Best Toyota Camry Car Insurance in 2024 (Compare the Top 10 Companies)

State Farm, Geico, and Progressive offer the best Toyota Camry car insurance with competitive rates starting around $35 per month. These top providers excel in coverage options, discounts, and customer service, ensuring optimal protection and value for Toyota Camry owners. Discover why these companies stand out.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,760 reviews

17,760 reviewsCompany Facts

Full Coverage for Toyota Camry

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Toyota Camry

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Toyota Camry

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviewsAmong these, State Farm stands out as the top choice, providing extensive coverage options and excellent customer service. Geico and Progressive also offer competitive rates and valuable discounts, positioning them as strong contenders for cheap car insurance.

Our Top 10 Company Picks: Best Toyota Camry Car Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Service | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 15% | A+ | Customizable Plans | Progressive | |

| #4 | 10% | A+ | Safe Drivers | Allstate | |

| #5 | 15% | A++ | Military Families | USAA | |

| #6 | 12% | A | Add-on Options | Liberty Mutual |

| #7 | 10% | A | Customer Service | Farmers | |

| #8 | 20% | A+ | Loyalty Benefits | Nationwide |

| #9 | 15% | A | Family Plans | American Family | |

| #10 | 13% | A++ | Reliable Coverage | Travelers |

When selecting the ideal insurance, consider these top providers to find the best balance of cost and coverage. You can start comparing quotes for Toyota Camry car insurance rates from some of the best car insurance companies by using our free online tool now.

- State Farm offers the best Toyota Camry car insurance with extensive coverage

- Geico and Progressive provide competitive rates and attractive discounts

- Monthly rates for Toyota Camry insurance start around $35 on average

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Coverage Portfolio: State Farm boasts a diverse array of coverage types tailored for Toyota Camry owners, ranging from basic liability to more comprehensive packages. This expansive selection allows for highly customizable policies, ideal for those seeking both fundamental protection and enhanced safety nets, as highlighted in our State Farm car insurance review.

- Attractive Discounts: Drivers of Toyota Camries can take advantage of a number of savings from State Farm, including those for safe driving practices, bundling insurance, and maintaining excellent academic standing. Although these savings can result in substantial cost savings, it’s important to keep in mind that State Farm’s basic rates occasionally exceed those of competing insurance providers.

- Roadside Assistance Perks: For added peace of mind, State Farm provides optional roadside assistance for Toyota Camry owners. This service encompasses emergency towing, fuel delivery, tire changes, and locksmith services, which can prove invaluable in unforeseen roadside predicaments.

Cons

- Elevated Premium Costs: Toyota Camry owners might find State Farm’s premiums higher compared to other insurers. While discount opportunities are available, they may not suffice to offset the total expense for every driver. It is prudent to weigh the overall cost, factoring in discounts, to assess whether State Farm presents the best value proposition.

Subpar Online Tools: Some Camry owners report that State Farm’s digital tools for managing policies or filing claims are not as intuitive or comprehensive as those provided by other insurers, potentially complicating the user experience for those preferring a fully online interface.

#2 – Geico: Best for Highly Competitive Rates

Pros

- Highly Competitive Rates: Geico is well-regarded for its competitive pricing strategies, often underpricing rivals, making it an attractive choice for Toyota Camry owners focused on minimizing insurance expenses. Geico aims to deliver cost-effective coverage without compromising service quality or coverage comprehensiveness.

- Extensive Discount Programs: Geico offers a number of discounts, including as those for safe drivers, active military personnel, government employees, and multi-policy holders, that can significantly lower insurance costs for Toyota Camry owners. When paired with the already affordable prices, these discounts can result in substantial savings.

- Innovative Usage-Based Insurance (DriveEasy): Geico’s DriveEasy program allows Toyota Camry drivers to benefit from lower premiums by showcasing safe driving behaviors. This program is especially advantageous for drivers confident in their driving skills and seeking to reduce insurance costs based on their habits.

Cons

- Limited Local Agent Presence: For Toyota Camry customers who prefer in-person consultations or more individualized care, Geico may not be the best option because it mostly operates online and has fewer local agents available.

Variable Customer Service Feedback: Although Geico generally receives favorable feedback, some Camry owners report inconsistent customer service experiences, particularly regarding claims handling, which might involve delays or communication gaps, as noted in our Geico car insurance review.

#3 – Progressive: Best for Snapshot Program Rewards

Pros

- Snapshot Program Rewards: Progressive’s Snapshot program is a unique offering that uses driving data to reward safe driving behaviors, potentially leading to significant savings for Toyota Camry owners. By monitoring factors like speed and braking, the program allows drivers to influence their insurance costs directly through safe driving practices.

- Comprehensive Coverage Choices: Progressive offers an extensive suite of coverage options, including gap insurance and pet injury coverage, making it a flexible choice for Camry owners seeking comprehensive protection.

- Diverse Discounts: Progressive provides various discounts, such as those for policy bundling and continuous insurance coverage, which can further reduce costs for Toyota Camry owners, as mentioned in our comprehensive guide titled “Progressive Car Insurance Discounts.”

Cons

- Average Customer Service Ratings: Some Toyota Camry owners report mixed experiences with Progressive’s customer service, particularly around responsiveness and claims handling, which could be a drawback for those prioritizing strong customer support.

- Higher Rates for High-Risk Drivers: Progressive’s rates may be less favorable for drivers with a history of accidents or traffic violations, potentially making it less appealing for high-risk Toyota Camry owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Extensive Coverage Options

Pros

- Extensive Coverage Options: Allstate offers a broad range of coverage options for Toyota Camry, including liability, collision, comprehensive, and optional add-ons like sound system coverage and new car replacement.

- Different Discount Offers: Allstate offers a number of discounts to Toyota Camry owners, including ones for secure driving and cars with cutting-edge safety features, and can lower costs., as noted in our Allstate car insurance review.

- Drivewise Program: Allstate’s Drivewise program offers additional savings opportunities for Toyota Camry owners by rewarding safe driving behaviors, potentially lowering premiums while providing feedback to enhance driving skills.

Cons

- Above-Average Premiums: Allstate’s insurance costs for Toyota Camry coverage are generally higher than those of some competitors, which might deter budget-focused drivers.

- Inconsistent Claims Handling: Some Toyota Camry owners report issues with Allstate’s claims process, including delays and difficulties in claims approval, which could be a concern for those valuing a smooth claims experience.

#5 – USAA: Best for Exceptionally Low Rates

Pros

- Exceptionally Low Rates: USAA is known for offering some of the most affordable insurance rates for Toyota Camry owners, especially for military members and their families, providing significant value without compromising on coverage quality.

- Tailored Discounts: Discounts for prudent driving, combining policies, and loyalty are just a few of the many Toyota Camry-specific benefits that USAA offers. These can further increase savings, especially for qualified military personnel.

- Comprehensive Military-Centric Coverage: USAA offers to Toyota Camry owners that comprehensive coverage is designed to meet the demands of military families, providing global deployment coverage, to guarantee ongoing security wherever they may be stationed.

Cons

- Restricted Eligibility: USAA’s offerings are exclusive to military members, veterans, and their families, limiting access for Toyota Camry owners who do not meet these criteria, as detailed in our USAA car insurance review.

- Limited Local Presence: USAA might not be the best choice for Toyota Camry owners who need local help or prefer directly contacts because of its smaller number of local offices.

#6 – Liberty Mutual: Best for Flexible Policy Options

Pros

- Flexible Policy Options: Liberty Mutual offers a range of customizable coverage options for Toyota Camry owners, allowing them to create a policy that aligns with their specific needs, from basic liability to comprehensive coverage packages, according to Liberty Mutual car insurance review.

- Accident Forgiveness Program: Liberty Mutual’s accident forgiveness program guarantees Toyota Camry owners that your rates won’t change following your first collision, giving careful drivers financial stability and peace of mind.

- Wide-ranging Discount Opportunities: When paired with their adaptable policy options, Liberty Mutual’s discounts for responsible drivers and multi-coverage holders, which are available to Toyota Camry owners, can dramatically reduce insurance rates.

Cons

- Greater Premiums Compared to Competitors: Customers who are budget conscious may choose not to use Liberty Mutual’s Toyota Camry insurance because its rates are frequently higher than those of other insurers.

