Best Subaru Crosstrek Car Insurance in 2025 (Top 10 Companies Ranked)

Secure the best Subaru Crosstrek car insurance with State Farm, AAA, and Erie, offering rates as low as $42 per month. These top providers include State Farm for excellent coverage and service, AAA for its top-rated app, and Erie for 24/7 support. Compare these options for the best coverage.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Aug 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Subaru Crosstrek

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Subaru Crosstrek

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Subaru Crosstrek

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsFor as low as $42 per month, the best Subaru Crosstrek car insurance providers are State Farm, AAA, and Erie. State Farm is the top pick overall for its exceptional coverage and service. This article helps Subaru Crosstrek car owners find the most cost-effective and comprehensive coverage tailored to their needs.

The article also covers key aspects of understanding your car insurance policy, offering insights into what to look for in coverage. Learn about comprehensive options, deductibles, and how different providers stack up. This guidance ensures Subaru Crosstrek owners make informed decisions for their insurance needs.

Our Top 10 Company Picks: Best Subaru Crosstrek Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 12% B Many Discounts State Farm

#2 16% A Online App AAA

#3 14% A+ 24/7 Support Erie

#4 18% A++ Custom Plan Geico

#5 10% A+ Innovative Programs Progressive

#6 19% A+ Usage Discount Nationwide

#7 11% A Customizable Polices Liberty Mutual

#8 17% A+ Add-on Coverages Allstate

#9 15% A Local Agents Farmers

#10 13% A++ Military Savings USAA

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm is the top pick for coverage

- Subaru Crosstrek Car Insurance starts at $54 per month

- Get insights on understanding your car insurance policy

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Affordable Premiums: State Farm offers competitive rates for Subaru Crosstrek insurance. This makes them a cost-effective choice for drivers seeking affordable coverage. More information about their rates in our State Farm car insurance review.

- Discount Programs: State Farm provides various discounts, such as safe driver discounts and multi-policy savings, which can help lower the insurance costs for Subaru Crosstrek owners.

- Wide Network of Agents: With a large network of local agents, State Farm ensures personalized service and support for Subaru Crosstrek owners, making it easier to get tailored insurance solutions.

Cons

- Higher Rates for High-Risk Drivers: Rates for high-risk drivers can be significantly higher with State Farm, which may impact the affordability of Subaru Crosstrek insurance for those with poor driving records.

- Limited Customization Options: State Farm may offer fewer customization options for Subaru Crosstrek insurance compared to some competitors, potentially limiting how well policies can be tailored to individual needs.

#2 – AAA: Best for Online App

Pros

- Comprehensive Coverage: As outlined in AAA car insurance review, AAA provides robust coverage options for the Subaru Crosstrek, including comprehensive and collision insurance, ensuring thorough protection for your vehicle.

- Member Discounts: AAA members can benefit from exclusive discounts on their Subaru Crosstrek insurance, making it a cost-effective choice for those who are also AAA members.

- Excellent Roadside Assistance: AAA offers superior roadside assistance services, which adds value to the Subaru Crosstrek insurance package and provides peace of mind on the road.

Cons

- Higher Premiums: AAA’s premiums for Subaru Crosstrek insurance are higher compared to some other providers, which may affect affordability.

- Availability Issues: AAA’s insurance services might not be available in all states, limiting options for Subaru Crosstrek owners depending on their location.

#3 – Erie: Best for 24/7 Support

Pros

- Competitive Coverage Options: Erie offers comprehensive coverage options for Subaru Crosstrek, including protection for both comprehensive and collision needs.

- Discount Opportunities: Erie provides various discounts, such as those for safe driving and multi-car policies, which can help reduce insurance costs for Subaru Crosstrek owners.

- High Customer Satisfaction: As outlined in our Erie car insurance review, Erie is known for high customer satisfaction, offering reliable service and support for Subaru Crosstrek drivers, which enhances the overall insurance experience.

Cons

- Higher Cost: Erie’s insurance premiums for Subaru Crosstrek are on the higher side, which may not be ideal for those seeking more budget-friendly options.

- Limited Availability: Erie’s insurance services are not available in all states, which could be a disadvantage for Subaru Crosstrek owners in regions where Erie does not operate.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Custom Plan

Pros

- Lowest Premiums: Geico offers some of the lowest premiums for Subaru Crosstrek insurance, making them a highly cost-effective option for drivers.

- Wide Range of Discounts: Geico provides numerous discounts, including those for safe driving and vehicle safety features, which can further lower insurance costs for Subaru Crosstrek owners.

