Best Pontiac Vibe Car Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Erie, and AAA provide the best Pontiac Vibe car insurance, starting at just $48 per month. These providers stand out due to their exceptional coverage options, superior customer service, and competitive pricing tailored specifically for Pontiac Vibe owners seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Pontiac Vibe

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Pontiac Vibe

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Pontiac Vibe

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

The best Pontiac Vibe car insurance providers are State Farm, Erie, and AAA, renowned for their comprehensive coverage and excellent customer service.

These companies stand out for their ability to offer tailored policies that cater specifically to the needs of Pontiac Vibe owners. With their strong reputations for reliability and customer satisfaction, they ensure that your vehicle is protected with the highest standard of insurance. Our complete article “Compare Pontiac Car Insurance Rates” goes over this in more detail.

Our Top 10 Company Picks: Best Pontiac Vibe Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% B Many Discounts State Farm

#2 15% A+ 24/7 Support Erie

#3 12% A Online App AAA

#4 18% A++ Custom Plan Geico

#5 20% A+ Innovative Programs Progressive

#6 14% A+ Add-on Coverages Allstate

#7 16% A Customizable Polices Liberty Mutual

#8 11% A+ Usage Discount Nationwide

#9 19% A++ Military Savings USAA

#10 17% A Local Agents Farmers

Whether you’re looking for affordability or extensive coverage, these insurers provide options that can suit a wide range of preferences and needs.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

- State Farm is the top pick for Pontiac Vibe car insurance

- Pontiac Vibe insurance needs are best met by companies with high reliability ratings

- Tailored insurance options ensure Pontiac Vibe owners receive optimal coverage

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies for Pontiac Vibe owners. Wondering about their level of customer service? Find out in our guide titled “State Farm Car Insurance Review.”

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage Pontiac Vibe usage, ideal for drivers who use their vehicles less frequently.

- Wide Coverage: State Farm offers a variety of options tailored to different Pontiac Vibe insurance needs, ensuring comprehensive protection.

Cons

- Limited Multi-Policy Discount: The multi-policy discount for Pontiac Vibe insurance at State Farm is lower compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels for Pontiac Vibe.

#2 – Erie: Best for 24/7 Support

Pros

- Higher Multi-Vehicle Discount: Erie offers a 15% discount for multi-vehicle policies, beneficial for Pontiac Vibe owners with multiple cars.

- Superior Customer Support: Known for excellent 24/7 customer support, Erie ensures Pontiac Vibe owners have constant assistance. Compare Erie’s rates with top competitors in our article titled “Erie Car Insurance Review.”

- Stable Financial Rating: With an A+ A.M. Best rating, Erie provides Pontiac Vibe owners reliable and financially secure insurance options.

Cons

- Geographic Availability: Erie’s coverage for Pontiac Vibe may be limited to specific regions, potentially excluding some drivers.

- No Major Low-Mileage Discounts: Unlike competitors, Erie does not offer substantial low-mileage discounts specifically for Pontiac Vibe drivers.

#3 – AAA: Best for Online App

Pros

- Strong Online Tools: AAA offers robust online app functionalities that facilitate management of Pontiac Vibe insurance policies easily.

- Good Multi-Vehicle Discount: AAA provides a 12% multi-vehicle discount, making it a cost-effective option for Pontiac Vibe owners with more than one car.

- High Financial Stability: With an A rating from A.M. Best, AAA is a stable choice for insuring your Pontiac Vibe. Learn more about AAA roadside assistance in our guide titled “AAA Car Insurance Review.”

Cons

- Membership Requirement: AAA requires a membership to access insurance for Pontiac Vibe, which could be an additional cost.

- Less Competitive for Single Policies: For Pontiac Vibe owners seeking single vehicle insurance, AAA may offer less competitive rates compared to bundled options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Custom Plan

Pros

- Highest Multi-Vehicle Discount: Geico offers an 18% discount for multi-vehicle policies, which is ideal for Pontiac Vibe owners insuring multiple cars.

