Best Temporary Car Insurance in 2025 (Your Guide to the Top 10 Providers)

Discover the best temporary car insurance with the industry leaders like Progressive, Allstate, and Geico offer rates starting at $45 per month. They stand out for their affordability, coverage options, and customer service. Compare quotes to find the right fit for your needs and ensure you're covered.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Temporary Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Temporary Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Temporary Car Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best temporary car insurance are Progressive, Allstate, and Geico, with rates starting at $45 per month. These providers excel in affordability, comprehensive insurance options, and customer service. Progressive stands out as the top pick overall, offering the best combination of price and coverage.

Allstate is notable for its robust policy features, while Geico is praised for its user-friendly online platform. Whether you need temporary car insurance for rental cars or borrowing a friend’s vehicle, these companies provide reliable short-term solutions.

Our Top 10 Company Picks: Best Temporary Car Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Flexible Coverage Progressive

#2 25% A+ Comprehensive Coverage Allstate

#4 25% A++ Competitive Rates Geico

#3 17% B Customer Service State Farm

#5 20% A+ Agent Network Nationwide

#6 10% A++ Military Benefits USAA

#7 10% A Comprehensive Policies Liberty Mutual

#8 15% A Roadside Assistance AAA

#9 8% A++ Safe-Driving Discounts Travelers

#10 20% A+ Discount Availability American Family

Compare quotes to find the best fit for your needs and ensure you’re covered. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Best temporary car insurance starts at $75 for short-term coverage needs

- Top pick Progressive offers comprehensive coverage starting at $45 per month

- Ideal for rentals or borrowing a car, with flexible policy durations

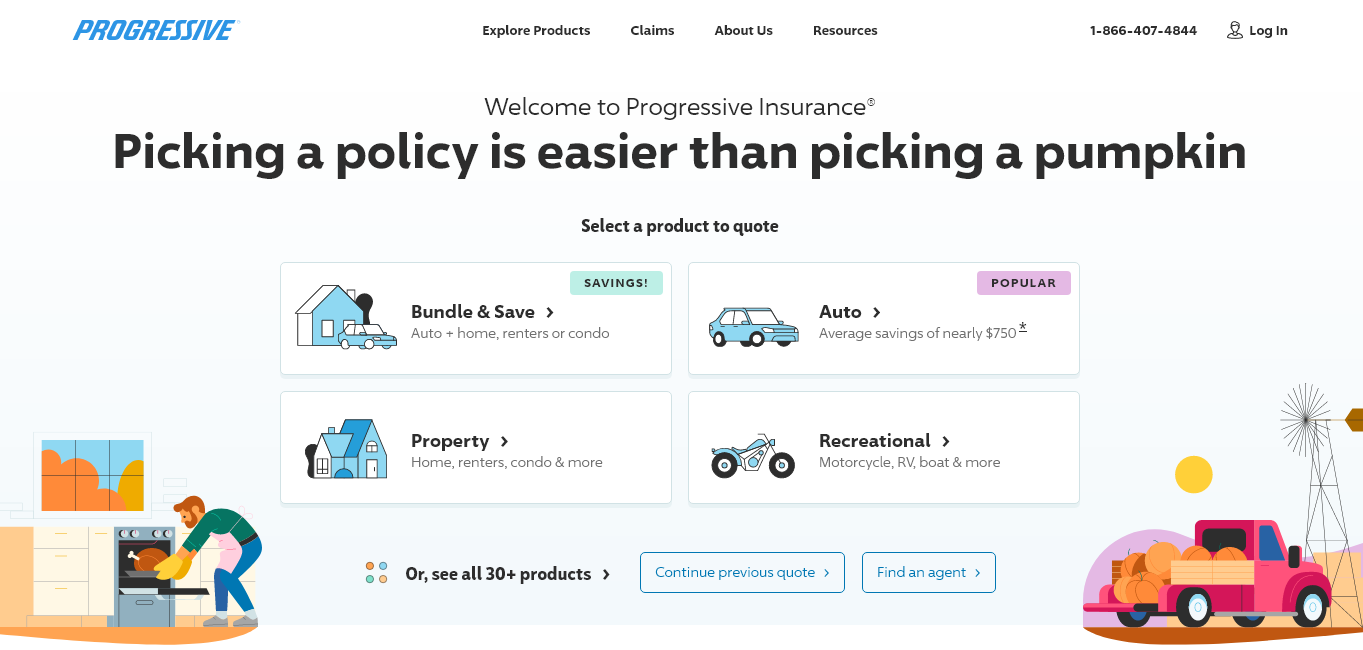

#1 – Progressive: Top Overall Pick

Pros

- Flexible Coverage: Progressive offers highly adaptable policies for short-term car insurance needs.

- Easy Online Management: Their user-friendly platform makes policy adjustments simple.

- Competitive Rates: Starting at $75, temporary car insurance by Progressive provides affordable temporary car insurance.

- 10% Multi-Policy Discount: Additional savings when bundling with other insurance policies.

- Strong Financial Rating: Our Progressive car insurance review highlights Progressive’s A+ rating by A.M. Best, ensuring reliable service.

Cons

- Limited Agent Availability: Primarily online, which may not suit those preferring in-person service.

- Average Customer Service: Not always rated as highly as competitors for customer support.

