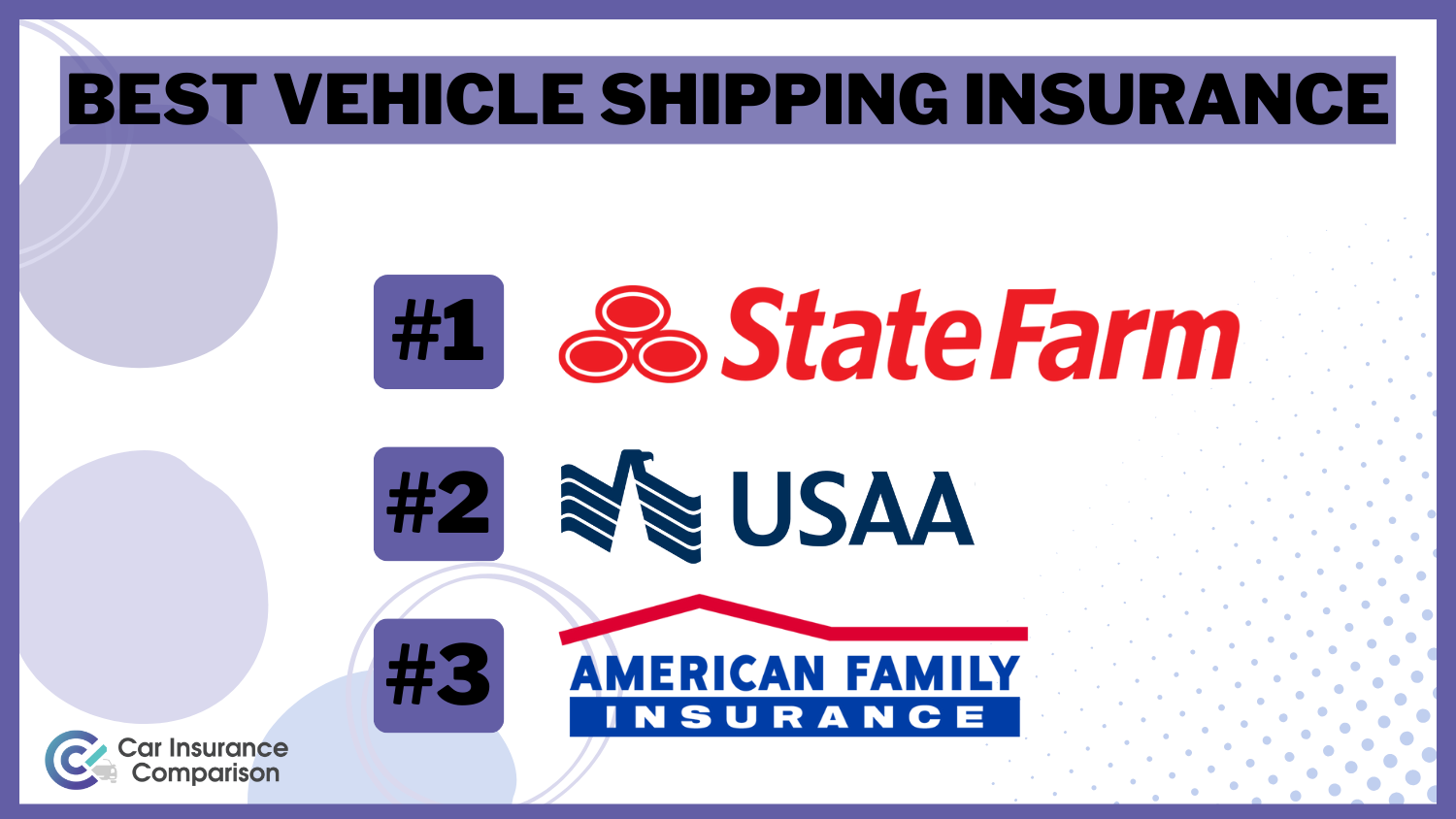

Best Vehicle Shipping Insurance in 2025 (Top 10 Companies)

Explore the best vehicle shipping insurance with top companies like State Farm, USAA, and American Family. Uncover key insights on rates as low as $55/mo, coverage, and discounts to make informed decisions and ensure secure international car shipping.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Shipping Cars Overseas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Shipping Cars Overseas

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Shipping Cars Overseas

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsThe best vehicle shipping insurance are State Farm, USAA, and American Family. This guide helps you make informed decisions for cost-effective car shipping.

