Best Toyota RAV4 Prime Car Insurance in 2025 (Check Out the Top 10 Companies)

Geico, State Farm, and USAA stand out as the top choices for the best Toyota RAV4 Prime car insurance, starting at a competitive rate of $89 per month. These leading providers offer exceptional coverage and benefits tailored to meet the needs of Toyota RAV4 Prime owners, ensuring optimal protection and value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Sep 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Toyota RAV4 Prime

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Toyota RAV4 Prime

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Toyota RAV4 Prime

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsGeico, State Farm, and USAA offer the best Toyota RAV4 Prime car insurance with competitive rates and comprehensive coverage.

Geico stands out as the top choice, thanks to its exceptional affordability and extensive discount options, with rates starting around $89 per month. This article explores these leading providers, examining how their features, discounts, and customer service stack up to ensure you get the best protection for your Toyota RAV4 Prime.

Our Top 10 Company Picks: Best Toyota RAV4 Prime Car Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Competitive Rates | Geico | |

| #2 | 17% | B | Customer Service | State Farm | |

| #3 | 10% | A++ | Military Benefits | USAA | |

| #4 | 10% | A+ | Comprehensive Coverage | Progressive | |

| #5 | 20% | A+ | Flexible Options | Nationwide |

| #6 | 25% | A | Balanced Cost | American Family | |

| #7 | 13% | A++ | Robust Coverage | Travelers | |

| #8 | 20% | A | Extensive Discounts | Farmers | |

| #9 | 25% | A | Policy Flexibility | Liberty Mutual |

| #10 | 25% | A+ | Broad Coverage | Allstate |

Discover which insurer offers the best balance of cost and coverage to meet your needs. To see fast, free Toyota RAV4 Prime insurance quotes right now, just enter your ZIP code above. We’ll provide you with personal Toyota RAV4 Prime insurance rate from top companies right away.