- User-Friendly Online Tools: Geico’s online tools and mobile app make it easy for Subaru Crosstrek drivers to manage their policies and file claims efficiently. Learn more in our Geico car insurance review.

Cons

- Basic Coverage Options: Geico’s coverage options might be more basic compared to some competitors, which could be a drawback for Subaru Crosstrek owners seeking more extensive protection.

- Customer Service Complaints: Some drivers report issues with Geico’s customer service, which can affect the overall experience for Subaru Crosstrek owners needing assistance.

#5 – Progressive: Best for Innovative Programs

Pros

- Comprehensive Coverage Plans: Progressive offers comprehensive coverage plans for Subaru Crosstrek, including collision and liability coverage.

- Discounts for Safe Drivers: Progressive provides significant discounts for safe driving records and for using safety features, which can reduce costs for Subaru Crosstrek owners.

- Flexible Payment Options: Progressive offers various payment plans, allowing Subaru Crosstrek owners to choose a plan that best fits their budget and financial situation. Learn more details in our Progressive car insurance review.

Cons

- Higher Premiums: Progressive’s premiums are higher than some competitors, which could impact affordability for Subaru Crosstrek drivers.

- Customer Service Issues: Some Subaru Crosstrek owners may experience challenges with Progressive’s customer service, including delays or difficulties in handling claims.

#6 – Nationwide: Best for Usage Discount

Pros

- Broad Coverage Options: Nationwide provides extensive coverage options for Subaru Crosstrek, including comprehensive and collision insurance.

- Discounts for Bundling: Subaru Crosstrek owners can benefit from discounts for bundling auto insurance with other types of insurance, such as home or renters insurance. Check out their ratings in our complete Nationwide car insurance discount.

- High Customer Ratings: Nationwide is known for good customer service and high satisfaction ratings, offering reliable support for Subaru Crosstrek insurance needs.

Cons

- Premiums Slightly Higher: Nationwide’s premiums for Subaru Crosstrek insurance are somewhat higher compared to some other providers, which may impact overall affordability.

- Regional Variability: Insurance rates and availability can vary by region, potentially affecting Subaru Crosstrek owners in areas with less favorable terms.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Polices

Pros

- Comprehensive Coverage: Liberty Mutual offers thorough coverage options for Subaru Crosstrek, including comprehensive and collision coverage. Learn more in our Liberty Mutual car insurance review.

- Discounts for Safety Features: Liberty Mutual provides discounts for vehicles equipped with advanced safety features, which can help reduce insurance costs for Subaru Crosstrek owners.

- Customizable Policies: Liberty Mutual allows for customization of insurance policies, enabling Subaru Crosstrek owners to tailor their coverage to their specific needs and preferences.

Cons

- Higher Average Premiums: Liberty Mutual’s premiums for Subaru Crosstrek are higher than some competitors, which may affect budget-conscious drivers.

- Complex Claims Process: Some Subaru Crosstrek owners report that Liberty Mutual’s claims process can be complex and time-consuming, potentially causing frustration during claims handling.

#8 – Allstate: Best for Add-on Coverages

Pros

- Extensive Coverage Options: As mentioned in our Allstate car insurance review, Allstate offers comprehensive and collision coverage for Subaru Crosstrek, ensuring thorough protection for the vehicle.

- Wide Range of Discounts: Subaru Crosstrek owners can benefit from various discounts with Allstate, including safe driver and multi-policy discounts, which can help lower insurance costs.

- Excellent Customer Support: Allstate is known for providing strong customer service and support, which can enhance the insurance experience for Subaru Crosstrek owners.

Cons

- Higher Premiums: Allstate’s premiums for Subaru Crosstrek are the highest, which might be less appealing for those looking for more affordable insurance options.

- Limited Discount Availability: Some Subaru Crosstrek owners may find that not all available discounts apply to their situation, potentially reducing overall savings.

#9 – Farmers: Best for Local Agents

Pros

- Comprehensive Coverage: Farmers offers robust coverage options for Subaru Crosstrek, including comprehensive and collision insurance.

- Discounts for Safe Drivers: Subaru Crosstrek owners can benefit from discounts for maintaining a clean driving record and for having safety features in their vehicle, which can lower insurance costs.

- Flexible Policy Options: Farmers provides customizable policy options, allowing Subaru Crosstrek owners to tailor their insurance coverage to fit their specific needs and preferences. Learn more in our Farmers car insurance review.