Shipping officials require you to provide the necessary documents before shipping your car out of the country. With said documents however, someone can perform international transports with ease. All that’s left is to figure out whether or not you want insurance when you’re shipping vehicles.

It is not a legal requirement to obtain an insurance policy while shipping your vehicle, although having one would be a wise idea. Insurance coverage while shipping overseas covers damage and theft during transit.

Our Top 10 Company Picks: Best Vehicle Shipping Insurance

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Many Discounts | State Farm | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 20% | 20% | Usage Discount | American Family | |

| #4 | 29% | 20% | Student Savings | Nationwide |

| #5 | 10% | 30% | Online Convenience | Progressive | |

| #6 | 10% | 30% | Add-on Coverages | Allstate | |

| #7 | 10% | 15% | Local Agents | Farmers | |

| #8 | 30% | 30% | Customizable Polices | Liberty Mutual |

| #9 | 13% | 10% | Accident Forgiveness | Travelers | |

| #10 | 20% | 20% | Deductible Reduction | The Hartford |

Enter your ZIP code above to get personalized insurance quotes tailored to your needs and budget.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Maximum Multi-Policy Discount: State Farm offers a significant multi-policy discount of up to 17%, providing customers with the opportunity to save on their overall insurance costs.

- Maximum Low-Mileage Discount: With a low-mileage discount of up to 30%, State Farm encourages and rewards customers who drive fewer miles, promoting safer driving habits.

- Consistent Pricing Across Coverage Levels: State Farm maintains a reasonable price balance between minimum coverage and full coverage, offering consistency in affordability.

Cons

- Low Maximum Low-Mileage Discount: While State Farm offers a generous low-mileage discount, it falls short compared to other companies on the list, limiting the potential savings for customers who drive less.

- Limited Military Savings: As mentioned in our State Farm car insurance review they don’t provide specific discounts for military personnel, making it less attractive for those seeking military-related savings.

#2 – USAA: Best for Military Savings

Pros

- Dedicated Military Savings: USAA stands out with its exclusive focus on military personnel, offering up to a 10% multi-policy discount and up to 20% low-mileage discount for service members.

- Solid Multi-Policy Discount: While not the highest, USAA’s multi-policy discount of up to 10% still contributes to potential savings for customers bundling their insurance.

- Consistent Affordability Across Coverage Levels: USAA maintains affordability across both minimum and full coverage, making it a consistent choice for customers seeking budget-friendly options.

Cons

- Limited Eligibility: USAA car insurance membership is limited to military members, veterans, and their families, excluding a significant portion of the population from accessing their insurance products.

- Average Multi-Policy Discount: While USAA provides a multi-policy discount, it falls behind other companies in terms of the maximum percentage offered, potentially providing less savings for some customers.

#3 – American Family: Best for Usage Discount

Pros

- Significant Usage Discount: American Family provides a noteworthy usage discount of up to 20%, encouraging safe driving habits and potentially leading to substantial savings.

- Competitive Maximum Multi-Policy Discount: With a multi-policy discount of up to 20%, American Family remains competitive in providing savings to customers bundling multiple insurance policies.

- Attractive Ricing Spectrum: American Family’s pricing spectrum, spanning from minimum to full coverage, offers customers a range of options, ensuring accessibility for various budget considerations.

Cons

- Limited Multi-Policy and Low-Mileage Discounts: While American Family offers decent discounts, the maximum percentages for multi-policy and low-mileage discounts are not the highest among the listed companies.

- Potential Restrictions on Usage Discount: The usage discount may have limitations or specific criteria, potentially making it less accessible to a broader customer base. Learn more about their limitations in our American Family car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Student Savings

Pros

- Generous Student Savings: Nationwide stands out by offering up to a 29% multi-policy discount and up to a 20% low-mileage discount, making it an attractive option for students looking to save on insurance costs.

- Competitive Multi-Policy Discount: Nationwide provides a substantial multi-policy discount as mentioned in our Nationwide car insurance discounts article, appealing to customers bundling various insurance policies for increased savings.

