through assessing coverage options, maximizing discounts, and comparing offers. This kind of understanding is the bedrock of maneuvering through your car insurance options to ultimately obtain the best deal possible.

How Safety Features Like ABS and Alarms Drive Car Insurance Discounts

The purpose of anti-lock brakes (ABS) is to make your normal brakes more effective by pumping them for you in some situations (wagnerbrake). com. ABS helps prevent wheel lockup, providing a firm grip in critical moments, avoiding panic braking, and ensuring safety while also reducing insurance costs by 10%.

These safety features car insurance discounts highlight how advanced technology can lead to significant savings. Whereas normal brakes could cause wheel lock during hard braking, ABS offers a clear advantage. In much the same way, an anti-theft alarm can bring down your premium as high as 25%.

The majority of car insurance providers offer a discount for cars that have a security system.

There are many types of these systems, from passive alarms that will set off if you lock your car via a key fob to more sophisticated silent alarms that alert owners of potential trouble. Not only do these features provide peace of mind, but as noted by Digital Trends and Auto Tips & Advice, they also reduce insurance rates substantially.

Insurance Discounts Through Safety and Eco-Friendly Features

Daytime running lights (DRLs) automatically activate with your engine, enhancing visibility, while automatic headlights turn on in low light without driver input. Electronic Stability Control (ESC), found in newer vehicles, reduces the risk of losing control and may qualify for a 5% discount from some car insurance companies.

ESC works by keeping the vehicle headed in the right direction, even when the vehicle nears or exceeds the limits of road traction.

Automatic forward-collision warning systems, which provide visual, auditory, or haptic alerts of imminent collisions, could reduce premiums by up to 8%. Eco-friendly drivers purchasing alternative fuel or hybrid vehicles can receive a 10% discount from insurers.

Some lane departure warning systems, which monitor vehicle lane positions, might also qualify for discounts, though these are less common and typically offered by insurers like Progressive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Defensive Driver

A defensive driver discount is a great way to save on your car insurance. It can help sharpen your skills by teaching defensive driving techniques and reaffirming forgotten skills to help you stay on the road if an emergency arises. Drivers who take a defensive driving course can expect savings of up to 10%.

Driving Device/App

Technology has changed the world and how it operates. It can also save you money on your car insurance. Many car insurance companies offer driving device/app car insurance discounts that monitor your driving to help reduce the cost of your auto insurance premiums. You get a discount for practicing safe driving habits. In the insurance industry, this is referred to as usage-based insurance.

High-tech driving stays pretty simplistic—and no matter where the apps and devices are from, they all do one thing: follow you up on how you drive while logging where and under what conditions. That data creates a profile for insurers to determine how considerable of a risk you present while driving.

With an effective app/device, a lot of good information about your driving habits gets conveyed to the insurance company.

If you avoid the riskiest routes, and you avoid traveling during bad weather or rush hour, your chances of an accident — and thus a new insurance premium hike for you — are reduced. This relatively safer driving is rewarded by insurance companies with discounts of up to 30%. So, using these tools and being a careful driver can help you save a lot on your car insurance.

Secrets to Saving: Specialty Discounts in Auto Insurance

If you are new to working from home and drive less than 6,000 miles per year, you could qualify for a low mileage discount of up to 30%. Additionally, safe drivers using electronic monitoring can save as much as 45%, as highlighted in State Farm’s discount list.

Unique discounts, such as Esurance’s 5% roadside assistance discount in select states and USAA’s 90% savings for garaging a vehicle (only available to military personnel and their families), illustrate significant potential savings. Farm vehicle owners using their cars on their property may see up to a 10% discount.

Additionally, medical student car insurance discounts are rare, but students maintaining high grades could access various discounts, although part-time students should verify eligibility directly with insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Strategic Savings: How Life Choices Impact Car Insurance Costs

A high credit score not only helps with loan approvals but also significantly reduces car insurance costs. If your score is over 700, you can save substantially more each year compared to someone with a lower score. Additionally, being married can lower your car insurance rates by up to 5%, as insurers consider married drivers to be lower risk.

Renters and homeowners can save up to 30% by bundling their policies with companies like Amica and Esurance. Federal employees, including military personnel, can receive up to a 10% discount on car insurance. Seniors also benefit from up to 10% off premiums, reflecting their driving experience.

Martin also adds that “community engagement is a two-way street” as volunteer car insurance discounts are available for your contribution back through service (American Family Insurance). This set of savings reflects the degree to which life choices, both personal and professional, can influence the price an individual pays for auto insurance.

Expert Advice on Discounts

Bundling auto insurance with home, condo, or renter’s insurance can lead to significant savings through discounts. Telematics discounts also offer savings by tracking driving habits via a device or app, helping many maximize their benefits.

Insurers also provide discounts for safe driving, anti-theft devices, good student and low mileage car insurance discounts. These may be available through affiliations with workplaces or alumni groups and can apply to advanced online driving courses beyond traditional driver’s education.

Kristen Gryglik is an agent in the Boston area with 15 years of experience in the insurance industry.

The most common discounts are for good and superior drivers, along with the home umbrella discount. However, the real value lies in overall premium reduction rather than just accumulating various discounts. I often ask clients: Would you prefer a larger discount or a lower premium? Ultimately, the premium you pay is what truly matters.

Scott W Johnson is an Independent Insurance Agent, based in Marin County California

Car insurance discounts vary widely, including multi-vehicle, safe driver, good student, and low mileage options. Insurers often bundle these with homeowners’ or renters’ insurance for additional savings.