- Inconsistent Customer Care: A few Toyota Camry owners have had contrasting experiences with Liberty Mutual’s handling of their claims and customer care, citing problems with everything from poor service to lengthy processing times.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Extensive Coverage Options

Pros

- Extensive Coverage Options: Farmers is celebrated for its extensive suite of coverage options tailored for Toyota Camry owners, featuring unique add-ons like customized equipment protection and rideshare coverage, ideal for Toyota Camry drivers with specialized insurance demands.

- Abundant Discount Opportunities: Farmers extends a variety of discounts to Toyota Camry owners, including incentives for safe driving and Toyota Camry vehicles equipped with advanced safety technology, helping to mitigate overall insurance expenditures for Toyota Camry owners.

- Accident Forgiveness Feature: Farmers’ accident forgiveness policy ensures that Toyota Camry insurance rates remain unchanged after a Toyota Camry driver’s first accident, providing both financial stability and peace of mind to Toyota Camry owners.

Cons

- Above-Average Premium Rates: Insurance premiums with Farmers for Toyota Camry coverage are generally higher compared to some competitors, potentially making it a less appealing choice for Toyota Camry drivers focused on cost-efficiency, as noted in our Farmers car insurance review.

- Inconsistent Customer Experiences: Customers who value dependable customer care may be discouraged by Farmers inconsistent customer feedback, which is especially evident when it comes to Toyota Camry owners’ claims handling.

#8 – Nationwide: Best for Vanishing Deductible Advantage

Pros

- Vanishing Deductible Advantage: Nationwide’s Vanishing Deductible program rewards Toyota Camry drivers for safe driving by incrementally reducing their deductible each year they remain claim-free, up to a set limit, offering substantial savings for Toyota Camry owners.

- Extensive Discount Program: To make Toyota Camry insurance more affordable overall, Nationwide offers a wide range of discounts to drivers of Toyota Camries. These include reductions for safe driving, premium bundling, and theft prevention techniques.

- Optional Roadside Assistance: Nationwide’s optional roadside assistance delivers added security with services such as towing, fuel delivery, and lockout support, ideal for Toyota Camry owners seeking extra peace of mind, as highlighted in our comprehensive guide titled “Nationwide Car Insurance Discounts.”

Cons

- Higher Than Average Premiums: Drivers who are mindful of expenses may find that Nationwide’s prices for insurance for the Toyota Camry are somewhat more than those of certain competitors.

- Mixed Feedback on Customer Service: Some Toyota Camry owners have expressed their displeasure with Nationwide’s assistance with customers and claims management, citing delays and inadequate communication in particular when it comes to Toyota Camry insurance.

#9 – American Family: Best for Competitive Rates for Younger Drivers

Pros

- Competitive Rates for Younger Drivers: American Family is a great option for households with either new or teenaged Toyota Camry drivers because of its competitive rates for younger drivers.

- User-Friendly MyAmFam App: The MyAmFam app enhances the policy management experience by providing easy access to billing, claims filing, and policy details, appealing to tech-savvy Toyota Camry owners, according to our American Family car insurance review.

- Diverse Coverage Offerings: American Family offers an extensive array of coverage options, including accident forgiveness and diminishing deductible programs, catering to a broad range of insurance needs for Toyota Camry drivers.

Cons

- Higher Costs for Other Age Groups: Although American Family is excellent for younger drivers, older Toyota Camry owners may find its rates less competitive compared to other insurers, potentially reducing its appeal for some demographics of Toyota Camry owners.

- Varied Customer Service Reputation: Feedback from Toyota Camry owners indicates a range of customer service experiences, which might affect those who highly value consistent and responsive support for their Toyota Camry insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Extensive Coverage Options

Pros

- Comprehensive New Car Replacement: Travelers provides a standout new car replacement option, which is highly beneficial for Toyota Camry owners seeking the assurance of a new Toyota Camry if their car is totaled within the first few years of ownership.

- Broad Spectrum of Discounts: Travelers makes its protection options more affordable to Toyota Camry drivers by giving a variety of discounts, such as those for prudent driving and multi-policy holders.

- Flexible Payment Plans: Travelers caters to different financial preferences by offering multiple payment options, including full payments, installments, and electronic payment choices, accommodating various needs of Toyota Camry drivers.

Cons

- Moderate Premium Rates: Insurance premiums for Toyota Camry coverage with Travelers are typically mid-range, which might not be the most competitive option for Toyota Camry drivers hunting for the lowest prices, according to Travelers car insurance review.

- Limited Agent Presence: For Toyota Camry owners who value conversations in person and individualized attention, the fewer neighborhood Travelers representatives could represent a drawback.

Toyota Camry Insurance Costs: Key Factors and Provider Comparisons

Navigating the labyrinth of insurance options for your Toyota Camry requires a keen understanding of both cost and coverage. With a myriad of rates from various providers, it’s imperative to dissect what each one brings to the table, ensuring you maximize value. Explore our detailed analysis on “Car Insurance Comparison | Compare Car Insurance Quotes” for additional information.

This guide delves into the intricacies of insuring a Toyota Camry, spotlighting critical factors that sway pricing and identifying the top-tier providers offering stellar coverage at competitive rates.