- Tailored Insurance Plans: Geico provides highly customizable insurance plans, allowing Pontiac Vibe owners to fine-tune their coverage to match their specific needs.

- Excellent Financial Rating: With an A++ rating from A.M. Best, Geico ensures robust financial reliability for Pontiac Vibe insurance. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

Cons

- Premium Fluctuations: Geico’s premiums for Pontiac Vibe insurance can vary significantly based on the driver’s profile and location, which may result in unpredictability in costs.

- Basic Online Tools: While Geico offers custom plans, their online tools for managing Pontiac Vibe insurance might not be as advanced as those offered by some competitors.

#5 – Progressive: Best for Innovative Programs

Pros

- Progressive Programs: Progressive offers innovative programs like Snapshot, which can lead to substantial savings for safe Pontiac Vibe drivers. Learn more about coverage options and monthly rates in our article titled “Progressive Car Insurance Review.”

- High Multi-Vehicle Discount: With a 20% discount on multi-vehicle policies, Progressive offers substantial savings for Pontiac Vibe owners with more than one car.

- Flexible Coverage Options: Progressive provides a variety of coverage options, giving Pontiac Vibe owners the flexibility to choose what suits their needs best.

Cons

- Higher Rates for High-Risk Drivers: Pontiac Vibe owners with a history of accidents or violations may face higher premiums at Progressive.

- Customer Service Variability: Some Pontiac Vibe owners may experience variability in customer service quality, depending on the region and agent.

#6 – Allstate: Best for Add-on Coverages

Pros

- Extensive Add-On Options: Allstate offers a wide range of add-on coverages that enhance protection for Pontiac Vibe, such as roadside assistance and rental reimbursement.

- Strong Multi-Vehicle Discount: With a 14% discount, Allstate provides good savings for Pontiac Vibe owners insuring multiple vehicles.

- Highly Customizable Policies: Allstate allows Pontiac Vibe owners to tailor their insurance policies extensively to fit their unique needs. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Review.”

Cons

- Higher Base Premiums: Allstate’s base premiums for Pontiac Vibe insurance may be higher compared to some other insurers, even after discounts.

- Complex Policy Management: Managing insurance policies with Allstate can sometimes be complex, particularly for Pontiac Vibe owners who prefer straightforward insurance solutions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customization at Its Best: Liberty Mutual offers highly customizable policies, allowing Pontiac Vibe owners to adjust their coverage levels and add-ons to fit their specific needs perfectly.

- Good Multi-Vehicle Discount: With a 16% discount for insuring multiple vehicles, Liberty Mutual is an attractive option for Pontiac Vibe owners with more than one car.

- Diverse Discount Options: Various discounts are available, including for safe driving, which can substantially lower premiums for Pontiac Vibe insurance. To see monthly premiums and honest rankings, read our guide titled “Liberty Mutual Car Insurance Review.”

Cons

- Variable Pricing: Prices can vary significantly for Pontiac Vibe owners based on geographic location and other factors, making it difficult to predict costs.

- Customer Feedback Mixed: Some Pontiac Vibe owners report mixed experiences with customer service and claim handling, depending on the region.

#8 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Discounts: Nationwide offers significant discounts for low-mileage Pontiac Vibe drivers through its SmartRide program, ideal for those who drive less.

- Solid Financial Stability: With an A+ rating from A.M. Best, Nationwide provides a financially secure option for insuring your Pontiac Vibe. Explore more discount options in our guide titled “Nationwide Car Insurance Discounts.”

- Wide Coverage Options: Nationwide’s extensive coverage options ensure that every aspect of Pontiac Vibe insurance needs can be met, from basic to comprehensive.

Cons

- Higher Rates for Some: Rates can be higher for Pontiac Vibe owners with less-than-perfect driving records or those living in high-risk areas.

- Policy Flexibility Issues: While Nationwide offers a range of options, some Pontiac Vibe owners might find the policies less flexible compared to other insurers.