- Balanced Pricing Structure: Nationwide’s pricing structure strikes a balance between affordability and coverage, providing customers with options that offer value for their insurance investment.

Cons

- Limited Low-Mileage Discount: While Nationwide offers a competitive multi-policy discount, its low-mileage discount doesn’t reach the same heights, potentially limiting savings for customers who drive less.

- Usage Discount Limitations: The usage discount may not be as versatile as those offered by other companies, potentially restricting its applicability to a broader customer base.

#5 – Progressive: Best for Online Convenience

Pros

- High Maximum Low-Mileage Discount: Progressive excels with a high maximum low-mileage discount of up to 30%, catering to customers who drive less and rewarding them with substantial savings.

- Emphasis on Online Convenience: Progressive stands out for its online convenience, making it easy for customers to manage their policies, file claims, and access information through digital platforms.

- Reasonable Full Coverage Rate: With a full coverage rate of $160, Progressive maintains affordability while providing customers with comprehensive insurance protection.

Cons

- Lower Maximum Multi-Policy Discount: While Progressive offers a competitive low-mileage discount, its maximum multi-policy discount is comparatively lower, potentially limiting savings for customers bundling multiple policies.

- Not Ideal for In-Person Interactions: Customers who prefer in-person interactions with agents might find Progressive’s emphasis on online convenience less appealing. (Read more: Progressive Car Insurance Review)

#6 – Allstate: Best for Add-on Coverages

Pros

- Flexible Add-on Coverages: Allstate shines in offering a variety of add-on coverages, allowing customers to customize their policies based on specific needs and preferences. Read more about their flexibility in our Allstate car insurance review.

- High Maximum Low-Mileage Discount: Allstate provides a generous low-mileage discount of up to 30%, appealing to customers who drive less and seek substantial savings.

- Options for Comprehensive Coverage: Allstate’s pricing structure accommodates customers seeking comprehensive coverage, ensuring they receive value for their investment in insurance.

Cons

- Average Maximum Multi-Policy Discount: While Allstate offers a multi-policy discount, it’s not the highest among the listed companies, potentially providing less savings for customers bundling multiple policies.

- Costs of Add-Ons: While the flexibility of add-on coverages is a pro, customers should be aware that opting for additional coverages may increase their overall insurance costs.

International Car Shipping Insurance Rates: A Comparative Overview

When shipping cars overseas, securing the right insurance coverage is paramount to safeguard against potential risks and uncertainties. The table below provides insights into the average monthly car insurance rates offered by prominent insurance companies for both minimum and full coverage.

Vehicle Shipping Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $75 | $180 |

| American Family | $80 | $170 |

| Farmers | $70 | $150 |

| Liberty Mutual | $85 | $190 |

| Nationwide | $75 | $145 |

| Progressive | $70 | $160 |

| State Farm | $65 | $155 |

| The Hartford | $75 | $165 |

| Travelers | $80 | $175 |

| USAA | $55 | $130 |

Additionally, a car may not be properly stowed, causing damage to the other vehicles, especially if the vehicles are on roll-on-roll-off vessels during shipping.

A policyholder should get compensations for damages while on transit, such as:

- Fires

- Breakages

- Dents on a car

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Methods of Shipping a Car

There are two common methods of transporting vehicles in a ship. They include the containerized shipping and the roll-on-roll-off vessels.

- Containerized Shipping: The shippers place the vehicles in containers to ensure maximum security of the vehicles. Up to six cars fit in a 40-inch container.

- Roll on-Roll Off Method: The workers secure vehicles inside the ships to their car decks. Although this is an easy and cheap way, it is highly prone to theft and damages.

Insurance companies will consider the method of shipping while calculating the average cost you will pay for coverage. The higher the risk with the shipment, the higher the cost will be. Container shipping might come out ahead, even if it’s the more expensive option. Customers may want to consider the costs of additional coverage when looking into international car transport.

Read more: Export Car Insurance

Insurance for Shipping Cars

Shipping your vehicle to foreign countries, as mentioned above, does come with its own set of risks. This is why it’s vital to figure not just your shipping options, but your insurance coverage as well.

An insurance company would cover any damage that occurs to a vehicle from when it moves out of the warehouse on its way to the terminal. Coverage is still in effect during the transportation, and it ends the moment you pick up the vehicle.