- Geico offers the best rates with competitive pricing for Toyota RAV4 Prime

- State Farm and USAA provide excellent coverage options and reliable service

- Explore how these top insurers compare in discounts and customer satisfaction

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

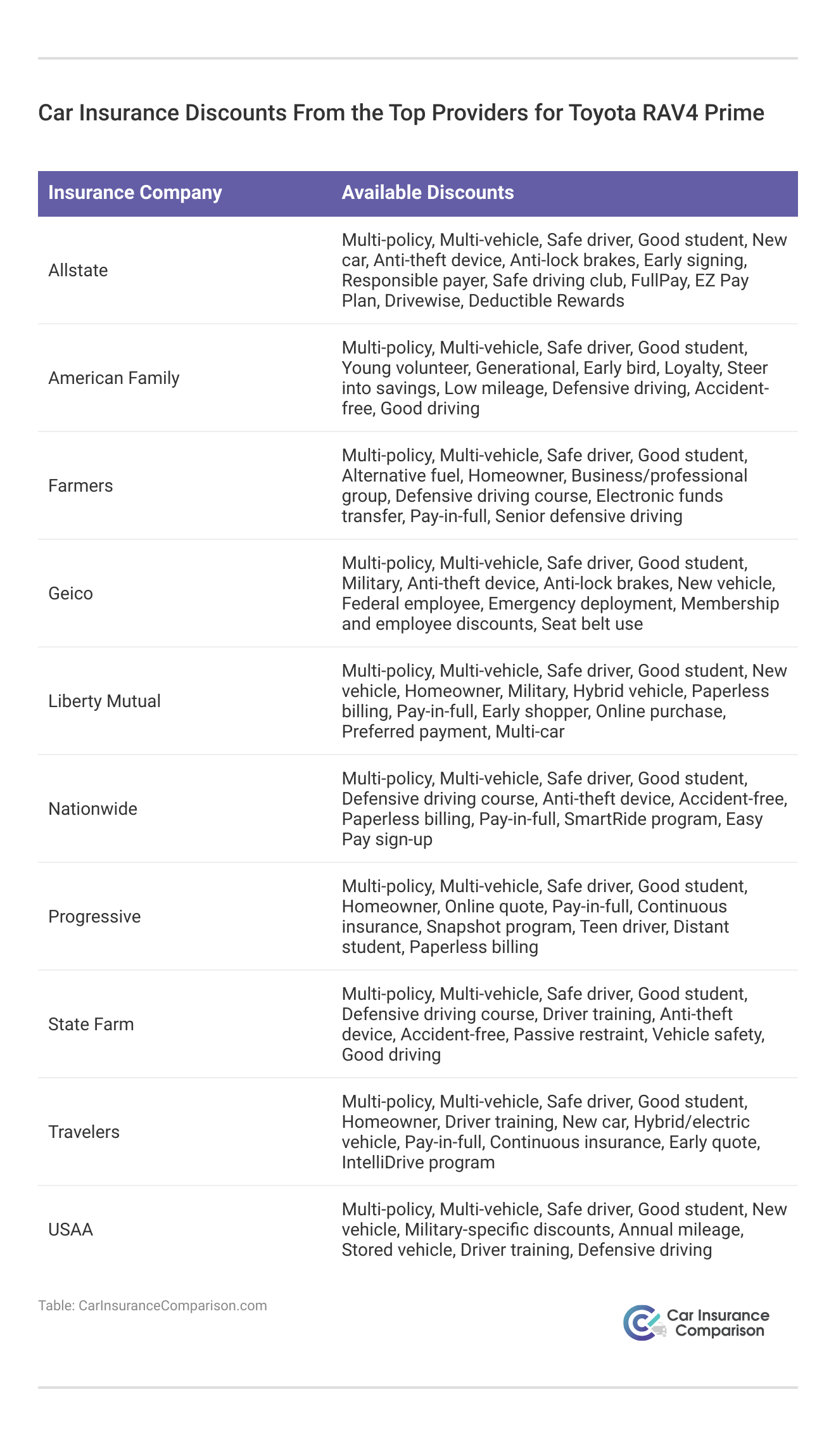

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico is renowned for its competitive pricing, offering some of the lowest premiums in the market, making it a extremely economical option for Toyota RAV4 Prime owners, as highlighted in our Geico car insurance review.

- Discounts: Geico offers a wide spectrum of discounts, slashing insurance costs for Toyota RAV4 Prime owners. From perks for safe driving and bundling policies to rewards for stellar students and cars packed with advanced safety tech, these discounts can lead to substantial savings.

- Accident Forgiveness: Geico offers accident forgiveness, which prevents your insurance rates from increasing after your first at-fault accident with your Toyota RAV4 Prime, providing peace of mind and financial protection.

Cons

- Coverage Variety: Geico has fewer specialty coverage options than some of its rivals, which may limit the amount of personalization that can be made to meet the particular requirements of Toyota RAV4 Prime customers.

- Repair Network Restrictions: The extremely affordable option of servicing your Toyota RAV4 Prime may be limited by the relatively small network of Geico’s preferred repair shops.

#2 – State Farm: Best for Reliable Coverage

Pros

- Reliable Coverage: State Farm delivers an expansive suite of coverage options, from collision and comprehensive to liability, meticulously designed to cater to the distinct needs of Toyota RAV4 Prime owners. This tailored approach ensures that every facet of protection is covered, as highlighted in our State Farm car insurance review.

- Discounts: State Farm dishes out an assortment of discounts, from safe driver perks and multi-car savings to rebates for vehicles boasting cutting-edge safety features. These diverse discounts can significantly slash premiums for Toyota RAV4 Prime owners, making coverage more affordable.

- Bundling Benefits: Toyota RAV4 Prime owners can unlock extra savings by combining their auto insurance with other policies, like home or life insurance. This strategic bundling not only simplifies their coverage but also drives down overall costs.

Cons

- Premium Pricing: Toyota RAV4 Prime owners might discover that State Farm’s rates are steeper compared to more budget-friendly insurers like Geico.

- Discount Limitations: The availability of discounts can vary by state, potentially constraining the savings for certain Toyota RAV4 Prime policyholders.

#3 – USAA: Best for Military Focus

Pros

- Military Focus: USAA is a great alternative for Toyota RAV4 Prime owners in this group because it specializes in offering competitive rates and coverage options for military people and their families.

- Options for Coverage: For owners of Toyota RAV4 Prime vehicles, USAA provides extensive coverage options along with extra advantages designed to meet the requirements of active duty personnel. These benefits include deployment and car storage reductions.

- Discounts: To help reduce premiums, USAA offers substantial savings for safe driving, loading the Toyota RAV4 Prime, and combining many policies.

Cons

- Eligibility: USAA is limited to military members, veterans, and their families, making it inaccessible to the general public, including some Toyota RAV4 Prime owners, as detailed in our USAA car insurance review.

- Digital Experience: While generally good, some Toyota RAV4 Prime users report that USAA’s digital tools and mobile app could be more user-friendly and intuitive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Attractive Pricing Strategies

Pros

- Attractive Pricing Strategies: Progressive stands out for its aggressive pricing, featuring an array of discounts and innovative usage-based programs such as Snapshot, which can drastically reduce premiums for cautious Toyota RAV4 Prime drivers who maintain safe driving habits.

- Tailored Coverage Flexibility: Progressive excels in offering adaptable coverage choices that can be fine-tuned to meet the unique needs of Toyota RAV4 Prime owners, enabling highly customized insurance solutions.

- Variety of Discounts: Progressive extends a broad spectrum of discounts, including savings for bundling multiple policies, maintaining continuous insurance, and owning a home, providing multiple avenues for lowering insurance costs, helping to reduce overall insurance costs for Toyota RAV4 Prime owners, as highlighted in our comprehensive guide titled “Progressive Car Insurance Discounts.”