#9 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA provides exclusive insurance rates and discounts for military members and their families, making it a top choice for Pontiac Vibe owners in the armed services.

- Top-Tier Customer Satisfaction: Known for exceptional customer service, USAA consistently ranks high in satisfaction among Pontiac Vibe owners.

- Comprehensive Coverage: USAA offers a range of coverage options that meet the diverse needs of Pontiac Vibe owners, ensuring thorough protection. Find out why USAA ranks among the cheapest providers in our article titled “USAA Car Insurance Review.”

Cons

- Eligibility Restrictions: USAA’s services are only available to military members, veterans, and their families, limiting access for Pontiac Vibe owners who are not affiliated with the military.

- Limited Physical Presence: While USAA excels in online services, it has fewer physical locations, which might be a drawback for some Pontiac Vibe owners who prefer in-person interactions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Local Agents

Pros

- Personalized Service Via Local Agents: Farmers uses a network of local agents to provide personalized service, making it easier for Pontiac Vibe owners to manage their policies and receive tailored advice.

- Competitive Multi-Vehicle Discounts: Farmers offers a 17% discount for multi-vehicle policies, benefiting Pontiac Vibe owners with multiple cars. Take a look at our article titled “Farmers Car Insurance Review.”

- Variety of Policy Options: Farmers offers a range of policy options, from basic to comprehensive, catering to the different insurance needs of Pontiac Vibe owners.

Cons

- Inconsistent Pricing: Pricing can vary widely for Pontiac Vibe insurance depending on the location and the agent, which might confuse some customers.

- Varied Customer Experience: The quality of service can vary significantly based on the local agent, which might affect the overall satisfaction for some Pontiac Vibe owners.

Monthly Insurance Rates for Pontiac Vibe: Minimum vs. Full Coverage

The following data provides a comprehensive overview of the monthly insurance rates for a Pontiac Vibe, broken down by coverage level and provider. This allows for a direct comparison of what you can expect to pay for either minimum or full coverage options across several leading insurance companies.

Pontiac Vibe Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $70 $278

Allstate $105 $220

Erie $80 $223

Farmers $48 $213

Geico $87 $162

Liberty Mutual $84 $243

Nationwide $63 $302

Progressive $74 $248

State Farm $71 $176

USAA $85 $275

Insurance costs for a Pontiac Vibe can vary significantly depending on the level of coverage selected. For example, Farmers offers the lowest monthly rate for minimum coverage at $48, while Nationwide presents the highest rate for full coverage at $302 per month. Discover insights in our guide titled “AAA vs. Farmers Car Insurance Comparison.”

On the more affordable end of full coverage, Geico provides a notable rate of $162, which is substantially lower compared to others. State Farm, known for its robust offerings, lists its full coverage at $176 monthly, striking a balance between comprehensive protection and cost-effectiveness.

This table showcases the diversity in pricing structures across different insurers, reflecting their varying approaches to insurance coverage for the same vehicle type.

How Much Should Car Insurance Cost for a Pontiac Vibe

The Pontiac Vibe was first produced in 2003 and finally ended production in August of 2009 (with 2010 models).

This small hatchback car is designed in a similar fashion to an SUV but is far more fuel-efficient. The target audience for this vehicle is vast; everyone from a teen driver in high school to a couple of grandparents can find enjoyable features in this vehicle.

The good news is that safety wise, the Vibe ranked a 9.2 according to U.S. News and World Report, based on findings by the Insurance Institute for Highway Safety and SaferCar.gov.

A 9.2 is a top notch score for crash tests and safety ratings, especially when measured by the insurance industry.

The Vibe also ranks very high in reliability, meaning breakdowns are rare. The cost to fix the car whenever there is an issue is small compared to other similar style cars. There have been very few recalls ordered.

This all helps keep insurance costs lower than they would be otherwise.