- Higher Premiums for High-Risk Drivers: Rates can be higher for drivers with poor records.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Offers extensive coverage options for temporary needs.

- 25% Multi-Policy Discount: Significant savings when combining with other policies.

- Accident Forgiveness: No premium increase after the first accident.

- A+ Financial Rating: Reliable and financially secure.

- Strong Claims Process: Insights from our Allstate car insurance review shows Allstate’s efficient and straightforward claims handling.

Cons

- Higher Base Rates: Tends to have higher starting premiums compared to some competitors.

- Average Online Experience: Website and app can be less intuitive.

- Limited Short-Term Options: Fewer short-term policy choices than some other providers.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Offers some of the lowest starting rates at $75.

- Easy Online Quotes: Simple process for getting quotes and managing policies.

- 25% Multi-Policy Discount: Substantial savings on multiple policies.

- A++ Financial Rating: Highest financial strength rating from A.M. Best.

- User-Friendly App: Our examination of Geico car insurance review shows Geico’s excellent mobile app for policy management.

Cons

- Limited Agent Network: Fewer in-person agents available for support.

- Mixed Customer Service Reviews: Variable experiences reported by customers.

- Higher Rates for Custom Coverage: Customizing policies can lead to higher premiums.

#4 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Service: Highly rated for support and assistance.

- Wide Coverage Options: Offers a range of coverage types to suit different needs.

- Discounts for Safe Drivers: Rewards for maintaining a good driving record.

- 17% Multi-Policy Discount: Savings on bundled insurance policies.

- Local Agents: The results of our State Farm car insurance review suggests State Farms’ extensive network of agents for personalized service.

Cons

- Lower Financial Rating: B rating from A.M. Best compared to higher-rated competitors.

- Higher Premiums: Often has higher premiums compared to other providers.

- Limited Online Services: Some features and services are less accessible online.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Agent Network

Pros

- Strong Agent Network: Extensive network of agents for personalized service.

- Comprehensive Coverage: Wide range of coverage options available.

- 20% Multi-Policy Discount: Significant savings when bundling policies. Check out further information on Nationwide car insurance discounts for more savings.

- A+ Financial Rating: Reliable and financially secure.

- Vanishing Deductible: Deductible decreases the longer you drive without an accident.

Cons

- Higher Rates: Premiums can be higher than some competitors.

- Average Online Tools: Website and mobile app can be less user-friendly.

- Limited Short-Term Options: Fewer short-term policy choices than other providers.

#6 – USAA: Best for Military Benefits

Pros

- Military-Focused Benefits: Tailored coverage and discounts for military members and their families.

- Competitive Rates: Offers affordable premiums, starting at $75.

- A++ Financial Rating: Our assessment of USAA car insurance review illustrates USAA’s exceptional financial stability and reliability.

- 10% Multi-Policy Discount: Savings when bundling multiple policies.

- Excellent Customer Service: Highly rated for support and assistance.

Cons

- Eligibility Restrictions: Only available to military members and their families.

- Limited Physical Locations: Fewer in-person offices compared to other insurers.

- Average Online Experience: Website and app can be less intuitive.

#7 – Liberty Mutual: Best for Comprehensive Policies

Pros

- Wide Range of Coverage: Offers extensive coverage options for various needs.

- 10% Multi-Policy Discount: Additional savings when bundling insurance policies.

- Accident Forgiveness: Prevents rate increases after the first accident.

- A Financial Rating: Our Liberty Mutual car insurance review highlights Liberty Mutual’s solid and reliable financial status.

- Flexible Payment Options: Various payment plans to suit different budgets.

Cons

- Higher Premiums: Often has higher premiums compared to some competitors.

- Average Customer Service: Mixed temporary car insurance reviews regarding support and assistance.

- Limited Short-Term Policies: Fewer short-term policy options available.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – AAA: Best for Roadside Assistance

Pros

- Comprehensive Roadside Assistance: Excellent support for breakdowns and emergencies.

- 15% Multi-Policy Discount: Significant savings on AAA temporary car insurance for having multiple policies.

- Discounts for Members: Additional savings and benefits for AAA members.

- A Financial Rating: Based on our AAA car insurance review, AAA shows reliability and financially security.

- Various Coverage Options: Wide range of insurance products and coverage types.

Cons

- Membership Requirement: Must be a AAA member to access certain benefits.

- Higher Rates: Premiums can be higher than some other providers.

- Limited Online Tools: Website and app can be less user-friendly.

#9 – Travelers: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Rewards for maintaining a good driving record.

- Competitive Rates: Offers affordable premiums starting at $75.

- A++ Financial Rating: The findings from our Travelers car insurance review demonstrates Travelers’ exceptional financial strength and reliability.

- 8% Multi-Policy Discount: Savings on bundled insurance policies.

- Strong Claims Process: Efficient and straightforward claims handling.

Cons

- Limited Short-Term Options: Fewer short-term policy choices available.

- Mixed Customer Service: Variable experiences reported by customers.

- Higher Rates for Custom Coverage: Customizing policies can lead to higher premiums.

#10 – American Family: Best for Discount Availability

Pros

- Extensive Discounts: Offers a wide range of discounts, including safe driver and loyalty discounts.

- 20% Multi-Policy Discount: Significant savings when bundling multiple policies.

- A+ Financial Rating: Reliable and financially secure.