Cons

- Higher Premiums: Farmers’ insurance for Subaru Crosstrek can be more expensive compared to some competitors, potentially affecting affordability.

- Customer Service Issues: Some drivers report challenges with Farmers’ customer service, including delays and difficulties in handling claims, which can impact the overall insurance experience.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Savings

Pros

- Competitive Premiums: USAA offers competitive insurance rates for Subaru Crosstrek, making them a cost-effective option for eligible members.

- Military Discounts: USAA provides special discounts for military members and their families, which can significantly reduce insurance costs for Subaru Crosstrek owners with military affiliations.

- Excellent Customer Service: Known for high customer satisfaction, USAA offers outstanding service and support for Subaru Crosstrek drivers, ensuring a positive insurance experience. Learn more in our USAA car insurance review.

Cons

- Eligibility Restrictions: USAA’s insurance services are only available to military members and their families, which may exclude some potential Subaru Crosstrek owners from accessing their competitive rates.

- Limited Local Agents: USAA’s reliance on online and phone-based service can limit personal interaction for Subaru Crosstrek owners who prefer face-to-face consultations with local agents.

Comparing Subaru Crosstrek Insurance Cost

The table below presents a clear snapshot of monthly rates for both minimum and full coverage from various insurance companies. This information will guide you in selecting a policy that aligns with your budget and coverage preferences.

Subaru Crosstrek Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $62 $187

Allstate $91 $255

Farmers $73 $232

Erie $73 $229

Geico $42 $133

Liberty Mutual $68 $205

Nationwide $64 $184

Progressive $72 $211

State Farm $54 $149

USAA $62 $181

Evaluating the monthly rates for minimum and full coverage allows you to pinpoint the most economical options for insuring your Subaru Crosstrek. This comparison not only helps in finding affordable coverage but also ensures that you choose a plan that meets your specific needs.

Consider these rates along with additional factors such as customer service and coverage benefits to make an informed and beneficial insurance choice.

Brad Larson LICENSED INSURANCE AGENT

Insurance rates for the Subaru Crosstrek can vary significantly based on different factors, including deductibles and driver profiles. The following table illustrates how these variables impact insurance costs, providing a snapshot of rates for various deductible levels and driver types.

Subaru Crosstrek car insurance rates vary by coverage type, with average rates around $110, discounted rates at $65, high deductible plans at $95, and high-risk drivers paying $234. Low deductibles cost $138, while teen drivers face the highest rates at $402 per month.

Understanding these variations allows you to make more strategic decisions about your insurance plan, whether opting for higher deductibles to lower premiums or considering the implications for high-risk or teen drivers.

Read More: Compare Teen Driver Car Insurance Rates

Subaru Crosstrek vs Other Crossovers

The chart below details how Subaru Crosstrek insurance rates compare to other crossovers like the Lexus NX 300, Honda HR-V, and Toyota C-HR.

Subaru Crosstreks Car Insurance Monthly Rates vs. Other Vehicles by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Audi Q5 | $31 | $60 | $30 | $134 |

| Honda HR-V | $31 | $44 | $25 | $113 |

| Hyundai Tucson | $31 | $39 | $25 | $108 |

| Kia Sportage | $31 | $39 | $23 | $107 |

| Lexus NX 300 | $31 | $57 | $31 | $133 |

| Subaru Crosstrek | $26 | $44 | $28 | $110 |

| Toyota C-HR | $22 | $38 | $21 | $90 |

When comparing Subaru Crosstrek insurance rates to other crossovers, the Crosstrek stands out with its competitive pricing. While Collision insurance for the Crosstrek is priced at $532, it remains more affordable than many other vehicles in its class.

To ensure you get the best subaru car insurance rates, consider shopping around and comparing quotes. Exploring options can help you find the most cost-effective coverage for your Subaru Crosstrek.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Subaru Crosstrek Insurance Savings

Save more on your Subaru Crosstrek car insurance rates. Take a look at the following five strategies that will get you the best Subaru Crosstrek auto insurance rates possible.

- Take a refresher course as an older driver.

- Check reviews and state complaints before you choose an insurer.

- Understand that your insurer can change your Subaru Crosstrek auto insurance rates mid-term for other. reasons.

- Ask for a Subaru Crosstrek discount if you have college degree or higher.

- Wait six years for accidents to disappear from your record.

Staying informed and managing your driving record effectively will further contribute to lowering your insurance costs and ensuring you get the best value for your coverage.