Toyota Camry Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $55 | $140 |

| American Family | $57 | $127 |

| Farmers | $53 | $138 |

| Geico | $35 | $105 |

| Liberty Mutual | $48 | $135 |

| Nationwide | $47 | $125 |

| Progressive | $50 | $130 |

| State Farm | $45 | $120 |

| Travelers | $52 | $132 |

| USAA | $40 | $110 |

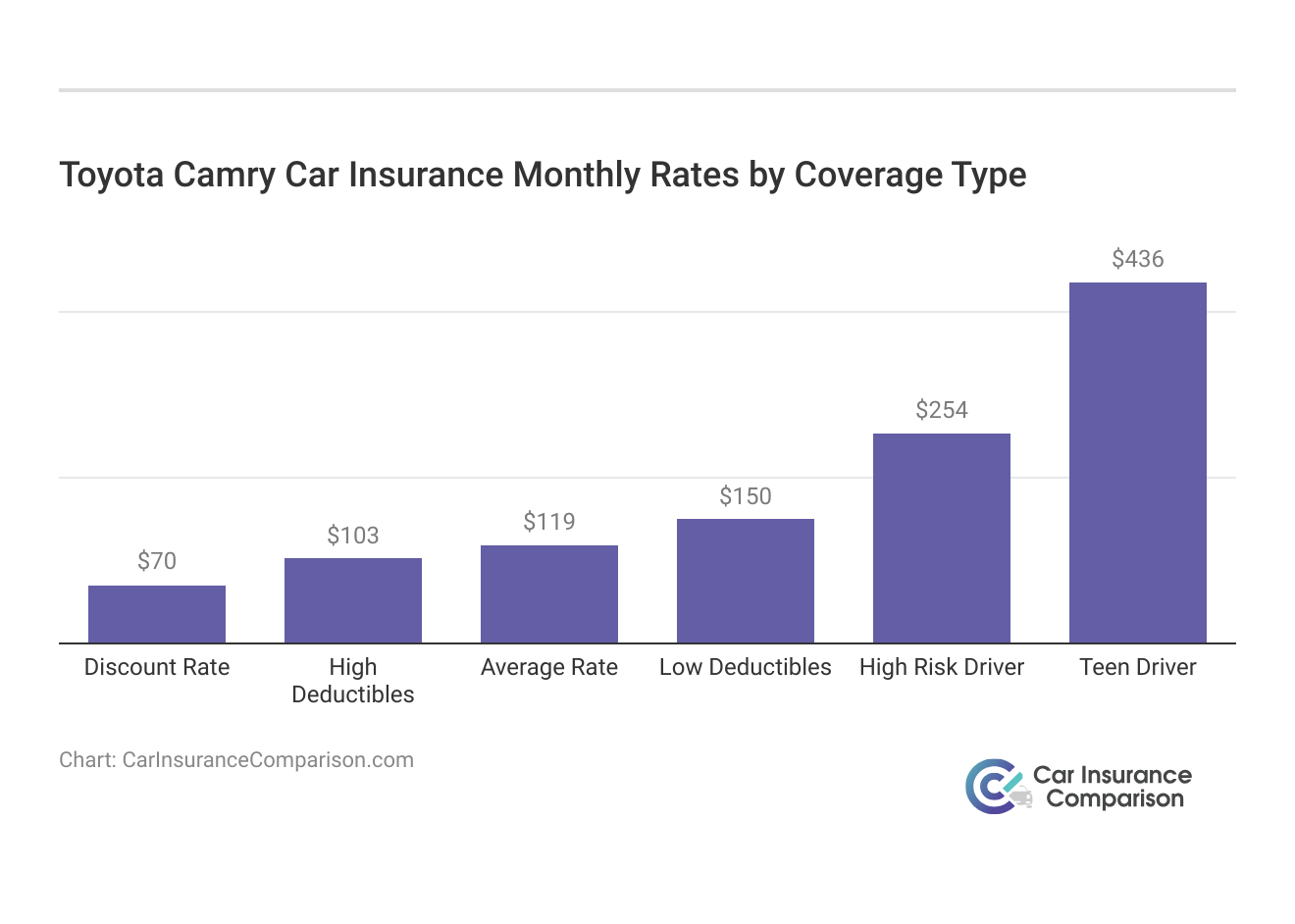

On average, insuring a Toyota Camry rings in at $1,432 annually, or roughly $119 monthly. Securing affordable yet comprehensive insurance is pivotal to enhancing your driving experience.

By meticulously comparing costs and coverage across leading providers, you can pinpoint a policy that strikes the perfect balance between affordability and protection for your Toyota Camry. Make an informed choice to ensure your insurance meets both your financial and protective needs.

Insurance Costs for Toyota Camrys: An Overview

Understanding the complexities of Toyota Camry insurance rates is crucial to choose coverage wisely. The safety features, repair costs, and total market worth of the car are important factors that influence insurance rates. You can find the perfect coverage that fits your demands and budget by comparing the rates provided by several insurers.

Yet, there are strategic steps you can take to snag the lowest Toyota insurance rates online. Get more insights by reading our expert “Compare Car Insurance by Coverage Type” advice.

The chart below details how Toyota Camry insurance rates compare to other sedans like the Chevrolet Impala, Kia Optima, and Dodge Charger.

Toyota Camry Car Insurance Monthly Rates vs. Other Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Toyota Camry | $26 | $50 | $31 | $119 |

| Chevrolet Impala | $23 | $44 | $31 | $112 |

| Kia Optima | $27 | $44 | $35 | $121 |

| Dodge Charger | $31 | $52 | $39 | $139 |

| Ford Focus | $20 | $45 | $33 | $111 |

| Chrysler 300 | $28 | $52 | $33 | $126 |

| Honda Accord | $23 | $42 | $31 | $109 |

Read more: Compare Kia Car Insurance Rates

In essence, Toyota Camry insurance costs fluctuate based on a variety of factors, including your chosen provider and the coverage options you select. By comparing quotes and scrutinizing policy details, you can lock in the most cost-effective and comprehensive insurance for your Toyota Camry. Regularly reviewing and tweaking your policy ensures you’re always getting the maximum value for your money.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding the Factors Behind Toyota Camry Insurance Rates

An important factor in deciding the total cost of your insurance coverage is the model and trim level of your Toyota Camry. The features, performance levels, and safety ratings of various trims and models can affect the cost of your car insurance premiums.

For example, choosing higher trim levels with more advanced equipment or improved performance may result in higher insurance premiums due to more expensive maintenance and greater risk profiles. Knowing how insurance costs are affected by different trim levels and models is essential to help you choose the ideal Toyota Camry that satisfies your driving needs and budget.

Age of the Vehicle

Older Toyota Camry cars typically have lower insurance costs. For example, the insurance for a 2020 Toyota Camry may cost approximately $120, whereas the insurance for a 2010 Toyota Camry usually costs approximately $98, indicating a $22 difference. This variance results from a number of factors, including the decreasing value of the vehicle, a decreased probability of costly repairs, and maybe lower risk evaluations by insurance companies.

Toyota Camry Car Insurance Monthly Rates by Model Year and Coverage Type

| Model Year | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Toyota Camry | $30 | $55 | $29 | $114 |

| 2023 Toyota Camry | $29 | $53 | $30 | $112 |

| 2022 Toyota Camry | $28 | $52 | $31 | $111 |

| 2021 Toyota Camry | $27 | $51 | $32 | $110 |

| 2020 Toyota Camry | $26 | $50 | $31 | $119 |

| 2019 Toyota Camry | $25 | $48 | $33 | $118 |

| 2018 Toyota Camry | $24 | $47 | $33 | $117 |

| 2017 Toyota Camry | $23 | $46 | $35 | $117 |

| 2016 Toyota Camry | $22 | $44 | $36 | $115 |

| 2015 Toyota Camry | $21 | $43 | $37 | $113 |

| 2014 Toyota Camry | $20 | $40 | $38 | $110 |

| 2013 Toyota Camry | $19 | $37 | $38 | $108 |

| 2012 Toyota Camry | $18 | $33 | $38 | $103 |

| 2011 Toyota Camry | $17 | $31 | $38 | $99 |

| 2010 Toyota Camry | $17 | $29 | $39 | $97 |

As cars age, their insurance premiums often decrease, making older models a more budget-friendly option for those looking to align the cost of ownership with affordable insurance premiums.

This $22 gap highlights how insurance costs can shift significantly with the vehicle’s model year, emphasizing the importance of considering both the initial purchase price and long-term insurance costs when choosing your Toyota Camry.

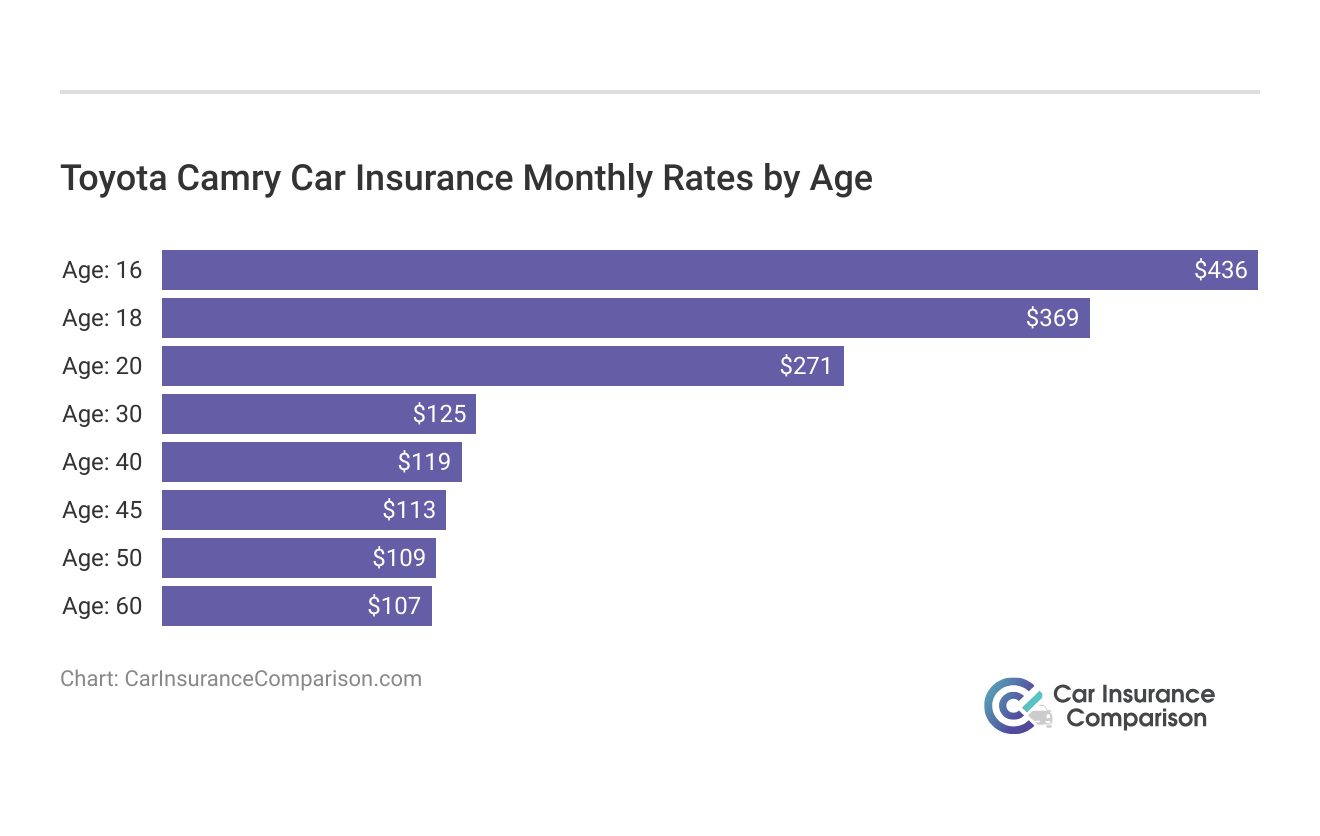

Driver Age

The age of the driver can greatly influence the cost of insuring a Toyota Camry. For instance, a 20-year-old may face monthly insurance costs up to $150 higher than those experienced by a 40-year-old driver.