- Flexible Coverage Options: Various policies to suit different needs.

- Strong Customer Service: According to our American Family car insurance review, American Family is highly rated for support and assistance.

Cons

- Higher Base Rates: Premiums can be higher compared to some competitors.

- Limited Online Services: Some features and services are less accessible online.

- Average Claims Process: Mixed reviews regarding the efficiency of claims handling.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Understanding Temporary Car Insurance

You may be asking yourself, what is temporary insurance? Or if can you buy car insurance for six months? These short-term insurances can be temporary monthly car insurance, for 24 hours, or six months. You can even buy one-week car insurance or 1 day temporary car insurance.

In order to decide if temporary car insurance meets your needs, you will need to get quotes on the cost and compare it to those of a long-term policy. If you don’t intend to have use of a car for a long period of time then try to compare weekly car insurance solution because this might be right for you. Some points about temporary car insurance are listed as follows:

- People with lapsed car insurance contracts can use temporary car insurance

- You can get short-term car insurance before deciding about long-term insurance

- It becomes highly expensive to manage temporary car insurance for consecutive days

- Non-owner car insurance may be an alternative solution

- Borrowing a car from someone can also be considered for temporary 1 day cheap car insurance

- Car rentals are the most common reason for obtaining temporary insurance

- People who already have driving plans do not need these plans as they can seek an extension of their own insurance plans

Car insurance policies for short-term periods result in higher premium rates. So use caution when you are seeking temporary car insurance. There are some temporary car insurance companies out there, but not all are reputable.

Finding Cheap Temporary Car Insurance for Younger Drivers

Where can I get temporary cheap car insurance? Car insurance for a 16-year-old driver just learning to drive is pricey. Families must decide to take the rate hike from adding a teen driver to the policy or to get the teen his or her own policy. Best temporary car insurance for young drivers may be an interim solution. Before purchasing short-term car insurance, parents of younger drivers should consider a few key factors.

Firstly, they should compare the temporary car insurance average cost vs a long-term policy, taking into account associated periodic charges, renewal costs, and total expenses tied to short-term car insurance. Additionally, they should assess the frequency of driving and compare the cost of adding a teen driver to the family policy.

Many parents opt for these types of insurances for their teenage children, particularly during summer vacation when teenagers enjoy driving with friends. It’s essential to factor in their needs, duration of driving, and incident rate before arranging driving insurance for them. As for where to obtain temporary car insurance, various insurance providers offer this type of coverage.

Temporary Car Insurance Quotes

How can I get temporary insurance coverage quotes? While requesting temporary car insurance quotes, it is beneficial to put in the correct information to avoid extra charges. There are numerous temporary car insurance companies that offer temporary car insurance policies. Anyone can try their services for free. Clear info helps understand insurance costs for short-term car insurance or annual car policies.

Even different car models have different rates. So it becomes necessary to apply with the correct data. Comparing free online quotes is an easier way to learn about the temporary car insurance insights. These options can be accessed remotely and without any charge.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Temporary Car Insurance Coverage

Temporary car insurance is any policy that expires before a year. Temporary insurance policies are often used in place of a standard car insurance policy for rental cars or borrowing a friend’s car.

- Technically any car insurance policy that expires before a year is temporary coverage

- Temporary car rental insurance is often purchased to use rental cars or borrow a friend’s car for a short time

- Non-owner insurance is available for as short of time as a month or as long as a year

- Some insurance providers offer a pay-as-you-go car insurance option as a cheaper policy coverage

- There are several options when it comes to temporary insurance, but you need to make sure you compare temporary car insurance from several companies before committing to one

Temporary car insurance is coverage for a vehicle for a limited period. It’s less common in the US but frequently bought in the UK and Europe for various reasons. Most standard car insurance policies don’t qualify as temporary because they expect you to stick with the same insurer for the duration of your annual contract.

Temporary Coverage in the UK

If you are traveling and need temporary travel car insurance in Europe then you should know that in the UK and other parts of Europe, temporary insurance is purchased for using rental cars or one-day use of borrowed vehicles. If the car insurance is only purchased for a day or two, it is a very affordable option. However, after several days, temporary car insurance becomes less beneficial compared to buying a regular insurance policy.

A temporary car insurance cost is between $10 to $25 a day while a regular insurance policy costs between $2 to $5 a day, depending on the type of policy you have. The laws in the UK are very strict when it comes to carrying car insurance. If you’re caught driving without car insurance, you might face fines or even immediate arrest. If you cause an accident without insurance, your likelihood of being arrested rises.

Progressive offers the best temporary car insurance rates starting at $45 per month, combining affordability, comprehensive coverage options, and exceptional customer service.

Brad Larson Licensed Insurance Agent

Additionally, be sure to stay away of the driving laws in the UK. Unlike the US, UK drivers not listed on an insurance policy cannot drive a vehicle without their own coverage. You also need to check your own insurance policy to see if your current policy covers you when you drive someone else’s vehicle.

In all likelihood, you will not be covered on any vehicle but your own. Whether you are borrowing a vehicle from a friend or hiring a car for the day, you need to make sure that you are properly insured. By buying car insurance temporarily, you can do just that.

Temporary Car Insurance Costs

Just like standard insurance policies, temporary car insurance options vary based on the type of insurance coverage you need.