Cons

- Claims Experience Variability: Customer experiences with Progressive’s claims process are diverse; while some Toyota RAV4 Prime owners praise the efficiency, others report frustrating delays and complications, leading to mixed satisfaction levels.

Limited Repair Network: Progressive’s partnership with a select group of repair facilities may constrain Toyota RAV4 Prime owners’ choices, potentially restricting them to a narrower range of options when it comes to vehicle repairs.

#5 – Nationwide: Best for Coverage Options

Pros

- Coverage Options: Nationwide provides owners of Toyota RAV4 Prime vehicles with a wide range of coverage options, including special features like accident forgiveness, full loss deductible waiver, and disappearing deductible, guaranteeing comprehensive and flexible protection.

- Discounts: Nationwide offers Toyota RAV4 Prime customers a number of discounts to assist lower rates. These include multi-policy savings, rewards for safe driving, and discounts for anti-theft equipment. The goal of these discounts is to make insurance more reasonable, as highlighted in our comprehensive guide titled “Nationwide Car Insurance Discounts.”

- Usage-Based Program: The SmartRide initiative doles out extra savings for conscientious Toyota RAV4 Prime drivers, slashing premiums by closely monitoring and applauding safer driving behaviors.

Cons

- Premium Expenses: Nationwide’s pricing might outpace some budget insurers, presenting a pricier option that could stretch the wallets of Toyota RAV4 Prime owners.

- Mobile Experience: Although functional, a segment of Toyota RAV4 Prime users feel Nationwide’s mobile app leaves room for enhancement, particularly in terms of user-friendliness and service quality.

#6 – American Family: Best for Customized Coverage

Pros

- Customized Coverage: American Family offers customizable coverage options specifically designed for the Toyota RAV4 Prime, allowing policyholders to tailor their insurance to their needs.

- Discounts: American Family provides a variety of discounts, including loyalty discounts, multi-vehicle discounts, and defensive driving discounts, which can help lower insurance premiums for Toyota RAV4 Prime owners.

- Additional Benefits: Unique coverage options like accident forgiveness, diminishing deductible, and a personal injury protection plan offer additional value and protection for Toyota RAV4 Prime owners.

Cons

- Premiums: For some drivers of Toyota RAV4 Prime, American Family’s rates may be more expensive than those of budget insurers, making it more expensive, according to our American Family car insurance review.

- Digital Tools: While functional, American Family’s online tools and mobile app might not be as advanced or user-friendly as those offered by some competitors, which might affect Toyota RAV4 Prime user experience.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers offers comprehensive and customizable coverage options that can be tailored to meet the needs of Toyota RAV4 Prime owners, ensuring extensive protection, according to Travelers car insurance review.

- Discounts: Travelers provides multiple discounts, including hybrid/electric vehicle discounts, safe driver discounts, and multi-policy discounts, helping to lower overall insurance costs for Toyota RAV4 Prime owners.

- Additional Benefits: Optional coverage add-ons, such as gap insurance and new car replacement coverage, offer additional value and protection for Toyota RAV4 Prime policyholders.

Cons

- Rates: Travelers’ rates often surpass those of other insurers, potentially deterring budget-conscious Toyota RAV4 Prime buyers from considering them.

- Claims Procedure: A number of Toyota RAV4 Prime owners have voiced concerns over prolonged claim processing delays, which might unsettle policyholders who need swift resolutions.

#8 – Farmers: Best for Coverage Options

Pros

- Coverage Options: Farmers provides extensive coverage options, including new car replacement and customized equipment coverage, tailored specifically to the Toyota RAV4 Prime, as noted in our Farmers car insurance review.

- Diverse Discount Opportunities: Farmers provides a range of discounts, including multi-policy savings, good student incentives, and reductions for Toyota RAV4 Prime vehicles equipped with advanced safety features, which can help lower overall insurance premiums.

- Exclusive Coverage Perks: With unique offerings like accident forgiveness and loss of use coverage, Farmers delivers extra layers of protection and added value, appealing to Toyota RAV4 Prime policyholders looking for comprehensive insurance options.

Cons

- Premium Rates: Farmers’ insurance rates can be on the higher side compared to some other providers, which might affect affordability for Toyota RAV4 Prime drivers seeking budget-friendly coverage.

- Regional Discount Limitations: Not all discounts are available in every area, which could restrict potential savings for some Toyota RAV4 Prime owners depending on their location.

#9 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Liberty Mutual offers flexible coverage options with additional benefits like new car replacement and better car replacement, specifically designed for Toyota RAV4 Prime owners, according to Liberty Mutual car insurance review.

- Abundant Discount Options: Liberty Mutual offers a wide array of discounts, such as multi-car savings, safe driver incentives, hybrid vehicle discounts, and rewards for remaining accident-free, all aimed at reducing premiums for Toyota RAV4 Prime owners.

- Robust Digital Tools: Liberty Mutual’s comprehensive suite of online tools and a user-friendly mobile app make it easy for Toyota RAV4 Prime policyholders to manage their policies, file claims, and access services, significantly enhancing overall convenience.