This significant difference underscores how age can affect insurance premiums, with younger drivers typically incurring higher costs compared to their older counterparts.

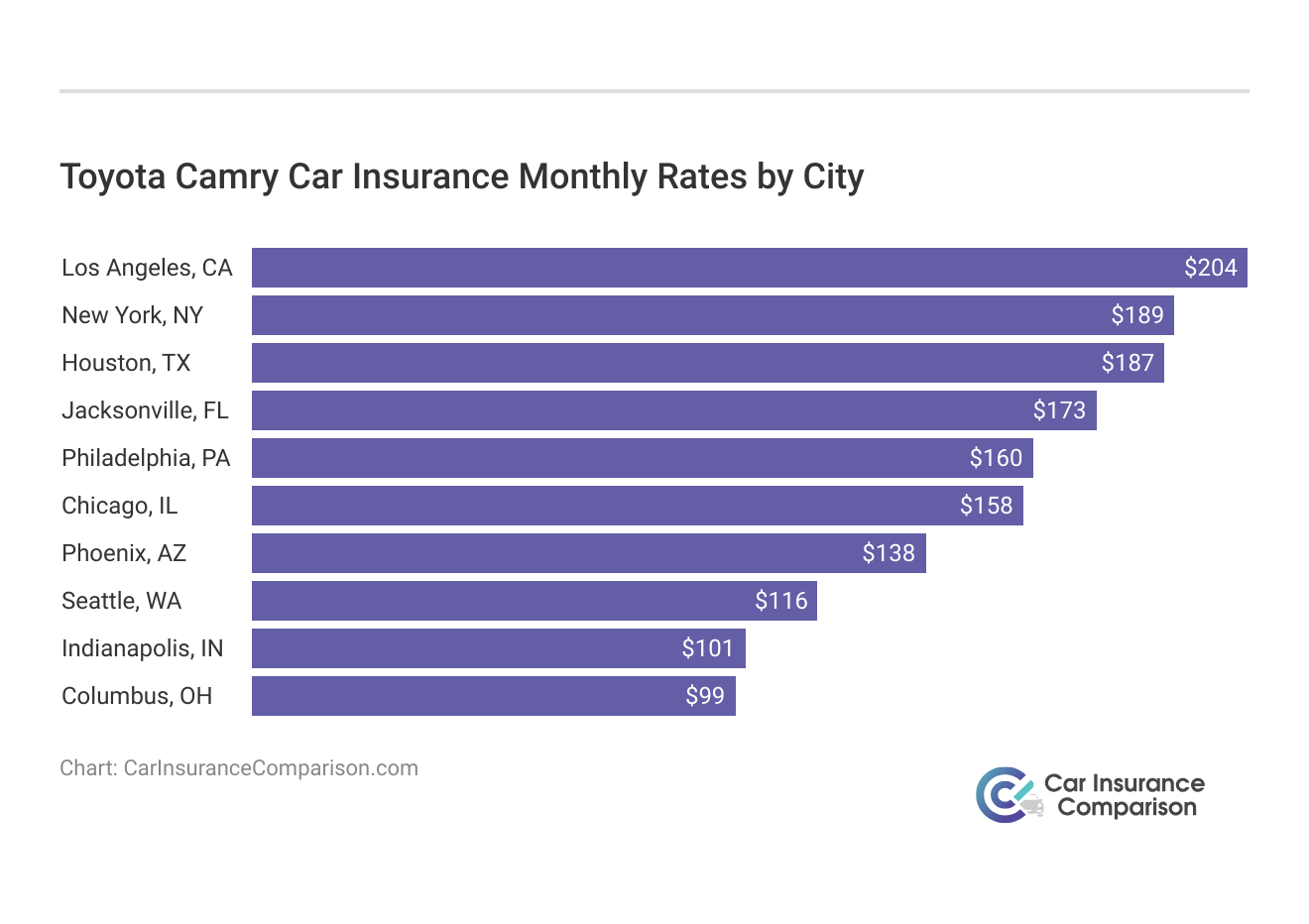

Driver Location

This notable difference underscores how various regional factors, such as traffic density, crime rates, and local insurance regulations, can substantially impact the amount you pay for coverage.

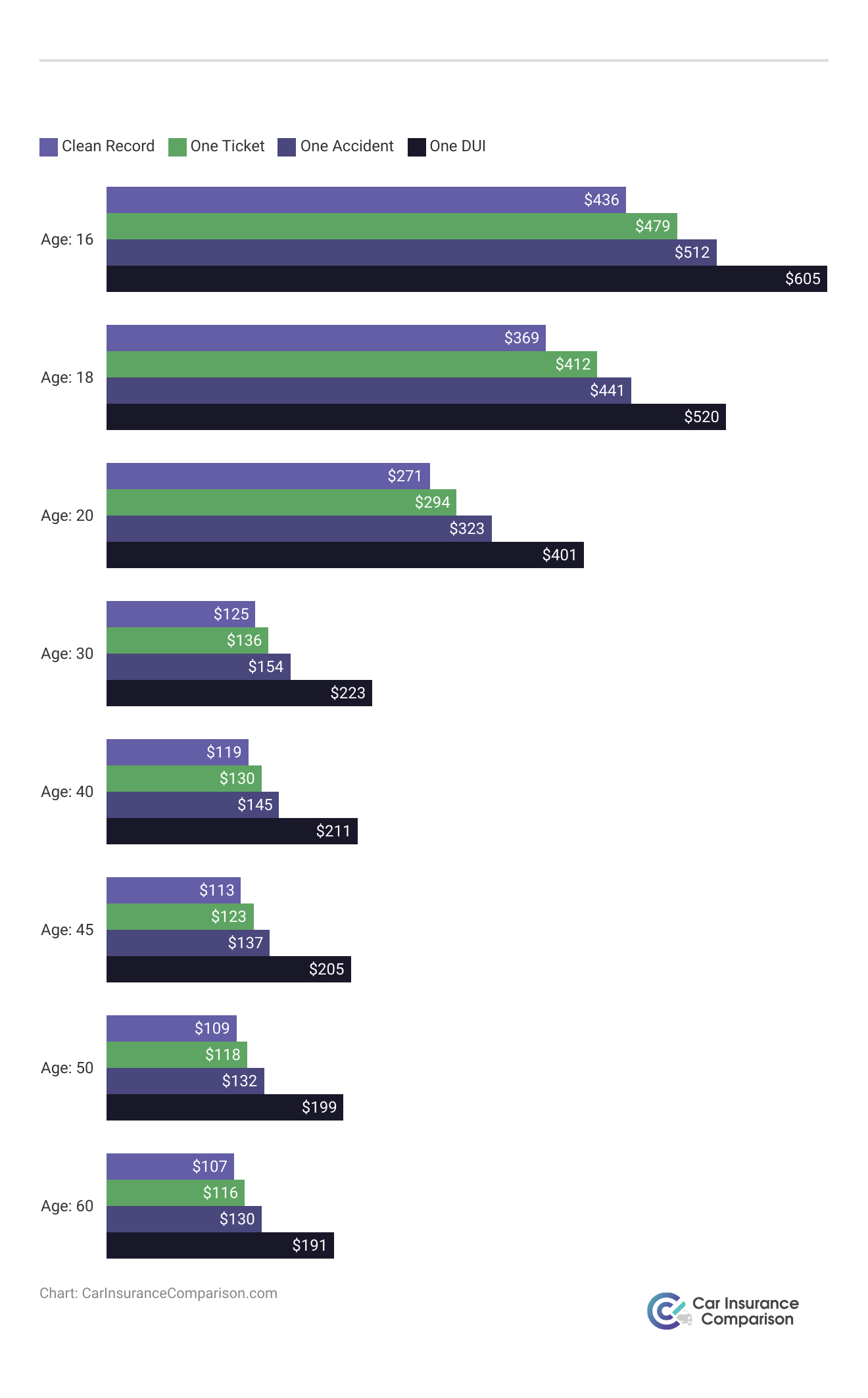

Your Driving Record

This sharp increase demonstrates how younger drivers can be disproportionately affected by a history of moving violations, which drives up their insurance costs significantly more than those of older, more seasoned drivers.