- If you are renting a car in the US, then you can purchase temporary rental car insurance directly from the rental car company. The typical temporary car insurance price is about $13 a day, which is very inexpensive. However, if you are renting a car for a couple of weeks, this car insurance isn’t very affordable.

- If you own your own vehicle, then you already have car insurance. You can contact your car insurance company and ask about adding a rental vehicle onto your insurance plan. There is the possibility that you will have to pay more for this addition; however, it will be far cheaper than paying for rental car insurance from the rental car company.

- One thing that you need to remember, however, is that if you have an accident while in a rental car and you file a claim with your car insurance company, then you will have an increase in your car rates. If, however, you use the rental company insurance, then you will not see an increase in your rates.

- Another option, if you need temporary insurance for a rental vehicle, is to check with your credit card company. Many credit card companies offer free temporary rental car insurance if you rent the car with their credit card.

Do you need insurance to drive someone’s car? If you are borrowing someone’s vehicle, you need to check with their insurance company to see if your insurance covers you if you drive your friend’s car. Some insurance companies allow any driver, regardless of policy status, as long as they don’t regularly use the vehicle. Others keep rates low by limiting driving privileges to listed policyholders..

If the friend or family member you are borrowing the vehicle from has restrictions on their policy, then discuss with them the possibility of adding you to their policy for a short period of time.

Temporary Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $58 $88

Allstate $55 $85

American Family $57 $87

Geico $45 $75

Liberty Mutual $65 $95

Nationwide $52 $82

Progressive $50 $80

State Farm $60 $90

Travelers $62 $92

USAA $48 $78

This addition may result in their insurance policy becoming more expensive, and if that is the case, you need to pay for this difference. They can remove you from their policy whenever they want to get their regular rate back. You also have the option of purchasing a non-owner car insurance policy.

You can purchase this type of policy for as short as one month and as long as a year. A non-owner insurance policy is an excellent choice for you if you are going to be driving other people’s cars or a rental vehicle for more than a few days. The one downside which applies to both the UK and the US is that most temporary insurance options are only available to individuals over the age of 21.

Obtain more information on our “Can I rent a car without having insurance?”

Some states, such as North Carolina, will sell a non-owner policy to teens because these states require teens to have car insurance before they can get their driver’s license.

In this case, you can expect the cost of a non-owner’s policy to be much higher than it would be for an adult. In addition, this option is typically only available as a liability car insurance policy. You can also check with your insurance company to see if they offer a temporary insurance or a pay-per-mile car insurance policy.

Check out the “Best Usage-Based Car Insurance Companies” for more insights

It is important to understand that some insurance companies offer certain types of coverage in some states but not in another, so you need to talk directly to your agent. Lastly, it is possible that an umbrella insurance policy will cover the cost of damages if you borrow or rent a car and have an accident.

A personal umbrella policy covers all of the damages that your other insurance doesn’t. While this is typically utilized if an accident occurs that causes hundreds of thousands of dollars in damage, it can be effective for this use as well.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Obtaining Temporary Car Insurance

The only place to purchase any kind of insurance is through a licensed insurance agent. However, temporary car insurance is pretty rare in the US. If you are in need of temporary coverage, your best bet is to find car insurance options that include car insurance coverage on a policy for a car you already own or purchase a non-owner insurance policy.

Quote tools are completely free and easy to use. While you will have to share some of your driving history as well as information on the type of vehicle that you want to insure, you won’t have to provide any of your personal information.

Companies Offering Temporary Car Insurance

What is the best car insurance for temporary cars? Temporary car insurance is harder to find and more expensive than traditional car insurance. Avoid lapses in coverage or you might face fines, driving suspensions, or jail time.

- It can be difficult to find companies offering temporary car insurance

- Temporary car insurance is more expensive than standard coverage

- Temporary car insurance is usually good for one to thirty days

- Temporary car insurance is also known as short-term coverage

Is there such a thing as temporary car insurance? Yes, there is such a thing. Temporary car insurance is not considered permanent car insurance because it only lasts for a short period of time. One to 30 days is the policy period for temporary coverage for car insurance, whereas six to twelve months is usually the policy period for permanent car insurance.

Although temporary car insurance is more expensive when compared to permanent car insurance, there are situations where it is a good move to buy a temporary policy. Most of the coverage offered will be the same, the rates will just be higher. So, the question is where can I get temporary car insurance or how do I lower the cost of insurance through discounts?

Not all car insurance companies offer temporary car insurance so you will need to check with multiple companies to find what you are looking for. No matter which kind of car insurance you are looking for, the best way to get the cheapest rates for the best coverage is to compare multiple companies.

Assessing the Need for Temporary Coverage

The minimum car insurance required in each state varies. All states except New Hampshire require vehicle owners to maintain minimum amounts of liability insurance set forth by state law. Keep in mind, even if you carry liability-only insurance, your damages to your vehicle and passengers is not covered.

But not everyone obeys those minimum liability laws. This table shows you just how many people in your state are driving without car insurance.