Cons

- Higher Premium Costs: The premiums at Liberty Mutual are often on the higher side compared to some other insurers, which could be a drawback for Toyota RAV4 Prime drivers who are particularly mindful of their budget.

- Inconsistent Claims Experience: Feedback on Liberty Mutual’s claims process is varied; while some Toyota RAV4 Prime customers are satisfied, others report experiencing delays and complications, leading to mixed reviews regarding efficiency.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Extensive Protection Options

Pros

- Extensive Protection Options: Allstate delivers an array of comprehensive coverage choices specifically designed for Toyota RAV4 Prime owners, encompassing collision, comprehensive, and liability coverage, offering robust protection against a variety of risks.

- Diverse Discount Opportunities: To help reduce insurance premiums, Allstate features a multitude of discounts, such as those for safe driving, bundling multiple policies, purchasing a new car, and installing anti-theft devices, providing substantial savings for Toyota RAV4 Prime drivers.

- Accident Forgiveness Assurance: With Allstate’s accident forgiveness program, Toyota RAV4 Prime owners can avoid premium hikes following their first at-fault accident, ensuring financial stability and peace of mind., as highlighted in our Allstate car insurance review.

Cons

- Higher Premium Rates: Toyota RAV4 Prime owners looking for economical insurance options may find it difficult to afford Allstate’s premiums as they often charge more than their less expensive rivals.

- Problems with Claims Handling: A number of Toyota RAV4 Prime owners have voiced their dissatisfaction with the lengths and complexities of the claims procedure, which can erode trust in Allstate’s support and negatively affect client satisfaction in general.

The Pricey Reality of Insuring a Toyota RAV4 Prime

The Toyota RAV4 Prime, a standout in the hybrid SUV market, offers impressive performance and advanced technology, which can often lead to higher insurance premiums.

Toyota RAV4 Prime Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $117 | $223 |

| American Family | $99 | $125 |

| Farmers | $127 | $199 |

| Geico | $108 | $129 |

| Liberty Mutual | $116 | $145 |

| Nationwide | $97 | $146 |

| Progressive | $98 | $121 |

| State Farm | $94 | $114 |

| Travelers | $101 | $130 |

| USAA | $89 | $112 |

This vehicle’s unique combination of electric and gasoline power, along with its advanced safety features and high resale value, can impact insurance costs significantly.

For Toyota RAV4 Prime owners, understanding these factors and how they influence insurance rates is essential for finding the best coverage at a reasonable price. By delving into how different providers evaluate these elements, you can make well-informed decisions and optimize your insurance expenses.

Navigating the insurance landscape for the Toyota RAV4 Prime requires careful consideration of how various factors affect premiums. With its advanced hybrid technology and safety features, insurance rates can be higher compared to conventional vehicles.