These details directly influence the insurance pricing for the Vibe. The facts and data considered by the insurance company determine the final cost, which will vary based on the car’s specifics, location, and driver, and may differ from initial estimates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Statistical Data Matters for Pontiac Vibe Drivers

Insurance companies base rates on statistics. These statistics come from the car but also from the driver and other drivers in the same area.

Words such as sporty, fast, and power, usually imply you will be paying a high price in premiums. However, words used to describe the Vibe are, practical, sensible, and reliable. This is a good indicator of lowered insurance rates.

For Pontiac Vibe owners, State Farm stands out by blending affordability with extensive coverage options effectively.

Scott W. Johnson Licensed Insurance Agent

To sum it up, insurance companies are in business to make money. They would all go out of business if they short-changed themselves with every contract.

The way they stay in business is basically by playing the odds. Much research is put into Vibe accident statistics.

Young, inexperienced drivers tend to be more accident-prone and so this costs the insurance companies money. Those under 25 years of age will pay higher than average rates as statistics show accident numbers decrease after a driver hits the age of 25. Unlock details in our guide titled “Best Car Insurance for Drivers Under 25.”

The same can be said of the type of car. Super-fast sports cars tend to be involved in more accidents than mini-vans; they also tend to cost much more to fix when there is an accident.

In order for the insurance companies not to lose money, those choosing to drive those sporty little statistical nightmares end up paying for them.

The good news is while the Vibe is a fun car to drive; statistics tend to be on its side as a sensible car. That means lower premiums for drivers in general, which is promising news.