The insurance policy does not cover the personal effects loaded in a car, and they would not compensate in case of loss or damage.

Insurance companies provide two types of coverage to policyholders shipping their cars overseas. The difference will be dependent on the type of coverage needed while the vehicle is in transit.

These two types include all risk and total loss. The premiums for all risk are slightly higher than the former, but might be worth the additional costs. With both types, the vehicle owner has to pay a deductible, which has an influence on the typical cost and what will be owed.

- Total Loss: Covers theft, fire, or complete loss of the entire shipment. In this case, the insurers replace the car with another one or offer a cash settlement of the total value.

- All Risk Insurance: Covers all damages that occur from the moment of loading, through transit, and ends at the arrival to the final destination. The settlement may either cover the repairs or offer a cash settlement (which is based on the current product value in the market) to cater for the cars destroyed.

Keep in mind that the coverage for all risk insurance only applies to the cars packed by a professional worker on the ship.

Read more: Compare Car Insurance for Cars Bought at Auction: Rates, Discounts, & Requirements

Talk to Your Insurance Provider

You should consider speaking to your insurance provider before getting insurance for shipping a car overseas. An insurance provider would advise you on the way forward in case they do not provide the coverage you need.

Additionally, your insurer may not provide coverage when driving your car in another country.

You will then need to get an international insurance policy in addition to the shipping insurance that expires the moment your car leaves the dock. The international coverage allows you to drive in the country of destination.

Read more: How do you get cheaper car insurance quotes?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Factors to Consider Before Purchasing Insurance

There are a few ways you can go about obtaining coverage for the vehicles you’re going to be shipping overseas. Naturally you’ll be focusing on shipping rates and international car transport companies, but you should also look closer to home as well. Finding solid rates and whether or not your current insurer offers the coverage you need will help you in the long run.

Shop for Quotes

Before settling on a company that will be able to provide you with transportation coverage, you should consider comparison shopping. Satisfied customers are those that are offered options, so it’s in your best interest to see what’s out there, and find the best deal.

Rates vary from one company to another, which means it might be easy to find a better rate than what you currently pay. This can be especially helpful if your current provider doesn’t offer coverage for a vehicle being shipped overseas.

Investigate Your Insurance Policy

Understanding your insurance coverage is a great way to prepare for your trip. As mentioned above, this will be what determines where you’ll get a policy, as well as how much of your vehicle will be covered. You should consider checking on whether your current policy covers damages that may occur during the loading and offloading of your vehicle. You should avoid purchasing coverage from a company that fails to provide details regarding any sort of policy.

Take Photos

Above anything else, take photos of your car before it gets loaded onto a ship or into a container. This is just in case you need to make a claim. The photos stand as evidence of the car’s condition before shipment. That way, if your car suffers any damage, you’ll be able to prove it happened while loaded onto a ship.

Case Studies: Car Insurance for Shipping Cars Overseas

Car insurance tailored for overseas transit not only provides financial security but also peace of mind during the intricate process of relocation or travel. Through a series of case studies, we delve into real-life scenarios where individuals sought insurance coverage for shipping cars overseas.

- Case Study #1 – Sarah’s Secure Shipping With State Farm: Sarah, a frequent traveler, needed to ship her car overseas for an extended work assignment. Concerned about potential risks during transit, she decided to explore insurance options. State Farm caught her attention due to its reputed discounts and comprehensive plans.

- Case Study #2 – Military Savings With USAA for John’s International Move: John, a military service member, was relocating overseas for a new assignment. Needing to ship his car, he sought an insurance provider with military-focused benefits. USAA stood out as a dedicated provider for military personnel. (Read more: Export Car Insurance: Rates, Discounts, & Requirements)

- Case Study #3 – Customizable Coverage for Emily’s Peace of Mind With Liberty Mutual: Emily, a meticulous planner, was shipping her vintage car overseas for a classic car show. Concerned about potential risks and desiring comprehensive coverage, she sought an insurance provider offering customization. Liberty Mutual caught her attention with its emphasis on customizable policies.

As individuals embark on their international journeys, these case studies serve as a testament to the value of proactive insurance planning and the assurance it brings in safeguarding valuable assets across borders.