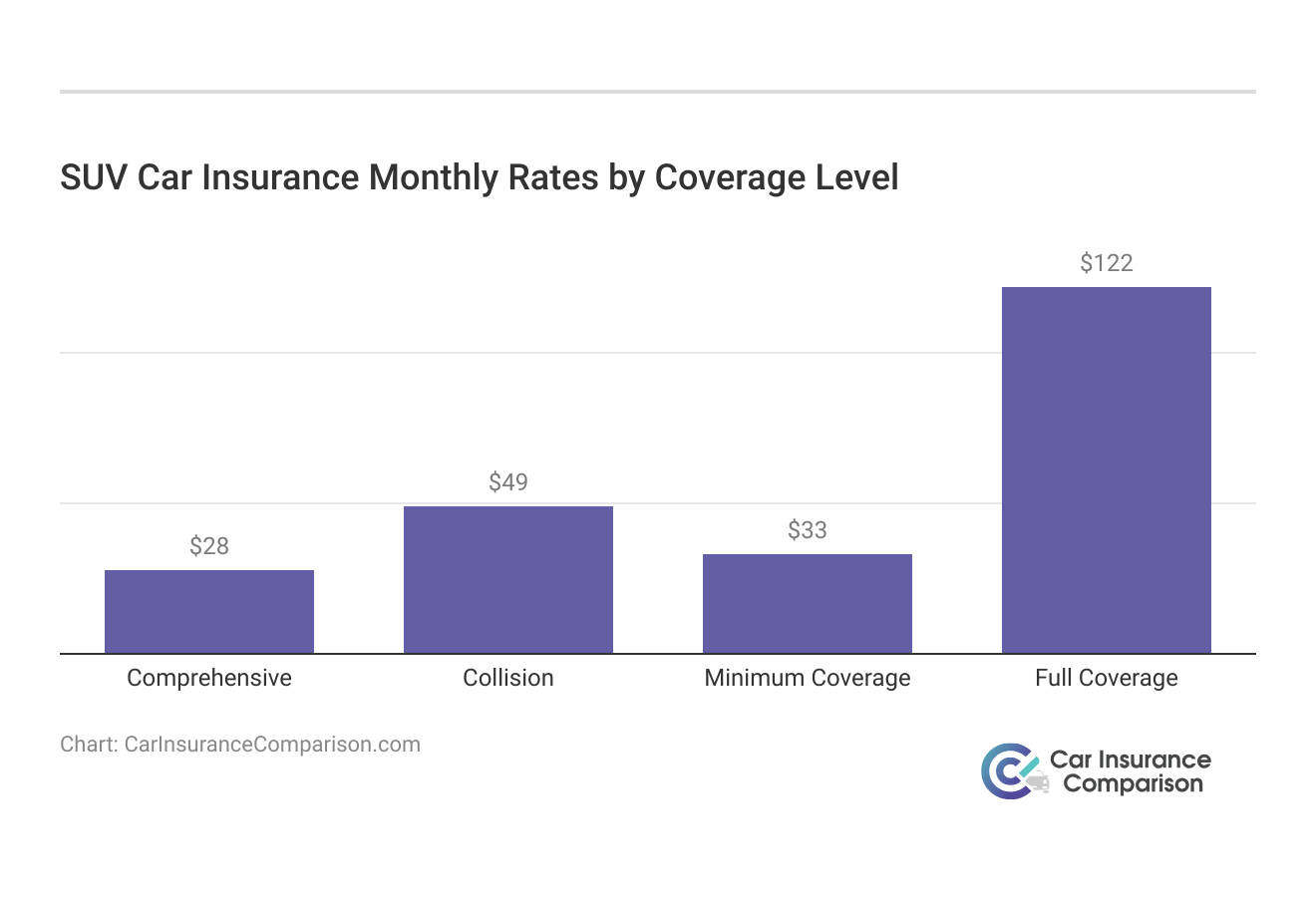

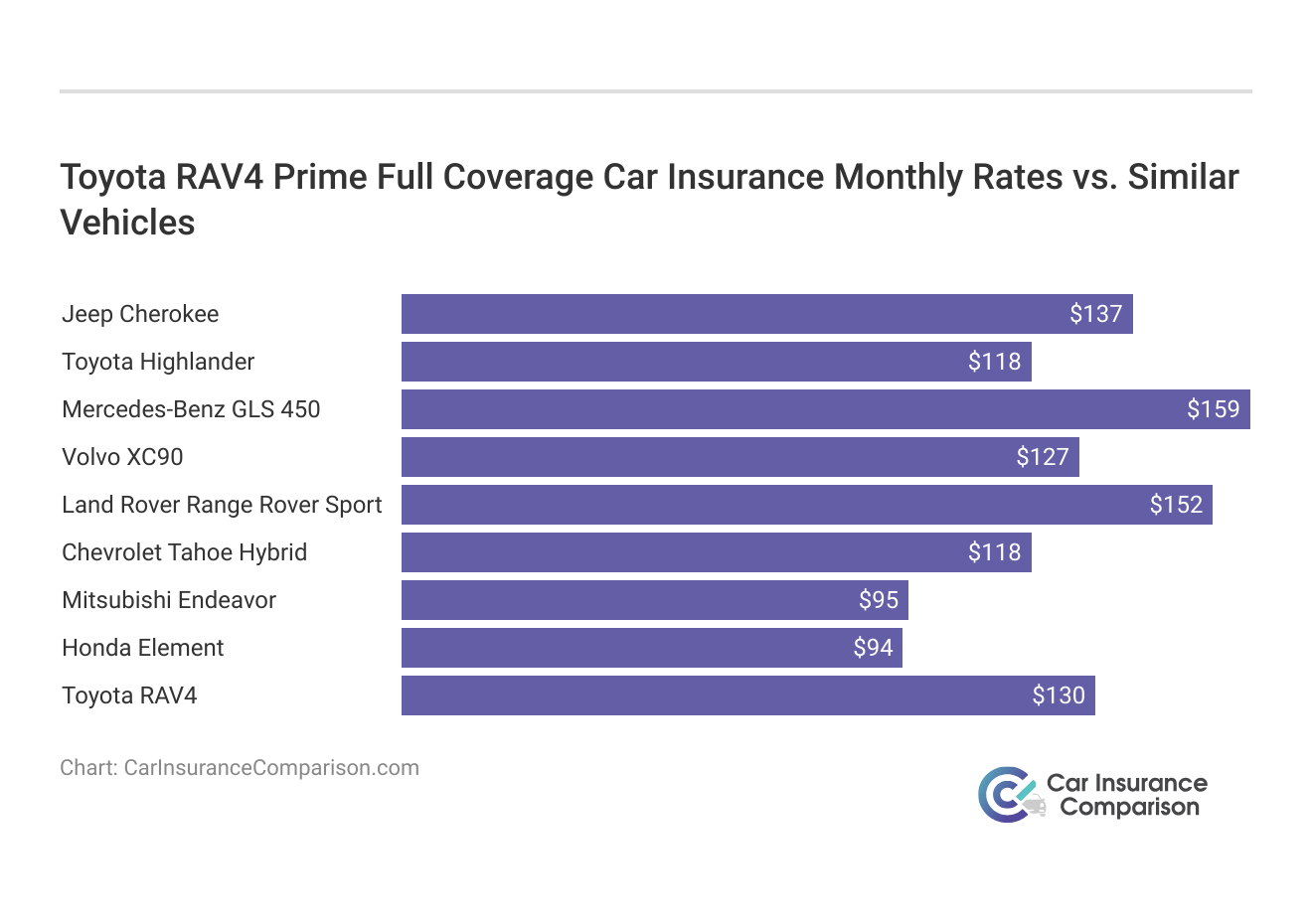

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Jeep Grand Cherokee | $27 | $47 | $31 | $118 |

| GMC Terrain | $27 | $47 | $26 | $111 |

| Dodge Nitro | $16 | $24 | $43 | $99 |

| Lexus RX 350 | $31 | $57 | $35 | $139 |

| Mercedes-Benz GLS 450 | $38 | $75 | $33 | $159 |

| Audi Q7 | $33 | $60 | $33 | $139 |

| Chevrolet Tahoe Hybrid | $24 | $43 | $38 | $118 |

| Chevrolet Captiva Sport | $21 | $34 | $37 | $104 |

| Toyota RAV4 Prime | $28 | $50 | $32 | $130 |

However, by taking the time to compare quotes from a variety of insurance providers and making use of available discounts, you can identify a policy that not only meets your coverage requirements but also fits comfortably within your budget. Engaging in this comparison process allows you to evaluate different options and ensure that you are not overpaying for the coverage you need.

Taking the time to explore and understand your options ensures you get the best possible deal, balancing protection with affordability for your Toyota RAV4 Prime. Explore our detailed analysis on “Compare Car Insurance by Coverage Type” for additional information.

Key Determinants of Toyota RAV4 Prime Insurance Costs

Understanding the key determinants of Toyota RAV4 Prime insurance costs involves examining several crucial factors that can significantly impact your car insurance premium.

These factors include the vehicle’s safety ratings, which influence risk assessments; repair and maintenance costs, which affect the overall expense of coverage; and your personal driving history, which can indicate potential risk levels.

Additionally, your location plays a role, as areas with higher accident rates or theft risks can drive up premiums. By evaluating these elements, you can gain insight into how they contribute to the overall cost of insuring a Toyota RAV4 Prime and identify ways to potentially lower your insurance expenses.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Pricing of the Toyota RAV4 Prime