Percentage of Drivers Without Car Insurance by State From Highest to Lowest

| Rank | State | Percentage |

|---|---|---|

| #1 | Florida | 26.70% |

| #2 | Mississippi | 23.70% |

| #3 | New Mexico | 20.80% |

| #4 | Michigan | 20.30% |

| #5 | Tennessee | 20% |

| #6 | Alabama | 18.40% |

| #7 | Washington | 17.40% |

| #8 | Indiana | 16.70% |

| #9 | Arkansas | 16.60% |

| #10 | Washington, D.C. | 15.60% |

| #11 | Alaska | 15.40% |

| #12 | California | 15.20% |

| #13 | Rhode Island | 15.20% |

| #14 | New Jersey | 14.90% |

| #15 | Wisconsin | 14.30% |

| #16 | Texas | 14.10% |

| #17 | Missouri | 14% |

| #18 | Illinois | 13.70% |

| #19 | Colorado | 13.30% |

| #20 | Louisiana | 13% |

| #21 | Oregon | 12.70% |

| #22 | Ohio | 12.40% |

| #23 | Maryland | 12.40% |

| #24 | Arizona | 12% |

| #25 | Georgia | 12% |

| #26 | Kentucky | 11.50% |

| #27 | Minnesota | 11.50% |

| #28 | Delaware | 11.40% |

| #29 | Nevada | 10.60% |

| #30 | Hawaii | 10.60% |

| #31 | Oklahoma | 10.50% |

| #32 | West Virginia | 10.10% |

| #33 | Montana | 9.90% |

| #34 | Virginia | 9.90% |

| #35 | New Hampshire | 9.90% |

| #36 | Connecticut | 9.40% |

| #37 | South Carolina | 9.40% |

| #38 | Iowa | 8.70% |

| #39 | Utah | 8.20% |

| #40 | Idaho | 8.20% |

| #41 | Wyoming | 7.80% |

| #42 | South Dakota | 7.70% |

| #43 | Pennsylvania | 7.60% |

| #44 | Kansas | 7.20% |

| #45 | North Dakota | 6.80% |

| #46 | Nebraska | 6.80% |

| #47 | Vermont | 6.80% |

| #48 | North Carolina | 6.50% |

| #49 | Massachusetts | 6.20% |

| #50 | New York | 6.10% |

| #51 | Maine | 4.50% |

If you are caught driving a vehicle without the proper amount of liability insurance, you could face:

- Heavy fines

- Revocation of vehicle tags

- Impoundment of vehicle

- Jail time

This table shows you the specific penalties for each state if you are caught driving without car insurance. Use the search box to find your state.

Penalties for Driving Without Car Insurance by State

| State | 1st Offense | 2nd Offense |

|---|---|---|

| Alabama | Fine: Up to $500; registration suspension with $200 reinstatement fee | Fine: Up to $1,000 and/or six-month license suspension; $400 reinstatement fee with four-month registration suspension |

| Alaska | License suspension for 90 days | License suspension for one year |

| Arizona | Fine: $500 (or more); license/registration/license plate suspension for three months | Fine: $750 (or more within 36 months); license/registration/license plate suspension for six months |

| Arkansas | Fine: $50 to $250; suspended registration/no plates until proof of coverage plus $20 reinstatement fee; court may order impoundment | Fine: $250 to $500 fine — minimum fine mandatory; suspended registration/no plates until proof of coverage plus $20 reinstatement fee. Court may order impoundment |

| California | Fine: $100-$200 plus penalty assessments. Court may order impoundment | Fine: $200-$500 within three years plus penalty assessments. Court may order impoundment |

| Colorado | Fine: $500 minimum fine; 4 points against your license; license suspension until you can show proof to the DMV that you are insured. Courts may add up to 40 hours community service | $1,000 minimum fine and license suspension for 4 months; 4 points against your license. Courts may add up to 40 hours community service |

| Connecticut | Fine: $100-$1000; suspended registration/license for one month (show proof of insurance) with $175 reinstatement fee | Fine: $100-$1000; suspended registration/license for six months (show proof of insurance) with $175 reinstatement fee |

| Delaware | Fine: $1500 minimum fine; license/privilege suspension for six months | Fine: $3000 minimum fine within three years; license/privilege suspension for six months |

| Florida | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $150 fee for first reinstatement | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $250 fee for second reinstatement |

| Georgia | Suspended registration with $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due | Within five years: Suspended registration with $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due |

| Hawaii | Fine: $500 fine or community service granted by judge. Either license suspension for three months or a required nonrefundable insurance policy in force for six months | Fine: $1500 minimum fine within five years; either license suspension for one year or a required non-refundable insurance policy in force for six months |

| Idaho | Fine: $75; license suspension until financial proof. No reinstatement fee. | Fine: $1000 maximum fine within five years and/or no more than six months in jail; license suspension until financial proof. No reinstatement fee. |

| Illinois | Fine: minimum of $500; License plate suspension until $100 reinstatement fee and insurance proof | Fine: minimum of $1,000; License plate suspension for four months; $100 reinstatement fee and insurance proof |

| Indiana | License/registration suspension for 90 days to one year | Within three years: license/registration suspension for one year |

| Iowa | Fine: $500 if in accident; Otherwise, fine: $250; community service in lieu of fine. Possible citation/warning if pulled over plus removal of plates and registration possible when pulled over without insurance and reissued upon payment of fine or completed community service, proof of insurance, and $15 fee; possible impoundment when pulled over | NA |

| Kansas | Fine: $300 to $1000 and/or confinement in jail up to six months; license/registration suspension; reinstatement fee: $100 | Fine: $800 to $2500 within three years; license/registration suspension; reinstatement fee: $300 if revoked within previous year, otherwise $100 |