Toyota Camry Safety Ratings

Your insurance rates might be greatly impacted by the safety ratings of the Toyota Camry, which are a result of a complex interaction of elements that insurers carefully examine. Because they suggest a decreased chance of accidents and fewer possible claims, high safety scores frequently translate into lower insurance prices.

Toyota Camry Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Conversely, a Camry with lower safety ratings might trigger elevated premiums, due to the perceived increased risk and potential for higher repair expenses. This nuanced evaluation of safety features, crash-test results, and overall vehicle resilience underscores how the Toyota Camry’s safety ratings play a pivotal role in shaping your insurance costs.

Toyota Camry Crash Test Ratings

The Toyota Camry’s crash test ratings are an important factor in deciding your insurance costs since they show how well-built the car is and how well it can protect its occupants from harm. Through a battery of demanding tests intended to appraise crashworthiness, structural integrity, and overall safety performance, these ratings are painstakingly determined.

Good Toyota Camry crash test ratings can lower your Toyota Camry auto insurance rates. See Toyota Camry crash test results below:

Toyota Camry Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Toyota Camry Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Toyota Camry 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Toyota Camry Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Toyota Camry 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Toyota Camry Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Toyota Camry 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Toyota Camry Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Toyota Camry 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Toyota Camry Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Toyota Camry 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Toyota Camry Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Toyota Camry 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Toyota Camry HV 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Camry 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Camry HV 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Camry 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

Because there is a decreased chance of harm and property damage in the event of an accident, higher crash test scores are frequently associated with lower insurance prices. On the other hand, lower ratings may result in higher premiums because insurers will assume a higher risk of expensive claims and repairs. The complex relationship between these ratings illustrates how much crash test results can affect your Toyota Camry’s insurance premium.

Toyota Camry Safety Features

The safety features of the Toyota Camry have a big influence on insurance costs; newer technology frequently result in cheaper premiums because they pose less danger.

Having a variety of safety features on your Toyota Camry can help lower your Toyota Camry insurance costs. The Toyota Camry’s safety features include:

- Driver Air Bag

- 4-Wheel ABS

- Brake Assist

- Electronic Stability Control

- Child Safety Locks

Enhanced safety systems can lower your insurance costs, while fewer features may result in higher premiums, reflecting the increased potential for claims and repairs.

Toyota Camry Insurance Loss Probability

Lower percentages translate into cheaper Toyota Camry auto insurance; greater percentages translate into more expensive Toyota Camry auto insurance. The likelihood of an insurance loss for a Toyota Camry varies depending on the type of coverage.

| Coverage | Loss |

|---|---|

| Collision | 10% |

| Property Damage | -6% |

| Comprehensive | 2% |

| Personal Injury | 48% |

| Medical Payment | 45% |

| Bodily Injury | 7% |

Understanding the factors that affect the cost of Toyota Camry insurance can help you make informed decisions about your coverage and potentially lower your premiums.

By considering elements like trim level, safety features, and driving habits, you can better manage your insurance costs and find the best coverage for your needs. Evaluating these factors ensures that you select a policy that provides both adequate protection and value.

Toyota Camry Finance and Insurance Cost

When financing a Toyota Camry, most lenders will mandate that you carry higher levels of coverage, including comprehensive insurance, to protect their financial interest in the vehicle.

It’s critical to thoroughly investigate and contrast insurance quotes in order to get the ideal offer for your particular requirements. Use the FREE tool below to get quotes from leading insurance companies and make sure you get the best deal on a policy that provides the necessary coverage for your Toyota Camry.

Proven Tips to Cut Toyota Camry Insurance Expenses

To keep your expenses under control, you must look for methods to reduce your Toyota Camry insurance. You may ensure sufficient coverage while reducing insurance premiums by investigating your options. This post will offer helpful tactics to assist you in locating cheap Toyota Camry insurance.

You have more options at your disposal to save money on your Toyota Camry car insurance costs. For example, try these five tips:

- Ask about usage-based insurance for your Toyota Camry.

- Ask for a higher deductible for your Toyota Camry insurance policy.

- Consider renting a car instead of buying a second Toyota Camry.

- Drive your Toyota Camry safely.

- Ask about discounts for people with disabilities.

Implementing these strategies can significantly reduce your Toyota Camry insurance costs while maintaining the coverage you need. Compare rates and discounts from different insurers to find the best deal and start saving today. For more information, explore our informative “16 Ways to Lower the Cost of Your Insurance” page.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

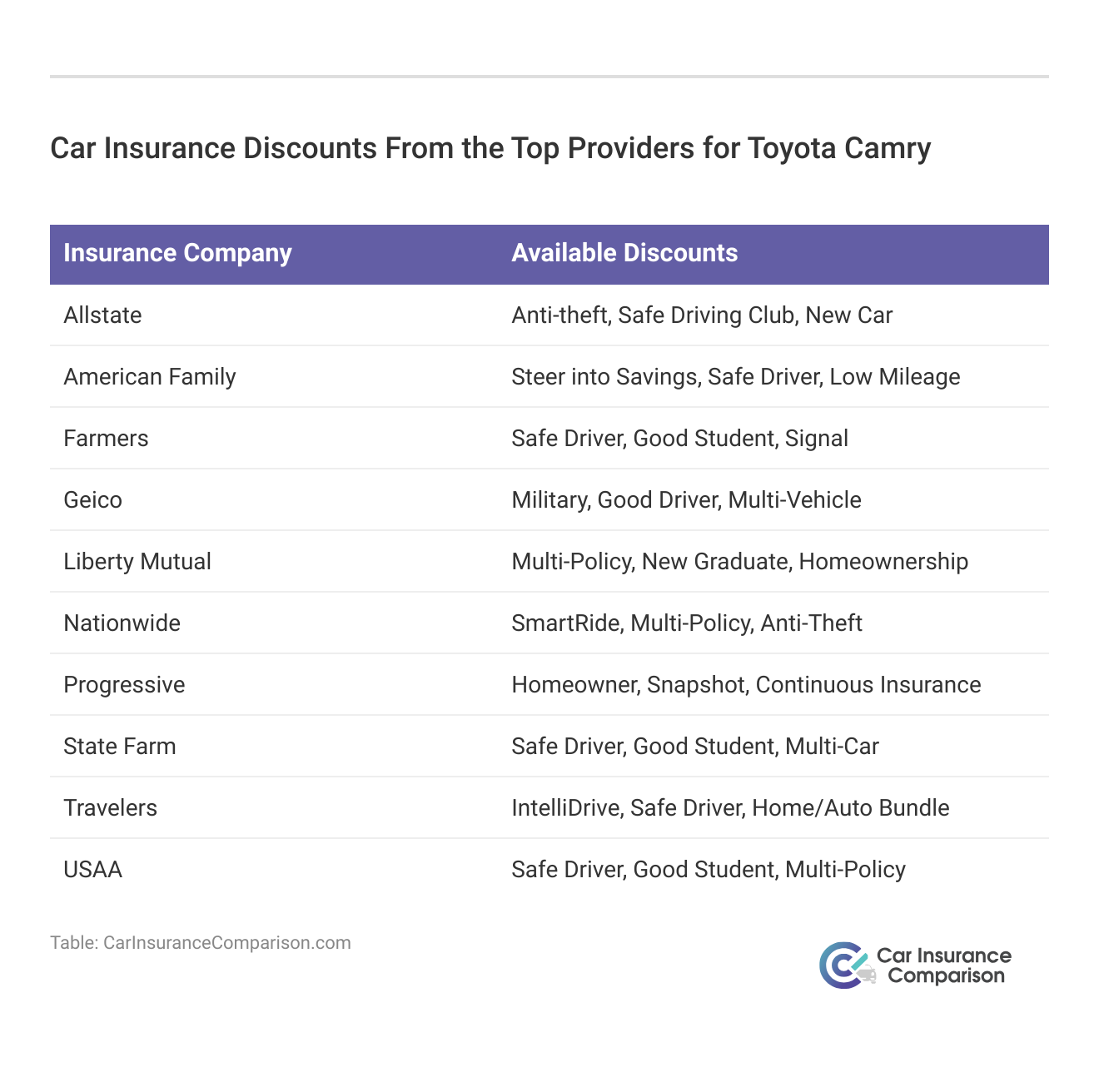

Best Insurance Deals for Toyota Camry Owners

Determining the leading car insurance provider for Toyota Camry insurance rates involves evaluating several factors that can influence your premium. While the rates you pay will vary based on individual circumstances, certain companies stand out for their competitive offers and broad market presence.