If you’re contemplating the purchase of a Toyota RAV4 Prime, the price is undoubtedly an important factor in your decision-making process. The Manufacturer’s Suggested Retail Price (MSRP) for the Toyota RAV4 Prime begins at $38,350, but this starting price can vary based on several factors.

The final cost will depend on the trim level you choose, as well as any optional features or packages you decide to add. Additionally, the negotiation process with the dealership can also influence the final price you pay.

Considering these variables will help you better understand the total cost and ensure that you make an informed purchase decision. Get more insights by reading our expert “Average Car Insurance Rates by Age and Gender ” advice.

Tips for Lowering Insurance Expenses for Your Toyota RAV4 Prime

Managing insurance costs for your Toyota RAV4 Prime is essential for keeping your overall vehicle expenses in check. Exploring a range of cost-saving strategies can help you find ways to reduce your premiums without sacrificing the quality of your coverage. Continue reading our full “Where can I find the lowest car insurance quotes?” guide for extra tips.

From leveraging discounts to choosing the right coverage options, there are several approaches you can take to make your insurance more affordable and tailored to your needs. There are several ways you can save even more on your Toyota RAV4 Prime car insurance rates.

Take a look at the following five tips:

- Wait six years for accidents to disappear from your record.

- Consider renting a car instead of buying a second Toyota RAV4 Prime.

- Tell your insurer how you use your Toyota RAV4 Prime.

- Consider Toyota RAV4 Prime insurance costs before buying a Toyota RAV4 Prime.

- Ask about Toyota RAV4 Prime safety discounts.

By applying these strategies, you can effectively lower your insurance premiums for your Toyota RAV4 Prime and achieve significant savings. Staying proactive about available discounts and making informed decisions about your coverage can help you get the most value from your insurance policy. With the right approach, you can maintain robust protection for your vehicle while managing costs effectively.