| Kentucky | Fine: $500 to $1000 fine and/or sentenced up to 90 days in jail; license plates and registration revoked for one year or until proof of insurance is shown | Within five years: 180 days in jail and/or $1000 to $2500; license plates and registration revoked for one year or until proof of insurance is shown |

| Louisiana | Fine: $500 to $1000; If in car accident, fine plus registration revoked and driving privileges suspended for 180 days | NA |

| Maine | Fine: $100 to $500; suspension of license and registration until proof of insurance | NA |

| Maryland | Lose license plates and vehicle registration privileges; pay uninsured motorist penalty fees for each lapse of insurance — $150 for the first 30 days, $7 for each day thereafter; Pay a restoration fee of up to $25 for a vehicle's registration | NA |

| Massachusetts | Fine: $500 to $5000 fine and/or imprisonment for one year or less | Within six years: License/driving privileges suspended for one year |

| Michigan | Fine: $200 to $500 fine and/or imprisonment for one year or less; license suspension for 30 days or until proof of insurance; $25 service fee to Secretary of State | NA |

| Minnesota | Fine: $200 to $1000 (or community service) and/or imprisonment for up to 90 days; License and registration revoked for no more than 12 months | NA |

| Mississippi | Fine: $1000; driving privileges suspended for one year or until proof of insurance | NA |

| Missouri | Four points against driving record; driver may be supervised; suspended until proof of insurance with $20 reinstatement fee | Four points against driving record; driver may be supervised; suspended for 90 days with $200 reinstatement fee |

| Montana | Fine: $250 to $500 fine and/or imprisonment for no more than 10 days | Fine: $350 and/or imprisonment for no more than 10 days — within 5 years; license and registration revoked until proof of insurance and payment of reinstatement fees within 90 days |

| Nebraska | License and registration suspension; reinstatement fee of $50 for each; proof of insurance to remain on file for three years | |

| Nevada | Fine: $250 to $1,000 depending on length of lapse; registration suspension — until payment of reinstatement fee and, depending on circumstances, an SR-22 (proof of financial responsiblity) if lapsed more than 90 days; reinstatement fee: $250 | Fine: $500 to $1000 depending on length of lapse; registration suspension — until payment of reinstatement fee and, depending on circumstances, SR-22 (proof of financial responsibility) if lapsed more than 90 days; Reinstatement fee: $500 |

| New Hampshire | Not a mandatory insurance state. Proof of insurance may be required as the result of a conviction, crash involvement, or administrative action. If you are required to file proof of insurance and vehicles are registered in your name, you will be required to file an Owner’s SR-22 Certificate of Insurance. | NA |

| New Jersey | Fine: $300 to $1000; license suspension for one year; pay surcharges for three years in the amount of $250 per year | Fine: up to $5000; two-year license suspension; 14-day, mandatory jail term, and an additional mandatory 30 days of community service |

| New Mexico | Fine: up to $300 and/or imprisoned for 90 days; license suspension | NA |

| New York | Fine: up to $1500 if involved in accident plus $750 civil penalty; license and registration suspension – revoked for one year; suspension of license if without insurance for 90 days; suspension lasts as long as registration suspension; Suspension of registration: equal to time without insurance or pays $8/day up to thirty days for which financial security was not in effect, $10/day from the thirty-first to the sixtieth day $12/day from the sixtieth to the ninetieth day and proof of security is provided. Or for the same time as the vehicle was operated without insurance. | NA |

| North Carolina | Fine: $50; registration suspension until proof of financial responsibility but 30-day suspension if in car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee | Fine: $100 within three years; registration suspension until proof of financial responsibility but 30-day suspension if in car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee |

| North Dakota | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; Proof of insurance must be provided for one year; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50, and the fee to remove this notation is $50. | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; license plates impounded until proof of insurance (provided for one year) plus $20 reinstatement fee; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50 and the fee to remove this notation is $50. |

| Ohio | License/plates/registration suspension until requirements are met and $100 reinstatement fee is paid; maintain special high-risk coverage on file with the BMV for three to five years; If involved in accident without insurance: all above penalties and a security suspension for two plus years and an indefinite judgment suspension (until all damages are satisfied) | License/plates/registration suspension for one year; $300 reinstatement fee; maintain special high-risk coverage on file with the BMV for three or five years; if involved in accident without insurance: all above penalties and a security suspension for two plus years and an indefinite judgment suspension (until all damages are satisfied) |

| Oklahoma | Fine: $250; jail time up to 30 days; license suspension with $275 reinstatement fee. Police can seize license plates and assign temporary plates and liability insurance — in effect for 10 days and can also impound the vehicle. The cost of the temporary coverage is added to the administrative fee and any fines paid for plates to be returned. If car impounded, owner must also pay towing and storage fees. | NA |

| Oregon | Fine: $130-$1000 ($260 is the presumptive fine); If involved in accident — at least a one year license suspension; proof of financial responsibility required for three years | NA |

| Pennsylvania | Registration suspended for three months (unless lapse was for less than 31 days and vehicle not operated during that time); $88 restoration fee plus proof of insurance required to get it back; $500 civil penalty fee is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period | NA |