Here are some of the top insurers providing Toyota Camry auto insurance coverage, listed by market share. Many of these companies recognize the value of Toyota Camry’s safety features and security systems by offering discounts that can further reduce your insurance costs. Dive deeper into “Car Insurance Company Comparison” with our complete resource.

Top Toyota Camry Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

Selecting the best auto insurance for your Toyota Camry requires taking into account reputable companies and any attainable savings. You may locate the greatest coverage at the most affordable prices by comparing offers and taking advantage of savings on safety features. Make an informed choice and obtain the greatest insurance for your Toyota Camry by using the information supplied.

Get Instant Free Insurance Quotes for Toyota Camry Online

For your Toyota Camry, compare free internet insurance quotes to find the best deals. You may quickly compare quotations from leading insurers and identify the coverage that best suits your needs by using our all-inclusive tool. Investigate your options and choose the coverage that provides the best value for your Toyota Camry to save time and money.

Take advantage of our free online comparison tool to find the most competitive Toyota Camry insurance quotes available. By comparing rates and coverage options, you ensure you get the best deal and protection for your vehicle. Learn more by visiting our detailed “Finding Free Car Insurance Quotes Online” section.

Start your search now and secure the best insurance for your Toyota Camry. You can start comparing quotes for Toyota Camry auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Manufacturer’s Suggested Retail Price (MSRP) for the Toyota Camry

When we talk about a vehicle’s MSRP, we are talking about the manufacturer’s suggested retail price, or what the car company thinks the dealership should be charging for the car.

This impacts your insurance prices because a higher MSRP means a higher replacement cost for a new vehicle in the event of an accident.

Expand your understanding with our thorough “Compare Liability Car Insurance” overview.

The 2020 Toyota Camry L has an MSRP of $25,380, making it the base model, while higher trims like the XLE or XSE can exceed $30,000. The Camry holds its value well, with the 2019 model priced at about $25,050. For new Camry buyers, comprehensive and collision insurance is essential, especially if you have a car loan, as lenders often require these coverages. Failure to maintain insurance could lead to the lender purchasing it for you at your expense. This is called forced-placed insurance.

Premium by Make and Model

| Make and Model | Rates |

|---|---|

| Honda CR-V | $1,128 |

| Ford Escape | $1,158 |

| Toyota Prius | $1,274 |

| GMC Acadia | $1,280 |

| Dodge Ram | $1,292 |

| Honda Accord | $1,298 |

| Ford F-150 | $1,306 |

| Honda Pilot | $1,310 |

| Toyota RAV4 | $1,310 |

| Ford Focus | $1,344 |

| Toyota Corolla | $1,384 |

| Nissan Rogue | $1,400 |

| Hyundai Sonata | $1,412 |

| Toyota Camry | $1,412 |

| Nissan Altima | $1,424 |

| GMC Sierra | $1,438 |

| Kia Optima | $1,438 |

| Chevrolet Silverado | $1,468 |

| Ford Fusion | $1,468 |

| Honda Civic | $1,518 |

The table shows annual full coverage premiums for different vehicles, including $500 deductibles, a 40-year-old driver, and a clean record. Higher vehicle costs lead to higher replacement costs, resulting in increased comprehensive and collision rates. Where can I easily finding quick car insurance quotes?” for additional insights.

How does the MSRP of the Toyota Camry affect collision car insurance rates?

The power and speed of your vehicle affect insurance rates, with high-performance cars costing more to insure. Powerful trucks and sports cars generally have higher premiums due to increased damage risks. The Toyota Camry, being a moderate vehicle, is relatively affordable to insure.

Insurance Rates by Model Year Toyota Camry

| Model Year | Comprehensive Car Insurance Rates | Collision Car Insurance Rates | Liability Car Insurance Rates | Average Annual Car Insurance Rates |

|---|---|---|---|---|

| 2018 | $282 | $566 | $398 | $1,404 |

| 2017 | $272 | $552 | $416 | $1,398 |

| 2016 | $262 | $530 | $430 | $1,380 |

| 2015 | $248 | $512 | $442 | $1,360 |

The table shows average rates for all Toyota Camry models, which may appear high for lower trims and lower for higher trims. These rates are based on a 40-year-old male driver with full coverage, $500 deductibles, and a clean record. Collision insurance covers damage to your vehicle in at-fault accidents, and a lender may require it if you have a car loan.

How does the MSRP of a Toyota Camry affect comprehensive car insurance rates?

Camry Comprehensive Coverage Chart

| Model Year | Comprehensive Car Insurance Rates | Collision Car Insurance Rates |

|---|---|---|

| 2018 | $282 | $566 |

| 2017 | $272 | $552 |

| 2016 | $262 | $530 |

| 2015 | $248 | $512 |

The table shows average rates for all Toyota Camry models, with higher costs for luxury trims. Rates are for a 40-year-old driver with full coverage, $500 deductibles, and a clean record. Comprehensive insurance covers non-accident damages like hail, theft, and vandalism, and may be required by lenders if you’re financing.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Theft Rates of the Toyota Camry

Popular cars like the Toyota Camry are more prone to theft due to their widespread presence and high demand for parts. In 2018, the Camry ranked as the fifth most stolen vehicle, which can affect comprehensive insurance rates. For further details, check out our in-depth “Car Insurance Discounts: Compare the Best Discounts” article.

State Farm consistently delivers outstanding customer service and comprehensive coverage options, making it a top choice for Toyota Camry owners.

Brandon Frady Licensed Insurance Agent

Increased theft rates in your ZIP code can lead to higher insurance premiums, so it’s wise to check with your insurer about potential rate changes if you move and ask about discounts for anti-theft devices.

Repair Costs for Toyota Camry

One of the reasons the Camry is such a big seller each year is that Toyota has a reputation for making excellent cars. Discover our comprehensive guide to “Best Full Coverage Car Insurance“ for additional insights.

They don’t need repairs the way other cars often do, and often their repairs are much more affordable than other cars. RepairPal lists average annual cost for repairs and maintenance of $388, compared to an average of $526 for midsize cars and $652 for all vehicle models.

The table below shows the average cost of maintenance for a Toyota Camry over five years:

Average Toyota Camry Maintenance Costs by Age

| Age of Vehicle | Average Maintenance Costs |

|---|---|

| Year 1 | $80.00 |

| Year 2 | $159.00 |

| Year 3 | $583.00 |

| Year 4 | $341.00 |

| Year 5 | $1,493.00 |

While those numbers are helpful, you may also need to know the average cost of repairing a Camry if the car is damaged.

Average Toyota Camry Repair Costs by Body Part

| Repair Type | Front Bumper | Rear Bumper | Hood | Roof | Left Front Door | Left Rear Door | Front Left Fender | Left Quarter Panel |

|---|---|---|---|---|---|---|---|---|

| Body Labor | $115.20 | $115.20 | $72.00 | $72.00 | $118.80 | $108.00 | $72.00 | $72.00 |

| Paint Labor | $144.00 | $144.00 | $151.20 | $180.00 | $122.40 | $122.40 | $129.60 | $136.80 |

| Paint Supplies | $104.00 | $104.00 | $109.20 | $130.00 | $88.40 | $88.40 | $93.60 | $98.80 |

| Color Tint | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 |

| Haz Waste Disposal | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 | $5.00 |

| Color Sand and Buff | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 | $18.00 |

| Cover Car | - | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 |

| Total | $404.20 | $414.20 | $383.40 | $433.00 | $380.60 | $369.80 | $346.20 | $358.60 |

In the table above we’ve broken down the itemized cost of each type of repair, showing what portion of your overall repair cost goes to parts, labor, paint, waste disposal, etc.