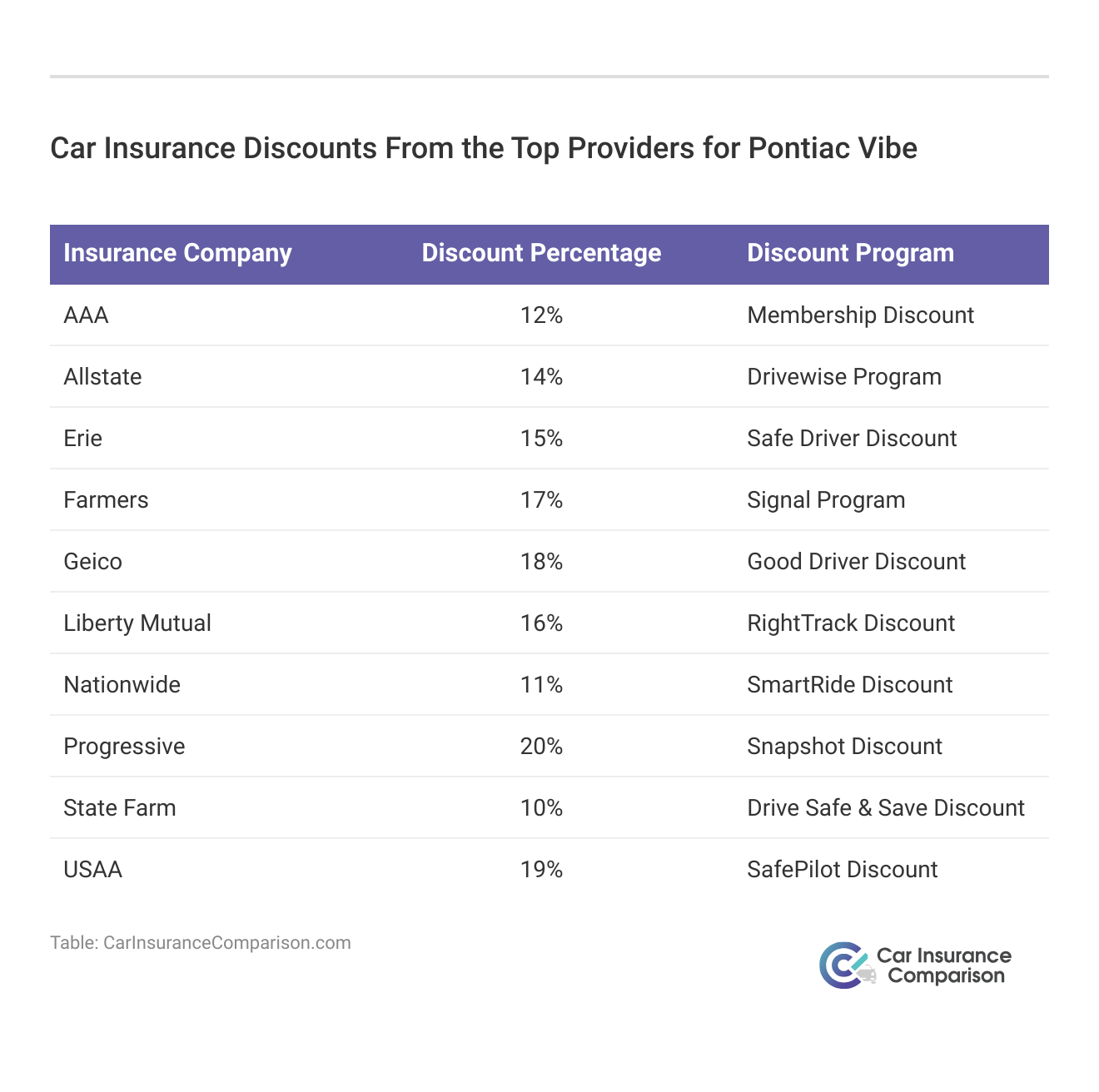

Where Can I Find Car Insurance Discounts for a Pontiac Vibe

While the type of car you drive can make a big difference in rates, don’t forget that your personal driving record also matters. Access comprehensive insights into our article titled “Do all car insurance companies check your driving records?”

Choosing State Farm means opting for a trusted provider with a robust $71 minimum coverage rate for the Pontiac Vibe.

Michelle Robbins Licensed Insurance Agent

To ensure that your insurance costs remain manageable, consider adhering to these strategic tips designed to help you maximize savings on your premiums:

- Always obey the law by adhering strictly to traffic regulations and road signs, ensuring both your safety and the safety of others on the road.

- Buckle up every time you drive, as wearing a seatbelt significantly increases your chances of surviving a car accident.

- Follow speed limits to maintain control of your vehicle and prevent accidents, as speeding is a major cause of traffic collisions.

- Avoid talking or texting while driving to ensure full attention to driving tasks; distracted driving is a leading factor in road incidents.

- If you have had some dings in your past, you may be able to take a driving safety class. Some insurance companies will give you a discount.

If you are after the lowest priced insurance for the Pontiac Vibe then the best advice is to follow is to shop around. Go online and find multiple quotes in a flash using a web chaser tool.

Remember to ask about any discounts you may qualify for such as discounts for seniors, students, or good drivers.

The cost of insurance for a Pontiac Vibe will all depend on varying factors, but the good news is it is a top-ranking car in safety and reliability.

With these factors, as well as some diligent deal hunting, you are sure to find an affordable insurance rate for your Vibe. For more information on car insurance costs for a Pontiac Vibe, enter your ZIP code now.

Frequently Asked Questions

How much should car insurance cost for a Pontiac Vibe?

The average car insurance cost for a Pontiac Vibe can vary depending on factors such as the model year and specific details of the vehicle. On average, the monthly cost of car insurance for a 2010 Pontiac Vibe is around $96, while a 2006 model may cost around $121 per month.

What statistical data matters for Pontiac Vibe drivers?

Insurance companies consider various statistical data when determining car insurance rates. Factors such as the car’s safety ratings, crash test results, reliability, and the driver’s demographic information are taken into account. The Pontiac Vibe has scored well in safety tests, making it a favorable choice for insurance companies, which can contribute to lower insurance rates.

Learn more by reading our guide titled “The Best Small Car Safety Ratings.”

How can I find affordable insurance rates for my Pontiac Vibe?