| Rhode Island | Fine: $100 to $500; license and registration suspension up to three months; reinstatement fee: $30 to $50 | Fine: $500; license and registration suspension up to six months; reinstatement fee: $30 to $50 |

| South Carolina | Fine: $100-$200 or 30-day imprisonment; failure to surrender registration and plates when insurance lapses; license/registration suspended until proof of insurance plus $200 reinstatement fee | Fine: $200 and/or 30-day imprisonment — within 10 years; license/registration suspended until proof of insurance plus $200 reinstatement fee |

| South Dakota | Fine: $100 and/or 30 days imprisonment; license suspension for 30 days to one year; filing proof of insurance (SR-22) with the state for three years from date of conviction. Failure to file proof will result in suspension of vehicle registration, license plates, and driver license. | NA |

| Tennessee | Pay $25 coverage failure fee within 30 days of notice; if not paid, then an additional $100 coverage failure fee with suspension or revocation of registration plus reinstatement fee of no more than $25 | NA |

| Texas | Fine: $175 to $350 fine; plus, pay up to a $250 surcharge every year for three years (may be reduced with certain requirements) | Fine: $350 to $1000; pay up to a $250 surcharge every year for three years (may be reduced with certain requirements); suspend the driver's license and vehicle registrations of the person unless the person files and maintains evidence of financial responsibility with the department until the second anniversary of the date of the subsequent conviction; Impoundment: for 180 days and cannot apply for release of car without evidence of financial responsibility and impoundment fee of $15/day. |

| Utah | Fine: $400; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee | Fine: $1000 — with three years; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee |

| Vermont | Fine: up to $500; license suspended until proof of insurance | NA |

| Virginia | Fine: may pay $500 Uninsured Motorists Vehicle fee to drive without insurance at your own risk. If this fee is not paid in lieu of insurance, all driving and vehicle registration privileges will be suspended until a $500 statutory fee is paid, proof of insurance is filed for three years, and a reinstatement fee (if applicable) is paid | NA |

| Washington | Fine: Up to $250 or more | NA |

| Washington D.C. | Fine: Up to $250; possible vehicle impoundment | Fine: Up to $500; possible vehicle impoundment |

| West Virginia | Fine: $200 to $5000; license suspended for 30 days with reinstatement fees, unless there's proof of insurance and $200 penalty fee | Fine: $200-$5000 fine and/or 15 days to one year in jail — within five years; license suspended for 90 days and registration revoked until proof of insurance |

| Wisconsin | Fine: up to $500 | NA |

| Wyoming | Fine: up to $750 fine and up to six months in jail | NA |

Moreover, if you are caught driving without insurance and cause an accident, you are responsible for paying for the injuries and property damages incurred by the parties involved in the accident. This can be thousands of dollars or more if people are injured and you are at fault. Temporary car insurance will protect you from these unfortunate consequences. However, you will need to decide what is the best temporary car insurance for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Purchasing or Renting a Car

If you buy a new car, and you do not have an existing permanent new car policy, you may need some time to shop around for the best deal on permanent car insurance for your new car. Until you have bought permanent car insurance, you should buy temporary coverage. This will protect your purchase and cover third parties in case of an accident.

You can purchase 14-day car insurance or even 24-hour car insurance in the USA. Further, temporary car insurance will keep you in line with state insurance laws.

Progressive stands out as the top choice for temporary car insurance, offering the best combination of affordability, coverage options, and customer service.

Scott W. Johnson Licensed Insurance Agent

Renting a car is another possible reason to need temporary car insurance. Rental companies will offer you the option to buy a damage waiver and liability insurance for a fee often called rental car insurance. The waiver relieves you of financial responsibility if the rental is damaged or stolen. Liability insurance will cover injury and damage to third parties in case of an accident. The below video gives more information.

Many people don’t know whether they should buy car coverage from the rental company. Keep reading to get more information.

Considering Temporary Car Insurance for Young Drivers

Before making a decision, consider your situation. You may not need to purchase temporary car insurance is you are just renting a car, if you already have the coverage on your permanent policy. However, there are other times it would be necessary, like if you are borrowing or getting a car insurance for a car you don’t own.

You Maintain Comprehensive and Minimum Liability Insurance

Your car insurance will generally extend to rental cars, depending on the type of coverage you carry. Therefore, if you have comprehensive car insurance with minimum liability limits, you probably do not need to purchase additional coverage from the rental company. But don’t forget there is a deductible you must pay before your insurance kicks in.

If you have a high car insurance deductible, you may want to consider buying rental coverage or a temporary policy with a lower deductible.

You Maintain Minimum Liability Insurance but not Comprehensive Insurance

Here you probably don’t need to buy additional liability insurance coverage from the rental car company if you are comfortable asking your insurance carrier to pay any liability claims against you. But you should consider purchasing rental car coverage or a temporary policy to cover the rental if it is damaged or stolen.

You should compare the daily cost of the damage waiver and the amount of the deductible, if any, to the daily cost of a temporary car insurance policy and the amount of the deductible. There are temporary policies that are cheaper than the cost of coverage through the rental company.

You are Totally Uninsured

The same cost analysis applies if you are totally uninsured. Remember to include the cost of liability insurance offered by the rental car company, assuming that minimum liability insurance is not built into the basic rental charge. Temporary car insurance bought from a separate company could be cheaper than insurance through a rental car company.