Top Toyota RAV4 Insurance Companies

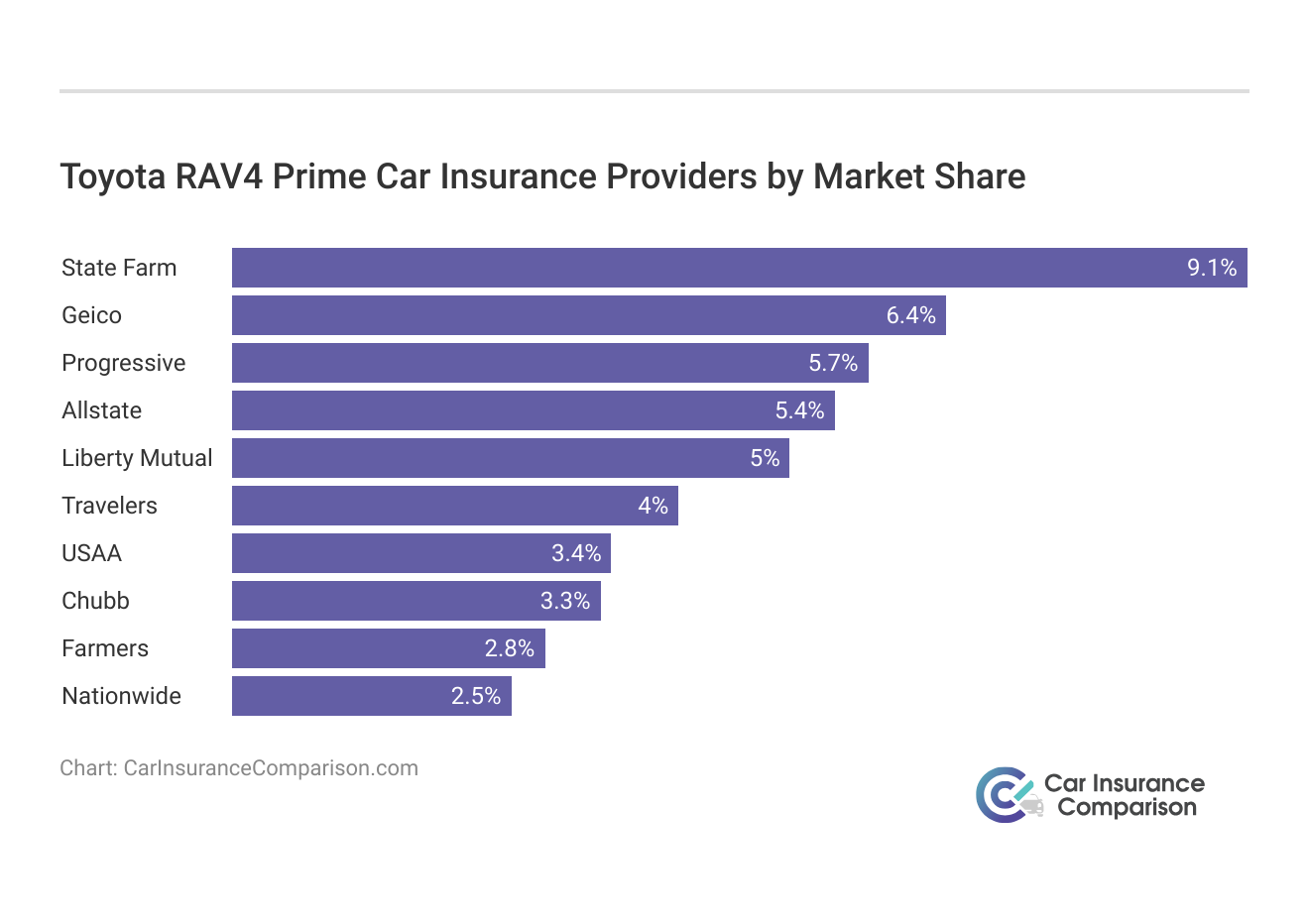

However, several leading insurance providers stand out for their competitive rates and comprehensive coverage tailored to the Toyota RAV4 Prime. These top companies, ranked by market share, offer a range of benefits, including discounts for the advanced safety features and security systems commonly found on the Toyota RAV4 Prime.

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

Choosing the right auto insurance for your Toyota RAV4 Prime can significantly impact your overall costs and peace of mind. By considering the top-rated insurance providers and the benefits they offer, you can find a policy that suits your needs and takes advantage of potential discounts. With the right coverage, you can drive confidently, knowing that you have comprehensive protection tailored to your vehicle.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exploring No-Cost Toyota RAV4 Prime Insurance Quotes Online

Choosing the right insurance for your Toyota RAV4 Prime involves careful consideration of various factors beyond just premium rates. By leveraging free online quotes, you can efficiently compare offerings from different insurers and find the most competitive coverage tailored to your specific needs.

Many insurance companies provide attractive rates for the Toyota RAV4 Prime, but it’s important to delve into the details of each policy to ensure you’re getting comprehensive protection that aligns with your requirements. For more information, explore our informative “Finding Free Car Insurance Quotes Online” page.

Geico consistently delivers some of the most competitive rates in the industry, making it a top choice for budget-conscious Toyota RAV4 Prime owners.