How does the cost of repairs affect collision and comprehensive car insurance rates?

As we’ve explained previously, collision insurance protects you by paying for damages to your vehicle if you’re at fault in an accident. Comprehensive, on the other hand, covers things that are nobody’s fault, such as weather damage and theft.

The more likely you are to file a claim for your Toyota Camry, the higher your insurance rates are likely to go. A clean driving record and a ZIP code with few reported car thefts will go a long way in reducing the cost of your car insurance.

Impact of Claim Frequency on Toyota Camry Insurance Rates

Insurance rates are typically determined by statistics and other data, so insurance companies pay close attention to the number of claims filed based on vehicle type each year. The more claims filed for a specific type of vehicle, the higher the insurance rates will be. Learn more by visiting our detailed “How do you file a car insurance claim?” section.

The table below shows claim frequency by vehicle type:

Claim Frequency by Vehicle Type

| Vehicle Type 2016-2018 Model Years | Claim frequency | Claim severity | Overall loss |

|---|---|---|---|

| Passenger cars and minivans | 8.4 | $5,949 | $501 |

| Pickups | 6.2 | 6,100 | 380 |

| SUVs | 6.5 | 6,045 | 393 |

| All passenger vehicles | 7.3 | $6,005 | $438 |

Keep in mind that this information is only ever available for used vehicles, so you won’t be able to look up these stats for newly released vehicles. Looking at the numbers above, it’s clear that having minimum liability coverage is an absolute necessity. Not only is it required by law in almost every state, but it’s also necessary to protect yourself financially in the event of an accident.

If you can afford it, raising your liability levels from state-required minimums, which could be as low as $10,000 in personal injury protection and $10,000 in property damage coverage, to the highest amount of coverage you can reasonably afford will protect your assets and provide peace of mind while driving.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Toyota Camry Size and Class

The 2016-2018 Toyota Camry is considered a midsize, four-door car. The early models from the 1980s and 1990s were considered compact cars, but the Camry has grown in size over the years, moving into a bigger category. Continue reading our full “Multiple Policy Car Insurance Discounts” guide for extra tips.

In the table below, smaller numbers indicate better safety ratings.

Midsize Car Insurance Collision Losses

| Midsize Car Type | Collision Losses |

|---|---|

| Chevrolet Malibu | 15% |

| Chevrolet Malibu hybrid | 20% |

| Ford Fusion | 5% |

| Ford Fusion 4WD | 5% |

| Ford Fusion hybrid | 18% |

| Ford Fusion plug-in hybrid | 16% |

| Honda Accord | 4% |

| Honda Accord hybrid | -3% |

| Hyundai Sonata | 23% |

| Hyundai Sonata plug-in hybrid | 27% |

| Kia Optima | 15% |

| Mazda 6 | -5% |

| Subaru Legacy 4WD | -24% |

| Subaru Legacy 4WD with EyeSight | -30% |

| Toyota Camry | 14% |

| Toyota Mirai fuel cell | 19% |

| Volkswagen Jetta | 13% |

| Volkswagen Passat | -9% |

Typically, a larger vehicle provides better protection during a crash than a smaller vehicle. This is partly because the distance from the front of the vehicle to the driver in bigger cars and SUVs offers more protection in front-end collisions. Heavier vehicles also continue moving forward in a crash, subjecting the driver and passengers to less force than people traveling in a smaller car.

Improvements in design and technology have made almost every vehicle safer, but larger vehicles still have an advantage over smaller vehicles, even when those improvements are taken into account.

Curb Weight of Vehicles Chart

| Curb weight | Shadow - 70-80 sq ft | Shadow - 81-90 sq ft | Shadow - 91-100 sq ft | Shadow - 101-110 sq ft | Shadow - > 110 sq ft |

|---|---|---|---|---|---|

| 2,001-2,500 lbs | Mini | Small | Small | Small | Midsize |

| 2,501-3,000 lbs | Small | Small | Midsize | Midsize | Midsize |

| 3,001-3,500 lbs | Small | Midsize | Midsize | Large | Large |

| 3,501-4,000 lbs | Small | Midsize | Large | Large | Very large |

| > 4,000 lbs | Midsize | Midsize | Large | Very large | Very large |

As you can see from the chart above, both the weight and overall size of a vehicle are considered when determining whether it’s small, midsize, large, or very large.

A vehicle’s shadow is its overall length times its width, measured in square feet. The wider frame is the biggest factor in re-categorizing the Camry as a midsize car in the 1990s.

How does the size of the Toyota Camry affect bodily injury liability car insurance rates?

Bodily injury liability insurance covers any injuries you may cause to another person if you’re at fault for an accident. The coverage is meant to pay for medical expenses, legal fees, and necessary compensation for lost wages and income, so even a small accident could end up with tens of thousands of dollars in bodily injury liability costs.

The Toyota Camry is actually rated better than average when it comes to bodily injury insurance losses, making it a safer car to drive and a cheaper car to insure than some of the other cars in the same class.

In the table below, smaller numbers indicate better safety ratings.

Midsize Car Insurance Bodily Injury Losses

| Midsize Car Type | Bodily Injury Losses |

|---|---|

| Chevrolet Malibu | 28% |

| Ford Fusion | 25% |

| Ford Fusion 4WD | -4% |

| Ford Fusion hybrid | 31% |

| Ford Fusion plug-in hybrid | 14% |

| Honda Accord | -32% |

| Mazda 6 | -4% |

| Nissan Maxima | 4% |

| Subaru Legacy 4WD | -12% |

| Subaru Legacy 4WD with EyeSight | -49% |

| Toyota Camry | -28% |

| Volkswagen Passat | -7% |

Using the Geico quote app, we ran a sample quote through their system based on a 2016 Toyota Camry. We ran this quote for a random 35-year-old woman with a clean driving record living in Dallas, which means your quoted rate might be different, even if you currently drive a Toyota Camry.

For state minimum levels of liability coverage (30/60/25) along with comprehensive and collision with a $1,000 deductible, our generic person was quoted $1,145.20 for a six-month policy. The bodily injury liability coverage was $252.10 of that total. If she increases her liability coverage to the maximum available levels (100/300/100) she would be quoted $1,291.54, of which $356.01 goes toward the bodily injury liability total.

The cost difference between the two levels of liability coverage is relatively small, which means that people who can afford to pay the extra cost each year can have significantly more protection if they need the extra coverage in an at-fault accident.

How does the size of the Toyota Camry affect property damage liability car insurance rates?

Property damage liability insurance covers costs for damage to others’ property in an at-fault accident, including vehicles and non-vehicle property like mailboxes or walls.

For example, a six-month Geico policy costs $1,145.20, with $314.60 allocated to the state minimum property damage coverage. Increasing the coverage to $100,000 raises the premium to $346.90, offering four times the coverage for under $100 more annually.

Toyota Camry Safety Ratings

IIHS rates a vehicle’s safety on two factors. The first is crashworthiness, or how well a car protects drivers and passengers in a crash, and crash avoidance and mitigation, which is a technology that helps prevent a crash or reduce the damage that comes from a crash.

The 2018 Toyota Camry is very highly rated in all categories, including physical structure, driver and passenger injury measures, and driver restraints. The only areas where the Camry rates Acceptable rather than Good are in passenger restraints, headlights, and trim level. For further details, check out our in-depth “Safe Driver Car Insurance Discounts” article.

To get a better idea of just how safe it is to drive a Toyota Camry, check out the video below:

As the Toyota Camry only has one body type, there is no other information available on IIHS for safety ratings on other body types. For example, if a vehicle came in a two-door or four-door style, we would include the safety information for both in this section, but the Camry is only available as a four-door sedan.

How does the safety of the Toyota Camry compare to other vehicles with the same size and class?

As we discussed in the sections above, the size of your vehicle plays a part in how safe it will be in an accident. Because of this, rates of driver deaths per million registered vehicles have typically been higher for smaller, lighter vehicles.