Once again, consider the cost of individual deductibles when making your decision. It may not make financial sense if the deductibles are too high.

Lending Your Car to Someone or Borrowing Someone Else’s Car

Maybe your friend needs to borrow your car for a few days and you want to make sure they are covered by insurance. As Nolo.com notes, your comprehensive and liability automobile insurance policy will cover your car, your friend, damages, and injuries sustained by third parties.

If you borrow your friend’s car for a few days, his/her comprehensive and liability automobile insurance policy will cover you, his/her car, and damages and injuries to third parties. Temporary or non-owner insurance policies may make sense if neither you nor your friend would want to file an accident claim with your respective insurance carriers.

Discover more knowledge whether “Does car insurance follow the car or the driver?”

Further, if you or your friend does not have complete insurance coverage or any insurance coverage at all, temporary car insurance is a good solution, not only to protect yourselves from a financial standpoint but also to preserve your relationship.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Shopping for Temporary Car Insurance

If you already have automobile insurance, you should ask your insurance carrier whether it offers temporary coverage. Some insurance companies offer discounted rates for current customers. The big question: Is short-term car insurance expensive?

The best way to find the cheapest temporary car insurance is to comparison shop by requesting online quotes from different insurance companies. Finding the cheapest temporary car insurance depends on the amount of monetary risk you are willing to assume. Temporary car insurance is expensive, so be sure to buy only what you need.

The best way to get the cheapest coverage is to compare prices from multiple insurance companies. No matter what type of car insurance you are looking for, we can help you. Who has the cheapest car insurance?

Case Studies: Exploring Real-Life Scenarios for Temporary Car Insurance

In this section, we delve into real-life case studies illustrating the importance and impact of temporary car insurance in various situations.

- Case Study 1 – Protecting a Rental Fleet: John, a car rental business owner, obtained temporary insurance coverage for his fleet during peak tourist season, ensuring adequate protection against accidents or damages.

- Case Study 2 – Borrowing a Friend’s Car: Sarah purchased temporary car insurance to cover her weekend getaway in her friend’s car, avoiding potential legal and financial consequences.

- Case Study 3 – Transitioning Between Vehicles: Mark secured temporary car insurance during the transition period between selling his old car and purchasing a new one, maintaining legal compliance and protection against unforeseen incidents.

- Case Study 4 – Short-Term Work Assignment: Emily opted for temporary coverage for her short-term work assignment, providing flexibility without the commitment of a long-term policy.

- Case Study 5 – Vacationing Abroad: David obtained temporary car insurance for his European road trip, ensuring compliance with local laws and protection throughout his vacation.

These case studies highlight the diverse scenarios in which temporary car insurance plays a crucial role, from rental fleets insurance to facilitating temporary vehicle use. Whether it’s for business or personal purposes, temporary insurance offers flexibility and peace of mind in various situations, ensuring individuals are adequately covered when they need it most.

Conclusion: Recognizing the Importance of Temporary Car Insurance

In conclusion, temporary car insurance provides essential short-term coverage for situations like rentals, borrowing a car, or short-term ownership. Although it tends to be more expensive per day compared to annual policies, it offers necessary protection. Providers like Progressive, Allstate, and Geico are notable for their affordability, coverage options, and customer service.

Comparing monthly insurance quotes from multiple insurers is crucial to finding the best deal. Understanding state-specific requirements and coverage limitations ensures you make an informed decision and remain protected. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Can I buy 1-month car insurance?

Yes, it is possible to buy month-to month car insurance. However, if you think you will need car insurance for more than a few months, it may be cheaper to get a regular policy.

Can you get car insurance for a couple of days?

Yes, you can get car insurance for just a few days if needed. Rates will vary by company so make sure to shop around.

Can I get temporary car insurance in California?

Yes, temporary car insurance is available in California. There is no legal reason to not be able to get short-term car insurance in California. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Is seven-day insurance legal in Michigan?

No. The Michigan Insurance Comissioner has barred the sale of seven-day insurance.

Can I get temporary car insurance if I don’t own a car?

Yes, you can obtain non-owner car insurance, which provides liability insurance coverage when you’re driving a car that you don’t own. This type of insurance is useful if you frequently borrow or rent cars.

Is temporary car insurance more expensive than regular car insurance?

Generally, temporary car insurance tends to be more expensive on a per-day basis compared to annual policies. However, the total cost depends on various factors such as your driving history, the type of coverage you need, and the duration of the temporary policy.

Can I purchase temporary car insurance for a specific event or occasion?

Yes, temporary car insurance can be useful for events such as weddings, vacations, or moving homes. You can purchase short-term coverage to ensure you’re adequately insured during these specific situations.

Does temporary car insurance cover rental cars or borrowed vehicles?

Yes, temporary car insurance can provide coverage for rental cars or vehicles that you borrow from friends or family members. It typically offers similar coverage options as regular car insurance, including liability, collision, and comprehensive coverage.

Are there age restrictions for obtaining temporary car insurance?

Yes, most insurance companies require policyholders to be at least 21 years old to purchase temporary car insurance. However, age restrictions may vary depending on the insurer and the state. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Can I cancel temporary car insurance before the policy term ends?

Yes, you can usually cancel temporary car insurance policies before the expiration date. However, some insurers may charge a cancellation fee, and you may only receive a partial refund depending on how much of the policy term has elapsed.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.