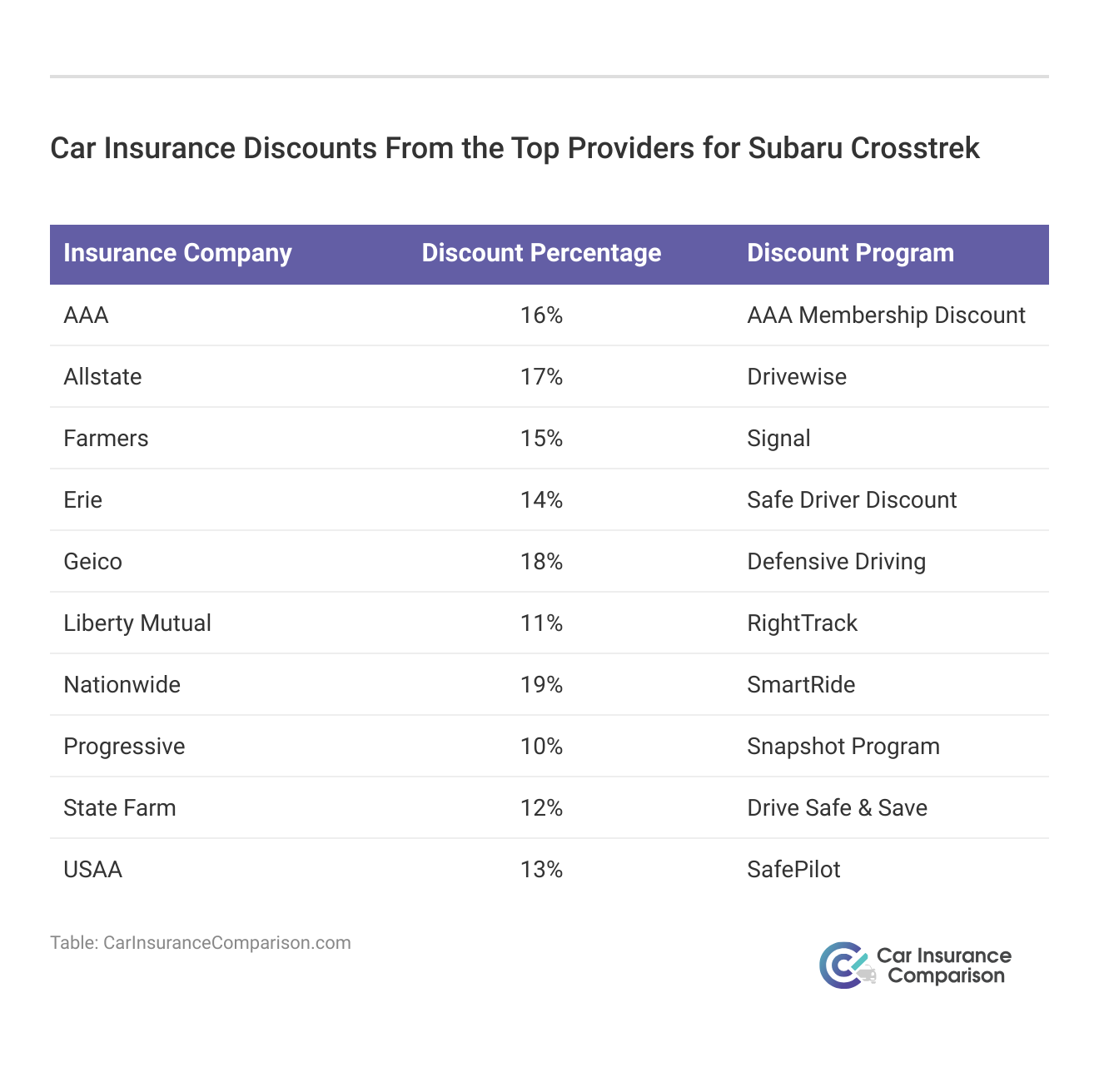

These discounts from top insurance providers for Subaru Crosstrek offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Read More: Understanding Car Accidents

Factors Impacting Subaru Crosstrek Auto Insurance

Your policy can be higher or lower depending upon your profile. Those factors include your age, home address, driving history, and the model year of your Subaru Crosstrek.

Age of the Vehicle

The cost of insuring a Subaru Crosstrek can vary depending on the model year. Generally, older models tend to be less expensive to insure compared to newer ones. The table below provides a breakdown of insurance costs for different model years of the Subaru Crosstrek.