Insurers such as State Farm and Progressive now offer telematics programs that monitor driving habits to offer customized rates. Similarly, pay-per-mile programs like Metromile cater to drivers who use their vehicles less, significantly lowering costs. Remember to inquire about all available discounts to maximize savings.

Lauren Emmons, Customer Success Manager at Clearsurance – an independent review & rating platform for insurance carriers, agencies, and agents; as well as a licensed Property & Casualty Insurance Producer in Massachusetts. www.clearsurance.com.

Car insurance discounts vary widely but commonly include bundling policies like homeowner, renter, or motorcycle insurance. Discounts also come from user-based driving programs that monitor habits through a smartphone app, encouraging safer driving by tracking behaviors like texting or hard braking.

Additionally, insurers offer standard discounts for safe drivers, good students under 25, members of certain groups like military personnel or college alumni, and those who complete defensive driving courses.

Tracey L. Wells is a licensed insurance agency owner with 23 years of experience.

More savings are available for having multiple vehicles, paying in full, monthly electronic funds transfer set up for automatic payments, early shopping for insurance, as well as paperless policies and billing. Such discounts not only make insurance more cost-effective but also promote responsible driving and financial behaviors.

Case Studies: Discount Car Insurance

Explore ways to save money on car insurance through real-life examples in our series of case studies. Each story highlights a unique discount strategy that not only lowers costs but also rewards responsible choices.

- Case Study #1 – The Multi-Policy Saver: Lisa bundled her car and home insurance with the same company, securing a 15% multi-policy discount. This not only simplified her policies under one insurer but also cut her overall insurance costs.

- Case Study #2 – The Good Student Advantage: High school student Jake maintained a B average, earning a 10% good student discount on his car insurance, making it more affordable and rewarding his academic efforts.

- Case Study #3 – The Safe Driver Reward: Sarah, with a clean driving record, secured a 20% safe driver discount from an insurer, lowering her car insurance premiums and rewarding her responsible driving.

These case studies show the real-world advantage of searching for auto insurance car discounts, however. From bundling policies together to excelling in school or even having a clean driving record, there are many benefits people can use to lower their premiums and make the insurance work for them. Also, be sure to talk with your insurer to see if you qualify for other kinds of discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Your Complete Guide to Securing Car Insurance Discounts

Car insurance discounts are offered for a variety of reasons, including whether or not you are a safe driver, the types of features on your vehicle, and how many policies you possess. Most car insurance companies offer a multitude of discounts that you can bundle for maximum savings.

However, not all discounts are available from every car insurance company, and the discount amounts can also vary. Ensure that you ask questions before you assume that the reductions are similar everywhere. Before you purchase discount car insurance, compare multiple companies to find the most affordable rates with the best car insurance discounts available to you.

Now that you know how to get discounts on car insurance, enter your ZIP code to compare free quotes from car insurance companies near you.

Frequently Asked Questions

How do I get a discount on car insurance for safety features?

Ask your insurer about discounts for car insurance that apply to safety features. State Farm, for example, offers discounts for vehicles equipped with advanced safety technology.

What are the best common car insurance discounts for young drivers?

Young drivers should look for common car insurance discounts such as those for good grades, driving education courses, and staying on family policies, which are offered by major insurers.

What auto insurance discounts are essential for securing the best car insurance deals?

When searching for the best car insurance deals, prioritize auto insurance discounts such as multi-vehicle, safe driver, and loyalty car insurance discounts. Companies like State Farm and Geico provide a comprehensive range of these discounts.

What are some popular organizations with Geico affiliation discounts?

Geico offers affiliation discounts through a variety of popular organizations, including professional associations, educational institutions, and military groups, providing excellent opportunities to save on policies.

What discounts can be found on the State Farm discounts list?

The State Farm discounts list includes auto insurance discounts for accident-free drivers, multiple automobiles, anti-theft devices, and more, helping customers reduce their premiums significantly.

How can I ensure I’m getting the best deals on car insurance through discounts?

When seeking out the most attractive offers on car insurance, it’s crucial to engage in a thorough car insurance company comparison. Taking the time to compare online quotes and ask about all possible discounts, including multi-policy discounts and defensive-driving credits from leading insurers such as State Farm, could save you hundreds of dollars on your premiums. This way, you can optimize the competitive market to your benefit.

Which discounts should eco-friendly vehicle owners look for?

Owners of eco-friendly vehicles should inquire about specific discounts for car insurance that cater to environmentally friendly cars, such as hybrid or electric vehicle discounts offered by insurers like Geico and State Farm.

How does bundling different insurance policies impact auto insurance discounts?

Bundling different policies, such as home and auto, can lead to substantial auto insurance discounts, with insurers like State Farm and Geico offering significant reductions for combined coverage.

Find the best comprehensive car insurance quotes and the best car insurance discounts by entering your ZIP code into our free comparison tool today.

Which providers offer the most comprehensive common car insurance discounts?

When looking for ways to pay less for your insurance, it’s helpful to be aware of companies like Geico, State Farm, and Progressive. These companies are well known for offering many of the standard car insurance discounts. Qualifying for multiple discount categories can dramatically lower your premiums, making insurance cheaper and customizable to your needs.

What questions should I ask to maximize discounts on my car insurance policy?

To maximize your savings, ask your insurer about the full list of auto insurance discounts you may be eligible for, including any specific discounts for car insurance related to your lifestyle or driving habits, and check annually to ensure all available discounts are applied.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.