Luckily, technological advances are making smaller vehicles safer, so the differences between large and small vehicles are less extreme today than they were in the past.

In the table below, we see occupant deaths per million registered vehicles:

Fatalities by vehicle class for the last ten years

| Year | Driver Fatality - Cars | Driver Fatality - Pickups | Driver Fatality - SUVs | Driver Fatality - All passenger vehicles | All Occupant Fatalities - Cars | All Occupant Fatalities - Pickups | All Occupant Fatalities - SUVs | All Occupant Fatalities - All passenger vehicles |

|---|---|---|---|---|---|---|---|---|

| 2008 | 65 | 87 | 35 | 61 | 92 | 114 | 52 | 85 |

| 2009 | 56 | 63 | 25 | 49 | 82 | 83 | 36 | 69 |

| 2010 | 49 | 64 | 20 | 43 | 71 | 80 | 29 | 61 |

| 2011 | 43 | 49 | 17 | 37 | 62 | 66 | 24 | 52 |

| 2012 | 42 | 44 | 16 | 35 | 61 | 56 | 23 | 49 |

| 2013 | 41 | 39 | 19 | 34 | 58 | 52 | 26 | 48 |

| 2014 | 37 | 38 | 18 | 32 | 53 | 47 | 24 | 44 |

| 2015 | 42 | 40 | 20 | 35 | 62 | 52 | 29 | 51 |

| 2016 | 44 | 39 | 21 | 36 | 63 | 48 | 32 | 51 |

| 2017 | 46 | 37 | 22 | 36 | 66 | 46 | 33 | 51 |

| 2018 | 48 | 34 | 23 | 36 | 69 | 42 | 32 | 50 |

This information is helpful, but it can also be good to know the fatality rates based on your vehicle size. You can use the table below to compare the fatality rates for midsize cars such as the Camry with other vehicle sizes to get a better understanding of how safe a vehicle is when it’s in an accident.

Fatality Rates Based On Car Size

| Car Size | Registered Vehicles | Deaths | Rate |

|---|---|---|---|

| Mini | 1,051,275 | 88 | 84 |

| Small | 7,965,422 | 427 | 54 |

| Midsize | 9,736,590 | 396 | 41 |

| Large | 2,282,524 | 122 | 53 |

| Very large | 1,787,340 | 47 | 26 |

| All cars | 22,823,151 | 1,088 | 48 |

Insurance companies will use these numbers to help determine your rates, so a lower number of fatalities in a category can translate into a lower insurance premium.

When it comes to types of crashes, frontal impacts were responsible for 56 percent of passenger vehicle deaths in 2018. Comparatively, side impacts accounted for only 23 percent of passenger vehicle deaths.

Other Car Insurance Coverage Rates for the Toyota Camry

So far we have talked about the way liability, collision, and comprehensive coverages impact the insurance rates for your Toyota Camry, but there is more to an insurance rate than just these factors. A car insurance calculator can help you estimate what your car insurance rates may be.

Below we’ll talk about some of the other types of coverage that you may need while driving.

How do safety ratings of the Toyota Camry affect personal injury protection (PIP) car insurance rates?

To get an idea of how the Toyota Camry fares when it comes to PIP coverage, take a look at the chart below:

Camry Personal Injury Losses

| Midsize Car Type | Personal Injury Losses |

|---|---|

| Chevrolet Malibu hybrid | -8% |

| Ford Fusion | 26% |

| Ford Fusion 4WD | -4% |

| Ford Fusion hybrid | 11% |

| Ford Fusion plug-in hybrid | 6% |

| Honda Accord | 29% |

| Mazda 6 | 0% |

| Subaru Legacy 4WD | -19% |

| Subaru Legacy 4WD with EyeSight | -27% |

| Toyota Camry | 32% |

| Volkswagen Jetta | 24% |

| Volkswagen Passat | 12% |

On this graph, lower numbers are better. The Camry ranks at 32 percent, which is significantly worse than many other cars in the midsize range. It isn’t the worst, however, outperforming Nissan, Chevrolet, and Hyundai.

Read more: Compare Nissan Car Insurance Rates

How do safety ratings of the Toyota Camry affect MedPay car insurance rates?

MedPay, otherwise known as medical payments coverage, is an optional coverage that can help pay your or your passengers’ medical expenses if you’re injured in a car accident, regardless of who is at fault. MedPay isn’t available in all states.

Camry Medical Payment Losses

| Midsize Car Type | Medical Payment Losses |

|---|---|

| Ford Fusion 4WD | -7% |

| Ford Fusion hybrid | 2% |

| Ford Fusion plug-in hybrid | 5% |

| Honda Accord | 9% |

| Mazda 6 | 1% |

| Subaru Legacy 4WD | -9% |

| Subaru Legacy 4WD with EyeSight | -28% |

| Toyota Camry | 30% |

| Toyota Camry hybrid | 17% |

| Volkswagen Passat | 14% |

Much like the graph above, lower numbers are better. The Camry ranks at 30 percent, which is worse than many other cars in the midsize range. It isn’t the worst, however, outperforming Nissan, Chevrolet, Ford, and Hyundai.

Please note that PIP and MedPay numbers represent claim frequency only.

Potential car buyers ought to remember that it’s essential to get quotes from multiple insurance providers so that they’re capable of locating the very best car insurance costs for their Toyota Camry. Actual pricing will range wildly from one part of the country to another, from one state to a different state, and from one city to a different city.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The History of the Toyota Camry

The Toyota Camry, first produced in 1982, began as a compact car and has since grown into a well-regarded midsize vehicle. The name “Camry” derives from the Japanese word for “crown,” reflecting Toyota’s tradition of naming cars after royalty and prestigious symbols.

Over the years, the Camry has evolved through various models and trim levels, including the CE, LE, SE, XLE, and hybrid variants, each offering different features and engine options.

Despite a recent decline in sales, the Camry remains a popular choice due to its reliability and affordability. The 2020 model, like its predecessors, combines new features with the dependable performance that has characterized the Camry throughout its history. Learn more by visiting our detailed “How do you get cheaper car insurance quotes?” section.

Frequently Asked Questions

What is the cheapest Toyota Camry insurance available?

The cheapest Toyota Camry insurance often comes from providers like Geico and State Farm, offering competitive rates based on your driving history and location.

How can I find the insurance cost for a Toyota Camry 2012?

To find the insurance cost for a Toyota Camry 2012, you can request quotes from various insurance companies online or contact them directly for a personalized rate based on your driving profile.

Which brand offers the cheapest car insurance for a Toyota Camry?

Geico is known for offering some of the lowest insurance rates for a Toyota Camry, followed closely by State Farm.

Explore our detailed analysis on “Where can I find the lowest car insurance quotes?” for additional information.

What is the comprehensive Toyota Camry car insurance cost?

Comprehensive Toyota Camry car insurance typically costs around $120 per month, though this can vary based on the model and other factors.

Which Toyota Camry model has the most expensive insurance?

The Toyota Camry XSE or XLE models generally have the most expensive insurance due to their higher value and additional features.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What is the most expensive color Toyota Camry insurance?

Generally, the color of a Toyota Camry does not significantly impact insurance rates, but some sources suggest that high-demand colors might affect the cost slightly.

Get more insights by reading our expert “Best Usage-Based Car Insurance Companies” advice.

What is the lowest form of Toyota Camry insurance coverage?

The lowest form of Toyota Camry insurance coverage is liability-only, which covers damages to other parties but not your own vehicle.

Can you explain TPL and comprehensive insurance for a Toyota Camry?

TPL (Third Party Liability) insurance covers damages to other people’s property and injuries in an accident where you are at fault. Comprehensive insurance covers non-collision incidents like theft, fire, and weather damage.

What is the cheapest Toyota Camry category to insure?

The Toyota Camry LE is often the cheapest category to insure due to its lower value and fewer high-cost features compared to other trims.

Continue reading our full “How do you get competitive quotes for car insurance?” guide for extra tips.

What is the cheapest cover for Toyota Camry insurance?

The cheapest cover for Toyota Camry insurance is typically liability-only coverage, which provides basic protection required by law.

What is the best type of Toyota Camry insurance?

The best type of Toyota Camry insurance is full coverage, which includes both collision and comprehensive coverage for maximum protection.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.