Subaru Crosstrek Car Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Liability | Comprehensive | Collision | Full Coverage |

|---|---|---|---|---|

| 2024 Subaru Crosstrek | $28 | $30 | $47 | $113 |

| 2023 Subaru Crosstrek | $28 | $30 | $46 | $112 |

| 2022 Subaru Crosstrek | $28 | $29 | $46 | $112 |

| 2021 Subaru Crosstrek | $27 | $29 | $45 | $111 |

| 2020 Subaru Crosstrek | $26 | $28 | $44 | $110 |

| 2019 Subaru Crosstrek | $28 | $27 | $43 | $108 |

| 2018 Subaru Crosstrek | $28 | $26 | $42 | $107 |

| 2017 Subaru Crosstrek | $30 | $25 | $41 | $107 |

| 2016 Subaru Crosstrek | $30 | $24 | $40 | $105 |

Insurance rates often decrease as the Subaru Crosstrek ages, reflecting lower replacement and repair costs for older models. This information can help you budget more effectively and select a policy that aligns with your financial goals.

Driver Age

The table below illustrates how insurance costs vary across different age groups, highlighting the substantial differences in rates for teen drivers compared to older, more experienced drivers.

Subaru Crosstrek Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $402 |

| Age: 20 | $249 |

| Age: 30 | $115 |

| Age: 40 | $110 |

| Age: 45 | $105 |

| Age: 50 | $100 |

| Age: 60 | $98 |

Understanding these variations can help you anticipate insurance expenses based on driver age and make informed decisions to manage your costs effectively. Consider this information when evaluating insurance options to ensure you find the most suitable plan for your situation.

Driver Location

Where you live can have a large impact on Subaru Crosstrek insurance rates. For example, drivers in Los Angeles may pay more than drivers in Philadelphia.

Subaru Crosstrek Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $188 |

| New York, NY | $174 |

| Houston, TX | $172 |

| Jacksonville, FL | $160 |

| Philadelphia, PA | $231 |

| Chicago, IL | $145 |

| Phoenix, AZ | $128 |

| Seattle, WA | $107 |

| Indianapolis, IN | $94 |

| Columbus, OH | $91 |

Insurance premiums for the Subaru Crosstrek can vary greatly depending on your location, with some cities having notably higher rates than others. How your location may impact your insurance expenses and explore options to find the most competitive rates available in your area.

Your Driving Record

Your driving record can have an impact on your Subaru Crosstrek auto insurance rates. Teens and drivers in their 20’s see the highest jump in their Subaru Crosstrek car insurance with violations on their driving record.

Subaru Crosstrek Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $810 | $1,150 | $780 |

| Age: 18 | $402 | $620 | $840 | $540 |

| Age: 20 | $249 | $410 | $620 | $350 |

| Age: 30 | $115 | $180 | $290 | $160 |

| Age: 40 | $110 | $170 | $280 | $150 |

| Age: 45 | $105 | $165 | $275 | $145 |

| Age: 50 | $100 | $160 | $270 | $140 |

| Age: 60 | $98 | $155 | $260 | $135 |

Use this information to assess how your driving history may affect your insurance rates and consider steps to improve your record for better savings.

Subaru Crosstrek Safety Ratings

The safety ratings of the Subaru Crosstrek play a key role in determining insurance costs. The table below outlines the vehicle’s performance in various safety tests, reflecting how these ratings can influence insurance premiums.

Subaru Crosstrek Cruiser Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

By reviewing these ratings, you can gain a better understanding of how the Crosstrek’s safety features impact insurance costs and make informed decisions about your coverage options.

Subaru Crosstrek Crash Test Ratings

Good Subaru Crosstrek crash test ratings can lower your Subaru Crosstrek auto insurance rates. See Subaru Crosstrek crash test results below:

Subaru Crosstrek Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Subaru Crosstrek Hybrid SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Subaru Crosstrek Hybrid SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Subaru Crosstrek Hybrid SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Subaru Crosstrek Hybrid SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Subaru Crosstrek Hybrid SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Subaru Crosstrek Hybrid SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Subaru Crosstrek SW AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Subaru Crosstrek SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Subaru Crosstrek Hybrid SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

Evaluating these ratings helps you understand how crashworthiness impacts insurance costs and can guide you in selecting a policy that offers both safety and affordability.

Subaru Crosstrek Safety Features

The Subaru Crosstrek is equipped with several key safety features that enhance passenger protection and can help reduce insurance premiums:

- Air Bags: Includes driver, passenger, front head, rear head, and side air bags for comprehensive protection in the event of a crash.