Brad Larson Licensed Insurance Agent

Exploring free Toyota RAV4 Prime insurance quotes online allows you to make a well-informed decision about your coverage. By examining and comparing multiple quotes, you gain insight into the best available options and can select an insurance plan that meets your needs and fits within your budget.

Take the time to review your choices and secure a policy that offers both value and protection for your Toyota RAV4 Prime. Save money by comparing Toyota RAV4 Prime insurance rates with free quotes online now.

Frequently Asked Questions

What is the Toyota RAV4 Prime insurance group?

The Toyota RAV4 Prime typically falls into a mid-range insurance group, often around Group 20-30. However, this classification can vary depending on the insurer and the specific model features, which can influence the exact group placement and associated insurance costs.

How can I find the cheapest Toyota RAV4 Prime to insure?

To find the cheapest Toyota RAV4 Prime to insure, you should compare insurance quotes from various providers, look for discounts linked to the vehicle’s safety features, and consider opting for a base trim model with fewer features, as these can often reduce insurance costs.

Are vehicles like the Toyota RAV4 Prime expensive to insure?

Insurance rates for vehicles like the Toyota RAV4 Prime can vary widely based on several factors. To get a clearer idea of potential insurance costs, it’s beneficial to compare rates for similar SUV models, which can serve as a benchmark for understanding the possible expenses.

Read our extensive guide on “Calculating Car Insurance Cost” for more knowledge.

Which are the top auto insurance companies for Toyota RAV4 Prime?

Several top auto insurance companies offer competitive rates and comprehensive coverage for the Toyota RAV4 Prime. Leading insurers typically include those with strong market presence and those offering discounts for safety features and other vehicle-specific benefits.

How can I compare Toyota RAV4 Prime insurance quotes online?

To find the best insurance rates for a Toyota RAV4 Prime, you can use online comparison tools that allow you to enter your ZIP code and receive free quotes from various insurance companies. This helps you make an informed decision by comparing coverage options and premiums.

Why should I consider comprehensive Toyota RAV4 Prime car insurance?

Comprehensive Toyota RAV4 Prime car insurance provides extensive coverage against damages that are not related to collisions, such as theft, vandalism, and natural disasters. This type of insurance offers broad protection and peace of mind by covering a wide range of potential risks.

Expand your understanding with our thorough “Best Full Coverage Car Insurance” overview.

Which is the cheapest Toyota RAV4 Prime category to insure?

The cheapest Toyota RAV4 Prime category to insure is generally the base model with fewer features compared to higher trims or specialty editions. Base models typically cost less to insure due to their lower value and reduced risk profile.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What should I know about Toyota RAV4 insurance group and cost?

The Toyota RAV4 insurance group determines how much you will pay for coverage, with higher groups usually resulting in higher premiums due to factors such as increased repair costs or vehicle value. Understanding the insurance group can help in estimating your insurance costs.

Where can I find information on Toyota RAV4 Prime insurance costs and providers?

Information on Toyota RAV4 Prime insurance costs and providers can be accessed through insurance comparison websites, direct quotes from insurance companies, and industry reports that provide detailed insights into rates and coverage options.

For more information, explore our informative “Where can I easily finding quick car insurance quotes?” page.

What does the cheapest Toyota RAV4 Prime insurance cost guide include?

The cheapest Toyota RAV4 Prime insurance cost guide includes details on the lowest available premiums, factors that influence insurance costs, and tips for saving money on coverage. This guide helps in identifying the most affordable options and understanding cost drivers.

How can I buy Toyota RAV4 Prime car insurance online?

You can purchase Toyota RAV4 Prime car insurance online by visiting the websites of various insurance companies or using comparison platforms that allow you to get quotes and complete the purchase process directly. This method offers convenience and often competitive rates.

What are the benefits of Toyota RAV4 Prime car insurance?

The benefits of Toyota RAV4 Prime car insurance include protection against various risks such as accidents, theft, and damage, access to discounts for safety features, and overall peace of mind knowing that you are covered for a wide range of potential issues.

Continue reading our full “Compare Collision Car Insurance” guide for extra tips.

What does it mean if my Toyota RAV4 Prime insurance group is 1?

If your Toyota RAV4 Prime is classified in insurance group 1, it indicates that the vehicle is considered low risk, leading to lower insurance premiums due to its lower repair and replacement costs. This classification typically results in more affordable insurance rates.

Does a red Toyota RAV4 Prime cost more to insure?

The color of a Toyota RAV4 Prime, such as red, does not generally affect insurance costs. Insurance premiums are primarily influenced by factors like the vehicle’s value, safety features, and overall risk profile rather than its color.

Where can I find cheap full-coverage Toyota RAV4 Prime insurance?

To find cheap full-coverage Toyota RAV4 Prime insurance, you should compare quotes from multiple insurers, explore available discounts, and seek out policies from companies known for offering competitive full-coverage plans. Comparing options can help you find the best rates.

Get more insights by reading our expert “How do you get cheaper car insurance quotes?” advice.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.