Ensuring Peace of Mind With Vehicle Shipping Insurance

While shipping is a safe method of transporting vehicles, purchasing an insurance policy should be considered necessary to ensure you don’t end up having to pay for anything else out of pocket.

However, some insurance providers may require you to pay for the minor damages on the vehicle such as dents or chipping of paint which helps in retaining the low rates of the insurance premiums.

Looking for better auto insurance rates before hitting the high seas? Don’t forget about our comparison tool and enter your ZIP code below, which will help you to compare quotes from various companies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is it mandatory to have insurance when shipping a car overseas?

No, it is not a legal requirement to obtain insurance when shipping your vehicle overseas. However, having insurance is highly recommended to cover potential damages and theft during transit. Insurance provides financial protection and peace of mind throughout the international shipping process.

Read more: Export Car Insurance: Rates, Discounts, & Requirements

What types of coverage do insurance companies offer for shipping cars overseas?

Insurance companies typically offer two main types of coverage for shipping cars overseas: all risk and total loss. All risk coverage provides comprehensive protection for damages during transit, while total loss coverage covers the complete loss of the vehicle. Premiums for all risk coverage may be slightly higher, but it offers more extensive protection.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Can I use my existing car insurance for international shipping, or do I need a separate policy?

In most cases, your existing car insurance may not cover international shipping. It’s advisable to speak to your insurance provider and inquire about coverage during overseas transport. Additionally, an international insurance policy may be necessary to cover your vehicle while driving in the destination country.

What factors influence the cost of insurance for shipping cars overseas?

The cost of insurance for shipping cars overseas is influenced by various factors, including the shipping method (containerized or roll-on-roll-off vessels), the shipping company’s risk assessment, and the chosen coverage type (all risk or total loss). The higher the risk associated with the shipment, the higher the insurance cost may be.

Are there specific discounts available for military personnel when shipping cars overseas?

Yes, some insurance providers, such as USAA, offer specific discounts for military personnel. These discounts may include multi-policy discounts and low-mileage discounts. If you are a member of the military or a veteran, it’s advisable to explore insurance options that cater to your specific needs and provide savings tailored to your service.

Read more: USAA Car Insurance Review

Is there a difference in insurance coverage between containerized shipping and roll-on-roll-off vessels?

Insurance coverage for shipping cars overseas may vary depending on the method of transportation. Containerized shipping and roll-on-roll-off vessels each present unique risks, which insurance companies take into account when calculating coverage and premiums. It’s essential to understand the differences in coverage offered for each method to ensure adequate protection during transit.

Are there any specific insurance requirements for shipping classic or vintage cars overseas?

Classic or vintage cars often require specialized insurance coverage due to their unique value and characteristics. Insurance providers may offer tailored policies to protect these vehicles during international shipping, including coverage for restoration costs, original parts, and agreed value. Classic car owners should discuss their insurance needs with providers experienced in insuring vintage vehicles to ensure comprehensive protection.

What documentation is required to obtain insurance for shipping cars overseas?

Insurance companies may require specific documentation to provide coverage for shipping cars overseas. Commonly requested documents include proof of ownership, vehicle registration, and details of the shipping arrangement. Additionally, insurers may require information about the vehicle’s value, condition, and destination country. Ensuring all necessary documentation is in order can streamline the insurance application process and ensure timely coverage.

Can I purchase insurance for shipping cars overseas if I’m shipping multiple vehicles at once?

If you’re shipping multiple vehicles overseas simultaneously, you may be eligible for specialized insurance coverage tailored to your unique shipping needs. Insurance companies may offer customizable policies to cover multiple vehicles under a single policy, providing cost-effective protection for bulk shipments. Discussing your specific requirements with insurance providers can help you find the most suitable coverage for your multi-vehicle shipping needs.

Read more: Best International Car Insurance

Are there any restrictions on the type of vehicles eligible for insurance coverage during overseas shipping?

While most standard vehicles are eligible for insurance coverage during overseas shipping, certain types of vehicles may have restrictions or additional requirements. High-value vehicles, commercial vehicles, and vehicles with modifications may require specialized coverage tailored to their unique characteristics and risks. It’s essential to disclose all relevant information about the vehicle to the insurance provider to ensure accurate coverage and avoid potential coverage gaps.

Find cheap car insurance quotes by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.