- Anti-lock Braking System (ABS): 4-wheel ABS helps prevent wheel lockup during sudden stops, improving control.

- Electronic Stability Control: Enhances vehicle stability by detecting and reducing skids, improving safety in challenging driving conditions.

- Lane Departure Warning and Lane Keeping Assist: Alerts the driver if the vehicle drifts out of its lane and helps keep the vehicle within its lane.

- Daytime Running Lights and Traction Control: Improves visibility during the day and helps maintain grip on slippery surfaces.

The Subaru Crosstrek’s safety features are designed to protect occupants and enhance overall vehicle safety, which can also lead to lower insurance premiums.

You can make informed decisions about your insurance coverage and appreciate how the vehicle’s safety technology contributes to both protection and potential cost savings.

Read More: Safety Features Car Insurance Discounts

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

What factors can affect Subaru Crosstrek car insurance rates?

There are several factors that affect car insurance rates for Subaru Crosstrek, including your driving history, age, location, credit score, deductible amount, coverage limits, and the specific insurance provider you choose. Additionally, the Crosstrek’s safety features, repair costs, and theft rates may also impact insurance premiums.

Are Subaru Crosstreks generally expensive to insure?

The cost of insuring a Subaru Crosstrek can vary depending on several factors. However, compared to some other vehicles in its class, the Crosstrek often has lower insurance rates due to its safety features and overall reliability. It’s always a good idea to compare quotes from different insurance companies to find the best rates for your specific circumstances.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

How can I find affordable insurance rates for my Subaru Crosstrek?

To find affordable insurance rates for your Subaru Crosstrek, consider shopping around and comparing quotes from multiple insurance providers. Look for discounts that are specific to Subaru Crosstrek owners or safe drivers. Increasing your deductibles, if you can afford to pay more out of pocket in the event of a claim, can also help lower your premiums.

Are there any specific insurance discounts available for Subaru Crosstrek owners?

Insurance providers may offer specific discounts for Subaru Crosstrek owners, depending on the company and your location. Some common discounts you might qualify for include those for advanced safety features, maintaining a clean driving record, or bundling your auto insurance with other policies such as home or renters insurance.

Does the Subaru Crosstrek’s fuel efficiency affect insurance rates?

Generally, fuel efficiency itself does not directly impact insurance rates for a Subaru Crosstrek. Insurance premiums are primarily based on factors such as the vehicle’s safety features, repair costs, theft rates, and the driver’s profile. However, fuel-efficient vehicles like the Crosstrek may indirectly affect rates by potentially qualifying for certain eco-friendly or low-mileage discounts offered by some insurance providers.

Read More: The Most Fuel-Efficient Cars

What is the impact of my driving record on Subaru Crosstrek insurance rates?

Your driving record plays a significant role in determining your insurance rates. A clean driving record can help you secure lower premiums, while violations or accidents may lead to higher rates. Insurance companies view a good driving record as a sign of lower risk, which can translate into savings on your insurance policy.

How does the Subaru Crosstrek’s safety rating affect insurance costs?

The Subaru Crosstrek’s safety ratings can positively influence insurance costs. Higher safety ratings often lead to lower premiums, as insurers consider vehicles with better safety features and crash test results to be less risky. Reviewing the vehicle’s safety ratings can help you understand how its safety features contribute to insurance costs.

Read More: Safest Cars in America

Does the location where I live impact my Subaru Crosstrek insurance rates?

Yes, your location can significantly affect Subaru Crosstrek insurance rates. Insurance premiums often vary by region due to differences in accident rates, theft rates, and repair costs. Drivers in urban areas may face higher premiums compared to those in rural areas. Comparing quotes from insurers in your specific location can help you find the most competitive rates.

How does the age of my Subaru Crosstrek affect insurance costs?

The age of your Subaru Crosstrek can influence insurance costs, with older models generally costing less to insure than newer ones. This is because older vehicles typically have lower replacement values and repair costs. Reviewing insurance rates for different model years can help you determine the most cost-effective coverage for your vehicle.

What are the most common types of coverage for Subaru Crosstrek insurance?

Common types of coverage for Subaru Crosstrek insurance include liability coverage, which covers damages and injuries you cause to others; collision coverage, which covers damage to your vehicle from a collision; comprehensive coverage, and uninsured/underinsured motorist coverage, which protects you if you’re involved in an accident with a driver who lacks sufficient insurance.

Find cheap car insurance quotes by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.