To find affordable insurance rates for your Pontiac Vibe, it’s crucial to shop around and compare quotes from different insurance providers. Utilize online tools and websites that offer car insurance comparisons to easily gather multiple quotes in a short amount of time. Additionally, maintaining a clean driving record, taking advantage of available discounts, and considering higher deductibles can help lower your insurance costs.

What factors can affect the cost of car insurance for a Pontiac Vibe?

Several factors can influence the cost of car insurance for a Pontiac Vibe, including your age, driving record, location, annual mileage, coverage options, and deductibles. Insurance companies assess these factors to determine the level of risk associated with insuring your vehicle.

Are there any specific features or modifications that can impact the insurance rates for a Pontiac Vibe?

Yes, certain modifications or added features to your Pontiac Vibe, such as aftermarket parts, engine enhancements, or customizations, may affect your insurance rates. It’s advisable to consult with your insurance provider to understand how these modifications can impact your premiums.

Access comprehensive insights into our guide titled “Does car insurance cover engine failure?”

Can I get a discount on my Pontiac Vibe car insurance if I have anti-theft devices installed?

Yes, having anti-theft devices installed in your Pontiac Vibe, such as alarm systems, immobilizers, or tracking devices, can often lead to discounts on your car insurance. These devices help reduce the risk of theft or vandalism, making your vehicle less of a liability for the insurance company.

Which type of insurance is best for a Pontiac Vibe car?

Comprehensive insurance is typically best for a Pontiac Vibe, offering broad protection against various incidents.

What is the lowest form of Pontiac Vibe car insurance?

The lowest form of Pontiac Vibe car insurance is liability-only coverage, which covers damage to others but not the vehicle itself.

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

At what age is Pontiac Vibe car insurance cheapest?

Pontiac Vibe car insurance is generally cheapest for drivers aged 25 and older, due to decreased risk factors.

Is it worth having full coverage on a Pontiac Vibe car?

Yes, having full coverage on a Pontiac Vibe is worth it, especially if the car is less than 10 years old or has high repair costs.

Who typically has the cheapest Pontiac Vibe car insurance?

Typically, companies like State Farm or Geico offer the cheapest Pontiac Vibe car insurance, depending on the region and discounts.

To find out more, explore our guide titled “Do car accidents where you live affect car insurance rates?”

What is the most basic car insurance you can have for a Pontiac Vibe?

The most basic car insurance for a Pontiac Vibe is state-mandated minimum liability insurance.

What car insurance group is the cheapest for Pontiac Vibe?

Pontiac Vibe is usually placed in lower insurance groups, making basic liability or collision coverage the cheapest options.

What is the best type of car insurance to get for a Pontiac Vibe?

The best type of car insurance for a Pontiac Vibe is a policy that includes comprehensive and collision coverage for full protection.

For additional details, explore our comprehensive resource titled “Compare Car Insurance by Coverage Type.”

Which insurance is best for a Pontiac Vibe car after 5 years?

After 5 years, choosing a policy with collision and comprehensive coverage at competitive rates from providers like Erie or AAA is best.

Who is cheaper for Pontiac Vibe, Geico or Progressive?

Geico typically offers cheaper rates than Progressive for Pontiac Vibe, but it’s best to compare quotes as prices can vary.

Is there a way to lower Pontiac Vibe car insurance?

Yes, increasing deductibles, maintaining a clean driving record, and qualifying for discounts can lower Pontiac Vibe car insurance.

To learn more, explore our comprehensive resource on guide titled “How to Find Your Car Insurance Deductible Amount.”

What is the most expensive Pontiac Vibe car color to insure?

Typically, car color does not significantly affect insurance costs, but custom or unusual colors might be more expensive to insure.

What are the cheapest full-coverage Pontiac Vibe car insurance?

The cheapest full-coverage Pontiac Vibe car insurance can often be found with companies like State Farm or Erie, depending on discounts and coverage levels.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.